It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

90% of US Households Face Huge Tax Hike Next

Year

Coming on January 2nd.

The current "tax cut" package expires.

The big question is whether or not this will trigger a new recession on top of what we have now.

Related Link:

Coming on January 2nd.

The current "tax cut" package expires.

The big question is whether or not this will trigger a new recession on top of what we have now.

On November 7th, while cleaning crews are still tidying up from election night parties, America's political class will be hurling themselves into another essential battle over government spending, taxes and debt. On January 2nd, 2013, absent some kind of budget deal, America will fall off the "fiscal cliff" and face a massive tax increase and across the board cuts in government spending. Like most crisis these days, its a creation of politicians.

A new study from the Brookings Institution's Tax Policy Center finds that the expiration of the Bush-ear tax cuts at the end of the year will hit Americans with a $500 billion tax hike. While liberal talking points suggest that only the wealthy received a tax cut under Bush, in fact every income group saw their taxes reduced. The rich got "more" tax cuts for the simple reason that they pay more in taxes. The expiration of the Bush tax cuts will hit everybody......

According to the study, almost 9 out of 10 households would see higher taxes. The economic impact is likely to be disastrous, as the economy is already teetering on the brink of recession.

90% of US Households Face Huge Tax Hike Next Year

This could be a Diaster waiting to happen

Related Link:

Almost nine in 10 households would pay more next year if the economy absorbs all of the tax increases in the so-called "fiscal cliff," a think tank reported Monday.

The report from the Urban-Brookings Tax Policy Center found that people in the U.S. would owe the Treasury a total of $536 billion more in 2013 if the fiscal cliff were not averted, with the average household taking a hit of almost $3,500.

Report: Nine in 10 would pay more taxes after the ‘fiscal cliff’

scare mongering nothing more than that.

The 90% is complete nonsense unless people who are on welfare and foodstamps are going to be required to pay income tax on those benefits next year.

9 out of 10 will pay more taxes? that would mean that 9 out of 10 households actually have to have earned income to pay taxes on.47% pay no taxes now, that includes people on welfare and people on social security.

If that 90% is correct that means that at least 37% of that 47% will have to start paying taxes which also means that only 10% of that 47% are now on welfare or SS or other non taxable government handouts.

The 90% figure is nonsense, the numbers just don`t jive, nice scare mongering though.

The 90% is complete nonsense unless people who are on welfare and foodstamps are going to be required to pay income tax on those benefits next year.

9 out of 10 will pay more taxes? that would mean that 9 out of 10 households actually have to have earned income to pay taxes on.47% pay no taxes now, that includes people on welfare and people on social security.

If that 90% is correct that means that at least 37% of that 47% will have to start paying taxes which also means that only 10% of that 47% are now on welfare or SS or other non taxable government handouts.

The 90% figure is nonsense, the numbers just don`t jive, nice scare mongering though.

edit on 1-10-2012 by Tardacus because: (no reason

given)

edit on 1-10-2012 by Tardacus because: (no reason given)

edit on 1-10-2012 by Tardacus because: (no reason

given)

reply to post by xuenchen

This sources to Breitbart, their article sources to another political opinion/blog site called "The Hill". So I cut to the chase and simply Googled the tax study myself.

It is a PDF and can be found here.

I have yet to read it, as it's rather large. But blogs sourcing blogs that source other blogs kind of worry me.

~Heff

Already I found this:

Temporary tax cuts expiring is fine with me. I don't want any Bush era tax cuts remaining around. And as for the other aspect...

Are Republicans actually complaining about an end to the stimulus? If so then I'm late, I'm late, for a very important date.... and must be off for tea with the Mad Hatter.

This sources to Breitbart, their article sources to another political opinion/blog site called "The Hill". So I cut to the chase and simply Googled the tax study myself.

It is a PDF and can be found here.

I have yet to read it, as it's rather large. But blogs sourcing blogs that source other blogs kind of worry me.

