It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by OutKast Searcher

reply to post by kozmo

I'm a Constitutional Libertarian.

Yes, you and every other Republican that is too embarressed to admit they are voting for Romney.

Sorry...I don't believe you.

I could care less if you "Believe" me. Address the substance of my post and stop with childish ad hominems. What you posted is not accurately sourced. In the real world, we call this LIBEL. I'm intersted in the source of your quotes.

After reading Mittens plan, the points you made aren't consistent with what you quoted. Please address your error. Thank you.

Originally posted by kozmo

reply to post by OutKast Searcher

These items, from the "plan" you linked to, include the following:

•Make permanent, across-the-board 20 percent cut in marginal rates

•Maintain current tax rates on interest, dividends, and capital gains

•Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

•Eliminate the Death Tax

•Repeal the Alternative Minimum Tax (AMT)

The first one is extending the Bush tax cuts...but "Bush tax cuts" is a dirty word so he doesn't say it.

The second and third one eliminates the tax on interest,dividens and capital gains for the wealthy like Romney...because he deosn't have a AGI.

The third is eliminating the inheritance tax.

The fourth wasn't discussed in my post.

I'm not seeing any of the things you quoted. So either you have mis-quoted, in violation of T&C's or you have made an egregious mistake that requires correcting. Which is it?

If you can't see it...then I'm sorry...I can't help you...you may need to go back to school or maybe you just don't have the capacity to understand.

And I quoted a fellow ATS member...exactly how do I mis-quote a member.

You are trying really hard to defend someone you don't support

But you are still failing...even though you don't support Romney

reply to post by Indigo5

Again, right from your link:

They fully admit that they are making ASSUMPTIONS. You know what they say about making assumptions, right?

Again, right from your link:

Because we have received no details on proposals to reduce tax preferences, the TPC analysis does not include those proposals.1

They fully admit that they are making ASSUMPTIONS. You know what they say about making assumptions, right?

reply to post by kozmo

I can't correct your reading comprehension problems.

It's all right there in front of you...sorry you can't understand that the same thing can be said multiple ways.

After reading Mittens plan, the points you made aren't consistent with what you quoted. Please address your error. Thank you.

I can't correct your reading comprehension problems.

It's all right there in front of you...sorry you can't understand that the same thing can be said multiple ways.

Originally posted by kozmo

reply to post by Indigo5

Again, right from your link:

Because we have received no details on proposals to reduce tax preferences, the TPC analysis does not include those proposals.1

They fully admit that they are making ASSUMPTIONS. You know what they say about making assumptions, right?

Holy crap...for real???

They are specifically NOT MAKING ASSUMPTIONS...that is why they say they aren't including the proposals that lack details.

reply to post by OutKast Searcher

Are you Dim or simply disingenuous??? AGI means ADJUSTED GROSS INCOME. Meaning, no tax on AGi BELOW $200,000 - the MIDDLE CLASS as defined by... OBAMA!

SHEESH! You guys stop at nothing to spread the propaganda.

Are you Dim or simply disingenuous??? AGI means ADJUSTED GROSS INCOME. Meaning, no tax on AGi BELOW $200,000 - the MIDDLE CLASS as defined by... OBAMA!

SHEESH! You guys stop at nothing to spread the propaganda.

reply to post by OutKast Searcher

Simply stated, it is YOUR lack of comprehension coupled by your unbridled partisanship which blinds you to the simple fact that this "Study" isn't a study at all.

After all, you didn't even know what ADJUSTED GROSS INCOME was!

ETA: The quote from the "Study" clearly states that since they have no details from Mittens, they couldn't factor them in. So, in other words, we paired our assumptions to arrive at our conclusions.

Simply stated, it is YOUR lack of comprehension coupled by your unbridled partisanship which blinds you to the simple fact that this "Study" isn't a study at all.

After all, you didn't even know what ADJUSTED GROSS INCOME was!

ETA: The quote from the "Study" clearly states that since they have no details from Mittens, they couldn't factor them in. So, in other words, we paired our assumptions to arrive at our conclusions.

edit on 1-8-2012 by kozmo because: (no reason given)

Originally posted by kozmo

I could care less if you "Believe" me. Address the substance of my post and stop with childish ad hominems. What you posted is not accurately sourced. In the real world, we call this LIBEL. I'm intersted in the source of your quotes.

