It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

1

share:

We read about companies earning billions for their stockholders, transferring the wealth to Luxemburg, Switzlerland, Monaco, Cypruss or whatever

Country is the most corrupt.

If a strong alliance of states like the USA - EU would force companies to just do their duty and pay at least 15-10% income taxes, the western wealth would be safe.

We also should tax or even forbid certain investment products. High risk and high gain is only a sure thing for those, who controll the market with the power of algorithms and computerpower, nanosecond trades and the power of the media outlets they own.

Wake up, be a democratic citizen. Republican, Democat, Black, White? Get over Memes, find a conclusion.

Don't hide behind reservations.

If a strong alliance of states like the USA - EU would force companies to just do their duty and pay at least 15-10% income taxes, the western wealth would be safe.

We also should tax or even forbid certain investment products. High risk and high gain is only a sure thing for those, who controll the market with the power of algorithms and computerpower, nanosecond trades and the power of the media outlets they own.

Wake up, be a democratic citizen. Republican, Democat, Black, White? Get over Memes, find a conclusion.

Don't hide behind reservations.

reply to post by pjfry

ENOUGH with the taxes already. Tax Tax Tax.... When will it be enough?? How much can Governments who collect these taxes spend before finally saying they have enough and need to steal no more from us? Businesses are made up of people. People who work, support families and produce the products we live on.

Worldwide Tax Rates

The US top end Corporate Tax Rate stands as the highest in the world, and only shared by a few others, whom I wouldn't hold up as shining examples of solid fiscal policy themselves. Add 20% and you have an effective tax rate of 55%. I rather like having business to work for and by things from. I've grown used to never needing to MAKE my own basic supplies.

When, perhaps, Governments stopped burning through every penny they can beg, borrow or outright steal ...while asking for virtual unlimited sums to follow? We may have a system which remains half way functional. Probably too late by now.....but more taxes are about the last thing we need when it's already running record highs for anything in RECENT memory and living experience. (The times that had it higher? Economic outcomes weren't exactly fit to point to as examples of what we want to emulate, IMO)

*Tax reform to close every backdoor and sneaky way to avoid the CURRENT tax rate? I'm 100% for... then lets see where we all stand when we actually COLLECT the taxes currently being levied. It's no where close to be adding more, to my thinking.

ENOUGH with the taxes already. Tax Tax Tax.... When will it be enough?? How much can Governments who collect these taxes spend before finally saying they have enough and need to steal no more from us? Businesses are made up of people. People who work, support families and produce the products we live on.

Worldwide Tax Rates

The US top end Corporate Tax Rate stands as the highest in the world, and only shared by a few others, whom I wouldn't hold up as shining examples of solid fiscal policy themselves. Add 20% and you have an effective tax rate of 55%. I rather like having business to work for and by things from. I've grown used to never needing to MAKE my own basic supplies.

When, perhaps, Governments stopped burning through every penny they can beg, borrow or outright steal ...while asking for virtual unlimited sums to follow? We may have a system which remains half way functional. Probably too late by now.....but more taxes are about the last thing we need when it's already running record highs for anything in RECENT memory and living experience. (The times that had it higher? Economic outcomes weren't exactly fit to point to as examples of what we want to emulate, IMO)

*Tax reform to close every backdoor and sneaky way to avoid the CURRENT tax rate? I'm 100% for... then lets see where we all stand when we actually COLLECT the taxes currently being levied. It's no where close to be adding more, to my thinking.

edit on 23-3-2013 by Wrabbit2000 because: (no reason given)

reply to post by pjfry

Nothing EVER goes to the people! Sure, there are programs that do nothing more than keep people down, in the guise of helping them, but when do the money changers EVER do anything for the benefit of the slaves whom have made them wealthy and powerful?

Nothing EVER goes to the people! Sure, there are programs that do nothing more than keep people down, in the guise of helping them, but when do the money changers EVER do anything for the benefit of the slaves whom have made them wealthy and powerful?

Raise the tax on corporations and it will cause prices to rise, that hurts the poor. Retirement savings are dependent on corporations profits. It is

not as simple as it seems at first glance. I don't have the answers but taxing more and more only hurts the people you are trying to help.

reply to post by Wrabbit2000

It's next to delusional to think that "western" companies actually pay taxes. You want streets to drive on, you want a efficient supply of electricity and eatable food, for a fait price.

