It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Originally posted by Flatfish

Originally posted by LevelHeaded

I have a silly idea...

Why doesn't Congress leave the tax rates alone and live within their means by balancing the budget. Make a 10 year commitment to this and show the business world that the gov't will quit screwing around with things for awhile. This would lead to to the economic stability the businesses are looking for.

As it stands now, businesses don't want to invest in capital equipment (upgrading manufacturing plants, etc...) or personnel because they don't know what going to happen next. Will they be able to use the capital they have to help their business grow or have to send it off to the gov't?

Develop some stability and you will see the markets grow and when the markets are growing, they are hiring.

I too have a silly idea...

Why don't we tell all the hungry people in America and around the world that what they are experiencing is not a food shortage, but rather over-consumption of the food they do have.

I mean really, once they just learn to eat less, all their problems will be solved.

That would be great if they were actually overeating. That analogy makes no sense because no one in washington is short on cash. They have raised the deficit more than any administration in history. So by your analogy the hungry people you are talking about have been at Golden Coral for weeks and the truck isnt there yet to refill the restaurant so they can gorge more.

Look at the facts. The spending in washington is CRAZY. They are not having to live on food stamps.

reply to post by Flatfish

Nah, bro. Your idea wasn't that silly.

Just dumb.

I too have a silly idea...

Nah, bro. Your idea wasn't that silly.

Just dumb.

reply to post by TheTardis

It will increase revenue. Revenue that can be used to address our debt that also plays a vital role in this crappy economy. There is a reason Moody downgraded us. there is a reason that there is uncertainty on whether the US can meet its obligations. The tax break is not creating jobs.

Revenue is based on demand for a product. If the demand isn't there, revenue decreases regardless of tax break.

No it is not. But what part of companies don't care about employees don't you get. If companies cared about employees, CEO's would share their wealth with their employees. Companies wouldn't be taking their jobs overseas. Everybody would have good benefits. The bottom line is profit, not taking care of employees. Don't believe me go ask people in the unemployment line.

I'm arguing that a tax break, good economy or bad economy, doesn't guarantee a job.

No No jealousy. The whole tax thing needs to be reexamined. But until then we have to deal with what is in front of us now.

But do you think raising taxes is going to fix that or make it even worse?

It will increase revenue. Revenue that can be used to address our debt that also plays a vital role in this crappy economy. There is a reason Moody downgraded us. there is a reason that there is uncertainty on whether the US can meet its obligations. The tax break is not creating jobs.

are you ok with the company you work for having a 50k decrease in revenue next year?

Revenue is based on demand for a product. If the demand isn't there, revenue decreases regardless of tax break.

Is a company making less money ever good for its employees?

No it is not. But what part of companies don't care about employees don't you get. If companies cared about employees, CEO's would share their wealth with their employees. Companies wouldn't be taking their jobs overseas. Everybody would have good benefits. The bottom line is profit, not taking care of employees. Don't believe me go ask people in the unemployment line.

Are you seriously arguing with me that a company getting taxed harder during a recession is a good thing.

I'm arguing that a tax break, good economy or bad economy, doesn't guarantee a job.

Or is it more that your just jealous and want people that make a lot of money punished for making that money?

No No jealousy. The whole tax thing needs to be reexamined. But until then we have to deal with what is in front of us now.

reply to post by LeoStarchild

I voted for Obama in 2008, because McCain scared me. I thought he might go to war in Iran, or expand the wars in Iraq and Afghanistan, and I didn't like the fact that he accepted Palin as a running mate without even meeting her, so I voted for Obama.

I've been disappointed in Obama, because the bailouts were wrong, the compromise on the debt ceiling was wrong, the first extension of tax cuts was wrong, the world apology tour was wrong, the healthcare bill was wrong, he just seemed to be a puppet on a string for the big corps and Dem party.

BUT, in 2012 he has impressed me a little bit more.

Seeing as how I don't think Romney is any different than Obama, and it doesn't look like Ron Paul will be on the ballot, I'm left to decide between Gary Johnson, or Robamney. If I have to choose between Romney or Obama, I might as well stick with Obama, at least I know what I'm getting.

