It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

16

share:

If one truly wishes to live in freedom one must take an active interest in identify those systems or mechanisms which majorly hinder one's freedom. ~ a quote I just made up to grab your attention

Welcome to the second and final part of True Money. I highly suggest reading Part I of this series to understand the fundamentals of money and get a feel of where I'm starting from in this part. After reading this you will truly understand how corrupt and absurd the system we live in actually is. We will examine many different concepts and begin by examining exactly what "debt based money" means and the implications of using such a system and correlate that to what we see on todays financial landscape.

WHAT IS DEBT BASED MONEY?

Understanding this concept is crucial if you want to understand the modern monetary system we use. I'm sure most of you have already heard the term "debt based money" before and some of you already know what it is. There are many articles and videos which attempt to explain this concept so I don't want to totally re-invent the wheel here. I will give a slightly simplified explanation and at the end I will refer to some other sources where you can learn more about this if you wish. However I will explain all you need to know in order to fully grasp the system.

The first thing to understand is that all money (in any country which uses a debt based money system) comes into existence via debt. Each note represents an interest bearing debt. The way this works is essentially through a process where the Governments trade bonds (debt) with the central banks in return for new currency. The Government or State does not have the ability to control the creation of money directly, the central bank does. In the United States the central bank is known as the Federal Reserve and it is a semi-private organization.

If there were no debts in our money system, there wouldn't be any money.

~ Marriner Eccles, Governor of the Federal Reserve, 1941

So the US Government would ask the Federal Reserve or its member banks for some money, but it's really more like they ask for a loan. They trade Government bonds (aka Government debt) for that new money. The Federal Reserve simply pulls the new money out of thin air essentially, and it's the only institution which can do this. This process is called "debt monetization" and through this process new money is typically created either physically or electronically. In fact something like 95% or more of all money only exists in electronic form.

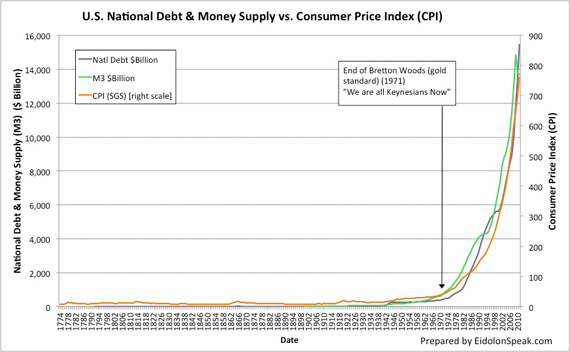

This money is said to be "backed by debt" because the bonds they are created with are debt instruments. And so we have "debt based money". Of course debt has no intrinsic value, and what "backed by debt" actually means is that the currency represents debt. Our debt backed money represents debt just as notes backed by gold would represent the gold backing them. Money equals debt in this absurd system, and we will see just why it's so absurd momentarily. This is why growth in national debt is closely correlated to growth in the money supply.

The Government must trade debt to create new money, so the act of creating new money also creates more debt. Quite ironic really isn't it? The graph above shows the national debt vs the M3 money supply vs the CPI. It really is one of the best economic graphs I've ever seen. We can see how the rise in prices directly correlates to the increase in the money supply, and we can see how the increase in the national debt also corresponds to the increasing money supply. This really is the "smoking gun" of graphs if there ever was one.

In January 1835, Jackson paid off the entire national debt, the only time in U.S. history that has been accomplished.[26][27] However, this accomplishment was short lived. A severe depression from 1837 to 1844 caused the national debt to increase to over $3.3 million by January 1, 1838[28] and it has not be paid in full since.

Wikipedia - Andrew Jackson

The last time the United States was completely debt free was under Andrew Jackson, after he removed the 2nd central bank of the United States. When asked what his greatest accomplishment had been during his two terms as President, Andrew Jackson replied "I killed the Bank". His whole political foundation was based on removing the central bank and restoring sound money. Unfortunately we didn't listen to his advice and before long a new central bank was established. The current Federal Reserve bank has an unlimited charter which will never expire.

WHAT IS BANK CREDIT?

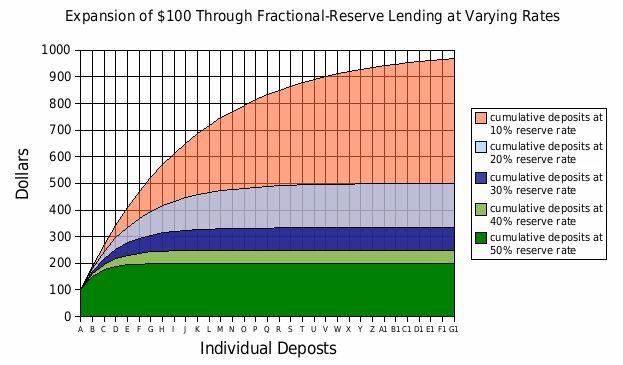

Bank credit is simply the money which only exists on bank computers. For example when you do a wire transfer bank credits are shuffled around the system. Your cash deposits are held as "reserves" and your account is "credited" with the corresponding amount. When you get a loan they don't actually take the money from another account, they "credit" your bank account with new bank credit which has been created out of nothing. They can loan out 9 times as much as they have in reserves thanks to fractional reserve banking.

You might think that the credit loans come from the existing reserves or from other bank accounts, but they don't, the bank credit simply comes from thin air like I just said. Keep in mind this process is another way that new money comes into existence, separately from the debt monetization process. These are the two main ways that the money supply can be expanded. These bank credits flow through the banking system and virtually act as real money, so in the process of creating new bank credits out of thin air they essentially expand the money supply.

Furthermore, when the Government "monetizes their debt" by trading their bonds in the process I described a moment ago, they deposit that newly created money into a commercial bank account and it becomes new reserves for the bank. Since the bank can loan out 9x as much [bank credit] as they have in reserve, these new reserves which were created out of thin air by the Federal Reserve can now be used as the basis for creating even more money out of thin air (the bank credit). Say someone then borrows this newly available money as part of a mortgage loan.

