It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

If this isn't insider trading, what do you think insider trading is? Martha Stewart went to jail for selling stock off of inside info.

www.investopedia.com...

The buying or selling of a security by someone who has access to material, nonpublic information about the security.

it is illegal when the material information is still nonpublic--trading while having special knowledge is unfair to other investors who don't have access to such knowledge.

www.investopedia.com...

edit on 13-8-2012 by RealSpoke because: (no reason given)

reply to post by RealSpoke

Dear RealSpoke,

I'm just not following this. Apparently, the trades were made before the meeting with Bernanke, and the entire country knew that the banking industry was in crisis.

How do you get to your belief that it was positively, proved beyond a doubt, insider trading. The evidence looks a little thin at the moment. How do you see it?

With respect,

Charles1952

Dear RealSpoke,

I'm just not following this. Apparently, the trades were made before the meeting with Bernanke, and the entire country knew that the banking industry was in crisis.

How do you get to your belief that it was positively, proved beyond a doubt, insider trading. The evidence looks a little thin at the moment. How do you see it?

With respect,

Charles1952

reply to post by charles1952

Of course I don't know for sure.

That's why I asked.

Of course I don't know for sure.

That's why I asked.

edit on 13-8-2012 by RealSpoke because: (no reason given)

reply to post by charles1952

Thank You! I stated earlier that this meeting did not even occur until after the Markets closed for the day. According to the NYT it was an evening/night meeting and the markets closed at 4 pm. House ethics investigators have examined these cases where warranted. Ryan has never been investigated by them or the SEC plus he disclosed a variety of transactions as required. These stocks were all moving like gangbusters in the weeks leading up to that fateful day. Day in and Day out it was the talk of Wall Street and experienced brokers and investment bankers.

Thank You! I stated earlier that this meeting did not even occur until after the Markets closed for the day. According to the NYT it was an evening/night meeting and the markets closed at 4 pm. House ethics investigators have examined these cases where warranted. Ryan has never been investigated by them or the SEC plus he disclosed a variety of transactions as required. These stocks were all moving like gangbusters in the weeks leading up to that fateful day. Day in and Day out it was the talk of Wall Street and experienced brokers and investment bankers.

Originally posted by RealSpoke

It should probably come as no surprise to anyone that someone like Paul Ryan would trade on inside information gained through his position as a congressman to line his pockets, but this particular instance is especially egregious. Ryan attended a closed meeting with congressional leaders, Bush's Treasury Secretary Henry Paulson, and Federal Reserve Chairman Ben Bernanke on September 18, 2008. The purpose of the meeting was to disclose the coming economic meltdown and beg Congress to pass legislation to help collapsing banks.

Instead of doing anything to help, Ryan left the meeting and on that very same day Paul Ryan sold shares of stock he owned in several troubled banks and reinvested the proceeds in Goldman Sachs, a bank that the meeting had disclosed was not in trouble. This is the guy Republicans want one heartbeat away from the presidency? He seems more than a little shady to me.

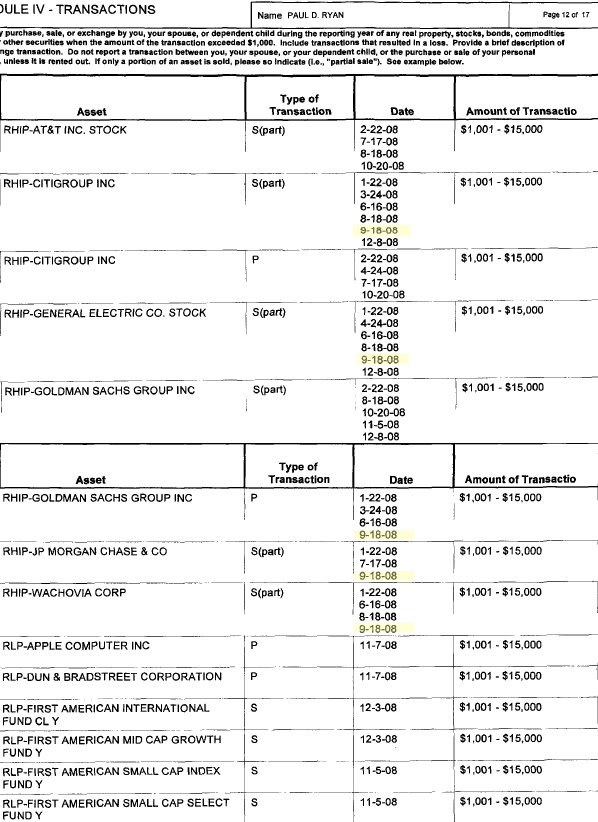

Have a look at Ryan's financial disclosure form for 2008--you can click on each page to enlarge them. The "Transactions" section begins on page 12--scroll through and look at all the trades Paul Ryan made on "9-18-08":

www.the-richmonder.com...

www.opensecrets.org...

