It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Alright, I'm not liking the looks of this considering the current state of the markets and bankers dying off as we saw a short while back. Maybe

it's nothing but I've never heard of "banking disaster preparedness" drills in the past.

Federal Reserve Issues Warning, Bank Drills, Possible False Flag

So, maybe we should make some withdrawals before these "disaster drills" take place. Any other perspectives on this other than get to an ATM now?

Federal Reserve Issues Warning, Bank Drills, Possible False Flag

Either the new Federal Reserve Chairman Janet Yellen is a prepper, or there is something afoot in the world of banking. Bankers typically talk in terms of contingency plans and liquidation programs, not prepping for disasters.

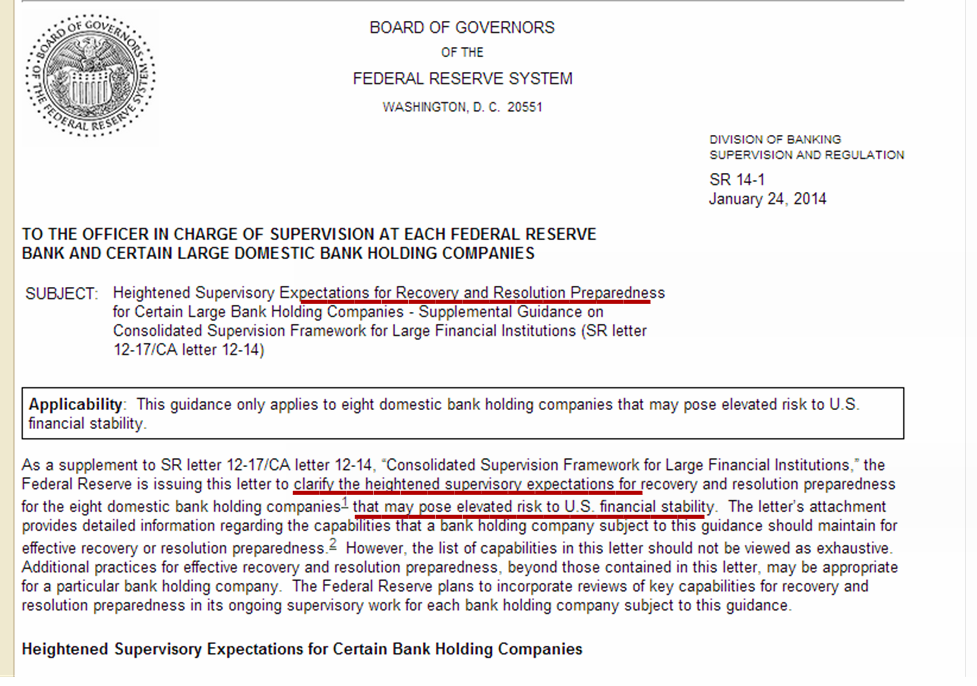

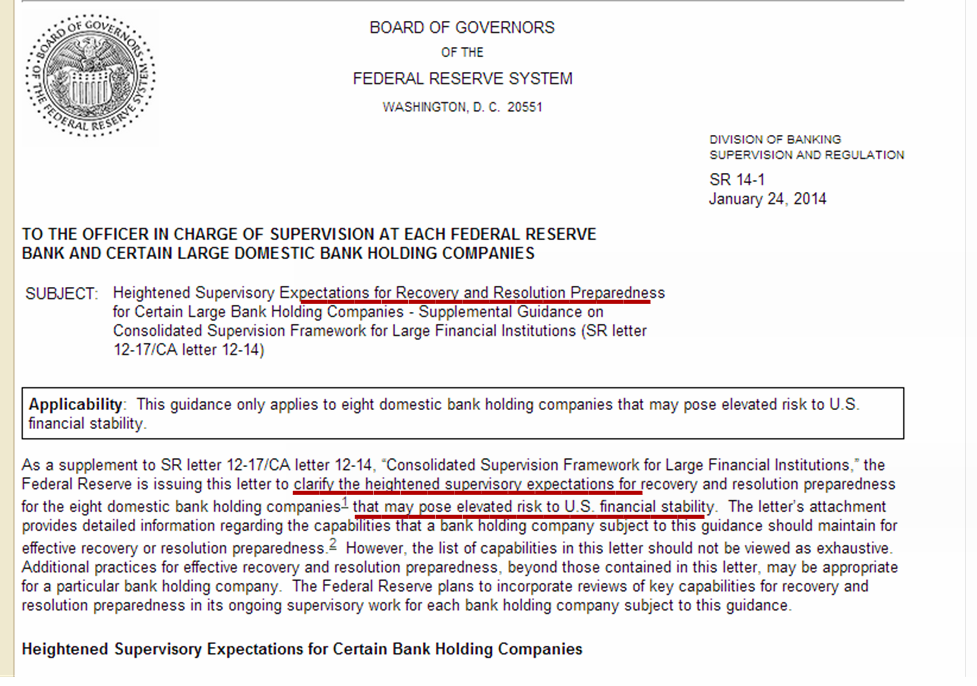

