It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by GregJ

The money go to :

1.Military (99.97%)

2.Education (0.02%)

3.Infrastructure (0.01%)

4.People (0%)

Just my assumption..LOL..

Why would you assume facts that are easy to check?

1. Social programs 'people' - 58%, you guessed 0%

Social Security-19%

Income Security-16%

Medicare-13%

Health-10%

2.Military- 19%, you guessed 99%

3.Education- 3%, you guessed .02%

4. Interest on debt- 5%, this could be tacked onto social programs as that is what is causing the national debt.

5. Other-15%, this is veterans benefits(4%), foriegn aid (1%), etc...

You are clearly far removed from the truth and have bought into a lot of lies.

Originally posted by links234

I'm not sure how you figure 52%, however, in response to your other question about where your tax dollars go there's this, from the White House.

Without getting too involved in my numbers; I was taxed at 12.5% federal (OASDI, income, medicare) and 3.3% state. This adds to a whopping 15.8% total tax rate. Depending on what I get back this spring I'll be able to tell what my effective rate was.

I seriously doubt anyone is getting hit for anything above 30% in this country.

Did you pay any taxes for things you purchased with the money you were already taxed for when you were paid?

When you registered your car for the current year, how much of that was tax?

When you put a gallon of gasoline in your car, how much of that was tax?

edit on 12/29/2012 by abecedarian because: (no reason given)

Originally posted by olaru12

Fighting wars is very expensive! Follow the money....

costofwar.com...edit on 29-12-2012 by olaru12 because: (no reason given)

Cost of both wars over 10 years: $1,408,000,000,000

Cost of Obamacare over 10 years: $2,600,000,000,000

Wars end, and that cost is gone. Obamacare doesn't end. I think you are sorely misled.

ETA: That is the cost AFTER new taxes are raised and healthcare is gutted. The hospital I work for is in financial crisis since 2010 when parts of the law went into effect.

edit on 29-12-2012 by OccamsRazor04 because: (no reason given)

Originally posted by minnow

I'm shocked to see claims of only paying 12% total tax rate on income (between fed & state governments)

Is anyone disputing the figures shown here:

blog.heritage.org...

It's clearly around 28% Federal income tax rate plus 15% Payroll tax plus state tax(unless ur in one of the about 6 states which have no state income tax).

Would be great to find somewhere that shows where all the tax (roughly half each paycheck) goes... still googling

edit on 29-12-2012 by minnow because: (no reason given)

The majority goes to social programs.

About 58% goes to social programs, 19% to defense, 5% to pay the debt for supporting social programs, the rest is random things.

www.truthfulpolitics.com...

reply to post by minnow

Yeah. I dispute it.

28% is the marginal rate for single filer income between $36,250 and $87,850 if nothing gets done. It is currently 25%. This of course, has nothing to do with any deductions which lower taxable income providing a lower effective tax rate. But even without that it ain't 50%.

The payroll tax (FICA, Medicare) rate will be 7.65% assuming the "holiday" is not extended. See, they failed to note that they include the employer's share in the figure they provide.

Is anyone disputing the figures shown here:

Yeah. I dispute it.

28% is the marginal rate for single filer income between $36,250 and $87,850 if nothing gets done. It is currently 25%. This of course, has nothing to do with any deductions which lower taxable income providing a lower effective tax rate. But even without that it ain't 50%.

The payroll tax (FICA, Medicare) rate will be 7.65% assuming the "holiday" is not extended. See, they failed to note that they include the employer's share in the figure they provide.

edit on 12/29/2012 by Phage because: (no reason given)

reply to post by minnow

If you are tired of paying taxes; why not do what the rich people do to avoid paying what everyone else does.

I use number 7 to lower my rate....A LOT!

www.businesspundit.com...

If you are to ignorant or lazy to take advantage of every legal loop hole....don't complain! Get an LLC and write most of your expenses off.

If you are tired of paying taxes; why not do what the rich people do to avoid paying what everyone else does.