After reading Mittens plan, the points you made aren't consistent with what you quoted. Please address your error. Thank you.

AGAIN...look at the last page...I gave you both Mittens link to his plan and the Tax Policy Center Analysis...SAME PLAN...AND HE was QOUTING ME...

Estate Tax = Inheritance tax = Mitt/Lutz call it "Death Tax"

Here is the Tax Policy Center

In his campaign for the Republican presidential nomination, Mitt Romney has proposed permanently extending the 2001-03 tax cuts, further cutting individual income tax rates, broadening the tax base by reducing tax preferences, eliminating taxation of investment income of most individual taxpayers, reducing the corporate income tax, eliminating the estate tax, and repealing the alternative minimum tax (AMT) and the taxes enacted in 2010’s health reform legislation. The Tax Policy Center (TPC) has completed a preliminary analysis of the Romney plan, based on information posted on the campaign website and email exchanges with campaign policy advisors. Because we have received no details on proposals to reduce tax preferences, the TPC analysis does not include those proposals.1

Governor Romney would permanently extend all the 2001 and 2003 tax cuts now scheduled to expire in 2013, repeal the AMT and certain tax provisions in the 2010 health reform legislation, and cut individual income tax rates by an additional 20 percent. He would also expand the tax base by cutting back tax preferences, but has supplied no information on which preferences would be reduced. Tax provisions in the 2009 stimulus act and subsequently extended through 2012 would expire. These include the American Opportunity tax credit for higher education, the expanded refundability of the child credit, and the expansion of the earned income tax credit (EITC). The plan would also eliminate tax on long-term capital gains, dividends, and interest income for married couples filing jointly with income under $200,000 ($100,000 for single filers and $150,000 for heads of household) and repeal the federal estate tax, while continuing the gift tax with a maximum tax rate of 35 percent.2

The plan would reduce the six current income tax rates by one-fifth, bringing the top rate down from 35 percent to 28 percent and the bottom rate from 10 percent to 8 percent. The accompanying repeal of the AMT would increase the tax savings from the rate cuts—without that repeal, the AMT would reclaim much of the tax savings.

The plan would recoup the revenue loss caused by those changes by reducing or eliminating unspecified tax breaks, thereby making more income subject to tax. Gov. Romney says that the reductions in tax breaks, in combination with moderately faster economic growth brought about by lower tax rates, will make the individual income tax changes revenue neutral compared with simply extending the 2001 and 2003 tax cuts. He also promises that low- and middle-income households will pay no larger shares of federal taxes than they do now.

At the corporate level, the Romney plan would make two major changes: 1) reduce the corporate income tax rate from 35 to 25 percent and 2) make the research and experimentation credit permanent, It would also extend for one year the full expensing of capital expenditures and allow a “tax holiday” for the repatriation of corporate profits held overseas. The plan does not specify, however, whether repatriated earnings would face any tax and, if so, at what rate. In the longer run, Gov. Romney would reduce the corporate rate further in conjunction with base broadening and simplification and would move the corporate tax to a territorial system.

Gov. Romney would also permanently repeal the 0.9 percent tax on wages and the 3.8 percent tax on investment income of high-income individual taxpayers that were imposed by the 2010 health reform legislation and are scheduled to take effect in 2013.

HERE IS MITTENS PUBLISHED PLAN

Indiv

•Make permanent, across-the-board 20 percent cut in marginal rates

•Maintain current tax rates on interest, dividends, and capital gains

•Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

•Eliminate the Death Tax

•Repeal the Alternative Minimum Tax (AMT)

Corp

•Cut the corporate rate to 25 percent

•Strengthen and make permanent the R&D tax credit

•Switch to a territorial tax system

•Repeal the corporate Alternative Minimum Tax (AMT)

reply to post by Indigo5

Thank you Indigo. I am quite clear on both Mitten's bullet points and the Tax Policy Center "Study". However, you folks are making quite a stretch to say it benefits the wealthy.

