It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I was kind of surprised to not find anything related to this tidbit. I did a little searching and didn't find this topic covered on ATS yet.

Here it goes again friends. Welcome to Quantitative Easing 3.0.

Quoted from the article on WSJ blogs:

visit the link for the full article:

blogs.wsj.com... unleash-qe3-this-week/

Here it goes again friends. Welcome to Quantitative Easing 3.0.

Quoted from the article on WSJ blogs:

“We now anticipate an announcement of another round of quantitative easing at the FOMC meeting on Sept. 13,” UBS economists wrote in a note to clients.

The QE3 parameters will likely entail a six-month program of at least $500 billion, primarily focused on buying Treasurys, UBS predicts, while also anticipating the Fed will extend its ultra-low rate guidance into 2015.

visit the link for the full article:

blogs.wsj.com... unleash-qe3-this-week/

I can't find where this has been officially announced as being adopted, but the announcement will be made today. I think we all know what the FED

will do...

The real question is how much farther can the US kick the can down the road with all of the banks?

Here's a link to a relevant thread:

Bernanke to Congress: We're Much Closer to Total Destruction Than You Think

The real question is how much farther can the US kick the can down the road with all of the banks?

Here's a link to a relevant thread:

Bernanke to Congress: We're Much Closer to Total Destruction Than You Think

and the devaluation of your currency continues

give it 10 years and you guys will get pretty pissed when you find your savings are worth like half they were today

give it 10 years and you guys will get pretty pissed when you find your savings are worth like half they were today

Originally posted by Insearchofthetruth1987

and the devaluation of your currency continues

give it 10 years and you guys will get pretty pissed when you find your savings are worth like half they were today

10 years..... try 18 months. the globe is closer to the cliff then you think.

With all of the threads I've read concerning the economy, I don't see that the US is working on a lasting solution.

The printing presses will continue. With the other news bit recently about Moody's talking about downgrading the US credit rating, things aren't looking good.

I wonder what a loaf of bread or a month's supply of food respectively will cost next year in the USA

The printing presses will continue. With the other news bit recently about Moody's talking about downgrading the US credit rating, things aren't looking good.

I wonder what a loaf of bread or a month's supply of food respectively will cost next year in the USA

CNBC is on this hot topic: www.cnbc.com...

Also reporting that unemployment and recession are climbing quick. Romney says he thinks not much of QE3. Like Han Solo says, "I got a bad feeling about this,.."

Also reporting that unemployment and recession are climbing quick. Romney says he thinks not much of QE3. Like Han Solo says, "I got a bad feeling about this,.."

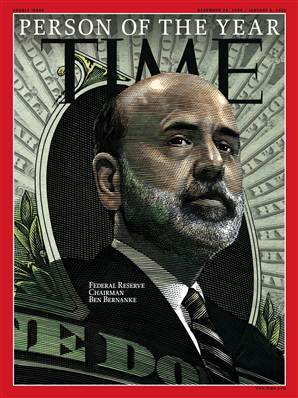

They should start printing $100,000. bills so when the weimar republic hyperinflation comes to america the proles won't need a wheelbarrow to carry

enough cash to buy a loaf of bread. AND I think BERNANKE's sorry mug should be on the front of the bill!!!!

Originally posted by InFriNiTee

I can't find where this has been officially announced as being adopted, but the announcement will be made today. I think we all know what the FED will do...

In reading a little more on this expected announcement by Bernanke I found an LA Times article with a schedule of events for the anticipated announcement today. Hope this helps:

All Eyes on Fed, Bernanke as Stimulus Announcement Expected

From the article above it looks as if we can expect an announcement of some sort by 12:30PM eastern time with Bernanke going before the cameras at around 2:15PM eastern time.

edit on 13-9-2012 by MyMindIsMyOwn because: (no reason given)

If it continues at the current rate I predict a gallon of Big Agriculture milk will cost $6-7 per gallon by this time in 2013. The reason for that is

because in 2010 I remember a gallon of milk costing ~$3.35 per gallon, and it costs ~$4.50-5.25 today.

What will it be like in 10 years from now? The insolvency of the US is festering wound right now, and dumping more money in to float the boat will eventually sink it.

