It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by newcovenant

Wow, I'm stunned!

There actually IS a Republican who understands economics and basic mathematics, reads the facts and statistics, and doesn't allow the party propaganda to convince him that up is down and back is front! I'm truly amazed.

Why is he seemingly alone? He knows the facts and he admits that the Republican propaganda BS is just that, complete BS. So how do millions of others resolutely refuse to accept the proven data and statistics and cling to their idea that Obama is responsible and taxing the rich is a bad move?

All of the evidence and statistics prove that there is a right course of action to take, and a wrong course of action to take. The evidence is out there for all to see. Obama did not cause this crisis, Bush created a worse crisis by throwing money at irresponsible gamblers without attaching any conditions, spending under Obama has been extremely low (even though the rabid Republicans refuse to accept the proven EVIDENCE of that)...

It's good to see that not all Republicans are so indoctrinated into their party that they are willing to face facts and accept the truth, even when it goes against the party BS.

I don't "trust" either party, but when it comes to hypocrisy, denial, religious insanity and propaganda, no party beats the Republican party. They really are a joke to most people outside of the US, and it's a constant surprise to all reasonable people around the world that they would be taken seriously as a political party - let alone actually have any power.

Why do you people vote for these lunatics?

Wow, I'm stunned!

There actually IS a Republican who understands economics and basic mathematics, reads the facts and statistics, and doesn't allow the party propaganda to convince him that up is down and back is front! I'm truly amazed.

Why is he seemingly alone? He knows the facts and he admits that the Republican propaganda BS is just that, complete BS. So how do millions of others resolutely refuse to accept the proven data and statistics and cling to their idea that Obama is responsible and taxing the rich is a bad move?

All of the evidence and statistics prove that there is a right course of action to take, and a wrong course of action to take. The evidence is out there for all to see. Obama did not cause this crisis, Bush created a worse crisis by throwing money at irresponsible gamblers without attaching any conditions, spending under Obama has been extremely low (even though the rabid Republicans refuse to accept the proven EVIDENCE of that)...

It's good to see that not all Republicans are so indoctrinated into their party that they are willing to face facts and accept the truth, even when it goes against the party BS.

I don't "trust" either party, but when it comes to hypocrisy, denial, religious insanity and propaganda, no party beats the Republican party. They really are a joke to most people outside of the US, and it's a constant surprise to all reasonable people around the world that they would be taken seriously as a political party - let alone actually have any power.

Why do you people vote for these lunatics?

Regardless of the winner in November tough decisions will NEED to be made to get this country back on track. Obama has to know that he can't keep

going down this road of reckless spending and if Romney would win he would need to not just slash entitlement programs, but he would need to raise

taxes along the way... Our country is in financial ruins and NONE of these politicians seem to get it. If a household ran their bank accounts and

spending like the Govt. they would be living on the streets homeless by now. Just because you're the POTUS doesn't give you the right to spend our

hard earned money like a total *sshole..

Reverse the Regan era tax code, problem solved. The people that can afford to pay, don't.

Originally posted by spinalremain

The fact of this issue is that supply side is nothing more than a scam.

If supply side economics was a job creator, why are we suffering unemployment upward of 8% right now?

We tried it for decades. It doesn't work and now the public knows it doesn't work. Stop pushing the elite agenda and start using your brain, people.

Posted Via ATS Mobile: m.abovetopsecret.com

Exactly right Trickle down doesn't work and it never will work. When the middle class has a lower tax burden then they have more money to put back into the economy when the wealthy has a lower tax burden then they just have more money to hide overseas. There is no good reason why someone like Romney should only pay 14% and someone making 50K a year should pay upwards to 30%.

Entitlements are the problem.

a. I was 10 years active duty and got paid $25k to leave when the iron curtain fell, a company can't afford to do that.

b. Paying someone 50% pay for the rest of their life after working 20 years? Impossible to sustain.

c. People making minimal wage or making nothing and living in $100k+ houses for free. Not sustainable.

d. Illegals flooding across the borders and taking our jobs, taking more jobs than our unemployment rate. Unsustainable.

e. Forcing hospitals to give medical care to anyone that walks in a door and having bankrupted over 80 hospitals because of illegals doing this. Unsustainable.

f. Over $5 billion in security and travel funds for a president's four years in office. Unsustainable.

g. Schools falling further behind in education levels because no child can be left behind and poorly performing teachers are protected by the unions. Unsustainable.

