It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by kaylaluv

Just posting so I can keep track of this thread. You know, I don't really mind paying taxes as a citizen, and I want to pay the principle of my credit card debt, because I bought a product and I shouldn't get it for free, but I'm getting pissed off every time those stupid credit card companies raise their interest rates, even though I have never missed a payment and never paid late - EVER. Chase Bank Visa is the WORST. I wouldn't mind stickin' it to them ... just cuz.

Thanks for the info - I'll look into it some more before doing anything.

.

I understand what you are saying, but think of it this way.

You purchased a TV for $1000 on your credit card

The bank creates $1000 out of nothing and pays the store, so the TV has been paid for, the store has the money.

Now you are going to pay the bank $1000 + interest. That is your real hard earned money you are giving to the bank to repay what is essentially nothing....

As i said about income tax earlier its doesn't pay for anything, it goes straight to the RBA or FED. Income tax does not go toward anything in your country

edit on 5/1/2013 by wycky because: Add

reply to post by MongusePro

You can use pay as you go type of sim. Anyone can do this, bad credit or not.

I use prepay gas and electricity contract - pay for it before you use it. Anyone in the UK can do this, bad credit or not.

Water companies here will turn your water on as soon as you organise a direct debit payment arrangement - whether bad credit or not.

But anyone can pay for anything with a debit card - in the UK you get a debit card with your bank account, you're just using your own money instead of the bank's.

Personally, I will never ever borrow another penny from the banks ever again, they took my home and sold it for peanuts, then came after me for the shortfall. I had at least £20,000 equity in that house when they took it and sold it, but because they virtually gave it away and sold it for less than I owed on the mortgage, I still owe them £18,000. They have made my life a misery the last couple of years, demanding money I don't have. Nitemare. But they can't have what I aint got.

They can stick their crooked loans up their hiney - I'll never trust the finance industry again.

How on earth are you going to cope for the next 2-6 years though?

* You wont be able to get a phone contract

You can use pay as you go type of sim. Anyone can do this, bad credit or not.

* No Utilities company is going to touch you

I use prepay gas and electricity contract - pay for it before you use it. Anyone in the UK can do this, bad credit or not.

Water companies here will turn your water on as soon as you organise a direct debit payment arrangement - whether bad credit or not.

* You can't pay for most flights and holidays without a credit card

But anyone can pay for anything with a debit card - in the UK you get a debit card with your bank account, you're just using your own money instead of the bank's.

Personally, I will never ever borrow another penny from the banks ever again, they took my home and sold it for peanuts, then came after me for the shortfall. I had at least £20,000 equity in that house when they took it and sold it, but because they virtually gave it away and sold it for less than I owed on the mortgage, I still owe them £18,000. They have made my life a misery the last couple of years, demanding money I don't have. Nitemare. But they can't have what I aint got.

They can stick their crooked loans up their hiney - I'll never trust the finance industry again.

Originally posted by Skywatcher2011

Do you think that sending those three letters could be used for wiping off or forgiving student loans????edit on 5-1-2013 by Skywatcher2011 because: (no reason given)

Sorry I am not to sure about student loans. If they are issued through a financial institute, i don't see why not, If it is via the Government i am not sure??

These claims are all over the internet and offer people ways to 'opt out' of paying taxes.

In the US, similar scams have a 100% fail-rate in the courts and can end

up in jail terms.

This OP is claiming that anyone can just set up an NGO and run a business without paying taxes. It's like 'Oh crap! There's this great loophole that nobody else knows about and 'THEY' haven't closed it! RAWK!!' Not only that, you can wipe out your debts AND never pay taxes.

To set up an NGO is a tough process and you need to prove that your running something on a philanthropic, social and/or charitable basis. Different countries have different terms of agreement and not all NGOs are recognised in major nations if they're originating in countries known for lax law-keeping and corruption.

Tell the US IRS you're a Zimbabwean NGO and they'll want to look up your skirts pretty fast. The UK Inland Revenue won't entertain you. Taxmen aren't in the business of letting people off the hook.