As for the $250,000, I know a lot of people that make somewhere in that range for their family income. Small business owners with around 10 employees or so. Households with two professionals like nurses or lawyers or professors, they make combined income in that range. It is not a pie in the sky number, it is about the threshhold where someone goes from just getting by, to actually being well off. It is by no means rich.

I think renewing cuts below $250k, and letting the ones above $250k expire is a very good idea.

I voted for Obama in 2008, because McCain scared me. I thought he might go to war in Iran, or expand the wars in Iraq and Afghanistan, and I didn't like the fact that he accepted Palin as a running mate without even meeting her, so I voted for Obama.

I've been disappointed in Obama, because the bailouts were wrong, the compromise on the debt ceiling was wrong, the first extension of tax cuts was wrong, the world apology tour was wrong, the healthcare bill was wrong, he just seemed to be a puppet on a string for the big corps and Dem party.

BUT, in 2012 he has impressed me a little bit more.

Seeing as how I don't think Romney is any different than Obama, and it doesn't look like Ron Paul will be on the ballot, I'm left to decide between Gary Johnson, or Robamney. If I have to choose between Romney or Obama, I might as well stick with Obama, at least I know what I'm getting.

As for the $250,000, I know a lot of people that make somewhere in that range for their family income. Small business owners with around 10 employees or so. Households with two professionals like nurses or lawyers or professors, they make combined income in that range. It is not a pie in the sky number, it is about the threshhold where someone goes from just getting by, to actually being well off. It is by no means rich.

I think renewing cuts below $250k, and letting the ones above $250k expire is a very good idea.

Originally posted by LevelHeaded

reply to post by Flatfish

I think you misunderstood what I was trying to get across. Businesses do not like turmoil. They want a stable market. If Congress could make a commitment to leaving things alone for some time and allow the economy to stabilize, then businesses would be more inclined to spend capital to improve the business.

How the budget gets balanced is a different aspect from the stability issue. We have both a revenue and spending problem. I am not against tax reform resulting in increased revenues for the gov't. I am also not opposed to cutting the spending. Both need to be done. I am sure there are multiple ways to accomplish both without resorting to the politics as usual and showing the world how dysfunctional our elected leaders can be.

Basically, quit playing politics with the economy. Fix the tax code to increase revenues without waiting until the last minute. Cut gov't spending to close the income to spending gap. Leave it alone for 10 years and let the economy stabilize.

Well I've got some breaking news for you, the current commandant of the TP/GOP, namely Grover Norquist, won't allow that tax restructuring to take place.

Furthermore, when the TP/GOP even mentions tax code restructuring, they always use the coded term "broadening the base," which does not mean closing corporate tax loopholes. What it means is increasing taxes on the poor and I'm sure that will go a long way towards balancing our budget.

Personally, I think we'd be better off doing what France just did and raise our highest marginal tax rate to 75% and leave that alone for 10 yrs. just to see what happens.

Don't you people ever get tired of getting screwed to the wall by the wealthy elite? Is their time and effort really worth that much more than yours?

reply to post by Flatfish

I see you still do not get what I have been trying to say.

Both parties are at fault for the situation we are in. It is a revenue problem (Republicans) AND a spending problem (Democrats). Neither side will budge to work on a solution to fix both problems and until THEY come together, it will be business "as usual".

Go ahead and continue to point the finger at one side all you want. That is not solving the problem, it is playing into their hand and dividing the nation.

I see you still do not get what I have been trying to say.

Both parties are at fault for the situation we are in. It is a revenue problem (Republicans) AND a spending problem (Democrats). Neither side will budge to work on a solution to fix both problems and until THEY come together, it will be business "as usual".

Go ahead and continue to point the finger at one side all you want. That is not solving the problem, it is playing into their hand and dividing the nation.

reply to post by TheTardis

Spending is up because at some point it time, we have to pay our debts. A little fact that the TP/GOP thought they could just ignore during the last debt limit increase debate resulting in our credit rating downgrade. That worked out really well.

