It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

10

share:

True Money: Part I

WHAT IS MONEY?

Lets boil it down to 2 very simple dot points:

- medium of exchange

- store of value

Back in "the day" when the use of currency was less common than it is now, people would often conduct trade by bartering directly with what ever they had, food, animals, etc. Humans soon realized that this method of conducting trade is very tedious and that by using smaller and lighter objects with a commonly agreed upon value, they could conduct trade without having to lug around the items they wished to trade with.

The objects we use as a currency act as our "medium of exchange" so that we don't have to barter with other less convenient objects. Because it is commonly accepted as a currency we must be sure it will act as a stable "store of value". Gold or silver for example are good candidates because they are rare resources which are hard to find and hard to create, thus they hold value well over the long term.

But how do we choose which objects to use as our currency? As a child I spent much of my time playing in the woods, and one day I invented a game where we would use "bush money" to trade with each other. The bush money was simply a certain type of tree bark, it wasn't very hard to find. It was easy to conduct exchange with the bark, but we quickly realized that this bark was too abundant to use as a currency.

Instead of trying to understand what a currency is, it's better to think about what a currency isn't. So what else would make a bad currency? Sand on a beach would make a bad currency, and again it's because there's too much sand. Of course sand has a small intrinsic value, and we'll get into that idea more later, but it's not relevant for now. The main point is that our currency must have certain properties for it to work as a currency.

As we can see, the single most important property of any currency is the ability of the currency to hold value over time, and for it to hold value over the long term it must remain scarce and hard to create. The purchasing power of our fiat paper money constantly decreases because the Government / central banks constantly create new money and put it into circulation. But there are also other properties a good currency should have.

IDEAL PROPERTIES OF A CURRENCY

Scarce: should be rare and hard to create/find

Divisible: should be easy to divide into smaller units

Storable: should be easy to securely store large amounts

Anonymous: should provide privacy on transactions made

Unspoofable: should be hard to counterfeit/forge

Practical: transactions should be fast and easy

Stable: future value should be relatively predictable

Decentralized: no single point of failure or issuing authority

How does beach sand fit those criteria? Not very well. It's not scarce but it is divisible. Considering the abundance of beach sand it would require a lot of sand to make purchases, and that would make it hard to store, as well as making transactions slow. Therefore it would not be practical. It would also be relatively easy to forge new sand since it's just crushed up sea shells, and that could make the value unstable.

Shell money is a good example of a tried and tested currency which was used for quite some time by people all over the world. Although many types of shells were used, the best ones to use were rare shells which are hard to find. These shells are also much harder to counterfeit than sand, especially back in the time they were used commonly as a currency.

Because the rare shells were so scarce they provided a stable basis as a store of value and transactions became practical. Shell money is even decentralized since anyone can go out and hunt for new shells. The only property which shells don't really have is divisibility, since breaking up the shell would surely invalidate its status as a unit of currency. In any case the shells worked as a pretty good currency back then.

Another interesting currency used quite some time ago was the Stone Money used on the island of Yap. These were extremely huge stones hand crafted into the shape of a massive donut or coin with a hole through the center. The larger the stone coin the more it was worth. These stones were scarce simply because they were so hard to create.

Since they were so rare and so hard to create they were worth quite a bit, but the downfall was that they were extremely hard to transport and they were not easily divisible. This made transactions difficult and the result was that these stone coins were only used in large transactions. This is why we tended to gravitate towards precious metals over time, they are more easily divided into smaller units.

Precious metals such as gold or silver fit the above criteria very well, with the only downfall being that carrying around a lot of gold or silver can be tedious due to its weight, and it could also be dangerous. To remedy this problem some nations like the United States adopted a gold standard, meaning they used paper notes which represented some amount of real gold in a vault some where, and you could even redeem your notes for gold.

However once we introduce paper notes we open the door for counterfeiters. This means we must have centralized organizations to not only supply the notes, but to ensure the integrity of the existing notes already in circulation. So a gold/silver standard is certainly not perfect, but it is much better than what we have now. Not to mention it is written in the Constitution of the United States that only gold or silver should be used.

Another more recent currency is the electronic P2P currency known as Bitcoin. The global P2P system enforces a limited currency and makes it virtually impossible to create fake bitcoins. It is highly divisible and provides a moderate amount of anonymity to users. The scarce and decentralized nature of bitcoin is unlike any other electronic currency ever seen before and is proving to be quite popular.

WHAT DETERMINES THE VALUE OF MONEY?

What do rare shells, huge boulders, precious metals and bitcoins all have in common? Obviously, they are all scarce. However, more importantly, no one was forced to use any of these currencies. In each case it was a spontaneous voluntary formation based on group consensus. Natural emergence fueled by the needs and desires of the masses. They recognized that a currency must have certain properties, and they chose accordingly from what was available to them.

What about tree bark, beach sand and fiat paper; what do they have in common with each other? Abundance. Isn't it odd that we don't use bark or sand, yet we use paper... not because we want to use paper, but because we are forced by the Government to use it as legal tender. What gives this paper money value if it's just paper the Government says is money and has nothing tangible backing it? This is a tricky question indeed.