When Google and Apple make Billions in profit and you can't even get the inflation out of your savings account, you really shouls ask yourself, if you want to accept this system.

And please don't tell me that you hold some decent stock and life of your interest...

Ask Mitt Romney, he does, he may even hook you up with some 10% Cayman Tax-Hookers...

It's next to delusional to think that "western" companies actually pay taxes. You want streets to drive on, you want a efficient supply of electricity and eatable food, for a fait price.

When Google and Apple make Billions in profit and you can't even get the inflation out of your savings account, you really shouls ask yourself, if you want to accept this system.

And please don't tell me that you hold some decent stock and life of your interest...

Ask Mitt Romney, he does, he may even hook you up with some 10% Cayman Tax-Hookers...

reply to post by pjfry

So if the corporations don't pay taxes, what good would it do to raise the tax rate? And let's just say everybody gets together and forces (with a gun?) every corporation to pay "their fair share" ( I love typing those 3 words in a row) why stop at 15 or 20%? Why we could cure the entire worlds problems with 50-75% of the profits from these evil entities.

I mean it would be criminal to stop at taking...erm I mean TAXING at a 15%. For the greater good it should be at least 50%, but to be on the safe side let's go with 75%. That still leaves the satanic evil disgusting capitalist pigs with millions.

Now that I think about it 15%, what are you some corporate shrill here to disrupt and confuse the people?

It's next to delusional to think that "western" companies actually pay taxes.

So if the corporations don't pay taxes, what good would it do to raise the tax rate? And let's just say everybody gets together and forces (with a gun?) every corporation to pay "their fair share" ( I love typing those 3 words in a row) why stop at 15 or 20%? Why we could cure the entire worlds problems with 50-75% of the profits from these evil entities.

I mean it would be criminal to stop at taking...erm I mean TAXING at a 15%. For the greater good it should be at least 50%, but to be on the safe side let's go with 75%. That still leaves the satanic evil disgusting capitalist pigs with millions.

Now that I think about it 15%, what are you some corporate shrill here to disrupt and confuse the people?

reply to post by pjfry

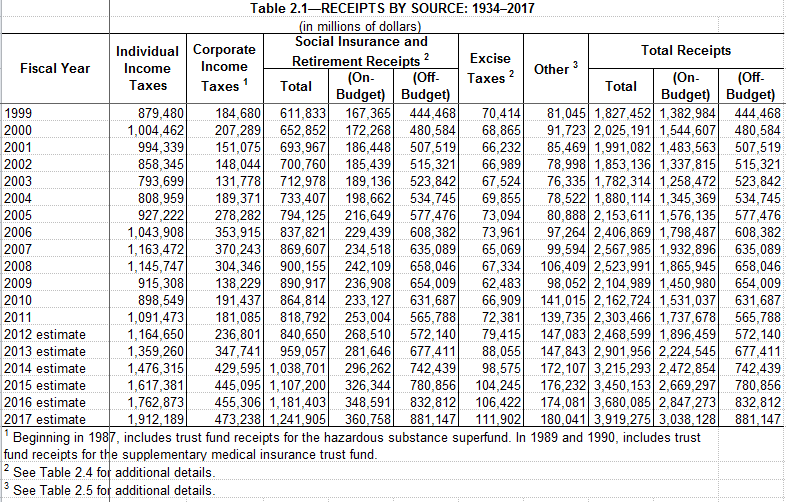

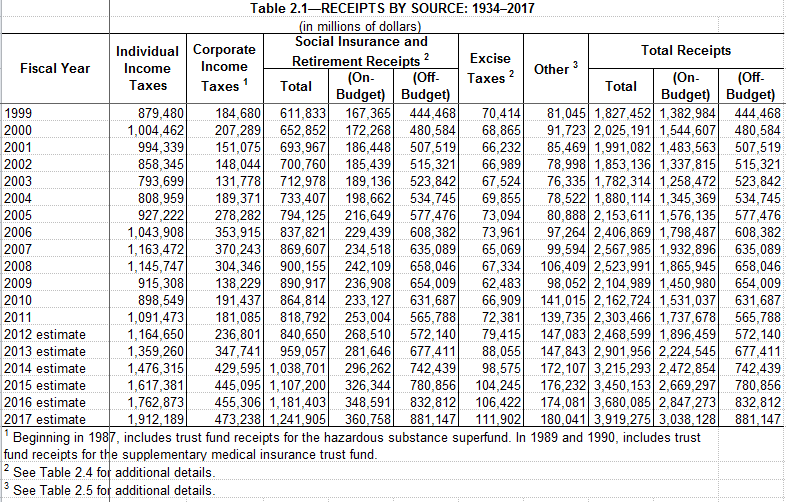

Did you actually check any hard numbers and totals before saying it's delusional to think business pays tax or were you just assuming? You know what they say about assuming....

