It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by ANOK

Originally posted by Logarock

All this talk about the rich is right out of the communist, Stalin days, development of the Russian communist party.

This kind of talk started way before then, right about the time capitalism replaced feudalism in the mid 1700's.

This kind of talk was started in France, Germany, and Britain long before the Russians appropriated the terms for their own agenda.

Before Lenin there were the Owenites for example.

Owenites were those followers of Robert Owen a social reformer and one of the founders of socialism and the cooperative movement.

In the 1850s the Owenites adopted secularism. Notable secularist Owenites included:

Josiah Gimson

Henry Hetherington

George Jacob Holyoake

Charles Southwell who was an Owenite ’socialist missionary’

Owenites

The cooperative movement began in Europe in the 19th century, primarily in Britain and France, although The Shore Porters Society claims to be one of the world's first cooperatives, being established in Aberdeen in 1498 (although it has since demutualized to become a private partnership).[1] The industrial revolution and the increasing mechanization of the economy transformed society and threatened the livelihoods of many workers. The concurrent labour and social movements and the issues they attempted to address describe the climate at the time....

History of the cooperative movement

Nothing to do with Russia, or China, Or Lenin, Or Mao. Nothing to do with what happened in those despot nations. Owen would have been just as appalled as you and I.

edit on 8/2/2012 by ANOK because: (no reason given)

THe wrokers can own the means of production right here, right now. Just get a bunch together, pool their resources, take out loans, and build a company or a factory.

Of course, would they then let new workers hired have an equal share of the factory? After all, new workers did not put the risk and effort into the startup as the original workers. WHat if some workers did not want to work as hard and let others take up their slack but still want an equal share? If everybody gets an equal share, regardless of how much work they do, then nobody would do any wrok.

The reason why the utopian vision of communism looks good on paper, but fails in reality is that people are not ants.

I think your kidding, but in case you aren't.

Millionaires and Billionaires don't need your help OP. They already have it sown up.

'Trickle down' might work in a closed system but in a globalised world its actually 'trickle away' to the developing world. Its been trickling away for quite some time now. The Chinese and Indian middle class thank you.

Its the shrinking western middle that carries the tax burden and will get hit harder and harder as the herd of dutiful hard working (employed) folks shrinks.

Theres nothing more amusing that watching somebody in the middle defending taxes avoidance for the rich because he thinks he is, or aspires to be, in the group above.

Millionaires and Billionaires don't need your help OP. They already have it sown up.

'Trickle down' might work in a closed system but in a globalised world its actually 'trickle away' to the developing world. Its been trickling away for quite some time now. The Chinese and Indian middle class thank you.

Its the shrinking western middle that carries the tax burden and will get hit harder and harder as the herd of dutiful hard working (employed) folks shrinks.

Theres nothing more amusing that watching somebody in the middle defending taxes avoidance for the rich because he thinks he is, or aspires to be, in the group above.

reply to post by Jean Paul Zodeaux

O, John. You keep misrepresenting my argument, and never respond directly to very clear points.

O, John. You keep misrepresenting my argument, and never respond directly to very clear points.

Originally posted by stanguilles7

reply to post by Jean Paul Zodeaux

O, John. You keep misrepresenting my argument, and never respond directly to very clear points.

Tell me what it is I am not responding to directly? Explain clearly, without any irony or understatement what it is I am "misrepresenting"?

Originally posted by Jean Paul Zodeaux

Originally posted by stanguilles7

reply to post by Jean Paul Zodeaux

O, John. You keep misrepresenting my argument, and never respond directly to very clear points.

Tell me what it is I am not responding to directly? Explain clearly, without any irony or understatement what it is I am "misrepresenting"?

I already have. Several times in this thread. You just ignore it. For one, you claim i conflated all taxes with income tax. In addition, you claimed i said that rich people arent doing well today, and that labor laws were a direct product of income tax. When i pointed out i never made these claims, you just ignored it in favor of new straw men. I would point out more, but you will likley just report my posts to get them removed.

reply to post by superman2012

What the hell do people think PROPERTY TAXES GO FOR? and then steal from Indiana to give funds to that crap in New York and California while others state like Indiana with smaller populations gets screwed.

Or the bridges to nowhere and airports in Nevada that no one goes to or high speed rails that no one is going to ride because the car is faster and cheaper.

No kidding it isn't working under the current system.

Forced taxation like the income tax which this country didn't have at the beginning of it's creation is RIDICULOUS.

The governments well being is no concern of me a bloated out of control tyrannical oligarchy of 536 little tyrants using money to control the people to stay in power is.

How do you propose infrastructure, schooling, etc., gets paid/subsidized?

What the hell do people think PROPERTY TAXES GO FOR? and then steal from Indiana to give funds to that crap in New York and California while others state like Indiana with smaller populations gets screwed.