I don't think it matters who gets elected this November, unless they can come up with a way to reopen factories and build a manufacturing base. I would be in support of any government program that would fund the creation of industry in America (as long as it actually created prosperity). American products might cost more, but this country used to be known for making some of the best products in the world. That's the only way I see of fixing the economic problems in the USA, but then there's the rest of the world too...

What will it be like in 10 years from now? The insolvency of the US is festering wound right now, and dumping more money in to float the boat will eventually sink it.

I don't think it matters who gets elected this November, unless they can come up with a way to reopen factories and build a manufacturing base. I would be in support of any government program that would fund the creation of industry in America (as long as it actually created prosperity). American products might cost more, but this country used to be known for making some of the best products in the world. That's the only way I see of fixing the economic problems in the USA, but then there's the rest of the world too...

Gold and Silver dropped like a fat rock at Noon EST today and appears to continue falling. That little bit of manipulation is the big precursur to

the QE infinity announcement today. Look for all the shorts to immediately try to cover just before the manipulators lose control and metals shoot

like a rocket for all investors looking to hedge against the massive wave of upcoming inflation.

I found a fairly up to date Debt to GDP ratio for many of the nations of the world:

Government Debt to GDP, List by Country

The numbers listed in each column of the chart are the year-by-year debt to GDP ratios. This chart has the most recent data I can find:

Debt to GDP ratios of the countries that are struggling the most. The USA sits in 5th place according to this data, and if you look at all of the top 5 countries, you can see how the Debt to GDP ratio has steadily increased over the years for each one. There isn't a country in the world that doesn't have debt, but the USA in 12 years has DOUBLED its ratio much like Portugal. Ireland did worse in this 12 year period.

If these trends continue, the USA will double its debt to gdp ratio again in 10-12 years. That would make the USA's debt worse than any in the world, and like the old saying goes, the bigger they are, the harder they fall.

Can a country with the size of the economy of the USA fix this? The outlook is grim.

Government Debt to GDP, List by Country

The numbers listed in each column of the chart are the year-by-year debt to GDP ratios. This chart has the most recent data I can find:

Japan 211.70%

Greece 165.30%

Italy 120.10%

Ireland 108.20%

Portugal 107.80%

United States 103.00%

Debt to GDP ratios of the countries that are struggling the most. The USA sits in 5th place according to this data, and if you look at all of the top 5 countries, you can see how the Debt to GDP ratio has steadily increased over the years for each one. There isn't a country in the world that doesn't have debt, but the USA in 12 years has DOUBLED its ratio much like Portugal. Ireland did worse in this 12 year period.

If these trends continue, the USA will double its debt to gdp ratio again in 10-12 years. That would make the USA's debt worse than any in the world, and like the old saying goes, the bigger they are, the harder they fall.

Can a country with the size of the economy of the USA fix this? The outlook is grim.

reply to post by larphillips

You see manipulation I see hedging their bets.

I you look at the individual transactions you will see small lot sizes. The big players don't trade that way.

Besides prices are up now.

That little bit of manipulation is the big precursur

You see manipulation I see hedging their bets.

I you look at the individual transactions you will see small lot sizes. The big players don't trade that way.

Besides prices are up now.

Originally posted by HUMBLEONE

AND I think BERNANKE's sorry mug should be on the front of the bill!!!!

This is great news! We the people pay to clean up the bankers balance sheets to allow them to further speculate in the Wall Street swindle called the stock market!

Bernanke is one of the worlds top scholars on the market crash that caused the great depression. That is exactly why he holds the seat he does. These sick bastards don't want a little crash resulting in a so called great depression 2. They want a crash so big and hard so that America will be destroyed forever. Once the federal reserve shareholders bleed us all dry and have exchanged all the real wealth for debt paper, they will cut and run and start the world anew.

edit on 13-9-2012 by METACOMET because: (no reason given)

And, as predicted, the moment the announcement was made Gold and Silver took off like rocketships, doubling the upside on the early drop and still

rising. Good for stackers, bad times ahead for us all.

Bring it on!

If you hold real money - not paper (fiat) you have nothing to worry about.

Silver $34.58/oz +1.31

www.coinflation.com...

If you hold real money - not paper (fiat) you have nothing to worry about.

Silver $34.58/oz +1.31

www.coinflation.com...

I can't believe this is the only thread talking about this, since it was a prediction thread, and now it has happened today.

