It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by karen61057

reply to post by schuyler

I dont believe that figure about 47% being on some kind of assistance like food stamps. No one in my entire family, sisters brother their kids, cousins, aunts and uncles, have ever been on any kind of assistance. We are not rich either. We are hard working middle class, ( at 50-70 K not 200K) people. If no one I know is on assistance then it cannot be 47 % because that would be one out of every two

Or it means that since you dont know anyone, someone else has their whole family on assistance. We're back to one out of every two.

EVERYONE

pays taxes no matter what anyone tells you.

Accounts Receivable Tax

Building Permit Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Dog License Tax

Excise Taxes

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel Permit Tax

Gasoline Tax (42 cents per gallon)

Gross Receipts Tax

Hunting License Tax

Inheritance Tax

Inventory Tax

IRS Interest Charges IRS Penalties (tax on top of tax)

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Personal Property Tax

Property Tax

Real Estate Tax

Service Charge Tax

Social Security Tax

Road Usage Tax

Sales Tax

Recreational Vehicle Tax

School Tax

State Income Tax

State Unemployment Tax (SUTA)

Tangible Taxes

Telephone Federal Excise Tax

Telephone Federal Universal Service Fee Tax

Telephone Federal, State and Local Surcharge Taxes

Telephone Minimum Usage Surcharge Tax

Telephone Recurring and Non-recurring Charges Tax

Telephone State and Local Tax

Telephone Usage Charge Tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft Registration Tax

Well Permit Tax

Workers Compensation Tax

You never seceded from the crown much less Rome

pays taxes no matter what anyone tells you.

Accounts Receivable Tax

Building Permit Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Dog License Tax

Excise Taxes

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel Permit Tax

Gasoline Tax (42 cents per gallon)

Gross Receipts Tax

Hunting License Tax

Inheritance Tax

Inventory Tax

IRS Interest Charges IRS Penalties (tax on top of tax)

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Personal Property Tax

Property Tax

Real Estate Tax

Service Charge Tax

Social Security Tax

Road Usage Tax

Sales Tax

Recreational Vehicle Tax

School Tax

State Income Tax

State Unemployment Tax (SUTA)

Tangible Taxes

Telephone Federal Excise Tax

Telephone Federal Universal Service Fee Tax

Telephone Federal, State and Local Surcharge Taxes

Telephone Minimum Usage Surcharge Tax

Telephone Recurring and Non-recurring Charges Tax

Telephone State and Local Tax

Telephone Usage Charge Tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft Registration Tax

Well Permit Tax

Workers Compensation Tax

You never seceded from the crown much less Rome

edit on 19-9-2012 by superluminal11 because: (no reason given)

Well written article actually. It spells it out.

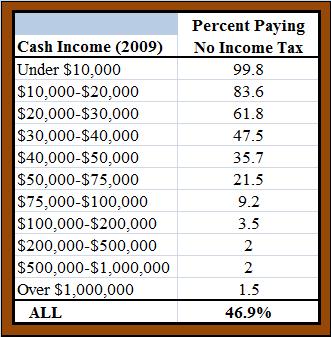

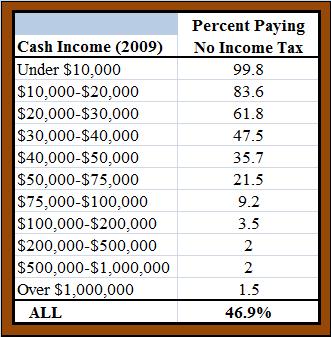

47% of Americans pay no income taxes

Did you known 47% of Americans pay no Federal income taxes even though they have earned income?

…The explanation is simple: the income tax serves two masters. On one hand, it raises nearly half of all federal revenues. On the other, it delivers a broad array of social benefits in the form of exemptions, deductions, and credits that reward people for government-favored behavior… Over the past two decades, Congress has repeatedly used the income tax to encourage or subsidize specific activities. We subsidize kids with the child credit, college attendance with multiple higher education credits, retirement with all sorts of tax-favored savings plans, work with the earned income credit, and child care with, you guessed it, the childcare credit. And we’ve retained most itemized deductions that subsidize homeownership, state and local governments, and charitable giving…

I realize that people who pay no income taxes still pay payroll taxes and sales taxes and so on. And, those taxes can be a high proportion of income. Nonetheless, payroll taxes go to cover Social Security or Medicare when someone retires, they do not fund the Federal government. Sales taxes go to states and cities, not the Feds.

47% of Americans pay no income taxes

reply to post by sonnny1

Here is the source for your picture.

www.taxpolicycenter.org...

The miss leading portion is they leave off most of the data.

Why is it that 1.5% of people making over a million dollars a year pay no taxes?

Here is the source for your picture.

www.taxpolicycenter.org...

The miss leading portion is they leave off most of the data.

