It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by jibajaba

You do know that many other presidents took substantially more GOLF Trips than Obama, also, that GW Bush had more holidays than any president ever?

but its not fun unless we're sticking it to Obama right?

You do know that many other presidents took substantially more GOLF Trips than Obama, also, that GW Bush had more holidays than any president ever?

but its not fun unless we're sticking it to Obama right?

........the ops total ignorance on spending and what all this really means is mind blowing.......

Its no surprise we aer where we are if ANYONE in gov actually thinks like the OP

Sorry OP ,but jesus man.......this inability to understand whats going on is a huge part of the problem..........

Its no surprise we aer where we are if ANYONE in gov actually thinks like the OP

Sorry OP ,but jesus man.......this inability to understand whats going on is a huge part of the problem..........

Kind of sad that this post only got one flag. Goes to show most ATS members thrive on negativity.. this should be good news.

If this thread was about the downfall of America it would have thousands of stars and flags... unbelievable.

If this thread was about the downfall of America it would have thousands of stars and flags... unbelievable.

edit on 7-3-2013 by 31Bravo

because: (no reason given)

I'm starting at these numbers and yet all I'm seeing is the amount of debt grow larger and larger every tick. The bigger the red numbers means the

larger the debt, green means positive money or no debt.

None of these red figures are shrinking, which would be ideal.

None of these red figures are shrinking, which would be ideal.

reply to post by Celestica

National Debt never will go down. Regardless of what Obama does now, IMO. He's personally gone too far in policy and the Fed has gone WAY too far under both Bush and Obama (Both Presidents have named Bernanke and seen him confirmed. Both own the outcome).

The thing is, even under Clinton and the multiple years of small (but real) national budget surplus, the national debt still grew. It will keep growing at this rate and faster as time goes. Compound Interest is a very nasty thing when one is on the debt side of it and the National Debt is the ultimate maker and show of compound interest at work.

We're still sitting at historic record low interest rates too. If those begin to rise back to normal levels or actually spike? Game Over faster than it takes to say it. Nations like Russia and China that literally have currency reserve sufficient to cover all or the majority of their small nation debt will win while nations like the U.S., Japan and some others will suffer badly. That's my take.

The overall picture it makes is... Well.... Breathtaking.

National Debt never will go down. Regardless of what Obama does now, IMO. He's personally gone too far in policy and the Fed has gone WAY too far under both Bush and Obama (Both Presidents have named Bernanke and seen him confirmed. Both own the outcome).

The thing is, even under Clinton and the multiple years of small (but real) national budget surplus, the national debt still grew. It will keep growing at this rate and faster as time goes. Compound Interest is a very nasty thing when one is on the debt side of it and the National Debt is the ultimate maker and show of compound interest at work.

We're still sitting at historic record low interest rates too. If those begin to rise back to normal levels or actually spike? Game Over faster than it takes to say it. Nations like Russia and China that literally have currency reserve sufficient to cover all or the majority of their small nation debt will win while nations like the U.S., Japan and some others will suffer badly. That's my take.

The overall picture it makes is... Well.... Breathtaking.

Originally posted by TauCetixeta

Originally posted by nomnom

reply to post by TauCetixeta

You do realize a deficit is in the negative, correct?

Look at the numbers carefully. Our debt to GDP ratio is still growing.

These cuts are minimal. The sequester counts for a mere 2.4% of the spending.

It's a joke.

If I'm reading that chart correctly, the cuts ammount to less than 1.1 trillion over a 9 year period. That doesn't even put a dent in the deficit.edit on 7-3-2013 by nomnom because: (no reason given)

No, we have a NEW trend.

The deficit number is falling not rising! I'll take it!

We needed to reduce spending. Thank God for the sequester!

Thanks to Bill O'reilly yelling at Alan Colmes now everybody is aware that we are near

a $17 Trillion national debt.

I am looking forward to seeing a Sequester 2.0 on that U.S. Debt Clock!

Lets get the National Deficit under $900 Billion and wave goodbye to the financially

irresponsible $$$ Trillion deficits!

I seriously can't tell, are you being sarcastic or are you really so clueless you believe the sequester actually accomplishes meaningful deficit reduction?

Let me make it clear, after the sequester cuts we save about 100 billion a year on average for the next 10 years, but we will still be running deficits over a trillion every year for as long as the market will allow it. Adding a trillion+ to the national debt every year does not equal a reduction.