The repeal of taxes on investment ONLY benefit those making less than $200,000. The death tax applies to EVERYONE, not just the wealthy. By the way... what right does the government have to CONFISCATE the wealth of someone simply because they have passed away?

Thank you Indigo. I am quite clear on both Mitten's bullet points and the Tax Policy Center "Study". However, you folks are making quite a stretch to say it benefits the wealthy.

The repeal of taxes on investment ONLY benefit those making less than $200,000. The death tax applies to EVERYONE, not just the wealthy. By the way... what right does the government have to CONFISCATE the wealth of someone simply because they have passed away?

Originally posted by kozmo

reply to post by Indigo5

Again, right from your link:

Because we have received no details on proposals to reduce tax preferences, the TPC analysis does not include those proposals.1

They fully admit that they are making ASSUMPTIONS. You know what they say about making assumptions, right?

And since Mittens wouldn't tell what loop-holes he would close to pay for it...they ran the analysis with the most generous assumptions they could give him...and it STILL screwed the middle class..

So say I, So says the Tax Policy Center...SO SAYS THE CONSERVATIVE FORBES MAGAZINE...

The Tax Policy Center cut him every break they could and his plan still screwed the Middle Class..

FORBES MAGAZINE

If you are willing to let the Republican presidential campaign off the hook by dismissing what is a fairly extensive, fair and balanced report (I suggest you read the study)—where the authors actually appear to go to the extreme to give the Governor the benefit of the doubt—then I have some California government bonds I’d like to sell you. They’re a great investment…honest.

www.forbes.com... partisan/3/

edit on 1-8-2012 by Indigo5 because: (no reason given)

Originally posted by kozmo

reply to post by Indigo5

Thank you Indigo. I am quite clear on both Mitten's bullet points and the Tax Policy Center "Study". However, you folks are making quite a stretch to say it benefits the wealthy.

No offense kozmo, but I think you need to read it again...Financial periodicals...ones that heavily lean conservative... are acknowledging the report as an accurate analysis.

FORBES above in my last post...now Business Insider...

