It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by xuenchen

Another joke within the political nightmare that the Obama administration is becoming, now congress is in charge of finding jobs for the unemployed in America.

How low can you go, this days, nothing but more waste and abuse under an attractive hope for the employment seekers group.

And government keeps getting bigger and bigger if not humongous this days and the crap still is the same.

Another joke within the political nightmare that the Obama administration is becoming, now congress is in charge of finding jobs for the unemployed in America.

How low can you go, this days, nothing but more waste and abuse under an attractive hope for the employment seekers group.

And government keeps getting bigger and bigger if not humongous this days and the crap still is the same.

edit on 7-2-2014 by marg6043 because: (no reason given)

Socialism pure and simple, take everything from those who work hard, and support those who don't with meaningless jobs at tax payers expense to all,

with little real work for the money. I have lots of experience with government job's. Once I worked for a major east coast city and was an "all

star"employee, promoted twice in 3 years, right out of college. Why? I worked a good 25 hours a week of honest work (the rest of the time in the

1970's I wasn't sober but still at work- that was ok since my bosses weren't sober either).

You say how could you be an all star worker at only 25 hours a week of actual work, sometimes not even sober, and getting paid well for 40 hours? That's because all the other workers worked much less that I did- some not at all for their money.

Government does not create real jobs or use your money wisely. Look at Greece, among the most socialist of EU countries with up to recently, 20% of the general population employed by government. Low productivity, a downward spiral of deficits and bailouts, that's what these clowns will bring to the USA, we are heading in that direction. Endless military jobs is the same as we were the self appointed world police to protect international companies that no longer care about USA as they have assets offshore. That's the right wing jobs program, same outcome, deficits and wasted resources- what did we get for the Iraq war, even the Afghan war, Karzi is the head of the opium cartel, largest producer in the world- that is who we are backing?

And the left wants inter-city jobs for all by borrowing more or printing more money. Insanity on both sides.

We should just do the opposite of whatever they propose- that will be the correct path. Individual initiative, honesty, productivity, incentives, with guaranteed opportunities yes, but not guaranteed equal outcomes, they miss that point. Not everyone deserves to be bailed out by those who work harder than others.

Need food, then have meal kitchens, not food stamps, need shelter and clothes, provide minimal short term tangible services and shelter one day at a time, but you have to clean the streets. Not F/T permanent jobs with little accountability paid by other peoples hard work- fools (of wait, they only want for others what they have for themselves- now I get it).

You say how could you be an all star worker at only 25 hours a week of actual work, sometimes not even sober, and getting paid well for 40 hours? That's because all the other workers worked much less that I did- some not at all for their money.

Government does not create real jobs or use your money wisely. Look at Greece, among the most socialist of EU countries with up to recently, 20% of the general population employed by government. Low productivity, a downward spiral of deficits and bailouts, that's what these clowns will bring to the USA, we are heading in that direction. Endless military jobs is the same as we were the self appointed world police to protect international companies that no longer care about USA as they have assets offshore. That's the right wing jobs program, same outcome, deficits and wasted resources- what did we get for the Iraq war, even the Afghan war, Karzi is the head of the opium cartel, largest producer in the world- that is who we are backing?

And the left wants inter-city jobs for all by borrowing more or printing more money. Insanity on both sides.

We should just do the opposite of whatever they propose- that will be the correct path. Individual initiative, honesty, productivity, incentives, with guaranteed opportunities yes, but not guaranteed equal outcomes, they miss that point. Not everyone deserves to be bailed out by those who work harder than others.

Need food, then have meal kitchens, not food stamps, need shelter and clothes, provide minimal short term tangible services and shelter one day at a time, but you have to clean the streets. Not F/T permanent jobs with little accountability paid by other peoples hard work- fools (of wait, they only want for others what they have for themselves- now I get it).

edit on 7-2-2014 by retsdeeps1 because: (no reason given)

Wrabbit2000

Which taxes do you figure are low and in what historic context are you reaching to come up with that theory? This is an area I don't even need to spend the hours (weeks as it happened) researching. I've already done it and know the outcomes..but I'm very curious as to the basis and examples behind your conclusions?