Of course he wont be given cash, he will have his bank account credited with the amount loaned from the bank. He will then proceed to wire this money to a real estate company and then he will get his house. He will then proceed to pay back the bank, much of which will come in the form of cash deposits. So in return for bank credit they created out of thin air they get cash which can be held as reserves and used as the basis for more loans. Now consider the case of foreclosure, they claim the house and get a real physical asset in return for imaginary credits.

So the private banks also have this mechanism for creating new money out of nothing. All they need is the minimum reserve requirements and the promise by the debtor to repay the loan. This is why most money only exists electronically, because the amount of bank credits is much higher than the actual amount of money created by the Federal Reserve. That's ok unless everyone wanted to withdraw their money at the same time. It wouldn't be possible, they have only 10% of the amount required, and this is what makes a run on the bank possible.

Many economists which support this system will argue it's good to have this type of "easy credit" system because if the banks can easily create more credit out of nothing it allows new businesses to easily get startup capital and thus helps promote economic activity and growth. If the business is successful the inflationary effects of creating that new money are offset by the economic activity generated by the business. But this whole concept depends on the ability of banks to make good loans, and they actually have incentive to give loans to clients with low credit ratings.

Also note this process creates the new bank credits based on debt, since they are provided as a loan to the debtor much like the Federal Reserve notes are provided as a type of loan to the Government. So money always comes into existence as debt, there are no exceptions. Whether it's through debt monetization or Fractional Reserve banking the end result is the same thing: debt based money. But if all of our money is based on debt, and debts usually generate interest fees, then surely all this debt-money must need to be serviced?

edit on 24/3/2013 by ChaoticOrder because: (no reason

given)

SERVICING THE DEBT BASED SYSTEM

Remember that when the Government gets new money from the Federal Reserve it's actually loaning that money. The Government must pay interest on this debt, however the Federal Reserve will claim nothing sinister is going on here because all the interest it gets from the Government goes back to the US Treasury. That is in fact true, and you might wonder why they would even bother charging interest in the first place if that's the case. The reason for it is complicated but it basically helps mitigate inflation rates, or so they say.

Now this sounds all fine and dandy on the surface, however it ignores the fact that a very large portion of the money supply actually exists in the form of bank credit created by private banks, and the interest paid to the private banks is not paid back to the treasury. Link this with the fact that the Federal Reserve makes extremely low interest rate loans to its member banks which proceed to put those loans into reserve and multiply that money through fractional reserve banking and you begin to see the true sinister nature of this enterprise.

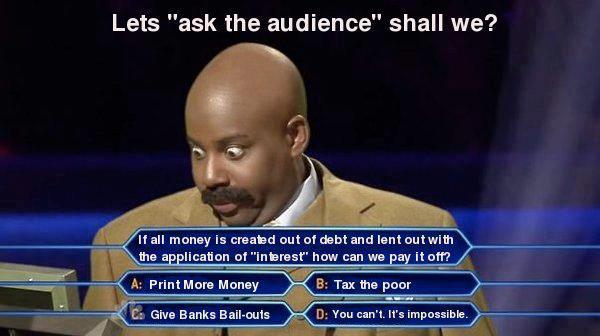

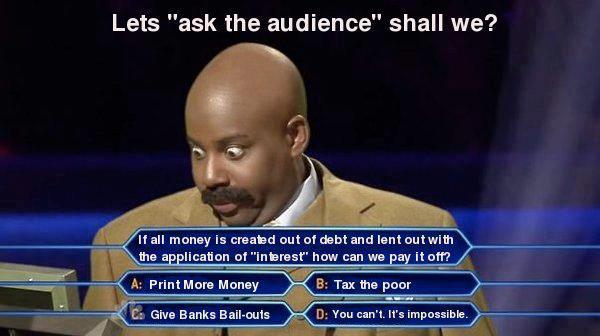

The Federal Reserve simply acts as the figure head for the private banks. In and of its self it's not that easy to incriminate if it's not truly profiting off the interest charged to the Government. But what about the interest it charges to the people through the network of private banks? Answer me this: if all money is created as debt, where is the money to service all this debt? It simply doesn't exist, that is the answer. This creates a type of perpetual loop of insanity where we require more and more money to maintain liquidity.

If all our debt-based money demands to be serviced, but all money comes into existence as debt, it means we constantly need to create new money to service the existing money. This is an inherent feature of any debt-based system. We are now reaching a point where the Federal Reserve is creating 85 billion a month through its unlimited quantitative easing program. Do not be intimidated by the term "quantitative easing", it's simply a type of debt monetization process very similar to the one I described earlier.

They know very well that this level of money creation will cause many people and nations to lose faith in the US dollar, and they know it will lead to very high rates of inflation which will cause all sorts of other problems... it's like trying to put out a fire by throwing more fuel on it, but they have no other choice if they wish to maintain liquidity in our debt based economy. If the debt cannot be serviced everything will begin to break down as all debt assets start to become toxic assets. It's a debt bubble just like the mortgage bubble, but this time it's a currency bubble.

However, as explained in Part I, this tool for maintaining stability will eventually become useless and stop working. We are starting to get very close to that point now where QE schemes and other money creation schemes will simply stop doing what they want it to do and they will no longer be able to maintain the currency bubble. At this point our debt based money will totally collapse and the entire scam will become painstakingly obvious to everyone. In truth the correct answer to the above question is D; in the long run it's impossible.

WHAT ARE STATE OWNED CURRENCIES?

State owned currencies are an alternative to debt based currencies. Instead of handing over control of currency issuance to private bankers, the State directly prints its own money without having to trade debt just to get new money. So all money comes into existence debt free and without attached interest. A prime example of a State owned currency is Lincoln's Greenback. The Greenback notes (aka the United States Note) were harshly opposed by the bankers and quickly taken out of circulation to make way for debt based money.