Or the bridges to nowhere and airports in Nevada that no one goes to or high speed rails that no one is going to ride because the car is faster and cheaper.

Not everyone can afford to pay for their own road, own water main, own sewer line, own streetlights, own sidewalks, private schooling,

No kidding it isn't working under the current system.

Saying that no one should pay income tax is a little ridiculous, as all it would do is either make other taxes go higher, or create new taxes.

Forced taxation like the income tax which this country didn't have at the beginning of it's creation is RIDICULOUS.

The governments well being is no concern of me a bloated out of control tyrannical oligarchy of 536 little tyrants using money to control the people to stay in power is.

edit on 3-8-2012 by neo96 because: (no reason given)

Heres an excellent example of Johns straw men:

NONE of those are things I have stated. They are just straw men.

Originally posted by Jean Paul Zodeaux

Why do you think that the only way Congress can tax is through "income" taxation and why do you believe this form of taxation ensures the kind of people you approve of flourishing and prospering and finally, why do you believe income taxation led to child labor laws?

NONE of those are things I have stated. They are just straw men.

reply to post by stanguilles7

This is what you keep repeating over and over, but what you will not explain is what you meant by ending all taxes. You will not explain what you meant, through sarcasm, but letting roads fall into disrepair, "milataries" (sic) coming to grinding halt, and the end of social services.

When I pointed out that there is no Constitutional mandate for standing armies, nor social services, you ignore this. Frankly, you've not explained anything at all other than you are really annoyed that I misinterpreted your sarcasm.

I already have. Several times in this thread. You just ignore it. For one, you claim i conflated all taxes with income tax. In addition, you claimed i said that rich people arent doing well today, and that labor laws were a direct product of income tax. When i pointed out i never made these claims, you just ignored it in favor of new straw men. I would point out more, but you will likley just report my posts to get them removed.

This is what you keep repeating over and over, but what you will not explain is what you meant by ending all taxes. You will not explain what you meant, through sarcasm, but letting roads fall into disrepair, "milataries" (sic) coming to grinding halt, and the end of social services.

When I pointed out that there is no Constitutional mandate for standing armies, nor social services, you ignore this. Frankly, you've not explained anything at all other than you are really annoyed that I misinterpreted your sarcasm.

Originally posted by tkwasny

But your caught in a catch22. There are no customers unless they have jobs where they can amass disposable income.

And while unemployment is still panfully high, 90% of Americans have jobs. It is not the lack of spending by the Jobless that is anchoring our economy, it is the lack of spending by EVERYONE, including the 90% who are employed and still just scraping by living paycheck to paycheck. They need to take home more of thier income and that won't happen as long as the 1% continues to loot the treasury through first...huge unfunded tax breaks...second, trillions in taxpayer bailouts..and now a majority of congress who would like them to have larger tax breaks...

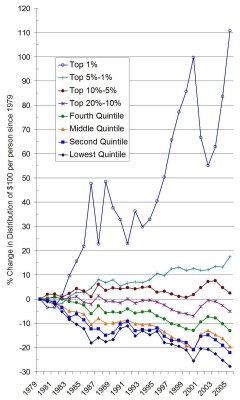

See a trend here??? And this chart was BEFORE the economic crisis and the bailouts aka "The Largest Transfer of Wealth in History"

Originally posted by tkwasny

The start point is MANY business owner's deciding to hire, not exclusively the demand for the business owner's products or services at the present time.

No...Banks don't loan to businesses who just decide to hire despite thier being no demand or customers.

Business owners don't hire with a hope that new customers will magically appear.

Business owners don't simply hire because they have more money, they hire when they EARN more money or if DEMAND increases and then banks will loan to them as well.

Originally posted by tkwasny

It is the fault of the local, state and federal govts that have imposed regulations, taxes, and restrictions that are the cause for owners to not hire. There is no positive future for accelleration if the govts are stomping on your brake pedal.

Wrong...business owners consitently rank regulations and taxes way down on the list of reasons for not hiring if they list it at all. #1 is economic or political uncertaintity assuming the have the funds to hire.

The large corps have cash in hand and aren't hiring because we have a congress that has apocalyptic rhetoric.

Taxes and regualtions is simply BS. It is not hindering the Business community in the least.

Originally posted by tkwasny

Trickle down ONLY works if there is incentive to expand the business.

It has NEVER worked...Never...not in the many times in the 130 years it has been tried.

You should read this book:

The New American Economy: The Failure of Reaganomics and a New Way Forward

And lest you think this is a book by some Liberal...It's written by the guy who CREATED Reagonomics aka trickle-down for Ronald Reagan!

