It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

The tittle is the actual tittle of the article, not mine. I would add please read the article as the two paragraphs we are allowed to quote misses

many of the talking points discussed in the article.

source

Life's not fair,

so tax the rich, they will not go hungry!

[url=

Now, thanks to recent tax cuts in Kansas and tax hikes in California, we have real-world tests of this idea. So far, the results do not support Laffer’s insistence that lower tax rates always result in more and better-paying jobs. In fact, Kansas’ tax cuts produced much slower job and wage growth than in California.

Tax hikes did not hurt California job growth because the taxes were not on jobs but on high incomes. A stiff state payroll tax that made each worker costlier would have dampened hiring because it would raise the overall cost of labor. But quitting California because the state takes $30,000 more out of each additional million dollars that top earners make would be penny wise and pound foolish: They can make more money staying in California

source

Life's not fair,

so tax the rich, they will not go hungry!

[url=

the results do not support Laffer’s insistence that lower tax rates always result in more and better-paying jobs.

Oh well then there is no need to tax cuts, and tax credits for the poor, and middle class.

Since they 'don't' work,

a reply to: neo96

You should at least have read what was quoted:

From OP:

Life's not fair,

so tax the rich, they will not go hungry!

You should at least have read what was quoted:

From OP:

Tax hikes did not hurt California job growth because the taxes were not on jobs but on high incomes. A stiff state payroll tax that made each worker costlier would have dampened hiring because it would raise the overall cost of labor.

Life's not fair,

so tax the rich, they will not go hungry!

a reply to: AlaskanDad

The problem has always been the assumption that tax cuts will result in investment in new business, leading to job creation. That may have worked historically but in my opinion, it was already a bad assumption by the time Laffer introduced the concept to Rumsfeld, Cheney and Jude Wanniski in 1978 — which is about the same time that manufacturing employment peaked.

The problem has always been the assumption that tax cuts will result in investment in new business, leading to job creation. That may have worked historically but in my opinion, it was already a bad assumption by the time Laffer introduced the concept to Rumsfeld, Cheney and Jude Wanniski in 1978 — which is about the same time that manufacturing employment peaked.

a reply to: AlaskanDad

of course tax cuts on the rich and businesses do not create higher wages and more jobs. with the rich and big business it is all about maximization of profit. being able to keep more money means exactly that, they will keep it for themselves. now perhaps if they set up a tax break that is dependent on hiring more full time people (at full time hours), and higher wages for lower level employees it just might do that if they can keep more money by doing it than by not doing it. it is all about greed.

of course tax cuts on the rich and businesses do not create higher wages and more jobs. with the rich and big business it is all about maximization of profit. being able to keep more money means exactly that, they will keep it for themselves. now perhaps if they set up a tax break that is dependent on hiring more full time people (at full time hours), and higher wages for lower level employees it just might do that if they can keep more money by doing it than by not doing it. it is all about greed.

a reply to: AlaskanDad

Yo same GD principal.

Taxes take money out of the economy.

The entire IDEA about Tax cuts is to let people keep more of what they earn.

But that doesn't apply to some people apparently.

Yo same GD principal.

Taxes take money out of the economy.

The entire IDEA about Tax cuts is to let people keep more of what they earn.

But that doesn't apply to some people apparently.

Yup.

That's what my business needs to grow, more taxes. I pay through the nose already.

That's what my business needs to grow, more taxes. I pay through the nose already.

I don't share your enthusiasm for paying taxes. Federal personal income taxes SHOULD be illegal if it weren't for the 16th amendment and no human

being should have to pay a tax to live on their own land. Paying a 'tax' to live on your land is just modern day feudalism.

Corporations should pay taxes and I actually don't have a problem with a tax on purchasing goods and services. At least a tax on goods discourages consumerism and makes savings and investing more attractive options.

If I have to pay income taxes I would be willing to pay state taxes before Federal taxes. The state taxes create more benefits for people and as far as I know there are no states at 'war' and actively killing people.

Corporations should pay taxes and I actually don't have a problem with a tax on purchasing goods and services. At least a tax on goods discourages consumerism and makes savings and investing more attractive options.

If I have to pay income taxes I would be willing to pay state taxes before Federal taxes. The state taxes create more benefits for people and as far as I know there are no states at 'war' and actively killing people.

a reply to: Metallicus

Really everyone knows what our tax money is used for. From bridges to no where. To giving it to evil Isreal. To Studying cow farts, and chinese hookers.