~Heff

Already I found this:

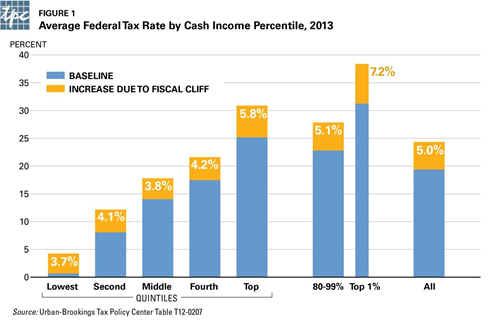

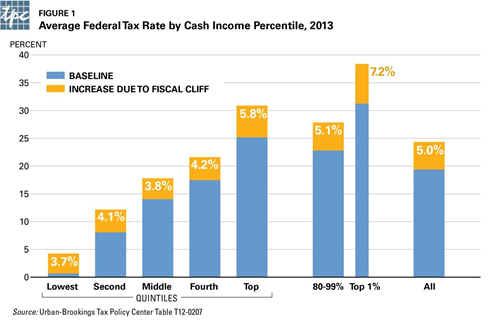

The components of the fiscal cliff have different effects on households at different income levels.

o For most households, the two biggest increases would be the expiration of the temporary cut in Social Security taxes and the expiration of the 2001/2003 tax cuts.

o Households with low incomes would be particularly affected by the expiration of the credits expanded or created by the 2009 stimulus.

o Households at the highest income levels would be particularly affected by expiration of the 2001/2003 tax cuts that apply to upper income levels and by the new health reform taxes.

o Upper middle-income households would be particularly affected by the expiration of the AMT patch.

Temporary tax cuts expiring is fine with me. I don't want any Bush era tax cuts remaining around. And as for the other aspect...

Are Republicans actually complaining about an end to the stimulus? If so then I'm late, I'm late, for a very important date.... and must be off for tea with the Mad Hatter.

edit on 10/1/12 by Hefficide because: (no reason given)

I swear the timing on this is just oh-so perfect. A few months after the election, suddenly 90% of tax-paying households are raped for more taxes.

This usually causes a bunch of people to suddenly decide to just not file a return. In my household, we are hit particularly hard, since our income comes from day trading, so it is considered capital gains, and is taxed at a much higher rate than straight wages.

I guess the thing that really chaps my hide about paying taxes is, we're only paying for the interest on the money printed by the fed. All that chest-beating and crying about paying for welfare queens and abortions is just smoke and mirrors. We do everything on credit, and like a credit card junkie who keeps getting more cards, that's all we have. The real wealth is long gone.

This usually causes a bunch of people to suddenly decide to just not file a return. In my household, we are hit particularly hard, since our income comes from day trading, so it is considered capital gains, and is taxed at a much higher rate than straight wages.

I guess the thing that really chaps my hide about paying taxes is, we're only paying for the interest on the money printed by the fed. All that chest-beating and crying about paying for welfare queens and abortions is just smoke and mirrors. We do everything on credit, and like a credit card junkie who keeps getting more cards, that's all we have. The real wealth is long gone.

reply to post by Tardacus and Heeficide

Dear Gentlemen,

I'm glad that you linked to the .pdf. That really does have to happen sooner or later in a thread like this. thank you very much. I pulled a couple of things from it, hope you don't mind if I put them up. These are some of the tax benefits that are ending:

It appears that the figure of approximately 90% could very well be accurate. The amount you owe will go up, or your refund will go down if you have any wages or salaries, are married, or have children. There may be other provisions which I missed in a first, quick reading.

If you care about the politics involved, you can count on Romney (if he is elected) getting strongly blamed for this because it will happen on his watch.

I'm scared.

With respect,

Charles1952

Dear Gentlemen,

I'm glad that you linked to the .pdf. That really does have to happen sooner or later in a thread like this. thank you very much. I pulled a couple of things from it, hope you don't mind if I put them up. These are some of the tax benefits that are ending:

So, even poor families will get back $500 less, per child, than they otherwise would.

