It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Well for starters 190,000 of that 47% are US

soldiers in Afghanistan!!!!!!

Oops!

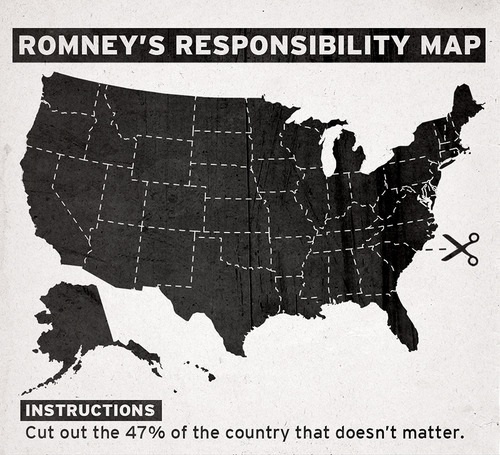

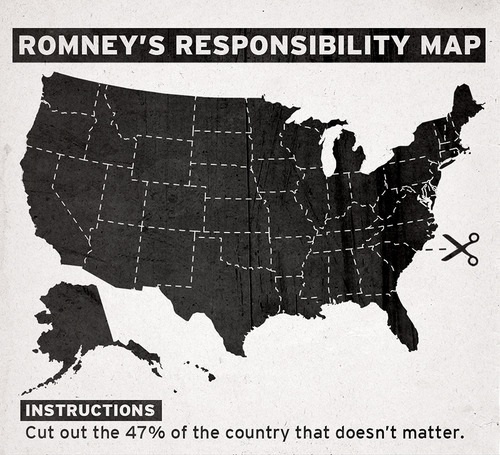

Of course by now many will have read that paying no federal income tax is not the same as paying no tax at all - but apparently the 47% are concentrated mostly in states that actualy tend to vote Republican!!

What amazes me is that people do still prefer this guy to anyone at all!! Like I have said before I'm way down in the sunny South Pacific, so it's not my election - but the whole republican right wing & religious conservative thing in the US looks bat-shirt insane from here!!

Of the 47 percent who didn't pay income tax in 2009, more than 60 percent of them paid payroll taxes, because they had a job. 22 percent of them were old people. 190,000 of them were soldiers deployed in Afghanistan and Iraq that year.

Oops!

Of course by now many will have read that paying no federal income tax is not the same as paying no tax at all - but apparently the 47% are concentrated mostly in states that actualy tend to vote Republican!!

(from link above)

A map put out by the Tax Foundation of the 10 states with the highest and lowest percentage of filers with no federal tax liability shows that the states with the highest percentage of non-filers are, by-and-large, states that typically vote Republican, while the 10 states with the lowest percentage of non-filers tend to be Democratic-leaning.

What amazes me is that people do still prefer this guy to anyone at all!! Like I have said before I'm way down in the sunny South Pacific, so it's not my election - but the whole republican right wing & religious conservative thing in the US looks bat-shirt insane from here!!

For once he had backbone and the truth came out. I'm definitely voting for him now.

reply to post by Aloysius the Gaul

Yepp. Interesting how he insulted mostly Republican voters lol. What a fool this man is. I definitely think he's going to lose.

Yepp. Interesting how he insulted mostly Republican voters lol. What a fool this man is. I definitely think he's going to lose.

Fact check.org?

What a a joke:

www.cbsnews.com...

money.cnn.com...

www.forbes.com...

Newsflash income tax is what we are talkng about.

47% percent have no tax liability which is BS and then turn around and scream increase someone elses taxes just not theirs.

Which is BS.

If you don't want someone sticking their hands in your walltets don't expect to sitck yours in someone else's.

Come on as the Potus says far share,fair play and all that jazz.

What a a joke:

www.cbsnews.com...

money.cnn.com...

www.forbes.com...

Newsflash income tax is what we are talkng about.

47% percent have no tax liability which is BS and then turn around and scream increase someone elses taxes just not theirs.

Which is BS.

If you don't want someone sticking their hands in your walltets don't expect to sitck yours in someone else's.

Come on as the Potus says far share,fair play and all that jazz.

edit on 18-9-2012 by neo96 because: (no reason given)

it doesn't matter

he insulted half the country

sure there are leetches on the system, but the large majority of people would rather have a job

screw him

he insulted half the country

sure there are leetches on the system, but the large majority of people would rather have a job

screw him

reply to post by Aloysius the Gaul

I'm actually looking forward to the Debates.

Mitt will be voted "best reality star" for the entertainment he will provide.

I'm actually looking forward to the Debates.

Mitt will be voted "best reality star" for the entertainment he will provide.

Does anyone still think it matters which of these two clowns are elected.

As long as Americans continue to chose one of the two offered up choices on a platter nothing will change, ever.

As long as Americans continue to chose one of the two offered up choices on a platter nothing will change, ever.

reply to post by neo96

Families cannot live off of $20,000 a year. Their tax liability is zero because they earn so little, their "share" of taxes is minuscule. Granted, if you totaled ALL of the poor people's "share" into it, it would be a good amount, but it would STILL be so much less than the upper class. The upper class can afford to pay higher taxes.

