It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

15

share:

I had a good laugh at gold's downward manipulation by the bankster cartel today.

So, what I'm getting from the news is that the main reason for the gold and silver price drop is lower numbers out of China, 7.7% growth, I must have heard this on the radio 50 times today. And this info is coming from the news channels on the radio, whose business hosts are apparently knowledgeable when it comes to business and economics, and have access to many knowledgeable guests. Well, lets look at that with a critical eye.

The GDP for China in 2012 is estimated to be about 8.2 trillion, lets figure out what 7.7% of that represents, .077 * $8.2 trillion = $631 billion. Yet back in 2005, when all we heard about was China amazing growth on the news, their economy was about $2.3 trillion, with about 15% growth, which equals = $345 billion.

So, yes, even growth has slowed, the Chinese economy is generating almost twice the economic activity than it was only 7 years ago? And this number is bad news? Am I missing something?

Don't you find it strange we had bombings in Iraq and the US on the same day? Do you know what a false flag is? The Powers That Be are trying to hide something or distract us from something. I think that something is that the Chinese economic numbers came out for 2012 (the above was an estimate), and they have taken over the #1 spot for world GDP. That would really shake the US dollar and gold would explode. Who knows, something is happening/happened/will happen that they want to hide/distract us from. So cover up the real news and kill gold - and do a couple of false flags.

Or maybe these buried news stories are another reason to artificially smash gold and silver:

France and China cut out US dollar

Or did you hear about the 2nd largest US gold mine collapsing a couple of days ago?

US 2nd largest gold mine collapses

They were expecting it to happen, though resumption of full production is expected to take up to a year.

When I see bullion dealers scrambling to sell all their inventory, then I will know the gold/silver bull market is over. As for today, most bullion dealers were NOT accepting orders at prices they knew represented a false "paper" price, and not a real "physical" price. Is it hard to understand how these could be out of whack when there is an estimated 100 ounces of "paper" gold and silver for every "physical" ounce?

So, what I'm getting from the news is that the main reason for the gold and silver price drop is lower numbers out of China, 7.7% growth, I must have heard this on the radio 50 times today. And this info is coming from the news channels on the radio, whose business hosts are apparently knowledgeable when it comes to business and economics, and have access to many knowledgeable guests. Well, lets look at that with a critical eye.

The GDP for China in 2012 is estimated to be about 8.2 trillion, lets figure out what 7.7% of that represents, .077 * $8.2 trillion = $631 billion. Yet back in 2005, when all we heard about was China amazing growth on the news, their economy was about $2.3 trillion, with about 15% growth, which equals = $345 billion.

So, yes, even growth has slowed, the Chinese economy is generating almost twice the economic activity than it was only 7 years ago? And this number is bad news? Am I missing something?

Don't you find it strange we had bombings in Iraq and the US on the same day? Do you know what a false flag is? The Powers That Be are trying to hide something or distract us from something. I think that something is that the Chinese economic numbers came out for 2012 (the above was an estimate), and they have taken over the #1 spot for world GDP. That would really shake the US dollar and gold would explode. Who knows, something is happening/happened/will happen that they want to hide/distract us from. So cover up the real news and kill gold - and do a couple of false flags.

Or maybe these buried news stories are another reason to artificially smash gold and silver:

France and China cut out US dollar

Or did you hear about the 2nd largest US gold mine collapsing a couple of days ago?

US 2nd largest gold mine collapses

They were expecting it to happen, though resumption of full production is expected to take up to a year.

When I see bullion dealers scrambling to sell all their inventory, then I will know the gold/silver bull market is over. As for today, most bullion dealers were NOT accepting orders at prices they knew represented a false "paper" price, and not a real "physical" price. Is it hard to understand how these could be out of whack when there is an estimated 100 ounces of "paper" gold and silver for every "physical" ounce?

edit on 15-4-2013 by PlanetXisHERE because: addition

edit on 15-4-2013 by PlanetXisHERE because: addition

I would also be interested to find out who is actually selling gold at the low prices.

Give them my phone number...tell em to call......