Increased tax benefits for families with children. EGTRRA doubled the child credit from $500 to $1,000, expanded its refundability, and increased the child and dependent care credit.

The marriage penalty goes up and the earned income tax credit starts going down more quickly than it used to.

Reduced marriage penalties. EGTRRA set both the standard deduction and the width of the 10 percent and 15 percent tax brackets for married couples filing joint income tax returns at twice those for single filers. It also raised the threshold at which the earned income tax credit (EITC) begins to phase out for married couples.

Expand the Earned Income Tax Credit (EITC) for Larger Families and Married Couples. The American Recovery and Reinvestment Tax Act of 2009 (ARRA) increased the EITC wage subsidy rate from 40 percent to 45 percent for families with three or more children and increased the start of the credit phaseout range for married couples filing joint tax returns to $5,000 more than that for single workers, up from $3,000 under previous law. (The threshold for couples would revert to that for other filers if the Bush-era tax cuts expire as scheduled.)

That increase will be cut.

Increase Refundability of the Child Tax Credit. Families can claim a child tax credit (CTC) of up to $1,000 per child under age 17. If the credit exceeds taxes owed, families can receive some or all of the balance as a refund, known as the additional child tax credit (ACTC). The ACTC is limited to 15 percent of earnings above a threshold—$12,550 in 2009 (indexed for inflation). ARRA lowered that threshold to an unindexed $3,000, making the ACTC available to more working parents and increasing its value for others. (The maximum credit would fall by half if the Bush-era tax cuts expire as scheduled.)

It appears that the figure of approximately 90% could very well be accurate. The amount you owe will go up, or your refund will go down if you have any wages or salaries, are married, or have children. There may be other provisions which I missed in a first, quick reading.

If you care about the politics involved, you can count on Romney (if he is elected) getting strongly blamed for this because it will happen on his watch.

I'm scared.

With respect,

Charles1952

Still reading. But so far a couple of things already stand out. First, since a picture is worth a thousand words, as they say, a graphic:

And then:

Brookings Institute PDF source

Notice the repetition of the word "Congress" in the above, where assignment of blame is invoked. Since I lose track easily, could somebody remind me of which party controls Congress these days?

Classic spin.

~Heff

And then:

Impending Tax Increases

Federal taxes are scheduled to rise in 2013 for six reasons.3 First, most of the Bush-era tax cuts that were enacted in 2001 and 2003 and extended for an additional two years at the end of 2010 are again set to disappear. Second, some of the temporary tax cuts that were part of the American Recovery and Reinvestment Act of 2009 (ARRA) and also extended at the end of 2010 will expire. Third, Congress has not acted on dozens of short-term tax breaks that are regularly extended. Fourth, the payroll tax cut, always intended to be temporary, is set to expire after a two-year run. Fifth, new taxes enacted in 2010’s Affordable Care Act (ACA) will take effect in tax year 2013. Finally, the AMT “patch” that protects tens of millions of taxpayers from additional taxes expired at the end of 2011. Unless Congress extends the patch retroactively, many taxpayers will owe AMT on their 2012 tax returns (the tax returns that people will file in early 2013).

Brookings Institute PDF source

Notice the repetition of the word "Congress" in the above, where assignment of blame is invoked. Since I lose track easily, could somebody remind me of which party controls Congress these days?

Classic spin.

~Heff

reply to post by Hefficide

Not fully spin. While the GOP controls the House, the Democrats control the Senate. The GOP has said they will not raise taxes on small business owners and those making more than $200k per year, though they favor extending the tax cuts and credits equally across the board for all Americans. The Democrats have said they want to see the cuts extended only for those making under $200k per year and refuse to consider extenting the cuts across the board. Both parties are using the American tax payers as playthings and both are using the middle class as a pawn in a juvenile game.