The sad reality is we pay our taxes until we're wealthy enough to employ someone to help us avoid paying them. Tax avoidance is for the rich and the rest of us will find no mercy.

This OP is claiming that anyone can just set up an NGO and run a business without paying taxes. It's like 'Oh crap! There's this great loophole that nobody else knows about and 'THEY' haven't closed it! RAWK!!' Not only that, you can wipe out your debts AND never pay taxes.

To set up an NGO is a tough process and you need to prove that your running something on a philanthropic, social and/or charitable basis. Different countries have different terms of agreement and not all NGOs are recognised in major nations if they're originating in countries known for lax law-keeping and corruption.

Tell the US IRS you're a Zimbabwean NGO and they'll want to look up your skirts pretty fast. The UK Inland Revenue won't entertain you. Taxmen aren't in the business of letting people off the hook.

The sad reality is we pay our taxes until we're wealthy enough to employ someone to help us avoid paying them. Tax avoidance is for the rich and the rest of us will find no mercy.

Originally posted by Kandinsky

These claims are all over the internet and offer people ways to 'opt out' of paying taxes. In the US, similar scams have a 100% fail-rate in the courts and can end up in jail terms.

This OP is claiming that anyone can just set up an NGO and run a business without paying taxes. It's like 'Oh crap! There's this great loophole that nobody else knows about and 'THEY' haven't closed it! RAWK!!' Not only that, you can wipe out your debts AND never pay taxes.

To set up an NGO is a tough process and you need to prove that your running something on a philanthropic, social and/or charitable basis. Different countries have different terms of agreement and not all NGOs are recognised in major nations if they're originating in countries known for lax law-keeping and corruption.

Tell the US IRS you're a Zimbabwean NGO and they'll want to look up your skirts pretty fast. The UK Inland Revenue won't entertain you. Taxmen aren't in the business of letting people off the hook.

The sad reality is we pay our taxes until we're wealthy enough to employ someone to help us avoid paying them. Tax avoidance is for the rich and the rest of us will find no mercy.

Your wrong setting up an NGO was a 2 week process and took only a couple hours of my time. All the documentation was done by Truthology, all i did was sign it and take it to the bank. I know it sounds too easy but it was.

For Truthology this is a business, they have streamlined the process and made it an easy one, they charged me $1,400 to set it up and for that kind of money it should be easy

However I am not to sure about the US though.

I was talking to my accountant and my friend spoke to his and they both said the same thing "its almost impossible to setup" all the paper work, blah blah, yet I did it.

Things like this are meant to appear "too hard" otherwise we would all be doing it.

Also remember if you do this you will no longer need an accountant so it not good business practice for them to be setting up NGO's

