It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by BubbaJoe

Seriously you made 50 - 70 K at the time and paid no income tax, I am not buying it. I do taxes for a living. If you did, you lied on your returns, or have about 20 kids. I am not saying that 50-70 is a boatload of cash, but if it was all reported you paid taxes on it. Some of you folks on the right think that those of us on the left are seriously ignorant. I am 50+ years old, have ridden this horse a few times, and you may fool some of us, but you ain't fooling us all. Seriously, get off of your partisan politics and bring something to the table that makes some sense. I am sick and tired of the partisan BS, but will invite anyone that wants to have an intelligent discussion on how to fix the country to contact me.

Ok lets look at 2008...

60k gross

-10k IRA

50k

-5k morgage tax/interest

45k

-10 family standard deduction

35k

-14 exemptions claimed

21k

tax owed 2008 21,000 joint

2700

Child tax credit

+3000

End result I make 300 bucks off the Government more than I paid...WEEEEeeee

reply to post by xuenchen

Panic...........

We're already being outraised, and we can't afford to fall further behind. Our records show that you're still waiting to make your first online donation -- now is the time.

Just ask those rich Democrats in Congress, for a bailout. They have the loot.

Panic...........

We're already being outraised, and we can't afford to fall further behind. Our records show that you're still waiting to make your first online donation -- now is the time.

Just ask those rich Democrats in Congress, for a bailout. They have the loot.

Originally posted by Xtrozero

Originally posted by RealSpoke

LIE

In fact, 64 percent of the country will pay more in payroll taxes than they do in income taxes this year.

A favorite talking point used by conservatives to justify giving more tax breaks to the wealthy is that 50% of Americans pay no taxes. The truth is that 86% of Americans pay taxes.”

The actual number of Americans who don’t pay any taxes isn’t half, but 14%. This group of non-taxpayers of any kind is largely composed of the elderly and disabled. The people who don’t pay taxes do so because they can’t work.

www.politicususa.com...

I paid no federal income taxes for years and years and I made above 50 to 70k at the time...

PLEASE stop with the no taxes thing, yes people pay taxes but 48% do not pay federal INCOME tax...

Who is saying "ANY" tax...do you read that in my post? Typically when we talk about comparing taxes we are talking about Federal income tax and that is it...

You either lied on your returns, or your just lying right now. I don't buy any bit of it.

reply to post by xuenchen

Ryan won't cause democrats to switch to republican.

Ryan may swing independents to switch. Maybe.

What has the left nervous is that Ryan is creating an enthusastic movement within the republican party. While the democrats are busy flinging mud or defending failed policies and high unemployment, Ryan is energizing the republican side.

This is a huge win for the right.

Ryan won't cause democrats to switch to republican.

Ryan may swing independents to switch. Maybe.

What has the left nervous is that Ryan is creating an enthusastic movement within the republican party. While the democrats are busy flinging mud or defending failed policies and high unemployment, Ryan is energizing the republican side.

This is a huge win for the right.

Originally posted by BubbaJoe

You do realize that a family of 4 making about 40 grand a year pays federal income taxes, it is not a lot but they do pay them, by your stats, you are perfectly ok with 48% of the families in the USA making less than 40K a year, while providing huge tax breaks to millionaires and billionaires? Seriously? I guess I am really screwed up.

ETA: That is with both parents working.edit on 8/13/2012 by BubbaJoe because: Forgot something important

40k

-10k standard deuctions

30k

-14.8k 4 member 3,700 each

15kish

15k tax is 1829.00

2k child tax credit

They make a profit of 171 bucks... This is with JUST the most basic deductions possable...

BTW a tax break means you pay taxes in the first place.. a "HUGE TAX BREAK" mean you pay at least HUGE TAXES....lol A tax credit is money in the pocket with zero taxes needed to be paid into it....

The rich get tax "BREAKS" the poor get tax "CREDITS"

edit on 14-8-2012 by Xtrozero because: (no reason given)

Originally posted by acidsweep

You either lied on your returns, or your just lying right now. I don't buy any bit of it.