Listen, people do need to pay taxes. As long as we are a part of this system that we all agree to live in, taxes are apart of our lives. But forcing poor people to give half of their money to the government would absolutely destroy this country's economy. People need money, and the poor need those tax credits they get from their children. It helps them keep their heads just a little above water, or provide clothes and supplies for the kids for the next school year, or a car for their teenager so he can drive to college and build a future where he WON'T be poor like mom and dad.

With great power comes great responsibility. In this country, money is power. The rich have a responsibility to pay taxes.

Families cannot live off of $20,000 a year. Their tax liability is zero because they earn so little, their "share" of taxes is minuscule. Granted, if you totaled ALL of the poor people's "share" into it, it would be a good amount, but it would STILL be so much less than the upper class. The upper class can afford to pay higher taxes.

Listen, people do need to pay taxes. As long as we are a part of this system that we all agree to live in, taxes are apart of our lives. But forcing poor people to give half of their money to the government would absolutely destroy this country's economy. People need money, and the poor need those tax credits they get from their children. It helps them keep their heads just a little above water, or provide clothes and supplies for the kids for the next school year, or a car for their teenager so he can drive to college and build a future where he WON'T be poor like mom and dad.

With great power comes great responsibility. In this country, money is power. The rich have a responsibility to pay taxes.

MITT WAS SO WRONG IT'S RIDICULOUS. BUT IT'S SAD YOU STILL HAVE PEOPLE ON ATS THAT CLAIM HE IS RIGHT. lol

Mitt Romney told a group of donors in a surreptitiously taped private fundraiser that voters who back President Obama are "entitled" and "dependent on government."

Romney seems to be referring to the estimated 47 percent of Americans who did not owe federal income taxes in 2011 because their incomes were so low that they qualified for a tax credit, or because they didn't work at all. Last year, 22 percent of people who didn't owe income taxes were elderly people on Social Security, and an additional 17 percent were students, disabled people or the unemployed. More than 60 percent of the group were low-income workers, many of whom qualified for the child tax credit or the earned income tax credit. (These workers did pay payroll taxes for Social Security and other programs.)

Originally posted by benrl

Does anyone still think it matters which of these two clowns are elected.

As long as Americans continue to chose one of the two offered up choices on a platter nothing will change, ever.

I agree it really doesn't matter. It's just so much fun watching conservatives try to justify their mans' stupidity.

I'm not voting for anyone but I damn sure know who I'm voting against!

Very wrong...

What's so ironic is how he was previously quoted as saying Obama is dividing the country and he would never do that.

It feels like 2008 all over again and it really worries me.

It seems the GOP is purposely tanking this thing, just as it seemed McCain and the GOP did then when they knew we were headed off a global economic cliff...

What's so ironic is how he was previously quoted as saying Obama is dividing the country and he would never do that.

It feels like 2008 all over again and it really worries me.

It seems the GOP is purposely tanking this thing, just as it seemed McCain and the GOP did then when they knew we were headed off a global economic cliff...

edit on 9/18/2012 by Sergeant Stiletto because: (no reason given)

Mitt the twit sticks his foot in his mouth once again. In the last few months he has just straight up insulted gay people, women, veterans and

publicly said he thinks equal rights are unconstitutional. It doesn't surprise me one bit that he took the next step and pretty much insulted half of

the country. He has pretty much sealed in Obama as POTUS for another 4 years with his big mouth. I don't see this guy winning at all.

How many of that 47% are rich people who pay no taxes due to tax loopholes?

How many are corporations( who are now considered to be people) who pay no taxes?

How many are old people who have worked all their lives and are now retired or disabled and collecting SS?

How many are are disabled vets?

I want a president who represents and stands up for ALL americans not just for the richest 50% of americans, romney is not that president.

How many are corporations( who are now considered to be people) who pay no taxes?

How many are old people who have worked all their lives and are now retired or disabled and collecting SS?

How many are are disabled vets?

I want a president who represents and stands up for ALL americans not just for the richest 50% of americans, romney is not that president.

According to the Huffington Post:

www.huffingtonpost.com...

So there you go.

Nearly half of American tax filers will pay no federal income taxes this year, according to data released by the Tax Policy Center. Some 76 million tax filers, or 46.4 percent of the total, will be exempt from federal income tax in 2011. But with the help of the government, a similar percentage of filers -- many of them among the bottom 40 percent of earners -- have legally avoided paying federal income tax for the past several years.

More than half the filers exempt from federal income tax in 2011 are in the lowest income quintile, meaning they make less than 80 percent of the country. As Bruce Bartlett at The New York Times notes, those in the bottom quintile have incomes of less than $16,812.

There are 40.7 million nonpayers in this group -- about 93.3 percent of the quintile, and 53.6 percent of all nonpayers overall. Nonpayers are well represented in the second-lowest quintile, as well: That group includes 22.2 million filers who won’t pay federal income taxes this year. This is 60.3 percent of the quintile and 29.2 percent of the total number of nonpayers.

