It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

6

share:

In the words of George Santayana "Those who cannot remember the past are condemned to repeat it." Obviously no one at Wells Fargo has ever heard

these words or if they have do not believe it could possibly apply to them.

Wells Fargo has brought the (continuing) financial disaster full circle once again with their return to offering subprime lending for mortgages. One has to wonder, are they crazy or just stupid? Perhaps they are just crazy and don't care.

The Crisis Circle Is Complete: Wells Fargo Returns To Subprime

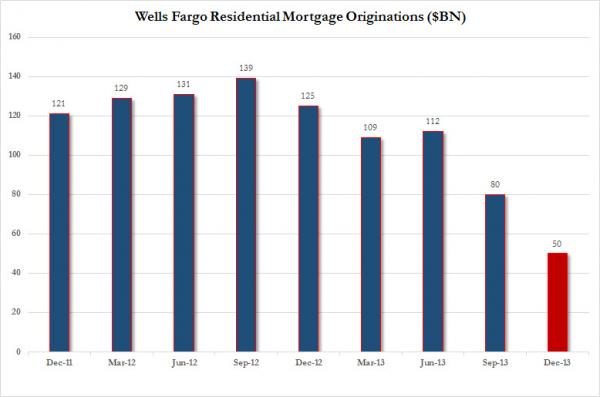

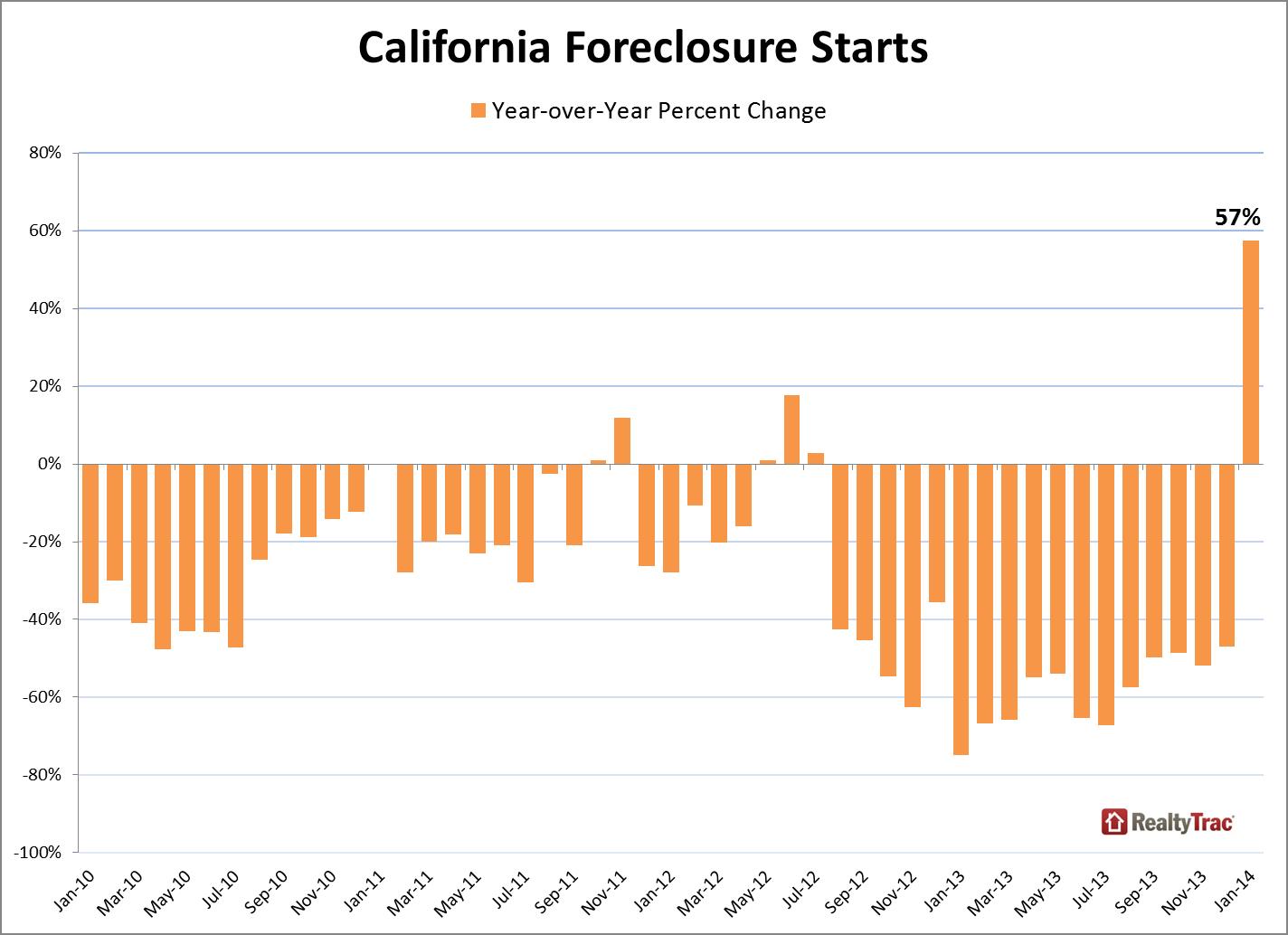

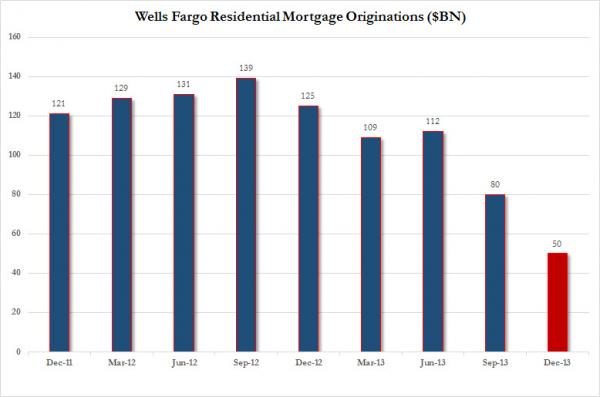

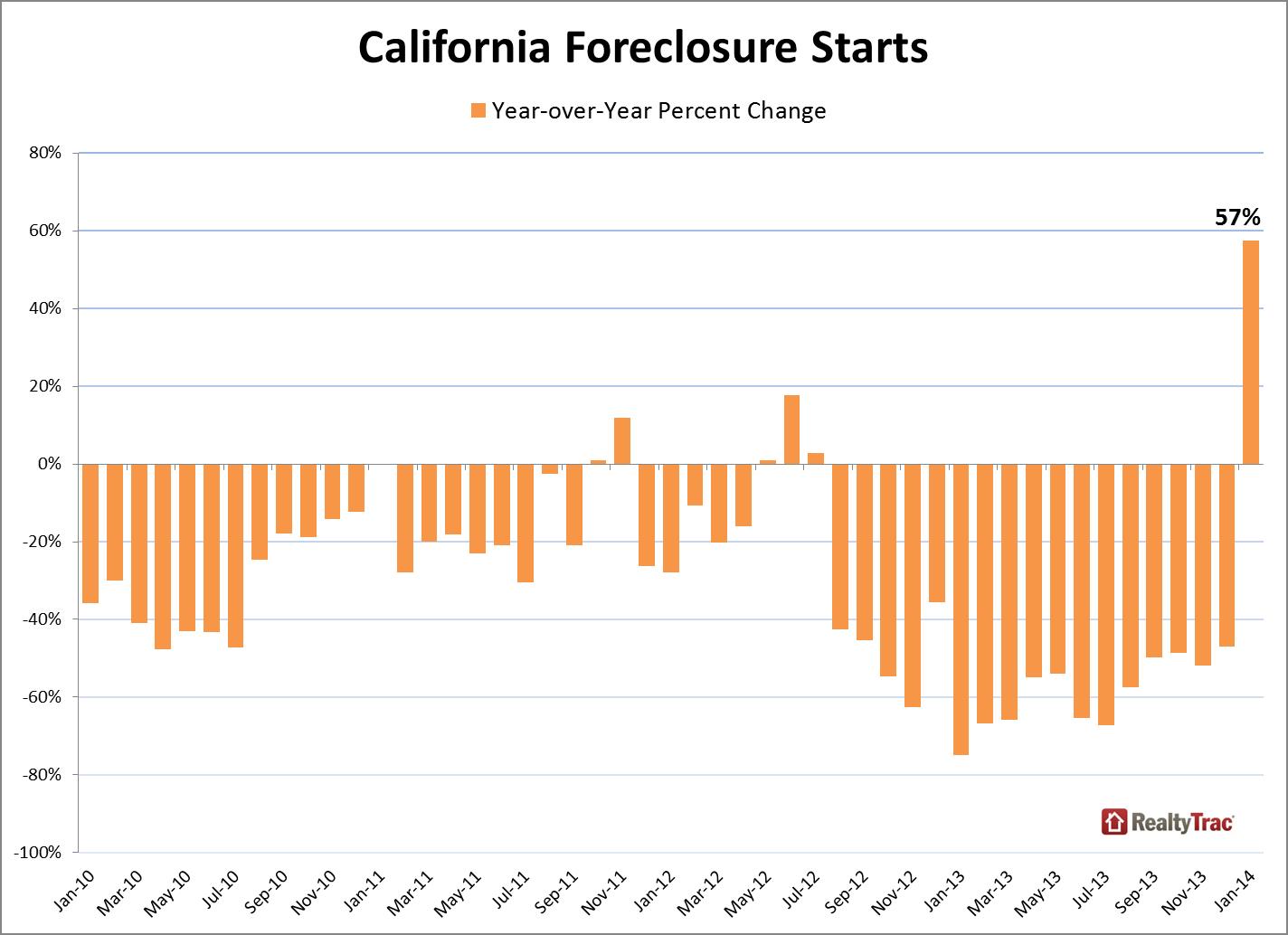

Now at this point you may be asking yourself why would Wells Fargo even consider such a thing. The answer is quite simple as the two charts below show.

Looks like Wells Fargo is getting desperate enough to take us back to a place we should not be going. It is just one bank though, right? Maybe if they rename subprime to something else it will make a difference. Hold on to your hats, here we go again.

Wells Fargo has brought the (continuing) financial disaster full circle once again with their return to offering subprime lending for mortgages. One has to wonder, are they crazy or just stupid? Perhaps they are just crazy and don't care.

The Crisis Circle Is Complete: Wells Fargo Returns To Subprime

So what is a bank with a limited target audience for its primary product to do? Why expand the audience of course. And in a move that is very much overdue considering all the other deranged aspects of the centrally-planned New Normal, in which all the mistakes of the last credit bubble are being repeated one after another, Reuters now reports that the California bank "is tiptoeing back into subprime home loans again."