The Greenback notes are actually still legal tender, but quite rare indeed. This State owned money system was opposed by the bankers because it took a lot of power away from them and gave a lot of power back to the State. The argument which has been used to justify a private debt based money system is that the Government is simply too untrustworthy, and it's not false. I mean think about it, at the end of the day it's the Government who is borrowing a lot of this money from the Federal Reserve and getting themselves into absurd levels of debt.

With a State owned currency the government can create money out of thin air without going into debt. By doing this they cause inflation and the value of the currency in question decreases, thus making the fortunes of the super rich worth less. And at the same time the new money they create is generally spent on public services such as the building and repair of infrastructure, healthcare and social security spending, and so on. So the general populace, which is mostly the middle class, actually gains wealth overall because the money gets spent on these types of things.

But would the Government really be any better if they could just create money out of thin air without needing to trade debt instruments? If they had full control over the money supply would we be in a better situation even if the money was no longer debt based? Many economists argue we need this type of central banking system to prevent the Government from abusing this power. However the same question must be asked... are these private bankers any more trustworthy and is it worth having the debt based system? At least Government officials have some sort of oversight right?

Are we really confined to just these two choices? Maybe we should start looking outside the box on this question. Maybe we don't have to trust the Government or the private bankers. Some digital currencies such as Bitcoin relieve us of choices by making the entire system decentralized over a P2P network. Instead of having to trust the Government or bankers, we only have to trust the math and cryptography. The code base is entirely open source so anyone can check how it works themselves, it's completely transparent in all ways.

LIMITED CURRENCIES VS UNLIMITED CURRENCIES

If we look past the State owned vs debt based money debate, there's a more important debate. Whether it's debt based or State owned, it can still be created endlessly. If you learnt anything from Part I it should be that a currency must be scarce and limited. The mere idea of something endless acting as a currency completely undermines the entire concept of what a currency should be. But if a State owned currency can do all these wonderful things like take power away from bankers and give wealth back to the middle class why not go with that?

Researchers such as Bill Still will argue we can't use anything scarce like gold or any other commodity because all those limited resources have already been hoarded away by the rich, they're too hard to find and if we tried to use them everyone would be poor because they would have no money. I respect Bill and I agree with much of what he says about the benefits of a State owned currency, but I simply cannot agree with him that endless money is superior to limited money. We have used a gold standard in the past and there's no reason we couldn't do so again.

All fiat currencies are interchangeable with gold anyway, it doesn't matter what type of currency we use, the rich will remain rich. It's a redundant and pointless task trying to design this currency which steals wealth from the rich and attempts to leak it back to the middle class through endless money printing. Why do you think the rich become rich in the first place? Of course the debt based money system helps a few bankers get very rich, but a relatively small percentage of the super wealthy individuals are actually bankers.

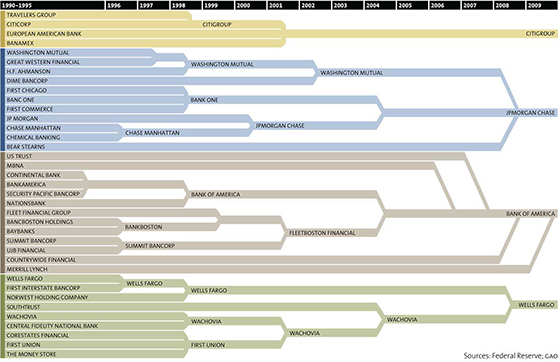

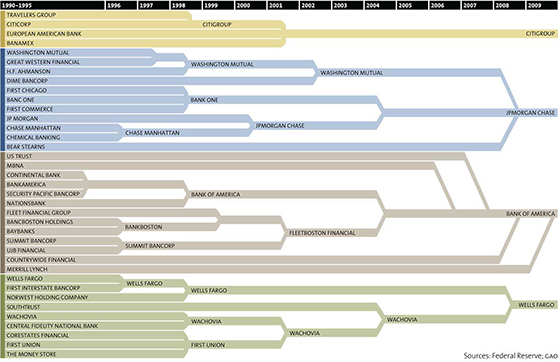

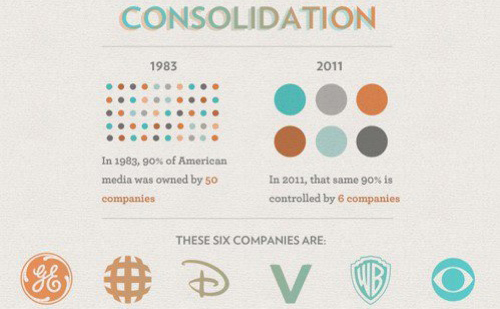

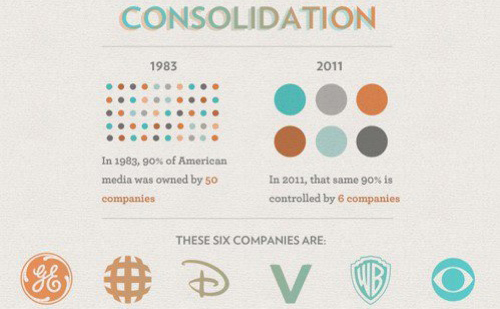

Using a State owned currency doesn't change the fact we have a business world dominated by huge monopolies and conglomerates which dominate the financial landscape of entire industries. It's more apparent if you look at industries like the media industry, the oil and energy industries, the banking industry, and so on. A lot of these industries have now been merged into a few single players which control the entire market. The end result is that much of the wealth generated in our economy flows up the major shareholders of these monopolies.

The extremely high levels of inequality we measure today are caused by the way we distribute wealth to people in the first place. And the way we distribute wealth is with our business system. This is really a business issue concerning the nature of "capitalism" that we now operate under, it isn't a money issue and shouldn't be fixed with money via inflation. Having endless paper money doesn't magically make people richer compared to using precious metals as money. Wealth will flow where wealth flows, regardless of the currency you use.