Why is it that 1.5% of people making over a million dollars a year pay no taxes?

edit on 20-9-2012 by JBA2848 because: (no reason

given)

Originally posted by JBA2848

reply to post by sonnny1

Here is the source for your picture.

www.taxpolicycenter.org...

The miss leading portion is they leave off most of the data.

Why is it that 1.5% of people making over a million dollars a year pay no taxes?edit on 20-9-2012 by JBA2848 because: (no reason given)

I thought this was telling from that link.

During the 2008 election campaign, President Obama proposed to create or expand a variety of refundable tax credits, most notably his Making Work Pay credit. Refundability was key for Obama — that’s the only way to make credits available to people who pay little or no tax. Critics decried the proposals, asking how you can cut taxes for people who pay no tax. The Tax Policy Center (TPC) estimated that, under then current law, 38 percent of all nondependent tax units would pay no income tax in 2009. Earlier this year, Obama signed into law the American Recovery and Reinvestment Tax Act of 2009 (P.L. 111-5), which, among other things, temporarily put into place some of the refundable credits proposed during the campaign. TPC estimates that under the new law, 47 percent of tax units will owe no income tax in 2009 (see table).

A final note: One Obama campaign proposal that hasn’t reappeared would have zeroed out income taxes for elderly households with income under $50,000. Perhaps the proposal’s disappearance simply reflects the fact that nearly 80 percent of those units already pay no tax.

I dont think it was misleading at all.

edit on 20-9-2012 by sonnny1 because: (no reason given)

Who Paid Neither Income Nor Payroll Taxes?

www.taxpolicycenter.org...

Same people who did the first report on who pays no income taxes.

www.taxpolicycenter.org...

Same people who did the first report on who pays no income taxes.

reply to post by JBA2848

So almost 20% of the country pay no income or payroll taxes. Half of those are elderly, which leaves 10% of the country paying no Payroll or Income tax. That's a lot.

So almost 20% of the country pay no income or payroll taxes. Half of those are elderly, which leaves 10% of the country paying no Payroll or Income tax. That's a lot.

reply to post by OccamsRazor04

I wished I had to pay that kind of tax bill.

Last year I made $37,820 and had a tax liability of $4,633.

I know that's only about 12.25 % but atleast I do pay taxes. Not as much as Romney's 13%.

ow the ignorance is crazy. Romney paid $3.1 million in federal income tax last year. Just wow .....

I wished I had to pay that kind of tax bill.

Last year I made $37,820 and had a tax liability of $4,633.

I know that's only about 12.25 % but atleast I do pay taxes. Not as much as Romney's 13%.

reply to post by OccamsRazor04

The big thing is the head of household tax credit. And that tax credit ends up going directly to the state in property tax. And it has been there since 1951. Also the other is the dependant tax credit. These two tax credits are what create the high numbers. So is Mitt Romney going to do away with the head of household and dependant tax credits? It would not matter to much to him with his wealth. But his Mormon followers would get hit with it hard. And if that is not what he wants to go after than it must be the elderly.

The big thing is the head of household tax credit. And that tax credit ends up going directly to the state in property tax. And it has been there since 1951. Also the other is the dependant tax credit. These two tax credits are what create the high numbers. So is Mitt Romney going to do away with the head of household and dependant tax credits? It would not matter to much to him with his wealth. But his Mormon followers would get hit with it hard. And if that is not what he wants to go after than it must be the elderly.

Now That My Campaign Is Over, I'd Like To Talk To You All About The Church Of Latter-Day Saints By Mitt Romney

Republican Nominee For President Of The United States September 19, 2012 | ISSUE 48•38

Oh,Dear!

My fellow Americans, can I have a moment of your time? It would appear that, following yesterday’s leaking of a video that shows me effectively writing off half the nation’s voters, we can pretty safely say my presidential campaign has come to an end. Oh, technically it may still exist, sure, but let’s be honest with each other: It’s all over. And I have fully accepted that reality. So, with that in mind, I would like to use my few remaining weeks in the public spotlight to tell the nation all about a truly great religious organization called the Church of Jesus Christ of Latter-day Saints.

Oh,Dear!

Originally posted by Benevolent Heretic

reply to post by D1Useek

Originally posted by D1Useek

If you’re thinking of the tax at MacDonald’s or Burger King or the liquor store, we’re not counting that.

Well, isn't it convenient that you're "not counting" the tax that the 47% DO pay...

So... 47% of the country don't pay taxes, (not counting the taxes they DO pay). Is that what you're selling? Seriously?

What are you selling??? Oh wow so someone pays taxes whiel on food stamps and section 8? Well bless thier harts.

Originally posted by hdutton

reply to post by OccamsRazor04

ow the ignorance is crazy. Romney paid $3.1 million in federal income tax last year. Just wow .....

I wished I had to pay that kind of tax bill.

Last year I made $37,820 and had a tax liability of $4,633.

I know that's only about 12.25 % but atleast I do pay taxes. Not as much as Romney's 13%.

See, nobody wants to hear that. Mitt still pays more in than several hundred making under 60,000.