TLDR Version;

On September 18, 2008, Ryan attended a closed meeting with congressional leaders, then-Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke, and was urged to craft legislation to help financially troubled banks. That same day Ryan sold shares in various troubled banks and invested in Goldman Sachs

And people wonder why congress is full of millionaires? Ryan is just more establishment slime just waiting to screw over the rest of America.edit on Mon Aug 13 2012 by DontTreadOnMe because: to use source title

Those look like scheduled trades aka automatic investing. Seeing he was buying Goldman back in Jan and also purchased it the 18th of August. BTW Goldman was trading at $129/share and three months later it was trading at $53.

Personally looking at those buys and sell it looks like dollar cost averaging to me, hell those sales could have just been a stop loss hit. You know, if the stock loses 10-20%, which ever you choose, the stock will automatically sell. Could be rebalancing his portfolio, etc...

The problem I have is, those trades are not time stamped and we dont know what time that meeting was or the price he paid at the time. So many factors are left out, we hardly can conclude that this was any kind of insider trading.

Originally posted by charles1952

Well, maybe, but you don't have a very strong case yet. CNN was reporting in August that there were 90 troubled banks on the list. And that number was up from previous announcements. Everybody knew that the banks were in trouble. Selling off those banks would have been a prudent move for any American. money.cnn.com...

So in other words, the fact that he had insider information doesn't make any difference right? Because he obviously didn't act on that information...Why wait until right after the meeting? It is obvious to anyone who thinks about it for two seconds.

Originally posted by RealSpoke

If this isn't insider trading, what do you think insider trading is? Martha Stewart went to jail for selling stock off of inside info.

The buying or selling of a security by someone who has access to material, nonpublic information about the security.

it is illegal when the material information is still nonpublic--trading while having special knowledge is unfair to other investors who don't have access to such knowledge.

www.investopedia.com...edit on 13-8-2012 by RealSpoke because: (no reason given)

It's legal for them to do it. He broke no law congress is above the law.

edit on 13-8-2012 by buster2010 because: (no reason given)

A blogger for Slate originally discussed this issue using the Richmonder source for his blog. This particular individual has written for

ThinkProgress and other liberal publications. And Slate is, of course, liberal. (Just want to show that you can trust him.)

Shortly thereafter he wrote a second blog article. Here's the main part:

www.slate.com...

Will someone start a thread now on some substantive national issue?

Shortly thereafter he wrote a second blog article. Here's the main part:

Let me apologize. I originally had a too-credulous item here linking to a piece at The Richmonder alleging that Paul Ryan has sold bank shares after a closed door meeting with Henry Paulson and Ben Bernanke on the financial crisis in 2008. As Eric Platt explains he certainly seems to have sold the shares on the same day as the meeting, but the meeting happened in the evening by which time the markets would have been closed. One can perhaps construct a scenario by which the Richmonder's theory of the case holds up, but they don't have the goods and I shouldn't have passed their analysis on with no qualification and so little scrutiny of my own.

As Brad DeLong writes, for one reason or another Ryan did quite a lot of trading of individual bank stocks in 2008 so the timing of this particularly transaction isn't particularly noteworthy when put in that context.

www.slate.com...

Will someone start a thread now on some substantive national issue?

Congress is at its lowest approval for corruption with things like this and who does Romney choose as his running mate...a member from congress. Its

not gonna work buddy boy. Ron Paul all the way

Of course Ryan used information from these meetings with the Big Banks to make trades. Too bad the STOCK Act, which would have stopped this practice,

was GUTTED by one of Ryan's cronies in Congress; See:

Eric Cantor's office has

thwarted the Stock Act disclosure rules

Cantor, like a sleaze, waited until AFTER the senate had passed the STOCK Act, but before the house would vote, he re-wrote a part of the Act that exempted spouses and families to allow them to continue with - you guessed it - insider trading with privy-Congressional intel.

Now, to the naysayers trying to defend Ryan for his trades, he clearly had very juicy information that the public did not have courtesy of his meeting with the heads of these banks and the Treasury sec. He made trades that very day selling stocks from the banks going belly up, and buying stock in a bank that was set to clean up on the action (Goldman Sachs). Just because he had other trades mixed in a few months apart from those dates does not indicate these were "routine" trades. To any court, this would be a clear example of INSIDER TRADING. If you or I had done this, we'd be looking at real jail time.

