It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: NightFlight

No one is stealing anything. We are Ponzi scheming ourselves.

No one is stealing anything. We are Ponzi scheming ourselves.

edit on 21-1-2015 by AugustusMasonicus because: networkdude has no beer

a reply to: AugustusMasonicus

It's not our money. We are not loaning ourselves money and buying our own debt. The Federal Reserve is privately owned. We owe interest to the owners of the Fed. They tell our govt how many U.S Treasuries they will buy and they determine the interest rate. Biggest scam in the history of the world!

Again, the Federal Reserve is privately owned. We are not buying our own debt. Any U.S Treasuries (debt) bought by the Fed is interest we owe back to private bankers that have tax exempt foundations so they only collect money from our hard work via the income tax.

Doubt me? Check out Congressman Norman Dodd's report on tax exempt foundations and read The Creature from Jekyll Island, which barely starts to scratch the surface. And the Rothschilds are just one family involved.

It's not our money. We are not loaning ourselves money and buying our own debt. The Federal Reserve is privately owned. We owe interest to the owners of the Fed. They tell our govt how many U.S Treasuries they will buy and they determine the interest rate. Biggest scam in the history of the world!

Again, the Federal Reserve is privately owned. We are not buying our own debt. Any U.S Treasuries (debt) bought by the Fed is interest we owe back to private bankers that have tax exempt foundations so they only collect money from our hard work via the income tax.

Doubt me? Check out Congressman Norman Dodd's report on tax exempt foundations and read The Creature from Jekyll Island, which barely starts to scratch the surface. And the Rothschilds are just one family involved.

edit on 21-1-2015 by sasquatch5100 because: (no reason

given)

edit on 21-1-2015 by sasquatch5100 because: (no reason given)

edit on 21-1-2015 by sasquatch5100 because: (no

reason given)

edit on 21-1-2015 by sasquatch5100 because: (no reason given)

a reply to: sasquatch5100

Then I guess it would be really easy for you to lay out the raw numbers of how much went where and at what rates.

Then I guess it would be really easy for you to lay out the raw numbers of how much went where and at what rates.

a reply to: AugustusMasonicus

No it would not. Because we are not allowed to audit the Federal Reserve. Ron Paul ran his entire campaign on auditing the Fed. Ben Bernanke pretty much told congress to mind its own business. His reasoning? The Fed needs to stay above the political fray, how convenient for them.

No it would not. Because we are not allowed to audit the Federal Reserve. Ron Paul ran his entire campaign on auditing the Fed. Ben Bernanke pretty much told congress to mind its own business. His reasoning? The Fed needs to stay above the political fray, how convenient for them.

originally posted by: AugustusMasonicus

originally posted by: NightFlight

We borrow money from them through the FED.

We are not borrowing money from Israel, we are borrowing money from ourselves which is actually much more absurd than borrowing from someone else.

No you are not. The FED is a private bank owned by share holder but who owns it is not public information.

When the government is short of funds, the Treasury issues bonds and delivers them to bond dealers, which auction them off. When the Fed wants to “expand the money supply” (create money), it steps in and buys bonds from these dealers with newly-issued dollars acquired by the Fed for the cost of writing them into an account on a computer screen. These maneuvers are called “open market operations” because the Fed buys the bonds on the “open market” from the bond dealers. The bonds then become the “reserves” that the banking establishment uses to back its loans. In another bit of sleight of hand known as “fractional reserve” lending, the same reserves are lent many times over, further expanding the money supply, generating interest for the banks with each loan. It was this money-creating process that prompted Wright Patman, Chairman of the House Banking and Currency Committee in the 1960s, to call the Federal Reserve “a total money-making machine.”

The FED even gives 6% dividends every year to it's owners.

Its shareholders are private banks. In fact, 100% of its shareholders are private banks. None of its stock is owned by the government.

edit on 21-1-2015 by LittleByLittle because: (no reason given)

originally posted by: sasquatch5100

No it would not. Because we are not allowed to audit the Federal Reserve.

Why do you need an audit to determine who purchased the notes? This is public knowledge.

originally posted by: LittleByLittle

No you are not. The FED is a private bank owned by share holder but who owns it is not public information.

All the national banks are members and many state banks are members.

The FED even gives 6% dividends every year to it's owners.

After it pays the remainder back to the United States Treasury. Last year it was about $90 billion in revenue of which $1.6 billion was kept by the Federal Reserve. Not exactly a stupendous amount of money considering what a typical hedge fund returns.

Its shareholders are private banks. In fact, 100% of its shareholders are private banks. None of its stock is owned by the government.

