It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

First you must know that the federal government took America off the gold standard in1933, during a staged bankruptcy called the “Great Depression” and replaced the gold with an economic principle known as, “Negotiable Debt Instruments.”

So if you borrowed money for a Mortgage and there’s no gold or real value to support the paper called U. S. Currency; what did you actually borrow? Factually, you borrowed debt! The Mortgage Company committed the ultimate fraud against you because they loaned you nothing to pay off the imaginary balance, not even their own debt instruments. They then told you that you owe them the unpaid balance of your home and that you must pay them back with interest, in monthly installments!

Here’s how they did it.

At your Closing, the Mortgage Company had you sign a “Promissory Note” in which you promised your sweat, your equity, full faith and credit against an unpaid balance. Then without your knowledge, the Mortgage Company sold your Promissory Note (your credit) to a Warehousing Institution such as, Fannie Mae or Freddie Mac. The Warehousing Institution uses your Promissory Note (your credit) as collateral and generates loans to other people and corporations with interest. Collateral is essential to a corporation because corporations have no money or credit. They’re not real, they’re a fiction and require the sweat, the equity, the full faith and credit of living individuals to breathe and sustain the life of the corporation. Corporate Governments operate under the same principle.

The Warehousing Institution makes money off the “Promissory Note” (your credit) and even though the profits made are nothing more than new (Negotiable Debt Instruments), those instruments still have buying power in a (Negotiable Debt Economy). These debt instruments are only negotiable because of the human ignorance of the American people and the human ignorance of people in other countries of the World,

More Fraud:

The Mortgage Company maintains two sets of books regarding your Mortgage payments. The local set of books, is a record that they loaned you money and that you agreed to repay that money, with interest, each month. The second set of books is maintained in another State office, usually a Bank because the Mortgage Companies usually sell your loan contract to a Bank and agree to monitor the monthly payments in order to conceal the fraud!

In the second set of books, your monthly Mortgage Payment is recorded by the bank as a savings deposit because there is no real loan! When you pay off the fraudulent mortgage, the Bank waits (90) days and then submits a request to the IRS. The request states: “That someone, unknown to this facility; deposited this money into our facility and has abandoned it! May we keep the deposit?” The IRS always gives their permission to the bank to keep the deposit and your hard earned money just feathered the nest of the Rockefeller, Rothschild and eleven other wealthy families in the world!

pepehateme.wordpress.com...

reply to post by tinhattribunal

If I may add........

And the same type of fraud is what your entire life is based upon,every transaction you make,every debt you incur during your life.

This is why so many are slaves without realizing it.You are not you,you are a surety for an artificial entity generated in your namesake,your "Strawman".

The strawman is a negotiable instrument you are held accountable for.

Or sumpin like'at............

If I may add........

And the same type of fraud is what your entire life is based upon,every transaction you make,every debt you incur during your life.

This is why so many are slaves without realizing it.You are not you,you are a surety for an artificial entity generated in your namesake,your "Strawman".

The strawman is a negotiable instrument you are held accountable for.

Or sumpin like'at............

reply to post by tinfoilman

I meant they should be able to save without the value of their savings slowly withering away into nothing over time. And you know damn well what I meant so stop playing stupid games.

People should be allowed to save their money if they wish.

They can, it's a free country. Go ahead.

I know you didn't, but we're talking about the effect of fractional reserve banking and the inflation caused by the process. That inflation is some what justified if those loans have actually helped create real economic growth, which is why banks need to be great lenders otherwise we end up with large bubbles and mass defaults. But I'm saying if they really did just loan out what they had, instead of loaning out money which doesn't really exist, we wouldn't have this problem in the first place and it wouldn't really matter how banks make their loans, because it wouldn't really effect thestrength of our dollar.

There's nothing wrong with banks loaning out what they really have.

I never said there was?

edit on 5/11/2012 by ChaoticOrder because: (no reason given)

reply to post by tinfoilman

Giving out as much money as will be spent is a Keynesian Economics idea.

By keeping demand high, production will always have a market and an incentive to produce.

However, easy money always leads to a boom and bust cycle, as there is not an unlimited supply of everything. Sooner or later something will become scarce and that scarcity will affect prices in an unforseeable way, causing a bust.