For example lets say we use a State owned currency and the Government continually creates new money to spend on public programs, increasing the wealth of the little guy and decreasing the wealth of the fat cats. However one must remember that this new money will often get funneled through to large companies directly (through lucrative gov contracts) or indirectly (via consumer spending etc), and what happens is that we get this uneven funneling process to distribute the wealth back to the super wealthy, where it wanted to be in the very first place.

Remember that when the Government gets new money from the Federal Reserve it's actually loaning that money. The Government must pay interest on this debt, however the Federal Reserve will claim nothing sinister is going on here because all the interest it gets from the Government goes back to the US Treasury. That is in fact true, and you might wonder why they would even bother charging interest in the first place if that's the case. The reason for it is complicated but it basically helps mitigate inflation rates, or so they say.

Now this sounds all fine and dandy on the surface, however it ignores the fact that a very large portion of the money supply actually exists in the form of bank credit created by private banks, and the interest paid to the private banks is not paid back to the treasury. Link this with the fact that the Federal Reserve makes extremely low interest rate loans to its member banks which proceed to put those loans into reserve and multiply that money through fractional reserve banking and you begin to see the true sinister nature of this enterprise.

The Federal Reserve simply acts as the figure head for the private banks. In and of its self it's not that easy to incriminate if it's not truly profiting off the interest charged to the Government. But what about the interest it charges to the people through the network of private banks? Answer me this: if all money is created as debt, where is the money to service all this debt? It simply doesn't exist, that is the answer. This creates a type of perpetual loop of insanity where we require more and more money to maintain liquidity.

If all our debt-based money demands to be serviced, but all money comes into existence as debt, it means we constantly need to create new money to service the existing money. This is an inherent feature of any debt-based system. We are now reaching a point where the Federal Reserve is creating 85 billion a month through its unlimited quantitative easing program. Do not be intimidated by the term "quantitative easing", it's simply a type of debt monetization process very similar to the one I described earlier.

They know very well that this level of money creation will cause many people and nations to lose faith in the US dollar, and they know it will lead to very high rates of inflation which will cause all sorts of other problems... it's like trying to put out a fire by throwing more fuel on it, but they have no other choice if they wish to maintain liquidity in our debt based economy. If the debt cannot be serviced everything will begin to break down as all debt assets start to become toxic assets. It's a debt bubble just like the mortgage bubble, but this time it's a currency bubble.

However, as explained in Part I, this tool for maintaining stability will eventually become useless and stop working. We are starting to get very close to that point now where QE schemes and other money creation schemes will simply stop doing what they want it to do and they will no longer be able to maintain the currency bubble. At this point our debt based money will totally collapse and the entire scam will become painstakingly obvious to everyone. In truth the correct answer to the above question is D; in the long run it's impossible.

WHAT ARE STATE OWNED CURRENCIES?

State owned currencies are an alternative to debt based currencies. Instead of handing over control of currency issuance to private bankers, the State directly prints its own money without having to trade debt just to get new money. So all money comes into existence debt free and without attached interest. A prime example of a State owned currency is Lincoln's Greenback. The Greenback notes (aka the United States Note) were harshly opposed by the bankers and quickly taken out of circulation to make way for debt based money.

The United States Note was a national currency whereas Federal Reserve Notes are issued by the privately-owned Federal Reserve System.[26] Both have been legal tender since the gold recall of 1933. Both have been used in circulation as money in the same way. However, the issuing authority for them came from different statutes.[24] United States Notes were created as fiat currency, in that the government has never categorically guaranteed to redeem them for precious metal - even though at times, such as after the specie resumption of 1879, federal officials were authorized to do so if requested. The difference between a United States Note and a Federal Reserve Note is that a United States Note represented a "bill of credit" and was inserted by the Treasury directly into circulation free of interest. Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate seigniorage, or interest, for the Federal Reserve System, which serves as a lending intermediary between the Treasury and the public.

United States Note - Comparison to Federal Reserve Notes

The Greenback notes are actually still legal tender, but quite rare indeed. This State owned money system was opposed by the bankers because it took a lot of power away from them and gave a lot of power back to the State. The argument which has been used to justify a private debt based money system is that the Government is simply too untrustworthy, and it's not false. I mean think about it, at the end of the day it's the Government who is borrowing a lot of this money from the Federal Reserve and getting themselves into absurd levels of debt.

With a State owned currency the government can create money out of thin air without going into debt. By doing this they cause inflation and the value of the currency in question decreases, thus making the fortunes of the super rich worth less. And at the same time the new money they create is generally spent on public services such as the building and repair of infrastructure, healthcare and social security spending, and so on. So the general populace, which is mostly the middle class, actually gains wealth overall because the money gets spent on these types of things.

But would the Government really be any better if they could just create money out of thin air without needing to trade debt instruments? If they had full control over the money supply would we be in a better situation even if the money was no longer debt based? Many economists argue we need this type of central banking system to prevent the Government from abusing this power. However the same question must be asked... are these private bankers any more trustworthy and is it worth having the debt based system? At least Government officials have some sort of oversight right?

Are we really confined to just these two choices? Maybe we should start looking outside the box on this question. Maybe we don't have to trust the Government or the private bankers. Some digital currencies such as Bitcoin relieve us of choices by making the entire system decentralized over a P2P network. Instead of having to trust the Government or bankers, we only have to trust the math and cryptography. The code base is entirely open source so anyone can check how it works themselves, it's completely transparent in all ways.

LIMITED CURRENCIES VS UNLIMITED CURRENCIES

If we look past the State owned vs debt based money debate, there's a more important debate. Whether it's debt based or State owned, it can still be created endlessly. If you learnt anything from Part I it should be that a currency must be scarce and limited. The mere idea of something endless acting as a currency completely undermines the entire concept of what a currency should be. But if a State owned currency can do all these wonderful things like take power away from bankers and give wealth back to the middle class why not go with that?