Which is exactly the point; you do not want the government owning the banks.

a reply to: AugustusMasonicus

The $90 billion in revenue is a drop in the ocean against what the private banks do afterwards with the deposits from the bonds.

Private banks creating the illusion of money that to not really exists. And when there is not enough money to support demand you get problems like in Greece when people wanted to take out money that did not exists as anything except debt since there is always more debt than real assets. Fractal banking.

The $90 billion in revenue is a drop in the ocean against what the private banks do afterwards with the deposits from the bonds.

Question: How does the Fed “create” money out of nothing?

Answer: It is a four-step process. But first a word on bonds. Bonds are simply promises to pay — or government IOUs. People buy bonds to get a secure rate of interest. At the end of the term of the bond, the government repays the principal, plus interest (if not paid periodically), and the bond is destroyed. There are trillions of dollars worth of these bonds at present. Now here is the Fed moneymaking process:

Step 1. The Fed Open Market Committee approves the purchase of U.S. Bonds on the open market.

Step 2. The bonds are purchased by the New York Fed Bank from whomever is offering them for sale on the open market.

Step 3. The Fed pays for the bonds with electronic credits to the seller’s bank, which in turn credits the seller’s bank account. These credits are based on nothing tangible. The Fed just creates them.

Step 4. The banks use these deposits as reserves. Most banks may loan out ten times (10x) the amount of their reserves to new borrowers, all at interest.

In this way, a Fed purchase of, say a million dollars worth of bonds, gets turned into over 10 million dollars in bank deposits. The Fed, in effect, creates 10% of this totally new money and the banks create the other 90%.

This also explains why the Fed consistently holds about 10% of the total US Treasury bonds. It had to buy those (with accounts or Fed notes the Fed simply created) from the public in order to provide the base for the rest of the money the private banks then get to create, most of which eventually winds up being used to purchase Treasury bonds, thus supplying Congress with the borrowed money to pay for its expenditures.

Due to a number of important exceptions to the 10% reserve ratio, some loans require less than 10% reserves, and many no (0%) reserves, making it possible for banks to create many times more than ten times the money they have in “reserve”. Due to these exceptions from the 10% reserve requirement, the Fed creates only a little under 2% of the total US money supply, while private banks create the other 98%.

To reduce the amount of money in the economy, the process is just reversed — the Fed sells bonds to the public, and money flows out of the purchaser’s local bank. Loans must be reduced by ten times the amount of the sale. So a Fed sale of a million dollars in bonds, results in 10 million dollars less money in the economy.

Private banks creating the illusion of money that to not really exists. And when there is not enough money to support demand you get problems like in Greece when people wanted to take out money that did not exists as anything except debt since there is always more debt than real assets. Fractal banking.

edit on 21-1-2015 by LittleByLittle because: (no reason given)

edit on 21-1-2015 by LittleByLittle because: (no

reason given)

a reply to: LittleByLittle

Yeah? And? Your source (unlinked, by the way) shows that the funds are used to run the government. Who is the government? Us.

We are borrowing to service our own debt and finance our future.

Yeah? And? Your source (unlinked, by the way) shows that the funds are used to run the government. Who is the government? Us.

We are borrowing to service our own debt and finance our future.