The Austrian School of Econimics says that prices should reflect all of the value that is put unto them. Prices should contain information about the world wide state of the economy. In an economy where costs are changed by the money supply rather than the costs of production, there is a disconnection from reality that leads to managerial mistakes and the bust.

Prices of almost everything should go down over time because of increased productivity. Prices always go up. Something has made prices go up 3,000 % since 1900.

Prices in 1910

Prices in 2010

The only thing all of these price increases have in common is money.

And giving a loan to someone to start a new start up plus giving someone else a loan for a car or house adds even more growth. It's not an either or thing. I don't care what the loan is for. I'm not here to debate what's a good loan versus a bad loan. That's for the bank to figure out.

Giving out as much money as will be spent is a Keynesian Economics idea.

By keeping demand high, production will always have a market and an incentive to produce.

However, easy money always leads to a boom and bust cycle, as there is not an unlimited supply of everything. Sooner or later something will become scarce and that scarcity will affect prices in an unforseeable way, causing a bust.

The Austrian School of Econimics says that prices should reflect all of the value that is put unto them. Prices should contain information about the world wide state of the economy. In an economy where costs are changed by the money supply rather than the costs of production, there is a disconnection from reality that leads to managerial mistakes and the bust.

Prices of almost everything should go down over time because of increased productivity. Prices always go up. Something has made prices go up 3,000 % since 1900.

Prices in 1910

Food & beverages

Apples, .19/6 qt basket

Bacon, Swift's, .20/lb

Beans, baked, White Rose, .15/no 3 can

Beef, pot roast, 12.5cents/lb

Bread, .10/3 loaves

Butter, fancy, .30/lb

Cereal, Kellogg's Corn Flakes, .09/box

Crackers, NBC, Uneeda, .10/3 boxes

Eggs, Fresh Western, .27/dozen

Flour, Christian's Best, .3.25/98 b sack

Ham, Swift's Sugar Cured Cal. Ham, .12/lb

Juice, Welch's Grape, .19/pint; .35/quart

Ketchup, .10/bottle

Lamb chops, .18/lb

Macaroni, Muellers, egg noodles, .25/3 boxes

Oats, rolled, New White, .19/6 lbs

Peaches, .15/no 3 can

Peanut brittle, .10/lb

Peanut butter, .09/jar

Root beer extract, .10/bottle

Sardines, domestic, in oil, .25/6 cans

Soup, Campbell's .25/3 cans

Tea, English Breakfast, .35/lb

Vinegar, .10/bottle

Prices in 2010

Food & beverages

(Food is no longer advertised in the newspaper; manufacturer's coupons only.. Foods/prices reported below were for sale in FoodTown, Cedar Knolls, NJ)

Apples, Macintosh, 2.99/3 lb bag

Baby food, Beechnut, 1.00/two 4oz jars

Beef, ground, 90% lean, 3.99/lb

Bananas, .99/3 lbs

Bread, Wonder, 5.00/two 16 oz loaves

Candy, Halloween, jumbo bags (KitKats, Reese'setc.), 4.19/bag

Cereal, Cheerios, 3.79/8.9 oz box

Cheese, Kraft, American Singles, 4.99/16 oz pkg

Coffee, Mxwell House, 3.99/11.5 oz can

Cookies, Nabisco, Mallomars, 3.99/8 oz box

Crackers, Nabisco, Ritz, 3.59/12 oz box

Eggs, Grade A, 2.29/dozen

Fish, tuna, Bumble Bee, solid white albacore, 1.59/3 oz can

Flour, Gold Medal, 2.49/5 lb bag

Juice, V8, 2.99/32 oz bottle

Ketchup, Heinz, 1.69/14 oz bottle

Macaroni, Ronzoni, elbows, .99/16 oz. box

Margarine, I can't believe it's not butter3.59/15 oz container

Mayonnaise, Hellmann's, 3.49/15 oz jar

Milk, 2.19/half gallon

Onions, yellow, 1.99/3 lb bag

Pineapple, fresh, whole, 3.99/each

Potatoes, Yukon Gold, 4.99/5 lbs

Soda, Coca Cola, 1.79/67.6 oz bottle

Soup, Campbell's, tomato, 2.00/three 10.75 oz cans

SPAM, 2.79/12 oz can

Spaghetti sauce, Classico, 2.99/24 oz bottle

Sugar, Domino, 3.99/5lbs

The only thing all of these price increases have in common is money.