^^ Like so much else I have pre-sorted and categorized for these debates ... That comes from the overall 2013 Budget package and analysis out of the White House, covering fiscal year 2013 and beyond. Projections are hardly 100% rock solid, of course .....but past record sure is and it's not likely to alter that radically. I've got other things that break it down to much finer detail than just those lump sums...but that shows the point being made.

Business uses whatever they can to avoid paying however much they can. Is it the fault of business? Should THEY be penalized? Well..I say no.

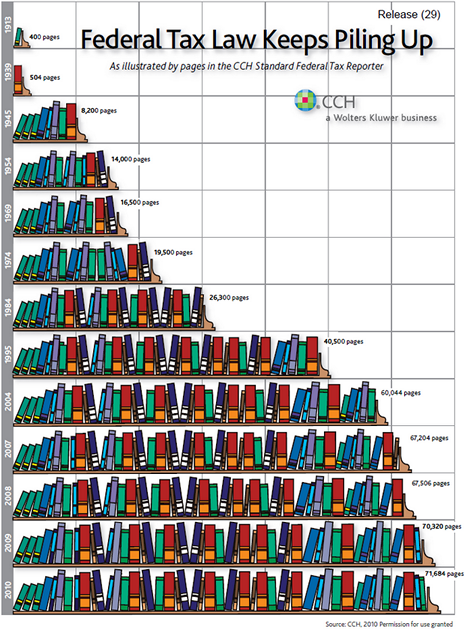

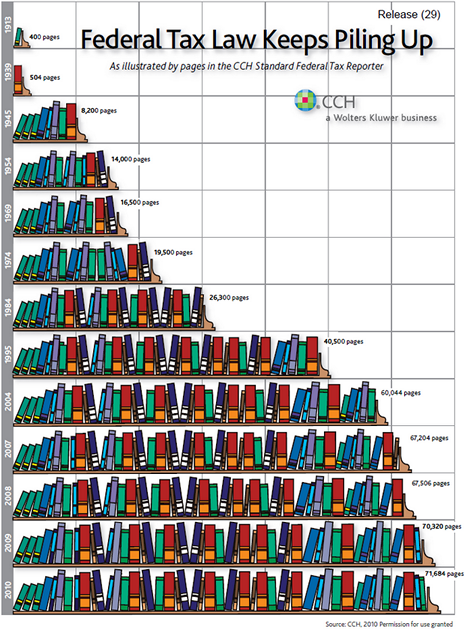

It's the people who wrote that nightmare of tax code, not those who follow it and do their best to survive it ...who we need to look at. It's the very Government you'd see more money given to that IS the problem and why so much is avoided for taxes paid as it stands. Close the deliberately written exceptions and exemptions...waivers and outright special cases? We may find we have enough money after all.

Did you actually check any hard numbers and totals before saying it's delusional to think business pays tax or were you just assuming? You know what they say about assuming....

^^ Like so much else I have pre-sorted and categorized for these debates ... That comes from the overall 2013 Budget package and analysis out of the White House, covering fiscal year 2013 and beyond. Projections are hardly 100% rock solid, of course .....but past record sure is and it's not likely to alter that radically. I've got other things that break it down to much finer detail than just those lump sums...but that shows the point being made.

Business uses whatever they can to avoid paying however much they can. Is it the fault of business? Should THEY be penalized? Well..I say no.

It's the people who wrote that nightmare of tax code, not those who follow it and do their best to survive it ...who we need to look at. It's the very Government you'd see more money given to that IS the problem and why so much is avoided for taxes paid as it stands. Close the deliberately written exceptions and exemptions...waivers and outright special cases? We may find we have enough money after all.

Global taxation?And who gets to collect that and divvy it up? How about lower taxes and leaving within your means? Look at the amount of waste and

fraud already within the government.

Governments only purpose is to maintain the quality of the infrastucture, education and wellfare of the people living in said environment.

