It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Let me begin my giving you brief information about myself:

I'm 21 years old.

I attended a small state college to earn my AA - paid out of pocket for that.

I'm currently attending Florida State University to earn my BA - paying a mixture of my own money and scholarships that I earned by getting good grades for my AA.

I've been living on my own since 18, before I started attending college.

Have supported myself the entire way.

I do not consider myself to be "especially hardworking", or an exception. Rather, I feel as if I represent the average of what someone my age can do and obtain.

Before starting college, I heard constantly about the "student debt crisis", and how expensive college was. I begin my AA at a small state college, and find that the tuition is really affordable. The cost of my AA turned out to be about $6240, which ended up being about $60 a week.

No biggie, this is a small cheap school, so costs are expected to be low.

As I began to attend FSU, I braced myself for the astronomical costs. After all, college is supposed to be absurdly expensive, right?

Wrong.

The cost of one year of tuition at FSU is only $5,016.

But everyone talks about it being "$20,000 per year!!!", right?

Well, sorta. Those high expenses come mostly from cost of living. Things like meal plans (one of the biggest wastes of money), fancy student housing, and other costs.

All part of the "college experience", they say.

THIS is what is sucking my fellow students into debt.

They're told to take out loans on not only their tuition, but also their rent, utilities, food, gas, everything!

It's foolish and absurd.

Want to know how much it costs to take one year of credits at a big university like FSU? $5,016. Let's break that down into manageable numbers.

Let's say you work a job and make $7.93 an hour, which is Florida's minimum wage. In order to afford an education, you would have to work 12 hours a week. Let's make it 16 hours a week, so we can account for taxes and such.

16 hours a week.

That's all it takes. That's all it takes to avoid crushing debt. But we're too lazy.

But you may tell me "What about cost of living?! How can they afford the other $15,000 a year in living costs?!"

$15,000 a year? Foolishness.

Act your wage. Maybe you shouldn't have the $500 per month rent at the nice apartment where you get your own room and bathroom? Maybe you shouldn't get the all inclusive meal-plan that let's you eat at Chick-fil-A or Tropical Smoothie three times a week? Maybe you shouldn't allow yourself $50 a weekend in spending money?

Maybe you should act like an adult NOW to save the future adult you some trouble?

My rent is $250 a month. For this, I share a large enough room with one other guy, and a bathroom.

I'm not special case here. MANY students do this. MANY students recognize the wisdom behind acting your wage.

Don't want $20,000+ of debt per year? Live within your means. Work some weekends.

Please, just stop saying how "tuition should be free", and how these loan companies are "robbing our youth".

Getting an education when you're young is entirely do-able, if you apply yourself. Work a job, save up money during the summer, get good grades so you can apply for scholarships.

Just stop expecting a hand-out.

I'm 21 years old.

I attended a small state college to earn my AA - paid out of pocket for that.

I'm currently attending Florida State University to earn my BA - paying a mixture of my own money and scholarships that I earned by getting good grades for my AA.

I've been living on my own since 18, before I started attending college.

Have supported myself the entire way.

I do not consider myself to be "especially hardworking", or an exception. Rather, I feel as if I represent the average of what someone my age can do and obtain.

Before starting college, I heard constantly about the "student debt crisis", and how expensive college was. I begin my AA at a small state college, and find that the tuition is really affordable. The cost of my AA turned out to be about $6240, which ended up being about $60 a week.

No biggie, this is a small cheap school, so costs are expected to be low.

As I began to attend FSU, I braced myself for the astronomical costs. After all, college is supposed to be absurdly expensive, right?

Wrong.

The cost of one year of tuition at FSU is only $5,016.

But everyone talks about it being "$20,000 per year!!!", right?

Well, sorta. Those high expenses come mostly from cost of living. Things like meal plans (one of the biggest wastes of money), fancy student housing, and other costs.

All part of the "college experience", they say.

THIS is what is sucking my fellow students into debt.

They're told to take out loans on not only their tuition, but also their rent, utilities, food, gas, everything!

It's foolish and absurd.

Want to know how much it costs to take one year of credits at a big university like FSU? $5,016. Let's break that down into manageable numbers.