But to simplify as much as possible, the value really comes from the demand for the currency in question. And the demand is really determined by how widely used that currency is and how much commerce is being conducted with that currency (this is why it's important for the US dollar to remain as the master petrodollar). It's like anything else, if more people demand something, but the supply of that something is limited, the value goes up.

Now you might wonder why all of our fiat currencies tend to decrease in value over time if economic growth causes the purchasing power of the currency to increase. The value of the currency will only increase if we have economic growth AND the currency supply remains limited. However this is not the case with our current money system. Instead new money is being created all the time and injected into circulation.

In reality the value of the dollar should increase with some link to economic growth in the United States, however they steal this extra value by constantly injecting billions and billions of new dollars into circulation. Not only that, they inject so much new money that it causes price inflation, meaning the purchasing power of the dollar is always dropping and your savings are always becoming worth less and less.

edit on

10/3/2013 by ChaoticOrder because: (no reason given)

HOW DOES ENERGY INPUT IMPACT VALUE?

Consider the huge stone coins, does the intrinsic value of the stone differ from the face value of the stone coin? Yes it certainly does, the historic value of the stone can even give it more value. So you see there isn't always a definite link between value and real tangible objects; historic value has no tangible properties. The face value of the stones is also determined by other important factors.

The energy which went into creating those stones plays a large role in determining their value. You cannot redeem the stones for the energy which went into creating them, yet much of their face value is still determined by the amount of energy burned up in their creation. In this case the money supply can be inflated without any damaging effects because they aren't easy to create like paper money.

When new stone coins are injected into circulation the market doesn't freak out because the market knows those rocks haven't just appeared from thin air, there was a lot of energy spent to put them into circulation. Not only is fiat paper money extremely easy to create, but they can put any denomination on the note. In fact they don't even need to print it, these days it's mostly created as electronic money.

Consider the reasons for the increase in the price of oil over the last few years (besides greedy shareholders). Is it really because we're getting low on oil? Well in reality there's still a fair amount of oil left to recover, probably some where around the total amount recovered in the history of man kind or more. However we've already recovered most of the easy-to-access oil, leaving us with the hard to reach stuff.

To reach this oil we often require deep sea drilling equipment and we need to use a lot of energy recovering that oil. The amount of energy required or the cost of recovering that oil impacts the final price of the oil. It probably doesn't impact it as much as other more sinister forces impact it, but it does impact it just like it impacts the value of the large stone coins.

Now consider the way bitcoins are created. Not only is there a finite limit placed on the amount which can ever be created, but the generation of new bitcoins requires a considerable amount of electrical energy to perform the calculations required. Like the stone coins, this gives them some sort of underlying value which is determined by the amount of energy put into their creation.

However once again the main force driving the increase in the value of bitcoin is simply the demand for bitcoin. But why is there demand for bitcoins if no one is forced to use them? Bitcoin emerged naturally, to include many of the ideal properties I listed earlier. It's decentralized, fairly anonymous, provably scarce, highly divisible, and very predictable (since we always know how many coins are in circulation).

The properties of bitcoin attract people to it because it can provide them with functionality that other currencies lack. To send an international transaction using the traditional banking system would require many hours or days, and extremely high fees. Bitcoin can get it done within about 5 minutes and the fees are extremely low even when sending huge amounts of money. This creates demand, and thus gives bitcoin value.

INTRINSIC VALUE VS FACE VALUE

Keep in mind that the demand for a currency may also increase if it has unique uses beyond just being a currency. For example gold has many uses in electronics and other things, which ensures that gold will always have some sort of value as long as it has some other use besides being a currency. Other currencies, such as fiat paper money, may collapse completely because at the end of the day it's only paper.

It's true that paper does have many uses, and the intrinsic value of paper is not zero (like sand), but it's just so abundant that it's not worth very much even with such a high amount of demand for it. However it's important to keep in mind that even gold is subject to this type of speculation. The value of gold can rapidly fall and rise within a single day based on the quickly changing levels of demand.

Over time, as the population grows, and more and more people contribute a demand for gold, the value of gold will increase. Is the intrinsic value of the gold actually changing? The answer would presumably be yes, since the face value of gold is really just the same as the "intrinsic value" of gold. Not all currencies are like this however, some currencies have low intrinsic value yet have a high face value.

The intrinsic value of fiat notes is only the value of the paper and the ink, but the face value (real purchasing power) of the note can be quite different from the intrinsic value of the note. It is possible to have a currency with low intrinsic value, but one must understand it will be based on trust, and if those who control the currency (central banks) abuse that trust it undermines the integrity of the currency.