We would need 12-15 times the size of cuts in the sequester to actually balance the budget which is not possible without entering a severe depression.

So to make this easy for anyone who wonders if our debt problem is solved just remember this, if we are not currently in, or coming out of the worst depression in US history than No, the debt problem has not been solved. There is Zero chance of avoiding a horrible depression, it is just a matter of when does it start.

Listen folks... The deficit is representative of the amount of money in circulation.

Granted, it is not equal to all of the money in circulation, but it represents a good chunk and do you know what happens when you take "a good chunk" of liquidity out of the global money supply?

Deflation that then results in recession.

The economy recedes because there is less money to fuel growth, which inevitably leads to a death spiral of scarcity in liquidity.

Our money is based on debt.

OUR MONEY IS BASED ON DEBT.

We need to start looking at debt as a good thing. Not because it is a good thing, but because we have no freaking choice.

We are bent over and taking it, and there is nothing that we can do about it.

The game is rigged so that we have to enjoy taking it, just so we can have a sound economy.

Every time in history that the government has run a surplus or has drastically reduced spending we have gone into a deflationary spiral that lead to recession or depression.

MONEY EQUALS DEBT.

MORE DEBT EQUALS MORE MONEY.

MORE MONEY GOOD.

MORE DEBT GOOD.

We aren't going to hell, we done been there and stayed folks.

Granted, it is not equal to all of the money in circulation, but it represents a good chunk and do you know what happens when you take "a good chunk" of liquidity out of the global money supply?

Deflation that then results in recession.

The economy recedes because there is less money to fuel growth, which inevitably leads to a death spiral of scarcity in liquidity.

Our money is based on debt.

OUR MONEY IS BASED ON DEBT.

We need to start looking at debt as a good thing. Not because it is a good thing, but because we have no freaking choice.

We are bent over and taking it, and there is nothing that we can do about it.

The game is rigged so that we have to enjoy taking it, just so we can have a sound economy.

Every time in history that the government has run a surplus or has drastically reduced spending we have gone into a deflationary spiral that lead to recession or depression.

MONEY EQUALS DEBT.

MORE DEBT EQUALS MORE MONEY.

MORE MONEY GOOD.

MORE DEBT GOOD.

We aren't going to hell, we done been there and stayed folks.

edit on 8/3/2013 by kyviecaldges because: To make some changes. Why do you want

to know this?

reply to post by kyviecaldges

Oh come now, the numbers aren't even remotely close and these things are not general guesses by any stretch. One of the things the Federal Reserve does is track every penny in circulation or deposit, in near real time and at all levels of the system. They're called the M-1, M-2 and M-3 numbers. They don't seem to think we need to know the M-3 number much these days because it would include the full depth of funny money they're printing and markets may really fixate on that. Wouldn't want that. We can see what the M-3 has been in the past and up to 2002 though.

US Federal Reserve Bank - Money Circulation Data

The last page of that may be the most useful in showing the plaing M 1-3 numbers from 1960 to 2002 for perspective of size and change. This other one shows M 1-2 numbers through 2012/13.

US Federal Reserve Circulation Data through 2012/2013

They actually get downright extreme about the micro-level of tracking currency by type and amount, where it's at and in what distribution. One can't say they aren't good at that aspect of what they do. I think enough of the financial world closely watches them watch those numbers to keep them relatively honest too. Far too many very wealthy people would stand to become less wealthy if those numbers got fudged too badly and people missed it happening, IMO.

There is nothing good about destroying the value of a currency by diluting it with near bottomless debt printing, IMO. Every nation that has traveled this road has ended badly before radically changing course .... or having it changed for them. Just my two cents on it.

Listen folks... The deficit is representative of the amount of money in circulation.

Granted, it is not equal to all of the money in circulation, but it represents a good chunk and do you know what happens when you take "a good chunk" of liquidity out of the global money supply?

Oh come now, the numbers aren't even remotely close and these things are not general guesses by any stretch. One of the things the Federal Reserve does is track every penny in circulation or deposit, in near real time and at all levels of the system. They're called the M-1, M-2 and M-3 numbers. They don't seem to think we need to know the M-3 number much these days because it would include the full depth of funny money they're printing and markets may really fixate on that. Wouldn't want that. We can see what the M-3 has been in the past and up to 2002 though.

US Federal Reserve Bank - Money Circulation Data

The last page of that may be the most useful in showing the plaing M 1-3 numbers from 1960 to 2002 for perspective of size and change. This other one shows M 1-2 numbers through 2012/13.