Let's not forget:

When Romney finally released his tax papers to the public back in January,

he contributed about $3 million to charity, reducing his effective tax rate to less than 14%.

This tax rate was lower than Reagan's tax rate, along with everyone else who paid income taxes last year.

When Romney finally released his tax papers to the public back in January,

he contributed about $3 million to charity, reducing his effective tax rate to less than 14%.

This tax rate was lower than Reagan's tax rate, along with everyone else who paid income taxes last year.

Originally posted by EyesWithoutAFace

Let's not forget:

When Romney finally released his tax papers to the public back in January,

he contributed about $3 million to charity, reducing his effective tax rate to less than 14%.

This tax rate was lower than Reagan's tax rate, along with everyone else who paid income taxes last year.

Yes, you can give away millions and lower your tax rate too. I do not know exactly how he donated, but I do know the biggest benfactor of most charities are the poor or needy. His tax + donation percentage is much much higher than almost all Americans.

Originally posted by JBA2848

reply to post by OccamsRazor04

The big thing is the head of household tax credit. And that tax credit ends up going directly to the state in property tax. And it has been there since 1951. Also the other is the dependant tax credit. These two tax credits are what create the high numbers. So is Mitt Romney going to do away with the head of household and dependant tax credits? It would not matter to much to him with his wealth. But his Mormon followers would get hit with it hard. And if that is not what he wants to go after than it must be the elderly.

I don't get the point of your thread. Romney should not have quoted the 47%, it takes away from his message. His message is that there are those will never vote for him because they want to pay no taxes whether it is fair or not. Those people are not a target audience for him, he is not going to spend precious time trying to get their votes. It doesn't matter if Romney would keep some of them paying no taxes, there is a perception which can't be overcome.

I will demonstrate the point Romney is making. I was watching this TV show called Repo Games. They ask them trivia questions and if they get the answers right the show pays off their car note. The question was "Who lived in Sherwood forrest stealing from the rich and giving to the poor?" The man answered Obama. The host was taken aback a bit and said are you sure that's what you want to answer? The man said yes that's Obama.

See, that man has a perception which can not be changed in the short time Romney has to sway voters. That is not his target audience. The point is further illustrated with the fact that you can NOT get back more taxes than what you pay in. There are exceptions. Obama has at length tried to institute these exceptions so that people get back money even if they pay NOTHING in. I can pay NO money and Uncle Sam will send me a refund. That's the mentality Romney says he can not overcome.

Originally posted by EyesWithoutAFace

Let's not forget:

When Romney finally released his tax papers to the public back in January,

he contributed about $3 million to charity, reducing his effective tax rate to less than 14%.

This tax rate was lower than Reagan's tax rate, along with everyone else who paid income taxes last year.

WOW! Had Obama had a comparable tax paper he would be seen as hero of the masses for giving to charity.....but Mitt now hes just a scum bag trying to get out of taxes.

Originally posted by Logarock

Originally posted by EyesWithoutAFace

Let's not forget:

When Romney finally released his tax papers to the public back in January,

he contributed about $3 million to charity, reducing his effective tax rate to less than 14%.

This tax rate was lower than Reagan's tax rate, along with everyone else who paid income taxes last year.

WOW! Had Obama had a comparable tax paper he would be seen as hero of the masses for giving to charity.....but Mitt now hes just a scum bag trying to get out of taxes.

Yep, this whole post has illustrated Romney was 100% right with his quote. For some people it does not matter what you do, you can NOT change their mind with all the facts and data in the world. Trying to is wasted resources.

Romney +1

new topics

-

Happy St George's day you bigots!

Breaking Alternative News: 57 minutes ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 1 hours ago -

Hate makes for strange bedfellows

US Political Madness: 3 hours ago -

Who guards the guards

US Political Madness: 6 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 8 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 3 hours ago, 14 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 13 hours ago, 10 flags -

Who guards the guards

US Political Madness: 6 hours ago, 10 flags -

1980s Arcade

General Chit Chat: 15 hours ago, 6 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 17 hours ago, 5 flags -

Deadpool and Wolverine

Movies: 16 hours ago, 4 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 1 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 8 hours ago, 2 flags -

Happy St George's day you bigots!

Breaking Alternative News: 57 minutes ago, 2 flags

active topics

-

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat • 5 • : TzarChasm -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 706 • : Threadbarer -

A Better Choice I Think

2024 Elections • 31 • : burritocat -

Russia Ukraine Update Thread - part 3

World War Three • 5716 • : Oldcarpy2 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 612 • : cherokeetroy -

1980s Arcade

General Chit Chat • 20 • : Drugstorecowboy56 -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 42 • : TzarChasm -

15 Unhealthiest Sodas On The Market

Health & Wellness • 39 • : Roma1927 -

Happy St George's day you bigots!

Breaking Alternative News • 9 • : Oldcarpy2 -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs • 15 • : Mantiss2021