And so the circle is complete.

Now at this point you may be asking yourself why would Wells Fargo even consider such a thing. The answer is quite simple as the two charts below show.

Looks like Wells Fargo is getting desperate enough to take us back to a place we should not be going. It is just one bank though, right? Maybe if they rename subprime to something else it will make a difference. Hold on to your hats, here we go again.

So far few other big banks seem poised to follow Wells Fargo's lead, but some smaller companies outside the banking system, such as Citadel Servicing Corp, are already ramping up their subprime lending. To avoid the taint associated with the word "subprime," lenders are calling their loans "another chance mortgages" or "alternative mortgage programs."

reply to post by Bassago

I know nothing about mortgages and all that but Wells Fargo is my bank and I do not like them but I'm kind of stuck with them. They are always bugging me to sign up for some form of credit from them. I don't even work! They push it every time i go there and every time they bug me I curse them out. You would think they'd stop trying!

Banks are crooks. They don't care if you go into debt and lose everything as long as they get you to sign the dotted line that is all they care about.

I know nothing about mortgages and all that but Wells Fargo is my bank and I do not like them but I'm kind of stuck with them. They are always bugging me to sign up for some form of credit from them. I don't even work! They push it every time i go there and every time they bug me I curse them out. You would think they'd stop trying!

Banks are crooks. They don't care if you go into debt and lose everything as long as they get you to sign the dotted line that is all they care about.

reply to post by mblahnikluver

Many folks don't pay much attention to mortgage stuff unless they're looking to buy a home. Pretty much everything Wells Fargo is doing here (again) could be viewed with the following in mind.

Basically they broke the world of finance, banking and as collateral damage millions of lives. Now they're beginning again.

Many folks don't pay much attention to mortgage stuff unless they're looking to buy a home. Pretty much everything Wells Fargo is doing here (again) could be viewed with the following in mind.

The U.S. subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2008. It was characterized by a rise in subprime mortgage delinquencies and foreclosures

Info on the SubPrime Crisis

Basically they broke the world of finance, banking and as collateral damage millions of lives. Now they're beginning again.

edit on

833pm4848pm12014 by Bassago because: add link

The first round of subprime was hailed as brilliance much like the creation of derivatives. This second round shows just how insanely retarded these

schmucks are.

I banked with wells fargo many years ago. Never again!

Chase bank these days, and I never have an issue, because I fully understand the contract and am not an idiot.

This bank should be dismantled and sold off to more competent banking institutions. Do they even exist anymore?

I banked with wells fargo many years ago. Never again!

Chase bank these days, and I never have an issue, because I fully understand the contract and am not an idiot.