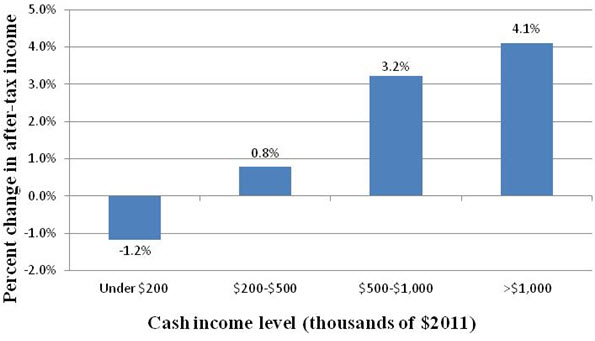

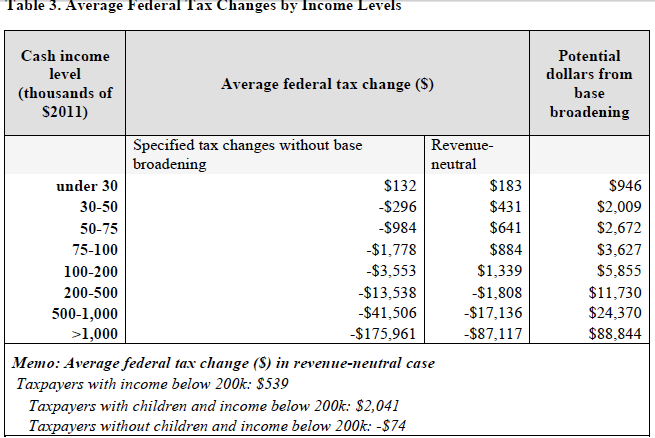

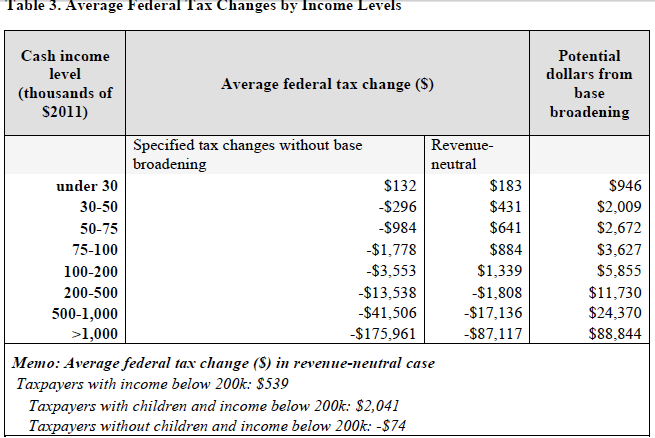

Here is a chart of how Romney's plan would effect after tax income

Originally posted by kozmo

The repeal of taxes on investment ONLY benefit those making less than $200,000.

You are confused...You can still earn 5 Million a year...then if you make less than 200k on "investments" that is tax free. If you make over that you enjoy the lion's share of his tax reduction in his plan.

NOT people making less than 200k...people making less than 200k on investments....that is tax free,

•Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

Sorry, we're going to disgaree here.

Bottom line: Lower taxes across the board with consideration toward AGIs of less than $200,000.

The libertarian in me believes the progressive tax system is in direct violation of the Constition that demands that all men be treated equally.

By the way, why are tax cuts bad? Only redistributionist/tax-and-spend liberls who support a nanny state operated by an over-bloated beauracracy would find that to be an abomination!

And the same would believe that the government has a right to CONFISCATE private wealth upon the death of the person who earned such wealth.

I see the unbalanced "Benefit" to the wealthy as a result of an unfair tax that the majority of Americans opposed in Obamacare being repealed. Beyond that, the tax reductions are 20% across the board - meaning EVERYONE. I see corporate tax cuts as allowing us to be competitive with other countries and attracting business as opposed to simply importing goods - but not benefiting the "Wealthy" as some would have us believe.

So, sorry... going to disagree here.

So, please continue with the histrionics and spastic fits if you so desire. I'm not defending Mittens, merely clearing the air of the propaganda.

Bottom line: Lower taxes across the board with consideration toward AGIs of less than $200,000.

The libertarian in me believes the progressive tax system is in direct violation of the Constition that demands that all men be treated equally.

By the way, why are tax cuts bad? Only redistributionist/tax-and-spend liberls who support a nanny state operated by an over-bloated beauracracy would find that to be an abomination!

And the same would believe that the government has a right to CONFISCATE private wealth upon the death of the person who earned such wealth.

I see the unbalanced "Benefit" to the wealthy as a result of an unfair tax that the majority of Americans opposed in Obamacare being repealed. Beyond that, the tax reductions are 20% across the board - meaning EVERYONE. I see corporate tax cuts as allowing us to be competitive with other countries and attracting business as opposed to simply importing goods - but not benefiting the "Wealthy" as some would have us believe.

So, sorry... going to disagree here.

So, please continue with the histrionics and spastic fits if you so desire. I'm not defending Mittens, merely clearing the air of the propaganda.

Originally posted by Indigo5

Originally posted by kozmo

The repeal of taxes on investment ONLY benefit those making less than $200,000.

You are confused...You can still earn 5 Million a year...then if you make less than 200k on "investments" that is tax free. If you make over that you enjoy the lion's share of his tax reduction in his plan.

NOT people making less than 200k...people making less than 200k on investments....that is tax free,

•Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

ADJUSTED GROSS INCOME includes ALL income, including everything you listed. The portion of said income that comes from "investment" will not be taxed. The earned income will!

One need simply look at a 1040 to understand what comprises AGI - it is the sum of ALL income, less specific deductions, but NOT itemized deductions.

Anyone earning an AGI OVER $200K WILL PAY the investment tax - include Mittens!

reply to post by kozmo

Mitt Romney's tax Plan.....At Revenue Neutral...everyone making less than 200k gets HIGHER taxes...broadening the base is fantasy numbers...the claim that more people will earn more money and pay more taxes due to the plan. But even under the fantasy of a significantly broadened tax base during an economic recovery...the advantage to the wealthiest is striking.

