It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

All the extra hype will surely bring on a bust...just like it did last decade. These fake currencies rarely last 10 years and usually end in a sh#tton

of corruption. They'll usually spawn copy cat currencies that try to ride the hype wave...

Make your money now if you got these made up/non backed currencies.

But if any one knows of an easy rig, post some details please. Think the bitcoin fad will last another year at least.

Make your money now if you got these made up/non backed currencies.

But if any one knows of an easy rig, post some details please. Think the bitcoin fad will last another year at least.

So far I've more than doubled my initial investment.

This technology is here to stay; the only question is who will adapt to it and continue thrive, and who will refuse to adapt and become obsolete?

This technology is here to stay; the only question is who will adapt to it and continue thrive, and who will refuse to adapt and become obsolete?

edit on 9-4-2013 by SilentKoala because: (no reason given)

Originally posted by wasaka

reply to post by ChuckNasty

185.50 Monday morning.

120usd. Still not bad if you compare the price to what it was a year ago. Didn't realize the bit mining got harder as time goes by. Yeah I know there is an ultimate cap to the total amount of bit coins, so it would make sense to control its growth.

Good luck to those of you who made out on the bitcoins.

Originally posted by dominicus

Someone needs to come out with another kind of digital currency so it;s not all Bitcoin dominant.

It needs to be decentralized and put in check by other currencies. The reason its so high is because its the only digital currency out there

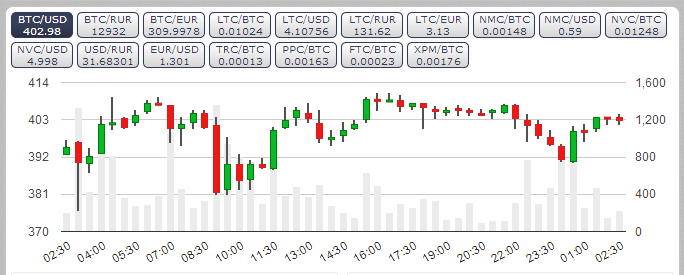

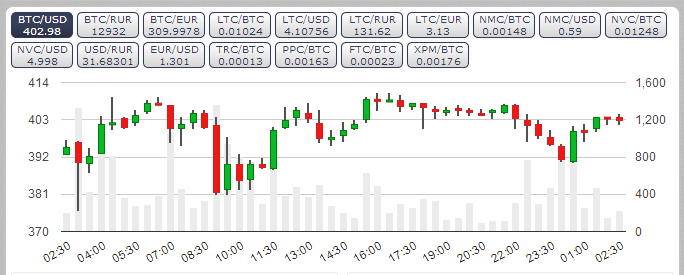

Up until now Bitcoin has been, by far, the most powerful contender in the crypto-currency market. Other alternative coins, such as Namecoin, Solidcoin and Litecoin, have arisen to offer various modifications on the core Bitcoin concept but none have achieved anything close to Bitcoin’s level of success. Litecoin is perhaps the most prominent out of all the alternatives, rumor has it that Litecoin will be tradable on Mt.Gox soon but so far the overwhelming majority of merchants – and merchant platforms, for that matter – have seen no reason to pay attention to them. Now, that may finally change with decentralized cryptocurrency’s new kid on the block: Ripple.

Bitcoin is clearly not an effective store of wealth — just look at how quickly that wealth can be evaporated with the recent market crash/correction. Neither is it a useful payments mechanism, given how fast its value can fluctuate. Currently, it can take an hour for a bitcoin transaction to clear, which means that the value of the transaction when it clears can be radically different from its value at inception. Bitcoin only works for payments if you can be reasonably sure that its value will remain reasonably steady for at least the next hour or so.

Seeing the problems and prospects of Bitcoin, a company named OpenCoin started developing the Ripple protocol. Ripple is a distributed open source payments system and its native math-based virtual currency is called ripples (XRP). Ripple enables free payments to merchants, consumers and developers; the ability to pay in any currency; no chargebacks; and instant global payments. Ripple can accommodate any currency, including dollars, yen, euros, and even bitcoin, making it the world’s first distributed currency exchange.

The Ripple project is actually older than Bitcoin itself. The original implementation was created by Ryan Fugger in 2004, the intent being to create a monetary system that was decentralized and could effectively empower individuals and communities to create their own money by swapping debts among a social network. With the influx of VC money it has become much more than that.

Ripple feels like bitcoin in many ways. Users are anonymous (or, technically, pseudonymous), for instance: if you want to send me money via Ripple, right now you have to pay rpU1neb5evF3Dk9CbPahxHoxkXRuiuYC3S rather than just my email address. It’s all open-source, too: OpenCoin has no privileged access to the way in which people pay each other. The fees are de minimis, just enough to prevent DDoS attacks and the like. There’s even a built-in crypto-currency, the Ripple, with a fixed money supply. But the great thing about the Ripple system is that individuals don’t have to pay each other in Ripples. Instead, they can pay each other in pretty much any currency in the world: Ripples, yes, or dollars, or yen, or euros, or even bitcoins. Ripple hasn’t succeeded yet, it is still in Beta and has a long way to go. But at least it has a genuine hope of doing so.

finance.yahoo.com...

The article goes on to say there are over 50 exchanges currently in existence and may more to come.

American broadcaster Max Keiser, a former Wall Sreet stock broker and inventor of the technology behind web-based game Hollywood Stock Exchange told CNBC.com that he was providing consulting for a new exchange to be set up in London.

"The 'market making' design for [Mt.Gox] is weak; as is the case across all the bitcoin exchanges. This is where we'll see some new initiatives - many are already in the pipeline," he said.

"I'm consulting on a project now in London with some excellent people who are part of what I would call the core bitcoin community of developers and financiers and it looks to be very exciting."

The article goes on to say there are over 50 exchanges currently in existence and may more to come.

the tears of sadness are flowing down my cheeks. I sold at 120...

I coulda bought an entire new system right now... and the ftc just keeps dropping to keep in line. ohhhhhh.. damn my stupid face..

I coulda bought an entire new system right now... and the ftc just keeps dropping to keep in line. ohhhhhh.. damn my stupid face..

new topics

-

Electrical tricks for saving money

Education and Media: 1 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 2 hours ago -

Sunak spinning the sickness figures

Other Current Events: 3 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 3 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 5 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 6 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 8 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 10 hours ago

top topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 17 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 13 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 2 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 15 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 13 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 10 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 3 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 3 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 5 hours ago, 2 flags

active topics

-

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 29 • : doubledan717 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 651 • : 777Vader -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 19 • : NoCorruptionAllowed -

VirginOfGrand says hello

Introductions • 5 • : burritocat -

The Reality of the Laser

Military Projects • 44 • : Zaphod58 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 42 • : Boomer1947 -

NASA Researchers Discover a Parallel Universe That Runs Backwards through Time - Alongside Us

Space Exploration • 71 • : charlyv -

Sunak spinning the sickness figures

Other Current Events • 4 • : annonentity -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 12 • : Hakaiju -

Huge ancient city found in the Amazon.

Ancient & Lost Civilizations • 61 • : Therealbeverage