Hmm don't buy any of it..it seems you and others just read left wing talking points....

BUT it is basic math....lol

reply to post by Xtrozero

Get out of here and take your phony-baloney malarkey with you. That is a bald-faced lie.

Even minimum wage jobs pay federal taxes. And no matter what you are ALWAYS paying sales taxes, FICA, state income taxes, property taxes, etc.

I paid no federal income taxes for years and years and I made above 50 to 70k at the time...

Get out of here and take your phony-baloney malarkey with you. That is a bald-faced lie.

Even minimum wage jobs pay federal taxes. And no matter what you are ALWAYS paying sales taxes, FICA, state income taxes, property taxes, etc.

Originally posted by Blackmarketeer

reply to post by Xtrozero

I paid no federal income taxes for years and years and I made above 50 to 70k at the time...

Get out of here and take your phony-baloney malarkey with you. That is a bald-faced lie.

Even minimum wage jobs pay federal taxes. And no matter what you are ALWAYS paying sales taxes, FICA, state income taxes, property taxes, etc.

bingo!

p.s. @ Xtrozero, don't believe you bro. Taxes come in many forms.

reply to post by beezzer

@NancyPelosi: Paul Ryan's budget ends the Medicare guarantee and shift costs to seniors simply to give tax breaks to the wealthiest Americans.

Nancy's Net Worth ?

$196,299,990

@NancyPelosi: Paul Ryan's budget ends the Medicare guarantee and shift costs to seniors simply to give tax breaks to the wealthiest Americans.

Nancy's Net Worth ?

$196,299,990

Originally posted by Blackmarketeer

reply to post by Xtrozero

I paid no federal income taxes for years and years and I made above 50 to 70k at the time...

Get out of here and take your phony-baloney malarkey with you. That is a bald-faced lie.

Even minimum wage jobs pay federal taxes. And no matter what you are ALWAYS paying sales taxes, FICA, state income taxes, property taxes, etc.

Wow...the left can't read very well...

FEDERAL INCOME TAXES... read a few posts above yours...lol

Really people.....

Originally posted by sonnny1

reply to post by beezzer

@NancyPelosi: Paul Ryan's budget ends the Medicare guarantee and shift costs to seniors simply to give tax breaks to the wealthiest Americans.

Nancy's Net Worth ?

$196,299,990

Pssst,just don't tell anyone that Obama cut 700 billion from Medicare.

(shhhhhhhhhhhhhhhhh)

Originally posted by acidsweep

Originally posted by Blackmarketeer

reply to post by Xtrozero

I paid no federal income taxes for years and years and I made above 50 to 70k at the time...

Get out of here and take your phony-baloney malarkey with you. That is a bald-faced lie.

Even minimum wage jobs pay federal taxes. And no matter what you are ALWAYS paying sales taxes, FICA, state income taxes, property taxes, etc.

bingo!

p.s. @ Xtrozero, don't believe you bro. Taxes come in many forms.

Wow you too? I can see now how Obama can screw up so bad and so many have no clue...

Taxes come in many form...YES WE ALL KNOW THAT!!

How many forms does you Federal INCOME tax come in....lol one...its called FEDERAL INCOME TAX and 48% of America do not pay it....lol

It is simple math look up a few posts and stop living some left wing spin.

Originally posted by Xtrozero

Originally posted by acidsweep

Originally posted by Blackmarketeer

reply to post by Xtrozero

I paid no federal income taxes for years and years and I made above 50 to 70k at the time...

Get out of here and take your phony-baloney malarkey with you. That is a bald-faced lie.

Even minimum wage jobs pay federal taxes. And no matter what you are ALWAYS paying sales taxes, FICA, state income taxes, property taxes, etc.

bingo!

p.s. @ Xtrozero, don't believe you bro. Taxes come in many forms.

Wow you too? I can see now how Obama can screw up so bad and so many have no clue...