Give them my phone number...tell em to call......

reply to post by PlanetXisHERE

I know that you know that your second link mentions nothing about gold. I also know that metals usually occur together.During the refining and purifying of copper, other trace elements (including gold) are captured during the process. Although the percentage of gold and other precious metals is small, it adds up considering the mega tons of ore they process overall.

I know that you know that your second link mentions nothing about gold. I also know that metals usually occur together.During the refining and purifying of copper, other trace elements (including gold) are captured during the process. Although the percentage of gold and other precious metals is small, it adds up considering the mega tons of ore they process overall.

Originally posted by stirling

I would also be interested to find out who is actually selling gold at the low prices.

Give them my phone number...tell em to call......

Well, it appears no one is selling silver, I saw this blog entry at ZeroHedge:

UPDATE: ALL US WHOLESALE SUPPLIERS ARE NOW SOLD OUT OF EVERY OUNCE OF PHYSICAL SILVER & HAVE SUSPENDED ALL SALES! SDBullion.com has closed due to lack of ANY AVAILABLE SILVER! Two of the largest wholesale suppliers in the US, including Amark and CNT, who is the supplier of gold blanks to the US Mint for Gold Eagles, and is a registered COMEX

Here are some more "takes" on the gold/silver smash today:

Why is gold crashing?

Originally posted by intrptr

reply to post by PlanetXisHERE

I know that you know that your second link mentions nothing about gold. I also know that metals usually occur together.During the refining and purifying of copper, other trace elements (including gold) are captured during the process. Although the percentage of gold and other precious metals is small, it adds up considering the mega tons of ore they process overall.

I didn't know that, I saw another similar article which mentioned the gold stats, but couldn't link to it, so thanks for pointing that out, here is the Wiki entry, this mine was the #4 gold producer for the US in 2006, I think it has since moved to # 2:

Most gold produced in Utah today is a byproduct of the huge Bingham Canyon copper mine, southwest of Salt Lake City. In 2006, the Bingham Canyon mine produced 16.3 tonnes of gold, making it the fourth-largest gold producer in the US

Wiki link

Originally posted by PlanetXisHERE

I had a good laugh at gold's downward manipulation by the bankster cartel today.

So, what I'm getting from the news is that the main reason for the gold and silver price drop is lower numbers out of China, 7.7% growth, I must have heard this on the radio 50 times today. And this info is coming from the news channels on the radio, whose business hosts are apparently knowledgeable when it comes to business and economics, and have access to many knowledgeable guests. Well, lets look at that with a critical eye.

The GDP for China in 2012 is estimated to be about 8.2 trillion, lets figure out what 7.7% of that represents, .077 * $8.2 trillion = $631 billion. Yet back in 2005, when all we heard about was China amazing growth on the news, their economy was about $2.3 trillion, with about 15% growth, which equals = $345 billion.

So, yes, even growth has slowed, the Chinese economy is generating almost twice the economic activity than it was only 7 years ago? And this number is bad news? Am I missing something?

Don't you find it strange we had bombings in Iraq and the US on the same day? Do you know what a false flag is? The Powers That Be are trying to hide something or distract us from something. I think that something is that the Chinese economic numbers came out for 2012 (the above was an estimate), and they have taken over the #1 spot for world GDP. That would really shake the US dollar and gold would explode. So cover up the real news and kill gold - and do a couple of false flags.

Or maybe these buried news stories are another reason to artificially smash gold and silver:

France and China cut out US dollar

Or did you hear about the 2nd largest US gold mine collapsing a couple of days ago?

US 2nd largest gold mine collapses

They were expecting it to happen, though resumption of full production is expected to take up to a year.