Something which doesn't get much media play, but is quite important to note: There's another huge tax increase which continues to expand and negatively affects the poor and middle class while benefitting mostly the wealthy (and, for what it is worth is 100% supported by both parties, particularly Obama and the Democratic leadership) and that is the real inflation and devaluation of the dollar brought about by the idiocy of Ben Bernanke. The QE program taxes the average American a hell of a lot worse than any of these other taxes do but, since it is implicitly supported by the Administration, it is heralded by the MSM as an economic survival tool rather than as the dry rear admiraling it really is.

Not fully spin. While the GOP controls the House, the Democrats control the Senate. The GOP has said they will not raise taxes on small business owners and those making more than $200k per year, though they favor extending the tax cuts and credits equally across the board for all Americans. The Democrats have said they want to see the cuts extended only for those making under $200k per year and refuse to consider extenting the cuts across the board. Both parties are using the American tax payers as playthings and both are using the middle class as a pawn in a juvenile game.

Something which doesn't get much media play, but is quite important to note: There's another huge tax increase which continues to expand and negatively affects the poor and middle class while benefitting mostly the wealthy (and, for what it is worth is 100% supported by both parties, particularly Obama and the Democratic leadership) and that is the real inflation and devaluation of the dollar brought about by the idiocy of Ben Bernanke. The QE program taxes the average American a hell of a lot worse than any of these other taxes do but, since it is implicitly supported by the Administration, it is heralded by the MSM as an economic survival tool rather than as the dry rear admiraling it really is.

reply to post by burdman30ott6

I starred that!

And I agree fully that it's both parties to blame. I also happen to believe that both parties serve the same master, big business. And Bernanke? Well history will be able to judge him more clearly than we can, but I happen to agree in thinking of him poorly.

What I want to point out is the spin involved. The game. The fact that we now live in a world where I can rob you blind, convince you it was the other guy, and then use that as a means of gaining your trust. Only, in truth, I happen to know that the other guy is also robbing you blind and, in fact, we are both splitting our ill gotten gains among ourselves while you try and figure out which one of us is actually the crook.

We got conned into letting a fox watch the henhouse. And then got further conned into hiring another fox to watch the fox who is watching the henhouse in the first place.

Speaking as a person who is NOT in the top 1% - and who often speaks against the Bush tax cuts... I am not a hypocrite. I'll happily pay my fair share to get us out of this mess. But the key word is my FAIR share. And I expect nothing less from those who have more money than I do.

From what I've read so far, this Brookings study tends to support that we're all going to have to get over ourselves and be a bit more disciplined for the duration.

~Heff

I starred that!

And I agree fully that it's both parties to blame. I also happen to believe that both parties serve the same master, big business. And Bernanke? Well history will be able to judge him more clearly than we can, but I happen to agree in thinking of him poorly.

What I want to point out is the spin involved. The game. The fact that we now live in a world where I can rob you blind, convince you it was the other guy, and then use that as a means of gaining your trust. Only, in truth, I happen to know that the other guy is also robbing you blind and, in fact, we are both splitting our ill gotten gains among ourselves while you try and figure out which one of us is actually the crook.

We got conned into letting a fox watch the henhouse. And then got further conned into hiring another fox to watch the fox who is watching the henhouse in the first place.

Speaking as a person who is NOT in the top 1% - and who often speaks against the Bush tax cuts... I am not a hypocrite. I'll happily pay my fair share to get us out of this mess. But the key word is my FAIR share. And I expect nothing less from those who have more money than I do.

From what I've read so far, this Brookings study tends to support that we're all going to have to get over ourselves and be a bit more disciplined for the duration.

~Heff

Breitbart Garbage

nothing to see here.

This article was the biggest trash "the sky is falling" piece I have ever seen here, man.

Can we please stick to the facts?

nothing to see here.

This article was the biggest trash "the sky is falling" piece I have ever seen here, man.