Let's say you work a job and make $7.93 an hour, which is Florida's minimum wage. In order to afford an education, you would have to work 12 hours a week. Let's make it 16 hours a week, so we can account for taxes and such.

16 hours a week.

That's all it takes. That's all it takes to avoid crushing debt. But we're too lazy.

But you may tell me "What about cost of living?! How can they afford the other $15,000 a year in living costs?!"

$15,000 a year? Foolishness.

Act your wage. Maybe you shouldn't have the $500 per month rent at the nice apartment where you get your own room and bathroom? Maybe you shouldn't get the all inclusive meal-plan that let's you eat at Chick-fil-A or Tropical Smoothie three times a week? Maybe you shouldn't allow yourself $50 a weekend in spending money?

Maybe you should act like an adult NOW to save the future adult you some trouble?

My rent is $250 a month. For this, I share a large enough room with one other guy, and a bathroom.

I'm not special case here. MANY students do this. MANY students recognize the wisdom behind acting your wage.

Don't want $20,000+ of debt per year? Live within your means. Work some weekends.

Please, just stop saying how "tuition should be free", and how these loan companies are "robbing our youth".

Getting an education when you're young is entirely do-able, if you apply yourself. Work a job, save up money during the summer, get good grades so you can apply for scholarships.

Just stop expecting a hand-out.

When I was a Freshman at U of S. Mississippi, I recall all freshmen had to live in the dorms (I'm not sure what the waiver process was). I'm not

familiar with universities now in terms of what is required of students, but I'm sure they levy these types of "requirements" all the time.

Education is business and business is good!

Im rooting for you. I think you will go far with that kind of drive and attitude.

It really depends on where you go…I on the other hand attend Fullsail University which is the top entertainment school in the US and arguably the

world. Cost of my BS is $74,000 but here's the kicker…I have a new class every month and we have no summer breaks so getting a job is basically

impossible. So tack on 28k(had to edit here after looking over the papers) a year to pay food gas rent and the likes. You'd think it would be less but

around here a decent place where you won't get raped shot or robbed is like 900$ a month and that's not even utilities. So I guess it can go both

ways. I just feel lucky knowing the hire rate of people with my degree is like 90%+ and most of them make really good money within a year or two if

not right outta the gate. I do agree that in places with a lot of college student your chances of finding entitled brats goes up…there is no

shortage of them.

edit on 8-10-2014 by RickyD because: (no reason given)

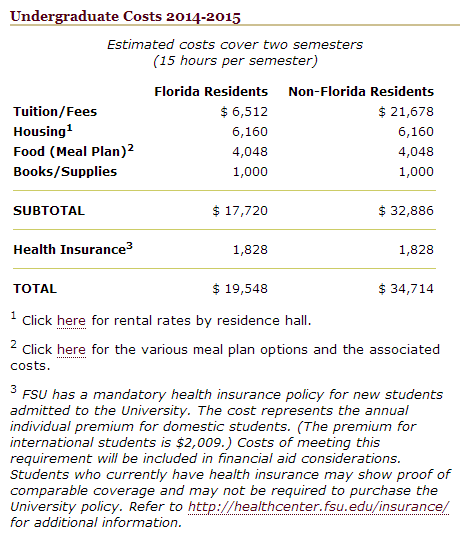

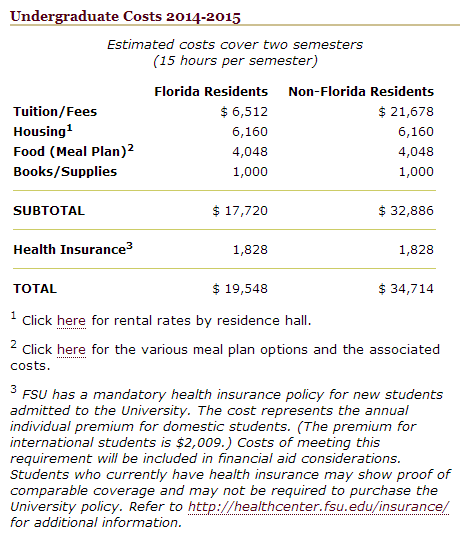

Here is the fee breakdown from Florida State University

admissions.fsu.edu

I don't live in Florida, but finding a decent apartment for $500/month would be extremely difficult in Denver area.

apartments.com

admissions.fsu.edu

I don't live in Florida, but finding a decent apartment for $500/month would be extremely difficult in Denver area.

apartments.com

edit on 8-10-2014 by Elton because: Clarity.