When I see bullion dealers scrambling to sell all their inventory, then I will know the gold/silver bull market is over. As for today, most bullion dealers were NOT accepting orders at prices they knew represented a false "paper" price, and not a real "physical" price. Is it hard to understand how these could be out of whack when there is an estimated 100 ounces of "paper" gold and silver for every "physical" ounce?

edit on 15-4-2013 by PlanetXisHERE because: addition

It is bad news when you were planning on having more than that. So yes it is bad news. It is also bad news that if at the same time some of Europes banks are going to sell to make debts. Less demand, more supply means lower prices. That is the way it works. The same thing is happening to the price of oil because of China its dropping. Gold has been do for a correction anyway it has been way over pushed to get suckers to buy it at high prices beyond where it should be. Just like any stock really.

reply to post by PlanetXisHERE

No prob. The gold is the profit. The copper pays the operating costs of the mine.

Edit: It might be a bit too involved for some, but here is the process that purifies copper from ore. The part at 3:00 explains the electrolytic purifying and mentions how the gold is saved for later processing (the same way).

No prob. The gold is the profit. The copper pays the operating costs of the mine.

Edit: It might be a bit too involved for some, but here is the process that purifies copper from ore. The part at 3:00 explains the electrolytic purifying and mentions how the gold is saved for later processing (the same way).

edit on 15-4-2013 by intrptr because: YouTube

Originally posted by MrSpad

It is bad news when you were planning on having more than that. So yes it is bad news. It is also bad news that if at the same time some of Europes banks are going to sell to make debts. Less demand, more supply means lower prices. That is the way it works. The same thing is happening to the price of oil because of China its dropping. Gold has been do for a correction anyway it has been way over pushed to get suckers to buy it at high prices beyond where it should be. Just like any stock really.

Really? If you are such an expert in supply and demand, then you will know what has been happening to mining costs over the past decade, and mines that were previously enormously profitable at $1000/per ounce are now only marginally profitable at $1360/ounce?

You must also know that gold mines are given a go ahead in their PEA (preliminary economic assessment) when the average grade is sometime less than 1 GRAM per tonne of rock - and they may have no other metals as offsets. Can you guess how much it costs to explore for, mine, process and clean up the environment for 1 gram per ton of rock?

What percentage of mines will be shuttered if gold drops below $1300? It has been estimated that 20% of all gold mines, the high cost ones, will shutter if gold drops to $1200, and I don't have to tell you what that will do to the supply and the price, Mr supply and demand expert.

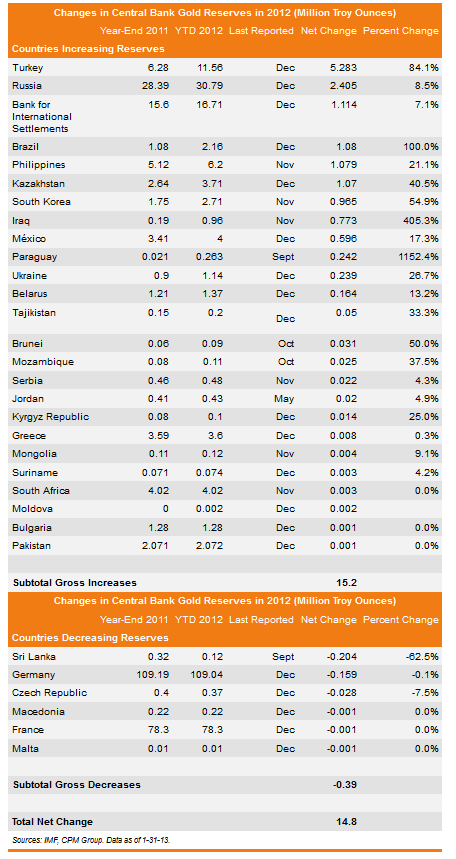

It looks kind of obvious to me what the trend is in terms of net position for central banks:

reply to post by PlanetXisHERE

Another interesting tidbit that should be duly noted from your link:

Zero Hedge

Looks like the Fed's attempt to fluff up and regain confidence in the USD andcasinos stock markets is back into full swing... yet

again. The same game they've playing for the past 60+ years.

Only this time, the game is very different and they're going to lose their manipulative control on it all, soon enough.

I have my lawn chair and case of cold beer ready to sit back and watch the entertainment unfold.

