It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by beezzer

I just noted from you link of what is open and what is closed, that the passport agency is "probably open" meaning that it may be closed.

That being the case, those that do not have a passport, will not be able to get one, and so are effectively locked inside the US.

Basically the door has closed, and you cannot get out!

I just noted from you link of what is open and what is closed, that the passport agency is "probably open" meaning that it may be closed.

That being the case, those that do not have a passport, will not be able to get one, and so are effectively locked inside the US.

Basically the door has closed, and you cannot get out!

Well, if America against raising the debt limit, they don't seem to be happy about the Republican party at the moment. You would think they would be

cheering for the Republicans. The Democratic Party has a 43% favorability rating.

Republican Party Favorability Sinks to Record Low

WASHINGTON, D.C. -- With the Republican-controlled House of Representatives engaged in a tense, government-shuttering budgetary standoff against a Democratic president and Senate, the Republican Party is now viewed favorably by 28% of Americans, down from 38% in September. This is the lowest favorable rating measured for either party since Gallup began asking this question in 1992.

Republican Party Favorability Sinks to Record Low

beezzer

reply to post by xuenchen

The secret is coming out.

The world won't burn if the debt ceiling is not raised.

Moody's is even saying it won't be the end of the world.

www.washingtonpost.com...-dc00-41d8-92cb-327c5c814d82

Jesus Christ!!!

IT WASN"T MOODY'S THAT DOWNGRADED THE US CREDIT RATING LAST TIME, IT WAS STANDARD AND POORS!!! MOODY'S Does as they are told and never downgraded the US Credit Rating.

Moody's will rate the USA AAA+ until the whole world burns down. The International community doesn't care about Moody's rating. They are watching Standard and Poors!

Standard & Poors has said that the "Debt Ceiling debate" is unlikely to change their rating, because they have already downgraded the US Credit rating to reflect dysfunction in DC...but they also say

Failure to raise the Debt Ceiling is not in Standard & Poors base case assumptions. If the Debt Ceiling was not raised by the Mid-October date, or the stop-gap measures employed in recent months are estimated to be exhausted, the United States will not be able to meet all of it's obligations. Should the government fail to service a debt obligation we would lower the Credit Rating to "SD" which stands for "Selective Default"

www.youtube.com...

More to the point...Investor Confidence would collapse.

Just effen insane that you wacko's are looking to destroy our economy...AND BSing from DC to Fox News telling Americans that default is OK!

edit on 9-10-2013 by Indigo5 because: (no reason given)

reply to post by beezzer

I believe you are gravely mistaken about this assumption beezzer. Do you honestly think that defaulting on the national debt is going to have no large consequences? I think people are really misunderstanding what I'm trying to say in this thread. I'm not saying that the debt ceiling should be raised, in fact I believe it shouldn't be raised. What I'm saying is that there will be fairly big consequences if that path is taken. You cannot simply choose to abandon this whole debt based system after it has been propped up over many decades and then expect it to have no large consequences.

If you want a fresh start then you must be willing to take the hit that will come along with it. There is no get out jail free card I'm afraid. As they say... it's darkest just before the new dawn, or something like that. You need to understand and appreciate that fact because the United States is at a very crucial point in its history right now. You have the chance to make a fresh start but it wont come easy. If you believe it will come easy then I would recommend you look at the situation more closely.

We're in a recession NOW! Perhaps a depression, NOW. If we don't raise the debt ceiling, all that'll happen is you progressives will be able to talk honestly about the economy and be on the same page as the rest of us!

I believe you are gravely mistaken about this assumption beezzer. Do you honestly think that defaulting on the national debt is going to have no large consequences? I think people are really misunderstanding what I'm trying to say in this thread. I'm not saying that the debt ceiling should be raised, in fact I believe it shouldn't be raised. What I'm saying is that there will be fairly big consequences if that path is taken. You cannot simply choose to abandon this whole debt based system after it has been propped up over many decades and then expect it to have no large consequences.