US Federal Reserve Circulation Data through 2012/2013

They actually get downright extreme about the micro-level of tracking currency by type and amount, where it's at and in what distribution. One can't say they aren't good at that aspect of what they do. I think enough of the financial world closely watches them watch those numbers to keep them relatively honest too. Far too many very wealthy people would stand to become less wealthy if those numbers got fudged too badly and people missed it happening, IMO.

There is nothing good about destroying the value of a currency by diluting it with near bottomless debt printing, IMO. Every nation that has traveled this road has ended badly before radically changing course .... or having it changed for them. Just my two cents on it.

reply to post by Wrabbit2000

You sure about that?!?!? I could swear that they calculate 17000 billion and change in circulation, according to the metric posted by you, which is 17 trillion, which is about the size of our deficit.

(I did the addition in my head, so I could be wrong)

Granted, that is not at all accurate because of the incredible number of bailouts and the even larger credit default swap market, but I was very specific in my comment.

I stated that you couldn't take that much LIQUID CASH out of the economy, and that is just what the sequester is doing, without there being deflation.

And deflation equals recession.

We have an economy built upon two pillars, debt and inflation.

I put out the numbers. You may have posted a link, but I see myself making a case, not so much with you mate.

You may have a case.

I could be wrong, but I would like to be proven wrong with some data, rather than a link to the data and a vague statement discounting my premise, but with no actual reference to any real numbers.

Oh come now, the numbers aren't even remotely close

You sure about that?!?!? I could swear that they calculate 17000 billion and change in circulation, according to the metric posted by you, which is 17 trillion, which is about the size of our deficit.

(I did the addition in my head, so I could be wrong)

Granted, that is not at all accurate because of the incredible number of bailouts and the even larger credit default swap market, but I was very specific in my comment.

I stated that you couldn't take that much LIQUID CASH out of the economy, and that is just what the sequester is doing, without there being deflation.

And deflation equals recession.

We have an economy built upon two pillars, debt and inflation.

I put out the numbers. You may have posted a link, but I see myself making a case, not so much with you mate.

You may have a case.

I could be wrong, but I would like to be proven wrong with some data, rather than a link to the data and a vague statement discounting my premise, but with no actual reference to any real numbers.

edit on 8/3/2013 by kyviecaldges because: To make some changes. Why do you want to know

that?

reply to post by Wrabbit2000

That link you posted projects a USA National Deficit in 2013 to be only $900 Billion.

Go ahead and wave goodbye to the $$$ Trillion + deficits.

I think i can already see Sequester 2.0.

It looks like the USA will retain its AAA rating.

That link you posted projects a USA National Deficit in 2013 to be only $900 Billion.

Go ahead and wave goodbye to the $$$ Trillion + deficits.

I think i can already see Sequester 2.0.

It looks like the USA will retain its AAA rating.

edit on 8-3-2013 by TauCetixeta because: (no reason given)

Originally posted by proximo

Originally posted by TauCetixeta

Originally posted by nomnom

reply to post by TauCetixeta

You do realize a deficit is in the negative, correct?

Look at the numbers carefully. Our debt to GDP ratio is still growing.

These cuts are minimal. The sequester counts for a mere 2.4% of the spending.

It's a joke.

If I'm reading that chart correctly, the cuts ammount to less than 1.1 trillion over a 9 year period. That doesn't even put a dent in the deficit.edit on 7-3-2013 by nomnom because: (no reason given)

No, we have a NEW trend.

The deficit number is falling not rising! I'll take it!

We needed to reduce spending. Thank God for the sequester!

Thanks to Bill O'reilly yelling at Alan Colmes now everybody is aware that we are near

a $17 Trillion national debt.

I am looking forward to seeing a Sequester 2.0 on that U.S. Debt Clock!

Lets get the National Deficit under $900 Billion and wave goodbye to the financially

irresponsible $$$ Trillion deficits!

I seriously can't tell, are you being sarcastic or are you really so clueless you believe the sequester actually accomplishes meaningful deficit reduction?

Let me make it clear, after the sequester cuts we save about 100 billion a year on average for the next 10 years, but we will still be running deficits over a trillion every year for as long as the market will allow it. Adding a trillion+ to the national debt every year does not equal a reduction.

We would need 12-15 times the size of cuts in the sequester to actually balance the budget which is not possible without entering a severe depression.

