It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

4

share:

What if the federal reserve took most of the US currency out of the system?

Then the Fed stopped creating new currency and sold government owned land/properties,comodities, and resources(like silver,gold,uranium,lithium, skilled labor, food stuffs,biofuels,higher education services, etc) to pay off the national debt.

Legalize drugs and tax them.

Legalize hemp and then grow and sell it en masse to foriegn debt holders for a cheap price.

Sell cheaper US coal to china,japan,canada and germany.

Sell cheaper US shale oil to china,japan,canada and germany.

Approve of the Keystone pipeline and create a tax free status for companies that sell oil to foriegn debt holders.

Ban all tax loop holes for companies that don't have US workers but sell to US customers(put in conditional trade tariffs),then create tax loop holes to sell to foriegn debt holders.

Lower corporate taxes if you have a US work force.

Lower income taxes on entrepenuers/small businesses that create US jobs.

Lower income taxes on entrepenuers/small businesses that sell to foriegn debt holders.

Remove the EPA and replace it with a vastly smaller(and more efficient) government contracted firm.

Remove most regulation on coal and natural gas.

Stop most of the unilateral wars and use coalitions of multiple countries with the most minimal american resources used.

Then the Fed stopped creating new currency and sold government owned land/properties,comodities, and resources(like silver,gold,uranium,lithium, skilled labor, food stuffs,biofuels,higher education services, etc) to pay off the national debt.

Legalize drugs and tax them.

Legalize hemp and then grow and sell it en masse to foriegn debt holders for a cheap price.

Sell cheaper US coal to china,japan,canada and germany.

Sell cheaper US shale oil to china,japan,canada and germany.

Approve of the Keystone pipeline and create a tax free status for companies that sell oil to foriegn debt holders.

Ban all tax loop holes for companies that don't have US workers but sell to US customers(put in conditional trade tariffs),then create tax loop holes to sell to foriegn debt holders.

Lower corporate taxes if you have a US work force.

Lower income taxes on entrepenuers/small businesses that create US jobs.

Lower income taxes on entrepenuers/small businesses that sell to foriegn debt holders.

Remove the EPA and replace it with a vastly smaller(and more efficient) government contracted firm.

Remove most regulation on coal and natural gas.

Stop most of the unilateral wars and use coalitions of multiple countries with the most minimal american resources used.

reply to post by John_Rodger_Cornman

The Federal Reserve doesn't have the authority to legalize drugs, or to change tax laws or modify organizations like the EPA or their regulations.

Or are these trick questions?

As far as the money goes they should stop creating about $75 billion a month though.

The Federal Reserve doesn't have the authority to legalize drugs, or to change tax laws or modify organizations like the EPA or their regulations.

Or are these trick questions?

As far as the money goes they should stop creating about $75 billion a month though.

reply to post by John_Rodger_Cornman

You do get that Federal Reserve is a private bank owned by a banking cartel, that makes money on the creation off money and that when a country lends from them they are increasing the need for taxes, since the country have to pay money to the banks in interest.

For the banks money do grow on trees and are free to create. The money system is a giant Ponzi scheme to create money with IOU(I owe you) for the banks while not having to have the money themselves to lend. And it is created to cause inflation and destroy the value of what you have saved.

Also you should probably know about the gold that have been stolen and sold already to China cheaply since they had to make sure the gold price did not go over a certain price. Fall of the PetroDollar. The positive thing is that when PetroDollar falls one of the reasons for all the wars in Middle East disappear.

You do get that Federal Reserve is a private bank owned by a banking cartel, that makes money on the creation off money and that when a country lends from them they are increasing the need for taxes, since the country have to pay money to the banks in interest.

For the banks money do grow on trees and are free to create. The money system is a giant Ponzi scheme to create money with IOU(I owe you) for the banks while not having to have the money themselves to lend. And it is created to cause inflation and destroy the value of what you have saved.

Also you should probably know about the gold that have been stolen and sold already to China cheaply since they had to make sure the gold price did not go over a certain price. Fall of the PetroDollar. The positive thing is that when PetroDollar falls one of the reasons for all the wars in Middle East disappear.

edit on 31-1-2014 by LittleByLittle because: (no reason given)

John_Rodger_Cornman

What if the federal reserve took most of the US currency out of the system?

Your premise is innately flawed. The private creation of currency and loaning it at interest means that you can take 100% of the supply in existence and it still won't pay back the initial loan. It's not just the USD on this system either.

reply to post by John_Rodger_Cornman

It may have just been easier for you to say "I am a libertarian"

It may have just been easier for you to say "I am a libertarian"

Then the Fed stopped creating new currency and sold government owned land/properties,comodities, and resources(like silver,gold,uranium,lithium, skilled labor, food stuffs,biofuels,higher education services, etc) to pay off the national debt.

