It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by spannera

Michael Snyder

Economic Collapse

August 14, 2013

Source: US NAVY, via Wikimedia Commons

Are we heading for a major stock market decline? Warnings about a crash of the financial markets are quite common these days, and usually they don’t materialize. But this time may be different. A number of top analysts are pointing out the fact that the biggest cluster of “Hindenburg Omens” has appeared since the last stock market crash. And those that have studied this insist that the more “Hindenburg Omens” there are in a cluster, the stronger the signal is. Meanwhile, another very disturbing sign is the fact that the yield on 10 year U.S. Treasuries is starting to soar again. On Tuesday it shot up from 2.62% to 2.727%. As I have written about previously, the yield on 10 year U.S. Treasuries is the most important number in the U.S. economy right now. If that number continues to rise, it is going to be very, very bad news for the financial system.

Jess.....that's correct .... 10 year headed for 3% on purpose prolly. What you said this means is correct, we've heard about this for three years or so, and now during the 2 month long vacation that europe takes....( August till September 25th or so....).....it's just a preview type occurrance because of low volatility, so we see bic erratic moves or snail like sluggish moves. this bullish usd, but this means kinda like a last ditch effort. 3 months more and.....and.....lets just say watch the gbp/jpy.....the pound-yen......it goes first by 20 minutes. down.....I don't want to post what comes after the second "and" in that last sentence. I have too much fun around 7:30 pm New York time.....really a blast.....yesterday, 81 pips in three hours.....some kind of record for most....I do that 3 times a week....while away from the laptop,even.

No problem as long as the western economies can get cheap credit due to market manipulation. But what happens if governments have to raise taxes to pay higher returns on their borrowing,

reply to post by St Udio

Yes the rumor is there, but you know that since the markets are a digital scam and the panic button was instituted we do not longer have the ability to tell exactly what is going on with Wall street.

Everything now is just rumors.

Yes the rumor is there, but you know that since the markets are a digital scam and the panic button was instituted we do not longer have the ability to tell exactly what is going on with Wall street.

Everything now is just rumors.

edit on 22-8-2013 by marg6043 because: (no reason given)

reply to post by St Udio

Doubtful... I don't think he and Bernanke would give anyone a heads-up on their plans.

some have speculated that all the cabinet/ department / Agency heads were told to get ready for the collapse of the dollar...

or the treasury notes...

or the seizing of bank accounts ...

or the seizing of 401Ks

Doubtful... I don't think he and Bernanke would give anyone a heads-up on their plans.

"Hey! What does this Wipe command do??" .....said the new network tech to the room.....as he hit enter...

This might be a dumb question... But, has trading resumed??? All systems go??? Some individual corner the market in a few hours???

NASDAQ Market Overcomes Trading Failures

Hrm.... Crisis averted???

Hrm.... Crisis averted???

Nasdaq first sent out an alert at 12:14 p.m., telling traders that it was halting trading in all stocks listed on the Nasdaq exchange until further notice. The exchange said the issue was a result of problems with the system on which trades are recorded. Trading was also halted on all Nasdaq options markets.

Nasdaq began reopening stocks for trading soon after 3 p.m. and was racing to get all of its systems back in operation as the trading day drew to a close.

During the halt, nearly every trading firm on Wall Street scrambled to determine what to do with orders for Nasdaq-listed stocks.

“There is no transparency for investors at this point,” said David Warhoftig, managing director of Highside Capital Management. “We were able to potentially get a few trades done when this first started, but now we are not able to do anything.”

Under normal conditions, if an exchange has problems, traders can direct their orders to other public exchanges. But because the problems involved the data feed from which prices are derived, all exchanges stopped trading Nasdaq stocks on Thursday.

A day before the incident, there was a total of $48 billion of trading in Nasdaq listed stocks, according to data from BATS Global Markets.

The breakdown appears to be one of the most significant technology problems to hit a trading world that has become accustomed to glitches. Earlier this week, Goldman Sachs sent out a barrage of erroneous options trades that briefly crippled the market.

For Nasdaq, the trading halt has brought back painful memories of the botched debut of Facebook shares in May 2012, a closely watched initial public offering that was marred by a delayed start and “technical errors.” Nasdaq paid a $10 million fine as a result of that incident and said it had extensively reworked its technology systems and testing.

On Thursday, traders complained that Nasdaq was providing few details on what had happened and how the problems would be resolved. Jonathan Corpina, a stock trader at Meridian Equity Partners on the floor of the New York Stock Exchange, said that he had many clients calling him “looking for answers and explanations because they can’t get through to the Nasdaq on the phone.”