I agree that there are way too many entitled college brats, however, I don't think you can generallize your experience to everyone else. Different

colleges have different tuition's based on many different variables. Also, the cost of living in many areas is just not affordable; not everyone can

find a tolerable person to live with and pay 250 a month for rent. I do agree though that people in college do need a reality check and to start

acting their wage.

double post

edit on 8-10-2014 by Voyaging because: (no reason given)

I'm going to have to take out a bank loan every year to pay for my college because I won't be able to pay out of my pocket anymore. Out of state

costs an eye and a foot.

It's always good to be responsible when dealing with money. You seem to have that kind of responsibility.

It's always good to be responsible when dealing with money. You seem to have that kind of responsibility.

a reply to: gatorboi117

I'm glad that working 16 hours at a minimum wage job is enough to, according to you, avoid crushing debt. That was not the case for me.

I graduated from Ohio State in 2013 and am currently in their MPA (Masters of Public Administration) program at the John Glenn School of Public Affairs. That doesn't matter. What does matter is that during my first year of school, I commuted to the main campus from my parents home about 25 miles north of Columbus (the purpose of this, of course, was to save money). I love my parents, but after a year of that, I wanted a bit of freedom, so a friend and I moved into a "cheap" two bedroom, one bath townhouse in a less-than desirable area off campus, but still within manageable walking distance of most of my classes (the school bus system also stopped close-by, but it wasn't always conducive with my schedule).

This two bedroom, one bath was almost $800 per month before utilities. It was not "fancy." It had leaks, rats, and electrical issues. I worked about 16 hours a week at a CVS Pharmacy, and I made about $8 an hour (I'd been with the company for a few years). Not only did this not cover my full rent after utilities, it didn't even cover the price of books nor did it take care of basic living expenses. I relied on some assistance from my parents, and yes, I took out a few loans to avoid living in poverty. I graduated with my Bachelor's with close to $30,000 in debt. That isn't crippling. I've had friends graduate with almost $100,000 in debt, and they're able to get by just fine with their $65,000+ year jobs (granted, I am not as fortunate; that's why I'm getting my Master's!).

I agree with you on how ridiculous student housing can be. A lot of institutions model their tuition rates around how much money students are able to get through federal loans, which in my opinion is criminal. It's also near criminal how real estate companies can charge students wanting to live just off campus insane monthly rates, especially considering the condition a lot of these apartments, townhouses, and homes are in.

Yes, some kids are snotty and entitled. But there are also a lot of us just trying to get by. Apparently it's easier to do so in Florida.

I'm glad that working 16 hours at a minimum wage job is enough to, according to you, avoid crushing debt. That was not the case for me.

I graduated from Ohio State in 2013 and am currently in their MPA (Masters of Public Administration) program at the John Glenn School of Public Affairs. That doesn't matter. What does matter is that during my first year of school, I commuted to the main campus from my parents home about 25 miles north of Columbus (the purpose of this, of course, was to save money). I love my parents, but after a year of that, I wanted a bit of freedom, so a friend and I moved into a "cheap" two bedroom, one bath townhouse in a less-than desirable area off campus, but still within manageable walking distance of most of my classes (the school bus system also stopped close-by, but it wasn't always conducive with my schedule).

This two bedroom, one bath was almost $800 per month before utilities. It was not "fancy." It had leaks, rats, and electrical issues. I worked about 16 hours a week at a CVS Pharmacy, and I made about $8 an hour (I'd been with the company for a few years). Not only did this not cover my full rent after utilities, it didn't even cover the price of books nor did it take care of basic living expenses. I relied on some assistance from my parents, and yes, I took out a few loans to avoid living in poverty. I graduated with my Bachelor's with close to $30,000 in debt. That isn't crippling. I've had friends graduate with almost $100,000 in debt, and they're able to get by just fine with their $65,000+ year jobs (granted, I am not as fortunate; that's why I'm getting my Master's!).