So to make this easy for anyone who wonders if our debt problem is solved just remember this, if we are not currently in, or coming out of the worst depression in US history than No, the debt problem has not been solved. There is Zero chance of avoiding a horrible depression, it is just a matter of when does it start.

Well now THAT was a very depressing post!

"There is Zero chance of avoiding a horrible depression, it is just a matter of when does it start."

That sounds like fun but i think we will take door #2.

Door #2: Grow the USA GDP and reign in spending. (Sequester 1.0, 2.0, 3.0 etc.)

We all knew this was coming. If we crash the whole system then the government would NOT

be able to care for those who can't care for themselves. That would NOT look very good in the

U.S. History books.

Originally posted by Wrabbit2000

reply to post by Celestica

National Debt never will go down. Regardless of what Obama does now, IMO. He's personally gone too far in policy and the Fed has gone WAY too far under both Bush and Obama (Both Presidents have named Bernanke and seen him confirmed. Both own the outcome).

The thing is, even under Clinton and the multiple years of small (but real) national budget surplus, the national debt still grew. It will keep growing at this rate and faster as time goes. Compound Interest is a very nasty thing when one is on the debt side of it and the National Debt is the ultimate maker and show of compound interest at work.

We're still sitting at historic record low interest rates too. If those begin to rise back to normal levels or actually spike? Game Over faster than it takes to say it. Nations like Russia and China that literally have currency reserve sufficient to cover all or the majority of their small nation debt will win while nations like the U.S., Japan and some others will suffer badly. That's my take.

The overall picture it makes is... Well.... Breathtaking.

The $16.6 Trillion National Debt looks like the end of the world BUT the Federal Reserve

owns a lot of that. Also, your chart is not up to date. USA GDP is $15.85 Trillion.

Big Picture Numbers Here:

Economy of the United States 2012 - Wikipedia

Apparently, the USA is STILL an economic superpower.

Originally posted by TauCetixeta

reply to post by Wrabbit2000

That link you posted projects a USA National Deficit in 2013 to be only $900 Billion.

Go ahead and wave goodbye to the $$$ Trillion + deficits.

I think i can already see Sequester 2.0.

It looks like the USA will retain its AAA rating.edit on 8-3-2013 by TauCetixeta because: (no reason given)

Are you being obtuse or just being argumentative for the sake of it?

My material and charts are dated and sourced. I've also mentioned, SEVERAL TIMES, that since September (after some of that material was created, by obvious date stamp indicated on it) Over ONE TRILLION in annual deficit spending has been added....ON TOP of the 900 billion already projected (months ago) and planned for the coming year.

That, by my math, makes it 1.9 TRILLION for the 2013 Fiscal year debt, at BEST, and as we know it so far. Now they say the December deals, January adjustments and tax changes as well as whatever comes from this last minute dealing on Government shut down ...will ADD to that, not draw down on it.

You're starting to just argue plain, basic economic theory as if this stuff hasn't been very thoroughly tested by real world experiences of living it over time, across many nations and many times before. It has and we're nothing special or even original. These bad bad ideas HAVE been done before. Many times before. They've utterly destroyed major nations, just as they are and will destroy us.

The worst cases of Hyperinflation in history

Hyperinflation isn't magic or some mysterious process. It's basic and simple economic theory for cause and effect. We're following the cause many have proven before and we'll suffer the effect in time or as soon as interest rates kick off their near flat line levels.

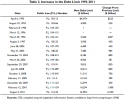

To be helpful though and in case you ever get to actually spending some time in reading the White House budget package to see the established numbers yourself (CBO's analysis and spoon feeding requested results aside), these are the assumptions used to produce the projections of revenue and debt carrying beyond 2020. (As shown in the 2013 fy budget package)

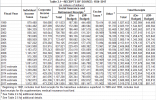

There is your Revenue, by source. Current, past and projected are shown.

and finally, the detailed drill down on the U.S. National Debt. You mention how it's not all equal in nature and held differently between public and private,. You're absolutely right. It is. Here is the numerical breakdown of how that is represented.

. . . and that really IS 25 trillion dollars in debt this President and his people wrote as expected outcome into 2022 and beyond. Those who love debt will get their chance to see what it's like to be totally overwhelmed by it. As bad as it is now, it's set to continue growing at an exponential rate.