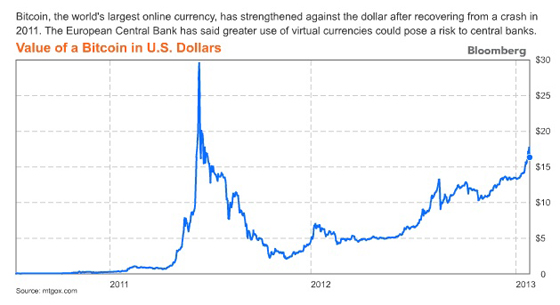

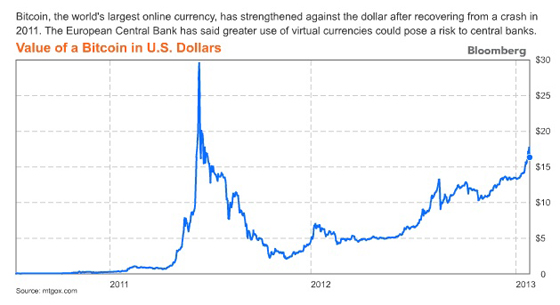

Bitcoins have no intrinsic value, yet their face value is consistently rising over the long term as demand for bitcoins increase. Despite the fact new bitcoins are still being generated and injected into circulation, the rise in demand still out-paces any inflationary effects one might expect to see. The fact that a lot of energy is required to make them also helps displace any inflationary effects.

Bitcoin is based on the premise that you don't need intrinsic value, however it relieves us from choosing who to trust. We don't need to trust the Government (like in the case of a state owned and issued currency) and we don't need to trust the central banks (like in the case of a privately controlled debt based currency). Trust is decentralized among the entire P2P network and we need only trust the math and cryptography.

Consider the huge stone coins, does the intrinsic value of the stone differ from the face value of the stone coin? Yes it certainly does, the historic value of the stone can even give it more value. So you see there isn't always a definite link between value and real tangible objects; historic value has no tangible properties. The face value of the stones is also determined by other important factors.

The energy which went into creating those stones plays a large role in determining their value. You cannot redeem the stones for the energy which went into creating them, yet much of their face value is still determined by the amount of energy burned up in their creation. In this case the money supply can be inflated without any damaging effects because they aren't easy to create like paper money.

When new stone coins are injected into circulation the market doesn't freak out because the market knows those rocks haven't just appeared from thin air, there was a lot of energy spent to put them into circulation. Not only is fiat paper money extremely easy to create, but they can put any denomination on the note. In fact they don't even need to print it, these days it's mostly created as electronic money.

Consider the reasons for the increase in the price of oil over the last few years (besides greedy shareholders). Is it really because we're getting low on oil? Well in reality there's still a fair amount of oil left to recover, probably some where around the total amount recovered in the history of man kind or more. However we've already recovered most of the easy-to-access oil, leaving us with the hard to reach stuff.

To reach this oil we often require deep sea drilling equipment and we need to use a lot of energy recovering that oil. The amount of energy required or the cost of recovering that oil impacts the final price of the oil. It probably doesn't impact it as much as other more sinister forces impact it, but it does impact it just like it impacts the value of the large stone coins.

Now consider the way bitcoins are created. Not only is there a finite limit placed on the amount which can ever be created, but the generation of new bitcoins requires a considerable amount of electrical energy to perform the calculations required. Like the stone coins, this gives them some sort of underlying value which is determined by the amount of energy put into their creation.

However once again the main force driving the increase in the value of bitcoin is simply the demand for bitcoin. But why is there demand for bitcoins if no one is forced to use them? Bitcoin emerged naturally, to include many of the ideal properties I listed earlier. It's decentralized, fairly anonymous, provably scarce, highly divisible, and very predictable (since we always know how many coins are in circulation).

The properties of bitcoin attract people to it because it can provide them with functionality that other currencies lack. To send an international transaction using the traditional banking system would require many hours or days, and extremely high fees. Bitcoin can get it done within about 5 minutes and the fees are extremely low even when sending huge amounts of money. This creates demand, and thus gives bitcoin value.

INTRINSIC VALUE VS FACE VALUE

Keep in mind that the demand for a currency may also increase if it has unique uses beyond just being a currency. For example gold has many uses in electronics and other things, which ensures that gold will always have some sort of value as long as it has some other use besides being a currency. Other currencies, such as fiat paper money, may collapse completely because at the end of the day it's only paper.

It's true that paper does have many uses, and the intrinsic value of paper is not zero (like sand), but it's just so abundant that it's not worth very much even with such a high amount of demand for it. However it's important to keep in mind that even gold is subject to this type of speculation. The value of gold can rapidly fall and rise within a single day based on the quickly changing levels of demand.

Over time, as the population grows, and more and more people contribute a demand for gold, the value of gold will increase. Is the intrinsic value of the gold actually changing? The answer would presumably be yes, since the face value of gold is really just the same as the "intrinsic value" of gold. Not all currencies are like this however, some currencies have low intrinsic value yet have a high face value.

The intrinsic value of fiat notes is only the value of the paper and the ink, but the face value (real purchasing power) of the note can be quite different from the intrinsic value of the note. It is possible to have a currency with low intrinsic value, but one must understand it will be based on trust, and if those who control the currency (central banks) abuse that trust it undermines the integrity of the currency.

Bitcoins have no intrinsic value, yet their face value is consistently rising over the long term as demand for bitcoins increase. Despite the fact new bitcoins are still being generated and injected into circulation, the rise in demand still out-paces any inflationary effects one might expect to see. The fact that a lot of energy is required to make them also helps displace any inflationary effects.