Taxes are your, or a companies share of their duty to keep "things running"

If companies evade taxes, the "public" (you) have to pay more to obtain a certain level of structure.

In the end, YOU pay for it, because, "global markets" and fairy tales...

Fact:

1970 2/3 Taxmoney came from companies

2010 1/3 Taxmoney came from companies

That 1/3 is what you pay right now, spread over multiple made up taxes, but YOU still pay them.

If you really want to discuss, research and compare numbers, read papers both from dem and reps.

If you can, just jump as high as you can and try to get a look at the facts.

Taxes are your, or a companies share of their duty to keep "things running"

If companies evade taxes, the "public" (you) have to pay more to obtain a certain level of structure.

In the end, YOU pay for it, because, "global markets" and fairy tales...

Fact:

1970 2/3 Taxmoney came from companies

2010 1/3 Taxmoney came from companies

That 1/3 is what you pay right now, spread over multiple made up taxes, but YOU still pay them.

If you really want to discuss, research and compare numbers, read papers both from dem and reps.

If you can, just jump as high as you can and try to get a look at the facts.

edit on 23-3-2013 by pjfry because: spelling™

Originally posted by pjfry

Governments only purpose is to maintain the quality of the infrastucture, education and wellfare of the people living in said environment.

If governments held even remotely close to those basic and core principles for their purpose in existing? This thread wouldn't exist. Nor would the progressively more crushing tax burden being levied against people where "rich" is being defined lower and lower all the time.

(Look at the bright side for some, I guess.. If they keep raising min. wage without logical foundation for doing it? We'll ALL qualify in their paper definition of 'Rich' as the two numbers meet at some point. )

reply to post by Wrabbit2000

Nobody says it's easy to turn around mechanics which have been in place for 50 years.

The economic construct, a 1980's President promoted it- didn't work out.

The Rich will give money to the poor, because they are richer than last year and give that money back to the working man?

en.wikipedia.org...

Just read it...

Nobody says it's easy to turn around mechanics which have been in place for 50 years.

The economic construct, a 1980's President promoted it- didn't work out.

The Rich will give money to the poor, because they are richer than last year and give that money back to the working man?

en.wikipedia.org...

Just read it...

reply to post by pjfry

Actually, I'm very familiar with the Trickle Down theory of economics. If you click on the guide link in my signature, you may notice I've spent a bit of time, in fact, deeply looking into the matter of just what President's did what in reality vs. myth and assumption. I worked pretty hard to include a broad and wide section of numbers, drawn from the sources handling them directly (as much as I could reasonably manage that level of top sourcing).

Reagan wasn't perfect and his system wasn't perfect. In the actual ranking of Presidents, he's not even classified as "Great" by a fairly fixed set of criteria they grade these things on. That was a surprise to learn but then, learning is fun that way.

You will notice though, the condition of the United States under Johnson, into Ford and then...to Mr Peanut. Notice thing like the 30yr interest rate just below a crushing 15% under his 'leadership'. Many of his policies are, in some form, being retread like an old tire and thrown on the Obama-Mobile for another run around the track.

Insanity is doing the same thing multiple times and expecting different results. It's been no shock to me that the results we've watched have come pretty close to the first guy in that office to have tried some of this in a modern economy. Economic theory doesn't suddenly work just because the man's name is Obama. Taxation when burdens are already painful is foolish and reckless unless and until *ALL FORMS* of Government waste an average person could find to be upset over are ended.

Just my two cents here...

Actually, I'm very familiar with the Trickle Down theory of economics. If you click on the guide link in my signature, you may notice I've spent a bit of time, in fact, deeply looking into the matter of just what President's did what in reality vs. myth and assumption. I worked pretty hard to include a broad and wide section of numbers, drawn from the sources handling them directly (as much as I could reasonably manage that level of top sourcing).

Reagan wasn't perfect and his system wasn't perfect. In the actual ranking of Presidents, he's not even classified as "Great" by a fairly fixed set of criteria they grade these things on. That was a surprise to learn but then, learning is fun that way.

You will notice though, the condition of the United States under Johnson, into Ford and then...to Mr Peanut. Notice thing like the 30yr interest rate just below a crushing 15% under his 'leadership'. Many of his policies are, in some form, being retread like an old tire and thrown on the Obama-Mobile for another run around the track.

