It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

8

share:

Brazil and China agree to currency swap

Are we surprised? As ZeroHedge puts it,

And just a reminder....

Does this mean China will hold the new GRC? Maybe, maybe not. They certainly are paving the way for the downfall of the dollar as the GRC, but that doesn't necessarily mean that Europe and the rest of the Americas will follow suit and put their trust and investment into the scary military superpower they've been conditioned to fear these past 10 years. We might see a new world without a GRC, where all trades are done in each country's own currency; we might see China's economy collapse to a certain extent and another country's currency will rise to the GRC surface. Only time will tell; nothing is predictable anymore.

Brazil has provided a vote of confidence in China’s efforts to promote the renminbi as a reserve currency by becoming the biggest economy yet to agree a swap deal with Beijing. Brazil and China announced the R$60bn (US$29bn) local currency swap after a bilateral meeting between Wen Jiabao, the Chinese premier, and Dilma Rousseff, Brazil’s president, on the sidelines of the Rio+20 environmental summit in Rio de Janeiro.

China has launched an aggressive campaign of “currency swap diplomacy”, signing about 20 such agreements over the past four years with countries ranging from Argentina to Australia and the United Arab Emirates.

While these have been largely symbolic – only Hong Kong so far has had to activate its swap line after a shortage of renminbi in the territory in 2010 – they are seen as helping the long march of the internationalisation of the Chinese currency.

Are we surprised? As ZeroHedge puts it,

When the US Dollar is ultimately dethroned as the world's reserve currency (and finally gets rid of all those ridiculous three letter post-Keynesian economic "theories") nobody will have seen it coming. Well, nobody except for the following headlines: ""World's Second (China) And Third Largest (Japan) Economies To Bypass Dollar, Engage In Direct Currency Trade", "China, Russia Drop Dollar In Bilateral Trade", "China And Iran To Bypass Dollar, Plan Oil Barter System", "India and Japan sign new $15bn currency swap agreement", "Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says", "India Joins Asian Dollar Exclusion Zone, Will Transact With Iran In Rupees."

And just a reminder....

Does this mean China will hold the new GRC? Maybe, maybe not. They certainly are paving the way for the downfall of the dollar as the GRC, but that doesn't necessarily mean that Europe and the rest of the Americas will follow suit and put their trust and investment into the scary military superpower they've been conditioned to fear these past 10 years. We might see a new world without a GRC, where all trades are done in each country's own currency; we might see China's economy collapse to a certain extent and another country's currency will rise to the GRC surface. Only time will tell; nothing is predictable anymore.

IT is true that the dollar is on the way out. As you say its' replacement may not be renminbi. There is an increased chance that Chinas' economy will

find itself on the ropes soon. So much of their growth has been artificially propped up, and like everything artificial in economics, it must come to

terms with reality some time. Much of what makes China such an attractive manufacturer is temporal. Cheap fuel helps the shipping costs to stay low

and a cheap workforce keeps manufacturing costs low. Both of these expenses will rise in the future. Once the cost efficiency of manufacturing in

China wanes (it will slowly wane) there is no reason to think that some of the luster may be lost. Personally, I like India. They are more stable

IMO.

edit on 22-6-2012 by Erectus because: spelling correction

[

And just a reminder....