Bush Jr. drove our economy off a cliff with tax cuts at a time when he was lying this nation into the Iraq War that cost us trillions. On top of that, he decided to enact Medicare Part D while refusing to fund it. etc...etc...etc...

It's real easy for a person to max-out their credit cards and then accuse the person who's paying them off of being an uncontrollable spender.

Spending is up because at some point it time, we have to pay our debts. A little fact that the TP/GOP thought they could just ignore during the last debt limit increase debate resulting in our credit rating downgrade. That worked out really well.

Bush Jr. drove our economy off a cliff with tax cuts at a time when he was lying this nation into the Iraq War that cost us trillions. On top of that, he decided to enact Medicare Part D while refusing to fund it. etc...etc...etc...

It's real easy for a person to max-out their credit cards and then accuse the person who's paying them off of being an uncontrollable spender.

Originally posted by LevelHeaded

Go ahead and continue to point the finger at one side all you want. That is not solving the problem, it is playing into their hand and dividing the nation.

It's not about playing into anyone's hand. The nation is clearly divided and rightly so!

Personally, I want nothing to do with the current TP/GOP mentality, or lack thereof and I think that they may well be the very incarnation of those with "anti-american views" that Michelle Bachman was looking for during her run for POTUS.

The masses will only take so much of this abuse imposed upon them by the greedy and what we are currently witnessing is the twilight of the elite and those who represent them.

reply to post by Flatfish

Raising the marginal rates to 75% wont change as much as you think. Ending the Bush era tax cuts for those over 250k a year would actually be more helpful because it keeps us within the "effective" tax rates. Tax cuts that should never have happened in the first place seeing as we were going to war and all. I wish that early on Obama would have realized that no amount of bipartisanship extended on his part would amount to anything. He should have been on the bully pulpit with both the GOP and the Democrats from day one.

Raising the marginal rates to 75% wont change as much as you think. Ending the Bush era tax cuts for those over 250k a year would actually be more helpful because it keeps us within the "effective" tax rates. Tax cuts that should never have happened in the first place seeing as we were going to war and all. I wish that early on Obama would have realized that no amount of bipartisanship extended on his part would amount to anything. He should have been on the bully pulpit with both the GOP and the Democrats from day one.

Originally posted by Rockdisjoint

I thought tax cuts were bad?

Shouldn't the middle class have to pay their ``fair share`` too?

30% isn't fair? What do you consider fair?

Originally posted by jjkenobi

There aren't any jobs being created right now because A) uncertainty about the economy and B) uncertainty about Obamacare.

Until Obama is out of office there won't be much confidence in the economy. Unfortunately thanks to the Supreme Court fudging a ruling the worries about Obamacare will continue on indefinitely. Nobody knows that is actually in the plan and what it will actually affect. Tax breaks won't make much of a difference since it won't affect either of those.

Obama just wants to run away from his terrible jobs report. -- 80,000 jobs --

-----------

Lets talk about tax cuts.

Well, wait a minute. How will tax cuts give us 200,000 jobs every month???

Originally posted by jam321

reply to post by TheTardis

But do you think raising taxes is going to fix that or make it even worse?

It will increase revenue. Revenue that can be used to address our debt that also plays a vital role in this crappy economy. There is a reason Moody downgraded us. there is a reason that there is uncertainty on whether the US can meet its obligations. The tax break is not creating jobs.

are you ok with the company you work for having a 50k decrease in revenue next year?

Revenue is based on demand for a product. If the demand isn't there, revenue decreases regardless of tax break.

Is a company making less money ever good for its employees?

No it is not. But what part of companies don't care about employees don't you get. If companies cared about employees, CEO's would share their wealth with their employees. Companies wouldn't be taking their jobs overseas. Everybody would have good benefits. The bottom line is profit, not taking care of employees. Don't believe me go ask people in the unemployment line.

Are you seriously arguing with me that a company getting taxed harder during a recession is a good thing.

