It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

4

share:

Traditional banks are some of the most corrupt institutions the world has ever known. They have enslaved nations and extort bailouts of taxpayer money

when their gambling with other people's money doesn't pay off. The people of the world must find some way to break free of this tyranny if society

hopes to survive.

One option to traditional banking is the use of peer-to-peer lending.

azizonomics

The main drawback of peer-to-peer lending is that there currently is no type of deposit insurance such as the big corporate banks enjoy but, when you balance that against the possible return rates, it still makes more sense in my eyes to put one's money into this venue.

BBC

The lender gets a higher rate of return and the borrower gets a more fair interest rate as well; it seems like a win for everybody! The P2P breaks up the lender money into $10 dollar units to reduce borrower risk. The woman in the story claims to get back a 7.4% interest rate in return for her investment. Compare that to what you're average banks gives for savings.

Go Banking Rates

The average is 0.2 %for the average traditional bank with even the best Credit Unions offering only 2.2% interest on savings. They claim the money is safe because it is insured and is a better deal because it is more liquid when you need it but, trade that off with the fact that the interest rate doesn't even keep up with the rate of inflation and it looks to me that people who keep money in savings accounts are probably losing value every year.

The banks make huge profits from YOUR money and give you a pittance back in return. Then, when things go bad for them, they get the governments of the world to bail them out using YOUR tax dollars while paying their execs huge bonuses for ripping of the little guy once again.

I think the risk of losing 0.5% on your investment while earning a much better return rate beats losing all the value of your savings to inflation in traditional banks.

This is a system that could renew the financial sector and bring more fairness to the world. Anything that hurts the banks is a good thing in my opinion.

One option to traditional banking is the use of peer-to-peer lending.

Banks are an Endangered Species

The old establishment banks — the ones that have been bailed out this week in Spain, and in 2008 in America — are unnecessary middlemen. This is because of the ludicrous spreads from which they profit. They borrow from central banks and from depositors at absurdly low rates of interest (that’s what ZIRP is all about) and lend at vastly higher rates. What useful function does it serve? At one time, banks generated value by being wise lenders, lending to businesses that they determined would add value. Today they prefer gamble up even bigger profits in the zero-sum derivatives casino and shadow banking whorehouse, requiring frequent bailouts when such schemes go awry. They are dinosaurs that offer no real value to their shareholders, their customers, or to society.

And for all their claims of systemic importance, for all the bailouts, all the whining, all the pontification they are gradually being sidelined by other forms of intermediation, specifically peer-to-peer lending wherein lenders and borrowers are matched directly often via the internet. The lender gets interest, the borrower pays interest, but because there is no middleman taking a (huge) cut both rates are more favourable — the borrower pays less interest, the lender receives more interest.

azizonomics

The main drawback of peer-to-peer lending is that there currently is no type of deposit insurance such as the big corporate banks enjoy but, when you balance that against the possible return rates, it still makes more sense in my eyes to put one's money into this venue.

Peer-to-peer lending via the internet hits £250m

HIGHER RETURNS

Lynne was fed up with the returns she was getting from banks and pension plans.

So she has lent a substantial part of her savings via the website, spreading it between hundreds of borrowers and by-passing the banking system.

The interest from the latest £5,000 is 7.4% a year before tax but after taking into account Zopa's 1% charge.

That is substantially more than is available on a typical savings account at a bank.

On the other side of the ledger, Jamie Hirst from Chippenham in Wiltshire has borrowed £4,500 through Zopa to cover the cost of a revamp of his kitchen and bathroom.

The 8.4% APR he is paying is 5% less than he was quoted by his bank.

THE DRAWBACKS

There is a significant drawback for savers: the lack of any guarantee that you will get your money back.

Peer-to-peer lending, as it is known, does not qualify for protection from the Financial Services Compensation Scheme (FSCS), which provides security up to £85,000 per bank, for each saver.

The peer-to-peer sites put their loan applicants through credit checks and Zopa says it divides people's savings into £10 chunks which are spread between borrowers, to minimise any risk.

On average, so far, its lenders have lost 0.5% of their money as a result of borrowers defaulting

BBC

The lender gets a higher rate of return and the borrower gets a more fair interest rate as well; it seems like a win for everybody! The P2P breaks up the lender money into $10 dollar units to reduce borrower risk. The woman in the story claims to get back a 7.4% interest rate in return for her investment. Compare that to what you're average banks gives for savings.

What is the Average Savings Account Interest Rate?