Go ahead and post your info. You can start with rates on tariffs, personal income, and capital gains.

reply to post by marg6043

Sure, you'll blame the government for high unemployment, but the moment someone suggests doing something about the problem, that's not the government's job. It's one or the other, not both.

now congress is in charge of finding jobs for the unemployed in America.

Sure, you'll blame the government for high unemployment, but the moment someone suggests doing something about the problem, that's not the government's job. It's one or the other, not both.

reply to post by DrEugeneFixer

Well, I'm interested in a discussion..not a monologue.

I'm curious as to your basis in thinking the United States currently has 'historic lows' in taxes? I don't believe that will take much to show otherwise, but I've learned the hard way...more than once...to ask on these things and clarify what the specific examples are. I could spend the next hour or two, crafting long and well thought out msgs to prove a point ...you weren't even making, as it may turn out.

Er.... never a fun thing to do or way to spend time. So..about those low taxes.. Which were you thinking?

Well, I'm interested in a discussion..not a monologue.

I'm curious as to your basis in thinking the United States currently has 'historic lows' in taxes? I don't believe that will take much to show otherwise, but I've learned the hard way...more than once...to ask on these things and clarify what the specific examples are. I could spend the next hour or two, crafting long and well thought out msgs to prove a point ...you weren't even making, as it may turn out.

Er.... never a fun thing to do or way to spend time. So..about those low taxes.. Which were you thinking?

reply to post by Wrabbit2000

I already gave you three... personal income, capital gains, and tariffs. Sounds like as good a place to start as any, so fire away.

So..about those low taxes.. Which were you thinking?

I already gave you three... personal income, capital gains, and tariffs. Sounds like as good a place to start as any, so fire away.

reply to post by DrEugeneFixer

Corporate, Capital Gains and Tarrifs... Hmm.. Okay. I'm not sure why we'd want to be so selective, but I'll include those, anyway.

In a fair assessment of taxes, it is a balance game that swings a bit, anyway. One tax may go down a bit for political reasons, while another rises a bit somewhere else to compensate the never ending need for revenue.

---

I believe I covered Corporate, Personal, Inflation, 10 year mortgage rates, and the price of Gold, Oil and refined gasoline at the pump on my Guide to the Presidents Thread and you'll find a bit more. Everything is well sourced and supported after the main post and the numbers run back to 1953 for a good comparison, independent of any outside media interpretation. The economy just isn't in very good shape and taxes are a part of that.

In one of my other major research threads on the Federal Budget, I'd refer to boards 4, 5 and 7 (which I numbered when I created them, in the upper left corner). They most directly relate to this, where taxes and the greed for more and more revenue has been and is going, as well as how totally out of control that area of it has gotten...and HOW FAST that has come about.

---

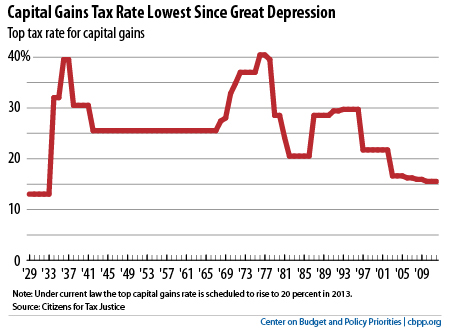

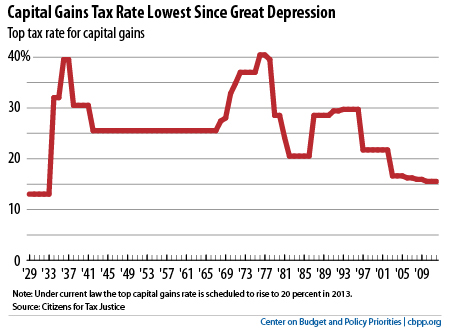

Capital Gains Taxes as they are shown at the link and fall between 1988 and 2013, seem a mixed bag of sorts in terms of who benefits and how much. As other costs have gone up and taxes in other areas that impact the same transactions have picked up, I'm not sure how much the overall gain is to people, even where a 5% drop may come up over the last years, going back. Some do seem to have had that rate drop a bit though.