Taxes come in many form...YES WE ALL KNOW THAT!!

How many forms does you Federal INCOME tax come in....lol one...its called FEDERAL INCOME TAX and 48% of America do not pay it....lol

It is simple math look up a few posts and stop living some left wing spin.

I still say you're full of it. You may not pay taxes, but where are you getting the 48% of Americans don't? To be blunt, I don't know very many people who DON'T pay federal taxes. Show me where you got that statistic from, otherwise you're just pulling another number out you arse.

seriously, LOL @ YOU

Originally posted by acidsweep

I still say you're full of it. You may not pay taxes, but where are you getting the 48% of Americans don't? To be blunt, I don't know very many people who DON'T pay federal taxes. Show me where you got that statistic from, otherwise you're just pulling another number out you arse.

seriously, LOL @ YOU

…The explanation is simple: the income tax serves two masters. On one hand, it raises nearly half of all federal revenues. On the other, it delivers a broad array of social benefits in the form of exemptions, deductions, and credits that reward people for government-favored behavior… Over the past two decades, Congress has repeatedly used the income tax to encourage or subsidize specific activities. We subsidize kids with the child credit, college attendance with multiple higher education credits, retirement with all sorts of tax-favored savings plans, work with the earned income credit, and child care with, you guessed it, the childcare credit. And we’ve retained most itemized deductions that subsidize homeownership, state and local governments, and charitable giving…

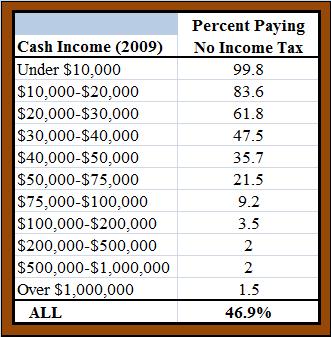

What with April 15 coming up again, I have seen many articles and blog posts on the issues of taxes, fairness and so on. Did you known 47% of Americans pay no Federal income taxes even though they have earned income? I am reproducing this chart from one of my favorite blogs, Carpe Diem, run by University of Michigan economist Mark Perry. The chart points out that many Americans do not pay income taxes even though they have income.

47% of Americans pay no income taxes

Well that was a lie Pauls plan clearly states anyone over 55 would have the same thing as they have now which brings us to the point of the liberal

lies.

They want to keep and use medicare as leverage over seniors to scare them into voting for them.

Rahter sleezy politics if I must say.

They want to keep and use medicare as leverage over seniors to scare them into voting for them.

Rahter sleezy politics if I must say.

Wasn't a certain Party talking of DEATH PANELS regarding Obamacare?

Originally posted by neo96

They want to keep and use medicare as leverage over seniors to scare them into voting for them.

Rahter sleezy politics if I must say.

Might be just me, but isn't that a Tad Bit Sleezy?

Trying to scare older voters?

Originally posted by sonnny1

Originally posted by acidsweep

I still say you're full of it. You may not pay taxes, but where are you getting the 48% of Americans don't? To be blunt, I don't know very many people who DON'T pay federal taxes. Show me where you got that statistic from, otherwise you're just pulling another number out you arse.

seriously, LOL @ YOU

…The explanation is simple: the income tax serves two masters. On one hand, it raises nearly half of all federal revenues. On the other, it delivers a broad array of social benefits in the form of exemptions, deductions, and credits that reward people for government-favored behavior… Over the past two decades, Congress has repeatedly used the income tax to encourage or subsidize specific activities. We subsidize kids with the child credit, college attendance with multiple higher education credits, retirement with all sorts of tax-favored savings plans, work with the earned income credit, and child care with, you guessed it, the childcare credit. And we’ve retained most itemized deductions that subsidize homeownership, state and local governments, and charitable giving…

What with April 15 coming up again, I have seen many articles and blog posts on the issues of taxes, fairness and so on. Did you known 47% of Americans pay no Federal income taxes even though they have earned income? I am reproducing this chart from one of my favorite blogs, Carpe Diem, run by University of Michigan economist Mark Perry. The chart points out that many Americans do not pay income taxes even though they have income.