Bitcoin is based on the premise that you don't need intrinsic value, however it relieves us from choosing who to trust. We don't need to trust the Government (like in the case of a state owned and issued currency) and we don't need to trust the central banks (like in the case of a privately controlled debt based currency). Trust is decentralized among the entire P2P network and we need only trust the math and cryptography.

edit on

10/3/2013 by ChaoticOrder because: (no reason given)

MECHANISMS TO ENCOURAGE STABILITY

Think back to the days when the US Government attempted to confiscate the gold of all US citizens and replace it with paper money. The fundamental reasoning behind this was that too many people were holding their savings in gold and therefore they weren't spending enough and there wasn't enough economic activity or growth. By replacing the gold with paper money which depreciates in value people are more inclined to spend their money quickly before its value drops.

This little tale is very telling and there's a very deep moral to this story. They believed that this "mechanism" would encourage spending and therefore promote economic growth and stability. However it was impossible to implement this mechanism for gold (they can't easily create gold and devalue it), so first they had to replace the gold with a currency which was easy for them (and only them) to create.

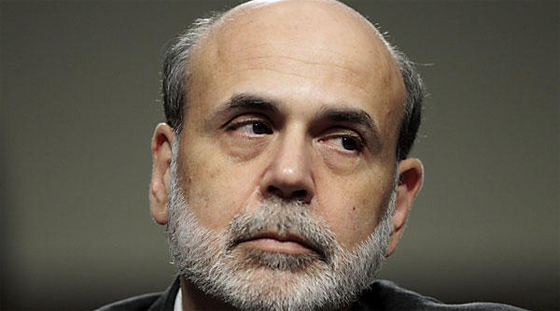

The Federal Reserve Bank is responsible for maintaining economic stability in the United States. But what tools do they have? In reality their one fit solution for most problems is debt monetization / quantitative easing (aka creating more money based on debt). So in essence it's the exact same old tricks they've always used. Only a non-scarce fiat currency would provide them with this mechanism.

Mainstream economists will argue we need central banks to be the mastermind behind maintaining our economic stability, but central banks only really have a purpose when the currency is a debt based fiat paper money. Under a limited money system they have no such mechanisms and they are at the whim of the natural free market forces. However they believe their feeble human minds to be wiser than the free market.

They believe they can use "mechanisms" to artificially force the market to where they want it to be, regardless of the short and long term side effects. They didn't seem to realize people only save money so that they can spend it later, if only they had waited a short time the savings would have came back into circulation and even if they didn't the market would become accustomed to the new level of spending and saving.

THE FLAW IN THEIR MECHANISM

At the end of the day people are going to find a way to save what they want to save and spend what they want to spend. The truth is that their "stability mechanisms" only serve to put off the instabilities for a few months or a few years, but during that time they are building up the bubble until the point where they can no longer put it off. For example consider the housing crisis of 2008, caused by the mortgage bubble.

The easy mortgage loans provided with assistance from the Government caused a huge mortgage bubble because all that debt couldn't be paid back, resulting in a vast ocean of toxic assets. The Government kept flooding the market with more and more of these toxic assets because they thought everything will just work its self out if they keep credit flowing. But in reality they are just slowly building the bubble up and up and up.

Until it reaches a point where they simply have no mechanism left for controlling it. When they reach that point where their mechanism essentially becomes useless, that's the tipping point where they lose all control and the bubble finally bursts, and the market evens out to where it wanted to be in the very first place. If they only had of just waited in the first place the market would have corrected its self naturally and this whole series of events could have been avoided.

They simply don't understand that these problems are caused by their interference in the first place. So it is my opinion that any type of non-scarce currency which can be manipulated in this way is inherently flawed. These problems could be avoided by letting the market take the natural course it wants to take according to natural market forces. And if there are little bubbles and dips along the way you don't freak out and keep kicking the bubble along hoping it wont collapse.

Trying to understand and control the market is like trying to understand and control the mind of every person who participates in the market... which is completely absurd. There is no economic theory on Earth which really explains exactly how things will happen because people are chaotic. When a system becomes too complex it will break into chaos, that is the nature of chaos theory.

Think back to the days when the US Government attempted to confiscate the gold of all US citizens and replace it with paper money. The fundamental reasoning behind this was that too many people were holding their savings in gold and therefore they weren't spending enough and there wasn't enough economic activity or growth. By replacing the gold with paper money which depreciates in value people are more inclined to spend their money quickly before its value drops.

This little tale is very telling and there's a very deep moral to this story. They believed that this "mechanism" would encourage spending and therefore promote economic growth and stability. However it was impossible to implement this mechanism for gold (they can't easily create gold and devalue it), so first they had to replace the gold with a currency which was easy for them (and only them) to create.

The Federal Reserve Bank is responsible for maintaining economic stability in the United States. But what tools do they have? In reality their one fit solution for most problems is debt monetization / quantitative easing (aka creating more money based on debt). So in essence it's the exact same old tricks they've always used. Only a non-scarce fiat currency would provide them with this mechanism.

Mainstream economists will argue we need central banks to be the mastermind behind maintaining our economic stability, but central banks only really have a purpose when the currency is a debt based fiat paper money. Under a limited money system they have no such mechanisms and they are at the whim of the natural free market forces. However they believe their feeble human minds to be wiser than the free market.