Entitlements are the problem.

Rich

a. I was 10 years active duty and got paid $25k to leave when the iron curtain fell, a company can't afford to do that.

b. Paying someone 50% pay for the rest of their life after working 20 years? Impossible to sustain.

c. People making minimal wage or making nothing and living in $100k+ houses for free. Not sustainable.

d. Illegals flooding across the borders and taking our jobs, taking more jobs than our unemployment rate. Unsustainable.

e. Forcing hospitals to give medical care to anyone that walks in a door and having bankrupted over 80 hospitals because of illegals doing this. Unsustainable.

f. Over $5 billion in security and travel funds for a president's four years in office. Unsustainable.

g. Schools falling further behind in education levels because no child can be left behind and poorly performing teachers are protected by the unions. Unsustainable.

Entitlements are the problem.

Rich

Originally posted by jibeho

Originally posted by Taiyed

reply to post by jibeho

OH, well if you say so, then I guess Ben Stein (a respected economic mind) is just wrong.

I'm sure you have credentials that match or exceed Mr Steins, right? Could we hear what those credentials are?

Too Funny!!

Just look up what I said. I study history...

So, its wrong to think that Stein may be on the wrong side of history....???

Whatever floats your boat buddy...edit on 26-10-2012 by jibeho because: (no reason given)

You can't tell if you are on the right or wrong side of history until you SAY OR DO SOMETHING and time goes by to prove you right or wrong. If history repeats itself, Stein is on the same side as history. He is trying not to repeat history's failures but to repeat history's proved success.

Originally posted by Oouthere

Entitlements are the problem.

a. I was 10 years active duty and got paid $25k to leave when the iron curtain fell, a company can't afford to do that.

b. Paying someone 50% pay for the rest of their life after working 20 years? Impossible to sustain.

c. People making minimal wage or making nothing and living in $100k+ houses for free. Not sustainable.

d. Illegals flooding across the borders and taking our jobs, taking more jobs than our unemployment rate. Unsustainable.

e. Forcing hospitals to give medical care to anyone that walks in a door and having bankrupted over 80 hospitals because of illegals doing this. Unsustainable.

f. Over $5 billion in security and travel funds for a president's four years in office. Unsustainable.

g. Schools falling further behind in education levels because no child can be left behind and poorly performing teachers are protected by the unions. Unsustainable.

Entitlements are the problem.

Rich

Interesting theory. Wonder what your credentials are?

Do they top Ben Steins?

Because he is completely disagreeing with you on this, and methodically lays out why.

edit on 26-10-2012 by newcovenant because: (no reason

given)

I do believe that even taxing the super rich at 100%, will still not get a grip on the debt .. because its not the debt .. its the compounding

interest.

I like Ben Stein but he is no old school republican or even leaning right. As long as you are an Obot, you get a pass.

I like Ben Stein but he is no old school republican or even leaning right. As long as you are an Obot, you get a pass.

Originally posted by Oannes

Reverse the Regan era tax code, problem solved. The people that can afford to pay, don't.

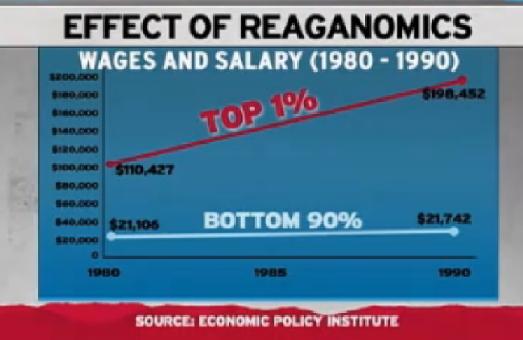

True...Reagonomics was a disaster for 70% of the country.

The only people who did do well were investors and people who had money in the stock market.

Originally posted by Wrabbit2000

Well, it's just a wild thing to see who has what opinions these days, isn't it? Take this one for instance...

By the way....this, from their own reports:

How is it the Rich don't pay their fair share? The Federal Government simply SPENDS MORE than even this tax structure can support and that's going quite a distance.edit on 26-10-2012 by Wrabbit2000 because: (no reason given)

"Their fair share" is not the question.