Another interesting tidbit that should be duly noted from your link:

Roberts also says:

This is an orchestration (the smash in gold). It’s been going on now from the beginning of April. Brokerage houses told their individual clients the word was out that hedge funds and institutional investors were going to be dumping gold and that they should get out in advance. Then, a couple of days ago, Goldman Sachs announced there would be further departures from gold. So what they are trying to do is scare the individual investor out of bullion. Clearly there is something desperate going on….

Zero Hedge

Looks like the Fed's attempt to fluff up and regain confidence in the USD and

Only this time, the game is very different and they're going to lose their manipulative control on it all, soon enough.

I have my lawn chair and case of cold beer ready to sit back and watch the entertainment unfold.

Copper is the profit, and gold is the operating cost.

That is fact, not conjecture.

But gold has been itching for a negetive bump for awhile.

Too much money just waiting to go somewhere else.

The dow was just a component.

That is fact, not conjecture.

But gold has been itching for a negetive bump for awhile.

Too much money just waiting to go somewhere else.

The dow was just a component.

Did anybody READ the link?

the bulk of the gurus say the price is being manipulated ...

the real value of gold (physical) is probably quite a bit higher than the paper promises they are selling in place of ingots.....

The shortage of physical gold is on going....

Buyers outnumbered sellers in the market as well.....

its all a scam...no matter if it goes up or goes down...its making profits for the big guys....

the bulk of the gurus say the price is being manipulated ...

the real value of gold (physical) is probably quite a bit higher than the paper promises they are selling in place of ingots.....

The shortage of physical gold is on going....

Buyers outnumbered sellers in the market as well.....

its all a scam...no matter if it goes up or goes down...its making profits for the big guys....

reply to post by stirling

Profits for the big guys - before their house of cards completely falls - wealth for the little guys - gone.

BUT THERE"S A BOMB EXPLOSION IN BOSTON!

Profits for the big guys - before their house of cards completely falls - wealth for the little guys - gone.

BUT THERE"S A BOMB EXPLOSION IN BOSTON!

And its over. Gold going back up. Well so much for the great gold conspiracy.

Originally posted by MrSpad

And its over. Gold going back up. Well so much for the great gold conspiracy.

Its not a gold conspiracy, its a US dollar conspiracy, gold is just one part of it.

So, find any conspiracies yet on ATS you're interested in and think might be true, or just having fun raining on everyone's elses conspiracies on the world's biggest conspiracy site?

Gold goes up,...and dow goes up,...

... but only because it takes more of the same dollars to buy them.

One word,...Inflation.

... but only because it takes more of the same dollars to buy them.

One word,...Inflation.

edit on 16-4-2013 by smirkley because: sp

I follow Jim Sinclair JSMineset

He has said everything from Russia and China, posted a former fed secretary saying it is the fed, as well as ETF's. ETF manipulation makes the most sense to me. It is paper gold and no one can prove they have the physical. If it is taken down by hedge funds, panic ensues and metals and mining share follow suit.

As a poster said, gold...and silver can't be found in the local dealer shops since the first of the year. Not making gold coins? I suspect this is true to keep it from the public. Or, my own conspiracy theory, drive the price lower so the US (or others govs) can stock up because they know what is coming. Plus, germany wants it's gold back. Do we have it? Texas wants it's gold back? Do we have it?

Big brokerage houses are in bed with the fed. I

He has said everything from Russia and China, posted a former fed secretary saying it is the fed, as well as ETF's. ETF manipulation makes the most sense to me. It is paper gold and no one can prove they have the physical. If it is taken down by hedge funds, panic ensues and metals and mining share follow suit.

As a poster said, gold...and silver can't be found in the local dealer shops since the first of the year. Not making gold coins? I suspect this is true to keep it from the public. Or, my own conspiracy theory, drive the price lower so the US (or others govs) can stock up because they know what is coming. Plus, germany wants it's gold back. Do we have it? Texas wants it's gold back? Do we have it?

Big brokerage houses are in bed with the fed. I

If it were me, and I wanted to get a lot of gold away from the mom and pop investors, I'd create a panic run by selling a bunch of my metals with my

left hand, feeding information to fuel the fire via the MSM, while buying with my right hand. An institution can easily create a panic with a "shaky

finger" and within 24 hours take the mom and pop money.

