It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Does anyone know of any kind of alternative ways we are repaying our debt?edit on 19-10-2013 by darkbake because: (no reason given)

Well, we could always do what smaller countries used to do when they couldn't make their debt payments to the IMF-give them hard items like factories, land, infrastructure...just kidding, that's a terrible idea.

The national debt is owed to a consortium of international banks. As long as the minimum payment can be made, the clowns in DC will keep things as they are. Should they default, well, there will be a bit of "adjustment." The FED could collapse the dollar, or China might call in its markers if BRIC is powerful enough and they've got an alternative currency. Things would suck for awhile, then Congress would go back to printing money, as mandated in the Constitution. The Government declares bankruptcy and gives the banks the finger. I guess the banks could use their gold to hire foreign troops to come in and force us to continue to use worthless fiat money, but that's a risk we're willing to take because we've got nukes. So, suck it world.

Snsoc

Does anyone know of any kind of alternative ways we are repaying our debt?edit on 19-10-2013 by darkbake because: (no reason given)

Well, we could always do what smaller countries used to do when they couldn't make their debt payments to the IMF-give them hard items like factories, land, infrastructure...just kidding, that's a terrible idea.

The national debt is owed to a consortium of international banks. As long as the minimum payment can be made, the clowns in DC will keep things as they are. Should they default, well, there will be a bit of "adjustment." The FED could collapse the dollar, or China might call in its markers if BRIC is powerful enough and they've got an alternative currency. Things would suck for awhile, then Congress would go back to printing money, as mandated in the Constitution. The Government declares bankruptcy and gives the banks the finger. I guess the banks could use their gold to hire foreign troops to come in and force us to continue to use worthless fiat money, but that's a risk we're willing to take because we've got nukes. So, suck it world.

The Government works for these same banks that you're telling to suck it.

KnowledgeSeeker81

What is needed is simply a "Shock and Awe" to corporations inside America. Make import taxes so insanely high that fiscally it becomes unsound, and the production becomes more financially sound to begin anew the industrial revolution inside America

....whoa just blacked out there for a second. Did I say something?

This is what needs to happen. Anything that isn't produced on our soil by our workers(read: American citizens!) should be taxed 100x over.

supremecommander

KnowledgeSeeker81

What is needed is simply a "Shock and Awe" to corporations inside America. Make import taxes so insanely high that fiscally it becomes unsound, and the production becomes more financially sound to begin anew the industrial revolution inside America

....whoa just blacked out there for a second. Did I say something?

This is what needs to happen. Anything that isn't produced on our soil by our workers(read: American citizens!) should be taxed 100x over.

Wont happen. The US will be taxed right back and Resources will be held back. The other problem is that foreign countries might start do demand on their US bonds. " The US have exported a great deal of its inflation out of the US"

The world have the US by their balls. Very tight too. The only reason the US havent fallen yet is because of their military strength. But the US is starting to show weaknes there to ref. The Syria conflict. Were Russia steped in and said NO.

edit on 27.06.08 by spy66 because: (no reason

given)

reply to post by watchitburn

A little context is needed. The more money you have, the greater debt you can carry. For that reason, the most common measures to gauge a country's debt is the debt as a percentage of GDP and budget deficit, i.e. how much more is spent than is earned as income.

For example, as a homeowner with multiple cars, my debt is much greater than a person that rents an apartment and walks to work. Does that make me fiscally irresponsible if you simply measure the size of my debt? It only becomes a problem if my expenses exceed my income.

Using debt-to-GDP, the total U.S. debt is slightly above our annual economic output. With the single largest economy in the world, we also have the highest debt.

By comparison, Japan's debt (3rd largest economy in the world) is double its GDP and Italy is close. The U.K., France and Canada are close to that mark, even fiscally responsible Germany. By comparison to the world, the U.S. debt-to-GDP (expense to revenue) is not too bad. But it does need to improve.