They believe they can use "mechanisms" to artificially force the market to where they want it to be, regardless of the short and long term side effects. They didn't seem to realize people only save money so that they can spend it later, if only they had waited a short time the savings would have came back into circulation and even if they didn't the market would become accustomed to the new level of spending and saving.

THE FLAW IN THEIR MECHANISM

At the end of the day people are going to find a way to save what they want to save and spend what they want to spend. The truth is that their "stability mechanisms" only serve to put off the instabilities for a few months or a few years, but during that time they are building up the bubble until the point where they can no longer put it off. For example consider the housing crisis of 2008, caused by the mortgage bubble.

The easy mortgage loans provided with assistance from the Government caused a huge mortgage bubble because all that debt couldn't be paid back, resulting in a vast ocean of toxic assets. The Government kept flooding the market with more and more of these toxic assets because they thought everything will just work its self out if they keep credit flowing. But in reality they are just slowly building the bubble up and up and up.

Until it reaches a point where they simply have no mechanism left for controlling it. When they reach that point where their mechanism essentially becomes useless, that's the tipping point where they lose all control and the bubble finally bursts, and the market evens out to where it wanted to be in the very first place. If they only had of just waited in the first place the market would have corrected its self naturally and this whole series of events could have been avoided.

They simply don't understand that these problems are caused by their interference in the first place. So it is my opinion that any type of non-scarce currency which can be manipulated in this way is inherently flawed. These problems could be avoided by letting the market take the natural course it wants to take according to natural market forces. And if there are little bubbles and dips along the way you don't freak out and keep kicking the bubble along hoping it wont collapse.

Trying to understand and control the market is like trying to understand and control the mind of every person who participates in the market... which is completely absurd. There is no economic theory on Earth which really explains exactly how things will happen because people are chaotic. When a system becomes too complex it will break into chaos, that is the nature of chaos theory.

edit on 10/3/2013 by ChaoticOrder because: (no reason

given)

Part II will cover some of these topics and more:

- debt based money, easy bank credit and FR Banking

- servicing the debt based system, quantitative easing etc

- state owned currency vs private debt based money

- limited currencies vs unlimited currencies

- corporate monopolies, the free market, and equality

- debt based money, easy bank credit and FR Banking

- servicing the debt based system, quantitative easing etc

- state owned currency vs private debt based money

- limited currencies vs unlimited currencies

- corporate monopolies, the free market, and equality

reply to post by ChaoticOrder

Bitcoin sounds like a really bad idea. It is created from nothing and there is a monoply on it.

And your post left out one of the most traded things by the rich - their souls.

You want a new currency that's fair to all? How about gratitude, love, compassion, and favors. Someone does something nice for you and then you return the favor. lol money is ridiculous because it will always be exploited.

eta: Nice thread by the way. I appreciate the work you put into it. It was neat learning about the giant rocks.

Bitcoin sounds like a really bad idea. It is created from nothing and there is a monoply on it.

And your post left out one of the most traded things by the rich - their souls.

You want a new currency that's fair to all? How about gratitude, love, compassion, and favors. Someone does something nice for you and then you return the favor. lol money is ridiculous because it will always be exploited.

eta: Nice thread by the way. I appreciate the work you put into it. It was neat learning about the giant rocks.

edit on 3/10/2013 by Bleeeeep

because: (no reason given)

reply to post by Bleeeeep

It seems to me like you need to re-read the part about energy input and intrinsic value vs face value, assuming you have read it already. It may have nothing tangible backing it, but unlike our current fiat money systems it is extremely difficult to create new bitcoins because of the energy required to create them. Not to mention there is a set limit on how many can ever be created (21 million bitcoins). And what is this monopoly you speak of, it's completely decentralized, there is no central bank or any official authority which control the issuance of bitcoins, anyone can mine them if they contribute the required energy to the system.

How about realism instead of fanciful fairy tale dreams?

Bitcoin sounds like a really bad idea. It is created from nothing and there is a monoply on it.

It seems to me like you need to re-read the part about energy input and intrinsic value vs face value, assuming you have read it already. It may have nothing tangible backing it, but unlike our current fiat money systems it is extremely difficult to create new bitcoins because of the energy required to create them. Not to mention there is a set limit on how many can ever be created (21 million bitcoins). And what is this monopoly you speak of, it's completely decentralized, there is no central bank or any official authority which control the issuance of bitcoins, anyone can mine them if they contribute the required energy to the system.

You want a new currency that's fair to all? How about gratitude, love, compassion, and favors.

How about realism instead of fanciful fairy tale dreams?

I do not think that people pay nearly enough attention to the theory of money. Everyone wants to "follow the money" when looking into why and how

things happened, but if our understanding of economics and money itself is limited than so too is our ability to effectively track it when seeking to

use it a clue to the truth. Far more people need to develop an understanding of these things to begin to see another layer of the world around them.

While your OP was a bit (no pun intended) bit coin heavy for my tastes the underlying beginner concepts about money/currency are things that are

greatly needed and you did a very complete job. Good read. Thanks. S&F.

And I was hoping to learn something new.

But alas, I found an advert for bitcoin.... Again

I do admire your relentless and tireless promotion of it though, because someone has got to do it.