In January of this year, Supervisory Regulation (SR) 14-01 was issued in regarding the need for bank preparedness particularly for the eight bank holding companies (BHCs) in the United States. According to the memo, there are eight Bank Holding Companies that appear to be at risk and that risk threatens the financial stability of the United States. These eight companies are Bank of America Corporation, Bank of New York Mellon Corporation, PLC, Citigroup Inc., Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, State Street Corporation, and Wells Fargo & Company.

The memo, dated January 24, was the first one of the year. It was sent from Michael Gibson to the top banks to stress increased supervisory expectations.

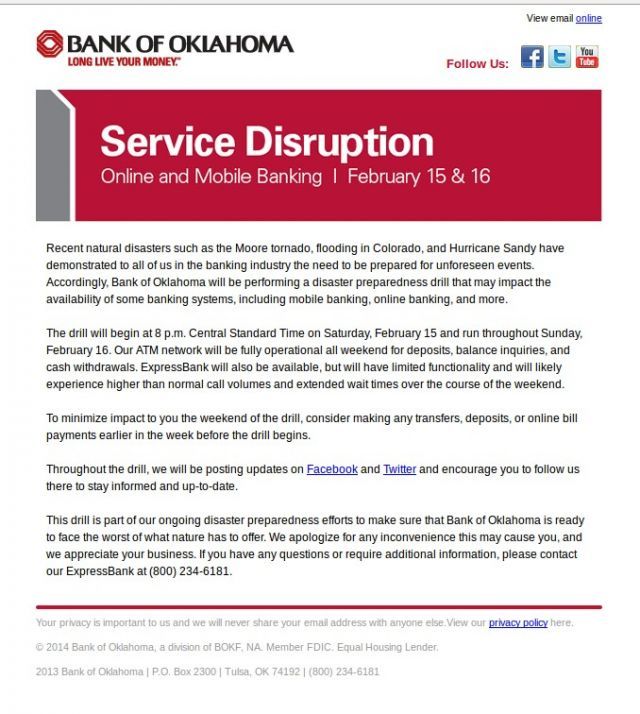

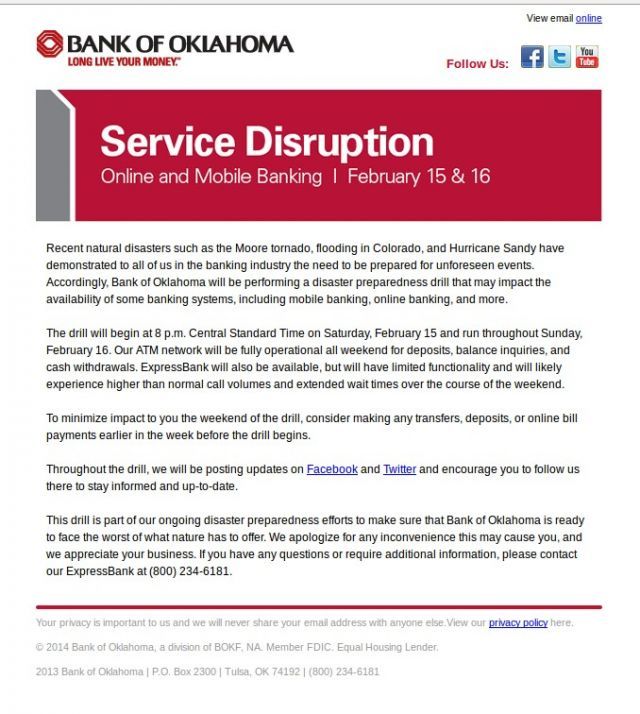

Shortly after the “increased supervision” of the big eight, customers at other banks started getting notices of bank drills where services will be limited.