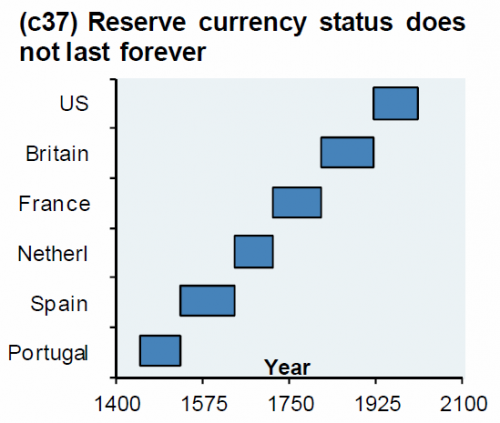

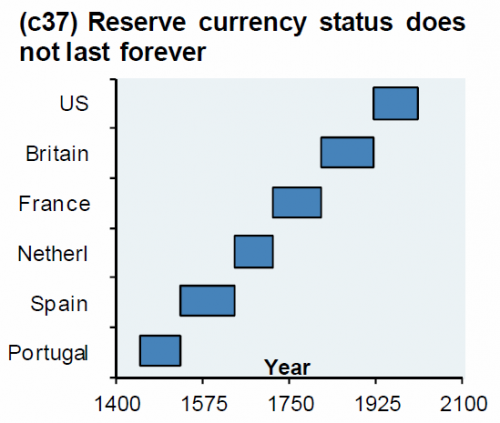

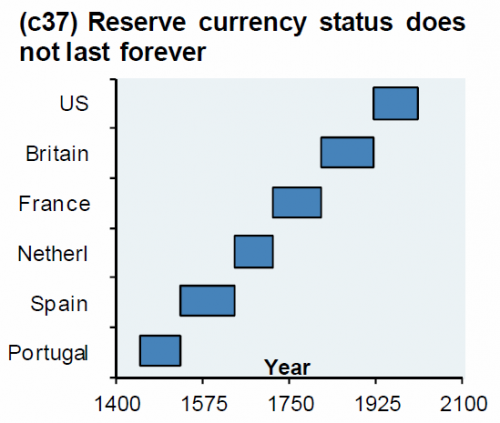

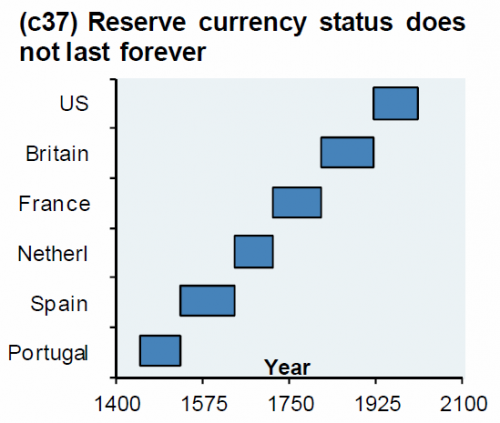

This pic is really important. A quick glance at the graphic shows the reserve currency system is PLANNED, with the rise and fall done in nice, complete sequences, and does not happen at random and is surely not done by "market forces." The process is rigged from the day the currency is established as the reserve, and, a death date is set accordingly. The US dollar was designed to last 100 years by contract...

And just a reminder....

This pic is really important. A quick glance at the graphic shows the reserve currency system is PLANNED, with the rise and fall done in nice, complete sequences, and does not happen at random and is surely not done by "market forces." The process is rigged from the day the currency is established as the reserve, and, a death date is set accordingly. The US dollar was designed to last 100 years by contract...

reply to post by 00nunya00

China want's to be the next super power and the gold they buying one

way to undermine the doller.

bullionvault

Everyone in the west needs to be more than a little worried.

China want's to be the next super power and the gold they buying one

way to undermine the doller.

They will Buy Gold...lots and lots of gold.

The Chinese are now clearly on a path to accumulate so much gold that one day soon, they will be able to restore the convertibility of their currency into a precious metal...just as they were able to do a century ago when the country was on the silver standard.

The West wasn't kind to China back then. The country was repeatedly looted and humiliated by Russia, Japan, Britain, and the United States. But today, it is a different story... Now, China is the fastest-growing country on Earth, with the largest cash reserves on the planet. And as befits a first-rate power, China's currency is on the path to being backed by gold.

China desperately wants to return to its status as one of the world's great powers...with one of the world's great currencies. And China knows that in this day and age – when nearly all governments around the globe are printing massive amounts of currency backed by nothing but an empty promise – it can gain a huge advantage by backing its currency with a precious metal.

As the great financial historian Richard Russell wrote recently: "China wants the Renminbi to be backed with a huge percentage of gold, thereby making the Renminbi the world's best and most trusted currency." I know this will all sound crazy to most folks. But most folks don't understand gold, or why it represents real, timeless wealth. The Chinese do.

bullionvault

Everyone in the west needs to be more than a little worried.

edit on 22/6/2012 by skuly because: bloody colour again

reply to post by skuly

True, and they are buying gold by the bucketful, but they have a lot of catching up to do to the US (allegedly) and to Germany. If the US doesn't actually have the gold they report having (and we all know there's a great chance there may be close to zero gold in Fort Knox et al), then Germany is actually the one that finds itself on the top of the gold heap, especially if they bolster their reserves with the sovereign gold of the EU countries they're being forced into bailing out.

