It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

No offence, but as a mathematician, you should have realised that US tax revenues have never reflected tax rates of 90%...ever.

acually 90% top tax rates were used in the us for certain reasons, for certain sectors and earners,

no error it was the top tax rate during ww1 for some sectors of the population in some areas of production,

war goods is one example.

It's all smoke and mirrors. Jack the advertised rate up to make all the lower incomes feel better, but, at the same time, increase all of the sheltering capabilities.

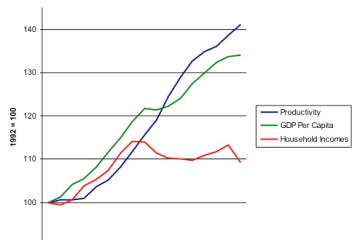

actually if you did the exact opposite of the bush tax cuts and raise the rates instead of dropping them you would see a boom in industry and consumption. see the sixties for an example, the largest growth in the middle class happened during times of high taxes on the top teir of earners

just look at history

The facts are pretty simple. US tax code has been over complicated intentionally, to allow those that know how, to abuse those that do not.

i agree the point

You want an easy solution...here:

Throw out US tax code.

Implement a simple, progressive tax structure (low-10%, high 30%).

Treat all income (regardless of source) as income.

including income from bonds shares and dividends?

Set business tax rates as progressive based on company size.

Institute fixed budgets to each branch based on GDP/capita.

tradition is important in this debate,

america has traditionally sought higher tax rates from the wealthy because they are the ones benefiting from finance and manufacture for consumption,

when the lower tier pay to much in taxes they have no discretionary money to spend on consumption,

this is a cycle that effects everyone.

if you tax the poor in proportion to their earnings, they will not buy goods,

that lowers demand and the producers and manufacturers suffer,

thats why countries like Australia with a high minimum wage are very prosperous ATM

xploder

reply to post by XPLodER

Its pretty ironic isnt it?

They are for socialism for the rich and everyone else has to pay the bill.

They are for ending all market regulations that stand in the way of profits, but gungho on keeping the biggest regulator of all in place.

Our military is used not for defensive national purposes but to regulate the world markets to their benefit.

We are ruled by a tyranny of the minority

Its pretty ironic isnt it?

They are for socialism for the rich and everyone else has to pay the bill.

They are for ending all market regulations that stand in the way of profits, but gungho on keeping the biggest regulator of all in place.

Our military is used not for defensive national purposes but to regulate the world markets to their benefit.

We are ruled by a tyranny of the minority

reply to post by Kali74

Interesting notion!! But, will that tax stop the spending? Every new tax, tax increase etc just seems like another revenue stream for the govt. to spend. D.C. has a spending problem and the credit cards are maxed out!

Interesting notion!! But, will that tax stop the spending? Every new tax, tax increase etc just seems like another revenue stream for the govt. to spend. D.C. has a spending problem and the credit cards are maxed out!