But Paul Ryan, like Eric Cantor, is above the law. Insider trading does not apply to them. Even when they sit in on a meeting between banks and the Treasury Dept. that will determine the fate of certain banks, Congress members like them can trade stocks in those companies using that information.

S+F OP, this is a big deal, but as it happens to be regarding a Tea Party darling, no one will care, and Congress will continue to flaunt the law.

No doubt you remember earlier this year when President Obama signed the Stock Act to end the exemption of House and Senate members from insider trading laws. Many of us were astonished and angered to learn the exemption existed in the first place.

Cantor, like a sleaze, waited until AFTER the senate had passed the STOCK Act, but before the house would vote, he re-wrote a part of the Act that exempted spouses and families to allow them to continue with - you guessed it - insider trading with privy-Congressional intel.

Robert Walker, a Washington ethics attorney and former chief counsel for both the House and Senate ethics committees, explained that Senate bill did include a provision that covered spouses and children, but when Cantor's office wrote the House version, this language was shifted to a different section of the bill. The change meant that spouses and dependent children weren't subject to the new reporting requirements.

"The House recrafted some of the provisions of it and moved some of the provisions around. In that process, some of the Senate bill that applied to filing of these new reports that was moved from one section of the bill to the other," Walker said.

Initially when contacted by CNN, Cantor's office insisted it did nothing to change the intent of the STOCK Act. But when pressed with the new information uncovered by CNN, the majority leader's office conceded it made changes to the House bill that effectively took out the requirement for spouses and children to file these reports.

Now, to the naysayers trying to defend Ryan for his trades, he clearly had very juicy information that the public did not have courtesy of his meeting with the heads of these banks and the Treasury sec. He made trades that very day selling stocks from the banks going belly up, and buying stock in a bank that was set to clean up on the action (Goldman Sachs). Just because he had other trades mixed in a few months apart from those dates does not indicate these were "routine" trades. To any court, this would be a clear example of INSIDER TRADING. If you or I had done this, we'd be looking at real jail time.

But Paul Ryan, like Eric Cantor, is above the law. Insider trading does not apply to them. Even when they sit in on a meeting between banks and the Treasury Dept. that will determine the fate of certain banks, Congress members like them can trade stocks in those companies using that information.

S+F OP, this is a big deal, but as it happens to be regarding a Tea Party darling, no one will care, and Congress will continue to flaunt the law.

reply to post by Blackmarketeer

It's a small thing, but it's late and I don't feel like tackling bigger projects right now.

It's a small thing, but it's late and I don't feel like tackling bigger projects right now.

As has been pointed out, these deals were made before the meeting began. The whole country had seen reports, and even Bernanke's speeches, to the effect that the banks were in trouble. I'd be more worried about Ryan if he hadn't gotten out of those banks.

He made trades that very day selling stocks from the banks going belly up, and buying stock in a bank that was set to clean up on the action (Goldman Sachs).

Just another anti-ryan thread at the behest of the DNC. Man you guys are working o/t.

As a side note, the Ryan pick sure is rattling some cages. It's almost comedic.

As a side note, the Ryan pick sure is rattling some cages. It's almost comedic.

edit on 14-8-2012 by ThirdEyeofHorus because: (no reason

given)

reply to post by RealSpoke

It didn't take insider information to know to sell those stocks.

Glenn Beck was saying to get out of the market at that time.

Do you believe that Glenn Beck is a financial genius?

It didn't take insider information to know to sell those stocks.

Glenn Beck was saying to get out of the market at that time.

Do you believe that Glenn Beck is a financial genius?

Paul Ryans minions have wrote to the TPM to try and debunk this (apparently he's worried enough by the allegations to try and get out in front of

this). The trouble is his debunking claims also don't hold up.

Paul Ryan traded on insider information to avoid 2008 crash

From: Brad DeLong weighs in on this so-called "debunking.";

The Ryan response: [The trades] were part of a Russell 1000 index fund that automatically traded stocks as part of a pre-set formula.

So why isn't the fund listed in the financial disclosure forms?

As the author writes;

Notable comments;

Personally, I have Index funds I have to disclose for my taxes. I list the Index fund - not every single stock traded by that Index fund. You own shares of an Index fund. For Ryan to claim these individual stock purchases and sales he listed on his financial form were part of the Russell 1000 Index 'rebalancing'...? Riiight.

One commenter on that page may be the closest to seeing what was going on:

The fact that these strange trades did stop after 2009 would also disprove the claim these trades were part of the Russell 1000 Index.

Secondly, as also pointed out by this comment, the trades were made by "RHIP", the Ryan-Hutter Investment Partnership. Meaning the Ryan flunkies who wrote to the TPM to debunk this claim were even further from the truth.