a reply to: AugustusMasonicus

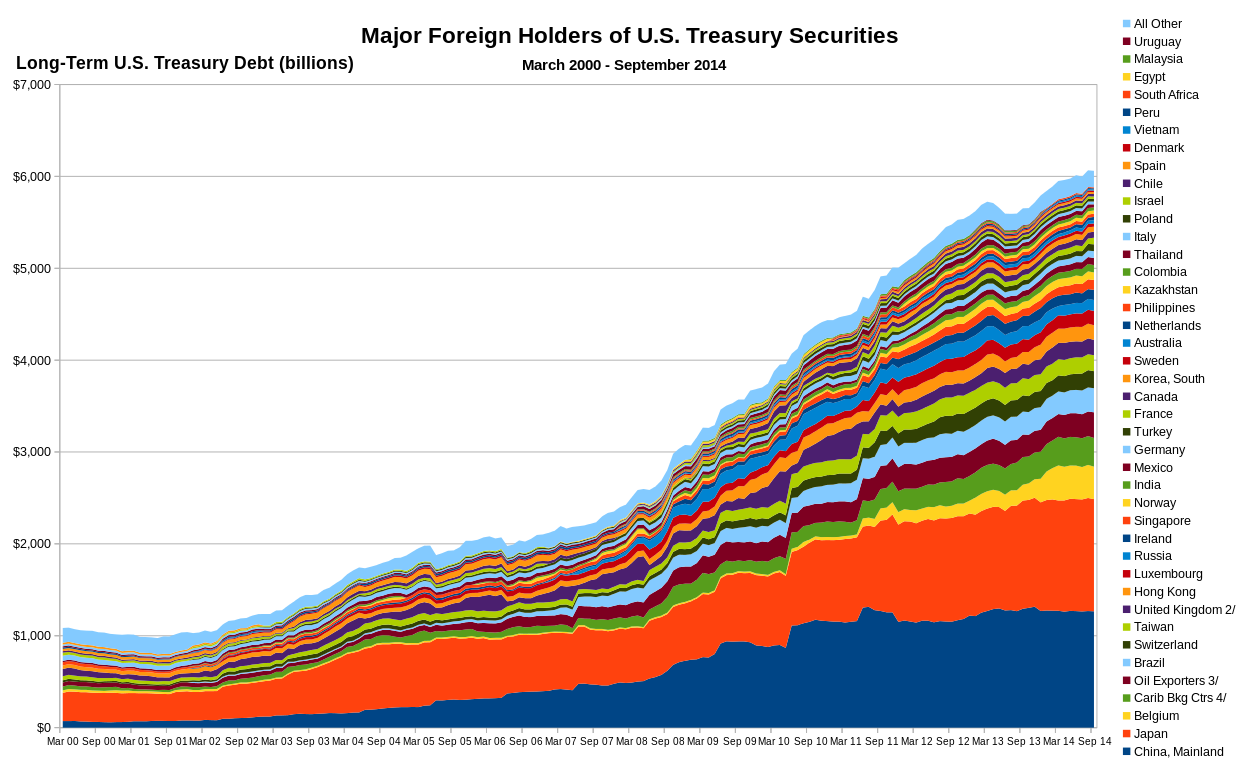

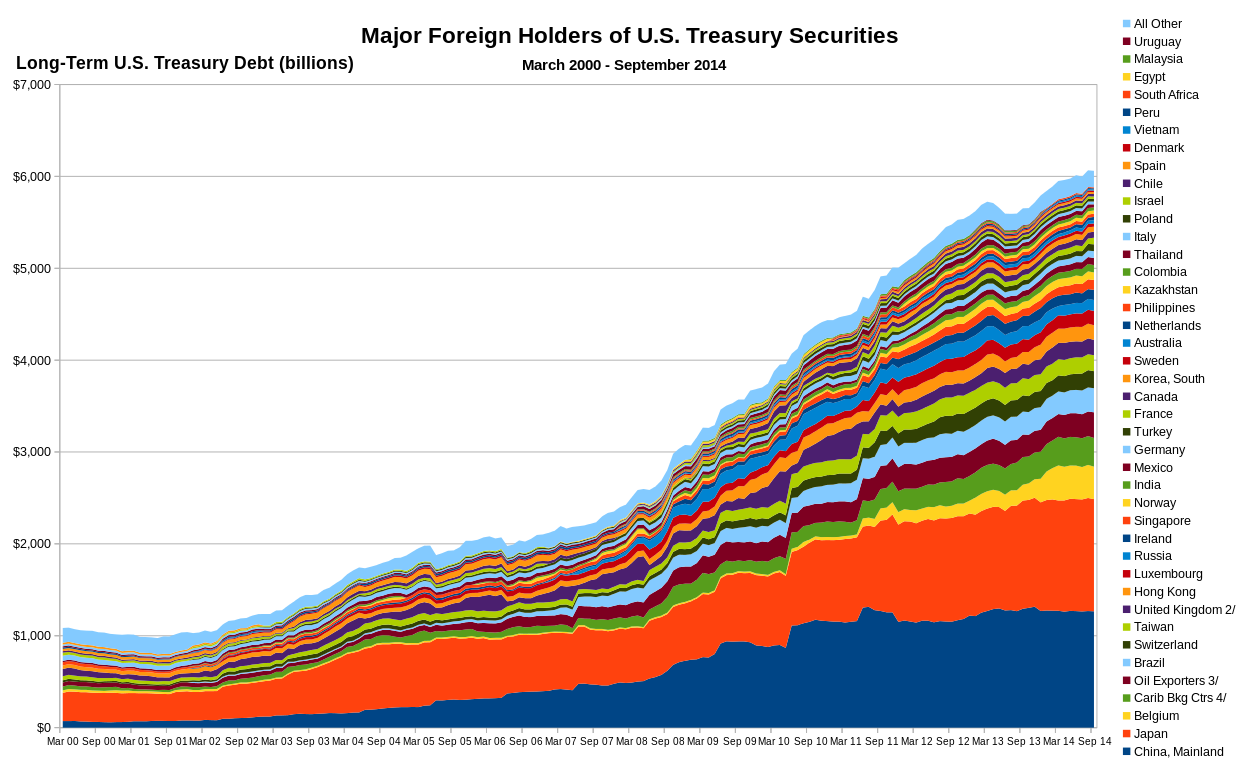

According to this US do not own its own debt.

en.wikipedia.org...