But alas, I found an advert for bitcoin.... Again

I do admire your relentless and tireless promotion of it though, because someone has got to do it.

Originally posted by KaiserSoze

Excellent thread, looking forward to part two. S&F

Thank you!

I'll try to get part two out within a few weeks but I've got a lot to do at the moment so it may be slightly longer.

reply to post by ChaoticOrder

Almost everyone's parents raise them because of love, compassion, gratitude, and then they reward them at times based on favors. These things I listed aren't fantasy and they are traded more than any other currency in the world - heck they can even be exploited by taking advantage of someone.

Bitcoins come from one place originally hints the monopoly. And yes I read the thread and even visited the bitcoin site before I posted. I read where they came from before I made my post. "they can come from other people and by mining them blah blah blah" No they come from the bitcoin program. That's where they are created thus they are a monopoly like most other systems. Not everyone can be on a computer but everyone can trade with love, compassion, gratitude, and favors. The best stuff in the world are created for those reasons too - people want love and gratitude and if they don't then head is in the wrong place and they deserve neither.

Almost everyone's parents raise them because of love, compassion, gratitude, and then they reward them at times based on favors. These things I listed aren't fantasy and they are traded more than any other currency in the world - heck they can even be exploited by taking advantage of someone.

Bitcoins come from one place originally hints the monopoly. And yes I read the thread and even visited the bitcoin site before I posted. I read where they came from before I made my post. "they can come from other people and by mining them blah blah blah" No they come from the bitcoin program. That's where they are created thus they are a monopoly like most other systems. Not everyone can be on a computer but everyone can trade with love, compassion, gratitude, and favors. The best stuff in the world are created for those reasons too - people want love and gratitude and if they don't then head is in the wrong place and they deserve neither.

edit on 3/10/2013 by Bleeeeep because: world not word

Originally posted by magma

And I was hoping to learn something new.

But alas, I found an advert for bitcoin.... Again

I do admire your relentless and tireless promotion of it though, because someone has got to do it.

I've made what, 3 or 4 threads over a year or more period. The vast majority of my threads have been non-bitcoin threads. Speaking about something you happen to like is not promotion. But more than anything I mentioned it because it fits into the discussion in a very important way and helps explain many different concepts. If you have a problem with bitcoin why not bring up those concerns rather than attacking me.

edit on 10/3/2013 by

ChaoticOrder because: (no reason given)

reply to post by Bleeeeep

So it's a monopoly for anyone who can use a computer? I thought monopolies were more concentrated than that?

No they come from the bitcoin program. That's where they are created thus they are a monopoly like most other systems. Not everyone can be on a computer

So it's a monopoly for anyone who can use a computer? I thought monopolies were more concentrated than that?

Originally posted by watcher3339

I do not think that people pay nearly enough attention to the theory of money. Everyone wants to "follow the money" when looking into why and how things happened, but if our understanding of economics and money itself is limited than so too is our ability to effectively track it when seeking to use it a clue to the truth. Far more people need to develop an understanding of these things to begin to see another layer of the world around them. While your OP was a bit (no pun intended) bit coin heavy for my tastes the underlying beginner concepts about money/currency are things that are greatly needed and you did a very complete job. Good read. Thanks. S&F.

I'm glad you enjoyed it and I appreciate the positive remarks. I agree with your assessment, more people certainly do need to pay attention to these fundamental money theory concepts. I find it coincidental that they don't teach these basic things about money in school, well not unless you study economics later in your school life, but even then your education would be highly slanted. I had to basically learn all this stuff myself through a lot of independent research. Part II will get deeper into many of these subjects and really start to expose the true level of absurdity within this current debt based money system.

reply to post by ChaoticOrder

Whilst there are some advantages in using bitcoin the disadvantages outweigh them.

I will present a 3rd party link which gives the facts clearly without emotional attachment.I wasn't having a go at you, it is just I do not like bitcoins and I believe you do and clearly you have an agenda with providing your thread as bitcoin is the island in the stream or the pot of gold at the end of the rainbow, well at least that is how I believe you presented the thread. Maybe if you did not have a bitcoin link in your signature and did not use fancy bitcoin graphics in you your presentation and mentioned bitcoin as an alternative currency without the preceding sales pitch, then sure it would have been quite informative.

However, having said that, everyone is entitled to their opinion and belief system and everyone is also entitled to say what they want about anything they like. Really thats what it is about. As I said I admire your tenaciousness and I think the thread was informative, if not a little biased.

Stanford Bitcoin link

love and light...

Whilst there are some advantages in using bitcoin the disadvantages outweigh them.

I will present a 3rd party link which gives the facts clearly without emotional attachment.I wasn't having a go at you, it is just I do not like bitcoins and I believe you do and clearly you have an agenda with providing your thread as bitcoin is the island in the stream or the pot of gold at the end of the rainbow, well at least that is how I believe you presented the thread. Maybe if you did not have a bitcoin link in your signature and did not use fancy bitcoin graphics in you your presentation and mentioned bitcoin as an alternative currency without the preceding sales pitch, then sure it would have been quite informative.

However, having said that, everyone is entitled to their opinion and belief system and everyone is also entitled to say what they want about anything they like. Really thats what it is about. As I said I admire your tenaciousness and I think the thread was informative, if not a little biased.