I use number 7 to lower my rate....A LOT!

www.businesspundit.com...

If you are to ignorant or lazy to take advantage of every legal loop hole....don't complain! Get an LLC and write most of your expenses off.

edit on 30-12-2012 by olaru12 because: (no reason given)

So many of us warned that with Obama being re-elected, this would happen. So many people didn't think that they would feel the impact of Obama's

foreign and domestic policies.

Obama's meme of divide, of class warfare catapulted him to believe that he now has a mandate to take more money from everyone in order to add and create larger government programmes.

We get the government we deserve. Well kids, here it is!

Obama's meme of divide, of class warfare catapulted him to believe that he now has a mandate to take more money from everyone in order to add and create larger government programmes.

We get the government we deserve. Well kids, here it is!

Originally posted by Phage

reply to post by minnow

Is anyone disputing the figures shown here:

Yeah. I dispute it.

28% is the marginal rate for single filer income between $36,250 and $87,850 if nothing gets done. It is currently 25%. This of course, has nothing to do with any deductions which lower taxable income providing a lower effective tax rate. But even without that it ain't 50%.

The payroll tax (FICA, Medicare) rate will be 7.65% assuming the "holiday" is not extended. See, they failed to note that they include the employer's share in the figure they provide.edit on 12/29/2012 by Phage because: (no reason given)

Let's not forget tax at the till.

I pay 30% on income and then 15% on every other dollar I spend with what remains. HST in Canada is a bitch.

Peace

Originally posted by jude11

Originally posted by Phage

reply to post by minnow

Is anyone disputing the figures shown here:

Yeah. I dispute it.

28% is the marginal rate for single filer income between $36,250 and $87,850 if nothing gets done. It is currently 25%. This of course, has nothing to do with any deductions which lower taxable income providing a lower effective tax rate. But even without that it ain't 50%.

The payroll tax (FICA, Medicare) rate will be 7.65% assuming the "holiday" is not extended. See, they failed to note that they include the employer's share in the figure they provide.edit on 12/29/2012 by Phage because: (no reason given)

Let's not forget tax at the till.

I pay 30% on income and then 15% on every other dollar I spend with what remains. HST in Canada is a bitch.

Peace

Canadian taxes are much higher because unless I am mistaken health care is included in that.

Anything over 50% makes one a defacto indentured servant....

to the government.

to the government.

We don't have it great in South Africa either-my husband is taxed 35% on his actual salary,we pay 14% vat on just about every single consumer item

except bread and milk-and the price of gas here is 11 ZAR per LITRE.Our taxes buy us the type of state hospital where a 16yr old girl died from

meningitis the other day because she was left without treatment for 4hours while her life drained away.So we pay over 7k ZAR a month for private

medical insurance-here,if you want to try and keep your children alive,at least more protected from preventable,avoidable death in a medical

emergency,you have No choice whatso ever.That does'nt leave much to actually live on.Im not saying you have it good in America,not the way things are

going lately,but food,2nd hand automobiles,clothing(regular,not designer) etc.is still a helluva lot cheaper than in many many other countries.Guns

are still easy to buy,and likely cost a fraction of the price it would be here.

Originally posted by Raxoxane

We don't have it great in South Africa either-my husband is taxed 35% on his actual salary,we pay 14% vat on just about every single consumer item except bread and milk-and the price of gas here is 11 ZAR per LITRE.Our taxes buy us the type of state hospital where a 16yr old girl died from meningitis the other day because she was left without treatment for 4hours while her life drained away.So we pay over 7k ZAR a month for private medical insurance-here,if you want to try and keep your children alive,at least more protected from preventable,avoidable death in a medical emergency,you have No choice whatso ever.That does'nt leave much to actually live on.Im not saying you have it good in America,not the way things are going lately,but food,2nd hand automobiles,clothing(regular,not designer) etc.is still a helluva lot cheaper than in many many other countries.Guns are still easy to buy,and likely cost a fraction of the price it would be here.