Researchers such as Bill Still will argue we can't use anything scarce like gold or any other commodity because all those limited resources have already been hoarded away by the rich, they're too hard to find and if we tried to use them everyone would be poor because they would have no money. I respect Bill and I agree with much of what he says about the benefits of a State owned currency, but I simply cannot agree with him that endless money is superior to limited money. We have used a gold standard in the past and there's no reason we couldn't do so again.

All fiat currencies are interchangeable with gold anyway, it doesn't matter what type of currency we use, the rich will remain rich. It's a redundant and pointless task trying to design this currency which steals wealth from the rich and attempts to leak it back to the middle class through endless money printing. Why do you think the rich become rich in the first place? Of course the debt based money system helps a few bankers get very rich, but a relatively small percentage of the super wealthy individuals are actually bankers.

Using a State owned currency doesn't change the fact we have a business world dominated by huge monopolies and conglomerates which dominate the financial landscape of entire industries. It's more apparent if you look at industries like the media industry, the oil and energy industries, the banking industry, and so on. A lot of these industries have now been merged into a few single players which control the entire market. The end result is that much of the wealth generated in our economy flows up the major shareholders of these monopolies.

The extremely high levels of inequality we measure today are caused by the way we distribute wealth to people in the first place. And the way we distribute wealth is with our business system. This is really a business issue concerning the nature of "capitalism" that we now operate under, it isn't a money issue and shouldn't be fixed with money via inflation. Having endless paper money doesn't magically make people richer compared to using precious metals as money. Wealth will flow where wealth flows, regardless of the currency you use.

For example lets say we use a State owned currency and the Government continually creates new money to spend on public programs, increasing the wealth of the little guy and decreasing the wealth of the fat cats. However one must remember that this new money will often get funneled through to large companies directly (through lucrative gov contracts) or indirectly (via consumer spending etc), and what happens is that we get this uneven funneling process to distribute the wealth back to the super wealthy, where it wanted to be in the very first place.

edit on 24/3/2013 by ChaoticOrder

because: (no reason given)

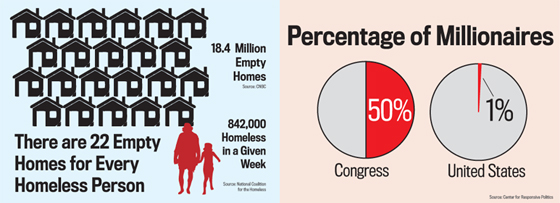

THE GAP BETWEEN RICH AND POOR

This process of how the money gets funneled up to the elite business people is the single greatest factor driving inequality, and until we fix the corrupted pyramidal system we call "capitalism" it doesn't matter what currency we use because the wealth will still get distributed unfairly. Ok, fine... so why don't we just continue printing more of our State owned currency and inject it to the middle class and make ourselves richer? Well that's what the Government would do if they used a State currency, they would rinse and repeat the process.

And this would go on forever... as wealth flows to the rich we continue expanding the money supply to make ourselves richer. So the Government would need to keep creating more money regardless of demand and economic growth, and that new money would continue to get sucked up to the super rich. Eventually the amount of money in active circulation would be tiny compared to the amount of money which has been horded away by the super rich through this continual funneling process, until they have extreme power over the market.

Lets say we were using a gold standard instead, and most of the money got funneled up to the wealthy leaving us with very little money to work with. Since it's based on gold we can't simply make ourselves richer by creating more money can we? However one must keep in mind that the elite actually have a motive to keep a certain level of money in circulation, because without that lower threshold in circulation economic activity would stutter and come to a halt, meaning their businesses would also suffer as a result and they would see their incomes dry up.

They certainly don't want that, so there's an inherent point of stability associated with a finite currency. The gap between the rich and the poor can only grow so large before that inherent point of stability is reached. There simply is no point of stability or stopping point if you use an unlimited currency. We can just inject more money into circulation to maintain liquidity even if it continues to get funneled up to the super rich. Within any unlimited money scheme like this the gap between the rich and the poor has no bounds.

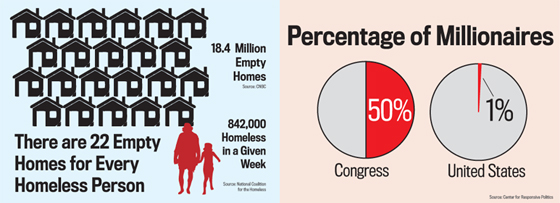

I can tell you right now that we are already way beyond the level of inequality which would be observed under a finite money scheme. The richest 400 individuals in America own more wealth than the entire bottom half of the poorest Americans. These 400 people own slightly more wealth than half a nation. This absurd level of inequality is only possible under a system of endless money coupled with a system like modern day capitalism which distributes wealth extremely unevenly. At least a finite currency puts a limit to the level of inequality.

In fact by trying to fix this inequality problem by creating more fiat money to even out the waters, the long term end result is that we simply make the problem worse than it was to begin with because of the wealth funneling process that I just described. That's exactly what is happening right now even under our debt based system, the vast amount of the currency in circulation is not in active circulation, but rather in the bank accounts of the super rich; but they always leave us with just enough to conduct our business.

Of course they are also continually injecting new money into circulation, but this privately controlled debt based money doesn't benefit the middle class anywhere near as much as State owned currency does. Most of the newly created debt based money goes to a private bank and the private banks also have the ability to issue their own bank credit based on debt. The new money serves those who get to use it first at its full purchasing power, but hurts the rest of us once the market adjusts via inflation and our savings become worth less.

THE FREE MARKET AND REGULATION

A lot of people will instinctively argue we need more regulations to control these huge monopolies with such a huge amount of power. Some say the mortgage crisis could have been avoided if we had just had more stringent regulations which stopped the banks from being allowed to make those sorts of risky gambles with toxic assets. However if you actually think about it, it was the Government who approved the whole Freddie Mae and Fannie Mac thing, flooding the market with toxic assets as a result. The banks merely had to deal with what the Government gave them.