A similar email advisory went out to all of their customers. The Bank of Arizona, Bank of Oklahoma, and the Bank of Texas have all been mentioned as having this drill.

So, maybe we should make some withdrawals before these "disaster drills" take place. Any other perspectives on this other than get to an ATM now?

reply to post by Bassago

oh...for the love of God....man!!

2013 sucked....2014 was supposed to be a better year. I had so much enthusiasm .... but all we are getting is more HOPE and CHANGE and TRANSPARENCY.

I know....it was silly of me....wishful thinking.

thanks for sharing Bassago.....

Edit: Isn't this how it all started in Cypress and Greece?

oh...for the love of God....man!!

2013 sucked....2014 was supposed to be a better year. I had so much enthusiasm .... but all we are getting is more HOPE and CHANGE and TRANSPARENCY.

I know....it was silly of me....wishful thinking.

thanks for sharing Bassago.....

edit on 7-2-2014 by UxoriousMagnus because: (no reason given)

Edit: Isn't this how it all started in Cypress and Greece?

edit on 7-2-2014 by UxoriousMagnus because: (no reason given)

edit

on 7-2-2014 by UxoriousMagnus because: (no reason given)

something related?

related

Key Regulatory Priorities for 2014

And I remember there was a drill taking place on 9/11/2001 too.

WASHINGTON, Feb 5 (Reuters) - A top U.S. bank regulator plans to tell lawmakers on Thursday that final leverage rules for U.S. banks will incorporate recent revisions to a global capital standard, which likely means tougher requirements for the institutions.

U.S. regulators proposed rules in July to limit the extent to which banks may fund their activities through debt, part of the Basel III global agreement to boost banks' capital levels.

In January, the international group revised the way it requires banks to calculate whether they are meeting the leverage requirements. That latest version is seen as somewhat tougher on banks than the method U.S. regulators initially proposed for firms operating in the country.

U.S. bank leverage rules to include global revisions -Fed governor

related

Key Regulatory Priorities for 2014

And I remember there was a drill taking place on 9/11/2001 too.

reply to post by xuenchen

I'm not sure whether it's related or not. Keeping up with all this is sometimes a bit difficult. One thing that bothered me was the wording in the Fed's message.

Then the Bank of Oklahoma points to threats such as floods, tornado's and Hurricane Sandy. Never seen the like of it before. Not saying they shouldn't be prepared, but some of these "drills" seem to run in tandem with disasters.

I'm not sure whether it's related or not. Keeping up with all this is sometimes a bit difficult. One thing that bothered me was the wording in the Fed's message.

"Eight domestic bank holding companies that may pose an elevated risk to US financial stability"

Then the Bank of Oklahoma points to threats such as floods, tornado's and Hurricane Sandy. Never seen the like of it before. Not saying they shouldn't be prepared, but some of these "drills" seem to run in tandem with disasters.

edit on 346am2525am12014 by Bassago because: (no reason

given)

Get your Money, get food. Store some fuel. This is working like Clock Work. What really gets me, is why NOT ONE member here is talking about the Davos

Economic Sumit just pasted. Within 24 hrs the collapse began. This was planned, and has nothing to do with the crap the talking heads are using as

excuse for the stock market! Planned and executed. Fact! Get your S%¤T together! It is not comming anymore it is here!

reply to post by Bassago

Maybe. If you bank at the Bank of Oklahoma.

So, maybe we should make some withdrawals before these "disaster drills" take place.

Maybe. If you bank at the Bank of Oklahoma.

edit on 2/7/2014 by Phage because: (no reason given)

reply to post by UxoriousMagnus

Well a little maybe. Here the Fed and banks seem to be looking to external disaster preparedness. With Cyprus they were crumbling internally under bad loans, corruption and...

Hmm...

Isn't this how it all started in Cypress and Greece?

Well a little maybe. Here the Fed and banks seem to be looking to external disaster preparedness. With Cyprus they were crumbling internally under bad loans, corruption and...

Hmm...

Phage

reply to post by Bassago

So, maybe we should make some withdrawals before these "disaster drills" take place.

Maybe. If you bank at the Bank of Oklahoma.edit on 2/7/2014 by Phage because: (no reason given)

Bank of Oklahoma is owned by BOK Financial. They also own Bank of Arkansas, Bank of Kansas City, Colorado State Bank and Trust, BOSC, Inc., Cavanal Hill, TransFund and HomeDirect Mortgage.

reply to post by Bassago

Ok.