The point is that banks transform a signed contract into real money. ......They can loan out 9 times as much as they actually have. Because they are banks, they have the ability to simply change some numbers of their computers and give a person some money, so it's easy for them to loan out money which they don't really have.

This is fantasy land and looking at banking in a wind tunnel. Money is fluid - it changes hands daily in a working economy.

First, banks have deposits on hand that "stick". These deposits aren't going anywhere. Your average retail bank branch can easily have $50 million in deposits at any given time -- and that is just one branch.

Secondly, banks -- in a normal environment - don't just give out loans like candy, the last decade excepted. In normal circumstances, borrowers have to prove that they are creditworthy and have the capacity to repay the loan.

Lastly, banks earn profits. When it collects interest on a loan, where do you think that profit goes? That profit is reinvested in the bank's core business -- lending. Some goes to pay normal operating expenses, but some of these profits are reinvested.

Lending is extremely profitable, if done correctly. Your typical 30 year mortgage earns the bank boatloads in interest. The borrower repays the principal balance a couple times over during the 30 year period. You act as if the bank doesn't earn profits - It does.

The only question on the table is where the money to buy it with came from.

See above. Take a look at your car payment invoice, or your mortgage payment invoice. Look at the amount of interest you pay on these loans. Guess who earns that interest? The bank. This interest paid is profit for the bank, less operating expenses.

What about where you work? If you have equipment, there is a good chance that it is financed with a bank. How about your computers at work? Same thing. How about your building? Your company's owner pays the bank a huge interest check every month to finance the building.

Have inventory? The bank finances it, and your employer pays interest on this financing.

You get the idea. Everywhere you turn, the bank earns profit, interest. Everyone here is acting like banks don't earn money themselves. And that they play some magic hocus-pocus to create funds out of thin air. Banks earn money, profits, in multiple ways.

Student loans. Credit cards. Merchant credit card processing. Every time you swipe your credit card at a gas station or a restaurant, the business owner is paying Chase or Bank of America 2-3% on every dollar swiped.

How about your 401k? Banks are in that business as well. They earn management fees for managing company's investment portfolios.

What about international wires? Banks charge fees for these services. Foreign exchange - Want to send a wire in Euros? Banks charge fees.

The point I am making is that banks have multiple streams of income that all touch our economy in hundreds of ways. They are involved in practically every form of economic transaction, and earn money in many different ways. They don't have to invent or conjure money out of thin air to make loans.

reply to post by Semicollegiate

Inflation? I don't remember saying there was no inflation.

Prices always go up. Something has made prices go up 3,000 % since 1900

Inflation? I don't remember saying there was no inflation.

reply to post by CookieMonster09

You are the one actually living in fantasy land. Justify it with all the technical babble you want, it wont change the facts. We are done here.

You are the one actually living in fantasy land. Justify it with all the technical babble you want, it wont change the facts. We are done here.

reply to post by ChaoticOrder

Well see the problem is, that's just an opinion. You have to justify that statement. The first thing we have to ask is, is it

the gov's job to make sure your money holds value under the mattress where it's not doing anything?

See the fed has the opinion that that is not their job. They take the position that it's better if your cash loses value so you'll invest it or spend it into economic growth instead of saving it and hoarding it.

Maybe the gov has no responsibility to make sure your investments hold their value. Maybe that's your responsibility. If you feel like you're getting screwed by cash, don't hold cash. You should buy silver or gold or start a business or invest in a CD maybe or what have you.

But that's just a difference of opinion.

I meant they should be able to save without the value of their savings slowly withering away into nothing over time. And you know damn well what I meant so stop playing stupid games.

Well see the problem is, that's just an opinion. You have to justify that statement. The first thing we have to ask is, is it

the gov's job to make sure your money holds value under the mattress where it's not doing anything?

See the fed has the opinion that that is not their job. They take the position that it's better if your cash loses value so you'll invest it or spend it into economic growth instead of saving it and hoarding it.

Maybe the gov has no responsibility to make sure your investments hold their value. Maybe that's your responsibility. If you feel like you're getting screwed by cash, don't hold cash. You should buy silver or gold or start a business or invest in a CD maybe or what have you.