Well you have this part right anyway - when the government can't pay their bills they start selling off tax-payer paid infrastructure...God only knows what the Chicoms are coming for the Grand Canyon, Yellowstone the Bakken Oil Field.

If you don't get it - see Greece!

BABYBULL24

Then the Fed stopped creating new currency and sold government owned land/properties,comodities, and resources(like silver,gold,uranium,lithium, skilled labor, food stuffs,biofuels,higher education services, etc) to pay off the national debt.

Well you have this part right anyway - when the government can't pay their bills they start selling off tax-payer paid infrastructure...God only knows what the Chicoms are coming for the Grand Canyon, Yellowstone the Bakken Oil Field.

If you don't get it - see Greece!

You do realize that we also own hundreds of millions of dollars worth of Chinese currency too right? Infact, as a percent of debt:gdp their holdings come to 6% of our GDP while our holdings come to 11% of their GDP. We're the creditor in that relationship, not them.

reply to post by Aazadan

The Fed would stop creating US currency and the US treasury would take money out of circulation and warehouse it.

All loans are also illegal unless backed by a hard asset(land,property,Intellectual Properties,silver,gold,human work and services).

Banks are no longer allowed to create a loan unless the loan is backed by a real asset or is used for pay in real human economic activity(like work or commercial production).

What I am saying if you take most of the dollars out of circulation then the dollar becomes more valuable because there are less dollars available. The debt would remain the same but the dollar can purchase more debt because it is stronger. It is stronger because it is more scarce and harder to obtain. Its the reverse of what the fed is doing now.

Then anyone holding dollars would get more purchasing power from a stronger currency.

The Fed would stop creating US currency and the US treasury would take money out of circulation and warehouse it.

All loans are also illegal unless backed by a hard asset(land,property,Intellectual Properties,silver,gold,human work and services).

Banks are no longer allowed to create a loan unless the loan is backed by a real asset or is used for pay in real human economic activity(like work or commercial production).

What I am saying if you take most of the dollars out of circulation then the dollar becomes more valuable because there are less dollars available. The debt would remain the same but the dollar can purchase more debt because it is stronger. It is stronger because it is more scarce and harder to obtain. Its the reverse of what the fed is doing now.

Then anyone holding dollars would get more purchasing power from a stronger currency.

John_Rodger_Cornman

reply to post by Aazadan

The Fed would stop creating US currency and the US treasury would take money out of circulation and warehouse it.

When currency leaves the system, it leaves from the bottom first... the poor. Then the middle class. The rich have the resources to move their wealth to a currency that isn't disappearing and feel no ill effects. There have been several instances throughout history where there has been less currency in the system and they have all caused and coincided with a poor economy. Similarly we have instances of fiat currencies actually being successful, for example the Greenback during the civil war which was created by Lincoln and backed by nothing.

All loans are also illegal unless backed by a hard asset(land,property,Intellectual Properties,silver,gold,human work and services).

Banks are no longer allowed to create a loan unless the loan is backed by a real asset or is used for pay in real human economic activity(like work or commercial production).

What I am saying if you take most of the dollars out of circulation then the dollar becomes more valuable because there are less dollars available. The debt would remain the same but the dollar can purchase more debt because it is stronger. It is stronger because it is more scarce and harder to obtain. Its the reverse of what the fed is doing now.

So essentially you're against fractional reserve banking. While there's nothing wrong with that, you should know it's origins. The idea is 500 years old and exists because money is a finite thing. Fractional reserve banking allows for the money supply to expand. Actually, it has expanded so much that there's not enough silver, gold, and platinum in the world (including what has yet to be mined) to back the USD to say nothing of all the other worldly currencies. There's enough oil to back the USD but once you expand the idea globally that falls apart too, unless you shift to a one world currency. The solution to this was to monetize debt which has generally been a good idea. Fractional reserve banking isn't the problem, the problem is that securities banks and investment banks are now the same thing. In the past we had several boom/bust cycles about once per 10 years and Glass-Steagall was written to prevent new ones, after the depression, it more or less worked for about 60 years where we didn't have any major cycles. The banker lobby managed to repeal it though, and sure enough about 10 years later we were hit with the 2008 collapse, we're due for another one sometime in the next 2-4 years.

The reason this happens is because the investment banks make investments with the depositors money. They keep the profits but pass the losses back to the customer. Because it's not their money a risky investment that doesn't pan out doesn't actually cost them anything, which means that over time their appetite for risk grows and grows until you get BS like investing in junk status mortgage backed securities.

That's where you should be focusing your efforts on change. Fractional reserve banking is a good thing, banks being both security and investment firms however is a very very bad thing.

I've had thoughts on fixing the system, I don't have it 100% solved yet, but I'm pretty sure I've identified the problems and requirements for a solution. I go into it in this thread, give it a read... maybe it will give you something to think about.