Mitt Romney's tax Plan.....At Revenue Neutral...everyone making less than 200k gets HIGHER taxes...broadening the base is fantasy numbers...the claim that more people will earn more money and pay more taxes due to the plan. But even under the fantasy of a significantly broadened tax base during an economic recovery...the advantage to the wealthiest is striking.

edit on 1-8-2012 by Indigo5 because: (no reason given)

Originally posted by kozmo

Originally posted by Indigo5

Originally posted by kozmo

The repeal of taxes on investment ONLY benefit those making less than $200,000.

You are confused...You can still earn 5 Million a year...then if you make less than 200k on "investments" that is tax free. If you make over that you enjoy the lion's share of his tax reduction in his plan.

NOT people making less than 200k...people making less than 200k on investments....that is tax free,

•Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

ADJUSTED GROSS INCOME includes ALL income, including everything you listed. The portion of said income that comes from "investment" will not be taxed. The earned income will!

One need simply look at a 1040 to understand what comprises AGI - it is the sum of ALL income, less specific deductions, but NOT itemized deductions.

Anyone earning an AGI OVER $200K WILL PAY the investment tax - include Mittens!

•Eliminate taxes for taxpayers with AGI below $200,000 on interest, dividends, and capital gains

By your defintion of AGI then someone that has a net worth of 5 Million, pays zero tax on the 190k in capital gains or interest he might take home each year?

reply to post by Indigo5

Again... based on the "Study" - assumptions and all. I will wait on details from Mittens and an objective analysis sans assumptions before I score mittens plan.

None-the-less, it won't matter... I'm libertarian. I just want a fair and honest fight.

Good night all!

Again... based on the "Study" - assumptions and all. I will wait on details from Mittens and an objective analysis sans assumptions before I score mittens plan.

None-the-less, it won't matter... I'm libertarian. I just want a fair and honest fight.

Good night all!

Originally posted by kozmo

reply to post by Indigo5

Again... based on the "Study" - assumptions and all. I will wait on details from Mittens and an objective analysis sans assumptions before I score mittens plan.

Mittens on the Tax Policy Center BEFORE they scored his plan..."An Objective 3rd Party Organization"

Originally posted by Indigo5

By your defintion of AGI then someone that has a net worth of 5 Million, pays zero tax on the 190k in capital gains or interest he might take home each year?

Net worth isn't income. Income would be the interest earned (Called UN-EARNED INCOME) on that net worth (Investments) PLUS any earned income; salary, bonus, options etc... TOGETHER that is Aduscted Gross Income. For the "Wealthy", their AGI would likely ALWAYS be over the $200K mark. The middle-class, with modest investments, would be able to accumulate wealth at a faster rate, retire earlier, and enjoy MORE of THEIR money due to the elimination of the tax penalty on the interest they earn.

Originally posted by Indigo5

Originally posted by kozmo

reply to post by Indigo5

Again... based on the "Study" - assumptions and all. I will wait on details from Mittens and an objective analysis sans assumptions before I score mittens plan.

Mittens on the Tax Policy Center BEFORE they scored his plan..."An Objective 3rd Party Organization"

Your obfuscating! An out of context and irrellevant non-sequitur.

new topics

-

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 1 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 3 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 5 hours ago -

Bobiverse

Fantasy & Science Fiction: 8 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 8 hours ago -

Former Labour minister Frank Field dies aged 81

People: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 17 hours ago, 19 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 8 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 12 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 10 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 8 hours ago, 3 flags -

Ode to Artemis

General Chit Chat: 17 hours ago, 3 flags -

This is our Story

General Entertainment: 14 hours ago, 3 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 1 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 5 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 3 hours ago, 0 flags

active topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 33 • : 0bserver1 -

Mood Music Part VI

Music • 3099 • : BrucellaOrchitis -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 88 • : grey580 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 20 • : budzprime69 -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 2 • : Cre8chaos79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 649 • : RookQueen2 -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 14 • : Raptured -

DerBeobachter - Electric Boogaloo 2

Introductions • 14 • : ElitePlebeian2 -

LaBTop is back at last.

Introductions • 16 • : ElitePlebeian2 -

VirginOfGrand says hello

Introductions • 4 • : ElitePlebeian2