Stanford Bitcoin link

love and light...

reply to post by magma

I really don't want to turn this thread into another debate about bitcoin, because the main premise of this thread was not about bitcoin. But since this thread isn't getting as much attention as I would have liked I will humor you. Skipping past all your generic worthless blab lets just look at the arguments presented in that article you linked.

This may have been a valid statement when that article was written, however bitcoins are now starting gain a lot traction and many large companies such as Wordpress are accepting bitcoins. We now even have a Bitcoin Electronics Super Store and many other services, some people even pay their rent with bitcoin. What you also need to remember is that bitcoin is highly scalable, it can reach anywhere in the world where internet access is available. In fact physiccal bitcoin coins such as casascius coins could be used anywhere in the world.

Gold can be lost. Paper notes can be lost. Gold and paper notes can not be encrypted and backed up by creating copies. Case closed.

The value of any currency or commodity will fluctuate. What they mean to say is that bitcoin has high volatility. This is another subject I'm going to look at in more detail in part II, but I did touch upon it here. First we must remember that demand causes the value to change. I explained why in the case of bitcoin the price tends to rise over the long term and is generally predictable over the long term because we can see exactly how many coins are in circulation... but I didn't talk about the short term changes.

The reason the volatility is so high for bitcoin right now is because it's so new, it's only now really starting to gain wide spread attention. Any new currency like this is obviously going to have a high level of volatility near the beginning when the demand is rapidly shifting as more people use it. Within several years the level of demand will start to level out and stabilize and things will slowly begin to operate much more smoothly on a day to day bases.

Because bitcoin is designed with the same properties as any limited commodity it's expected to behave like any other commodity in the long term. If I asked you whether gold was stable how would you answer? You might say it's pretty volatile on a day to day basis, but in general it's holds its value well over the longer term because the supply remains limited and virtually static. It's the exact same thing with bitcoin, you can reasonably expect your BTC to be worth the same or more this time next year.

This is a simple side-effect of having completely irreversible transactions. Would you rather it be like PayPal, where they can return your money to scammers and freeze your account? Anyway, like that article mentions there are still escrow services which can help make transactions safer for buyers. There is even a "Bitcoin Bank. Before you say anything, it wont actually be a normal bank. They just have the authority now to do things like issue bank cards and other mainstream bank stuff. The bitcoin network still remains under completely decentralized control.

With over 3 years and still going strong I don't think anyone is going to find any flaws any time soon or they would have done so already. Bitcoin is based on well tested and trusted cryptography which is used all throughout the banking system. If the cryptography in bitcoin is broken then we'll many more problems than just bitcoin. And I was also say that everything has a risk of technical flaws, bank networks are hacked every day. Yet the actual bitcoin network has never been compromised.

Bitcoin is based on the Austrian school of thought rather than Keynesian economics. This argument is exactly the same for gold... oooh gold holds value too well, therefore it's a "bad currency" and we must use paper which can come from thin air otherwise it's "not fair". This is probably the single most delusional problem with mainstream economics and it's a topic I intend to really flesh out in part two when I look at limited currencies vs unlimited currencies. So without saying anything more on this point I'll leave it for part II so I can make my point properly.

It is true that the early adopters will benefit a lot more than late comers, but that is true with almost anything. Business ventures always benefit the early adopters, the first people to mine gold benefited more because it was so easy to find. To label bitcoin a pyramid scheme for such a reason is completely absurd, because it would suggest almost everything in our society is based on a scam. The early adopters always have to take a larger risk, and thus they are better rewarded.

As I already mentioned it is possible to have physical bitcoin coins (the private keys are simply secured inside the coin with a hologram or something) and this same concept can be used to produce "bitcoin notes". It's even possible to have bitcoin bank cards, there's a lot of work going on in that area right now.

Oh look out, there's no central bank to control the stability of the value!!! That's basically what they argue there, and I've already explained why a currency left to free market forces is more desirable than a currency which can be artificially manipulated by those who think they can mastermind the course of the market. Of course it's true that if bitcoin collapsed nothing would be left at the end, but all out fiat paper systems are no different. As I've spent a great amount of time trying to explain, bitcoin attempts to offset this problem by making it very difficult to generate new bitcoins, unlike our current fiat systems.

And now rather than relying on external sources to present arguments you don't fully grasp, try articulating your concerns in your own words and where you think the true problem lies with bitcoin. I am not saying bitcoin is perfect, my thread says nothing like that, it is far from perfect. But it is better than many currencies we currently have and I appreciate it for that and at the very least it certainly deserves mention in this thread, whether you want to accept it in the same light as other decentralized limited commodities or not.

I really don't want to turn this thread into another debate about bitcoin, because the main premise of this thread was not about bitcoin. But since this thread isn't getting as much attention as I would have liked I will humor you. Skipping past all your generic worthless blab lets just look at the arguments presented in that article you linked.