Then anyone holding dollars would get more purchasing power from a stronger currency.

National level finance doesn't work this way. Few dollars means few entities hold dollars in debt. Which means dollars aren't being used to back currency. At an international level debt doesn't mean debt like it does to an individual. Instead it's an expression of faith in a countries currency. The USD is seen as strong for example because so many other countries in the world are willing to hold US debt, they then go out and say their currency like the Yuan or the Yen are backed by USD (debt), which in turn makes their currency stronger. Because the US also holds foreign debt, it in turn makes ours stronger.

This system was created partially because it increases currency stability, but more importantly because it creates military stability. Due to the interconnectedness no major country can declare war against one another because it will so thoroughly crash their economy (and everyone elses) that their nation will collapse. This was the solution to phasing out MAD. MAD works when there's two superpowers but it doesn't work when there's 10 nations with long range nuclear weapons, some big and some small. This system puts every nation on equal footing as far as it's ability to destroy the world economic system, and it happens to everyone simultaneously.

edit on 2-2-2014 by Aazadan because: (no reason given)

reply to post by Aazadan

That is probably the reason why china and the US will not attack each other. Our economies are intertwined so much that a outright war would be suicide. Good point. However. Letting a group of unelected people have that kind of control over the world economy is dangerous as we have witnessed in 2007-2008.

Repealing the Glass-Steagal act(Gramm–Leach–Bliley Act)was disastrous for the world economy.

Former senator Gramm now works for UBS AG as a vice chairman of the Investment Bank division.

I am not an economist,a commodity trader,a speculator,broker, nor am I investment banker. Do you think that the US should frame its monetary policy similar to what the US constitution has outlined?

What ways can we prevent a group of unelected people from nearly crashing the world economy again?

en.wikipedia.org...

That is probably the reason why china and the US will not attack each other. Our economies are intertwined so much that a outright war would be suicide. Good point. However. Letting a group of unelected people have that kind of control over the world economy is dangerous as we have witnessed in 2007-2008.

Repealing the Glass-Steagal act(Gramm–Leach–Bliley Act)was disastrous for the world economy.

Former senator Gramm now works for UBS AG as a vice chairman of the Investment Bank division.

I am not an economist,a commodity trader,a speculator,broker, nor am I investment banker. Do you think that the US should frame its monetary policy similar to what the US constitution has outlined?

What ways can we prevent a group of unelected people from nearly crashing the world economy again?

edit on 2-2-2014 by John_Rodger_Cornman

because: (no reason given)

en.wikipedia.org...

edit on 2-2-2014 by John_Rodger_Cornman because: (no reason given)

reply to post by 999zxcv

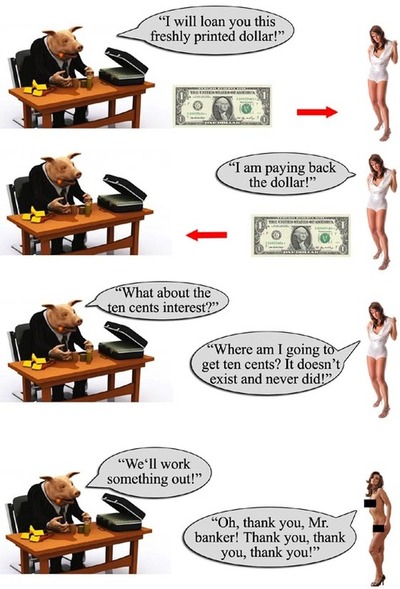

Yo I am going to jack this and throw it on facebook..

This is an actually good explanation on how debt is..

I used to use the 2 moon rock you borrow 1 and promise to give me another moon rock which is impossible.. But this one with a pig and hot chick... way more easier.

Yo I am going to jack this and throw it on facebook..

This is an actually good explanation on how debt is..

I used to use the 2 moon rock you borrow 1 and promise to give me another moon rock which is impossible.. But this one with a pig and hot chick... way more easier.

John_Rodger_Cornman

I am not an economist,a commodity trader,a speculator,broker, nor am I investment banker. Do you think that the US should frame its monetary policy similar to what the US constitution has outlined?

I don't. I think the constitution set good policy for the time it was written but it doesn't set good policy for today. When the policy was written there were problems with states issuing their own unbacked currency, additionally they were printing it without restraint. States like Rhode Island had major issues, and most of us know the stories about Continental Currency which was so heavily printed that congress was eventually forced to not even accept it for taxes.

Coming off of that I completely understand why they wanted a commodity to back the value of the dollar. The main problem with that today however is that population growth outpaces commodity growth. This means if money is tied to a particular good, that we end up in a deflationary spiral that shrinks the economy. Although it can represent other things, inflation also represents economic growth because it puts more money into the economy, it's also a way to prevent transactions from being 0 sum.