I'm arguing that a tax break, good economy or bad economy, doesn't guarantee a job.

Or is it more that your just jealous and want people that make a lot of money punished for making that money?

No No jealousy. The whole tax thing needs to be reexamined. But until then we have to deal with what is in front of us now.

Obama tax increase will get him about $80 billion.

The US Government spends $80 billion in only 8 days.

That tiny amount changes absolutely nothing. Obama doesn't care. He just wants

to play the fair share, fair shot, fair whatever game during an election year.

reply to post by Eurisko2012

Absolutely right. This is about standing up there and spouting off about republicans trying to give the rich a break. The rich pay in plenty. Think of it as stated above. 80mil can run the government for 8 days. That doesnt mean much. But 80mil spread out over small and medium businesses can make make a difference.

Absolutely right. This is about standing up there and spouting off about republicans trying to give the rich a break. The rich pay in plenty. Think of it as stated above. 80mil can run the government for 8 days. That doesnt mean much. But 80mil spread out over small and medium businesses can make make a difference.

Originally posted by TheTardis

reply to post by Eurisko2012

Absolutely right. This is about standing up there and spouting off about republicans trying to give the rich a break. The rich pay in plenty. Think of it as stated above. 80mil can run the government for 8 days. That doesnt mean much. But 80mil spread out over small and medium businesses can make make a difference.

It's a good thing i'm here to put out the simple truth.

It's easy to cut through the Obama BS.

-----------

Another simple truth: job creation comes mainly from small businesses.

- Stop attacking small business !!! -

Originally posted by TheTardis

reply to post by Eurisko2012

Absolutely right. This is about standing up there and spouting off about republicans trying to give the rich a break. The rich pay in plenty. Think of it as stated above. 80mil can run the government for 8 days. That doesnt mean much. But 80mil spread out over small and medium businesses can make make a difference.

