It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by mikegrouchy

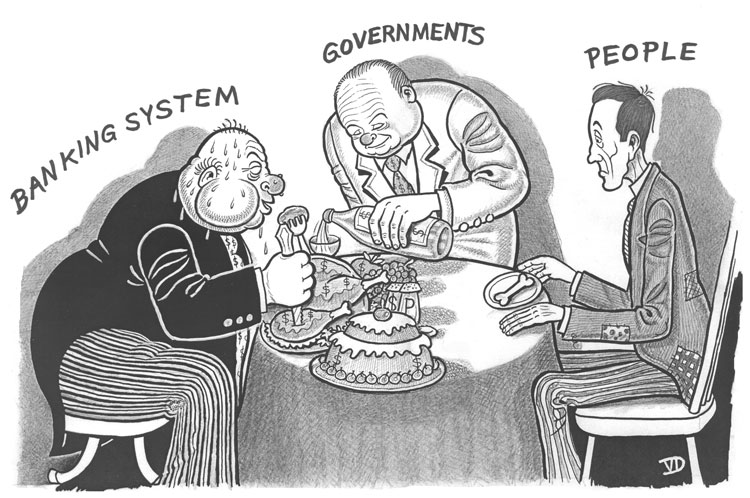

There have been many times I have felt like the guy on the right in your picture.

These are the times when I remember, there are more of us than there are of them.

So let's continue to "fatten-up" the bankers and remember;

"When times get really really hard, we can just eat the rich".

There have been many times I have felt like the guy on the right in your picture.

These are the times when I remember, there are more of us than there are of them.

So let's continue to "fatten-up" the bankers and remember;

"When times get really really hard, we can just eat the rich".

MissBeck

Biigs

I got a nice letter from my bank telling me that my account had been upgraded, it didnt actually tell me anything about what thta meant only this little gem at the end that said "service charge changes apply".

That wouldn't have been Halifax by any chance would it? They did exactly the same to me a few years back. Never asked, just did it. I kept the account, purely because it has a few added extras that are useful to me, but at a standing charge/account fee of £15 a month.

But I would like to have been asked!

It wasnt the Halifax it was the HSBC.

I really dont understand what the difference is between earning X amount and then 10% more the next month and then needing a standard service charge to do exactly what they did in the damned first place, i mean WTF holycrap this is stupid! Im paying a flat fee for somthing i got last month for free? ARE YOU JOKING?!

rant is the right place for this, its utterly stupid.

reply to post by mikegrouchy

Dude, I used to work for Bank of America in their Credit Card department as a customer service rep. This was back in 2008. They actually told us EXACTLY what to say to people asking why the bank got a bailout and they didn't. The management never came out and told us it was a lie, but everyone knew it. I hated that job with a passion.

Dude, I used to work for Bank of America in their Credit Card department as a customer service rep. This was back in 2008. They actually told us EXACTLY what to say to people asking why the bank got a bailout and they didn't. The management never came out and told us it was a lie, but everyone knew it. I hated that job with a passion.

I never saw the need for hell,

until I contemplated modern banking.

Mike Grouchy

TwoTonTommy

g146541

reply to post by mikegrouchy

On several occasions here at ATS and other boards I have urged folks to dump their banks.

They cannot survive without us, but we can thrive without them.

There is a reason that banks were a major target of robbers during the last depression, in the next depression they will be again.

Where was my bailout?

I agree. I've been telling folks for years to drop the corporate mega-banks and go with a small local bank. I remember hearing about Occupy Wall St. in New York raising all kinds of money --- and depositing it with Bank of America! We gotta take action, or the system will suck us all dry.

You misunderstood me, I said dump your bank.

Big, small, credit union, dump them all.

They are not there to help you, they are there to line their own pockets.

There is no need for a bank, if you cannot afford it, save up for it.

reply to post by mikegrouchy

Nothing "modern" about this banking system.

And it actually feeds "Hell", it is already there, which is why they need to leech off of us through the proxy of "banks" so they do not die.

They enjoy the energy of misdirected hate VERY MUCH.

Nothing "modern" about this banking system.

And it actually feeds "Hell", it is already there, which is why they need to leech off of us through the proxy of "banks" so they do not die.

They enjoy the energy of misdirected hate VERY MUCH.

Even credit unions? I suppose they are just he lesser of two evils. I've kept my account to specifically pay bills and bills alone, otherwise it's

good ol' cash in pocket for me. its suprising how much money you save that way...