According to this federal reserve have 2,705.9 billion dollars debt in 2014:Q2.

research.stlouisfed.org...

If the private banks use 10% fractal reserving that means they can play this up to at least 27.059 trillion dollars if they want. Any wonder why private banks love quantitative easing.

Those that get the money first wins. The rest gets hyperinflation.

According to this US do not own its own debt.

en.wikipedia.org...

According to this federal reserve have 2,705.9 billion dollars debt in 2014:Q2.

research.stlouisfed.org...

If the private banks use 10% fractal reserving that means they can play this up to at least 27.059 trillion dollars if they want. Any wonder why private banks love quantitative easing.

Those that get the money first wins. The rest gets hyperinflation.

edit on 21-1-2015 by LittleByLittle because: (no reason given)

originally posted by: LittleByLittle

According to this US do not own its own debt.

Did you bother to read the words accompanying that graph?

As of September 2014, foreigners owned $6.06 trillion of U.S. debt, or approximately 47% of the debt held by the public of $12.8 trillion and 34% of the total debt of $17.8 trillion.

Some simple math would demonstrate that we own the majority of our own debt.

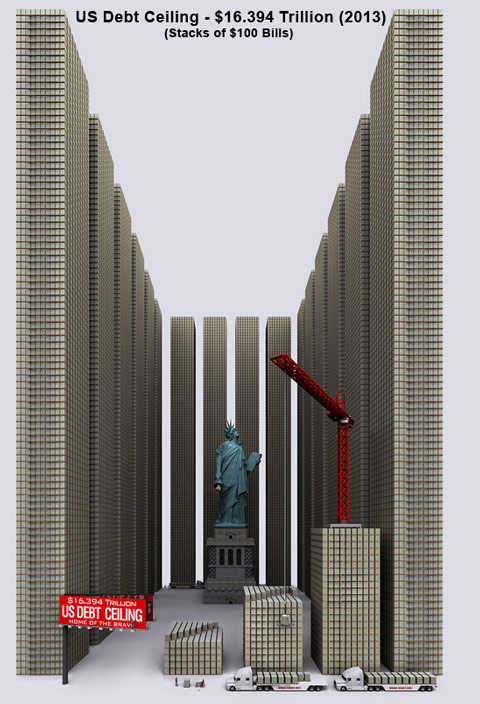

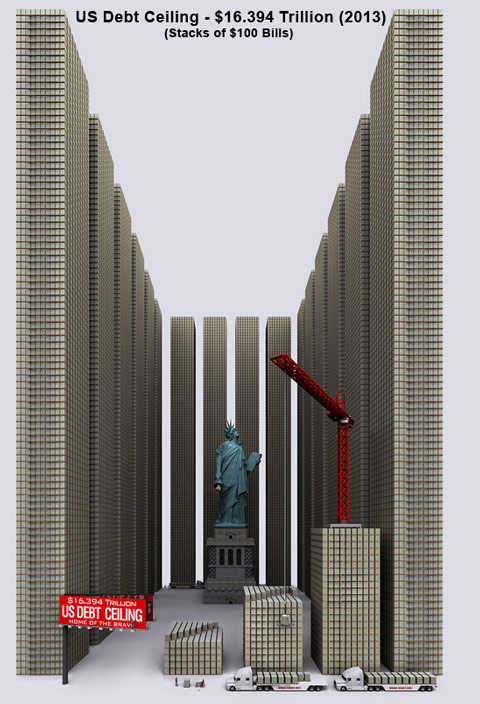

To create money we have to have debt. Our debt will never go away in the current system of money and interest. We owe more in interest than we do in

debt and can't create enough money to pay off either. These numbers can only go up. This system of money is a brick wall in human evolution of

technology and sustainability. Money is the reason we fight wars, burn fossil fuels, go to work and buy useless junk. There is no future for us while

a monetary system runs its course. More people die from disease and allergies than from terrorism, yet the goobernment spends more money to protect us

from "terrorism". If we spend instead half of our war money on bettering our country we could see life turn around even temporarily. We will never

be free from the chains of modern slavery with an established monetary system.