Paul Ryan traded on insider information to avoid 2008 crash

UPDATE: Ryan's staff has responded and TPM accepts their explanation and calls this story "debunked."

Brad DeLong weighs in on this so-called "debunking." Did Ryan's flacks lie to Benjy Sarlin of TPM? Why would they lie if they have nothing to hide?

From: Brad DeLong weighs in on this so-called "debunking.";

The Ryan response: [The trades] were part of a Russell 1000 index fund that automatically traded stocks as part of a pre-set formula.

So why isn't the fund listed in the financial disclosure forms?

As the author writes;

There is no way in hell--if you are rebalancing to try to track the Russell 1000 index--you make only 58 trades in a year, that you make 27 of those 58 in large money-center banks, and that 10 of those trades involve shifting your money from Citi to Goldman and back five times.

No way in hell.

I don't know what was going on. But it appears that Ryan's flacks are--for some reason--simply making s@#& up.

Notable comments;

It is very obvious what was going on. This was tax-loss harvesting, designed to avoid the 30 day wash sale rule. All the sales came 30 days or more after purchases and everytime something was sold, a correlated asset was bought. Rebalancing the index??? That is hilarious.

If the trades don't make sense -- and financially they don't -- there's probably something else going on. Leaks of committee info?

Personally, I have Index funds I have to disclose for my taxes. I list the Index fund - not every single stock traded by that Index fund. You own shares of an Index fund. For Ryan to claim these individual stock purchases and sales he listed on his financial form were part of the Russell 1000 Index 'rebalancing'...? Riiight.

One commenter on that page may be the closest to seeing what was going on:

He always bought high and sold low. It's part of what makes the insider-trading charge absurd. No one's that unlucky; Ryan was deliberately registering losses on these sales. That seems strange. But if you're trying to stay in a sector to catch an eventual rebound, and want to maximize your losses for future taxes, it makes a fair degree of sense. And sure enough, once 2009 rolls around and the markets achieve a degree of stability, the strange sales suddenly stop.

The fact that these strange trades did stop after 2009 would also disprove the claim these trades were part of the Russell 1000 Index.

Secondly, as also pointed out by this comment, the trades were made by "RHIP", the Ryan-Hutter Investment Partnership. Meaning the Ryan flunkies who wrote to the TPM to debunk this claim were even further from the truth.

Wow! Repubs are eager to bend over backwards to defend against this strong information that PR engaging in illegal activity.

The complete dishonesty of the whole stock market system shows that it is just a form of legalized gambling and should be taxed as such.

Capital gains on the sale of stocks should be taxed at 40% for people who play the market. Retirees who have legitimate long term investments should get the 14% tax rate, up to a certain amount.

These day traders are nothing but leeches.

The complete dishonesty of the whole stock market system shows that it is just a form of legalized gambling and should be taxed as such.

Capital gains on the sale of stocks should be taxed at 40% for people who play the market. Retirees who have legitimate long term investments should get the 14% tax rate, up to a certain amount.

These day traders are nothing but leeches.

reply to post by Blackmarketeer

So now we're supposed to equate the liberal progressive Talking Points Memo to the SEC. Where is the SEC investigation? Where is the house Ethics Committee investigation? Its been nearly 4 years since.... and all of this information has been in the open since then...

Now opinion suddenly becomes the law.... Okie Dokie...

So now we're supposed to equate the liberal progressive Talking Points Memo to the SEC. Where is the SEC investigation? Where is the house Ethics Committee investigation? Its been nearly 4 years since.... and all of this information has been in the open since then...

Now opinion suddenly becomes the law.... Okie Dokie...

Originally posted by Blackmarketeer

Of course Ryan used information from these meetings with the Big Banks to make trades. Too bad the STOCK Act, which would have stopped this practice, was GUTTED by one of Ryan's cronies in Congress; See: Eric Cantor's office has thwarted the Stock Act disclosure rules

No doubt you remember earlier this year when President Obama signed the Stock Act to end the exemption of House and Senate members from insider trading laws. Many of us were astonished and angered to learn the exemption existed in the first place.

Cantor, like a sleaze, waited until AFTER the senate had passed the STOCK Act, but before the house would vote, he re-wrote a part of the Act that exempted spouses and families to allow them to continue with - you guessed it - insider trading with privy-Congressional intel.

Robert Walker, a Washington ethics attorney and former chief counsel for both the House and Senate ethics committees, explained that Senate bill did include a provision that covered spouses and children, but when Cantor's office wrote the House version, this language was shifted to a different section of the bill. The change meant that spouses and dependent children weren't subject to the new reporting requirements.