Anyone who disputers Americans have it great is a fool or a liar. Just because we have it great does not mean we should be tossing money into the endless pit that our politicians created though.

reply to post by OccamsRazor04

1 trillion isn't an accurate estimate for the cost of the wars.

It's more like 4 trillion.

www.reuters.com...

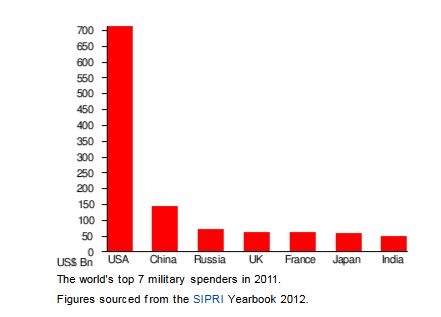

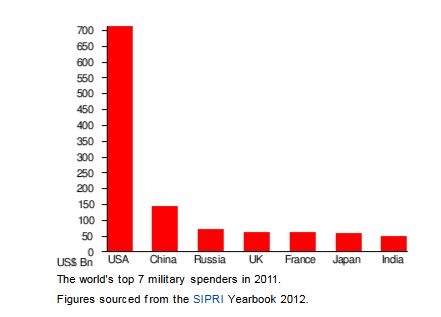

And the US military budget is not proportionate to the rest of the worlds

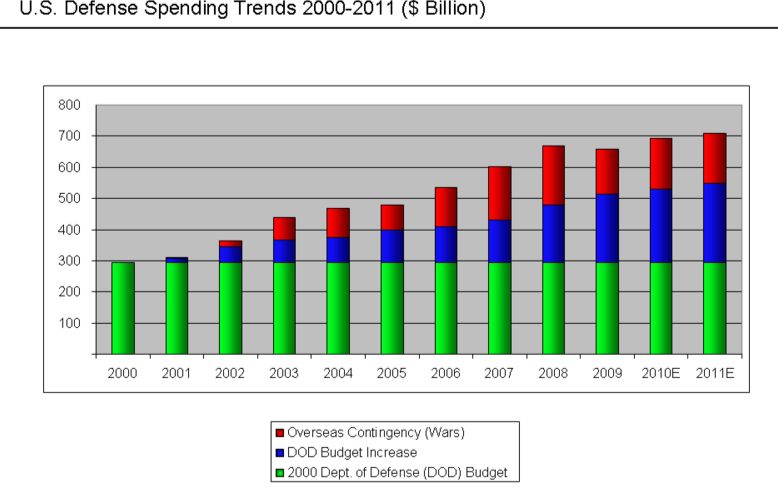

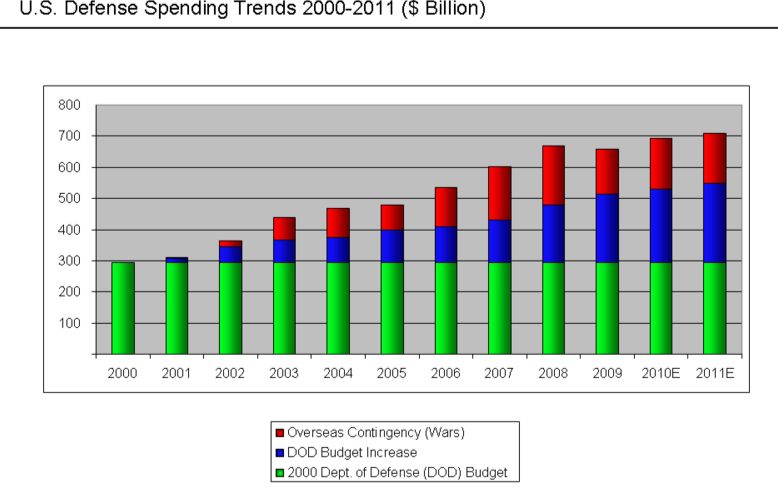

And the budget just keeps growing

1 trillion isn't an accurate estimate for the cost of the wars.

It's more like 4 trillion.