This bank should be dismantled and sold off to more competent banking institutions. Do they even exist anymore?

reply to post by webedoomed

I don't know if any exist or not. Especially in light of the fiat money fractional-reserve banking schemes, depositor haircuts and insolvent deposit insurance plans.

Selling them probably wouldn't help as another bank would just buy them out and current banking seems controlled by systemic greed and opportunism.

This bank should be dismantled and sold off to more competent banking institutions. Do they even exist anymore?

I don't know if any exist or not. Especially in light of the fiat money fractional-reserve banking schemes, depositor haircuts and insolvent deposit insurance plans.

Selling them probably wouldn't help as another bank would just buy them out and current banking seems controlled by systemic greed and opportunism.

edit on 846pm4040pm12014 by Bassago because: (no reason given)

I'm going to play devil's advocate here.

The isolated act of subprime lending is not inherently bad. In fact, it's good for a lot of people. Banks and investors can invest money at an increased return if they're interested in the risk, and people with less-than-perfect credit can still purchase a house and build equity.

However it's extremely important in these cases that there is transparency about the risk to all involved parties.

In the subprime crisis, there was a combination of

1) Adjustable rate mortgages. Increasing interest rates on these mortgages inflated the payments beyond what could be paid, resulting in these subprime loans defaulting at higher than expected rates

2) Many subprime mortgages were "packaged" with regular, less risky mortgages. These were sold to other institutions and used to back assets and further borrowing.

So with 1, borrowers who were not financially savvy or easily misled made poor decisions and agreed to contracts they could not be even reasonably sure they would be able to fulfill.

And with 2, investors were shown rates of return on investments which were very high and looked great, but were not properly informed of the increased risk. These packages were essentially gold-plated lead bars being advertised as solid gold.

Now of course, greed, mainly from the bankers, caused this big problem.

But in no way does that mean that simply the act of offering loans to those with lower credit scores is a bad thing.

Of course, they'll probably do all the "bad stuff" again to cause another crisis anyway

The isolated act of subprime lending is not inherently bad. In fact, it's good for a lot of people. Banks and investors can invest money at an increased return if they're interested in the risk, and people with less-than-perfect credit can still purchase a house and build equity.

However it's extremely important in these cases that there is transparency about the risk to all involved parties.

In the subprime crisis, there was a combination of

1) Adjustable rate mortgages. Increasing interest rates on these mortgages inflated the payments beyond what could be paid, resulting in these subprime loans defaulting at higher than expected rates

2) Many subprime mortgages were "packaged" with regular, less risky mortgages. These were sold to other institutions and used to back assets and further borrowing.

So with 1, borrowers who were not financially savvy or easily misled made poor decisions and agreed to contracts they could not be even reasonably sure they would be able to fulfill.

And with 2, investors were shown rates of return on investments which were very high and looked great, but were not properly informed of the increased risk. These packages were essentially gold-plated lead bars being advertised as solid gold.

Now of course, greed, mainly from the bankers, caused this big problem.

But in no way does that mean that simply the act of offering loans to those with lower credit scores is a bad thing.

Of course, they'll probably do all the "bad stuff" again to cause another crisis anyway

reply to post by TheBlackTiger

I agree with you on both counts. There are many who suffer under poor credit scores due to no fault of their own, such as medical crisis or loss of a job. If the the banks take this into account (assuming the person now has a job) then they should be able to buy a home.

Currently banks seem to be doing a lot of bad things.

But in no way does that mean that simply the act of offering loans to those with lower credit scores is a bad thing.

Of course, they'll probably do all the "bad stuff" again to cause another crisis anyway

I agree with you on both counts. There are many who suffer under poor credit scores due to no fault of their own, such as medical crisis or loss of a job. If the the banks take this into account (assuming the person now has a job) then they should be able to buy a home.

Currently banks seem to be doing a lot of bad things.

new topics

-

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago -

Bobiverse

Fantasy & Science Fiction: 9 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago -

Former Labour minister Frank Field dies aged 81

People: 11 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 13 hours ago, 7 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago, 7 flags -

This is our Story

General Entertainment: 16 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 11 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 9 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago, 2 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 96 • : CriticalStinker -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 8 • : lordcomac -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 140 • : Annee -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 16 • : grey580 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 22 • : RickyD -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 35 • : Consvoli -

Late Night with the Devil - a really good unusual modern horror film.

Movies • 1 • : DAVID64 -

Ditching physical money

History • 18 • : annonentity -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 32 • : SchrodingersRat -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 279 • : KrustyKrab

6