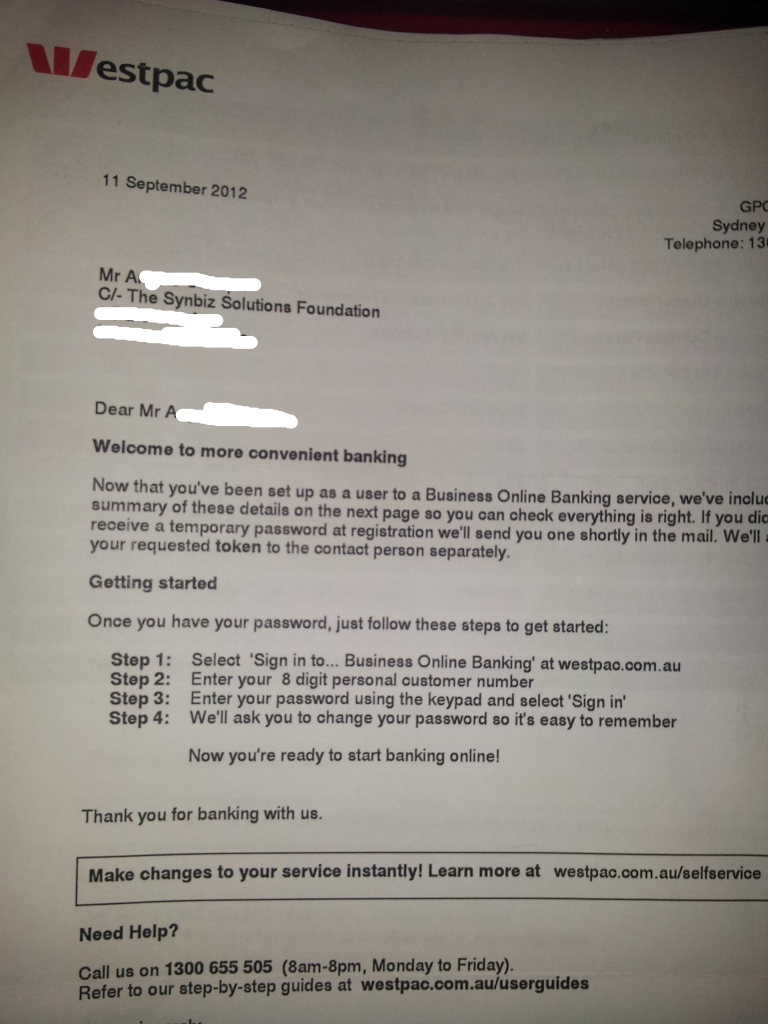

Here is mine

I have nothing to gain from this, I am just passing on what i have learnt and trying to help others.

I spent approx a year learning about this, Strawman theory and a Freeman way of life Its all connected.

Don't spend 2min doing a google search and tell me its fraud

I have nothing to gain from this, I am just passing on what i have learnt and trying to help others.

I spent approx a year learning about this, Strawman theory and a Freeman way of life Its all connected.

Don't spend 2min doing a google search and tell me its fraud

edit on 5/1/2013 by wycky because: (no reason given)

reply to post by wycky

Fair enough. What are you a 'self employed Consultant' of? What did you tell the these guys you were doing

that justified NGO status?

In the US people have paid websites money and found the taxman asking for his money months later after they thought they were off the hook. Be careful.

In the US people have paid websites money and found the taxman asking for his money months later after they thought they were off the hook. Be careful.

So you add nothing to your country and suck it for all you can get?

Your not an Australian, your a leech!

Your not an Australian, your a leech!

Originally posted by Kandinsky

reply to post by wycky

Fair enough. What are you a 'self employed Consultant' of? What did you tell the these guys you were doing that justified NGO status?

In the US people have paid websites money and found the taxman asking for his money months later after they thought they were off the hook. Be careful.

I don't have to tell thoes guys anything. I operate outside their jurisdiction.

The business you are dealing with give them a 3346 form which you can get from the ATO website

Then they comply with you.

"The form 3346 is a form provided by the ATO which is a statement by the supplier as to the reason for not quoting an ABN, therefore not collecting GST on the transaction.

You can review the form and details at: www.ato.gov.au...

You will be selecting the box which says the reason for not quoting and ABN is wholly of a private or domestic nature (from the supplier’s perspective). "

edit on 5/1/2013 by wycky because: (no reason given)

Originally posted by pacifier2012

So you add nothing to your country and suck it for all you can get?

Your not an Australian, your a leech!

For the 3rd time INCOME TAX DOES NOT GO TO THE COUNTRY!

It goes the the RBA via the ATO

There are another 129 taxes I pay that support this country

Originally posted by wycky

The part about OPTUS is not a lie, why would I lie.[

My home Internet is Telstra I have no issue, my phones use OPTUS i can't access the site. I have a friend on OPTUS broadband and can't access the site, I have another friend on Internode which use OPTUS and he can't access the site.

because Optus have not blocked it, I am on Optus and can access it....

What reason did Optus giive you when you told them you could not acces that site?

reply to post by wycky

I'm not understanding how you have NGO status. The letters don't demonstrate NGO status.