True, and they are buying gold by the bucketful, but they have a lot of catching up to do to the US (allegedly) and to Germany. If the US doesn't actually have the gold they report having (and we all know there's a great chance there may be close to zero gold in Fort Knox et al), then Germany is actually the one that finds itself on the top of the gold heap, especially if they bolster their reserves with the sovereign gold of the EU countries they're being forced into bailing out.

So you think. They have displayed political unstabilities in the past (50's and 60's) that were some major drawback for their country. However they do have their own domestic issues to sort out before they can drive in this direction.

Originally posted by Erectus

Personally, I like India. They are more stable IMO.edit on 22-6-2012 by Erectus because: spelling correction

Originally posted by hp1229

So you think. They have displayed political unstabilities in the past (50's and 60's) that were some major drawback for their country. However they do have their own domestic issues to sort out before they can drive in this direction.

Originally posted by Erectus

Personally, I like India. They are more stable IMO.edit on 22-6-2012 by Erectus because: spelling correction

Like feeding their people, for starters. We have hunger issues in the US, but nothing near India. Their "poverty line" is unrealistically low, and millions are literally starving.

When the dollar goes, so does every nation.

This will not happen.

This will not happen.

Originally posted by 00nunya00

Originally posted by hp1229

So you think. They have displayed political unstabilities in the past (50's and 60's) that were some major drawback for their country. However they do have their own domestic issues to sort out before they can drive in this direction.

Originally posted by Erectus

Personally, I like India. They are more stable IMO.edit on 22-6-2012 by Erectus because: spelling correction

Like feeding their people, for starters. We have hunger issues in the US, but nothing near India. Their "poverty line" is unrealistically low, and millions are literally starving.

Well that holds true but that is related to the corruption. That country is also one of the bread baskets of the world and has a significant production of cash crops. It produces sufficient to feed its people but most of it is 'inflated' by the locals to make money. Corruption is their biggest challenge in addition to Poverty. Then again which country isn't corrupt

I'm honestly confused as to what the BRICS think they're doing. I mean, the West in general makes up a huge chunk of their economic activity and are

major players in the economies of other people around them. Do they really think that they'll escape unscathed? Especially when they themselves,

particularly China, have been taking plays out of Western playbooks?

With Israel dragging USA into wars to fight for it, I would not be surprised if the next currency was Israeli or even gold dinars...

The planned obsoletion and fall of currency puts wealth into the hands of a few elite every cycle. The rich keep getting richer and richer...

The planned obsoletion and fall of currency puts wealth into the hands of a few elite every cycle. The rich keep getting richer and richer...

edit on 093030p://6America/ChicagoFri, 22 Jun 2012 21:09:39 -0500 by THE_PROFESSIONAL because: (no reason given)

Pretty sad when the censorship around here has gotten to the point that a person can't even respond to trolling.

Sad, and pathetic.

Perhaps if I make it really vague, then TPTB will let it through?

Anyone still thinking we're okay is sadly, and hilariously, mistaken.

On-topic and well-mannered enough for you mods? In my own thread? Shall I go around and flag every post that's not really off-topic but not "good enough" as mine apparently was? I can make plenty of work, if so. Let's play.

Sad, and pathetic.

Perhaps if I make it really vague, then TPTB will let it through?

Anyone still thinking we're okay is sadly, and hilariously, mistaken.

On-topic and well-mannered enough for you mods? In my own thread? Shall I go around and flag every post that's not really off-topic but not "good enough" as mine apparently was? I can make plenty of work, if so. Let's play.

edit on 22-6-2012 by 00nunya00 because: (no reason

given)

Originally posted by 00nunya00

Brazil and China agree to currency swap

"The System" will not be amused...

"Germany’s unforgivable crime before WW2 was its attempt to loosen its economy out of the world trade system and to build up an independent exchange system from which the world-finance couldn’t profit anymore. ...We butchered the wrong pig."

-Winston Churchill (The Second World War - Bern, 1960)

reply to post by crankyoldman

Hmm, don't Congress or us get to vote next year as to whether to keep the feds? Yea, one of us do.