There's not enough commodities at current values to back the USD M2 monetary supply, much less everyone elses currency. As a result, the only other option without a major reduction of the money supply (very bad) is to use fiat currency. The main thing with a fiat currency however is it needs to be handled responsibly. A slow steady increase keeping pace with or slightly outpacing population growth is a good thing (currently about 1%/year which would equate to 111 billion in newly created money per year). This is in contrast to our current philosophy which is to create as much currency as humanly possible (85 billion/month) to keep failing banks from collapsing.

reply to post by Aazadan

But even then if the states issued their own currencies and then mismanaged their monetary policy they would then have to deal with the massive inflation because of their incompetence. You don't bail them out you let them fail. Then the states that did not destroy their currency with QE,tarp,and bailouts and manage their monetary policy responsibly will not have hyper-inflated currency. At least then its not global and effecting the entire world's economy nor is it effecting the entire countries economy.

Why not back it with a worker service credit?

A person's skilled labor converted into a electronic virtual credit system similar to bitcoin.

But even then if the states issued their own currencies and then mismanaged their monetary policy they would then have to deal with the massive inflation because of their incompetence. You don't bail them out you let them fail. Then the states that did not destroy their currency with QE,tarp,and bailouts and manage their monetary policy responsibly will not have hyper-inflated currency. At least then its not global and effecting the entire world's economy nor is it effecting the entire countries economy.

Why not back it with a worker service credit?

A person's skilled labor converted into a electronic virtual credit system similar to bitcoin.

edit on 3-2-2014 by John_Rodger_Cornman because:

(no reason given)

John_Rodger_Cornman

reply to post by Aazadan

But even then if the states issued their own currencies and then mismanaged their monetary policy they would then have to deal with the massive inflation because of their incompetence. You don't bail them out you let them fail. Then the states that did not destroy their currency with QE,tarp,and bailouts and manage their monetary policy responsibly will not have hyper-inflated currency. At least then its not global and effecting the entire world's economy nor is it effecting the entire countries economy.

Why not back it with a worker service credit?

A person's skilled labor converted into a electronic virtual credit system similar to bitcoin.edit on 3-2-2014 by John_Rodger_Cornman because: (no reason given)

I'm not quite sure what you're getting at here. States cannot have their own currencies, basically because of the mess it creates with interstate commerce. If we were all trying to trade using 51 currencies (50 states plus the dollar) things would be a nightmare. It would also lead to a situation where some states would cease to be functional because they would mismanage the monetary system. You could say let them fail, but then what happens? The answer is the same thing that happens when a country declares bankruptcy... debt gets canceled. Anyone that did business with the state would be out money, and the people would pay the price for the states incompetence. That is not a good system.

You can't back the dollar with a worker service credit because international trade has very little to do with worker time (to say nothing of the logistical issue that different work is worth different amounts), when you control a printing press for currency, it takes on a different meaning.

On a local level it doesn't matter what the currency is backed by, it can be backed by nothing and be a medium of exchange. With 8 simple words the government can make any item from styrofoam packing peanuts to gold bars a desired currency. All they have to say is "X is accepted for the payment of taxes".

As for bitcoin, it's also backed by nothing, though it does have a much higher electricity cost to create than most other currencies. The advantage of bitcoin is that it's not under the control of any nation. No one has access to a printing press for it to create as much as they want. Atleast directly. A nation could in theory create a fractional reserve banking system dealing in the trade of bitcoins for dollars, yen, yuan, etc as long as they keep a reserve amount of actual bitcoins in stock. The only nation that owns enough bitcoins to do this right now is the US, which holds a lot of bitcoins due to asset seizures.

new topics

-

Bobiverse

Fantasy & Science Fiction: 2 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 2 hours ago -

Former Labour minister Frank Field dies aged 81

People: 4 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 6 hours ago -

This is our Story

General Entertainment: 9 hours ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 11 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 11 hours ago, 14 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 17 hours ago, 6 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 15 hours ago, 6 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 2 hours ago, 5 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 16 hours ago, 4 flags -

Ditching physical money

History: 15 hours ago, 4 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 6 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 4 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 12 hours ago, 3 flags -

This is our Story

General Entertainment: 9 hours ago, 3 flags

active topics

-

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 273 • : FlyersFan -

The Reality of the Laser

Military Projects • 38 • : 5thHead -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 58 • : WeMustCare -

VirginOfGrand says hello

Introductions • 3 • : F2d5thCavv2 -

The Acronym Game .. Pt.3

General Chit Chat • 7743 • : F2d5thCavv2 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 25 • : Cvastar -

Suspended Nigerian Poverty Minister had $24M in her Bank Accounts

Political Issues • 11 • : malamarabi -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 47 • : Cvastar -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 2 • : mysterioustranger -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7133 • : underpass61

4