If you want a fresh start then you must be willing to take the hit that will come along with it. There is no get out jail free card I'm afraid. As they say... it's darkest just before the new dawn, or something like that. You need to understand and appreciate that fact because the United States is at a very crucial point in its history right now. You have the chance to make a fresh start but it wont come easy. If you believe it will come easy then I would recommend you look at the situation more closely.

edit on 9/10/2013 by ChaoticOrder because: (no reason given)

reply to post by beezzer

We are in a depression and we have not come out of it. All that has happened is the long term unemployed have fallen off the screen. The actual unemployment has been 22%---> 23% during the entire Obama Admin.

It was Clinton that changed how unemployment was figured no doubt because he knew the World Trade Organization ratification and his sale of US technology to China would permanently cripple the US economy.

A measure of the health of our economy is the balance of good traded or the trade deficit. You can see our trade deficit nose dive HERE.

...We're in a recession NOW! Perhaps a depression, NOW....

We are in a depression and we have not come out of it. All that has happened is the long term unemployed have fallen off the screen. The actual unemployment has been 22%---> 23% during the entire Obama Admin.

It was Clinton that changed how unemployment was figured no doubt because he knew the World Trade Organization ratification and his sale of US technology to China would permanently cripple the US economy.

August 24th, 2004

...Up until the Clinton administration, a discouraged worker was one who was willing, able and ready to work but had given up looking because there were no jobs to be had. The Clinton administration dismissed to the non-reporting netherworld about five million discouraged workers who had been so categorized for more than a year. As of July 2004, the less-than-a-year discouraged workers total 504,000. Adding in the netherworld takes the unemployment rate up to about 12.5%.

The Clinton administration also reduced monthly household sampling from 60,000 to about 50,000, eliminating significant surveying in the inner cities. Despite claims of corrective statistical adjustments, reported unemployment among people of color declined sharply, and the piggybacked poverty survey showed a remarkable reversal in decades of worsening poverty trends....

www.shadowstats.com...

A measure of the health of our economy is the balance of good traded or the trade deficit. You can see our trade deficit nose dive HERE.

Ballooning Trade Deficit Under the NAFTA-WTO Model

Prior to the establishment of Fast Track and the trade agreements it enabled, the United States had balanced trade; since then, the U.S. trade deficit has exploded. The pre-Fast Track period (before 1973) was one of balanced U.S. trade and rising living standards for most Americans. In fact, in 1973, the United States had a slight trade surplus, as it did in nearly every year between World War II and 1975. But in every year since Fast Track was first implemented in 1975, the United States has run a trade deficit. And since establishment of NAFTA and the WTO in the mid-1990s, the U.S. trade deficit jumped exponentially from under $100 billion to over $700 billion — over 5 percent of national income. The establishment of the extraordinary Fast Track trade procedure coincided with President Nixon’s decision to abandon managed exchange rates — the so-called gold standard...

www.citizen.org...

reply to post by Indigo5

Who says we would default on debt if it gets paid from continued income revenues ?

Who says we always have to borrow ?

Revenues are streaming in.

Just limit everything to that.

What's the problem ?

There's plenty of money.

Who says we would default on debt if it gets paid from continued income revenues ?

Who says we always have to borrow ?

Revenues are streaming in.

Just limit everything to that.

What's the problem ?

There's plenty of money.

C-U-T the binge spending !!!

beezzer

We're in a recession NOW! Perhaps a depression, NOW. If we don't raise the debt ceiling, all that'll happen is you progressives will be able to talk honestly about the economy and be on the same page as the rest of us!

(Welcome to the Tea Party)

lolz

No thank you. America is not be required to meet the TP's deluded apocalyptic fantasies, no more than they are required to elect Romney by a landslide like the far right so confidently predicted. You folks are free to keep stockpiling for the end of times, but you are not entitled to bring them about and then blame others.

Despite every economic indicator showing a recovery that is picking up speed, you folks are hell bent in making your reality disconnect of economic apocalypse real, just so after you get done shooting the hostage you can look at the family and say...see what you did?

Enough of the crazy...it was amusing until the wacko's actually got elected and decided to genuinely kill the economy.