Can we please stick to the facts?

reply to post by Hefficide

I am not a hypocrite either, though my opinion is 180 degrees from your own. I find the "fair share" argument to be a joke placed in front of people based of an antiquated set of morals and values that modern society no longer holds. We have become a society of leeches, blood donors, and doctors with very little middle ground between the three. You either absorb money for little to no return from the government, pay the government an ever growing share of your sweat equity until the day you die only to watch it distributed to the leeches, or you're in a position of authority which allows you the blessing of being able to move the leeches from one involuntary donor to the next. That's present day America.

The goal of the doctors is to ensure that any qualms get trapped between the leeches and the donors or within the two groups themselves and limit the amount of fingers pointing directly at the doctors for facilitating this theft in the first place. In layman's terms, CLASS WARFARE. Let's turn the publics' eyes away from the fact that everybody who earns a paycheck or makes reported income takes the same expletive straight to their other expletive and instead focus on the fact that idiot A makes more than imbecile B and is taxed at a different enough rate to ensure that idiot A can at least still see some fruits borne from their hard work in comparison to imbecile B.

The enemy here is the initial idea that anyone other than my own flesh and blood has any claim to the product of my labors. I trudge my ass to work every day (though I honestly do enjoy my job) to feed my family, house my family, provide a conduscive to happiness life for my family NOT to offer up some sort of dowry to a bunch of fat pigs at a trough in DC to redistribute to those who are incapible of providing for their own. The system isn't just about redistribution of wealth, it is about creating a death spiral of government subservitude and reliance. If they can pry enough of the middle class' dollars away, guess what? The middle class eventually goes on the dole, too.

This man neither recognizes nor owes any "fair share." The media has carefully adopted terms like "owes", "fair share", "share of the debt", and "tax responsibility" because those words soften the public's perception of and the reality of the fact that it is legalized, mandated even, theft. It's ironic considering the nation was founded on a tax revolt in the first place... guess we have forgotten that the Tree of Liberty requires frequent fertilization with the blood of tyrants.

I am not a hypocrite either, though my opinion is 180 degrees from your own. I find the "fair share" argument to be a joke placed in front of people based of an antiquated set of morals and values that modern society no longer holds. We have become a society of leeches, blood donors, and doctors with very little middle ground between the three. You either absorb money for little to no return from the government, pay the government an ever growing share of your sweat equity until the day you die only to watch it distributed to the leeches, or you're in a position of authority which allows you the blessing of being able to move the leeches from one involuntary donor to the next. That's present day America.

The goal of the doctors is to ensure that any qualms get trapped between the leeches and the donors or within the two groups themselves and limit the amount of fingers pointing directly at the doctors for facilitating this theft in the first place. In layman's terms, CLASS WARFARE. Let's turn the publics' eyes away from the fact that everybody who earns a paycheck or makes reported income takes the same expletive straight to their other expletive and instead focus on the fact that idiot A makes more than imbecile B and is taxed at a different enough rate to ensure that idiot A can at least still see some fruits borne from their hard work in comparison to imbecile B.

The enemy here is the initial idea that anyone other than my own flesh and blood has any claim to the product of my labors. I trudge my ass to work every day (though I honestly do enjoy my job) to feed my family, house my family, provide a conduscive to happiness life for my family NOT to offer up some sort of dowry to a bunch of fat pigs at a trough in DC to redistribute to those who are incapible of providing for their own. The system isn't just about redistribution of wealth, it is about creating a death spiral of government subservitude and reliance. If they can pry enough of the middle class' dollars away, guess what? The middle class eventually goes on the dole, too.

This man neither recognizes nor owes any "fair share." The media has carefully adopted terms like "owes", "fair share", "share of the debt", and "tax responsibility" because those words soften the public's perception of and the reality of the fact that it is legalized, mandated even, theft. It's ironic considering the nation was founded on a tax revolt in the first place... guess we have forgotten that the Tree of Liberty requires frequent fertilization with the blood of tyrants.

reply to post by burdman30ott6

You do all of these things by utilizing communally paid for infrastructure. Roads and the like. You sleep well at night knowing that if something goes wrong there are firemen, cops, paramedics... all to come and help. You get water through pipes. You get electricity through the power grid.