But the letter is talking about Bank of Oklahoma. Not Bank of Arkansas, Bank of Kansas City, Colorado State Bank and Trust, BOSC, Inc., Cavanal Hill, TransFund or HomeDirect Mortgage.

But I don't bank with any of them anyway.

Ok.

But the letter is talking about Bank of Oklahoma. Not Bank of Arkansas, Bank of Kansas City, Colorado State Bank and Trust, BOSC, Inc., Cavanal Hill, TransFund or HomeDirect Mortgage.

But I don't bank with any of them anyway.

Or these "drills" could be a test to see how people respond to their bank telling them they will not be able to get money for two days. I'm

suggesting that maybe they just want to see how many customers show up to withdraw their money. A "testing" for bank runs.

There was an economist I listened to years ago who said that when the banks in America started making announcements that customers would not be able to withdraw their funds, that this would cause bank runs. That's how banks start collapsing. The next few weeks will be intersting with some of the headlines the last few days.

There was an economist I listened to years ago who said that when the banks in America started making announcements that customers would not be able to withdraw their funds, that this would cause bank runs. That's how banks start collapsing. The next few weeks will be intersting with some of the headlines the last few days.

reply to post by Bassago

No.

SR 14-1 is not about disaster preparedness. It is about bank holding companies ensuring that the assets they are dealing with are valid. Nothing about "external disaster".

www.federalreserve.gov...

Oh, BOK is not on the list of 8 holding companies referred to in the letter.

Here the Fed and banks seem to be looking to external disaster preparedness.

No.

SR 14-1 is not about disaster preparedness. It is about bank holding companies ensuring that the assets they are dealing with are valid. Nothing about "external disaster".

Through horizontal comparisons, Federal Reserve supervisory staff has observed a range of capabilities which are critical to certain large bank holding companies’ operational resilience and contingency planning in circumstances where capital and liquidity buffers are strained and to the resiliency of the financial system as a whole. Specifically, a bank holding company subject to this guidance should have:

www.federalreserve.gov...

Oh, BOK is not on the list of 8 holding companies referred to in the letter.

reply to post by Phage

True. The article only speculates that this may extend to their corporate level or further but without any actual proof of that (yet) it is just speculation.

I suppose it simply comes down to your faith in banks. Mine is pretty low though.

Edit to add - So what I'm getting here is the Fed telling banks to stress test to ensure compliance with Dodd-Frank and the Bank of OK is saying it's because of tornado's and floods. . ? Maybe I'm reading this wrong.

But the letter is talking about Bank of Oklahoma.

True. The article only speculates that this may extend to their corporate level or further but without any actual proof of that (yet) it is just speculation.

I suppose it simply comes down to your faith in banks. Mine is pretty low though.

Edit to add - So what I'm getting here is the Fed telling banks to stress test to ensure compliance with Dodd-Frank and the Bank of OK is saying it's because of tornado's and floods. . ? Maybe I'm reading this wrong.

edit on 371am1717am12014 by Bassago because: (no reason given)

Bassago

reply to post by UxoriousMagnus

Isn't this how it all started in Cypress and Greece?

Well a little maybe. Here the Fed and banks seem to be looking to external disaster preparedness. With Cyprus they were crumbling internally under bad loans, corruption and...

Hmm...

do you think this "preparedness" could be a result of China pushing heavily for the USD being removed as the international standard?

reply to post by UxoriousMagnus

No don't think so. China has a way to go yet before they can get enough consensus to pull that off. Plus it will probably cause a world war and they're not ready for that yet.

do you think this "preparedness" could be a result of China pushing heavily for the USD being removed as the international standard?

No don't think so. China has a way to go yet before they can get enough consensus to pull that off. Plus it will probably cause a world war and they're not ready for that yet.

reply to post by UxoriousMagnus

I don't see anything about stress tests from the Fed. Just a friendly reminder to the 8 to mind their Ps and Qs to avoid the same kind of crap that triggered the banking mess previously.

So what I'm getting here is the Fed telling banks to stress test to ensure compliance with Dodd-Frank and the Bank of OK is saying it's because of tornado's and floods. . ? Maybe I'm reading this wrong.