Real people, real families, real lives, by the millions are going to be impacted and ARE being impacted.

It's not just one half of the country that is coming for the extremists now, it is the CEO's, the Chamber of Commerce...the sane GOP...and everyone that depends on the American Economy in small everyday ways...the economy you have taken hostage and are gleefully telling us it will be OK to shoot.

Whatever the end game is...it involves the end of the TP...that is a certaintity...so start thinking up new names and a new banner...someplace you can hide and claim that you were never a TPer...just like the TPers never supported GW Bush...always another rock to hide beneath, but Americans won't soon forget this blow when they were just getting back on their feet.

edit on 9-10-2013 by Indigo5 because: (no reason given)

reply to post by xuenchen

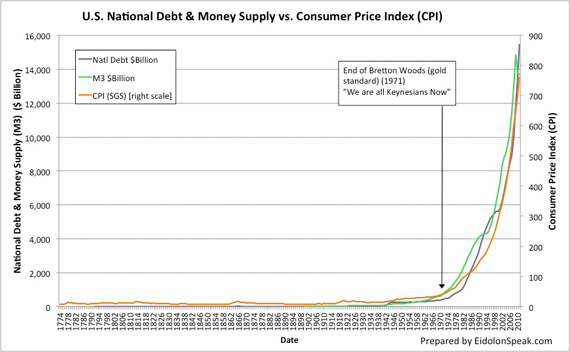

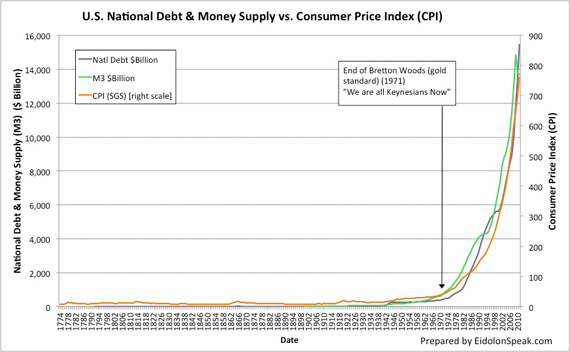

xuenchen, I tend to respect you a lot but I have to take the position that no amount of spending cuts will stop the debt from rising. Let me show you a very interesting graph:

Why do you think it is that the national debt is rising in such an exponential fashion and why does the M3 Money Supply follow that same trend so nicely? It's because MONEY IS DEBT in a debt based system. We all need to start to understand the implications of that fact. The debt will always continue to rise so long as the US operates within a debt based system.

xuenchen, I tend to respect you a lot but I have to take the position that no amount of spending cuts will stop the debt from rising. Let me show you a very interesting graph:

Why do you think it is that the national debt is rising in such an exponential fashion and why does the M3 Money Supply follow that same trend so nicely? It's because MONEY IS DEBT in a debt based system. We all need to start to understand the implications of that fact. The debt will always continue to rise so long as the US operates within a debt based system.

If there were no debts in our money system, there wouldn't be any money.

~ Marriner Eccles, Governor of the Federal Reserve, 1941

edit on 9/10/2013 by ChaoticOrder because: (no reason given)

reply to post by Indigo5

Painting a rosy picture of high unemployment, record high food stamp usage, record high welfare enrollment, aren't you.

Some of us just don't see the world through Obama-style glasses.

Painting a rosy picture of high unemployment, record high food stamp usage, record high welfare enrollment, aren't you.

Some of us just don't see the world through Obama-style glasses.

reply to post by Kaploink

Depends on who is doing the polling.

2% of Democrats Say End Shutdown; 71% of GOP Say Keep It Going

The poll of generic voting is 40% Dems, 40% Republicans a bit up for the Republicans when looking at the listing in Generic Congressional Ballot but it is not statistically significant.

62% Think U.S. Likely To Default on Debt

64% Think Spending Cuts Best for Economy

Seventy-five percent (75%) of Likely U.S. Voters consider the economy Very Important in terms of how they will vote in the next congressional election,

Can you say a vote of no confidence?