---

US and World Policy on Tarriffs is interesting because duties and tarriffs are what was, in many ways, originally supposed to fund this ugly beast we now call a Government with a straight face. As they've consistently dealt away the original means of funding, OUR taxes in places like income, have been created and then 'risen with the times'. Just as all the free trade stuff has not only made offshoring business, labor and coporate operations VERY attractive where it can be done, it's left no OTHER way to fund now EXCEPT to take it from what is based within the United States and forming the very structure of it. Quite the opposite of some original intentions for all this.

---

** For the record and in relation to my Presidential Set for Corp tax rates, there are two ways of measuring that. I used marginal corporate income tax rate for that presentation, and used the same across the set, so which isn't as important as keeping proportional change over time clear. The Official Corp tax rate for the United States is 40%, putting our nation pretty much at the top for taxing the living crap out of business and the engine which drives a national economy. As the site I got the figures from, states it:

The 40% rate has been steady across the timeline there. Nothing better..nothing improving. Just more of the same all around.

So, how folks can say that taxes are at historic lows is ..baffling. To say the least. There is also, always, this:

I'm sure a couple (dozen) books can be added for representation, since that was created. Just my hunch on that, of course.

Corporate, Capital Gains and Tarrifs... Hmm.. Okay. I'm not sure why we'd want to be so selective, but I'll include those, anyway.

In a fair assessment of taxes, it is a balance game that swings a bit, anyway. One tax may go down a bit for political reasons, while another rises a bit somewhere else to compensate the never ending need for revenue.

---

I believe I covered Corporate, Personal, Inflation, 10 year mortgage rates, and the price of Gold, Oil and refined gasoline at the pump on my Guide to the Presidents Thread and you'll find a bit more. Everything is well sourced and supported after the main post and the numbers run back to 1953 for a good comparison, independent of any outside media interpretation. The economy just isn't in very good shape and taxes are a part of that.

In one of my other major research threads on the Federal Budget, I'd refer to boards 4, 5 and 7 (which I numbered when I created them, in the upper left corner). They most directly relate to this, where taxes and the greed for more and more revenue has been and is going, as well as how totally out of control that area of it has gotten...and HOW FAST that has come about.

---

Capital Gains Taxes as they are shown at the link and fall between 1988 and 2013, seem a mixed bag of sorts in terms of who benefits and how much. As other costs have gone up and taxes in other areas that impact the same transactions have picked up, I'm not sure how much the overall gain is to people, even where a 5% drop may come up over the last years, going back. Some do seem to have had that rate drop a bit though.

---

US and World Policy on Tarriffs is interesting because duties and tarriffs are what was, in many ways, originally supposed to fund this ugly beast we now call a Government with a straight face. As they've consistently dealt away the original means of funding, OUR taxes in places like income, have been created and then 'risen with the times'. Just as all the free trade stuff has not only made offshoring business, labor and coporate operations VERY attractive where it can be done, it's left no OTHER way to fund now EXCEPT to take it from what is based within the United States and forming the very structure of it. Quite the opposite of some original intentions for all this.

---

** For the record and in relation to my Presidential Set for Corp tax rates, there are two ways of measuring that. I used marginal corporate income tax rate for that presentation, and used the same across the set, so which isn't as important as keeping proportional change over time clear. The Official Corp tax rate for the United States is 40%, putting our nation pretty much at the top for taxing the living crap out of business and the engine which drives a national economy. As the site I got the figures from, states it:

Corporate Tax Rates - 2006 Through 2013

The corporate tax rate is 40%. The marginal federal corporate income tax rate on the highest income bracket of corporations (currently USD 18,333,333 and above) is 35%. State and local governments may also impose income taxes ranging from 0% to 12%, the top marginal rates averaging approximately 7.5%. A corporation may deduct its state and local income tax expense when computing its federal taxable income, generally resulting in a net effective rate of approximately 40%. The effective rate may vary significantly depending on the locality in which a corporation conducts business. The United States also has a parallel alternative minimum tax (AMT) system, which is generally characterized by a lower tax rate (20%) but a broader tax base.