U.S. Average Savings Account Interest Rate

The interest rate that banks offer is their choice. Historically, online banks have offered their customers a higher interest rate because they have lower overhead costs due to the fact they do not have to pay rent on their local branches. Throughout the entire industry, the national average savings account interest rate is only .20 percent. The best savings rates range from a high of 2.02% APY from Houston Police Credit Union to 1.60% APY from Twinstar Credit Union.

For the security of knowing your money is safe from bank closures, you will earn less interest on your deposit. However, it is worth keeping your cash liquid, especially with the current state of the economy. For most investing novices, any higher risk investment may feel a bit too intimidating at this time.

Go Banking Rates

The average is 0.2 %for the average traditional bank with even the best Credit Unions offering only 2.2% interest on savings. They claim the money is safe because it is insured and is a better deal because it is more liquid when you need it but, trade that off with the fact that the interest rate doesn't even keep up with the rate of inflation and it looks to me that people who keep money in savings accounts are probably losing value every year.

The banks make huge profits from YOUR money and give you a pittance back in return. Then, when things go bad for them, they get the governments of the world to bail them out using YOUR tax dollars while paying their execs huge bonuses for ripping of the little guy once again.

I think the risk of losing 0.5% on your investment while earning a much better return rate beats losing all the value of your savings to inflation in traditional banks.

This is a system that could renew the financial sector and bring more fairness to the world. Anything that hurts the banks is a good thing in my opinion.

edit on 6/12/12 by FortAnthem because: ___________ extra DIV

reply to post by FortAnthem

Okay, this is going to be one of those “do as I say not as I do” posts. I couldn't keep a dime to save a nickel. Never have. I don't overdraft, but I don't save either. And I wish I could say the same thing about traditional banks, but I can't. With all the bailouts that the big ones all across the world are getting, that's obvious. They can save, but they do it at our expense. If not with the disparity between what they give us vs. what they charge us, then with our tax dollars that bail them out because they don't know how to keep a ledger straight.

Peer to Peer lending is just another term for a bond and I think it makes perfect sense in this day and age. Not only do the banks need to evolve ( Which they probably won't because they're making too much of a profit with the way things are ), but consumers need to change the way they percieve their money. Specifically, how they can make more by saving and investing it correctly. If more people gravitate towards this type of savings program, the banks will have to take notice because they would start losing money.

What is on a lot of peoples' minds I think is the safety and security of their money. They think “Well at least with a bank my money is Federally insured. There are a few things that people need to realize. First off, back when banks started insuring the money that was in them, they did so as a safeguard against a total country-wide financial collapse. The Great Depression is what got FDR to establish the FDIC. That's the purpose it was set up for, for when things like that happen that are out of the banks' control. What's happening now is well within the banks' control because it is the banks themselves that are causing the financial collapse. They float bad loans and invest in schemes that even mobster flunkies who got demoted to Las Vegas wouldn't be a part of.

Secondly, people need to realize that THEY are the ones who are essentially “proecting” their money . When bailouts happen, they happen with OUR tax money. We keep them afloat so they can keep ripping us off via the interest rates. Talk about licking the boots that kick you, I swear. The bottom line with this is that there are no guatentees when it comes to asset protection. The best a person can do is to take steps to minimize their risks, and things like stocks and bonds have always been an option to that. The thing is, most people see those as secondary options. Back up plans if you will because the smart investor knows not to put all of his/her eggs in one basket . People need to start seeing things like peer to peer loans as their main option because they really can see a bigger return on their nvestment than the banks offer. And the icing on the cake is that the average citizen is helping another average citizen. People helping people.

Business models like Federally insured banks have run their course. It's gotten to the point where if you want to make your savings grow, don't go to a bank. Remember too that the FDIC was set up as a temporary fix. FDR had no intention of keeping it around yet, here we are 70 years later and, it's still here. The reason, I think, is that even back then the bankers realized that the FDIC could be of more use to THEM than US later on down the road. And they were right. It helped put the Government in the bankers' pockets. Personally, I would much rather help out other people like me than Governments and and bankers, and I'm going to suggest to the next woman I get with that she look into these sorts of things to help save money. God knows I can't. That's why she's going to get the checks.