But hey make them evil rich PAY MORE.

LOL.

I wish they would wake up to the fact the problem isn't the evil rich it's the GD monetary system in this country.

Since the dollar is fiat. Rob from one group, and give more worthless paper for them to spend, and they really don't care it all ends up in the same place.

Them evil corporations pockets.

It is utter nonsense.

I favor abolition of the income tax since it has been bastardized in to paying the peoples bills where the power of taxation was given to the state to pay it's own bills.

If I have to pay income taxes I would be willing to pay state taxes before Federal taxes. The state taxes create more benefits for people and as far as I know there are no states at 'war' and actively killing people.

Really everyone knows what our tax money is used for. From bridges to no where. To giving it to evil Isreal. To Studying cow farts, and chinese hookers.

But hey make them evil rich PAY MORE.

LOL.

I wish they would wake up to the fact the problem isn't the evil rich it's the GD monetary system in this country.

Since the dollar is fiat. Rob from one group, and give more worthless paper for them to spend, and they really don't care it all ends up in the same place.

Them evil corporations pockets.

It is utter nonsense.

I favor abolition of the income tax since it has been bastardized in to paying the peoples bills where the power of taxation was given to the state to pay it's own bills.

a reply to: neo96

Wrong the only time higher taxes takes money out of the economy is when the higher taxes is on people who spend close to 100% of their income back into the economy. People that earn a million plus do not spend all of their income back into the economy. Taxing the wealthy does not take money out of the economy.

Taxes take money out of the economy.

Wrong the only time higher taxes takes money out of the economy is when the higher taxes is on people who spend close to 100% of their income back into the economy. People that earn a million plus do not spend all of their income back into the economy. Taxing the wealthy does not take money out of the economy.

a reply to: buster2010

Wrong about what ?

Taken a look at the cost of living in the peoples republic of california, and new york.

Yo that is taxation at work.

Yes it does.

But hey who cares right.

Wrong about what ?

Taken a look at the cost of living in the peoples republic of california, and new york.

Yo that is taxation at work.

Taxing the wealthy does not take money out of the economy.

Yes it does.

But hey who cares right.

a reply to: neo96

Most states today can't pay their own bills. Would you for like your state to jack up your taxes ill they can pay their own bills?

I favor abolition of the income tax since it has been bastardized in to paying the peoples bills where the power of taxation was given to the state to pay it's own bills.

Most states today can't pay their own bills. Would you for like your state to jack up your taxes ill they can pay their own bills?

a reply to: buster2010

Thats right they can't.

Wanna know why ?

They are too busy paying for 'education' and 'free homes', and 'free' healthcare and other rubbish.

Thats right they can't.

Wanna know why ?

They are too busy paying for 'education' and 'free homes', and 'free' healthcare and other rubbish.

a reply to: buster2010

I would dump my money offshore too considering the greed of the mob.

But then again that's a lie for the most part because some people don't bother looking up the reality.

With stuff like the FACTA

www.irs.gov...

Why yes them GD evil rich people only exist to pay for the mob wants!!!!!

I would dump my money offshore too considering the greed of the mob.

But then again that's a lie for the most part because some people don't bother looking up the reality.

With stuff like the FACTA

www.irs.gov...

Why yes them GD evil rich people only exist to pay for the mob wants!!!!!

a reply to: theantediluvian

The Laffer curve does work in some circumstances - the problem was the gross, untested and now provably WRONG assumption by some that it worked in ALL circumstances.

The Laffer curve does work in some circumstances - the problem was the gross, untested and now provably WRONG assumption by some that it worked in ALL circumstances.

edit on 2-12-2014 by Aloysius the Gaul because: curve, not cure!! :O

The govt takes in plenty in tax money. The real problem is spending a $1.40 when you only have $1.00.

We have a 500 billion dollar deficit in 2014.

Take all the money of the ten richest americans and you can almost pay the deficit this year. Next year they will not have that money but that's ok.

Income is not the problem it's overspending.

We have a 500 billion dollar deficit in 2014.

Take all the money of the ten richest americans and you can almost pay the deficit this year. Next year they will not have that money but that's ok.

Income is not the problem it's overspending.

a reply to: buster2010

Even when wealth is put only in a savings account (which wealthy people don't do because of the piss poor return rate on that), that is the money from which banks can loan money to less-wealthy individuals--for business loans, for personal loans, for mortgages, etc.