The 40% rate has been steady across the timeline there. Nothing better..nothing improving. Just more of the same all around.

So, how folks can say that taxes are at historic lows is ..baffling. To say the least. There is also, always, this:

I'm sure a couple (dozen) books can be added for representation, since that was created. Just my hunch on that, of course.

reply to post by Wrabbit2000

That lengthy post is misleading at best.

US Effective Corporate Tax Rates:

This is the rate actually paid after accounting for loopholes. That rate is almost as low as it has ever been, and it has been on a downward trend since the fifties. I'd call that a historic low point.

Tariffs:

These are lower than they have ever been in history, almost nothing. I'd call that a historic low point.

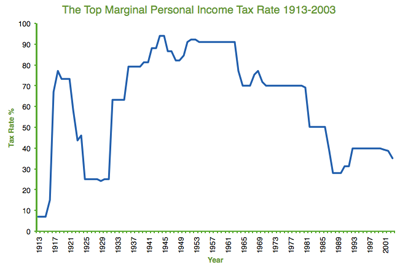

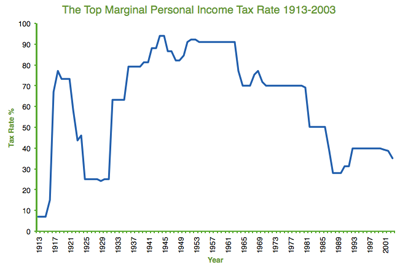

Personal Income Taxes, top rate:

These were actually a bit lower in the eighties, but before that we haven't seen rates this low since the great depression. We are near, but not at historic lows.

Capital Gains Taxes:

Lowest level seen since the great depression. Historic Low.

If you had any information that contradicted what I said, you'd have posted it, instead of linking to other threads where you allege you have posted info about tax rates along with a buttload of irrelevancies. What it boils down to is this: everything I said was correct, and easily verifiable by a google search.

I don't see any evidence that high taxes are a significant factor in high unemployment. As the charts show, we've had many periods of better economic performance with much higher tax rates. Tax cuts are not the answer.

That lengthy post is misleading at best.

US Effective Corporate Tax Rates:

This is the rate actually paid after accounting for loopholes. That rate is almost as low as it has ever been, and it has been on a downward trend since the fifties. I'd call that a historic low point.

Tariffs:

These are lower than they have ever been in history, almost nothing. I'd call that a historic low point.

Personal Income Taxes, top rate:

These were actually a bit lower in the eighties, but before that we haven't seen rates this low since the great depression. We are near, but not at historic lows.

Capital Gains Taxes:

Lowest level seen since the great depression. Historic Low.

If you had any information that contradicted what I said, you'd have posted it, instead of linking to other threads where you allege you have posted info about tax rates along with a buttload of irrelevancies. What it boils down to is this: everything I said was correct, and easily verifiable by a google search.

I don't see any evidence that high taxes are a significant factor in high unemployment. As the charts show, we've had many periods of better economic performance with much higher tax rates. Tax cuts are not the answer.

reply to post by DrEugeneFixer

Well, first of all, you need to attribute those graphics for source or for all I know, you made them. I sure have no idea where they came up with the data plugged into their copy of Excel or whatever they used to generate the charts. They're sourced with comments within the graphics...but did the United States Federal Reserve Bank actually produce that first chart or did someone else produce it based on data they entered from the Federal Reserve Bank? Which Fed Reserve Bank produced it?

We can chat down on the level of MSM ..like this:

.....where the media references official United States Government sources.... or where they directly quote them like this:

Your chart shows the Corp tax rate as being well below what the U.S. President himself was trying to get it down TO...in 2012. Then again, your chart stops in 2011, too.