All that nice stuff - but when it comes time to cough up your "fair share" for the communally used resources, you're a rugged individualist who don't need nobody and don't want your dime touched....

See the irrationality here?

~Heff

You do all of these things by utilizing communally paid for infrastructure. Roads and the like. You sleep well at night knowing that if something goes wrong there are firemen, cops, paramedics... all to come and help. You get water through pipes. You get electricity through the power grid.

All that nice stuff - but when it comes time to cough up your "fair share" for the communally used resources, you're a rugged individualist who don't need nobody and don't want your dime touched....

See the irrationality here?

~Heff

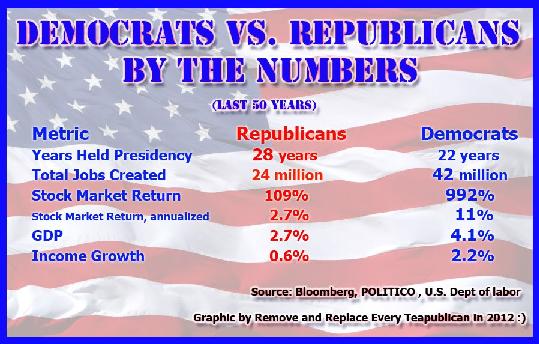

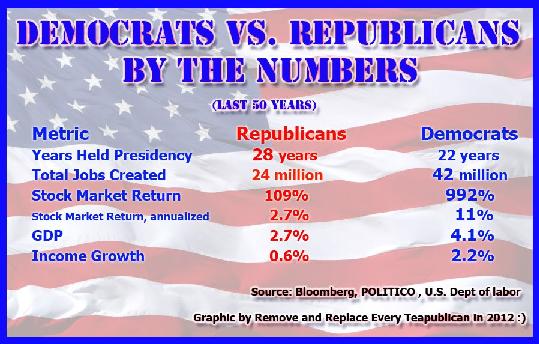

reply to post by xuenchen

That's only if Romney wins he will reinstate the Bush tax cuts for the rich and raise taxes on the middle class.

Who's better for the country?

That's only if Romney wins he will reinstate the Bush tax cuts for the rich and raise taxes on the middle class.

Who's better for the country?

reply to post by Hefficide

I pay property taxes, water bills, electricity bills, surcharges on medical bills, etc.

What about all the things my tax dollars go toward which are none of my concern nor my responsibility? Why is it, if we are talking fair shares, that my taxes pay for the "shares" of multiple families thanks to a redistrinution that moves downward by law? Who uses the services the most, while we are on that topic? My kid's school, a public school I pay for with taxes, has a slew of programs such as free lunches, free tutoring, free busing, and free after school programs, all of which my son is ineligible for because we don't qualify as poor. Curious, that, considering by the time I get done paying all those taxes, fees, and inflated prices thanks to the decreasing worth of the little pieces of paper I break myself to recieve every week I feel poorer than most of the folks who get all the freebies.

I'm tired of it, Heff. I signed up to pay for my wife and my kids. I did that by marrying my wife and deciding to have children. No complaint there. Hell, I'll even throw my parents some slack here and take on the responsibility of caretaking for them when they become too old to handle it themselves seeing as how they kept me safe and well fed until I was 21. I refuse to take on the respobsility of anyone else. This never ending cycle of paying for the little guy is bullcrap and must end.

I pay property taxes, water bills, electricity bills, surcharges on medical bills, etc.

What about all the things my tax dollars go toward which are none of my concern nor my responsibility? Why is it, if we are talking fair shares, that my taxes pay for the "shares" of multiple families thanks to a redistrinution that moves downward by law? Who uses the services the most, while we are on that topic? My kid's school, a public school I pay for with taxes, has a slew of programs such as free lunches, free tutoring, free busing, and free after school programs, all of which my son is ineligible for because we don't qualify as poor. Curious, that, considering by the time I get done paying all those taxes, fees, and inflated prices thanks to the decreasing worth of the little pieces of paper I break myself to recieve every week I feel poorer than most of the folks who get all the freebies.