When is this collapse going to happen, already? its time for big banks to pay for what they've done to this country and the world. That ATS post about the severe trend we're following with the great depression was very, very intriguing.

When is this collapse going to happen, already? its time for big banks to pay for what they've done to this country and the world. That ATS post about the severe trend we're following with the great depression was very, very intriguing.

ParasuvO

reply to post by mikegrouchy

Nothing "modern" about this banking system.

And it actually feeds "Hell", it is already there, which is why they need to leech off of us through the proxy of "banks" so they do not die.

They enjoy the energy of misdirected hate VERY MUCH.

No contest.

I'm not saying you're right, and

I'm not saying you are wrong, but

that what you have said is true whether I like it or not.

Lynx1102

Even credit unions? I suppose they are just he lesser of two evils. I've kept my account to specifically pay bills and bills alone, otherwise it's good ol' cash in pocket for me. its suprising how much money you save that way...

From what I've heard from many people over the years,

some credit unions can be alright. That, and the fact

that the big banks don't like them is enough for me to

give them a nod and a pass.

Lynx1102

When is this collapse going to happen, already? its time for big banks to pay for what they've done to this country and the world. That ATS post about the severe trend we're following with the great depression was very, very intriguing.

From the small print that I read,

they have to gain the whole world, before they

irrevocably lose their souls.

/maniacal laugh

Mu ah ha ha,

mu ah, ha ha-ha-ha ha!

Mike Grouchy

mikegrouchy

....and now, let us ask the question...

..which of these persons can be best described as ENTITLED?

the little guy? really?!

Come on, people! Lighten up on the banks and the "entitled"! Don't you see? They've all been suffering from Affluenza!

Um, 2nd line?

Um, 2nd line?

I don't mean to be sounding like some kind of new age hippy

But the sooner that we as a race/people realize that our dependency on money is a shackle, and get rid of it, the sooner we shall start moving towards a better goal...

TRY AND THINK OF ANY PROBLEM, WORLD OR PERSONAL, SOCIAL OR DOMESTIC THAT CANNOT BE TRACED BACK TO MONEY

But the sooner that we as a race/people realize that our dependency on money is a shackle, and get rid of it, the sooner we shall start moving towards a better goal...

TRY AND THINK OF ANY PROBLEM, WORLD OR PERSONAL, SOCIAL OR DOMESTIC THAT CANNOT BE TRACED BACK TO MONEY

Lolliek

Come on, people! Lighten up on the banks and the "entitled"! Don't you see? They've all been suffering from Affluenza!

Um, 2nd line?

Hmmm, you've got me thinking here. If we can prove that the big banks are suffering from affluenza then perhaps we can get the government to institutionalize all of the heads of them for a very long time, too. After all, they're clearly suffering from such a mental disorder.

reply to post by mikegrouchy

Yes, I remember all those good things around the early 1980's . Inflation at 5% or less, savings interest rates at 10%, credit card interest at 15%, private pension plans with employers you stayed with for life. Homes and mortgages that just required one wage earner. A second wage earner allowed the family to buy little luxuries.

Before then, there were green stamp savings schemes. You bought stamps, put them in a book, and then redeem those stamps for a cheque. A safe way to save money. Banks would have little information leaflets showing you much money you could save using compound interest. It was a curve that looked like a rocket launch.

TV used to be good as well - watching any programme would be like a reflection into your own home. They would always have the studios decorated for Christmas and New Year with tinsel and decorations and Easter with eggs and bunnies.

Then all the banks started being public traded, and then the "investors" just kept taking more and more. Savings interest rates kept being cut, credit card interest rates started rising. There was the great crash around 1990, when the economy went into meltdown as everyone panicked about getting onto the housing market, and prices just rocketed. Private pension schemes were raided when the stock traders want to "skim off pension fund surpluses". Then the government wanted their dip as well by removing tax credits for employee and employer contributions. Companies could no longer afford to pay into these schemes and they have been shut down.

Now we have all our traditionally local banks under foreign ownership. It's worthwhile checking for the "major shareholders in XXXX bank". Invariably, you'll find they are Credit Suisse, Santander, Goldman Sachs, Lloyds, and they cross-invest into each other, but the outcome is the same - money gets sucked out away from the customers.

I was in Edinburgh for years before RBoS got into trouble, and I saw what was happening. RBoS directors wangled their way with the council to get permission to build their new corporate campus over a golf course in the Green Belt. This allowed them to move staff out of office blocks dotted across the city and get everyone on one site. The directors actually wanted to buy a second golf course to play on.