A little context is needed. The more money you have, the greater debt you can carry. For that reason, the most common measures to gauge a country's debt is the debt as a percentage of GDP and budget deficit, i.e. how much more is spent than is earned as income.

For example, as a homeowner with multiple cars, my debt is much greater than a person that rents an apartment and walks to work. Does that make me fiscally irresponsible if you simply measure the size of my debt? It only becomes a problem if my expenses exceed my income.

Using debt-to-GDP, the total U.S. debt is slightly above our annual economic output. With the single largest economy in the world, we also have the highest debt.

By comparison, Japan's debt (3rd largest economy in the world) is double its GDP and Italy is close. The U.K., France and Canada are close to that mark, even fiscally responsible Germany. By comparison to the world, the U.S. debt-to-GDP (expense to revenue) is not too bad. But it does need to improve.

There is no way to stop the machinations.

It's full speed ahead.

The US economy, and thus, the dollar will soon die as the reserve currency, as all reserve currencies eventually do. And a new one will be rebirthed. Most likely it'll be gold and silver in the interim until some other nation steps up to the plate and flexes their biceps.

And in another 50-100 years, we'll go through this crap all over again.

The only thing the US has been successful at is how long they managed to cling onto it.

You guys can threaten to nuke the planet all you want, but you can't stop the natural evolution of this faulty monetary system we call "the global economy". Just ask the English, they can tell you all about how that works.

It's just the way the ball bounces.

It's full speed ahead.

The US economy, and thus, the dollar will soon die as the reserve currency, as all reserve currencies eventually do. And a new one will be rebirthed. Most likely it'll be gold and silver in the interim until some other nation steps up to the plate and flexes their biceps.

And in another 50-100 years, we'll go through this crap all over again.

The only thing the US has been successful at is how long they managed to cling onto it.

You guys can threaten to nuke the planet all you want, but you can't stop the natural evolution of this faulty monetary system we call "the global economy". Just ask the English, they can tell you all about how that works.

It's just the way the ball bounces.

edit on 20-10-2013 by CranialSponge because: (no reason given)

sighbul

reply to post by w810i

When debt is destroyed (i.e. payed off), money is destroyed. So if our debt went to zero, we'd have no money, i.e. dollars. Sounds crazy I know. Watch this video and if you understand it, you'll see the world in an entirely different way.

Beat me to it, the answers are all in here for those who would rather understand than bicker....great vid

You know, I never graduated college, but I did attend. Some private university that was expensive, and like most every US based educational system,

profit driven.

I was attending an economics 101 class, where the teacher was explaining that our country needs debt to operate. I was baffled. For me personally, I could not live in debt; yet here was a college professor explaining the USA absolutely had to be in debt to survive.

After trying to stomach the lesson that countries (along with USA) need to operate in debt to sustain the "economy", the discussion turned into free trade somehow. I asked a question along the lines of "why not restrict free trade to be equal, so we tax imports on countries that tax our exports?" I was simply brushed off by being told that window of opportunity is closed and cannot ever happen. I was wtf at that point.

At this point in time, I think so many ideologies and beliefs are being foisted upon an unknowing populace who are upset with the status quo but are unsure why. Perhaps it is because there is such a large and in power older generation unwilling to change, or with an agenda. Who knows, but in time and as the young replaces the old, things change... albeit slowly

I was attending an economics 101 class, where the teacher was explaining that our country needs debt to operate. I was baffled. For me personally, I could not live in debt; yet here was a college professor explaining the USA absolutely had to be in debt to survive.

After trying to stomach the lesson that countries (along with USA) need to operate in debt to sustain the "economy", the discussion turned into free trade somehow. I asked a question along the lines of "why not restrict free trade to be equal, so we tax imports on countries that tax our exports?" I was simply brushed off by being told that window of opportunity is closed and cannot ever happen. I was wtf at that point.