Again though, keep in mind...these numbers were ALL produced many months ago and much has been added or adjusted spending side of the sheet. Much, including that 1 trillion a year by the Fed and Treasury came AFTER all that was put together for the 2013 Budget proposal and so, couldn't be reflected in the numbers as shown.

Just as a bonus and because I happened to have it handy in the same image storage area, this is the list of Debt Ceiling adjustments by request to congress since 1993. It's a real two party abuse problem...this spending issue we have.

edit on 8-3-2013 by Wrabbit2000 because: (no reason given)

reply to post by kyviecaldges

I really try to avoid correcting people on this because it's almost embarrassing for the simplicity of the issue, however, you're basing your argument on it so it's of critical importance here.

Deficit = The amount of money in excess of revenue taken in on a YEARLY basis. This number resets every year on the first day of the new fiscal year with a bright zero, full of hope it won't rise ...which always changes within seconds.

Annual US Federal Deficit/Surplus from 1940 to 2013

National Debt = The amount the United States owes other nations and the majority it owes to private citizens and business in the form of T-Bills, Bonds, Notes and other financial instruments, issued at different levels to sustain and fund the debt.

White House Tables and Data on Revenue and Debt

That last link is enough to make a guy go blind in the endless data sheets behind those links. It's a big part of where my time was spent making the budget thread...but it's where the real numbers sit and no one said getting the real scoop would be quick or easy. It IS out there and, in fact, right there at that link, for anyone to see who has the time and patience to dig it up.

You sure about that?!?!? I could swear that they calculate 17000 billion and change in circulation, according to the metric posted by you, which is 17 trillion, which is about the size of our deficit.

(I did the addition in my head, so I could be wrong)

I really try to avoid correcting people on this because it's almost embarrassing for the simplicity of the issue, however, you're basing your argument on it so it's of critical importance here.

Deficit = The amount of money in excess of revenue taken in on a YEARLY basis. This number resets every year on the first day of the new fiscal year with a bright zero, full of hope it won't rise ...which always changes within seconds.

Annual US Federal Deficit/Surplus from 1940 to 2013

National Debt = The amount the United States owes other nations and the majority it owes to private citizens and business in the form of T-Bills, Bonds, Notes and other financial instruments, issued at different levels to sustain and fund the debt.

White House Tables and Data on Revenue and Debt

That last link is enough to make a guy go blind in the endless data sheets behind those links. It's a big part of where my time was spent making the budget thread...but it's where the real numbers sit and no one said getting the real scoop would be quick or easy. It IS out there and, in fact, right there at that link, for anyone to see who has the time and patience to dig it up.

I just came across this thread and am right now looking at the "debt clock" according to it, both "U.S.National Debt" and "U.S. Total Debt" are

steadily increasing.

Originally posted by Majiq1

I just came across this thread and am right now looking at the "debt clock" according to it, both "U.S.National Debt" and "U.S. Total Debt" are steadily increasing.

Keep looking.

Find the number for " U.S. Federal Budget Deficit". --- Steadily decreasing ---

We should come in at around $900 Billion for 2013.

Go ahead and wave goodbye to the $$$ Trillion + deficits.

The Sequester has reigned in spending and it has Obama steaming mad!

Orders from Obama: Make Americans feel Maximum Pain! That will show them.

edit on 8-3-2013 by TauCetixeta because: (no reason

given)

edit on 8-3-2013 by TauCetixeta because: (no reason given)

reply to post by Wrabbit2000

I am correct with the title of this thread. Go look for yourself.

Watch the U.S. Federal Budget Deficit number falling.

The red bars for 2013 & 2014 will be smaller if unexpected Cap Gains Tax Checks

arrive at the IRS.

The USA is STILL an economic superpower.

USA GDP $15.8 Trillion (Q4 2012)

This Link is better for you

Our economy is the envy of the world.

The USA is also a Military Superpower.

I am correct with the title of this thread. Go look for yourself.

Watch the U.S. Federal Budget Deficit number falling.

The red bars for 2013 & 2014 will be smaller if unexpected Cap Gains Tax Checks

arrive at the IRS.

The USA is STILL an economic superpower.

USA GDP $15.8 Trillion (Q4 2012)

This Link is better for you

Our economy is the envy of the world.