Then all the banks started concentrated on "selling services" like loans, mortgages, credit cards rather than saving money. Pension fund management schemes started imposing 40% penalty clauses if anyone tried withdrawing their money before 30 years.

I spent six years battling Clydesdale Bank to get around £12000 in PPI payments refunded. PPI was an insurance scam where they took 10% of the outstanding amount on your account as a form of payment in case you were ever off ill. But since the credit card limit was £1500, the most that would ever have paid was £150, but they took in around £12000.

There's a service called the Financial Ombudsman service, as well as a website called Consumer Action Group:

www.consumeractiongroup.co.uk...

The little ****'ers played a game where they nudge people into a debt trap where the most they can afford to pay each month is the minimum payment on the debt. For me, this is what they deserve:

Lake of Fire

Yes, I remember all those good things around the early 1980's . Inflation at 5% or less, savings interest rates at 10%, credit card interest at 15%, private pension plans with employers you stayed with for life. Homes and mortgages that just required one wage earner. A second wage earner allowed the family to buy little luxuries.

Before then, there were green stamp savings schemes. You bought stamps, put them in a book, and then redeem those stamps for a cheque. A safe way to save money. Banks would have little information leaflets showing you much money you could save using compound interest. It was a curve that looked like a rocket launch.

TV used to be good as well - watching any programme would be like a reflection into your own home. They would always have the studios decorated for Christmas and New Year with tinsel and decorations and Easter with eggs and bunnies.

Then all the banks started being public traded, and then the "investors" just kept taking more and more. Savings interest rates kept being cut, credit card interest rates started rising. There was the great crash around 1990, when the economy went into meltdown as everyone panicked about getting onto the housing market, and prices just rocketed. Private pension schemes were raided when the stock traders want to "skim off pension fund surpluses". Then the government wanted their dip as well by removing tax credits for employee and employer contributions. Companies could no longer afford to pay into these schemes and they have been shut down.

Now we have all our traditionally local banks under foreign ownership. It's worthwhile checking for the "major shareholders in XXXX bank". Invariably, you'll find they are Credit Suisse, Santander, Goldman Sachs, Lloyds, and they cross-invest into each other, but the outcome is the same - money gets sucked out away from the customers.

I was in Edinburgh for years before RBoS got into trouble, and I saw what was happening. RBoS directors wangled their way with the council to get permission to build their new corporate campus over a golf course in the Green Belt. This allowed them to move staff out of office blocks dotted across the city and get everyone on one site. The directors actually wanted to buy a second golf course to play on.

Then all the banks started concentrated on "selling services" like loans, mortgages, credit cards rather than saving money. Pension fund management schemes started imposing 40% penalty clauses if anyone tried withdrawing their money before 30 years.

I spent six years battling Clydesdale Bank to get around £12000 in PPI payments refunded. PPI was an insurance scam where they took 10% of the outstanding amount on your account as a form of payment in case you were ever off ill. But since the credit card limit was £1500, the most that would ever have paid was £150, but they took in around £12000.

There's a service called the Financial Ombudsman service, as well as a website called Consumer Action Group:

www.consumeractiongroup.co.uk...

The little ****'ers played a game where they nudge people into a debt trap where the most they can afford to pay each month is the minimum payment on the debt. For me, this is what they deserve:

Lake of Fire

I don't do business with a mega bank, never have. My husband and I still do business with the small banks we each started out with. I have a deposit

in mine that went from a low of $0.97 to somewhere around $100 now. W00T! If it weren't for the fact that my bank is about 4 hours away by auto,

we'd be doing more business with it. I think we were pondering a savings account there because the funds would be harder to touch. No impulse grabs -

if you know what I mean.

stormcell

reply to post by mikegrouchy

Yes, I remember all those good things around the early 1980's . Inflation at 5% or less, savings interest rates at 10%, credit card interest at 15%, private pension plans with employers you stayed with for life. Homes and mortgages that just required one wage earner. A second wage earner allowed the family to buy little luxuries.

Before then, there were green stamp savings schemes. You bought stamps, put them in a book, and then redeem those stamps for a cheque. A safe way to save money. Banks would have little information leaflets showing you much money you could save using compound interest. It was a curve that looked like a rocket launch.

TV used to be good as well - watching any programme would be like a reflection into your own home. They would always have the studios decorated for Christmas and New Year with tinsel and decorations and Easter with eggs and bunnies.