47% of Americans pay no income taxes

Okay, I can admit when I'm wrong. Thanks for pointing me to the article. I guess I make too much money orrr.. I need a new accountant.

ps. That doesn't mean I'm not going to do more research on this subject though!

edit on 14-8-2012 by acidsweep because: (no reason

given)

Originally posted by acidsweep

I still say you're full of it. You may not pay taxes, but where are you getting the 48% of Americans don't? To be blunt, I don't know very many people who DON'T pay federal taxes. Show me where you got that statistic from, otherwise you're just pulling another number out you arse.

seriously, LOL @ YOU

Do you do taxes, and you know what deductions and exemptions are? Just Google it dude...lol but let's look at it for 2012. Do we both agree that 0 income equals zero taxes?

A Family of 4...

11400 standard deductions

14800 exemptions

16000 equals tax credit for two children

40,800 gross no taxes paid

add 5k interest/property tax

add 10k IRA

55,800 gross will pay no taxes, plus there are many other breaks I didn't list...

That is 100% tax break!! a person who makes 80K is getting 70 to 85% tax break!!

A guy who makes 250k gets no IRA, no child tax credit, just basic deductions... 27800. and that is about 12% tax break...

Some millionaire takes 50 million of their money he has already paid taxes on and invest it with risks and pays 15% on the profit. He risks 50 million but makes 10 million then he pays 1.5 million in taxes...he risks 50 million and loses 10 million he gets nothing....

If you want to tax him 50% then he will not risk it and keep his money in a show box.

Originally posted by Xtrozero

Originally posted by acidsweep

I still say you're full of it. You may not pay taxes, but where are you getting the 48% of Americans don't? To be blunt, I don't know very many people who DON'T pay federal taxes. Show me where you got that statistic from, otherwise you're just pulling another number out you arse.

seriously, LOL @ YOU

Do you do taxes, and you know what deductions and exemptions are? Just Google it dude...lol but let's look at it for 2012. Do we both agree that 0 income equals zero taxes?

A Family of 4...

11400 standard deductions

14800 exemptions

16000 equals tax credit for two children

40,800 gross no taxes paid

add 5k interest/property tax

add 10k IRA

55,800 gross will pay no taxes, plus there are many other breaks I didn't list...

That is 100% tax break!! a person who makes 80K is getting 70 to 85% tax break!!

A guy who makes 250k gets no IRA, no child tax credit, just basic deductions... 27800. and that is about 12% tax break...

Some millionaire takes 50 million of their money he has already paid taxes on and invest it with risks and pays 15% on the profit. He risks 50 million but makes 10 million then he pays 1.5 million in taxes...he risks 50 million and loses 10 million he gets nothing....

If you want to tax him 50% then he will not risk it and keep his money in a show box.

Did you read my last post? LOL. get off it.

My tax bracket is much higher, and I guess, so are the people around me. Hence why I didn't believe you when you said you're not paying taxes. btw, I have an accountant who does my taxes, he knows the in and outs. sorry bud.

edit on 14-8-2012 by acidsweep because: (no reason given)

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 27 minutes ago -

Electrical tricks for saving money

Education and Media: 3 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 4 hours ago -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 5 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 8 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 10 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 15 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 8 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 4 hours ago, 8 flags -

Bobiverse

Fantasy & Science Fiction: 15 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 12 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 3 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 5 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 10 hours ago, 1 flags

active topics

-

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 53 • : pianopraze -

Sunak spinning the sickness figures

Other Current Events • 5 • : glen200376 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 44 • : MikeDeGrasseTyson -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 31 • : budzprime69 -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 33 • : rickymouse -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 32 • : ThatSmellsStrange -

The Reality of the Laser

Military Projects • 46 • : Zaphod58 -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 0 • : randomuser2034 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 136 • : ImagoDei -

Electrical tricks for saving money

Education and Media • 3 • : Mike72