The phenomenon of low-earning Americans escaping the federal income tax burden isn't a new one. In 2002, The Wall Street Journal coined the term "lucky duckies" to describe people who were exempt from income tax because they didn't make enough money.

www.huffingtonpost.com...

So there you go.

reply to post by EvilSadamClone

Boy I wish I was one of those "lucky duckies" who was so poor I didn't have to pay any tax - what a good wicket that would be!!

(sarcasm alert!!)

The phenomenon of low-earning Americans escaping the federal income tax burden isn't a new one. In 2002, The Wall Street Journal coined the term "lucky duckies" to describe people who were exempt from income tax because they didn't make enough money.

Boy I wish I was one of those "lucky duckies" who was so poor I didn't have to pay any tax - what a good wicket that would be!!

(sarcasm alert!!)

reply to post by Aloysius the Gaul

Sorry, but being poor sucks.

While being rich does have its problems, I'd still rather have lots of money.

Sorry, but being poor sucks.

While being rich does have its problems, I'd still rather have lots of money.

As other posters pointed out, the poorest people pay about 15% of their income in the form of payroll taxes.

If we want to get hypertechnical and only say those that pay tax on ordinary income are paying their taxes, then people like Romney are the biggest freeloaders. Almost all of Romney's income is capital gains income, so Romney and others like him are paying little or no income tax. They are also paying about 15% of their income in taxes.

So as it stands the people paying the lowest tax rates are the poor and the rich, with the middle class paying the highest rates. Most of us don't have too many qualms with somebody who is barely scraping by on a minimum wage job paying a low tax rate. We do however, have qualms with billionaires paying lower tax rates than their secretaries when the country is going broke.

If we want to get hypertechnical and only say those that pay tax on ordinary income are paying their taxes, then people like Romney are the biggest freeloaders. Almost all of Romney's income is capital gains income, so Romney and others like him are paying little or no income tax. They are also paying about 15% of their income in taxes.

So as it stands the people paying the lowest tax rates are the poor and the rich, with the middle class paying the highest rates. Most of us don't have too many qualms with somebody who is barely scraping by on a minimum wage job paying a low tax rate. We do however, have qualms with billionaires paying lower tax rates than their secretaries when the country is going broke.

Of the fifty three percent that are paying taxes, most of them will be retiring someday and not be paying taxes themselves. If these people can't

see their own future, something is wrong with their perception. They are cutting their own throats.

Mitt Romney Right: Dependency Subverts Democracy

news.investors.com...

news.investors.com...

The Republican challenger speaks an uncomfortable truth — that it's hard enough to beat an incumbent president without almost half the electorate feeling dependent on him for some kind of government benefit.

reply to post by sad_eyed_lady

Firstly, as has been pointed out several times, the vast majority of these people DO pay taxes - jsut not the Federal tax mitt decided to highlight while ignoring everything else.

And 190,0000 of them are servicemen and women in Afghanistan!

Now Mitt could choose to ensure they paid the same taxes - there is no reason why they MUST prefer the incumbant.

however AFAIK he is proposing to increase taxes on lower paid people in order to decrease it for the well off.

that is his choice - not something that is fundamental to the makeup of the universe.

Firstly, as has been pointed out several times, the vast majority of these people DO pay taxes - jsut not the Federal tax mitt decided to highlight while ignoring everything else.

And 190,0000 of them are servicemen and women in Afghanistan!

Now Mitt could choose to ensure they paid the same taxes - there is no reason why they MUST prefer the incumbant.

however AFAIK he is proposing to increase taxes on lower paid people in order to decrease it for the well off.

that is his choice - not something that is fundamental to the makeup of the universe.

new topics

-

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 2 hours ago -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 3 hours ago -

Russia Flooding

Other Current Events: 4 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 5 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 5 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 5 hours ago -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 8 hours ago -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 8 hours ago -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 8 hours ago -

Elites disapearing

Political Conspiracies: 10 hours ago

top topics

-

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 12 hours ago, 13 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 8 hours ago, 11 flags -

Elites disapearing

Political Conspiracies: 10 hours ago, 9 flags -

Freddie Mercury

Paranormal Studies: 13 hours ago, 7 flags -

Nirvana - Immigrant Song

Music: 17 hours ago, 5 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 10 hours ago, 5 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 3 hours ago, 5 flags -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 5 hours ago, 5 flags -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 5 hours ago, 4 flags -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 8 hours ago, 4 flags

active topics

-

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 5 • : sine.nomine -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 22 • : Lazy88 -

Russia Flooding

Other Current Events • 2 • : Hakaiju -

God is watching.

Politicians & People • 27 • : PrivateAngel -

Mood Music Part VI

Music • 3051 • : BrucellaOrchitis -

I Guess Cloud Seeding Works

Fragile Earth • 21 • : BrucellaOrchitis -

Elites disapearing

Political Conspiracies • 20 • : HerbertWest -

What Time is it on the Moon ?

Space Exploration • 50 • : wildespace2 -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies • 6 • : annonentity -

Israel ufo shoot down drones?

Aliens and UFOs • 26 • : GENERAL EYES