But that's just a difference of opinion.

reply to post by tinfoilman

Inflation is only becasue of money creation, correct?

I guess you are saying that all of the inflation was caused from the money created by the Federal Reserve and only that money.

That means the Fed puts money into the economy by giving it to the government and letting the government spent it, and only in this way.

In that case, the sum of all US Government bonds bought by the fed should equal the change in the money supply since 1913.

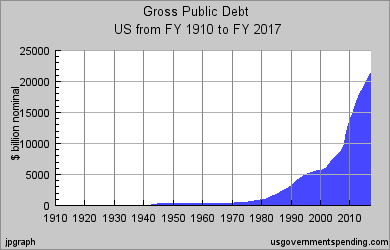

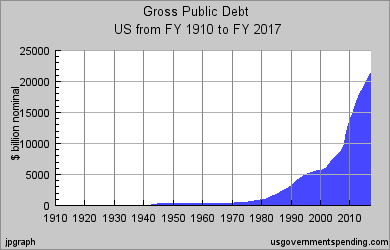

Goverment Debt Since 1913

must use customize chart feature at the link to obtain this chart

This chart shows about an averge of 1 trillion per year since 1980.

30 years would amount to 30 trillion dollars.

However the current money supply is 747 trillion.

www.usdebtclock.org...

The Fed didn't create it all itself, unless there is some other means of money creation the Fed has used all this time.

Inflation? I don't remember saying there was no inflation.

Inflation is only becasue of money creation, correct?

I guess you are saying that all of the inflation was caused from the money created by the Federal Reserve and only that money.

That means the Fed puts money into the economy by giving it to the government and letting the government spent it, and only in this way.

In that case, the sum of all US Government bonds bought by the fed should equal the change in the money supply since 1913.

Goverment Debt Since 1913

must use customize chart feature at the link to obtain this chart

This chart shows about an averge of 1 trillion per year since 1980.

30 years would amount to 30 trillion dollars.

However the current money supply is 747 trillion.

www.usdebtclock.org...

The Fed didn't create it all itself, unless there is some other means of money creation the Fed has used all this time.

reply to post by tinfoilman

But the point is I still have to use cash, I need to have a bank account with a moderate amount of money in it to do what I need to do. I need cash to pay at any shop I go to... and that is really where the real fraud comes into play. We all get paid in cash, and our wages rise extremely slowly, but commodity prices rise at incredibly ridiculous rates... making it harder and harder to keep up with this rat race every single day.

It seems you've overlooked the simple thing I mentioned before: 99% of people put their savings in a bank, and that bank will then proceed to invest those funds in numerous things. I would certainly rather put my money in a bank because I can get interest on those savings. I simply don't see why they feel it's necessary to keep creating endless amounts of money if peoples savings are being put to good use anyway.

See the fed has the opinion that that is not their job. They take the position that it's better if your cash loses value so you'll invest it or spend it into economic growth instead of saving it and hoarding it.

I try to invest my savings in many things, one of the ones I like the most is bitcoin because I don't need to stash away a tonne of precious metals and it can't be debased by the Government or any other central authority.

Maybe the gov has no responsibility to make sure your investments hold their value. Maybe that's your responsibility. If you feel like you're getting screwed by cash, don't hold cash.

But the point is I still have to use cash, I need to have a bank account with a moderate amount of money in it to do what I need to do. I need cash to pay at any shop I go to... and that is really where the real fraud comes into play. We all get paid in cash, and our wages rise extremely slowly, but commodity prices rise at incredibly ridiculous rates... making it harder and harder to keep up with this rat race every single day.

edit on

5/11/2012 by ChaoticOrder because: (no reason given)

reply to post by tinfoilman

No

The government can't decide what money should be worth, no number of people can really figure that out.

The market should decide what money is worth. The market decides impartially and correctly.

The first thing we have to ask is, is it

the gov's job to make sure your money holds value under the mattress where it's not doing anything?

No

The government can't decide what money should be worth, no number of people can really figure that out.

The market should decide what money is worth. The market decides impartially and correctly.

Originally posted by Semicollegiate

reply to post by tinfoilman

The first thing we have to ask is, is it

the gov's job to make sure your money holds value under the mattress where it's not doing anything?