When President Barack Obama cited cost as a reason to bring troops home from Afghanistan, he referred to a $1 trillion price tag for America's wars.

Staggering as it is, that figure grossly underestimates the total cost of wars in Iraq, Afghanistan and Pakistan to the U.S. Treasury and ignores more imposing costs yet to come, according to a study released on Wednesday.

The final bill will run at least $3.7 trillion and could reach as high as $4.4 trillion, according to the research project "Costs of War" by Brown University's Watson Institute for International Studies.

In the 10 years since U.S. troops went into Afghanistan to root out the al Qaeda leaders behind the September 11, 2001, attacks, spending on the conflicts totaled $2.3 trillion to $2.7 trillion.

Those numbers will continue to soar when considering often overlooked costs such as long-term obligations to wounded veterans and projected war spending from 2012 through 2020. The estimates do not include at least $1 trillion more in interest payments coming due and many billions more in expenses that cannot be counted, according to the study.

The White House says the total amount appropriated for war-related activities of the Department of Defense, intelligence and State Department since 2001 is about $1.3 trillion, and that would rise to nearly $1.4 trillion in 2012.

Researchers with the Watson Institute say that type of accounting is common but too narrow to measure the real costs.

In human terms, 224,000 to 258,000 people have died directly from warfare, including 125,000 civilians in Iraq. Many more have died indirectly, from the loss of clean drinking water, healthcare, and nutrition. An additional 365,000 have been wounded and 7.8 million people -- equal to the combined population of Connecticut and Kentucky -- have been displaced.

www.reuters.com...

And the US military budget is not proportionate to the rest of the worlds

And the budget just keeps growing

edit on 30-12-2012 by WaterBottle because: (no reason given)

edit on 30-12-2012 by WaterBottle because: (no reason

given)

edit on 30-12-2012 by WaterBottle because: (no reason given)

edit on 30-12-2012 by WaterBottle because: (no

reason given)

edit on 30-12-2012 by WaterBottle because: (no reason given)

reply to post by Phage

If you're self employed you have to pay both the employee and employer share.

Just because half the tax is on the employer doesn't necessarily mean it isn't affecting your take home pay. It's like a sales tax, only on the employee's salary. Just because you make $16 an hour doesn't mean it only costs the business $16 an hour to higher you.

Just because half the tax is on the employer doesn't necessarily mean it isn't affecting your take home pay. It's like a sales tax, only on the employee's salary. Just because you make $16 an hour doesn't mean it only costs the business $16 an hour to higher you.

Originally posted by jude11

It all goes towards the over bloated Govt. including Military to conquer the World which will be a lost cause in time. Quite simply, your money will be used to kill innocent civilians in far away Countries that no one ever hears of and therefore, don't care.

That's one "expense". Another expense is the massive fraud between colluding politicians, Wall Street and central banksters. Yet another expense is the huge spraying program pushing aluminum, barium and other contaminates into our air, surface water and soils.

When the cancer of corruption consumes virtually 100% of a political organism, it's time to let the diseased organism die. It's time to dissolve the federal government. Period.

Originally posted by METACOMET

Taxation with representation ain't so hot either.

I disagree. Taxation with representation is not the problem...

The problem is, we are no longer represented.

edit on 30-12-2012 by MrWendal because: (no reason given)

Originally posted by GregJ

The money go to :

1.Military (99.97%)

2.Education (0.02%)

3.Infrastructure (0.01%)

4.People (0%)

Just my assumption..LOL..

Your assumption is ignorant while trying to mask it in some sort of awkward levity.

In honesty, it is hard to determine exactly where tax-dollars are being spent without a budget. We can see how much each department gets, how much federal workers are paid, etc, etc, but they are all funded currently on stop-gap measures piecemeal together in various bills that rarely have anything to do with the intention of the bill.

For clarity sake - the military gets about as much tax-dollars as does entitlement funding and now "health-care". Education receive a ridiculous amount of money that keeps increasing while providing absolutely no return of investment from the government.

Here is a more accurate break-down: 2009 estimates per person.