reply to post by jacobe001

its called socialising losses and privatizing profits

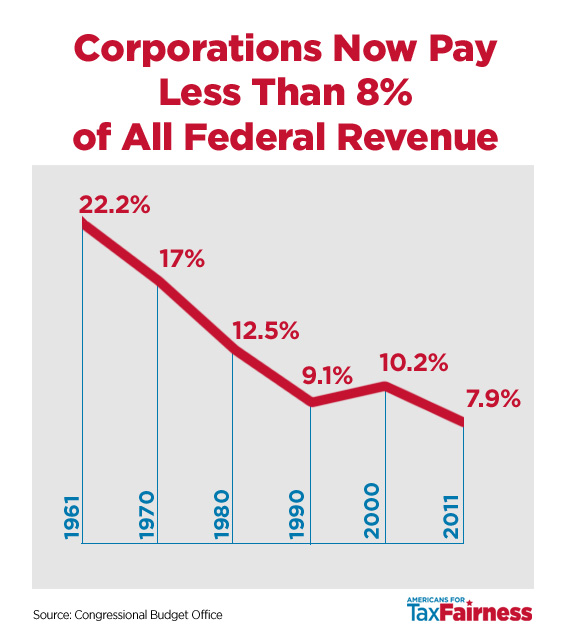

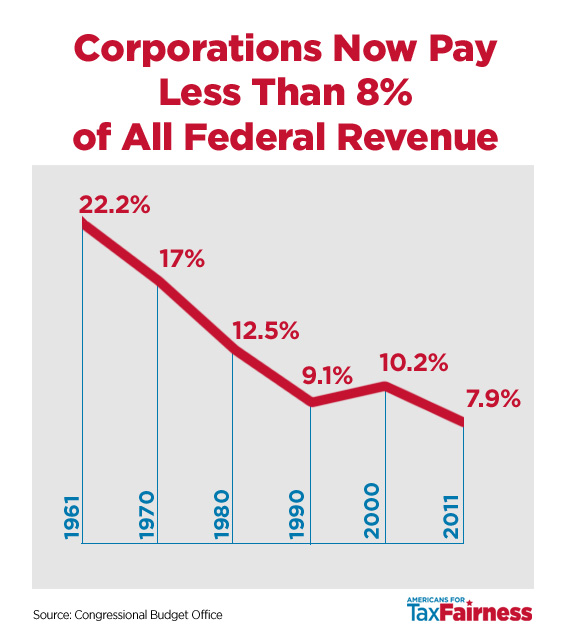

if corporations payed their traditional rates the problem would reverse itself in no time,

neo is just spewing nonsense again trying to get people to agree to cut their own throats.

banks making record profits are safe from noes scrutiny,

but the poor or the sick well they are fair game

xploder

its called socialising losses and privatizing profits

if corporations payed their traditional rates the problem would reverse itself in no time,

neo is just spewing nonsense again trying to get people to agree to cut their own throats.

banks making record profits are safe from noes scrutiny,

but the poor or the sick well they are fair game

xploder

reply to post by jibeho

Spending would have to be addressed of course. Problems such as raising prices on what the government buys is an issue I can foresee.

Spending would have to be addressed of course. Problems such as raising prices on what the government buys is an issue I can foresee.

Originally posted by jibeho

reply to post by Kali74

Interesting notion!! But, will that tax stop the spending? Every new tax, tax increase etc just seems like another revenue stream for the govt. to spend. D.C. has a spending problem and the credit cards are maxed out!

you keep pointing to spending to obfuscate the real problem,

the real problem is socialising losses (read entitlement to corporations)

and privatizing profits (read zero effective tax rate)

you keep looking in the wrong direction, is that on purpose?

xploder

reply to post by Kali74

How ridiculous this whole thread has become............

Arguing over how we are ALL being screwed, WHILE AT THE SAME G.D. TIME STICKING UP FOR THE CRIMINAL ELEMENTS IN DC WHO MADE IT ALL POSSIBLE!

None of you have a damn clue..........

How ridiculous this whole thread has become............

Arguing over how we are ALL being screwed, WHILE AT THE SAME G.D. TIME STICKING UP FOR THE CRIMINAL ELEMENTS IN DC WHO MADE IT ALL POSSIBLE!

None of you have a damn clue..........

reply to post by XPLodER

How?

When half of this country has zero tax liability?

Whose cutting their throats?

Tax those evil corporations so people can go out any buy more corporate products!!!!

Only they won't have a job to.

if corporations payed their traditional rates the problem would reverse itself in no time,

How?

When half of this country has zero tax liability?

Whose cutting their throats?

Tax those evil corporations so people can go out any buy more corporate products!!!!

Only they won't have a job to.

Originally posted by seeker1963

reply to post by Kali74

How ridiculous this whole thread has become............

Arguing over how we are ALL being screwed, WHILE AT THE SAME G.D. TIME STICKING UP FOR THE CRIMINAL ELEMENTS IN DC WHO MADE IT ALL POSSIBLE!

None of you have a damn clue..........

you would rather we debate who the worst political party is?

that is a really bad idea.

why should someone who makes money off finacial transactions for a living pay no taxes?

after all this is just another form of labour,

and why if these products are sold should they be free from sales taxes?

are financiers really that special that they can play by different rules?

xploder

Originally posted by XPLodER

Actually 90% top tax rates were used in the us for certain reasons, for certain sectors and earners,

no error it was the top tax rate during ww1 for some sectors of the population in some areas of production,

war goods is one example.

I am aware of when and why advertised tax rates were set at 90%. That doesn't change the fact that the US government has never actually received that income...ever.

As I am sure you are aware, in 1944-45 (when tax rates at the highest bracket were 94%), the actual paid taxes were closer to 40% on earned income. Less for those that invested heavily.