That contract was signed back in 1913, seems its time is up. Like we all knew on ATS, it's a scam, plain and simple. That graph i dunno, it's like pointing out the obvious.

Hmm, don't Congress or us get to vote next year as to whether to keep the feds? Yea, one of us do.

That contract was signed back in 1913, seems its time is up. Like we all knew on ATS, it's a scam, plain and simple. That graph i dunno, it's like pointing out the obvious.

edit on 23-6-2012 by cenpuppie because: (no reason given)

Originally posted by cenpuppie

reply to post by crankyoldman

Hmm, don't Congress or us get to vote next year as to whether to keep the feds? Yea, one of us do.

That contract was signed back in 1913, seems its time is up. Like we all knew on ATS, it's a scam, plain and simple. That graph i dunno, it's like pointing out the obvious.edit on 23-6-2012 by cenpuppie because: (no reason given)

I am unclear about this. There was a meeting, last year I think, another Jekyll Island kind of thing, but I have no idea what happened - gee wonder why. Someone posted a great graph on another thread about the rise and fall of each of the past reserve currencies. The plan is clear, and it would seem it is time for the Federal Reserve Debt Note to die right on time, BUT, and it is a big but, the Fed debt system turned the US into the global policeman, the fall of the dollar would end that and I'm not sure that will happen until Iran, Syria, Cuba and NK, Sudan's assets are put into the IMF pool: I suspect that list is only Syria and Iran at this point. Converging of events..........

reply to post by 00nunya00

Remember India bought a tons of gold too and probably still is. There is a thread on here about it. They know the dollar is being replaced so everyone is backing up their currencies.

I wonder what happens when folks find out most of the gold in fort knox ain't real, just like a shipment the US (i believe it was them) sent to the IMF. Remember about a year ago there was a nasty rumor floating around on the web that the IMF chief got squeezed cuz he found out all the US gold is gone. What ever happened to those charges and him?

Makes me wonder if the Fed is backing the greenskin with gold, oh that's right they totally aren't. Here is an article guys and why we pretty much are.. hurtin Fed Lawyer Alvarez: "The Federal Reserve Does NOT Own Any Gold at All" .

And now you have china buying up lots of gold.. Uh oh.

Remember India bought a tons of gold too and probably still is. There is a thread on here about it. They know the dollar is being replaced so everyone is backing up their currencies.

I wonder what happens when folks find out most of the gold in fort knox ain't real, just like a shipment the US (i believe it was them) sent to the IMF. Remember about a year ago there was a nasty rumor floating around on the web that the IMF chief got squeezed cuz he found out all the US gold is gone. What ever happened to those charges and him?

Makes me wonder if the Fed is backing the greenskin with gold, oh that's right they totally aren't. Here is an article guys and why we pretty much are.. hurtin Fed Lawyer Alvarez: "The Federal Reserve Does NOT Own Any Gold at All" .

And now you have china buying up lots of gold.. Uh oh.

reply to post by crankyoldman

Back in 1913 during the great depression (which was artificially created according to the sources i read) is when the government central banks was replaced with the Fed. It was for a 100 year lease so to speak. So, after their time is up, it has to be voted for again to keep the Fed as our central bank.

And their time is almost up.

Back in 1913 during the great depression (which was artificially created according to the sources i read) is when the government central banks was replaced with the Fed. It was for a 100 year lease so to speak. So, after their time is up, it has to be voted for again to keep the Fed as our central bank.

And their time is almost up.

new topics

-

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 21 minutes ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 56 minutes ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago -

Weinstein's conviction overturned

Mainstream News: 2 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 4 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 4 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 8 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 17 hours ago, 11 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 4 hours ago, 7 flags -

Weinstein's conviction overturned

Mainstream News: 2 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 4 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 16 hours ago, 5 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 6 hours ago, 3 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 56 minutes ago, 3 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 8 hours ago, 2 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 1 hours ago, 2 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 13 hours ago, 1 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 150 • : Threadbarer -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 145 • : ImagoDei -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 7 • : nugget1 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 86 • : Consvoli -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 674 • : Thoughtful3 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 51 • : Threadbarer -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 2 • : xuenchen -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 53 • : confuzedcitizen -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 21 • : confuzedcitizen -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum • 1 • : xuenchen

8