----

On Tarrifs... Yes... We have free trade, for how it's destroying this nation. Yes indeed... low tariffs for all, with American products unable to compete on level fields against labor and regulatory costs elsewhere that are ANYTHING but equal. Free trade and the LACK of tariffs are killing our nation and our economy...and some think this is a good thing? Wow.... Okay, we at least agree there on the direction of the metric, if not the impact of it.

----

In terms of personal income taxes... Two questions here.. First, are we saying they ARE the lowest..or "kinda close to what was the lowest"? It is..or it isn't..and in this case, it's not. Current top end individual federal income tax rate for the top bracket is 35%. It's been 35% since George W. Bush changed from 38.6% to that in 2003.

The low end bracket was dropped to 10% from 15%, again, by George Bush in 2002. It's remained there since... Of course.. That's never the whole story.

Individual State Income Taxes 2000 - 2013

If you're not including state income taxes, while making sweeping statements about the status of tax policy, then you're ignoring the felt impact of taxes on those actually paying them....and the impact is considerably above 15-35%

The numbers of the Tax Foundation's table can be double checked and verified here, where they have the original IRS figures within an embedded reader for convenience.

----

The figures I linked about the Capital Gains Tax on my prior post, directly reference IRS documents for their accuracy. Their other documents, including the personal income rates linked above have proven accurate with the originals to check against, so I'll take their numbers to be accurate. I don't know where your chart came from or the org that has their name on the bottom of it.

Capital gains show a mixed back since Reagan left office. It continues to be a mixed bag and I'm sourcing the sources or one step off them, directly. Uncle Sam is who you'd want to direct debate with at this stage. Those are his numbers, not mine.

I'd love to debate this more, but are we debating on the same level or not? Please source...with links everyone can independently assess for credibility....what you're looking at? Thanks!

Well, first of all, you need to attribute those graphics for source or for all I know, you made them. I sure have no idea where they came up with the data plugged into their copy of Excel or whatever they used to generate the charts. They're sourced with comments within the graphics...but did the United States Federal Reserve Bank actually produce that first chart or did someone else produce it based on data they entered from the Federal Reserve Bank? Which Fed Reserve Bank produced it?

We can chat down on the level of MSM ..like this:

Source: CNN Money

NEW YORK (CNNMoney) -- On Sunday, the United States gets a distinction no nation wants -- the world's highest corporate tax rate.

Japan, which currently has the highest rate in the world -- a 39.8% rate on business income between national and local taxes -- cuts its rate to 36.8% as of April 1. The U.S. rate stands at 39.2% when both federal and state rates are included.

.....where the media references official United States Government sources.... or where they directly quote them like this:

Source: Obama: Slash corporate tax breaks and rates

NEW YORK (CNNMoney) -- After more than a year in the making, the Obama administration on Wednesday released its plan to overhaul the corporate tax code.

The main proposal for reform would slash the corporate tax rate to 28% from 35% and pay for the reduction by eliminating "dozens" of business tax breaks. There are currently more than 130 on the books.

The Obama administration's plan is in sync with Republicans in terms of wanting to lower the top rate. But Republicans want to lower the corporate rate even further to 25%.

Your chart shows the Corp tax rate as being well below what the U.S. President himself was trying to get it down TO...in 2012. Then again, your chart stops in 2011, too.

----

On Tarrifs... Yes... We have free trade, for how it's destroying this nation. Yes indeed... low tariffs for all, with American products unable to compete on level fields against labor and regulatory costs elsewhere that are ANYTHING but equal. Free trade and the LACK of tariffs are killing our nation and our economy...and some think this is a good thing? Wow.... Okay, we at least agree there on the direction of the metric, if not the impact of it.

----

In terms of personal income taxes... Two questions here.. First, are we saying they ARE the lowest..or "kinda close to what was the lowest"? It is..or it isn't..and in this case, it's not. Current top end individual federal income tax rate for the top bracket is 35%. It's been 35% since George W. Bush changed from 38.6% to that in 2003.

The low end bracket was dropped to 10% from 15%, again, by George Bush in 2002. It's remained there since... Of course.. That's never the whole story.