Keeping the country from falling over a fiscal cliff is.

Here is another interesting view point as long as we are pulling out the charts and graphs.

edit on 26-10-2012 by newcovenant because: (no reason given)

reply to post by newcovenant

Credentials? 2+2=4.

(No income) - $100K (1.5 @ 20 year intervals) = bankrupt government

$30K x 50%(2% inflation) x 50 years + medical benefits = bankrupt government

I can take my shoes off and do numbers....it's not really difficult.

Rich

Credentials? 2+2=4.

(No income) - $100K (1.5 @ 20 year intervals) = bankrupt government

$30K x 50%(2% inflation) x 50 years + medical benefits = bankrupt government

I can take my shoes off and do numbers....it's not really difficult.

Rich

edit on 26-10-2012 by Oouthere because: (no reason given)

reply to post by Oouthere

I am sure you know your stuff friend but listening to you do your math here, I have to say that you are sounding to me a little like Joe the Plumber. Forgive me if I don't take what you say and your remedies for saving the economy and America in the process...to heart.

I am sure you know your stuff friend but listening to you do your math here, I have to say that you are sounding to me a little like Joe the Plumber. Forgive me if I don't take what you say and your remedies for saving the economy and America in the process...to heart.

And Ben Stein just got kicked out of the party I got ran out for having an opinion rather similar to his.

I love Mr. Stein. Right or wrong he calls it as he sees it, regardless of what side of the line he sits. He uses his brain instead of pandering to his

party. If there more folks like him in every political party, we'd have a much more balanced America, one that compromise could actually happen in.

for Ben.

Originally posted by Oannes

Reverse the Regan era tax code, problem solved. The people that can afford to pay, don't.

Now that you mention it, here is a chart to show the way Reaganomics trickled down....(or rather UP)

Look what all those grateful "job creators" did for the bottom 90%

Absolutely nothing.

edit on 26-10-2012 by newcovenant because: (no reason given)

reply to post by newcovenant

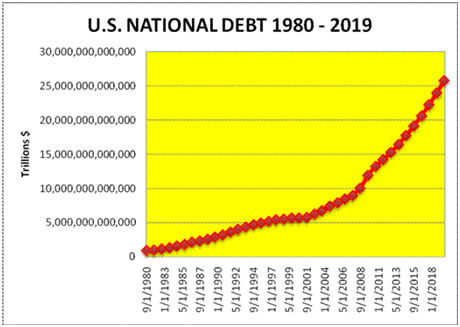

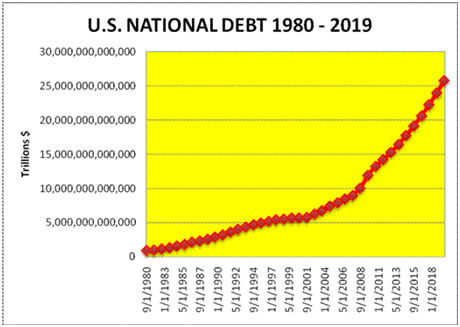

Well, as you may notice from my posts...I like numbers too. The national debt is a set of numbers Obama simply loses on and he loses across the board, singularly as the worst in history. Bar none. Without comparable example in even RATIO outside of the spike to the stratosphere for World War II. I looked at your chart and video...and I have a few of those myself, Very similar charts. Those are correct as far as they go, too. I won't dispute what George W and his Father did to us on spending. Reagan will always get a pass. I don't expect those who didn't live with the Soviet Union as a true reality to understand, but I don't fault Reagan a dime it took to end the daily and constant threat of possible global nuclear war.

Those charts tho.. yes.. Accurate as far as they go. I have no dispute with the accuracy of this one:

(It's big)

(It's big)

Source

You know the problem though...and the U.S. Treasury is as bad as anyone about this, they don't generally cover Obama's years. Treasury stops it's stats as I saw them a few minutes ago at 2010. Hmm.. now that isn't very accurate when we're living in 2012. It's that CURRENT Administration we're deciding on another 4 years of, after all. Not the past one.

So, what does the last 4 years and the next ones to come look like under Obama and his planning?

Source

Source

now that one looks a little pessimistic. I'll be fair and look at the White Houses own projections.