No

The government can't decide what money should be worth, no number of people can really figure that out.

The market should decide what money is worth. The market decides impartially and correctly.

Exactly the words I was looking for.

I dont know much about banking, but lets say my country has $10 million and I split that between all the citizens for work they do, food production,

housing, transportation and all.

So now there is $10 mill in circulation, people can either trade or use the legal tender. I do not understand why that amount would increase over time.

So now there is $10 mill in circulation, people can either trade or use the legal tender. I do not understand why that amount would increase over time.

reply to post by Semicollegiate

I'm not sure of your point exactly. I said there are certain types of money creation that only the fed does. But there are other types.

I'm not sure of your point exactly. I said there are certain types of money creation that only the fed does. But there are other types.

reply to post by Semicollegiate

The market does have an influence but our current system was set up with the idea that there should be some central control for certain situations. Like when the market crashes and so forth. Then they can try fix it by lowering interest rates and so forth. Like they're doing now.

I know your opinion is the opposite. But not everyone shares that opinion.

The market does have an influence but our current system was set up with the idea that there should be some central control for certain situations. Like when the market crashes and so forth. Then they can try fix it by lowering interest rates and so forth. Like they're doing now.

I know your opinion is the opposite. But not everyone shares that opinion.

reply to post by Semicollegiate

Like for example if there was a systemic banking collapse or a currency crisis. Martial law could break out and 99 percent of the people screaming get rid of the fed! Would be the same people screaming in the streets about why doesn't the gov do something? Why doesn't the fed do something? Well they can't there's no fed.

The only way the gov could do anything is if they had at least some control of the situation.

Like for example if there was a systemic banking collapse or a currency crisis. Martial law could break out and 99 percent of the people screaming get rid of the fed! Would be the same people screaming in the streets about why doesn't the gov do something? Why doesn't the fed do something? Well they can't there's no fed.

The only way the gov could do anything is if they had at least some control of the situation.

reply to post by tinfoilman

The idea is that money is only a medium of exchange.

If more medium of exchange is needed, make smaller denominations, not more money in total.

Inflation is a hidden tax benefitting the first spenders of the new money.

And they know that.

The idea is that money is only a medium of exchange.

If more medium of exchange is needed, make smaller denominations, not more money in total.

Inflation is a hidden tax benefitting the first spenders of the new money.

And they know that.

reply to post by tinfoilman

Yeah, it's like you can't get there from here.

Changing to hard money won't be easy or soon.

There would be no economic problems if we had always had hard money.

Like for example if there was a systemic banking collapse or a currency crisis. Martial law could break out and 99 percent of the people screaming get rid of the fed! Would be the same people screaming in the streets about why doesn't the gov do something? Why doesn't the fed do something? Well they can't there's no fed.

The only way the gov could do anything is if they had at least some control of the situation.

Yeah, it's like you can't get there from here.

Changing to hard money won't be easy or soon.

There would be no economic problems if we had always had hard money.

reply to post by Semicollegiate

Well first of all most money is digital now. Denominations are irrelevant. And I'm pretty sure we would still have economic problems. We just wouldn't have the boom bust cycle like we have now.

Well first of all most money is digital now. Denominations are irrelevant. And I'm pretty sure we would still have economic problems. We just wouldn't have the boom bust cycle like we have now.

edit on 6-11-2012 by tinfoilman because: (no reason given)

new topics

-

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 22 minutes ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 37 minutes ago -

Weinstein's conviction overturned

Mainstream News: 1 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 3 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 3 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 8 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 17 hours ago, 11 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 3 hours ago, 7 flags -

Weinstein's conviction overturned

Mainstream News: 1 hours ago, 6 flags -

Sunak spinning the sickness figures

Other Current Events: 17 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 15 hours ago, 5 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 3 hours ago, 5 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago, 3 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 37 minutes ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 8 hours ago, 2 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago, 1 flags

active topics

-

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 85 • : Consvoli -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 50 • : matafuchs -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 139 • : cherokeetroy -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 756 • : matafuchs -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 3 • : network dude -

Graham Hancock being proven right all along about ancient humans in America.

Ancient & Lost Civilizations • 106 • : JonnyC555 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 47 • : matafuchs -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 1 • : IndieA -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 673 • : Thoughtful3 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 66 • : SchrodingersRat