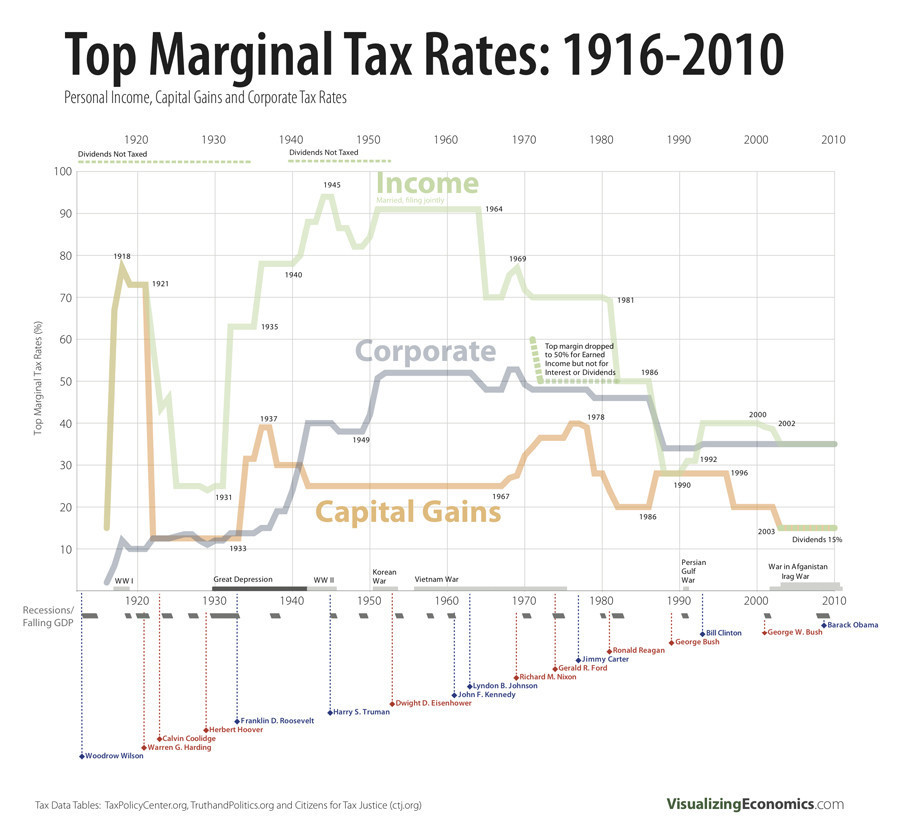

If you would just take a look at the history of America's top marginal tax rates, you will clearly see that it's the wealthy elite who are screwing our nation into bankruptcy. Furthermore, it's not that the republicans are trying to give "the rich a break." What they are actually doing is making an attempt to institute this screwing as permanent policy. As history clearly shows, they haven't been paying their fair share for quite a while now.

I know that the numbers in this chart are little out of place, but I think you should be able to extrapolate the numbers into their correct positions and see what I'm talking about. You can visit the link for a better view.

en.wikipedia.org...

[hide]Table of historical income tax rates

not adjusted for inflation (1913–2010)

Year $10,001 $20,001 $60,001 $100,001 $250,001

1913 1% 2% 3% 5% 6%

1914 1% 2% 3% 5% 6%

1916 2% 3% 5% 7% 10%

1918 16% 21% 41% 64% 72%

1920 12% 17% 37% 60% 68%

1922 10% 16% 36% 56% 58%

1924 7% 11% 27% 43% 44%

1926 6% 10% 21% 25% 25%

1928 6% 10% 21% 25% 25%

1930 6% 10% 21% 25% 25%

1932 10% 16% 36% 56% 58%

1934 11% 19% 37% 56% 58%

1936 11% 19% 39% 62% 68%

1938 11% 19% 39% 62% 68%

1940 14% 28% 51% 62% 68%

1942 38% 55% 75% 85% 88%

1944 41% 59% 81% 92% 94%

1946 38% 56% 78% 89% 91%

1948 38% 56% 78% 89% 91%

1950 38% 56% 78% 89% 91%

1952 42% 62% 80% 90% 92%

1954 38% 56% 78% 89% 91%

1956 26% 38% 62% 75% 89%

1958 26% 38% 62% 75% 89%

1960 26% 38% 62% 75% 89%

1962 26% 38% 62% 75% 89%

1964 23% 34% 56% 66% 76%

1966–76 22% 32% 53% 62% 70%

1980 18% 24% 54% 59% 70%

1982 16% 22% 49% 50% 50%

1984 14% 18% 42% 45% 50%

1986 14% 18% 38% 45% 50%

1988 15% 15% 28% 28% 28%

1990 15% 15% 28% 28% 28%

1992 15% 15% 28% 28% 31%

1994 15% 15% 28% 31% 39.6%

1996 15% 15% 28% 31% 36%

1998 15% 15% 28% 28% 36%

2000 15% 15% 28% 28% 36%

2002 10% 15% 27% 27% 35%

2004 10% 15% 25% 25% 33%

2006 10% 15% 15% 25% 33%

2008 10% 15% 15% 25% 33%

2010 10% 15% 15% 25% 33%

Here's another graph that clearly demonstrates what I'm talking about;

visualizingeconomics.com...

IMO, their plan is to drive us into such debt that we have to eliminate all spending except for defense and corporate subsidies while creating an atmosphere in which they have the opportunity to kill Medicare, Medicaid, Social Security, public education and all the other social welfare programs they so despise. God forbid we help anyone other than them.

edit on 11-7-2012 by Flatfish because: (no reason given)

reply to post by Flatfish

Interesting graph and table.

Is there anything about how much any "higher" rates would have added to Federal revenues ?

We need to compare the amounts of money actually collected to the amounts that would have been collected.

(say for the last 10 or 15 years)

The "impact" may not be as substantial as some would hope.

And how would higher rates affect spending ?

Interesting graph and table.

Is there anything about how much any "higher" rates would have added to Federal revenues ?

We need to compare the amounts of money actually collected to the amounts that would have been collected.

(say for the last 10 or 15 years)

The "impact" may not be as substantial as some would hope.