(White House 2013 fy Budget Proposal)

(White House 2013 fy Budget Proposal)

Now it's really important to note here, Bush's worst deficit year was 501 Billion Dollars (2004 Inflation Adjusted) and by the same source, Obama's lowest one to date is 1.1 TRILLION. As their figures in the chart above show out of the White House itself, their best projections show it remaining ABOVE 600 Billion right on through 2022.

Is Romney better? I dunno....but I DO know what we are being offered here is doom. Flip for your flavor of it, I suppose... 4 years of this plan though and we just see a 10 year projection holding to deficits above anything in previous history. Umm.. Nope. Not my vote.

Well, as you may notice from my posts...I like numbers too. The national debt is a set of numbers Obama simply loses on and he loses across the board, singularly as the worst in history. Bar none. Without comparable example in even RATIO outside of the spike to the stratosphere for World War II. I looked at your chart and video...and I have a few of those myself, Very similar charts. Those are correct as far as they go, too. I won't dispute what George W and his Father did to us on spending. Reagan will always get a pass. I don't expect those who didn't live with the Soviet Union as a true reality to understand, but I don't fault Reagan a dime it took to end the daily and constant threat of possible global nuclear war.

Those charts tho.. yes.. Accurate as far as they go. I have no dispute with the accuracy of this one:

(It's big)

(It's big) Source

You know the problem though...and the U.S. Treasury is as bad as anyone about this, they don't generally cover Obama's years. Treasury stops it's stats as I saw them a few minutes ago at 2010. Hmm.. now that isn't very accurate when we're living in 2012. It's that CURRENT Administration we're deciding on another 4 years of, after all. Not the past one.

So, what does the last 4 years and the next ones to come look like under Obama and his planning?

now that one looks a little pessimistic. I'll be fair and look at the White Houses own projections.

(White House 2013 fy Budget Proposal)

(White House 2013 fy Budget Proposal) Now it's really important to note here, Bush's worst deficit year was 501 Billion Dollars (2004 Inflation Adjusted) and by the same source, Obama's lowest one to date is 1.1 TRILLION. As their figures in the chart above show out of the White House itself, their best projections show it remaining ABOVE 600 Billion right on through 2022.

Is Romney better? I dunno....but I DO know what we are being offered here is doom. Flip for your flavor of it, I suppose... 4 years of this plan though and we just see a 10 year projection holding to deficits above anything in previous history. Umm.. Nope. Not my vote.

Look at what was mentioned in the OP

The nation was not prosperous because of the High Taxes...

History in perspective...

www.aei-ideas.org...

One other point to note about Steins reference to that 91% tax rate...1950's tax code was so full of shelters and loopholes that the 91% rate only ended up around 45%

www.tomwoods.com...

Now, put Ben's comments into proper historical context.... look at the numbers look at the charts...

"The biggest growth and prosperity we've ever had in this country was from roughly 1941 to 1973. That was the best years we've ever had and those were years of much higher taxes than we have now." "Taxes were at 70, 80 percent then," said Steve Doocy. "And yet, we were very prosperous," Stein replied. "The highest rate was in the 90s during parts of the 50s, and yet we were very prosperous."

The nation was not prosperous because of the High Taxes...

History in perspective...

1. The 1950s was no Golden Age. The U.S. economy grew by an average of 3.4% a year between 1948 and 2007. How did the 1950s do in comparison? If you measure the 1950s from 1950 to 1959, it did a bit better than average, growing at an annual rate of 3.6%. If you measure the decade from 1951 to 1960, it grew at a below average 3.0% rate. The period also saw three recessions, July 1953-May 1954, August 1957-April 1958, and April 1960-February 1961. Now, overall, it was a strong period for the economy, especially for folks with still-fresh memories of the Great Depression. But recall that John F. Kennedy’s 1960 presidential campaign said he would “get this country moving again.” That’s a slogan a politician uses after a decade of stagnation, not hypergrowth. (Of course, JFK sharply cut taxes and the economy boomed.)

From 1950 to 1963, income tax revenue averaged 7.5 percent of GDP; that’s less than in the Reagan years when rates were being slashed. This could suggest that rates are right around the Laffer Curve equilibrium point in the current economy.