The USA is also a Military Superpower.

edit on 8-3-2013 by TauCetixeta because: (no reason given)

reply to post by TauCetixeta

Yeah I see that, but that is just the budget deficit. That will continue to fall as the "sequester cuts" increase. The problem is that the sequester cuts will stop at about 84-85 billion. they are already up to over 15 billion. sequester is a start but doesn't do nearly enough and will not bring down the debt. In fact the debt is on a steady rise. We need real cuts in spending, not this sequester which only slows growth of government

Yeah I see that, but that is just the budget deficit. That will continue to fall as the "sequester cuts" increase. The problem is that the sequester cuts will stop at about 84-85 billion. they are already up to over 15 billion. sequester is a start but doesn't do nearly enough and will not bring down the debt. In fact the debt is on a steady rise. We need real cuts in spending, not this sequester which only slows growth of government

reply to post by Wrabbit2000

I calculated wrong. I missed a decimal.

The amount of cash in circulation at this time is 1.17 trillion.

But that only exemplifies my point even more, because for every one of those dollars that we owe on our deficit, we actually owe a federal reserve note. The deficit can only be paid in federal reserve notes, and federal reserve notes by nature are instruments of inflation.

For every dollar/fed note we borrow to facilitate our economy, we owe more than 1 dollar back.

This is all econ 101 stuff.

We never have enough money in circulation to pay off the value of federal reserve notes.

Now, maybe foreign capital could take care of that, but that is irrelevant.

By removing billions from the economy, we are creating deflation, which is the exact opposite of what we need.

You can speculate and I can speculate, but in the end we can only see what happens, and I predict that this sequester will stall growth and effectively destroy any headway we have created.

I calculated wrong. I missed a decimal.

The amount of cash in circulation at this time is 1.17 trillion.

But that only exemplifies my point even more, because for every one of those dollars that we owe on our deficit, we actually owe a federal reserve note. The deficit can only be paid in federal reserve notes, and federal reserve notes by nature are instruments of inflation.

For every dollar/fed note we borrow to facilitate our economy, we owe more than 1 dollar back.

This is all econ 101 stuff.

We never have enough money in circulation to pay off the value of federal reserve notes.

Now, maybe foreign capital could take care of that, but that is irrelevant.

By removing billions from the economy, we are creating deflation, which is the exact opposite of what we need.

You can speculate and I can speculate, but in the end we can only see what happens, and I predict that this sequester will stall growth and effectively destroy any headway we have created.

Originally posted by Majiq1

reply to post by TauCetixeta

Yeah I see that, but that is just the budget deficit. That will continue to fall as the "sequester cuts" increase. The problem is that the sequester cuts will stop at about 84-85 billion. they are already up to over 15 billion. sequester is a start but doesn't do nearly enough and will not bring down the debt. In fact the debt is on a steady rise. We need real cuts in spending, not this sequester which only slows growth of government

Food For Thought: Is it possible will see a Sequester 2.0 in the near future?

For Example: Another $85 Billion?

History Can repeat itself.

Bringing Down The National Debt: That will require an economic boom like

President Clinton saw during the Dot.com BOOM.

I remember when the first SURPLUS arrived for Clinton. Washington D.C. was caught

off guard when the......unexpected.....Cap Gains Tax Checks arrived at the IRS.

Also, Newt controlled spending. Goal: Aim For Zero

4 years of surpluses arrived during the 1990s.

When surpluses arrive again THEN we can talk about " Bringing Down The National Debt".

edit on 8-3-2013 by TauCetixeta because: (no reason given)

new topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 39 minutes ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 2 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 7 hours ago -

Electrical tricks for saving money

Education and Media: 10 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 11 hours ago, 9 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 15 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 12 hours ago, 4 flags -

Electrical tricks for saving money

Education and Media: 10 hours ago, 4 flags -

Sunak spinning the sickness figures

Other Current Events: 12 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 14 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 2 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 17 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 7 hours ago, 0 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 39 minutes ago, 0 flags

active topics

-

Black mirror, what happened.

Television • 20 • : seekshelter -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 5 • : BeyondKnowledge3 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 29 • : andy06shake -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 25 • : andy06shake -

Russia Ukraine Update Thread - part 3

World War Three • 5730 • : Arbitrageur -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 43 • : Hakaiju -

Everest-sized ‘Devil comet’ Pons-Brooks Visible Now

Space Exploration • 17 • : Compendium -

Nakedeye Mother of Dragons Comet Is Here!

Space Exploration • 5 • : Compendium -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 38 • : BernnieJGato -

15 Unhealthiest Sodas On The Market

Health & Wellness • 43 • : JPRCrastney