Every person in America owes $ 180.000 to the government for the debt

Lets try this again.

1. FED creates debt 2,705.9 (A) billion dollars 2014:Q2

2. Private banks get deposits and can with fractal lending create a tenfold deposit of the deposit FED created. 27.059 trillion dollars (B=10A). (it can be more but 10 times is easy to count with)

3. Private banks give specific people C access to B to invest without having to pay big interest.

4. C buys up companies and real resources for the B creating oligarchies and monopolies. Bubbles are created since increased demand drives prices up. (stock market?)

5. Dollar in the end hyper inflates due to the increased deposits B and all people except the ones who got the fiat money first looses.

Rinse and repeat.

research.stlouisfed.org...

says A was 2,705.9 billion dollar in 2014:Q2

www.bloomberg.com...

say A was $4.48 trillion in 014-10-24

1. FED creates debt 2,705.9 (A) billion dollars 2014:Q2

2. Private banks get deposits and can with fractal lending create a tenfold deposit of the deposit FED created. 27.059 trillion dollars (B=10A). (it can be more but 10 times is easy to count with)

3. Private banks give specific people C access to B to invest without having to pay big interest.

4. C buys up companies and real resources for the B creating oligarchies and monopolies. Bubbles are created since increased demand drives prices up. (stock market?)

5. Dollar in the end hyper inflates due to the increased deposits B and all people except the ones who got the fiat money first looses.

Rinse and repeat.

research.stlouisfed.org...

says A was 2,705.9 billion dollar in 2014:Q2

www.bloomberg.com...

say A was $4.48 trillion in 014-10-24

edit on 21-1-2015 by LittleByLittle because: (no reason given)

originally posted by: LittleByLittle

Lets try this again.

Yes, let us.

The conversation was about who owns United States debt.

Did you figure it out yet? It was in your own source.

Never mind. I'm out. Have fun.

edit on 21-1-2015 by LittleByLittle because: (no reason given)

Due to the system they have basicly imprisoned themselves. They create infinite debt until the system collapses.

a reply to: lordcomac

What has dropped is the deficit.

That is diffrent than than the debt,

The deficit is the gap between the money the goverment brings in and its expenses.

If the expenses are more than what the goverment brings in then the debt goes up.

The deficit can thus go down but if it is still there the debt will rise.

UK and US have both cut the deficit. But our debts are still rising as we both still have a deficit.

What has dropped is the deficit.

That is diffrent than than the debt,

The deficit is the gap between the money the goverment brings in and its expenses.

If the expenses are more than what the goverment brings in then the debt goes up.

The deficit can thus go down but if it is still there the debt will rise.

UK and US have both cut the deficit. But our debts are still rising as we both still have a deficit.

new topics

-

The Baloney aka BS Detection Kit

Social Issues and Civil Unrest: 3 hours ago -

Suspected Iranian agent working for Pentagon while U.S. coordinated defense of Israel

US Political Madness: 3 hours ago -

How does my computer know

Education and Media: 6 hours ago -

USO 10 miles west of caladesi island, Clearwater beach Florida

Aliens and UFOs: 10 hours ago

top topics

-

USO 10 miles west of caladesi island, Clearwater beach Florida

Aliens and UFOs: 10 hours ago, 8 flags -

Suspected Iranian agent working for Pentagon while U.S. coordinated defense of Israel

US Political Madness: 3 hours ago, 4 flags -

How does my computer know

Education and Media: 6 hours ago, 2 flags -

The Baloney aka BS Detection Kit

Social Issues and Civil Unrest: 3 hours ago, 1 flags

active topics

-

Suspected Iranian agent working for Pentagon while U.S. coordinated defense of Israel

US Political Madness • 5 • : ImagoDei -

Afterlife, unknown, so prepare, or just go into the unknown (bad)!!

ATS Skunk Works • 51 • : Kennyb75 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 190 • : Threadbarer -

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 628 • : Lazy88 -

Mandela Effect - It Happened to Me!

The Gray Area • 99 • : ArMaP -

America's Infant Mortality Rate Increases for the First Time in 20 Years

Medical Issues & Conspiracies • 18 • : Kurokage -

OUT OF THE BLUE Chilling moment pulsating blue cigar-shaped UFO is filmed hovering over PHX AZ

Aliens and UFOs • 38 • : ArMaP -

How does my computer know

Education and Media • 9 • : BernnieJGato -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 474 • : McTech2 -

Running Bible prophecy about to consummate?

Predictions & Prophecies • 12 • : ntech620