Defense: -- 17%

SS: -- 16%

Medicare: -- 16%

Income Security -- 16%

Health: -- 13%

Education: -- 3%

Other various amounts are spent too: VA, general government expenses, etc, etc.

Originally posted by Ghost375

Originally posted by Jetman44

This is the United States of America...we fought to break away from England and all of the taxes, but here we are being taxed just like the british.

Actually taxes played a very small role in the revolt.

Your right, the war stared when the red coats tried to take the people's guns away at Lexington and concord. Will history repeat it's self when these gun grabbing NWO types try to take our guns again?

reply to post by abecedarian

Is this where they're getting their 52% from? If you pay, let's say 10%, on a $25,000 car that's not the same as paying an additional 10% tax on your income.

You can't add the percentage of sales tax to your income tax and claim you're being taxed at a 50% or 75% rate because you'd be wrong. Very wrong.

Is this where they're getting their 52% from? If you pay, let's say 10%, on a $25,000 car that's not the same as paying an additional 10% tax on your income.

You can't add the percentage of sales tax to your income tax and claim you're being taxed at a 50% or 75% rate because you'd be wrong. Very wrong.

So the illusion of scarcity can keep you downtrodden and submissive, of course.

I really don't expect much else out of a government these days, do you?

I really don't expect much else out of a government these days, do you?

new topics

-

The US Supreme Court Appears to Side With the January 6th 2021 Capitol Protestors.

Political Conspiracies: 11 minutes ago -

That which the "news" never talks about; Truth about election fraud

Mainstream News: 1 hours ago -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness: 1 hours ago -

Horizon Post office scandal

Regional Politics: 2 hours ago -

Joe Biden and Donald Trump are both traitors

US Political Madness: 4 hours ago -

I'm new here. Avid conspiracy fan.

Introductions: 4 hours ago -

Denmark's Notre-Dame moment - 17th Century Borsen goes up in Flames

Mainstream News: 5 hours ago

top topics

-

Suspected Iranian agent working for Pentagon while U.S. coordinated defense of Israel

US Political Madness: 13 hours ago, 16 flags -

The Baloney aka BS Detection Kit

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

That which the "news" never talks about; Truth about election fraud

Mainstream News: 1 hours ago, 6 flags -

Denmark's Notre-Dame moment - 17th Century Borsen goes up in Flames

Mainstream News: 5 hours ago, 4 flags -

How does my computer know

Education and Media: 16 hours ago, 3 flags -

Joe Biden and Donald Trump are both traitors

US Political Madness: 4 hours ago, 3 flags -

I'm new here. Avid conspiracy fan.

Introductions: 4 hours ago, 3 flags -

Horizon Post office scandal

Regional Politics: 2 hours ago, 1 flags -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness: 1 hours ago, 1 flags -

The US Supreme Court Appears to Side With the January 6th 2021 Capitol Protestors.

Political Conspiracies: 11 minutes ago, 1 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 245 • : matafuchs -

The US Supreme Court Appears to Side With the January 6th 2021 Capitol Protestors.

Political Conspiracies • 0 • : WeMustCare -

Afterlife, unknown, so prepare, or just go into the unknown (bad)!!

ATS Skunk Works • 55 • : 0bserver1 -

Biden doesnt want the votes of "Death to America" chanters

US Political Madness • 4 • : Hakaiju -

Are the 'Abrahamic Religions' all Really the Worshipping the Same Abrahamic God?

Conspiracies in Religions • 186 • : Coelacanth55 -

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 754 • : Vermilion -

That which the "news" never talks about; Truth about election fraud

Mainstream News • 4 • : Justoneman -

US and Israel Reportedly Conclude Most Hostages Still Held in Gaza Are Dead

War On Terrorism • 151 • : NorthOS -

SHORT STORY WRITERS CONTEST -- April 2024 -- TIME -- TIME2024

Short Stories • 19 • : JJproductions -

I'm new here. Avid conspiracy fan.

Introductions • 11 • : 19Bones79