I think the take home is except for some die-hards most people are fed-up with the liars and cheats in Congress and would willingly boot them out if given decent alternatives.

Well, if America against raising the debt limit, they don't seem to be happy about the Republican party at the moment. You would think they would be cheering for the Republicans.

Depends on who is doing the polling.

2% of Democrats Say End Shutdown; 71% of GOP Say Keep It Going

The poll of generic voting is 40% Dems, 40% Republicans a bit up for the Republicans when looking at the listing in Generic Congressional Ballot but it is not statistically significant.

62% Think U.S. Likely To Default on Debt

64% Think Spending Cuts Best for Economy

Seventy-five percent (75%) of Likely U.S. Voters consider the economy Very Important in terms of how they will vote in the next congressional election,

Congressional Performance

Friday, October 04, 2013

It’s hard to believe it could get any worse, but negative reviews for Congress are at their highest level in nearly two years.

Nine percent (9%) of Likely Voters rate the way Congress is doing its job as good or excellent, according to the latest Rasmussen Reports national telephone survey. Seventy percent (70%) of voters say Congress is doing a poor job...

While 74% of Democrats and voters not affiliated with either major political party say Congress is doing a poor job, 62% of Republicans agree. Fifteen percent (15%) of Republicans now give the legislature positive ratings, up from seven percent (7%) a month ago.

Politically liberal voters are more critical of Congress than conservative voters are.

As the federal government shutdown enters its fourth day, (50%) of all voters view the agenda of Republicans in Congress as extreme, while 46% say the same of the Democratic congressional agenda....

Can you say a vote of no confidence?

I think the take home is except for some die-hards most people are fed-up with the liars and cheats in Congress and would willingly boot them out if given decent alternatives.

reply to post by ChaoticOrder

Our demise is greatly over-rated.

We have plenty to pay the debt, we just don't have the additional trillions to pay into social programs that have been propping up the shambles of our economy like timber shoring up a condemned house.

Our demise is greatly over-rated.

We have plenty to pay the debt, we just don't have the additional trillions to pay into social programs that have been propping up the shambles of our economy like timber shoring up a condemned house.

beezzer

reply to post by ChaoticOrder

Our demise is greatly over-rated.

We have plenty to pay the debt, we just don't have the additional trillions to pay into social programs that have been propping up the shambles of our economy like timber shoring up a condemned house.

You need to try and understand what Indigo5 is saying. It's not just about paying the debt, it's about market confidence in the US dollar. The US dollar is the world reserve currency and the default petrodollar. If the US chooses to put a cap on the debt ceiling it is all but given that the US will have to at least partially default on some of the debt and that will have implications which ripple around the world, because so many countries hold US debt. If all the debt suddenly turns into toxic assets which the US is unable to pay you'll end up with something similar to when the mortgage bubble popped back in 08, but it'll be the popping of the debt based currency bubble this time and the repercussions will extend much further.

reply to post by ChaoticOrder

You know, maybe you're right. But right now, we're giving morphine to a terminal cancer patient. Sure, another dose and he'll feel GREAT!

But the cancer is still there.

You know, maybe you're right. But right now, we're giving morphine to a terminal cancer patient. Sure, another dose and he'll feel GREAT!

But the cancer is still there.

reply to post by beezzer

Like I said near the top of this page, I don't think the debt ceiling should be raised. I think the US needs to bite the bullet and start fresh. Personally I think the only plausible option is to go back to some sort of sound money system based on gold or silver. If the US wants to put a cap on its debt than it is totally infeasible for it to continue operating under a debt based money system. That will be learnt the hard way or the easy way depending on how the US government chooses to proceed.

Like I said near the top of this page, I don't think the debt ceiling should be raised. I think the US needs to bite the bullet and start fresh. Personally I think the only plausible option is to go back to some sort of sound money system based on gold or silver. If the US wants to put a cap on its debt than it is totally infeasible for it to continue operating under a debt based money system. That will be learnt the hard way or the easy way depending on how the US government chooses to proceed.