At this point in time, I think so many ideologies and beliefs are being foisted upon an unknowing populace who are upset with the status quo but are unsure why. Perhaps it is because there is such a large and in power older generation unwilling to change, or with an agenda. Who knows, but in time and as the young replaces the old, things change... albeit slowly

Someone had stated earlier that Obama was not technically lying when he said that increasing the debt ceiling would not necessarily increase our debt,

I call BS.

OP Source Link

150 Days Since the Treasury Department Reports Have Shown No Increase in Debt

Does anyone doubt that Obama was well aware of the extraordinary measures, or that they had to be paid back as soon as more debt was available? Not exactly breaking news that he lied though, I mean, his lips were moving.

It will be interesting to see how they use the unlimited ceiling through February 7th. I feel like they will restrain themselves so they can say that having no limit is not so bad. Then they may be able to push through legislation to suspend it forever, forcing a vote to keep it from increasing automatically. They've floated that idea before.

The $328 billion increase shattered the previous high of $238 billion set two years ago. The giant jump comes because the government was replenishing its stock of “extraordinary measures” — the federal funds it borrowed from over the last five months as it tried to avoid bumping into the debt ceiling. Under the law, that replenishing happens as soon as there is new debt space.

OP Source Link

150 Days Since the Treasury Department Reports Have Shown No Increase in Debt

Does anyone doubt that Obama was well aware of the extraordinary measures, or that they had to be paid back as soon as more debt was available? Not exactly breaking news that he lied though, I mean, his lips were moving.

It will be interesting to see how they use the unlimited ceiling through February 7th. I feel like they will restrain themselves so they can say that having no limit is not so bad. Then they may be able to push through legislation to suspend it forever, forcing a vote to keep it from increasing automatically. They've floated that idea before.

reply to post by Artlogic

So if money were gold...

Let's say I owe you 50 grams of gold.

Then I pay you 50 grams of gold.

How is 50 grams of gold destroyed?

So if money were gold...

Let's say I owe you 50 grams of gold.

Then I pay you 50 grams of gold.

How is 50 grams of gold destroyed?

Philippines

reply to post by Artlogic

So if money were gold...

Let's say I owe you 50 grams of gold.

Then I pay you 50 grams of gold.

How is 50 grams of gold destroyed?

A lot of People think that a dollar bill is Money. But in reality it is not. It is a medium of Exchange. It is a banknote.

To day People have no Clue as to what their dollar bill is backed up With. It used to be Gold "Money" But it is not any more.

People who were born after 1971 are not used to a dollar bill being backed up by Gold. And they are not being thought much about it in School either. To day a dollar bill is being used as a synonym for the concept of Money.

reply to post by Philippines

Gold is money. The dollar is currency. So really the correct wording is, when debt is destroyed, currency is destroyed. Real money, I.e. Gold and/or silver can't be destroyed, can't be printed, thus why gold in particular had been a store of value for the last several hundred years, and will continue to be in the future. The video I posted earlier takes you step by step in how all this works...

Gold is money. The dollar is currency. So really the correct wording is, when debt is destroyed, currency is destroyed. Real money, I.e. Gold and/or silver can't be destroyed, can't be printed, thus why gold in particular had been a store of value for the last several hundred years, and will continue to be in the future. The video I posted earlier takes you step by step in how all this works...

reply to post by sighbul

Don't worry about sound money I understand... Then I lost my savings in a tragic boating accident in a remote area and only I know the location of where it is. I think it's ok though, I should get insurance on the loss and maybe reclaim it one day

Don't worry about sound money I understand... Then I lost my savings in a tragic boating accident in a remote area and only I know the location of where it is. I think it's ok though, I should get insurance on the loss and maybe reclaim it one day

Philippines

reply to post by Artlogic

So if money were gold...

Let's say I owe you 50 grams of gold.

Then I pay you 50 grams of gold.

How is 50 grams of gold destroyed?

It wouldn't be. Watch the vid again, currency and money are two different things. China and India have been very busy acquiring all the gold they can get their hands on, why do you suppose that is?