I'm tired of it, Heff. I signed up to pay for my wife and my kids. I did that by marrying my wife and deciding to have children. No complaint there. Hell, I'll even throw my parents some slack here and take on the responsibility of caretaking for them when they become too old to handle it themselves seeing as how they kept me safe and well fed until I was 21. I refuse to take on the respobsility of anyone else. This never ending cycle of paying for the little guy is bullcrap and must end.

reply to post by burdman30ott6

"Paying for the little guy", as you put it, strikes me. I don't know how to define "the little guy". Are we talking about the folks who abuse the system? Those who sell their food stamps for drugs and use their TANF checks to drive Escalades? If so then I can only say that, though they do exist, they are the exception and not the rule.

Is the "little guy" the person born with a disease or deformity that precludes them from being able to participate socially and in for their own profit? If we are speaking about them, then are we talking eugenics? Or social Darwinism? I am sorry but, morally, I can't ignore those who are easily ignored. It is in my nature to want to defend the defenseless.

Is "the little guy" a term to mean the median? The average guy? If so, then all I can say is that I'm all for him, because he is me. And, being the kind of guy I am, I'll protect him with all I can possibly muster. My self interest dictates it.

These political paradigms have totally split not just our nation - making us the literal laughingstock of the world. But it's also fractured most of us as human beings. We feel so stressed, strained, and afraid, that we circle the wagons and adopt this sort of "forget everybody else, I'm taking care of me and mine." mindset that is, quite literally, antithetical to the very concept of society.

We are being led directly back into feudalism and not only do we not see it... a great many of us are championing the process.

My .02 cents.

~Heff

"Paying for the little guy", as you put it, strikes me. I don't know how to define "the little guy". Are we talking about the folks who abuse the system? Those who sell their food stamps for drugs and use their TANF checks to drive Escalades? If so then I can only say that, though they do exist, they are the exception and not the rule.

Is the "little guy" the person born with a disease or deformity that precludes them from being able to participate socially and in for their own profit? If we are speaking about them, then are we talking eugenics? Or social Darwinism? I am sorry but, morally, I can't ignore those who are easily ignored. It is in my nature to want to defend the defenseless.

Is "the little guy" a term to mean the median? The average guy? If so, then all I can say is that I'm all for him, because he is me. And, being the kind of guy I am, I'll protect him with all I can possibly muster. My self interest dictates it.

These political paradigms have totally split not just our nation - making us the literal laughingstock of the world. But it's also fractured most of us as human beings. We feel so stressed, strained, and afraid, that we circle the wagons and adopt this sort of "forget everybody else, I'm taking care of me and mine." mindset that is, quite literally, antithetical to the very concept of society.

We are being led directly back into feudalism and not only do we not see it... a great many of us are championing the process.

My .02 cents.

~Heff

Originally posted by newcovenant

That's only if Romney wins he will reinstate the Bush tax cuts for the rich and raise taxes on the middle class.

Who's better for the country?

Can't have it both ways... lol

So was the last four years Bushs failures as Obama says or his failures?

If you agree with Obama that it was Bush's failures then your little chart shows that the Democrats handed the Republicans a big bag of crap, and when the republicans finally fix it they give it back to the Democrats who enjoy the fruits as they screw it up again.

Clinton did hand Bush a bag of crap and no one complained about Bush's first four years as we recovered. So, which one is it?

edit on 1-10-2012 by Xtrozero because: (no reason given)

Originally posted by Hefficide

Brookings Institute PDF source

~Heff

I look forward to this in gleeful anticipation. Obama is going to win and the old adage "be careful for what you wish for, you just might get it" comes to mind. I get tired of debating all this and I'm at the point to let old Obama show his cards.