ChaoticOrder

reply to post by beezzer

Like I said near the top of this page, I don't think the debt ceiling should be raised. I think the US needs to bite the bullet and start fresh. Personally I think the only plausible option is to go back to some sort of sound money system based on gold or silver. If the US wants to put a cap on its debt than it is totally infeasible for it to continue operating under a debt based money system. That will be learnt the hard way or the easy way depending on how the US government chooses to proceed.

Agreed.

reply to post by ChaoticOrder

I think a lot of us know about the increase in debt. Unfortunately continuing to raise the debt ceiling just doesn't work. The ONLY reason the USA has gotten away with it is because we are the world reserve currency. At this point The Latest American Export: Inflation In 2010, prices rose by more than 5% in major emerging markets such as China, Brazil and Indonesia.

Here is an article on Hyperinflation. He explains being the world reserve currency has given the USA a get out of jail free card. He also explains the conditions for hyperinflation.

This is why I watch the world reserve currency. Tax compliance? That is starting to change. The $2 trillion shadow economy is the recession's big winner

Unemployment is high and capacity utilization is low? Problem is we have no demand for US products as we now buy cheap foreign goods.

I think a lot of us know about the increase in debt. Unfortunately continuing to raise the debt ceiling just doesn't work. The ONLY reason the USA has gotten away with it is because we are the world reserve currency. At this point The Latest American Export: Inflation In 2010, prices rose by more than 5% in major emerging markets such as China, Brazil and Indonesia.

Here is an article on Hyperinflation. He explains being the world reserve currency has given the USA a get out of jail free card. He also explains the conditions for hyperinflation.

April 8, 2011

What are the preconditions for Hyperinflation?

The surge in money supply and the lack of productive resources led to hyperinflation and collapse.

The key to Weimar’s hyperinflation was two-fold.

The German government had a large foreign currency debt obligation.

The German economy lost huge amounts of productive capacity causing prices to soar as demand outstripped supply.

That’s Weimar.

Zimbabwe

While the facts in Zimbabwe are different, the underlying causes for hyperinflation were the same: foreign currency obligations and a loss of productive capacity.

Zimbabwe had established Independence from Britain in 1980. Yet, by the late 1990s 70% of productive arable land was still held by the small minority 1% of white farmers in the country. After years of talk about redistribution, in 2000, the President Robert Mugabe began to redistribute this land.

The redistribution process was a disaster, both legally and economically. Many whites fled as violence escalated. The result was an enormous decline in Zimbabwe’s agricultural production. With agricultural production having plummeted, Zimbabwe was forced to pay to import food in hard currency.

Meanwhile, the government turned to the printing presses to fulfil its domestic obligations. as in Germany, the foreign currency obligations, the loss of productive capacity and the money printing was a toxic brew which ended in hyperinflation.

As you can see from the two most severe cases of hyperinflation, the problem in each case was a loss of productive capacity, foreign currency liabilities, and a loss of the ability to tax....

So, hyperinflation has very specific preconditions that are not apparent in the U.S..

No foreign currency liability: The U.S. dollar is the world’s reserve currency so the U.S. can pay for trade goods in U.S. dollars. The U.S. does not have a peg to gold or some other currency which acts as a de facto foreign currency liability. And the U.S. government has substantially no foreign currency liabilities. All of the debt is issued in domestic currency.

Price pressures are still anchored: While commodity prices are rising, they are rising in all currencies, not just in USD. Moreover, their rise will create demand destruction before any hyperinflation could occur. Why? Unemployment is high and capacity utilization is low, meaning there are no inflationary pressures on that front to help push inflation higher before demand destruction sets in.

Currency revulsion has not set in: Tax compliance is high in the U.S. We are not talking about Russia, Greece or Argentina where government has had a difficult time in raising tax. Moreover, as the USD is still the world’s reserve currency, there has been no freefall sell off of dollars, nor do I anticipate any in the near-to-medium term.

In short, there will be no hyperinflation in the U.S. any time soon.