Insanity is doing the same thing multiple times and expecting different results. It's been no shock to me that the results we've watched have come pretty close to the first guy in that office to have tried some of this in a modern economy. Economic theory doesn't suddenly work just because the man's name is Obama. Taxation when burdens are already painful is foolish and reckless unless and until *ALL FORMS* of Government waste an average person could find to be upset over are ended.

Just my two cents here...

edit on 23-3-2013 by Wrabbit2000 because: (no reason given)

Stabilizing the tax rate in each country to an equal global rate would actually be an effective way to stop some of the antics that are going on in

regards to tax avoidance in very large, globalized corporations. Although the US has some of the highest (if not the highest) corporate tax rate, you

can't just simply look at that tax rate and pass judgment. There are a number of ways that globalized corporations lower that tax rate down to a 0%

tax rate or even find a way to get a refund. There is the marginal tax rate and the effective tax rate. The effective tax rate is what they

actually pay in taxes. For example, in the year 2010, GE had $14.2 billion in global profits and it paid $0 in US federal tax. When GE was facing

public acrimony in regards to their tax avoidance, CEO Immelt claimed that they would pay their full tax rate of 33% in the next tax season. They

ended up paying an effective tax rate of 11.5% of their profits that year so they didn't pay that 33% at all--it was pure lip service. Even better

would be some of the largest banks in the US such as Bank of America or Chase, which would earn a couple billion in profits for the year and get a tax

refund. In the meantime, some mid sized mom and pop corporation that is making $1 million or more is ending up paying the 33% because they don't have

access to some of the tools used in tax avoidance strategies (ie creating a shell company within an offshore tax haven). Technically, that's

anti-competitive when you find a smaller corporation having to pay the full marginal tax rate and more tax than a globalized mega corporation because

they have the ability to construct shell companies worldwide.

And that's not all. When these globalized mega corporations utilize these offshore tax havens, they are essentially claiming that monies were made there. The moment they bring this money onshore in the US, it becomes subject to tax. So they just keep it sitting or utilize the monies to expand their interests outside of the US. The shareholders within these corporations may receive little or reduced dividends as a result because paying out a dividend would be bringing it onshore again. So really, the globalized corp antics have a triple damaging effect on the US economy through a. no or reduced dividends due to tax avoidance, b. decreased monies used in expanding activities within the US, and c. reduced corporate tax revenue within the US. The last one does indeed have a dramatic effect on tax revenues and most definitely has something to do with our deficit. The media just doesn't really have an interest in pushing this within the news however because well, if they did and there was a unified public outcry, then that would be shooting themselves in their own foot.

Probably why GE owns a very large chunk of the media...

P.S. the offshore tax havens would NEVER agree to this.

And that's not all. When these globalized mega corporations utilize these offshore tax havens, they are essentially claiming that monies were made there. The moment they bring this money onshore in the US, it becomes subject to tax. So they just keep it sitting or utilize the monies to expand their interests outside of the US. The shareholders within these corporations may receive little or reduced dividends as a result because paying out a dividend would be bringing it onshore again. So really, the globalized corp antics have a triple damaging effect on the US economy through a. no or reduced dividends due to tax avoidance, b. decreased monies used in expanding activities within the US, and c. reduced corporate tax revenue within the US. The last one does indeed have a dramatic effect on tax revenues and most definitely has something to do with our deficit. The media just doesn't really have an interest in pushing this within the news however because well, if they did and there was a unified public outcry, then that would be shooting themselves in their own foot.

Probably why GE owns a very large chunk of the media...

P.S. the offshore tax havens would NEVER agree to this.

edit on 24/3/13 by WhiteAlice because: added the ps

reply to post by WhiteAlice

"Global" tax - "Algore's carbon tax" - will go to the UN, not individual countries, and we all know how good they are at running things in

the world.

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 5 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago -

Weinstein's conviction overturned

Mainstream News: 7 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 7 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 11 hours ago, 6 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago, 5 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago, 5 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago, 2 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 76 • : YourFaceAgain -

The Acronym Game .. Pt.3

General Chit Chat • 7750 • : bally001 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 681 • : MetalThunder -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 20 • : chr0naut -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 7 • : rickymouse -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 10 • : chr0naut -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 50 • : watchitburn -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 55 • : CarlLaFong -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 23 • : Ravenwatcher -

Is there a hole at the North Pole?

ATS Skunk Works • 40 • : Oldcarpy2

1