"The House recrafted some of the provisions of it and moved some of the provisions around. In that process, some of the Senate bill that applied to filing of these new reports that was moved from one section of the bill to the other," Walker said.

Initially when contacted by CNN, Cantor's office insisted it did nothing to change the intent of the STOCK Act. But when pressed with the new information uncovered by CNN, the majority leader's office conceded it made changes to the House bill that effectively took out the requirement for spouses and children to file these reports.

Now, to the naysayers trying to defend Ryan for his trades, he clearly had very juicy information that the public did not have courtesy of his meeting with the heads of these banks and the Treasury sec. He made trades that very day selling stocks from the banks going belly up, and buying stock in a bank that was set to clean up on the action (Goldman Sachs). Just because he had other trades mixed in a few months apart from those dates does not indicate these were "routine" trades. To any court, this would be a clear example of INSIDER TRADING. If you or I had done this, we'd be looking at real jail time.

But Paul Ryan, like Eric Cantor, is above the law. Insider trading does not apply to them. Even when they sit in on a meeting between banks and the Treasury Dept. that will determine the fate of certain banks, Congress members like them can trade stocks in those companies using that information.

S+F OP, this is a big deal, but as it happens to be regarding a Tea Party darling, no one will care, and Congress will continue to flaunt the law.

Great points here. I love the way that Cantor was caught lying and the supporters of the corrupted US government completely ignore it. Insider trading has been the dirty not so little secret of congress for a long time. I have been wondering for a while now when people are going to start getting upset by this abuse of position and power. Great topic OP!

reply to post by jibeho

Why would they be investigating it? For Paul Ryan, it's LEGAL to engage in insider trading. He and every other Congressman/woman can use the information from their committees and backroom Congressional dealings with banks to trade stocks.

This was also in 2008, before there was a backlash against Congressional insider trading that led to the creation of the STOCK Act (Stop Trading on Congressional Knowledge). Too bad, however, the STOCK Act was shot down in flames by Eric Cantor (another Republican, 'natch). Cantor added a loophole that allows families and spouses of Congress members to continue insider trading with privileged info. So someone like Paul Ryan can use his family members on something like the Ryan-Hutter Investment Partnership to make trades all day long.

The SEC can't do anything about it because Congress wrote itself some pretty slick rules exempting themselves from the law. Asking "why didn't the SEC investigate" is pointless, the law has to be changed first.

For more on that:

Why would they be investigating it? For Paul Ryan, it's LEGAL to engage in insider trading. He and every other Congressman/woman can use the information from their committees and backroom Congressional dealings with banks to trade stocks.

This was also in 2008, before there was a backlash against Congressional insider trading that led to the creation of the STOCK Act (Stop Trading on Congressional Knowledge). Too bad, however, the STOCK Act was shot down in flames by Eric Cantor (another Republican, 'natch). Cantor added a loophole that allows families and spouses of Congress members to continue insider trading with privileged info. So someone like Paul Ryan can use his family members on something like the Ryan-Hutter Investment Partnership to make trades all day long.

The SEC can't do anything about it because Congress wrote itself some pretty slick rules exempting themselves from the law. Asking "why didn't the SEC investigate" is pointless, the law has to be changed first.

For more on that:

new topics

-

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 27 minutes ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 35 minutes ago -

I hate dreaming

Rant: 1 hours ago -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics: 3 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 3 hours ago -

Biden says little kids flip him the bird all the time.

2024 Elections: 3 hours ago -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 3 hours ago -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 3 hours ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 5 hours ago -

MH370 Again....

Disaster Conspiracies: 6 hours ago

top topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 5 hours ago, 14 flags -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 3 hours ago, 10 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 16 hours ago, 8 flags -

A man of the people

Medical Issues & Conspiracies: 11 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 3 hours ago, 7 flags -

Biden says little kids flip him the bird all the time.

2024 Elections: 3 hours ago, 6 flags -

4 plans of US elites to defeat Russia

New World Order: 13 hours ago, 4 flags -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics: 3 hours ago, 4 flags -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 3 hours ago, 3 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 8 hours ago, 3 flags

active topics

-

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 77 • : Consvoli -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 35 • : BernnieJGato -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 19 • : glend -

I hate dreaming

Rant • 4 • : Macenroe1982 -

12 jurors selected in Trump criminal trial

US Political Madness • 103 • : SideEyeEverything1 -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 34 • : DBCowboy -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 28 • : JoelSnape -

Old School Punk

Music • 537 • : underpass61 -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs • 1 • : imitator -

Man sets himself on fire outside Donald Trump trial

Mainstream News • 28 • : KKLOCO