The company name in the letter (Synbiz Solutions foundation) is a call-centre business in Hyderabad, India. Basically a service industry with no material supplies to be off-set by the PDF you linked. The PDF describes how an ABN is required when dealing with small enterprises and that taxes can be withheld to ~46.5%

You'll have to be clearer here.

The company name in the letter (Synbiz Solutions foundation) is a call-centre business in Hyderabad, India. Basically a service industry with no material supplies to be off-set by the PDF you linked. The PDF describes how an ABN is required when dealing with small enterprises and that taxes can be withheld to ~46.5%

You'll have to be clearer here.

Originally posted by hellobruce

Originally posted by wycky

The part about OPTUS is not a lie, why would I lie.[

My home Internet is Telstra I have no issue, my phones use OPTUS i can't access the site. I have a friend on OPTUS broadband and can't access the site, I have another friend on Internode which use OPTUS and he can't access the site.

because Optus have not blocked it, I am on Optus and can access it....

What reason did Optus giive you when you told them you could not acces that site?

I didn't contact them. I just assumed it had been blocked because my self and about 4 other people on OPTUS could not access the site.

Are you in Australia ?

Edit:

I take it all back, I just check it on my phone and it works.

My best friend tried accessing the site over a period of about 3 weeks could never access it and gave up

edit on 5/1/2013 by wycky because:

oops

Originally posted by Kandinsky

reply to post by wycky

I'm not understanding how you have NGO status. The letters don't demonstrate NGO status.

The company name in the letter (Synbiz Solutions foundation) is a call-centre business in Hyderabad, India. Basically a service industry with no material supplies to be off-set by the PDF you linked. The PDF describes how an ABN is required when dealing with small enterprises and that taxes can be withheld to ~46.5%

You'll have to be clearer here.

I determine that my business has an NGO status, and no governing body can tell me otherwise.

To setup up and NGO you don't need proof of this all that is required is 2 documents 1. Article of Association 2. Minuets. That is where all the work is, thats the hard part.

I know its hard to get your head around, I suggest you go to the site and check out the info.

This may be of some help:

Its a question i asked after i setup my foundation:

Earlier today I was speaking with Phill from Westpac and he said to be careful with what i purchase from the account because they are heavily audited by Westpac.

He said Westpac check what is being purchased, and if it looks like it is being used as a normal account and a NFP they will close the account and off a business account....?

How are we suppose to use this as an everyday account as you said we can?

My Response from Truthology:

Firstly, I would say that “of course’ Phil would say that...and he is correct. He is employed by the Bank and they are obliged to tell you that.

In fact so will we, as the account is to be used ONLY for N-F-P Purposes.

Have you read the articles of association that you have in your folder ?

Are you fully aware of what is acceptable for the foundation, as clearly outlined in those articles of association ?

Again, if so you will be aware that YOU are able to decide what is appropriate for your foundation as it is “self assessable’ i.e No one can dictate to you what is or is not acceptable use of the foundation.

You can use the card, and or account however you wish, the Bank can NEVER say that you are not using it for N-F-P purposes, as they even have a copy of the Articles on file !....YOU decide what is and is not appropriate...again your foundation is a ‘self assessable’ entity.

You need to be fully aware of your sovereignty, and the fact that no ‘purported authority’ has any right to dictate to you any longer. Now the BANK will of course will advise you to use the account appropriately to cover themselves, BUT they have right or jurisdiction or power to do so UNLESS you give it to them. You have no need to ask for their permission or have to report to them in any way shape or form from now on, nor would you ever consent to an audit or any approach from the bank to try and make you change the account.... i would never even think to agree with them....and for the record, with over 500 foundations established by us, we have NEVER been approached by them to do so.

Who are they to tell you what to do with the foundation and or its money ? If you stand behind your right as a FREE being and have conviction in your beliefs, then any attempt by a ‘purported authority’ to control or dictate to you will be in vain. I would also refrain from having much to do with them at all.... they have no understanding of the entity that you have established nor its use, and you will only confuse both them and you if you try and have them assist you. They should be used for any admin issue...but thats it in our opinion.