So, yes, a tax on income removes every cent that is taxed from the economy, unless someone stuffs it in a freezer and forgets it's there.

Even when wealth is put only in a savings account (which wealthy people don't do because of the piss poor return rate on that), that is the money from which banks can loan money to less-wealthy individuals--for business loans, for personal loans, for mortgages, etc.

So, yes, a tax on income removes every cent that is taxed from the economy, unless someone stuffs it in a freezer and forgets it's there.

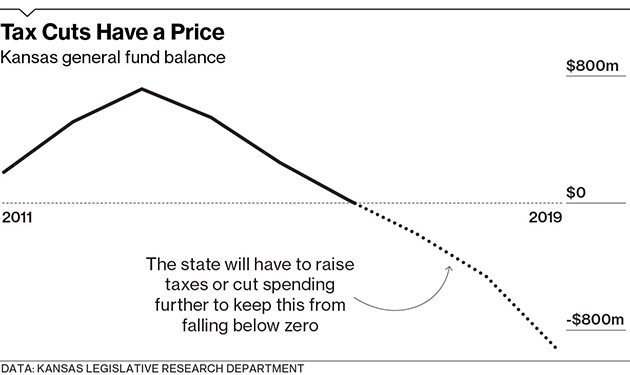

Sam Brownback has been a Tea Partier since before the Tea Party was born. When he became governor of Kansas in 2011, he set about making the state a testing ground for conservative principles, including cutting funding for some public education and the eventual elimination of the state’s income tax. “Our new pro-growth tax policy will be like a shot of adrenaline into the heart of the Kansas economy,” he wrote in a 2012 op-ed. He predicted cutting taxes would “pave the way to the creation of tens of thousands of new jobs, bring tens of thousands of people to Kansas, and help make our state the best place in America to start and grow a small business.”

A little more than a year has passed since the first phase of the Brownback tax cuts went into effect on Jan. 1, 2013, so it’s possible to make a preliminary assessment of their effects. The early verdict: not too good. The jury is still out on whether lower taxes will stimulate businesses to expand and hire over the long term. But the immediate effect has been to blow a hole in the state’s finances without noticeable economic growth.

source

edit on 2-12-2014 by AlaskanDad because: added graph

new topics

-

That which the "news" never talks about; Truth about election fraud

Mainstream News: 26 minutes ago -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness: 33 minutes ago -

Horizon Post office scandal

Regional Politics: 1 hours ago -

Joe Biden and Donald Trump are both traitors

US Political Madness: 3 hours ago -

I'm new here. Avid conspiracy fan.

Introductions: 3 hours ago -

Denmark's Notre-Dame moment - 17th Century Borsen goes up in Flames

Mainstream News: 4 hours ago

top topics

-

Suspected Iranian agent working for Pentagon while U.S. coordinated defense of Israel

US Political Madness: 12 hours ago, 16 flags -

The Baloney aka BS Detection Kit

Social Issues and Civil Unrest: 12 hours ago, 7 flags -

That which the "news" never talks about; Truth about election fraud

Mainstream News: 26 minutes ago, 5 flags -

Denmark's Notre-Dame moment - 17th Century Borsen goes up in Flames

Mainstream News: 4 hours ago, 4 flags -

How does my computer know

Education and Media: 15 hours ago, 3 flags -

I'm new here. Avid conspiracy fan.

Introductions: 3 hours ago, 3 flags -

Joe Biden and Donald Trump are both traitors

US Political Madness: 3 hours ago, 2 flags -

Horizon Post office scandal

Regional Politics: 1 hours ago, 1 flags -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness: 33 minutes ago, 0 flags

active topics

-

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 748 • : Oldcarpy2 -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 18 • : argentus -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 240 • : Threadbarer -

Abortions in first 12 weeks should be legalised in Germany, commission says

Medical Issues & Conspiracies • 18 • : Consvoli -

That which the "news" never talks about; Truth about election fraud

Mainstream News • 1 • : watchitburn -

Joe Biden and Donald Trump are both traitors

US Political Madness • 34 • : andy06shake -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness • 1 • : Disgusted123 -

How does my computer know

Education and Media • 18 • : MrGashler -

Truth Social goes public, be careful not to lose your money

Mainstream News • 114 • : matafuchs -

NYAG Letitia James Prepares to Begin Seizing TRUMP Assets Even Though There Was No Crime.

Above Politics • 285 • : matafuchs