It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I'm glad you brought that ratio up because that is also ridiculously high. Here you go:

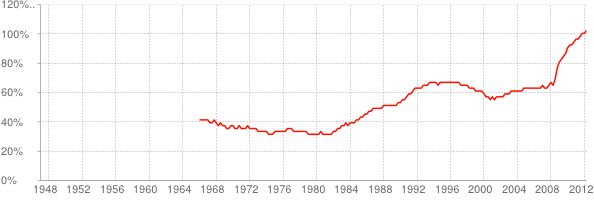

Debt to GPD Ratio

First off Debt to GDP is at an all time high of 101.73%. Keep in mind that according to the Euro Convergence Criteria this ratio must be at or below 60% to be eligible to be in the EU which the US isn't in, but I believe its still a good percentage to shoot for.

Let's look at a few of these charts:

So according to this graph as well as the table data from the site I posted, we were right above 60% when Obama took office and then the ratio proceeded to almost double.

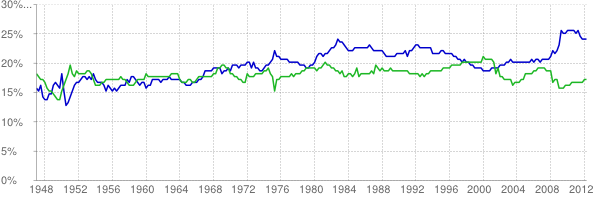

According to this graph the gap between receipts and expenditures has never been wider and again the gap occurred when Obama took office.

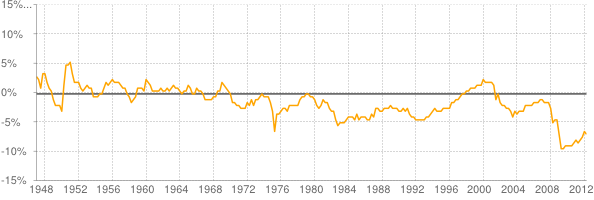

Here's another ratio to observe. Notice a trend starting at 2008?

Now to address your other question, here is a list of all major countries and their GDP to Debt ratios:

Debt-to-GDP Ratios of countries

For your convenience I'll list the top countries above 100% and their ratio (note this data was collected in 2011 and is probably off by a few percentage points at this point, hence the discrepancy between the US's two ratios):

1. Zimbabwe: 230.8%

2. Japan: 208.2%

3. Saint Kitts and Nevis: 200%

4. Greece: 165.3%

5. Lebanon: 137.1%

6. Eritrea: 133.82%

7. Iceland: 130.1%

8. Antigua and Barbuda: 130%

9. Jamaica: 126.5%

10. Italy: 120.9%

11. Singapore: 118.2%

12. Portugal: 108.5%

13. Ireland: 108.4%

14. Barbados: 103.9%

15. United States: 102.94%

16. Sudan: 100.8%

I'd like to note that out of 180 countries on that list the United States had the 15th highest ratio. Other countries of note on this list are: Japan, Greece, Iceland, Italy, Portugal, and Ireland. Also back to the whole needing to be at or below 60% dept to GDP ratio. Of the 180 countries on this list, 49 are at 62% or above which is 27% of the countries in this list. In other words a quarter of the world's countries are above the Euro Convergence Criteria. Now obviously not all those countries (including the US) are in the EU, but it is still a percentage worth looking at.

Debt to GPD Ratio

First off Debt to GDP is at an all time high of 101.73%. Keep in mind that according to the Euro Convergence Criteria this ratio must be at or below 60% to be eligible to be in the EU which the US isn't in, but I believe its still a good percentage to shoot for.

Government debt: The ratio of gross government debt to GDP must not exceed 60% at the end of the preceding fiscal year. Even if the target cannot be achieved due to the specific conditions, the ratio must have sufficiently diminished and must be approaching the reference value at a satisfactory pace.

Let's look at a few of these charts:

Total Debt as a Fraction of GDP

So according to this graph as well as the table data from the site I posted, we were right above 60% when Obama took office and then the ratio proceeded to almost double.

Government Receipts and Expenditures as a Fraction of GDP

According to this graph the gap between receipts and expenditures has never been wider and again the gap occurred when Obama took office.

Government Budget Surplus or Deficit as a Fraction of GDP: ( Receipts - Expenditures )

Here's another ratio to observe. Notice a trend starting at 2008?

Now to address your other question, here is a list of all major countries and their GDP to Debt ratios:

Debt-to-GDP Ratios of countries

For your convenience I'll list the top countries above 100% and their ratio (note this data was collected in 2011 and is probably off by a few percentage points at this point, hence the discrepancy between the US's two ratios):

1. Zimbabwe: 230.8%

2. Japan: 208.2%

3. Saint Kitts and Nevis: 200%

4. Greece: 165.3%

5. Lebanon: 137.1%

6. Eritrea: 133.82%

7. Iceland: 130.1%

8. Antigua and Barbuda: 130%

9. Jamaica: 126.5%

10. Italy: 120.9%

11. Singapore: 118.2%

12. Portugal: 108.5%

13. Ireland: 108.4%

14. Barbados: 103.9%

15. United States: 102.94%

16. Sudan: 100.8%

I'd like to note that out of 180 countries on that list the United States had the 15th highest ratio. Other countries of note on this list are: Japan, Greece, Iceland, Italy, Portugal, and Ireland. Also back to the whole needing to be at or below 60% dept to GDP ratio. Of the 180 countries on this list, 49 are at 62% or above which is 27% of the countries in this list. In other words a quarter of the world's countries are above the Euro Convergence Criteria. Now obviously not all those countries (including the US) are in the EU, but it is still a percentage worth looking at.

edit on 17-10-2012 by Krazysh0t because: (no reason given)

edit on 17-10-2012 by Krazysh0t because: (no reason

given)

There are valid points presented in this thread.

Star for the individual who chooses to continue.

I'll be back to offer counter-points once I can afford the time.

Until then:

Star for the individual who chooses to continue.

I'll be back to offer counter-points once I can afford the time.

Until then:

new topics

-

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago -

Bobiverse

Fantasy & Science Fiction: 9 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago -

Former Labour minister Frank Field dies aged 81

People: 11 hours ago