Individual State Income Taxes 2000 - 2013

If you're not including state income taxes, while making sweeping statements about the status of tax policy, then you're ignoring the felt impact of taxes on those actually paying them....and the impact is considerably above 15-35%

The numbers of the Tax Foundation's table can be double checked and verified here, where they have the original IRS figures within an embedded reader for convenience.

----

The figures I linked about the Capital Gains Tax on my prior post, directly reference IRS documents for their accuracy. Their other documents, including the personal income rates linked above have proven accurate with the originals to check against, so I'll take their numbers to be accurate. I don't know where your chart came from or the org that has their name on the bottom of it.

Capital gains show a mixed back since Reagan left office. It continues to be a mixed bag and I'm sourcing the sources or one step off them, directly. Uncle Sam is who you'd want to direct debate with at this stage. Those are his numbers, not mine.

I'd love to debate this more, but are we debating on the same level or not? Please source...with links everyone can independently assess for credibility....what you're looking at? Thanks!

reply to post by Wrabbit2000

Dude, all of the information that I posted is easily accessible on the first page of a google image search for the following terms, or you could reverse google image search. None of this is controversial in the least bit. pick any source you want! They all say the same thing... I am right.

Effective Corporate Tax Rate

I ncome Tax Rate History

Capital Gains Tax Rate History

U S Tariff Rate History

or maybe you could do some kind of research that would show us all how taxes are skyrocketing... I won't hold my breath.

Dude, all of the information that I posted is easily accessible on the first page of a google image search for the following terms, or you could reverse google image search. None of this is controversial in the least bit. pick any source you want! They all say the same thing... I am right.

Effective Corporate Tax Rate

I ncome Tax Rate History

Capital Gains Tax Rate History

U S Tariff Rate History

or maybe you could do some kind of research that would show us all how taxes are skyrocketing... I won't hold my breath.

"Full-employment caucus" and "government action" is code for "we're going to start using unemployed people and welfare recipients as slave labor."

Now, I'm not a fan of people collecting eternal welfare while sitting back and doing nothing. But I'd rather see my tax dollars going to welfare programs than towards the military-industrial complex. And I'd NEVER sign over my fellow humans to the arms of an uncaring and daemonic government.

Believe me, the government hasn't played all its cards yet on this issue. But if they want these "full employment" measures, you'd better believe we the people should fight this tooth and nail.

Now, I'm not a fan of people collecting eternal welfare while sitting back and doing nothing. But I'd rather see my tax dollars going to welfare programs than towards the military-industrial complex. And I'd NEVER sign over my fellow humans to the arms of an uncaring and daemonic government.

Believe me, the government hasn't played all its cards yet on this issue. But if they want these "full employment" measures, you'd better believe we the people should fight this tooth and nail.

edit on 8-2-2014 by therealguyfawkes because: (no reason given)

reply to post by DrEugeneFixer

You've got to be kidding me. I spent the time to get source and near source material to support every point I've made. I refer to threads it took me literal weeks to make for the figures they compiled, and those ARE all, to the last single number, sourced to top level, *ORIGINAL* sources/authority....(Read my signature link to learn the difference between a source and a reference, it'll help for future efforts.) but you give me GOOGLE image search to support your points?

That's just beyond belief.

Have a good evening... I'm off. I seek discussion ....and I get google image search. (sigh)

You've got to be kidding me. I spent the time to get source and near source material to support every point I've made. I refer to threads it took me literal weeks to make for the figures they compiled, and those ARE all, to the last single number, sourced to top level, *ORIGINAL* sources/authority....(Read my signature link to learn the difference between a source and a reference, it'll help for future efforts.) but you give me GOOGLE image search to support your points?

That's just beyond belief.

Have a good evening... I'm off. I seek discussion ....and I get google image search. (sigh)

DrEugeneFixer

reply to post by charles1952

Imagine how much good we could do this country if we got millions of people off of welfare, food stamps, and unemployment benefits and put them to work repairing crumbling infrastructure, repairing environmental damage, educating children, etc. specific projects would best be left to local authorities to prioritize. When you consider how much money would be saved on other programs, the cost would be much less than it mightt seem on the face of it.