If we really had a free market would we even have these huge monopolies in the first place? I'm not of the mindset that a free market naturally leads to ever decreasing levels of competition and ends with only a few super players. It's important to keep in mind that in reality most of the regulations which are passed are actually influenced by the large power brokers and lobbyists which work for these huge monopolies. The legislation which comes into existence only serves to benefit these huge monopolies because it is controlled by the same monopolies with all the power.

So the entire field is rigged, there's no longer any chance for new players to come in and provide more competition to these monopolies because their lobbyists collude with the Government regulators to rig the game in their favor. We no longer live in anything that resembles anything like a free market, most of the players in all the major industries have been bought out and consolidated into massive monopolies. This takes away our choice of product and minimizes our job opportunities to a set of heartless conglomerates.

These huge companies, for example Wal-Mart, always strive for increased profits at the expense of the product quality and by minimizing payouts to their employees. With little competition this makes it very easy for them to pay their employees slave wages because many of their employees simply have no hope of finding work anywhere else. So we are left to choose from a range of low quality crap, and that's exactly what our super markets are starting to turn into. Even the supposed high quality stuff is getting worse and providing less bang for the buck.

The problem is not that we lack regulations, it's that we have too many regulations which make it extremely hard for anyone to start a business. Not to mention the many regulations favoring only a select few Government approved companies. We have a system which denies a free market and gives us something which is almost like the opposite of a free market. And then some people try and claim these problems are caused by having a free market with not enough regulations... absurdity! The true path to freedom is limited sound money and a truly free market.

The free market is self-regulating and sound money doesn't need to be controlled with "stability mechanisms" because it too is self correcting. Look at the mess we have gotten ourselves into by thinking we are smarter than the free market and we know how to steer the path of the market better than the market its self. This is pure insanity, we need to get back to the basics of money, there isn't a single unlimited fiat currency which has ever been successful. We will never have a better world until we get a fairer money system based on sound principles.

This process of how the money gets funneled up to the elite business people is the single greatest factor driving inequality, and until we fix the corrupted pyramidal system we call "capitalism" it doesn't matter what currency we use because the wealth will still get distributed unfairly. Ok, fine... so why don't we just continue printing more of our State owned currency and inject it to the middle class and make ourselves richer? Well that's what the Government would do if they used a State currency, they would rinse and repeat the process.

And this would go on forever... as wealth flows to the rich we continue expanding the money supply to make ourselves richer. So the Government would need to keep creating more money regardless of demand and economic growth, and that new money would continue to get sucked up to the super rich. Eventually the amount of money in active circulation would be tiny compared to the amount of money which has been horded away by the super rich through this continual funneling process, until they have extreme power over the market.

Lets say we were using a gold standard instead, and most of the money got funneled up to the wealthy leaving us with very little money to work with. Since it's based on gold we can't simply make ourselves richer by creating more money can we? However one must keep in mind that the elite actually have a motive to keep a certain level of money in circulation, because without that lower threshold in circulation economic activity would stutter and come to a halt, meaning their businesses would also suffer as a result and they would see their incomes dry up.

They certainly don't want that, so there's an inherent point of stability associated with a finite currency. The gap between the rich and the poor can only grow so large before that inherent point of stability is reached. There simply is no point of stability or stopping point if you use an unlimited currency. We can just inject more money into circulation to maintain liquidity even if it continues to get funneled up to the super rich. Within any unlimited money scheme like this the gap between the rich and the poor has no bounds.

I can tell you right now that we are already way beyond the level of inequality which would be observed under a finite money scheme. The richest 400 individuals in America own more wealth than the entire bottom half of the poorest Americans. These 400 people own slightly more wealth than half a nation. This absurd level of inequality is only possible under a system of endless money coupled with a system like modern day capitalism which distributes wealth extremely unevenly. At least a finite currency puts a limit to the level of inequality.

In fact by trying to fix this inequality problem by creating more fiat money to even out the waters, the long term end result is that we simply make the problem worse than it was to begin with because of the wealth funneling process that I just described. That's exactly what is happening right now even under our debt based system, the vast amount of the currency in circulation is not in active circulation, but rather in the bank accounts of the super rich; but they always leave us with just enough to conduct our business.

Of course they are also continually injecting new money into circulation, but this privately controlled debt based money doesn't benefit the middle class anywhere near as much as State owned currency does. Most of the newly created debt based money goes to a private bank and the private banks also have the ability to issue their own bank credit based on debt. The new money serves those who get to use it first at its full purchasing power, but hurts the rest of us once the market adjusts via inflation and our savings become worth less.

THE FREE MARKET AND REGULATION

A lot of people will instinctively argue we need more regulations to control these huge monopolies with such a huge amount of power. Some say the mortgage crisis could have been avoided if we had just had more stringent regulations which stopped the banks from being allowed to make those sorts of risky gambles with toxic assets. However if you actually think about it, it was the Government who approved the whole Freddie Mae and Fannie Mac thing, flooding the market with toxic assets as a result. The banks merely had to deal with what the Government gave them.

If we really had a free market would we even have these huge monopolies in the first place? I'm not of the mindset that a free market naturally leads to ever decreasing levels of competition and ends with only a few super players. It's important to keep in mind that in reality most of the regulations which are passed are actually influenced by the large power brokers and lobbyists which work for these huge monopolies. The legislation which comes into existence only serves to benefit these huge monopolies because it is controlled by the same monopolies with all the power.

So the entire field is rigged, there's no longer any chance for new players to come in and provide more competition to these monopolies because their lobbyists collude with the Government regulators to rig the game in their favor. We no longer live in anything that resembles anything like a free market, most of the players in all the major industries have been bought out and consolidated into massive monopolies. This takes away our choice of product and minimizes our job opportunities to a set of heartless conglomerates.

These huge companies, for example Wal-Mart, always strive for increased profits at the expense of the product quality and by minimizing payouts to their employees. With little competition this makes it very easy for them to pay their employees slave wages because many of their employees simply have no hope of finding work anywhere else. So we are left to choose from a range of low quality crap, and that's exactly what our super markets are starting to turn into. Even the supposed high quality stuff is getting worse and providing less bang for the buck.