Then all the banks started being public traded, and then the "investors" just kept taking more and more. Savings interest rates kept being cut, credit card interest rates started rising. There was the great crash around 1990, when the economy went into meltdown as everyone panicked about getting onto the housing market, and prices just rocketed. Private pension schemes were raided when the stock traders want to "skim off pension fund surpluses". Then the government wanted their dip as well by removing tax credits for employee and employer contributions. Companies could no longer afford to pay into these schemes and they have been shut down.

Now we have all our traditionally local banks under foreign ownership. It's worthwhile checking for the "major shareholders in XXXX bank". Invariably, you'll find they are Credit Suisse, Santander, Goldman Sachs, Lloyds, and they cross-invest into each other, but the outcome is the same - money gets sucked out away from the customers.

I was in Edinburgh for years before RBoS got into trouble, and I saw what was happening. RBoS directors wangled their way with the council to get permission to build their new corporate campus over a golf course in the Green Belt. This allowed them to move staff out of office blocks dotted across the city and get everyone on one site. The directors actually wanted to buy a second golf course to play on.

Then all the banks started concentrated on "selling services" like loans, mortgages, credit cards rather than saving money. Pension fund management schemes started imposing 40% penalty clauses if anyone tried withdrawing their money before 30 years.

I spent six years battling Clydesdale Bank to get around £12000 in PPI payments refunded. PPI was an insurance scam where they took 10% of the outstanding amount on your account as a form of payment in case you were ever off ill. But since the credit card limit was £1500, the most that would ever have paid was £150, but they took in around £12000.

There's a service called the Financial Ombudsman service, as well as a website called Consumer Action Group:

Great history lesson StormCell!

stormcell

www.consumeractiongroup.co.uk...

The little ****'ers played a game where they nudge people into a debt trap where the most they can afford to pay each month is the minimum payment on the debt. For me, this is what they deserve:

That's what the hell I'm talkin about !!!!11

Mike Grouchy

edit on 14-12-2013 by mikegrouchy because: (no reason given)

I went to get a bank account once, and I was asking all kinds of questions, and was getting answers I didn't really like. I've never made a lot of

money, and they told me (if I remember this correctly) that if I didn't have at least 100 dollars in my account at the first of each month, id be

charged 35 dollars... So of course I crumpled up the papers I had been given and threw it in the guys face. My friend that had brought me to his bank

(Told him I didn't want a bank account, he just kept telling me to go down there with him one day) was stunned, lol. The only reason I have a bank

account now, that I just got like 6 months ago, is because my job made me get it.

Believing they'll goto hell may be nice, but how do you know there is a hell? Furthermore, assuming there is how can you be so sure they'll go

there? You're not the one that makes the decision.

If you want to fix the problem, take action against them. Don't rely on divine retribution.

If you want to fix the problem, take action against them. Don't rely on divine retribution.

Someone has taken up the rant.

Rage against the regulators

December 14th, 2013 00:12:44 GMT by Louise Cooper | 11 Comments

She says that until the individuals are fined for their criminal behavior

it will continue. Fining the bank itself does nothing, but put the cost

back on the customers.

Mike Grouchy

Rage against the regulators

December 14th, 2013 00:12:44 GMT by Louise Cooper | 11 Comments

She says that until the individuals are fined for their criminal behavior

it will continue. Fining the bank itself does nothing, but put the cost

back on the customers.

Mike Grouchy

new topics

-

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 1 hours ago -

Hurt my hip; should I go see a Doctor

General Chit Chat: 2 hours ago -

Israel attacking Iran again.

Middle East Issues: 3 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 3 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 4 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 5 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 6 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 6 hours ago -

I hate dreaming

Rant: 6 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 8 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 9 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 11 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 16 hours ago, 11 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 8 hours ago, 9 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 8 hours ago, 8 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 3 hours ago, 6 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 6 hours ago, 6 flags -

Israel attacking Iran again.

Middle East Issues: 3 hours ago, 5 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 6 hours ago, 4 flags -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 1 hours ago, 4 flags

active topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 68 • : Mahogani -

Man sets himself on fire outside Donald Trump trial

Mainstream News • 35 • : TheMisguidedAngel -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 404 • : Zanti Misfit -

When an Angel gets his or her wings

Religion, Faith, And Theology • 4 • : randomuser2034 -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 10 • : Degradation33 -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 100 • : WeMustCare -

Israel attacking Iran again.

Middle East Issues • 23 • : KrustyKrab -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 37 • : charlyv -

Hurt my hip; should I go see a Doctor

General Chit Chat • 11 • : TheLieWeLive -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest • 7 • : Caver78