The post-war U.S. economy was in an incredibly strong international position. Did the the “91% or Bust” crowd forget about World War Two? A National Bureau of Economic Research study described the situation this way: “At the end of World War II, the United States was the dominant industrial producer in the world. With industrial capacity destroyed in Europe—except for Scandinavia—and in Japan and crippled in the United Kingdom, the United States produced approximately 60 percent of the world output of manufactures in 1950, and its GNP was 61 percent of the total of the present (1979) OECD countries. This was obviously a transitory situation.”

When you’re as dominant as the U.S. was, it papers over a lot of bad economic policy coming from Washington. Today, of course, America competes with a slew of strong, technologically advanced economies including the EU, China, and Japan.

www.aei-ideas.org...

One other point to note about Steins reference to that 91% tax rate...1950's tax code was so full of shelters and loopholes that the 91% rate only ended up around 45%

The dishonesty or perhaps ignorance in the tax debate that is going on today is the complete misrepresentation of the pre-TRA86 [Tax Reform Act of 1986] higher marginal rates in the old ’53 code. Sure the marginal rates were insane, but the underlying tax code was rife with loopholes that a good tax planner (I was one) could exploit to get a person’s effective tax rate as low or lower then it is today. Those loopholes are no longer part of the tax code which is a good thing as they encouraged investors to invest in projects that had no economic viability other then the income sheltering effect they created.

What else is ignored in the conversation is the fact that there was a massive amount of tax fraud at all income levels under the old code. It was so bad and so common that most people took pride in telling others how they cheated on their taxes. When I was practicing it was quite common for us to pick up clients that had owned businesses that had grown into large enterprises that cheated extensively on their income taxes sometimes for decades. Usually the only reason this ever got exposed was due to the owners wanting to sell or go public.

www.tomwoods.com...

Now, put Ben's comments into proper historical context.... look at the numbers look at the charts...

reply to post by Wrabbit2000

That is your opinion. If I were having a heart transplant I would want an expert in the field and not someone who reads up on them. Pardon me for saying so but Ben Stein agrees with this President on this issue alone. He does not agree with him on any other. I trust his knowledge here in this matter since he has no alliance to the President whatsoever and there is no reason for him to lie. I will not trust the charts and theories put forth of those with an ax to grind, who simply will say anything to get Obama out.

That is your opinion. If I were having a heart transplant I would want an expert in the field and not someone who reads up on them. Pardon me for saying so but Ben Stein agrees with this President on this issue alone. He does not agree with him on any other. I trust his knowledge here in this matter since he has no alliance to the President whatsoever and there is no reason for him to lie. I will not trust the charts and theories put forth of those with an ax to grind, who simply will say anything to get Obama out.

reply to post by jibeho

He wasn't saying High Taxes CAUSED prosperity.

He is saying that Taxes, high or low, have no EFFECT on prosperity.

The nation was not prosperous because of the High Taxes

He wasn't saying High Taxes CAUSED prosperity.

He is saying that Taxes, high or low, have no EFFECT on prosperity.

reply to post by Wrabbit2000

You are looking at debt when more importantly you should be looking at growth.

I may owe money but if I am not growing - if I am still dying,

it does nothing (and does not even bode well) to lessen that debt.

You are looking at debt when more importantly you should be looking at growth.

I may owe money but if I am not growing - if I am still dying,

it does nothing (and does not even bode well) to lessen that debt.

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 1 hours ago -

Electrical tricks for saving money

Education and Media: 4 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 5 hours ago -

Sunak spinning the sickness figures

Other Current Events: 6 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 6 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 8 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 9 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 11 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 16 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 5 hours ago, 8 flags -

Bobiverse

Fantasy & Science Fiction: 16 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 13 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 4 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 6 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 6 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 8 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 11 hours ago, 1 flags

active topics

-

Electrical tricks for saving money

Education and Media • 4 • : Lumenari -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 19 • : WeMustCare -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 38 • : SchrodingersRat -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 54 • : Ophiuchus1 -

DONALD J. TRUMP - 2024 Candidate for President - His Communications to Americans and the World.

2024 Elections • 514 • : WeMustCare -

The Acronym Game .. Pt.3

General Chit Chat • 7744 • : bally001 -

Truth Social goes public, be careful not to lose your money

Mainstream News • 128 • : Astyanax -

Sunak spinning the sickness figures

Other Current Events • 5 • : glen200376 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 44 • : MikeDeGrasseTyson -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 31 • : budzprime69