This is why I watch the world reserve currency. Tax compliance? That is starting to change. The $2 trillion shadow economy is the recession's big winner

Unemployment is high and capacity utilization is low? Problem is we have no demand for US products as we now buy cheap foreign goods.

reply to post by xuenchen

I'm not surprised, not everyone in America is brain dead, expecting the American people to be happy that they are funding the government's blatant tyranny against it's own citizens is like paying a guy 20 bucks to kick your ass and sleep with your wife, it's insane.

I'm not surprised, not everyone in America is brain dead, expecting the American people to be happy that they are funding the government's blatant tyranny against it's own citizens is like paying a guy 20 bucks to kick your ass and sleep with your wife, it's insane.

edit on 9-10-2013 by

Helious because: (no reason given)

Most American, products of our decrepit education system, don’t know what he debt ceiling is, and the ramifications of it, one way or the other.

But if you ask them if America should default on its bills they would overwhelmingly say no. So the poll is meaningless.

But if you ask them if America should default on its bills they would overwhelmingly say no. So the poll is meaningless.

edit on 9-10-2013 by Willtell because: (no reason given)

reply to post by beezzer

Lol well I'm glad we were able to reach an agreement on that. Although I knew we would eventually agree once I explained my full argument. Some times I prefer to post my argument in segmental blocks and it can be a bit difficult to understand the point I'm trying to make at first. But it's interesting to see how people react to those individual posts, I've never felt so unstarred in my life, lol.

Lol well I'm glad we were able to reach an agreement on that. Although I knew we would eventually agree once I explained my full argument. Some times I prefer to post my argument in segmental blocks and it can be a bit difficult to understand the point I'm trying to make at first. But it's interesting to see how people react to those individual posts, I've never felt so unstarred in my life, lol.

edit on 9/10/2013 by ChaoticOrder

because: (no reason given)

reply to post by ChaoticOrder

All good points.

But Americans have already been feeling it the *hard way* for a long time.

Most of the economic system is not helping the average person.

All the part time jobs, unemployment etc have caught up.

The perceptions are changing.

The politicians really need to get money back into the pockets of the citizens and put the corporations and bankers *on notice* so to speak.

Perhaps a limited and selectivedefault *delay* of some securities payments might make the foreign interests think about a thing or

two.

They seem to assume people here will just continue to go broke for their interests.

Nancy Pelosi might say it like this;

..... " You have to try it so you can see what it does "

All good points.

But Americans have already been feeling it the *hard way* for a long time.

Most of the economic system is not helping the average person.

All the part time jobs, unemployment etc have caught up.

The perceptions are changing.

The politicians really need to get money back into the pockets of the citizens and put the corporations and bankers *on notice* so to speak.

Perhaps a limited and selective

They seem to assume people here will just continue to go broke for their interests.

Nancy Pelosi might say it like this;

..... " You have to try it so you can see what it does "

new topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 4 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 4 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 7 hours ago -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 8 hours ago -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 10 hours ago -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 11 hours ago -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 11 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 11 hours ago, 24 flags -

George Knapp AMA on DI

Area 51 and other Facilities: 4 hours ago, 19 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 12 hours ago, 18 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 7 hours ago, 7 flags -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 12 hours ago, 7 flags -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 17 hours ago, 6 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 10 hours ago, 5 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 8 hours ago, 3 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 4 hours ago, 3 flags -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 11 hours ago, 3 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 384 • : WeMustCare -

George Knapp AMA on DI

Area 51 and other Facilities • 17 • : nerbot -

Election Year 2024 - Interesting Election-Related Tidbits as They Happen.

2024 Elections • 64 • : Zanti Misfit -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 45 • : RazorV66 -

Truth Social goes public, be careful not to lose your money

Mainstream News • 119 • : Kaiju666 -

OUT OF THE BLUE Chilling moment pulsating blue cigar-shaped UFO is filmed hovering over PHX AZ

Aliens and UFOs • 42 • : Ophiuchus1 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 531 • : cherokeetroy -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 20 • : Halfswede -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 33 • : Halfswede -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 7 • : JonnyC555