Yes that is true. I agree that it will be a great idea if we could get as many people out of the welfare system and into the productive working class and save billions of dollars a year, you know, that was the way it was back when American bread and butter call the manufacturing industry was in full gear and they were the ones that supported the middle class as employers, now is the government the biggest employer in the nation

'Working poor' are turning to food pantries, soup kitchens in growing numbers

Read more: www.nydailynews.com...

Food Stamps, Public Policy, and the Working Poor

thesocietypages.org...

But sadly that is not the way things works, most of the jobs been generated this days are what is call the working poor jobs, when people are working but still need help from the welfare system to support their families, that is why people do not understand why with what the numbers given by the government on job creation the welfare numbers still keep growing

edit on 9-2-2014 by marg6043 because: (no reason given)

reply to post by DrEugeneFixer

They are not doing anything about it, dear, just to make people feel good and hopeful, is nothing more than bigger government in a government that already are braking apart at the seams.

They are not doing anything about it, dear, just to make people feel good and hopeful, is nothing more than bigger government in a government that already are braking apart at the seams.

reply to post by DrEugeneFixer

Dear DrEugeneFixer,

You are a fascinating character and I'd like to see what happens if we try to extend our conversation a little further. Three issues come to mind immediately. They may not be the most important, but it might be fun to start with them.

1.) Taxes are going down or are at all-time lows.

2.) We need to get people off welfare and food stamps, which can be done by

3.) Spending more money on infrastructure projects.

1.) Well, of course, taxes are taxes, I'd never deny that. For our purposes, a little broader definition might be useful. How about "Taxation is the act of a government taking money or value from an individual or group of individuals, which can not be avoided?" The reason I'm going that way is that I believe printing money, borrowing, and taxing, are all forms of taxation.

Consider the excessive printing of money. That causes inflation, meaning the money in circulation isn't worth as much any more. Everyone working in dollars loses a bit of the value of their currency, which is transferred to D.C. A tax, in other words. When the government borrows money it proclaims, "We will promise that our children or grandchildren will pay this debt." In essence, it's a tax on future generations. And, of course taxation is taxation.

The single number that combines all these different taxes is "government spending." That tells you how much taxation has occurred. And everyone, knows that the budgets under Obama, starting from the 2009 one (If you don't know why, just ask) are monuments of towering government spending. In short, taxation, in the broad sense, is higher under Obama than anyone else could have imagined.

2.) "We need to get people off welfare." Do you really think that digging ditches, and filling holes isn't welfare? And the idea of taking the homeless or jobless and making them teachers in order to solve the unemployment problem is, frankly, stunning. If these people were put to work on infrastructure, the Unions would demand their workers be hired first, and if there were any more workers needed, they would have to be paid at Union wages with Union membership dues.

We've moved past the time when we need a hundred men to spread asphalt, or break up old roads. We have machines for that now. Those workers would be welfare cases and everyone would know it. The only difference is that they would have to get hot and sweaty before they got their welfare check.

One of my favorite stories involves a salesman for heavy construction equipment, on a trip to China to make some sales. He is shown their current, major road building project and notices that the workers are using picks and shovels to clear away a very large hill. Sensing a sale, he tells the foreman that his company's equipment could reduce the men required for the job from 600 to 8, and could get the job done in a tenth of the time.

His host smiles at him in a condescending manner and says, "You do not understand our culture. We are very old and have learned that having men employed is much superior to them being laid off. We have a terrible unemployment problem as it is."

The salesman looks at the Chinese with their shovels, turns to the foreman, and says, "In that case, perhaps you'd be interested in our company's line of teaspoons."

3.) The importance of spending more money on infrastructure work. This baffles me most of all. Have you forgotten that Obama's stimulus program choked a TRILLION dollars out of the taxpayers? There doesn't appear to be any significant result. As Obama said "It looks like there aren't any shovel ready jobs." There aren't now either. So, what happened to the money? The estimates I've seen indicate that about 3/4 of it went to Obama supporters. Construction unions, teacher unions, Google, environmental groups, and democrat political officials. But whoever ended up with it didn't provide any benefits to the country. And to do the same thing again strikes me as criminally naive.