I don't see anything about stress tests from the Fed. Just a friendly reminder to the 8 to mind their Ps and Qs to avoid the same kind of crap that triggered the banking mess previously.

edit on 2/7/2014 by Phage because: (no reason given)

reply to post by Bassago

This is likely tied to the deadline that is Feb 7th on the U.S. debt...

the 7th being today. Things might be bumpy.

www.nbcnews.com...

Just like last time, ( remember they downgraded the U.S. and now the Whitehouse is

in suit against the ratings agency )

things get dicey until there is an assurance by the Fed they

wont default. Too big to fail banks listed below

From your link:

wink wink

(bank of oklahoma is not on that list)

so your pretty much on the mark with concerns here with this news.

But it will likely be ok they will find a way to patch it up for a while yet

new gal in town Janet will have to smooth the jitters.

Not to say she has control over the markets though....

Nor does she have control over the gold delivery deadlines.

All of this creates an unpredictable situ for the big 8 banks listed

also here is the actual Fed memo

www.federalreserve.gov...

Too big to fail so they say until it is time for one to be thrown on the alter

This is likely tied to the deadline that is Feb 7th on the U.S. debt...

the 7th being today. Things might be bumpy.

www.nbcnews.com...

Just like last time, ( remember they downgraded the U.S. and now the Whitehouse is

in suit against the ratings agency )

things get dicey until there is an assurance by the Fed they

wont default. Too big to fail banks listed below

From your link:

According to the memo, there are eight Bank Holding Companies that appear to be at risk and that risk threatens the financial stability of the United States. These eight companies are Bank of America Corporation, Bank of New York Mellon Corporation, PLC, Citigroup Inc., Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley, State Street Corporation, and Wells Fargo & Company.

wink wink

(bank of oklahoma is not on that list)

so your pretty much on the mark with concerns here with this news.

But it will likely be ok they will find a way to patch it up for a while yet

new gal in town Janet will have to smooth the jitters.

Not to say she has control over the markets though....

Nor does she have control over the gold delivery deadlines.

All of this creates an unpredictable situ for the big 8 banks listed

also here is the actual Fed memo

www.federalreserve.gov...

Too big to fail so they say until it is time for one to be thrown on the alter

edit on 7-2-2014 by burntheships because: this is not financial advice

By performing some selected disruption of service drills it does make one wonder just what type of contingency is being practiced. Is it actually some

shock testing to help prepare for some larger changes of banking practice? Or maybe there just not is the backup and redundancy one would expect for

worlds best banking practice in the system, so it is just being prudent like how schools perform fire drills. How would the surrounding banks go if

some city did actually burn down. With the amount of scamming going on with 9/11 in the moments of destruction, fore knowledge of disasters are

profitable for some with anarchy and chaos for many.

If I actually had anything worth withdrawing at the bank I might consider this. We are in a process of dumping everything extra on our mortgage.

That way if something happens, we won't have to worry about a place to live. I am sure that our savings will disappear but not the mortgage.

reply to post by InFriNiTee

Ding ding ding, we have a winner.

This is shock testing to gauge the economic reaction of we the people, specifically as described in Silent Weapons for Quiet Wars, just like that article about the Harvard Professor withdrawing his money from BoA.

Ding ding ding, we have a winner.

This is shock testing to gauge the economic reaction of we the people, specifically as described in Silent Weapons for Quiet Wars, just like that article about the Harvard Professor withdrawing his money from BoA.

The objective of such studies is to acquire the know-how to set the public economy into a predictable state of motion or change, even a controlled self-destructive state of motion which will convince the public that certain "expert" people should take control of the money system and reestablish security (rather than liberty and justice) for all. When the subject citizens are rendered unable to control their financial affairs, they, of course, become totally enslaved, a source of cheap labor.

Not only the prices of commodities, but also the availability of labor can be used as the means of shock testing. Labor strikes deliver excellent tests shocks to an economy, especially in the critical service areas of trucking (transportation), communication, public utilities (energy, water, garbage collection), etc.

By shock testing, it is found that there is a direct relationship between the availability of money flowing in an economy and the real psychological outlook and response of masses of people dependent upon that availability.

edit on 7-2-2014 by therealguyfawkes because: (no reason

given)

reply to post by Phage

"Basel 3 requirements to boost capital levels" Its more than that.