And how would higher rates affect spending ?

Originally posted by xuenchen

reply to post by Flatfish

Interesting graph and table.

Is there anything about how much any "higher" rates would have added to Federal revenues ?

We need to compare the amounts of money actually collected to the amounts that would have been collected.

(say for the last 10 or 15 years)

The "impact" may not be as substantial as some would hope.

And how would higher rates affect spending ?

Yes, always look at the - Big Picture -.

When you think of the US government always think -- IN COME & OUT GO --

The liberals love to dwell on the -- IN COME -- but conveniently try to ignore the

-- OUT GO --.

We need to cut spending ! Reduce the size of the US government.

- Defund and abolish the Dept. of Education -- turn education over to the

individual states. Fire everyone there and shut off the electrical power.

We have to start someplace start there!

--------

Stop flushing cash down the toilet on - Solyndra Scandals -.

-------

Raise the retirement age to 67 just like Canada. - People are living longer.

-------

Repeal ObamaCare and Replace it with an alternative that includes - Tort Reform -.

edit on 11-7-2012 by Eurisko2012 because: (no reason

given)

Originally posted by xuenchen

reply to post by Flatfish

Interesting graph and table.

Is there anything about how much any "higher" rates would have added to Federal revenues ?

We need to compare the amounts of money actually collected to the amounts that would have been collected.

(say for the last 10 or 15 years)

The "impact" may not be as substantial as some would hope.

And how would higher rates affect spending ?

Wow! Are you kidding me? It's all about percentages, not dollars!

In 1913, the U.S. population was estimated to be a little over 76 million and today we're banging up against 312 million. Surely you're not trying to profess that our government can meet the needs of a nation of 312 million people for the same number of "dollars" as was required to meet the needs of 76 million, are you? Not to mention the fact that these numbers have not been adjusted for inflation and/or valuation of the U.S. dollar.

Anyone who would attempt to side-track this conversation into one of dollars spent then versus dollars spent now, contributes nothing pertinent to the debate. What it does is, it demonstrates their complete lack of "Critical Thinking Skills," something that our current GOP controlled state legislature here in Texas is currently attempting to eliminate the teaching of, in our public schools. Go figure!

www.abovetopsecret.com...

www.abovetopsecret.com...

www.abovetopsecret.com...

edit on 11-7-2012 by Flatfish because: (no reason given)

reply to post by Flatfish

The GOP in Texas has saved Texas.

North Dakota & Texas are doing the best right now.

The GOP in Texas has saved Texas.

North Dakota & Texas are doing the best right now.

new topics

-

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 1 hours ago -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 6 hours ago -

1980s Arcade

General Chit Chat: 8 hours ago -

Deadpool and Wolverine

Movies: 9 hours ago -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 10 hours ago -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 11 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 13 hours ago, 20 flags -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration: 16 hours ago, 13 flags -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies: 17 hours ago, 8 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 11 hours ago, 8 flags -

15 Unhealthiest Sodas On The Market

Health & Wellness: 16 hours ago, 6 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 6 hours ago, 6 flags -

1980s Arcade

General Chit Chat: 8 hours ago, 4 flags -

Deadpool and Wolverine

Movies: 9 hours ago, 3 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 10 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 1 hours ago, 0 flags

active topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 23 • : burritocat -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion • 1 • : andy06shake -

15 Unhealthiest Sodas On The Market

Health & Wellness • 36 • : tanstaafl -

My wife just had a very powerful prophetic dream - massive war in Israel...

The Gray Area • 12 • : SchrodingersRat -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 606 • : burritocat -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 199 • : FlyersFan -

It takes One to Be; Two to Tango; Three to Create.

Philosophy and Metaphysics • 7 • : Terpene -

Take it to the Media when you protest.. Don't let them ignore you!

Education and Media • 4 • : SchrodingersRat -

They Killed Dr. Who for Good

Rant • 62 • : FlyersFan -

Definitive 9.11 Pentagon EVIDENCE.

9/11 Conspiracies • 421 • : Lazy88