As a domestic policy advisor to Ronald Reagan, Bruce Bartlett was one of the originators of Reaganomics, the supply-side economic theory that conservatives have clung to for decades. In The New American Economy, Bartlett goes back to the economic roots that made Impostor a bestseller and abandons the conservative dogma in favor of a policy strongly based on what’s worked in the past. Marshalling compelling history and economics, he explains how economic theories that may be perfectly valid at one moment in time under one set of circumstances tend to lose validity over time because they are misapplied under different circumstances. Bartlett makes a compelling, historically-based case for large tax increases, once anathema to him and his economic allies.

www.amazon.com...

edit on 3-8-2012 by Indigo5 because: (no reason given)

Originally posted by elitegamer23

think of all the jobs that would be created if we didnt ask the job creators to pay any taxes.

we would have so many jobs that the whole nation would be employed.

wages would skyrocket because of all the jobs that the job creators would create that we could actually raise taxes on the middle class and poor because they would have so much money. many people in the middle class and lower class could become job creators themselves because they would also have so much money.

any tax cut for the job creators will simply not be enough. that is just keeping another job from being created.

to save america and the working class and poor we must have jobs. reduce taxes on the job creators to zero and id bet you see 12 million new jobs created in no time. after those jobs are filled more job creators will be created and they will create more jobs and america would be great again.

You've been watching too much FOX NEWS. Most millionnaires and billionnaires make their money from investments, not from starting businesses.

Recent stats have shown that companies are sitting on Trillions of dollars in unspent capital, and aren't hiring based on invested money. Most corporations already spend $0 on taxes given loopholes, they'd rather spend money on accountants and lawyers to figure out tax breaks than on paying their actual taxes, so I guess they're creating a few jobs here.

Reducing taxes on richest people never creates jobs, if it did, we would have a job bonanza right now as taxes are the lowest they've ever been both on millionnaires and on corporate America.

IN the big scheme of things, most millionnaires and billionnaires are already maxed out at the highest possible tax contributions anyway, so raising taxes on them or letting Bush tax cuts expire won't actually increase revenue for the Federal Govt.

www.livescience.com - Mere Thought of Money Makes People

Selfish...

www.rawstory.com - Upper-class people less empathetic than lower-class people: study...

blogs.discovermagazine.com - Eat the Rich...

www.good .is - Americans Are Horribly Misinformed About Who Has Money...

phys.org - Study shows powerful corporations really do control the world's finances...

www.time.com - Do We Need $75,000 a Year to Be Happy...?

www.rawstory.com - Upper-class people less empathetic than lower-class people: study...

blogs.discovermagazine.com - Eat the Rich...

www.good .is - Americans Are Horribly Misinformed About Who Has Money...

phys.org - Study shows powerful corporations really do control the world's finances...

www.time.com - Do We Need $75,000 a Year to Be Happy...?

reply to post by Jean Paul Zodeaux

There is a need for taxation in any system, though our system has become corrupt. It still does not justify throwing all taxation out of the window. In the ideal system, the government would tax its citizens a decent amount, yet citizens would see a return on their taxes in the form of well maintained roads, upgrades to their nation's infrastructure, safe and available drinking water, abundant electricity with a power grid built underground so millions of people don't lose power in storms, and so on. You know, things that we expect from our government.

If taxes actually went towards bettering this country for everyone in it, I don't think many people would have a problem paying them. However, our system is so corrupt and deplorable I'd rather burn my money than give it to the government. I wish we as citizens could decide what our tax dollars fund; I think this would be the only way of achieving a democratic taxation system. Vote for issues of importance with your tax dollars.

On the other hand, if all taxation stopped, everything would become privatized and we'd be at the mercy of corporations rather than our government. Oh wait, we basically already are.

There is a need for taxation in any system, though our system has become corrupt. It still does not justify throwing all taxation out of the window. In the ideal system, the government would tax its citizens a decent amount, yet citizens would see a return on their taxes in the form of well maintained roads, upgrades to their nation's infrastructure, safe and available drinking water, abundant electricity with a power grid built underground so millions of people don't lose power in storms, and so on. You know, things that we expect from our government.

If taxes actually went towards bettering this country for everyone in it, I don't think many people would have a problem paying them. However, our system is so corrupt and deplorable I'd rather burn my money than give it to the government. I wish we as citizens could decide what our tax dollars fund; I think this would be the only way of achieving a democratic taxation system. Vote for issues of importance with your tax dollars.

On the other hand, if all taxation stopped, everything would become privatized and we'd be at the mercy of corporations rather than our government. Oh wait, we basically already are.

reply to post by DestroyDestroyDestroy

How did you extrapolate "no taxation" from this post of mine:

How did you extrapolate "no taxation" from this post of mine:

No one should be taxed - in perpetuity - on the income they earn. Not the janitor, ditch digger, or industrialist. All people everywhere have the right to earn income and the right to expect to keep every cent they earned.

reply to post by Jean Paul Zodeaux

I didn't, but I'm laying down a counterpoint to your statement; the relationship between government and citizen shouldn't be hostile and one-sided as it is in the states; there should be a mutual co-dependence. If a government does nothing for its citizens in return for taking their money in the form of taxes, then the taxation is unjustified and the citizens have every right to not pay it. However, if a government isn't run by asshats and actually puts tax dollars towards bettering living conditions for its citizens, to not pay taxes is to leech off of the system; in this scenario citizens shouldn't expect to keep every cent they earn.