I win either way...If he does pull it off I will take advantage of that and if he fails and the country gets into a world of hurt over it, I can enjoy the old "I told you so" and call people idiots for a few decades.

reply to post by Xtrozero

Clinton handed Bush a 3 trillion dollar surplus which he quickly burned through waging 2 wars, offering a tax cut to the rich and a prescription drug benefits program for seniors that helped big pharma sell drugs to old folks that didn't really want them.

Bush didn't include the cost of the wars in the country's deficit.

Obama added them when he started and now people want to say he spent it.

That's disingenuous.

Anyway as you nicely pointed out by re-copying my post the numbers don't lie and Democrats are far and away better for the country no matter how much kicking screaming and lying the Republicans do.

Clinton handed Bush a 3 trillion dollar surplus which he quickly burned through waging 2 wars, offering a tax cut to the rich and a prescription drug benefits program for seniors that helped big pharma sell drugs to old folks that didn't really want them.

Bush didn't include the cost of the wars in the country's deficit.

Obama added them when he started and now people want to say he spent it.

That's disingenuous.

Anyway as you nicely pointed out by re-copying my post the numbers don't lie and Democrats are far and away better for the country no matter how much kicking screaming and lying the Republicans do.

reply to post by newcovenant

You might want to make a small adjustment to your figures:

Also, interestingly, the eight years of Clinton increased our debt by $1.4 trillion. en.wikipedia.org...

Just trying to help.

You might want to make a small adjustment to your figures:

www.factcheck.org... claims that, not counting Social Security, which the government likes to call "off the books," The combined surplus for 1999 and 2000 was under $90 billion. Your number is 33 times that.

Clinton handed Bush a 3 trillion dollar surplus which he quickly burned through waging 2 wars,

Also, interestingly, the eight years of Clinton increased our debt by $1.4 trillion. en.wikipedia.org...

Just trying to help.

reply to post by burdman30ott6

While I fully respect your desire to pay for only your own family's sustinence, what I DON'T get about this whole argument, is why no one ever mentions how much they don't want to pay for all of our unnecessary wars and military interventions, although this amount FAR exceeds the amount the gov't spends on keeping people fed, housed, and healthy. Will you please explain how war is not on your radar, but "leeches" on public assistance are?

While I fully respect your desire to pay for only your own family's sustinence, what I DON'T get about this whole argument, is why no one ever mentions how much they don't want to pay for all of our unnecessary wars and military interventions, although this amount FAR exceeds the amount the gov't spends on keeping people fed, housed, and healthy. Will you please explain how war is not on your radar, but "leeches" on public assistance are?

reply to post by xuenchen

is already teetering on the brink of recession...............

Really?

I would say more like we are entering a Depression, if we are already not there.

is already teetering on the brink of recession...............

Really?

I would say more like we are entering a Depression, if we are already not there.

new topics

-

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 19 minutes ago -

12 jurors selected in Trump criminal trial

US Political Madness: 3 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 3 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 3 hours ago -

George Knapp AMA on DI

Area 51 and other Facilities: 9 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 9 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 11 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 16 hours ago, 25 flags -

George Knapp AMA on DI

Area 51 and other Facilities: 9 hours ago, 24 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 17 hours ago, 19 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 3 hours ago, 13 flags -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 17 hours ago, 7 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 11 hours ago, 7 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 9 hours ago, 5 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 14 hours ago, 5 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 3 hours ago, 5 flags -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 15 hours ago, 4 flags

active topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 51 • : TheMisguidedAngel -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 47 • : SchrodingersRat -

Elites disapearing

Political Conspiracies • 30 • : SchrodingersRat -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 10 • : OmegaLogos -

12 jurors selected in Trump criminal trial

US Political Madness • 21 • : VictorVonDoom -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 64 • : Degradation33 -

Iran launches Retalliation Strike 4.18.24

World War Three • 14 • : Cloudbuster1 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 0 • : Consvoli -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 17 • : SchrodingersRat -

Canadian Forces bow out and loose interest in UFO’s

Aliens and UFOs • 20 • : Ophiuchus1