With respect,

Charles1952

Dear DrEugeneFixer,

You are a fascinating character and I'd like to see what happens if we try to extend our conversation a little further. Three issues come to mind immediately. They may not be the most important, but it might be fun to start with them.

1.) Taxes are going down or are at all-time lows.

2.) We need to get people off welfare and food stamps, which can be done by

3.) Spending more money on infrastructure projects.

1.) Well, of course, taxes are taxes, I'd never deny that. For our purposes, a little broader definition might be useful. How about "Taxation is the act of a government taking money or value from an individual or group of individuals, which can not be avoided?" The reason I'm going that way is that I believe printing money, borrowing, and taxing, are all forms of taxation.

Consider the excessive printing of money. That causes inflation, meaning the money in circulation isn't worth as much any more. Everyone working in dollars loses a bit of the value of their currency, which is transferred to D.C. A tax, in other words. When the government borrows money it proclaims, "We will promise that our children or grandchildren will pay this debt." In essence, it's a tax on future generations. And, of course taxation is taxation.

The single number that combines all these different taxes is "government spending." That tells you how much taxation has occurred. And everyone, knows that the budgets under Obama, starting from the 2009 one (If you don't know why, just ask) are monuments of towering government spending. In short, taxation, in the broad sense, is higher under Obama than anyone else could have imagined.

2.) "We need to get people off welfare." Do you really think that digging ditches, and filling holes isn't welfare? And the idea of taking the homeless or jobless and making them teachers in order to solve the unemployment problem is, frankly, stunning. If these people were put to work on infrastructure, the Unions would demand their workers be hired first, and if there were any more workers needed, they would have to be paid at Union wages with Union membership dues.

We've moved past the time when we need a hundred men to spread asphalt, or break up old roads. We have machines for that now. Those workers would be welfare cases and everyone would know it. The only difference is that they would have to get hot and sweaty before they got their welfare check.

One of my favorite stories involves a salesman for heavy construction equipment, on a trip to China to make some sales. He is shown their current, major road building project and notices that the workers are using picks and shovels to clear away a very large hill. Sensing a sale, he tells the foreman that his company's equipment could reduce the men required for the job from 600 to 8, and could get the job done in a tenth of the time.

His host smiles at him in a condescending manner and says, "You do not understand our culture. We are very old and have learned that having men employed is much superior to them being laid off. We have a terrible unemployment problem as it is."

The salesman looks at the Chinese with their shovels, turns to the foreman, and says, "In that case, perhaps you'd be interested in our company's line of teaspoons."

3.) The importance of spending more money on infrastructure work. This baffles me most of all. Have you forgotten that Obama's stimulus program choked a TRILLION dollars out of the taxpayers? There doesn't appear to be any significant result. As Obama said "It looks like there aren't any shovel ready jobs." There aren't now either. So, what happened to the money? The estimates I've seen indicate that about 3/4 of it went to Obama supporters. Construction unions, teacher unions, Google, environmental groups, and democrat political officials. But whoever ended up with it didn't provide any benefits to the country. And to do the same thing again strikes me as criminally naive.

With respect,

Charles1952

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 3 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 4 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 4 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 5 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 6 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 6 hours ago -

Weinstein's conviction overturned

Mainstream News: 7 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 9 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 9 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 9 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 9 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 7 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 12 hours ago, 6 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 6 hours ago, 5 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 4 hours ago, 5 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 6 hours ago, 5 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 3 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 4 hours ago, 2 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 201 • : DBCowboy -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 163 • : rigel4 -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 23 • : DontTreadOnMe -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 13 • : xuenchen -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 684 • : daskakik -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 10 • : Caver78 -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 21 • : WhitewaterSquirrel -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 78 • : chr0naut -

The Acronym Game .. Pt.3

General Chit Chat • 7750 • : bally001 -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 7 • : rickymouse