Bitcoins Are Not Widely Accepted

This may have been a valid statement when that article was written, however bitcoins are now starting gain a lot traction and many large companies such as Wordpress are accepting bitcoins. We now even have a Bitcoin Electronics Super Store and many other services, some people even pay their rent with bitcoin. What you also need to remember is that bitcoin is highly scalable, it can reach anywhere in the world where internet access is available. In fact physiccal bitcoin coins such as casascius coins could be used anywhere in the world.

Wallets Can Be Lost

Gold can be lost. Paper notes can be lost. Gold and paper notes can not be encrypted and backed up by creating copies. Case closed.

Bitcoin Valuation Fluctuates

The value of any currency or commodity will fluctuate. What they mean to say is that bitcoin has high volatility. This is another subject I'm going to look at in more detail in part II, but I did touch upon it here. First we must remember that demand causes the value to change. I explained why in the case of bitcoin the price tends to rise over the long term and is generally predictable over the long term because we can see exactly how many coins are in circulation... but I didn't talk about the short term changes.

The reason the volatility is so high for bitcoin right now is because it's so new, it's only now really starting to gain wide spread attention. Any new currency like this is obviously going to have a high level of volatility near the beginning when the demand is rapidly shifting as more people use it. Within several years the level of demand will start to level out and stabilize and things will slowly begin to operate much more smoothly on a day to day bases.

Because bitcoin is designed with the same properties as any limited commodity it's expected to behave like any other commodity in the long term. If I asked you whether gold was stable how would you answer? You might say it's pretty volatile on a day to day basis, but in general it's holds its value well over the longer term because the supply remains limited and virtually static. It's the exact same thing with bitcoin, you can reasonably expect your BTC to be worth the same or more this time next year.

No Buyer Protection

This is a simple side-effect of having completely irreversible transactions. Would you rather it be like PayPal, where they can return your money to scammers and freeze your account? Anyway, like that article mentions there are still escrow services which can help make transactions safer for buyers. There is even a "Bitcoin Bank. Before you say anything, it wont actually be a normal bank. They just have the authority now to do things like issue bank cards and other mainstream bank stuff. The bitcoin network still remains under completely decentralized control.

Risk of Unknown Technical Flaws

With over 3 years and still going strong I don't think anyone is going to find any flaws any time soon or they would have done so already. Bitcoin is based on well tested and trusted cryptography which is used all throughout the banking system. If the cryptography in bitcoin is broken then we'll many more problems than just bitcoin. And I was also say that everything has a risk of technical flaws, bank networks are hacked every day. Yet the actual bitcoin network has never been compromised.

Built in Deflation

Bitcoin is based on the Austrian school of thought rather than Keynesian economics. This argument is exactly the same for gold... oooh gold holds value too well, therefore it's a "bad currency" and we must use paper which can come from thin air otherwise it's "not fair". This is probably the single most delusional problem with mainstream economics and it's a topic I intend to really flesh out in part two when I look at limited currencies vs unlimited currencies. So without saying anything more on this point I'll leave it for part II so I can make my point properly.

It is true that the early adopters will benefit a lot more than late comers, but that is true with almost anything. Business ventures always benefit the early adopters, the first people to mine gold benefited more because it was so easy to find. To label bitcoin a pyramid scheme for such a reason is completely absurd, because it would suggest almost everything in our society is based on a scam. The early adopters always have to take a larger risk, and thus they are better rewarded.

No Physical Form

As I already mentioned it is possible to have physical bitcoin coins (the private keys are simply secured inside the coin with a hologram or something) and this same concept can be used to produce "bitcoin notes". It's even possible to have bitcoin bank cards, there's a lot of work going on in that area right now.

No Valuation Guarantee

Oh look out, there's no central bank to control the stability of the value!!! That's basically what they argue there, and I've already explained why a currency left to free market forces is more desirable than a currency which can be artificially manipulated by those who think they can mastermind the course of the market. Of course it's true that if bitcoin collapsed nothing would be left at the end, but all out fiat paper systems are no different. As I've spent a great amount of time trying to explain, bitcoin attempts to offset this problem by making it very difficult to generate new bitcoins, unlike our current fiat systems.

And now rather than relying on external sources to present arguments you don't fully grasp, try articulating your concerns in your own words and where you think the true problem lies with bitcoin. I am not saying bitcoin is perfect, my thread says nothing like that, it is far from perfect. But it is better than many currencies we currently have and I appreciate it for that and at the very least it certainly deserves mention in this thread, whether you want to accept it in the same light as other decentralized limited commodities or not.

edit on 11/3/2013 by ChaoticOrder because: (no

reason given)

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 25 minutes ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 1 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 1 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 2 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 3 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 3 hours ago -

Weinstein's conviction overturned

Mainstream News: 4 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 6 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 6 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 7 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 4 hours ago, 6 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 9 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 6 hours ago, 5 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 3 hours ago, 4 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 3 hours ago, 4 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 7 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 11 hours ago, 2 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 1 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 1 hours ago, 1 flags

active topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 2 • : Ophiuchus1 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 783 • : Threadbarer -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 19 • : Consvoli -

Sunak spinning the sickness figures

Other Current Events • 21 • : Xtrozero -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 87 • : Xtrozero -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 187 • : Irishhaf -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 30 • : confuzedcitizen -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 19 • : DontTreadOnMe -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 60 • : Annee -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 489 • : Threadbarer

10