I hope that clarifies for you that it is YOU who decides what is appropriate use for your N-F-P entity from now on.

To add:

My business Name was Synbiz Solutions It is now called The Synbiz Solutions Foundation on my Paper work from the bank.

There may be a place in India with the same name I can't help that

edit on 5/1/2013 by wycky because: Add

edit on 5/1/2013 by

wycky because: (no reason given)

Originally posted by wycky

I determine that my business has an NGO status,

Sorry, that makes no sense at all. There are only 2 different types of organisations, government and non government. You do not decide to set up a NGO, as you cannot set up a government organisation...

You seem confused.

Originally posted by hellobruce

Originally posted by wycky

I determine that my business has an NGO status,

Sorry, that makes no sense at all. There are only 2 different types of organisations, government and non government. You do not decide to set up a NGO, as you cannot set up a government organisation...

You seem confused.

An NGO Non Government Organisation means that the Government / ATO has no access to my records

A normal business setup is a Government Organisation, it means that the Government and ATO can access your records, it doesn't mean you are setting up your own government organisation.

When is comes to this type of thing its all "legalese" a lot of words have different meaning compared to common language.

reply to post by wycky

awesome

thanks

truly refreshing and essential survival info in these times we need thrival ~

∞LOVE

mayallsoulsbefree∞

awesome

thanks

truly refreshing and essential survival info in these times we need thrival ~

∞LOVE

mayallsoulsbefree∞

Wycky is right about one thing for sure, banks use fear to get what they want.

I had loans and cards upto 12grand I couldn't pay so I dropped off the radar for a bit and after 6 years no contact here in the UK your debt becomes statute barred which means the bank cant chase you for it any more.

You must make no contact whatsoever though if you use this method or the 6 years begin again.

Miraculously I have never moved house..I still live in the same house where I took out the loan and credit cards! Im not saying its the right thing to do but when you need to survive you gotta do what you gotta do.

I had loans and cards upto 12grand I couldn't pay so I dropped off the radar for a bit and after 6 years no contact here in the UK your debt becomes statute barred which means the bank cant chase you for it any more.

You must make no contact whatsoever though if you use this method or the 6 years begin again.

Miraculously I have never moved house..I still live in the same house where I took out the loan and credit cards! Im not saying its the right thing to do but when you need to survive you gotta do what you gotta do.

Originally posted by wycky

An NGO Non Government Organisation means that the Government / ATO has no access to my records

A normal business setup is a Government Organisation, it means that the Government and ATO can access your.

You have been conned out of $1400...

www.ato.gov.au.../content/33150.htm&mnu=45425&mfp=001/004

www.ato.gov.au...

australia.gov.au...

The ATO is awake to con artists, you will get caught!

I will be forced to take further action under Section 1 of the Protection from Harassment Act 1997. '

That is a UK law, you are in Australia.... you are very very confused!

new topics

-

4 plans of US elites to defeat Russia

New World Order: 32 minutes ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 4 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 6 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 6 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 7 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 13 hours ago, 25 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 7 hours ago, 16 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 15 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 6 hours ago, 6 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 13 hours ago, 5 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 6 hours ago, 4 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 4 hours ago, 4 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 16 hours ago, 3 flags -

4 plans of US elites to defeat Russia

New World Order: 32 minutes ago, 1 flags

active topics

-

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 61 • : strongfp -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 22 • : TheMisguidedAngel -

Running Through Idiot Protestors Who Block The Road

Rant • 110 • : FlyersFan -

4 plans of US elites to defeat Russia

New World Order • 4 • : Oldcarpy2 -

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 888 • : DISRAELI2 -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 18 • : GENERAL EYES -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 537 • : brewtiger123 -

Graham Hancock being proven right all along about ancient humans in America.

Ancient & Lost Civilizations • 105 • : bluesfreak2 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 2 • : DerBeobachter2 -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics • 23 • : andy06shake