Nasdaq’s own stock was not trading on Thursday afternoon because it is listed on its exchange. That made it hard to immediately gauge how much the outage might hurt the company. But market participants said there is likely to be significant fallout for the company.

The Securities and Exchange Commission said in a statement: “We are monitoring the situation and are in close contact with the exchanges.”

I will not be surprised if in the coming days a company shows to be out of business, without telling their investors exactly what happen.

The markets are a scam they are making sure you don't find how deep the scam runs.

The markets are a scam they are making sure you don't find how deep the scam runs.

Ran across this and thought I'd add it here. Its a speculitive look at what happened today but its worth filing away incase something big happens.

USATODAY: Hacked? LINK

USATODAY: Hacked? LINK

reply to post by Zarniwoop

Look to see if large companies are refinancing or assigning their assets to large banks. Before the crash in '08 I noticed an abnormal amount of assets from various small companies being absorbed by .... Freddie and Fannie.

Guess who got bailed out?

So, that would be one indicator...

Look to see if large companies are refinancing or assigning their assets to large banks. Before the crash in '08 I noticed an abnormal amount of assets from various small companies being absorbed by .... Freddie and Fannie.

Guess who got bailed out?

So, that would be one indicator...

reply to post by WeBrooklyn

I wonder if it was to keep Microsoft from crashing after the Germans called them out on their spying backdoor in windows 8?

I wonder if it was to keep Microsoft from crashing after the Germans called them out on their spying backdoor in windows 8?

So we still don't have an 'official" reason for this?

Today on the money channel they were upset because their trading had been interrupted for more than a few minutes. Computer "glitches" have occurred before but never for hours at a time. The "news" experts spoke endlessly but never asked why it was happening (theres your sign).

Computers will halt trading if they sense too much sudden movement of stocks that could presage a run like the kind that starts a sell off. To stop any domino effect from spiking, the software automatically shuts down trading.

Of course they don't want to admit that there might be a problem. I heard once analyst say it was "software"-- bold faced lie. If software has been running (working) it doesn't suddenly stop (working) unless it receives a command to stop. That is not an "error" in the program, that is planned.

Like closing a bridge to vehicle traffic.... BANG.

The people that shut the bridge know its shut and why.

Today on the money channel they were upset because their trading had been interrupted for more than a few minutes. Computer "glitches" have occurred before but never for hours at a time. The "news" experts spoke endlessly but never asked why it was happening (theres your sign).

Computers will halt trading if they sense too much sudden movement of stocks that could presage a run like the kind that starts a sell off. To stop any domino effect from spiking, the software automatically shuts down trading.

Of course they don't want to admit that there might be a problem. I heard once analyst say it was "software"-- bold faced lie. If software has been running (working) it doesn't suddenly stop (working) unless it receives a command to stop. That is not an "error" in the program, that is planned.

Like closing a bridge to vehicle traffic.... BANG.

The people that shut the bridge know its shut and why.

edit on 22-8-2013 by intrptr because: (no reason given)

Originally posted by marg6043

reply to post by St Udio

Yes the rumor is there, but you know that since the markets are a digital scam and the panic button was instituted we do not longer have the ability to tell exactly what is going on with Wall street.

Everything now is just rumors.

edit on 22-8-2013 by marg6043 because: (no reason given)

Yes, though if one considers it, that's what the market is and what drives it, is it not? Perception, information, rumors, and back to perception.....combined with gambling, affected by algorythms that fluctuate strongly driven by speed, bandwidth, day trading : very, very short speculative gambling, as opposed to in 1929, the market was more or less a handful of investors: think of the "regulars" at the poker table in a closed game every night, and investment "strategy" was more geared to the "long" view of investment in tangible products, the production of these goods, and the institutions---banks, insurance companies, and basic needs providers, such as electrical companies, etc.... I t was really, in that way, a whole different game, a whole different market then it is today, where we now have "futures," predictive and a hedging and wedging of time vs. value...which again, brings us back to perception of information, value and speculation. And also, trading no longer stops when the market shuts down at 4:00 pm or so.....trading continues all night long, in fact.....

Then, you also have to consider, all the world's markets in all these different countries and time zones, affect one another, as well.

Fascinating microcosm/macrocosm stuff going on here......

Tetra50

So... where are we with this?

Are they up to something?

Is it Anonymous?

Does it have anything to do with this:

Is Obama About To Crash The Gold Market Again?

www.zerohedge.com...

Are they up to something?

Is it Anonymous?

Does it have anything to do with this:

Is Obama About To Crash The Gold Market Again?

www.zerohedge.com...