Granted, I am of the thought that the US government did it intentionally to spur large investment.

actually if you did the exact opposite of the bush tax cuts and raise the rates instead of dropping them you would see a boom in industry and consumption. see the sixties for an example, the largest growth in the middle class happened during times of high taxes on the top teir of earners

just look at history

Hard to say. I personally believe that taxes paid (versus tax rates) are socially driven, not economically.

To use your example of the 60's, that is also the period of greatest patriotism inside the US. A very strong social motivator to pay more towards the betterment of your society as a whole.

That also explains why certain countries will tolerate higher taxation levels then others.

including income from bonds shares and dividends?

All incomes. When a person receives income from bonds, shares, and dividends, the amount that they received is no longer acting towards the investment, in and of itself, so it should no longer be treated as an investment.

If the people this effects (myself included) do not like it, they can always keep the money in the investment by not removing it as income.

tradition is important in this debate,

america has traditionally sought higher tax rates from the wealthy because they are the ones benefiting from finance and manufacture for consumption,

when the lower tier pay to much in taxes they have no discretionary money to spend on consumption,

this is a cycle that effects everyone.

if you tax the poor in proportion to their earnings, they will not buy goods,

that lowers demand and the producers and manufacturers suffer,

Note my use of a progressive tax basis. In Canada we define progressive taxes as burdening all equally. By that definition, you can not take 30% of a low income and 30% of a high income, as you would have created unequal burden through equal taxation.

thats why countries like Australia with a high minimum wage are very prosperous ATM

Cross country comparisons on singular institutions (like comparing minimum wage between two countries) is never accurate.

There is just too many differences between the entire economic environments to compare them equally.

You can say it is Australia's minimum wages, and I can say it is their level of taxes, education spending, defence spending, etc.

reply to post by XPLodER

You pay more in taxes than corporations-LIE.

www.cbsnews.com...

money.cnn.com...

www.forbes.com...

You pay more in taxes than corporations-LIE.

www.cbsnews.com...

money.cnn.com...

www.forbes.com...

if corporations payed their traditional rates the problem would reverse itself in no time,

How?

When half of this country has zero tax liability?

2 trillion dollars is parked in the kaymen islands tax free, if taxed at 22.5% and if corperations were to also pay 22.5% on money earned in america the resulting figaur is enough to rebuild ALL THE CRUMBLING INFRASTRUCTURE IN AMERICA that these corperations use to make money.

that puts people to work and gives them money to spend (ie a healthy economy)

Whose cutting their throats?

Tax those evil corporations so people can go out any buy more corporate products!!!!

Only they won't have a job to.

thats BS

it would cost a small fraction of the MASSIVE RECORD BREAKING profits they currently enjoy.

AND OFFSHORE

xploder

reply to post by XPLodER

Contrary to some peoples beliefs money made offshore is untouchable by the Us federal government that is like saying New York has a right to California's money.

thanks made my point for me: tax those evil rich so the less fortunate can go buy corporate products.

2 trillion dollars is parked in the kaymen islands tax free

Contrary to some peoples beliefs money made offshore is untouchable by the Us federal government that is like saying New York has a right to California's money.

hat puts people to work and gives them money to spend (ie a healthy economy)

thanks made my point for me: tax those evil rich so the less fortunate can go buy corporate products.

edit on 22-3-2013 by neo96 because: (no

reason given)

Originally posted by neo96

No that is the US federal government who will do anything to destroy anyone or anything that gets in its way.

So I take it you are going to protest or go after the politicians in DC that hail from the likes of the Big Wall Street Banks and Big Multi National Corporations?

There are many who say that there are no gold bars in Fort Knox. That the gold bars were sold off on the London Gold exchange as a means to control

the price of gold worldwide.

Seriously, nobody pays taxes any more because money is imaginary. It's just that some know how to create imaginary money better than others.

The welfare checks and the food stamp card.....imaginary. Which is about as far as the socialist's imagination will take them.

Which leads to a higher crime rate.

Crime is not imaginary. Someone is out to hurt you.

Seriously, nobody pays taxes any more because money is imaginary. It's just that some know how to create imaginary money better than others.

The welfare checks and the food stamp card.....imaginary. Which is about as far as the socialist's imagination will take them.

Which leads to a higher crime rate.

Crime is not imaginary. Someone is out to hurt you.