Panic selling equals panic buying, and when there are buyers there is no issue, it is when there are sellers and no buyers is when there is an issue.

Panic selling equals panic buying, and when there are buyers there is no issue, it is when there are sellers and no buyers is when there is an issue.

Originally posted by crankyoldman

If it were me, and I wanted to get a lot of gold away from the mom and pop investors, I'd create a panic run by selling a bunch of my metals with my left hand, feeding information to fuel the fire via the MSM, while buying with my right hand. An institution can easily create a panic with a "shaky finger" and within 24 hours take the mom and pop money.

Panic selling equals panic buying, and when there are buyers there is no issue, it is when there are sellers and no buyers is when there is an issue.

Speaking of Mom and Pop investors.......

Someone should chart the stats on "We buy your gold (and sometimes silver)" shops opening and closing. From the late nineties when one would be hard pressed to name a single location, they are virtually now in every mall, plaza, strip mall, town, village, hamlet...............you get the picture. Obviously someone is buying the gold from these shops.

I will start to worry when I see these shops closing down in droves and no more ads on the tv or radio.............until then I'll hold onto my gold and silver, and try to educate people about the ponzi scheme that the US dollar is, as well as many other paper assets.

Originally posted by PlanetXisHERE

Originally posted by crankyoldman

If it were me, and I wanted to get a lot of gold away from the mom and pop investors, I'd create a panic run by selling a bunch of my metals with my left hand, feeding information to fuel the fire via the MSM, while buying with my right hand. An institution can easily create a panic with a "shaky finger" and within 24 hours take the mom and pop money.

Panic selling equals panic buying, and when there are buyers there is no issue, it is when there are sellers and no buyers is when there is an issue.

Speaking of Mom and Pop investors.......

Someone should chart the stats on "We buy your gold (and sometimes silver)" shops opening and closing. From the late nineties when one would be hard pressed to name a single location, they are virtually now in every mall, plaza, strip mall, town, village, hamlet...............you get the picture. Obviously someone is buying the gold from these shops.

I will start to worry when I see these shops closing down in droves and no more ads on the tv or radio.............until then I'll hold onto my gold and silver, and try to educate people about the ponzi scheme that the US dollar is, as well as many other paper assets.

Interesting point, gold has always been as it is, but post 08 these things seem to be more like collection agencies for someone. I've heard that the banks own many of the payday loan places, could be they own these places too at some level. Do they even pay spot prices?

new topics

-

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 1 hours ago -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 2 hours ago -

Russia Flooding

Other Current Events: 3 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 4 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 5 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 5 hours ago -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 7 hours ago -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 7 hours ago -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 7 hours ago -

Elites disapearing

Political Conspiracies: 10 hours ago

top topics

-

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media: 17 hours ago, 17 flags -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 12 hours ago, 13 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 7 hours ago, 11 flags -

Elites disapearing

Political Conspiracies: 10 hours ago, 9 flags -

Freddie Mercury

Paranormal Studies: 12 hours ago, 7 flags -

Nirvana - Immigrant Song

Music: 16 hours ago, 5 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 10 hours ago, 5 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 2 hours ago, 5 flags -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 5 hours ago, 5 flags -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 5 hours ago, 4 flags

active topics

-

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 15 • : Lazy88 -

Elites disapearing

Political Conspiracies • 19 • : annonentity -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies • 6 • : annonentity -

Israel ufo shoot down drones?

Aliens and UFOs • 26 • : GENERAL EYES -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 4 • : GENERAL EYES -

The Acronym Game .. Pt.3

General Chit Chat • 7722 • : bally001 -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness • 7 • : Disgusted123 -

Russia Flooding

Other Current Events • 1 • : ksihkahe -

Running Through Idiot Protestors Who Block The Road

Rant • 107 • : FlyersFan -

Russia Ukraine Update Thread - part 3

World War Three • 5694 • : F2d5thCavv2

15