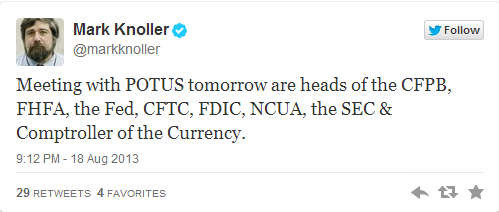

Meeting with POTUS tomorrow are heads of the CFPB, FHFA, the Fed, CFTC, FDIC, NCUA, the SEC & Comptroller of the Currency.

9:12 PM - 18 Aug 2013

CBS News White House Correspondent

Washington, D.C. · cbsnews.com

twitter.com... 87207755776&tw_p=tweetembed

reply to post by WeBrooklyn

Are these two events related?

Nasdaq halts all trading

www.abovetopsecret.com...

by WeBrooklyn

started on 8/22/2013 @ 02:34 PM

Bernanke's getting out of Dodge?

www.abovetopsecret.com...

by MidnightTide

started on 4/21/2013 @ 09:47 PM

Jackson Hole economic summit in Wyoming 2013

Thursday 29 August to Saturday 31 August 2013

www.zapaday.com...

Are these two events related?

Nasdaq halts all trading

www.abovetopsecret.com...

by WeBrooklyn

started on 8/22/2013 @ 02:34 PM

Bernanke's getting out of Dodge?

www.abovetopsecret.com...

by MidnightTide

started on 4/21/2013 @ 09:47 PM

Federal Reserve Chairman Ben Bernanke will miss the annual Jackson Hole monetary policy symposium this year due to a scheduling conflict, skipping the prestigious event for the first time since taking the helm of the central bank in 2006.

The conference, held in late August in the splendor of the Grand Teton National Park in Wyoming, draws top central bankers from around the world. Bernanke's absence would mark the first time in 25 years that a Fed chairman has not attended.

A Fed spokeswoman, responding to a Reuters enquiry, said the chairman was currently not planning to attend because of a personal scheduling conflict.

www.reuters.com...

Jackson Hole economic summit in Wyoming 2013

Thursday 29 August to Saturday 31 August 2013

www.zapaday.com...

everything is automated, and so far past the ideal of a person on the floor trading, much more complex than may be percieved. here is 1/1000th of of

second of a single stock

reply to post by WeBrooklyn

They pull "The Kill Switch" every time reality sets in and they are going to lose money.

In a way, its a good thing for stability, but in this case, it is actually really bad.

For it is prolonging the inevitable for the benefit of a few.

Those few are nothing more than a polished zit on the ass of humanity.

They are using your currency to wipe and shine themselves.

S&F

They pull "The Kill Switch" every time reality sets in and they are going to lose money.

In a way, its a good thing for stability, but in this case, it is actually really bad.

For it is prolonging the inevitable for the benefit of a few.

Those few are nothing more than a polished zit on the ass of humanity.

They are using your currency to wipe and shine themselves.

S&F

Originally posted by OpViper7

This is the beginning of what is to come..

Ok Slayer69.....

I think you meant to post in the thread above this one.

Technical problem my ass

The next move in the world chess game is about to go down. I certainly wouldn't say its beginning but I would argue we are a few moves from mate. Sadly most didnt know we were playing.....

new topics

-

Hurt my hip; should I go see a Doctor

General Chit Chat: 43 minutes ago -

Israel attacking Iran again.

Middle East Issues: 1 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 1 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 2 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 3 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 4 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 4 hours ago -

I hate dreaming

Rant: 5 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago -

Biden says little kids flip him the bird all the time.

Politicians & People: 7 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 8 hours ago, 17 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 10 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 15 hours ago, 10 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 7 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago, 7 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 4 hours ago, 6 flags -

Israel attacking Iran again.

Middle East Issues: 1 hours ago, 5 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 1 hours ago, 4 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 4 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 17 hours ago, 4 flags

active topics

-

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 51 • : Zaphod58 -

Israel attacking Iran again.

Middle East Issues • 19 • : stelth2 -

Hurt my hip; should I go see a Doctor

General Chit Chat • 5 • : Caver78 -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs • 7 • : Ophiuchus1 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 549 • : cherokeetroy -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 9 • : VariedcodeSole -

When an Angel gets his or her wings

Religion, Faith, And Theology • 1 • : lilzazz -

A man of the people

Medical Issues & Conspiracies • 14 • : chr0naut -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 68 • : ToneD -

MH370 Again....

Disaster Conspiracies • 9 • : WakeUpBeer