The problem is not that we lack regulations, it's that we have too many regulations which make it extremely hard for anyone to start a business. Not to mention the many regulations favoring only a select few Government approved companies. We have a system which denies a free market and gives us something which is almost like the opposite of a free market. And then some people try and claim these problems are caused by having a free market with not enough regulations... absurdity! The true path to freedom is limited sound money and a truly free market.

The free market is self-regulating and sound money doesn't need to be controlled with "stability mechanisms" because it too is self correcting. Look at the mess we have gotten ourselves into by thinking we are smarter than the free market and we know how to steer the path of the market better than the market its self. This is pure insanity, we need to get back to the basics of money, there isn't a single unlimited fiat currency which has ever been successful. We will never have a better world until we get a fairer money system based on sound principles.

edit on 24/3/2013 by

ChaoticOrder because: (no reason given)

For further information on the debt based system see:

Zeitgeist Addendum

Money as Debt

Debunking Money

Zeitgeist Addendum

Money as Debt

Debunking Money

Great thread.... you covered this topic very well in both parts.

Originally posted by OptimusSubprime

Great thread.... you covered this topic very well in both parts.

Thank you for the kind words. This series is the result of a lot of time and research dedicated to understanding all these obscure details of the monetary system. I hope many people will find it useful in understanding what has taken me a few years to learn.

lol this video on Quantitative Easing is absolutely hilarious.

If you still aren't sure what QE means just watch this.

But in all seriousness if you want to get a real good understanding of quantitative easing and the logic behind it watch this video:

Keep in mind both those videos were made in 2010, but they are still extremely relevant to our situation today.

If you still aren't sure what QE means just watch this.

But in all seriousness if you want to get a real good understanding of quantitative easing and the logic behind it watch this video:

Keep in mind both those videos were made in 2010, but they are still extremely relevant to our situation today.

edit on 25/3/2013 by

ChaoticOrder because: (no reason given)

Great thread! S&F

Getting people to even think about this is a pain, as I'm sure you know. The first thing everyone says is Communist!!! Then it's "how dare you question my money I work hard blah....blah...blah..."

If people stopped toiling for digital numbers that are backed by nothing and hold no value whatsoever (ever try to eat money? Its terrible...chewy...) and learn where and how money is created there would be a Run On The Bank of epic proportions.

Getting people to even think about this is a pain, as I'm sure you know. The first thing everyone says is Communist!!! Then it's "how dare you question my money I work hard blah....blah...blah..."

If people stopped toiling for digital numbers that are backed by nothing and hold no value whatsoever (ever try to eat money? Its terrible...chewy...) and learn where and how money is created there would be a Run On The Bank of epic proportions.

Great thread! Very well thought out and informative. Thanks for sharing.

In fact, I recommend this as required reading.

You should check your u2u.

In fact, I recommend this as required reading.

You should check your u2u.

reply to post by ChaoticOrder

Great Post , you explained alot here . Thank You for the Education !................

Great Post , you explained alot here . Thank You for the Education !................

I am glad this thread was suddenly revived after all these months. And at the perfect time too imo, understanding the content in this thread really

helps to understand what is happening in the world right now.

One question:

How do we get off this infernal ferris wheel?

I understand limited currencies but how to make the transition from the position we're in with hundreds if not thousands of trillions of derivatives floating around?

Wonderful primer on money principles btw.

Nice job!

How do we get off this infernal ferris wheel?

I understand limited currencies but how to make the transition from the position we're in with hundreds if not thousands of trillions of derivatives floating around?

Wonderful primer on money principles btw.

Nice job!

edit on 9-10-2013 by Asktheanimals because: added comment

Asktheanimals

One question:

How do we get off this infernal ferris wheel?

Well there are a lot of answers to that question depending on why you listen to. My personal opinion is that the only legitimate economy is one which is based on some form of currency which cannot be created easily. So the US would need to go back to a gold or silver standard, or use some other precious metal. But that comes at a big cost and will be very hard to pull off because so much of the world is now operating on the debt based money system.

The next best option is to do what Bill Still argues, have congress issue a state owned currency which is not based on debt, like the United States note issued by Lincoln. It's still a currency which can be created out of thin air but it's much better than debt based money which can be created out of thin air. I think maybe a state owned currency with legislation designed to limit the amount which can be created is possible a good option. The most important thing is really just that it can't be created endlessly.

For example bitcoin has nothing in the real world which backs it, if the bitcoin network were to get hacked and it crashed, there wouldn't be any gold or anything else left at the end. But bitcoins still have a very high value and continue to go up in value because they are very hard to create and there is a limit to how many can be created. The government doesn't even need a stockpile of precious metals, all they need to do is make sure the currency is hard to create.

Adding to that, I think practices such as fractional reserve banking should be outlawed or they should make the reserve requirements much higher. But we both know all these things are very unlikely to happen unless the US experiences a total collapse. They will do everything they can to prolong that collapse and make it look like it's not happening, but when it does happen that will be the chance to start fresh with a new type of monetary system.

As long as it's not debt based and as long as there's a limit to how much currency can be created, the market should never run into huge debt bubbles like this. I think if you just look back at history it's clear that people have always agreed on the basic idea that money must not be like endless grains of sand on the beach. For money to be worth anything in the first place it must abide by the basic principle of rarity/scarcity, anything less is illegitimate.

The debt based system is illegitimate because there's no limit to how much debt can be injected into the system. So we end up with these huge fantastical debts, all nations which use debt based central banking tend to have a huge national debt. All these nations are broke yet none of them seem to be rich, so where exactly is all the money going? How can all these nations be facing a global debt crisis at the same time? One questions where the money actually is.