The U.S. budget and debt ceiling circus is not the real problem. The issue here very simply is the long term solvency of the United States of

America. This gap based deficit is going to kill us . We are going to be in very serious trouble in this next year 2014-15, and the global markets

know this is happening.

They are not going to address the long term solvency problems of the United States. That’s going to trigger a massive decline in the dollar in the not-too-distant future, and that, in turn, will give us the early stages of hyperinflation in this next year.We’re basically at a point where we can’t kick the can down the road. This is it.

Going forward from here, you’re going to generally see a weaker dollar, and it will get much weaker. You’re going to have a dollar panic, but I can’t give you the exact timing on that.”

You can protect your wealth by holding hard assets. If your assets are denominated in dollars and Treasury bonds, those will become worthless in hyperinflation.

My guess is we will convert to a credit system and do away with currency. Part of the New World Order. It's a set-up for those who cant see this. The G-20 will come to the rescue with a treaty, that halts the US Constitution. Beware of this.

They are not going to address the long term solvency problems of the United States. That’s going to trigger a massive decline in the dollar in the not-too-distant future, and that, in turn, will give us the early stages of hyperinflation in this next year.We’re basically at a point where we can’t kick the can down the road. This is it.

Going forward from here, you’re going to generally see a weaker dollar, and it will get much weaker. You’re going to have a dollar panic, but I can’t give you the exact timing on that.”

You can protect your wealth by holding hard assets. If your assets are denominated in dollars and Treasury bonds, those will become worthless in hyperinflation.

My guess is we will convert to a credit system and do away with currency. Part of the New World Order. It's a set-up for those who cant see this. The G-20 will come to the rescue with a treaty, that halts the US Constitution. Beware of this.

edit on 20-10-2013 by wonderworld because: edit to add info

sighbul

reply to post by Philippines

Gold is money. The dollar is currency. So really the correct wording is, when debt is destroyed, currency is destroyed. Real money, I.e. Gold and/or silver can't be destroyed, can't be printed, thus why gold in particular had been a store of value for the last several hundred years, and will continue to be in the future. The video I posted earlier takes you step by step in how all this works...

I agree we should all have some physical gold and silver on hand.

Government bonds used to be the safest route but it is like a teeter totter. We almost defaulted on the thing most protected. Buying US Treasuries for safety. I see many bubbles about to burst!

I'm thinking about how FDIC had to be bailed out in 2008. I think if hyperinflation hits food is the hot stock to have; although phicical food, physical metals not stocks.

reply to post by Philippines

Our system is based on debt, money comes into existence when borrowed and disappears when repaid. That's what inflation deflation is. This is the point of it all, perpetual debt creating perpetual slaves. Gold is real and tangible so it isn't destroyed.

Our system is based on debt, money comes into existence when borrowed and disappears when repaid. That's what inflation deflation is. This is the point of it all, perpetual debt creating perpetual slaves. Gold is real and tangible so it isn't destroyed.

reply to post by watchitburn

The national debt will keep going up and can never be paid off - this principal is ingrained in the whole banking system controlled by the Federal Reserve. The only way to increase our money supply is to borrow money with interest from the Federal Reserve, who creates it out of thin air. Since all of the money in existence would be necessary to pay off just the principal, and interest keeps on compounding, the debt will always increase. As the population increases, the money supply also needs to increase, but cannot do so without getting us into more debt. It is an evil plan by the big bankers of the Western World to control the world. Although the Federal Reserve was created in 1913, the general idea was put forward by Thomas Jefferson much earlier, who thought that manipulating a never ending debt was a good way to regulate the money supply and appease the bankers at the same time. While we cannot pay off the debt, we can make it grow faster by spending more money on war, something that Congress has done under both political parties. But still, this should not be a partisan political issue. We need to get deeper into the fundamental causes of the debt.