I agree with you on how ridiculous student housing can be. A lot of institutions model their tuition rates around how much money students are able to get through federal loans, which in my opinion is criminal. It's also near criminal how real estate companies can charge students wanting to live just off campus insane monthly rates, especially considering the condition a lot of these apartments, townhouses, and homes are in.

Yes, some kids are snotty and entitled. But there are also a lot of us just trying to get by. Apparently it's easier to do so in Florida.

a reply to: gatorboi117

Ahh no.

The government is making a PROFIT off students. That's wrong.

The Colleges or Universities are the ones who are charging 15 thousand a year to feed and room students, which is obviously grossly over what it would cost to any normal person.

Congrats on you being able to do that on your own, but that's actually NOT possible for a lot of people.

Tuition costs are low at YOUR school, that does not mean they are low at other schools.

Source

So regardless, costs have risen 40%.

For no reason other than greed.

I applaud you for doing what you are doing, that's great and you'll probably come out ahead of a lot of other people. The issue here is that the post secondary education market is gouging students with fees that should not be that high under any sane person's perspective.

ETA: Sorry if I seem a bit upset, I'm a father of 4 who is currently paying tuition for 2 of my children, to prevent them from being robbed by the federal government in loans. I also live in Canada and the costs associated here can be ridiculous.

~Tenth

Ahh no.

The government is making a PROFIT off students. That's wrong.

The Colleges or Universities are the ones who are charging 15 thousand a year to feed and room students, which is obviously grossly over what it would cost to any normal person.

Congrats on you being able to do that on your own, but that's actually NOT possible for a lot of people.

Tuition costs are low at YOUR school, that does not mean they are low at other schools.

Source

Tuition costs of colleges and universities

Question:

What are the trends in the cost of college education?

Response:

For the 2011–12 academic year, annual current dollar prices for undergraduate tuition, room, and board were estimated to be $14,300 at public institutions, $37,800 at private nonprofit institutions, and $23,300 at private for-profit institutions. Between 2001–02 and 2011–12, prices for undergraduate tuition, room, and board at public institutions rose 40 percent, and prices at private nonprofit institutions rose 28 percent, after adjustment for inflation. The inflation-adjusted price for undergraduate tuition, room, and board at private for-profit institutions was 2 percent lower in 2011–12 than in 2001–02.

SOURCE: U.S. Department of Education, National Center for Education Statistics. (2013). Digest of Education Statistics, 2012 (NCES 2014-015), Chapter 3.

So regardless, costs have risen 40%.

For no reason other than greed.

I applaud you for doing what you are doing, that's great and you'll probably come out ahead of a lot of other people. The issue here is that the post secondary education market is gouging students with fees that should not be that high under any sane person's perspective.

ETA: Sorry if I seem a bit upset, I'm a father of 4 who is currently paying tuition for 2 of my children, to prevent them from being robbed by the federal government in loans. I also live in Canada and the costs associated here can be ridiculous.

~Tenth

edit on 10/8/2014 by tothetenthpower because: (no reason given)

a reply to: tothetenthpower

Thank you for pointing this out.

I've often wondered when the state/federal government stopped looking at college as an investment in the future, and started looking at it as a way to make money off of cash-strapped middle-class students. Universities are just as guilty.

In my case, Ohio State continues to increase tuition rates, add to the football stadium, and build impressive new structures (student centers, dorms, classrooms, etc). Yet all the while, you can walk through any building at any time during the day and find more than half the classrooms empty. Totally unused. In fact, my senior year I remember taking my final Spanish class in the top floor of a five-story building. Our classroom was the only one being utilized on the entire floor. Walking to the bathroom was like walking through an abandoned early-century high school. It was genuinely creepy.

Now, all of these new buildings aren't being built just from additional revenues from tuition rates, as there are always millionaire alumni looking to fund most of the costs of a new building just to have their name plastered on the side of it, but the problem still exists. The university has more money than they know what to do with, yet they're always looking for more. It's greed.

Thank you for pointing this out.