I am aware of when and why advertised tax rates were set at 90%. That doesn't change the fact that the US government has never actually received that income...ever.

they were advertised at 90% for some sectors, weather that was the effective rate acually collected is another matter, so agree with what you say

As I am sure you are aware, in 1944-45 (when tax rates at the highest bracket were 94%), the actual paid taxes were closer to 40% on earned income. Less for those that invested heavily.

it caused capital investment and that lead to factories and jobs, it had its intended effect

Granted, I am of the thought that the US government did it intentionally to spur large investment.

might be a good way to spur those offshore funds back into the real economy instead of sitting dormant in offshore bank accounts

Hard to say. I personally believe that taxes paid (versus tax rates) are socially driven, not economically.

so we should demand social responcability for large corporations and wealthy 1% types

To use your example of the 60's, that is also the period of greatest patriotism inside the US. A very strong social motivator to pay more towards the betterment of your society as a whole.

this is why i refereed to the 1% as anti american

That also explains why certain countries will tolerate higher taxation levels then others.

because of the notion that to suceed as an individual you have to have a functioning society for you to benefit from

If the people this effects (myself included) do not like it, they can always keep the money in the investment by not removing it as income.

or spend it on capital investment, which would drive production, and supply jobs to americans

Note my use of a progressive tax basis. In Canada we define progressive taxes as burdening all equally. By that definition, you can not take 30% of a low income and 30% of a high income, as you would have created unequal burden through equal taxation.

i agree with you on this point, a millionaire is not going to eat 100X the number of hamburgers, as a poor person,

but that money in the hands of 100 people will

Cross country comparisons on singular institutions (like comparing minimum wage between two countries) is never accurate.

There is just too many differences between the entire economic environments to compare them equally.

yes i admit the comparison was flawed, mining, increasing population and ect

You can say it is Australia's minimum wages, and I can say it is their level of taxes, education spending, defence spending, etc.

i conceed to your point being correct, but america is one of the only OECD contries without a minimum wage

and some of the largest percentages of poor while living in one of the richest countries on earth

xploder

Originally posted by jacobe001

Originally posted by neo96

No that is the US federal government who will do anything to destroy anyone or anything that gets in its way.

So I take it you are going to protest or go after the politicians in DC that hail from the likes of the Big Wall Street Banks and Big Multi National Corporations?

There is only one group of people that make me pay them, and make me buy corporate products those DC politicians.

Originally posted by seeker1963

reply to post by Kali74

How ridiculous this whole thread has become............

Arguing over how we are ALL being screwed, WHILE AT THE SAME G.D. TIME STICKING UP FOR THE CRIMINAL ELEMENTS IN DC WHO MADE IT ALL POSSIBLE!

None of you have a damn clue..........

Very true....and many of these posters are bound and determined to remain that way.

Which makes Big Brother very happy. It makes their job of keeping the masses in a prison without bars that much simpler.

reply to post by XPLodER

That 90% percent tax rate is BS due to the value of the dollar was more, there were less people in government programs, and most of the programs did not even exist.

That 90% percent tax rate is BS due to the value of the dollar was more, there were less people in government programs, and most of the programs did not even exist.

Originally posted by neo96

reply to post by XPLodER

You pay more in taxes than corporations-LIE.

www.cbsnews.com...

money.cnn.com...

www.forbes.com...

they buy up liability from other companies so they dont pay taxes,

effectively paying no taxes AND getting entitlements from government welfare,

its a bait and switch type of accounting,

i suspect its to complex for me to explain it to you under the current conditions of this debate.

xploder

new topics

-

A man of the people

Diseases and Pandemics: 1 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 1 hours ago -

4 plans of US elites to defeat Russia

New World Order: 2 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 6 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 9 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 9 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 9 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 15 hours ago, 26 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 9 hours ago, 16 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 17 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 9 hours ago, 6 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 15 hours ago, 5 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 6 hours ago, 5 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 9 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 2 hours ago, 2 flags -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 1 hours ago, 1 flags -

A man of the people

Diseases and Pandemics: 1 hours ago, 1 flags

active topics

-

12 jurors selected in Trump criminal trial

US Political Madness • 25 • : Dandandat3 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 4 • : Shoshanna -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 19 • : Scratchpost -

A man of the people

Diseases and Pandemics • 2 • : midicon -

The Fight for Election Integrity Continues -- Audits, Criminal Investigations, Legislative Reform

2024 Elections • 4139 • : IndieA -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues • 5 • : Shoshanna -

Mood Music Part VI

Music • 3060 • : TheWoker -

4 plans of US elites to defeat Russia

New World Order • 10 • : andy06shake -

Elites disapearing

Political Conspiracies • 32 • : SchrodingersRat -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 67 • : Consvoli