No offense to the OP. I am just truly surprised this is not frontpage ATS news today with more than one thread on it!This is a big deal! Basically the Fed just said they will just buy up MBS monthly forever, and will keep money cheap or free.

So once the rally ends after today, what do they do then??? When you've promised easing indefinitely and it still doesn't ease the troubles, it's all downhill from there!

Stock up now. Not much else to do to ease the future pain of all this.

No offense to the OP. I am just truly surprised this is not frontpage ATS news today with more than one thread on it!This is a big deal! Basically the Fed just said they will just buy up MBS monthly forever, and will keep money cheap or free.

So once the rally ends after today, what do they do then??? When you've promised easing indefinitely and it still doesn't ease the troubles, it's all downhill from there!

Stock up now. Not much else to do to ease the future pain of all this.

edit on 13-9-2012 by SunnyDee because: (no reason given)

Originally posted by SunnyDee

I can't believe this is the only thread talking about this, since it was a prediction thread, and now it has happened today.

No offense to the OP. I am just truly surprised this is not frontpage ATS news today with more than one thread on it!This is a big deal! Basically the Fed just said they will just buy up MBS monthly forever, and will keep money cheap or free.

So once the rally ends after today, what do they do then??? When you've promised easing indefinitely and it still doesn't ease the troubles, it's all downhill from there!

Stock up now. Not much else to do to ease the future pain of all this.edit on 13-9-2012 by SunnyDee because: (no reason given)

I guess I'm not surprised the way the MSM has completely buried this story. You're right though, this is a very big deal.

When I searched for this news on ATS, it surprised me also. This meeting was scheduled for quite some time.

Here's a link to the live blog of what was discussed at the meeting.

I haven't had time to read through it all yet, but they are trying to say this is a "small" round of QE:

Fed Unveils QE3: Bernanke Speaks At The Press Conference (Live Blog)

Searching for video, but I can't find it yet.

Here's a link to the live blog of what was discussed at the meeting.

I haven't had time to read through it all yet, but they are trying to say this is a "small" round of QE:

Fed Unveils QE3: Bernanke Speaks At The Press Conference (Live Blog)

Searching for video, but I can't find it yet.

Originally posted by SunnyDee

I can't believe this is the only thread talking about this, since it was a prediction thread, and now it has happened today.

No offense to the OP. I am just truly surprised this is not frontpage ATS news today with more than one thread on it!This is a big deal! Basically the Fed just said they will just buy up MBS monthly forever, and will keep money cheap or free.

So once the rally ends after today, what do they do then??? When you've promised easing indefinitely and it still doesn't ease the troubles, it's all downhill from there!

Stock up now. Not much else to do to ease the future pain of all this.edit on 13-9-2012 by SunnyDee because: (no reason given)

one thing the people will notice is higher food prices and gas prices. They'll blame it on "gready" CEOs and profits when after all its the FED printing money and inflating prices.

Gas is already at $4.25 were i live and there starting QE3 at the top of the market???? There has not even been a crash yet and there starting QE3 right now..... Things must be bad at the banks for them to do it today

edit on 13-9-2012 by camaro68ss because: (no reason given)

Originally posted by HUMBLEONE

They should start printing $100,000. bills so when the weimar republic hyperinflation comes to america the proles won't need a wheelbarrow to carry enough cash to buy a loaf of bread. AND I think BERNANKE's sorry mug should be on the front of the bill!!!!

Need wage inflation for that to happen. Haven't seen that starting yet.

new topics

-

Electrical tricks for saving money

Education and Media: 1 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 2 hours ago -

Sunak spinning the sickness figures

Other Current Events: 3 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 3 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 5 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 6 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 8 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 10 hours ago

top topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 17 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 13 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 2 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 15 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 13 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 10 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 3 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 3 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 5 hours ago, 2 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 126 • : DBCowboy -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues • 44 • : BrotherKinsMan -

Terrifying Encounters With The Black Eyed Kids

Paranormal Studies • 73 • : burritocat -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 43 • : boatguy12 -

The Reality of the Laser

Military Projects • 45 • : 5thHead -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 13 • : Albone -

Spectrophilia - Women Who Have Had Affairs With Ghosts Say Spooks Are Better Lovers Than Real Men

Paranormal Studies • 31 • : charlyv -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 29 • : doubledan717 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 651 • : 777Vader -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 19 • : NoCorruptionAllowed