I've often wondered when the state/federal government stopped looking at college as an investment in the future, and started looking at it as a way to make money off of cash-strapped middle-class students. Universities are just as guilty.

In my case, Ohio State continues to increase tuition rates, add to the football stadium, and build impressive new structures (student centers, dorms, classrooms, etc). Yet all the while, you can walk through any building at any time during the day and find more than half the classrooms empty. Totally unused. In fact, my senior year I remember taking my final Spanish class in the top floor of a five-story building. Our classroom was the only one being utilized on the entire floor. Walking to the bathroom was like walking through an abandoned early-century high school. It was genuinely creepy.

Now, all of these new buildings aren't being built just from additional revenues from tuition rates, as there are always millionaire alumni looking to fund most of the costs of a new building just to have their name plastered on the side of it, but the problem still exists. The university has more money than they know what to do with, yet they're always looking for more. It's greed.

a reply to: Judge_Holden

"Acting your wage" means not moving into an apartment for the reason of 'wanting some freedom.' In your case, you got a little freedom from parents (but lived with a roommate in a not-so-great apartment), and in return got $30,000 in debt.

I'd have put up with mom and dad a bit longer if my goal was to avoid the shackles of debt post schooling. Freedom from parents is overrated when replaced wi thte shackles of debt, IMO.

"Acting your wage" means not moving into an apartment for the reason of 'wanting some freedom.' In your case, you got a little freedom from parents (but lived with a roommate in a not-so-great apartment), and in return got $30,000 in debt.

I'd have put up with mom and dad a bit longer if my goal was to avoid the shackles of debt post schooling. Freedom from parents is overrated when replaced wi thte shackles of debt, IMO.

a reply to: SlapMonkey

Oh, I lived within my wage the best I could. I ate Ramen noodles, microwavable mac-n-cheese, peanut butter and jelly sandwiches, the like. I did not wind up with this debt because I wanted a little bit of freedom. You are gravely ignorant of my situation, but that's fine. I didn't cover every little detail.

I wound up in debt because of increasing tuition rates, horrible wages, and overpriced books. But as I mentioned, the debt I have is by no means crippling, and your use of the term "shackled with debt" is incorrect (in my case, at least). I am a full-time graduate student with a well-paying job that provides me with loan assistance, debt relief, health insurance, etc. Maybe I'm lucky, but I did it the right way. I busted my butt in school, graduated with honors, worked internships (the majority of which were unpaid), and as a result, I am able to live comfortably while being "shackled" with debt.

The point of my original response to the OP was that he/she seems to think that their circumstance can be applied to everyone, which clearly is not the case. Tuition rates are different depending on where you live, whether or not you are attending a school in your home state, whether or not the school is public or private, etc. It's easy to say that recent college grads are in debt because they are lazy, but that doesn't make it so.

Oh, I lived within my wage the best I could. I ate Ramen noodles, microwavable mac-n-cheese, peanut butter and jelly sandwiches, the like. I did not wind up with this debt because I wanted a little bit of freedom. You are gravely ignorant of my situation, but that's fine. I didn't cover every little detail.

I wound up in debt because of increasing tuition rates, horrible wages, and overpriced books. But as I mentioned, the debt I have is by no means crippling, and your use of the term "shackled with debt" is incorrect (in my case, at least). I am a full-time graduate student with a well-paying job that provides me with loan assistance, debt relief, health insurance, etc. Maybe I'm lucky, but I did it the right way. I busted my butt in school, graduated with honors, worked internships (the majority of which were unpaid), and as a result, I am able to live comfortably while being "shackled" with debt.

The point of my original response to the OP was that he/she seems to think that their circumstance can be applied to everyone, which clearly is not the case. Tuition rates are different depending on where you live, whether or not you are attending a school in your home state, whether or not the school is public or private, etc. It's easy to say that recent college grads are in debt because they are lazy, but that doesn't make it so.

a reply to: mwood

Look them up and you'll understand. Also not every program there is a good investment…however for Live Show Production it is the top in the US hands down. They are the only school I could find allowing students time on actual top notch industry standard equipment out there. Also I just heard Clair Bros…(biggest touring company out there) is building a school up at their PA H.Q. that going to top Fullsail…but only for their employees. It will feature places to fly entire full-size Pas and any stage that would be used for a full size international tour.