Granted it's a bit of a socialist viewpoint and would fail in actuality, it looks alright on paper.

I didn't, but I'm laying down a counterpoint to your statement; the relationship between government and citizen shouldn't be hostile and one-sided as it is in the states; there should be a mutual co-dependence. If a government does nothing for its citizens in return for taking their money in the form of taxes, then the taxation is unjustified and the citizens have every right to not pay it. However, if a government isn't run by asshats and actually puts tax dollars towards bettering living conditions for its citizens, to not pay taxes is to leech off of the system; in this scenario citizens shouldn't expect to keep every cent they earn.

Granted it's a bit of a socialist viewpoint and would fail in actuality, it looks alright on paper.

You obviously drank the Kool-Aid didn't you? Thanks OK, I understand, I too used to believe in Santa Claus the Easter Bunny and the U.S. Government,

but alas experience has taught me some hard lessons. Millionaires and Billionaire are hoarders and do not create jobs, they outsource them to places

like India and China where they can create sweat shops to exploit the worker even better. Think of money as "life support credits", because that's

really what this worthless paper really is isn't it? You use these credits to buy things like, food, water, clothing, shelter and fuel and most of

us workers, work damn hard to get these credits. We spend our valuable time away from those that we love to toil for these credits in order to

survive. Meanwhile these Capitalist, pig, bastards (millionaires and billionaires) are hoarding life support credits, credits made off the sweat,

tears and blood of the working class (thats you and me). They create nothing and yet they own everything. If you think that you too can become a

Capitalist, pig, bastard, put down the bath salts, because you don't have a chance because the game is rigged.. I hope that you find that out before

it's too late. Best of luck to you and stay off the Kool- Aid, it's not good for you. PEACE.

reply to post by DestroyDestroyDestroy

Respectfully, arguing that "no taxation" is a bad idea is not a counterpoint to my argument. I have argued that income taxation in perpetuity is a bad idea. I have not argued that taxation is a bad idea. This a huge difference, but by claiming your argument of "no taxation" is a bad idea is a "counterpoint" to my argument that income taxation in perpetuity is a bad idea, you are implicitly arguing that income taxation is the only way Congress can tax.

Congress has the complete and plenary power of taxation and can tax whatever they see fit. I have not argued against taxation. I am expressly arguing against perpetual income taxation. I am not even arguing against limited income taxes that are repealed once the revenue needed is raised. I am arguing that income taxation in perpetuity is just plain stupid.

In 1913 when the current income tax scheme was passed, the national debt was hovering around 3 billion dollars. Today that national debt is somewhere near 16 trillion dollars...16 trillion...trillion...bad, bad, bad, idea.

I didn't, but I'm laying down a counterpoint to your statement

Respectfully, arguing that "no taxation" is a bad idea is not a counterpoint to my argument. I have argued that income taxation in perpetuity is a bad idea. I have not argued that taxation is a bad idea. This a huge difference, but by claiming your argument of "no taxation" is a bad idea is a "counterpoint" to my argument that income taxation in perpetuity is a bad idea, you are implicitly arguing that income taxation is the only way Congress can tax.

Congress has the complete and plenary power of taxation and can tax whatever they see fit. I have not argued against taxation. I am expressly arguing against perpetual income taxation. I am not even arguing against limited income taxes that are repealed once the revenue needed is raised. I am arguing that income taxation in perpetuity is just plain stupid.

In 1913 when the current income tax scheme was passed, the national debt was hovering around 3 billion dollars. Today that national debt is somewhere near 16 trillion dollars...16 trillion...trillion...bad, bad, bad, idea.

new topics

-

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 19 minutes ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 13 hours ago, 10 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 17 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 14 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 12 hours ago, 4 flags -

Sunak spinning the sickness figures

Other Current Events: 14 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 16 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago, 2 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago, 0 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 19 minutes ago, 0 flags

active topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 62 • : Ophiuchus1 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 18 • : Threadbarer -

Sunak spinning the sickness figures

Other Current Events • 17 • : Ohanka -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 59 • : Vermilion -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 2 • : underpass61 -

Hate makes for strange bedfellows

US Political Madness • 44 • : 19Bones79 -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 261 • : YourFaceAgain -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 8 • : mysterioustranger -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 280 • : FlyersFan -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 48 • : oldhead1967