The answer is that the money is the debt, that is the meaning of the debt based system. It's really quite fascinating and absurd to learn that as they create more money they also create more debt. I mean who thought this debt based system was a good idea in the first place anyway? It's clearly a ponzi scheme designed to weaken all nations and put them into shackles of imaginary debt. The answer is to break free of these shackles.

edit

on 9/10/2013 by ChaoticOrder because: (no reason given)

reply to post by Asktheanimals

To answer your question about the derivatives more precisely, I don't think it's really possible to avoid defaulting on a lot of the debt based derivatives because the US has just handed it out like candy. But like I said in my last post much of the debt doesn't exist. It's skewed by the fact that all money represents a debt within the debt based money system. The real level of debt owed by the US government to foreign parties and private entities is clearly not over 15 trillion dollars.

To answer your question about the derivatives more precisely, I don't think it's really possible to avoid defaulting on a lot of the debt based derivatives because the US has just handed it out like candy. But like I said in my last post much of the debt doesn't exist. It's skewed by the fact that all money represents a debt within the debt based money system. The real level of debt owed by the US government to foreign parties and private entities is clearly not over 15 trillion dollars.

reply to post by ChaoticOrder

Thank you for that informative reply. Collapse or not people need to know what a better substitute would be so that we have a plan of sorts, something to aim for.

I truly believe the US has little if any gold reserves. My understanding is we sent it to European ceentral banks long ago. Nixon took us off the gold standard when DeGaulle demanded France redeem her dollars for real money. Another reason so many assassination attempts were made on him.

Do you think the real reason a collapse may be imminent is due to little or no growth and thus no new debt? Once all the FRNs end up in the hands of the super-rich there are not enough in circulation among consumers to be spending and thus creating new debt.

I would hope we could avoid a collapse but I think the greed of certain people would never allow enough FRNs back in to circulation to stop it.

Thank you for that informative reply. Collapse or not people need to know what a better substitute would be so that we have a plan of sorts, something to aim for.

I truly believe the US has little if any gold reserves. My understanding is we sent it to European ceentral banks long ago. Nixon took us off the gold standard when DeGaulle demanded France redeem her dollars for real money. Another reason so many assassination attempts were made on him.

Do you think the real reason a collapse may be imminent is due to little or no growth and thus no new debt? Once all the FRNs end up in the hands of the super-rich there are not enough in circulation among consumers to be spending and thus creating new debt.

I would hope we could avoid a collapse but I think the greed of certain people would never allow enough FRNs back in to circulation to stop it.

reply to post by Asktheanimals

I would agree with that assessment.

Actually the timing of this caught me very much by surprise, I wasn't expecting this collapse to start happening for a least another year. It seemed like just a month ago that the employment levels in the US were rising and the economy was experiencing a bit of growth. Now of all of the sudden the picture looks very different. Maybe the growth was a temporary benefit of the latest QE scheme and now it's backfiring on them and doing the opposite of what they want it to do like I predicted. It's hard to really say at this point, it's not exactly clear what the real reasons behind this government shutdown are. And I also think that gold may play a large role in the problem, many nations are holding US bonds which they traded for their gold a long time ago. Several nations are really starting to want their gold back now but I highly doubt the US can deliver, which may be one of the potential reasons why they would consider defaulting on the debt so seriously at this point.

Well that's the magic of debt based money, the consumers can just go and get a new credit card or a new loan so that they can continue spending. But that only works so long as the Federal Reserve is constantly injecting new debt into the economy. I don't think the problem is really because of too few people holding too many Federal Reserve Notes, I think it comes down to the fact that the debt bubble can only be propped up to a certain extent before it collapses. Like any ponzi scheme, it cannot last forever. There will naturally come a point when the debt based economy implodes on its self. Whether that day is tomorrow or 10 years from now is another matter, but it will happen sooner or later.

I truly believe the US has little if any gold reserves.

I would agree with that assessment.

Do you think the real reason a collapse may be imminent is due to little or no growth and thus no new debt?

Actually the timing of this caught me very much by surprise, I wasn't expecting this collapse to start happening for a least another year. It seemed like just a month ago that the employment levels in the US were rising and the economy was experiencing a bit of growth. Now of all of the sudden the picture looks very different. Maybe the growth was a temporary benefit of the latest QE scheme and now it's backfiring on them and doing the opposite of what they want it to do like I predicted. It's hard to really say at this point, it's not exactly clear what the real reasons behind this government shutdown are. And I also think that gold may play a large role in the problem, many nations are holding US bonds which they traded for their gold a long time ago. Several nations are really starting to want their gold back now but I highly doubt the US can deliver, which may be one of the potential reasons why they would consider defaulting on the debt so seriously at this point.

Once all the FRNs end up in the hands of the super-rich there are not enough in circulation among consumers to be spending and thus creating new debt.

Well that's the magic of debt based money, the consumers can just go and get a new credit card or a new loan so that they can continue spending. But that only works so long as the Federal Reserve is constantly injecting new debt into the economy. I don't think the problem is really because of too few people holding too many Federal Reserve Notes, I think it comes down to the fact that the debt bubble can only be propped up to a certain extent before it collapses. Like any ponzi scheme, it cannot last forever. There will naturally come a point when the debt based economy implodes on its self. Whether that day is tomorrow or 10 years from now is another matter, but it will happen sooner or later.

edit on 10/10/2013 by

ChaoticOrder because: (no reason given)

new topics

-

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 17 minutes ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 52 minutes ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago -

Weinstein's conviction overturned

Mainstream News: 2 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 3 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 8 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 17 hours ago, 11 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago, 7 flags -

Weinstein's conviction overturned

Mainstream News: 2 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 3 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 16 hours ago, 5 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago, 3 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 52 minutes ago, 3 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 8 hours ago, 2 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago, 2 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 13 hours ago, 1 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 145 • : ImagoDei -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 7 • : nugget1 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 149 • : xuenchen -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 86 • : Consvoli -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 674 • : Thoughtful3 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 51 • : Threadbarer -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 2 • : xuenchen -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 53 • : confuzedcitizen -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 21 • : confuzedcitizen -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum • 1 • : xuenchen

16