Look them up and you'll understand. Also not every program there is a good investment…however for Live Show Production it is the top in the US hands down. They are the only school I could find allowing students time on actual top notch industry standard equipment out there. Also I just heard Clair Bros…(biggest touring company out there) is building a school up at their PA H.Q. that going to top Fullsail…but only for their employees. It will feature places to fly entire full-size Pas and any stage that would be used for a full size international tour.

Yeah about a year ago I had a couple of guys in class bragging about how they spent 1,500+ of student loan money on a party. They started whining

after about a month because they had no money left and would whine about how they (the school) needed to give more money in loans bc they couldn't

live off of what they got. I just laughed...

You know what I'm sick of?

People thinking all college students are entitled, lazy, and stupid. As well as being self righteous about it.

The numbers you put in your post are extremely unrealistic in terms of tuition, working hours, and rent. You may be able to find a decent apartment for 500$ a month in Florida but here in Fort Collins, CO and many other parts of the US it's extremely hard.

Your 16 working hours? I don't know what kind of job you have but at 8.00$ an hour that's 512$ a month before taxes. Hardly enough to afford tuition, an apartment, food, any medications, gas, a car payment, cellphone bill, insurance, or any other expenses someone may have.

Unless a student is extremely lucky with the major they have chosen there is no way they can work much more than 20 hours and remain sane. My major was in Music and while that may seem like an easy major it wasn't. Most of my classes were 1 credit or less but required much more time in commitment than that. For instance I was in the Marching Band for 3 years and received scholarship money for doing so. However most of my Saturdays were spent playing at games, there were two hours of practice time each MWF evening add the rest of my classes on that and you have little time for a part time job. Not everyone is taking out debt just to be lazy.

End rant.

People thinking all college students are entitled, lazy, and stupid. As well as being self righteous about it.

The numbers you put in your post are extremely unrealistic in terms of tuition, working hours, and rent. You may be able to find a decent apartment for 500$ a month in Florida but here in Fort Collins, CO and many other parts of the US it's extremely hard.

Your 16 working hours? I don't know what kind of job you have but at 8.00$ an hour that's 512$ a month before taxes. Hardly enough to afford tuition, an apartment, food, any medications, gas, a car payment, cellphone bill, insurance, or any other expenses someone may have.

Unless a student is extremely lucky with the major they have chosen there is no way they can work much more than 20 hours and remain sane. My major was in Music and while that may seem like an easy major it wasn't. Most of my classes were 1 credit or less but required much more time in commitment than that. For instance I was in the Marching Band for 3 years and received scholarship money for doing so. However most of my Saturdays were spent playing at games, there were two hours of practice time each MWF evening add the rest of my classes on that and you have little time for a part time job. Not everyone is taking out debt just to be lazy.

End rant.

a reply to: asmall89

Exactly. Op is clearly blinded by his own position and attitutes.

We can only hope this keeps working out for op, however, I do feel we should warn you that many of us have, at some point in life, thought "hey, this life thing id pretty easy! Stupid people complaoning...", and that, is when she slaps you in the face when you least expect it.

Good luck with that well thought out routine, im honestly not being ironic!

Exactly. Op is clearly blinded by his own position and attitutes.

We can only hope this keeps working out for op, however, I do feel we should warn you that many of us have, at some point in life, thought "hey, this life thing id pretty easy! Stupid people complaoning...", and that, is when she slaps you in the face when you least expect it.

Good luck with that well thought out routine, im honestly not being ironic!

a reply to: Judge_Holden

Forgive my grave ignorance--I could only comment on what I read from what you were willing to share.

I'm glad that you're doing well for yourself and aren't shackled down by the debt you incurred. The sad thing is, I know plenty who are because they unfortunately started in a university that was above their means (during a decent economy) and then graduated the same college when there were no jobs (in a crappy economy). While their situation is unfortunate, no one forced them to take out loans, as there are plenty of alternatives to a four-year degree that cost way less and could lead to as good a financial life.