The major cause of the Too Big to fail bailouts was caused by overvaluation of sub-prime mortgages, and imprudent lending practise. If you think somethings not afoot then think of the Cypress savers haircut as a test run.

Since then under Basel III depositors will now rank lower than Bond holders and third party counter party derivate owners will be bailed out by depositors all in the name of relieving the taxpayer of bailing out banks"

At G20 summit in St Petersburg, to discuss the progress on implementing a global so-called “bail-in” regime, which the G20 is overseeing through the Bank for International Settlements (BIS) and its Financial Stability Board (FSB)

(cecaust.com.au...

Or do you contend that since 2009 wealth concentration has not increased into fewer hands. Its the same old game run by the Rothschilds since 1700's. The average joe will foot the bill only this time confiscated savings will be "paid back to them in equity of a new restructed bank" after the failure. So from saver to shareholder...and you get no say in it. Now why would they do that?

from barnabyisright.com...

"As of March 2013, Australian banks also have a new record $21.5 Trillion in Off-Balance Sheet “business” that is mostly derivatives; an increase of $2.5 Trillion in the March quarter alone, including a $2.2 Trillion increase in Interest Rate derivative contracts:”

from www.zerohedge.com...

"Finally, one does not need to go any further than the following chart from the OCC showing total bank derivative holdings for all US banks and just the Top 4. The punchline: just the 4 biggest US banks hold $217.5 trillion, or 93% of the total $233.9 trillion in derivatives."

Something is definitly in the pipeline

I don't see anything about stress tests from the Fed. Just a friendly reminder to the 8 to mind their Ps and Qs to avoid the same kind of crap that triggered the banking mess previously.

"Basel 3 requirements to boost capital levels" Its more than that.

The major cause of the Too Big to fail bailouts was caused by overvaluation of sub-prime mortgages, and imprudent lending practise. If you think somethings not afoot then think of the Cypress savers haircut as a test run.

Since then under Basel III depositors will now rank lower than Bond holders and third party counter party derivate owners will be bailed out by depositors all in the name of relieving the taxpayer of bailing out banks"

At G20 summit in St Petersburg, to discuss the progress on implementing a global so-called “bail-in” regime, which the G20 is overseeing through the Bank for International Settlements (BIS) and its Financial Stability Board (FSB)

(cecaust.com.au...

Or do you contend that since 2009 wealth concentration has not increased into fewer hands. Its the same old game run by the Rothschilds since 1700's. The average joe will foot the bill only this time confiscated savings will be "paid back to them in equity of a new restructed bank" after the failure. So from saver to shareholder...and you get no say in it. Now why would they do that?

from barnabyisright.com...

"As of March 2013, Australian banks also have a new record $21.5 Trillion in Off-Balance Sheet “business” that is mostly derivatives; an increase of $2.5 Trillion in the March quarter alone, including a $2.2 Trillion increase in Interest Rate derivative contracts:”

from www.zerohedge.com...

"Finally, one does not need to go any further than the following chart from the OCC showing total bank derivative holdings for all US banks and just the Top 4. The punchline: just the 4 biggest US banks hold $217.5 trillion, or 93% of the total $233.9 trillion in derivatives."

Something is definitly in the pipeline

new topics

-

Hate makes for strange bedfellows

US Political Madness: 2 hours ago -

Who guards the guards

US Political Madness: 4 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 6 hours ago -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 11 hours ago

top topics

-

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 16 hours ago, 11 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 11 hours ago, 10 flags -

Hate makes for strange bedfellows

US Political Madness: 2 hours ago, 9 flags -

Who guards the guards

US Political Madness: 4 hours ago, 8 flags -

1980s Arcade

General Chit Chat: 13 hours ago, 5 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 15 hours ago, 4 flags -

Deadpool and Wolverine

Movies: 14 hours ago, 4 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 6 hours ago, 2 flags

active topics

-

Hate makes for strange bedfellows

US Political Madness • 14 • : Terpene -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 101 • : WeMustCare -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 684 • : Threadbarer -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 27 • : RookQueen2 -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs • 14 • : alldaylong -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 234 • : KrustyKrab -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues • 42 • : TheWoker -

Deadpool and Wolverine

Movies • 4 • : FlyersFan -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 113 • : Consvoli -

Fast Moving Disc Shaped UFO Captured on Camera During Flight from Florida to New York City

Aliens and UFOs • 20 • : MaximusNewmanus