The national debt will keep going up and can never be paid off - this principal is ingrained in the whole banking system controlled by the Federal Reserve. The only way to increase our money supply is to borrow money with interest from the Federal Reserve, who creates it out of thin air. Since all of the money in existence would be necessary to pay off just the principal, and interest keeps on compounding, the debt will always increase. As the population increases, the money supply also needs to increase, but cannot do so without getting us into more debt. It is an evil plan by the big bankers of the Western World to control the world. Although the Federal Reserve was created in 1913, the general idea was put forward by Thomas Jefferson much earlier, who thought that manipulating a never ending debt was a good way to regulate the money supply and appease the bankers at the same time. While we cannot pay off the debt, we can make it grow faster by spending more money on war, something that Congress has done under both political parties. But still, this should not be a partisan political issue. We need to get deeper into the fundamental causes of the debt.

OtherSideOfTheCoin

17 TIMES!!!!!

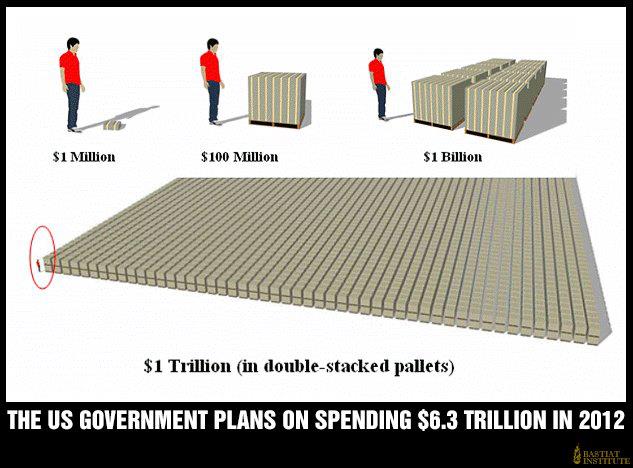

and that is what American National debt looks like in $100 bills.

Add to that the 90 TRILLION in unfunded liabilities and think of a perspective that will work.

Any computer graphics geeks here that could make something like that?

No matter how you look at it, the reality is that it is unsustainable, eventuality the dollar will crash, the US economy will collapse, and the impact will be as devastating globally as it is here.

17 + 90 TRILLION =?

wonderworld

sighbul

reply to post by Philippines

Gold is money. The dollar is currency. So really the correct wording is, when debt is destroyed, currency is destroyed. Real money, I.e. Gold and/or silver can't be destroyed, can't be printed, thus why gold in particular had been a store of value for the last several hundred years, and will continue to be in the future. The video I posted earlier takes you step by step in how all this works...

I agree we should all have some physical gold and silver on hand.

With a devalued dollar, and hyperinflation, if a loaf of bread costs $1,000, how much will an ounce of gold buy?

new topics

-

Who guards the guards

US Political Madness: 2 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 3 hours ago -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 8 hours ago -

1980s Arcade

General Chit Chat: 10 hours ago -

Deadpool and Wolverine

Movies: 11 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 16 hours ago, 20 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 8 hours ago, 9 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 13 hours ago, 8 flags -

Deadpool and Wolverine

Movies: 11 hours ago, 4 flags -

1980s Arcade

General Chit Chat: 10 hours ago, 4 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 12 hours ago, 3 flags -

Who guards the guards

US Political Madness: 2 hours ago, 1 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 3 hours ago, 0 flags

active topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 106 • : Annee -

They Killed Dr. Who for Good

Rant • 65 • : grey580 -

House Overwhelmingly Passes Funding for Ukraine, Israel and Taiwan

US Political Madness • 60 • : Justoneman -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 628 • : FlyersFan -

I Guess Cloud Seeding Works

Fragile Earth • 38 • : seekshelter -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 203 • : Xtrozero -

Another person lights themselves on fire and dies on College campus, happened in Red Deer, Canada

Mainstream News • 28 • : seekshelter -

23,000 Dead People Registered Within a Two Week Period In One State

US Political Madness • 41 • : Xtrozero -

Deadpool and Wolverine

Movies • 2 • : chiefsmom -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion • 2 • : seekshelter