I think that was the OP's point--there are alternatives to the "norm" of hitting a 4-year college straight out of high school, especially when the common step to getting there is (often times) insurmountable debt. Imagine if you hadn't landed the job you have...I know plenty of my university contemporaries who are still not working in the field that we studied. Some re-educated themselves for something else, while others are still trying. We seem to be fortunate--through hard work, luck, or both--that we are not in those shoes.

But like I said, please excuse my initial response, but you only gave me so much info with which to work.

Forgive my grave ignorance--I could only comment on what I read from what you were willing to share.

I'm glad that you're doing well for yourself and aren't shackled down by the debt you incurred. The sad thing is, I know plenty who are because they unfortunately started in a university that was above their means (during a decent economy) and then graduated the same college when there were no jobs (in a crappy economy). While their situation is unfortunate, no one forced them to take out loans, as there are plenty of alternatives to a four-year degree that cost way less and could lead to as good a financial life.

I think that was the OP's point--there are alternatives to the "norm" of hitting a 4-year college straight out of high school, especially when the common step to getting there is (often times) insurmountable debt. Imagine if you hadn't landed the job you have...I know plenty of my university contemporaries who are still not working in the field that we studied. Some re-educated themselves for something else, while others are still trying. We seem to be fortunate--through hard work, luck, or both--that we are not in those shoes.

But like I said, please excuse my initial response, but you only gave me so much info with which to work.

originally posted by: asmall89

You know what I'm sick of?

People thinking all college students are entitled, lazy, and stupid. As well as being self righteous about it.

The numbers you put in your post are extremely unrealistic in terms of tuition, working hours, and rent. You may be able to find a decent apartment for 500$ a month in Florida but here in Fort Collins, CO and many other parts of the US it's extremely hard.

Your 16 working hours? I don't know what kind of job you have but at 8.00$ an hour that's 512$ a month before taxes. Hardly enough to afford tuition, an apartment, food, any medications, gas, a car payment, cellphone bill, insurance, or any other expenses someone may have.

Unless a student is extremely lucky with the major they have chosen there is no way they can work much more than 20 hours and remain sane. My major was in Music and while that may seem like an easy major it wasn't. Most of my classes were 1 credit or less but required much more time in commitment than that. For instance I was in the Marching Band for 3 years and received scholarship money for doing so. However most of my Saturdays were spent playing at games, there were two hours of practice time each MWF evening add the rest of my classes on that and you have little time for a part time job. Not everyone is taking out debt just to be lazy.

End rant.

Cars (and, by extension, gas and repairs), cell phones, insurance--those are all luxuries if you can't afford them. That's a fact that you can't ignore. Yes, they are societal norms, but societal norms are why 1/3 American adults have debt in collections. Keeping up with the Joneses, so to speak, is not a financially viable way to live, especially when in college.

While I agree that some of the OP's math doesn't quite add up in the real world (unless one has a parent willing and capable of helping out), he's not far off the mark with his philosophy on the subject. It's easy to make excuses as to why someone needs more money to do something--the government does it all the time--but it's extremely hard to actually set up a minimalist's budget and stick to it. And that's the point the OP made; it's the feeling that it's a necessity to take out student loans for things other than tuition and books. THAT is where the debt comes from, by funding a lifestyle that college students don't need, but want, and most can't afford, but find a way to pay someone on Tuesday for a hamburger today.

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 46 minutes ago -

Electrical tricks for saving money

Education and Media: 3 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 5 hours ago -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 6 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 9 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 11 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 16 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 5 hours ago, 8 flags -

Bobiverse

Fantasy & Science Fiction: 16 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 13 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 3 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 6 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 11 hours ago, 1 flags

active topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 34 • : WeMustCare -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 53 • : pianopraze -

Sunak spinning the sickness figures

Other Current Events • 5 • : glen200376 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 44 • : MikeDeGrasseTyson -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 31 • : budzprime69 -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 33 • : rickymouse -

The Reality of the Laser

Military Projects • 46 • : Zaphod58 -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 0 • : randomuser2034 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 136 • : ImagoDei -

Electrical tricks for saving money

Education and Media • 3 • : Mike72