All a person has to do really is look into the history of things like this and they'll realize that the way banks are set up are entirely self-serving. They haven't had our best interests in mind for quite some time now. But because they have silver tounges ( smooth talkers) and positions of prominance, people will go with that instead of doing their homework. Bottom line: Banks are failures because they constantly need Governements to bail them out because they keep overdrafting their ledgers. People who go to peer to peer lending do so, so they DON'T overdraft their ledgers. They're practicing financial foresight that the banks seem to be incapable of. And I'll go with responsible people like that every time before I go with irresponsible banks.

But again, don't take my word for it......do your homework. Don't NOT go with a bank just for the sake of it. Do it for the sake of your money.

Okay, this is going to be one of those “do as I say not as I do” posts. I couldn't keep a dime to save a nickel. Never have. I don't overdraft, but I don't save either. And I wish I could say the same thing about traditional banks, but I can't. With all the bailouts that the big ones all across the world are getting, that's obvious. They can save, but they do it at our expense. If not with the disparity between what they give us vs. what they charge us, then with our tax dollars that bail them out because they don't know how to keep a ledger straight.

Peer to Peer lending is just another term for a bond and I think it makes perfect sense in this day and age. Not only do the banks need to evolve ( Which they probably won't because they're making too much of a profit with the way things are ), but consumers need to change the way they percieve their money. Specifically, how they can make more by saving and investing it correctly. If more people gravitate towards this type of savings program, the banks will have to take notice because they would start losing money.

What is on a lot of peoples' minds I think is the safety and security of their money. They think “Well at least with a bank my money is Federally insured. There are a few things that people need to realize. First off, back when banks started insuring the money that was in them, they did so as a safeguard against a total country-wide financial collapse. The Great Depression is what got FDR to establish the FDIC. That's the purpose it was set up for, for when things like that happen that are out of the banks' control. What's happening now is well within the banks' control because it is the banks themselves that are causing the financial collapse. They float bad loans and invest in schemes that even mobster flunkies who got demoted to Las Vegas wouldn't be a part of.

Secondly, people need to realize that THEY are the ones who are essentially “proecting” their money . When bailouts happen, they happen with OUR tax money. We keep them afloat so they can keep ripping us off via the interest rates. Talk about licking the boots that kick you, I swear. The bottom line with this is that there are no guatentees when it comes to asset protection. The best a person can do is to take steps to minimize their risks, and things like stocks and bonds have always been an option to that. The thing is, most people see those as secondary options. Back up plans if you will because the smart investor knows not to put all of his/her eggs in one basket . People need to start seeing things like peer to peer loans as their main option because they really can see a bigger return on their nvestment than the banks offer. And the icing on the cake is that the average citizen is helping another average citizen. People helping people.

Business models like Federally insured banks have run their course. It's gotten to the point where if you want to make your savings grow, don't go to a bank. Remember too that the FDIC was set up as a temporary fix. FDR had no intention of keeping it around yet, here we are 70 years later and, it's still here. The reason, I think, is that even back then the bankers realized that the FDIC could be of more use to THEM than US later on down the road. And they were right. It helped put the Government in the bankers' pockets. Personally, I would much rather help out other people like me than Governments and and bankers, and I'm going to suggest to the next woman I get with that she look into these sorts of things to help save money. God knows I can't. That's why she's going to get the checks.

All a person has to do really is look into the history of things like this and they'll realize that the way banks are set up are entirely self-serving. They haven't had our best interests in mind for quite some time now. But because they have silver tounges ( smooth talkers) and positions of prominance, people will go with that instead of doing their homework. Bottom line: Banks are failures because they constantly need Governements to bail them out because they keep overdrafting their ledgers. People who go to peer to peer lending do so, so they DON'T overdraft their ledgers. They're practicing financial foresight that the banks seem to be incapable of. And I'll go with responsible people like that every time before I go with irresponsible banks.

But again, don't take my word for it......do your homework. Don't NOT go with a bank just for the sake of it. Do it for the sake of your money.

edit on 13-6-2012 by Taupin Desciple because: Sentence structure

edit on 13-6-2012 by Taupin Desciple because: See if you can

find it.

P2P lending clubs have been gaining more acceptance;

Is 'Peer-to-Peer' Lending Worth the Risk? - WSJ.com

The difference however is that these are still not close to offering a traditional banking service. A business that needs a traditional banking service like billing and CC processing and checking and lines of credit won't find that at a P2P lending club like Prosper or Lending Club. BUT it does offer an intriguing avenue for future growth... I'd suggest a credit union for your banking needs and if you need to borrow, look into the reputable lending clubs.

Is 'Peer-to-Peer' Lending Worth the Risk? - WSJ.com

The difference however is that these are still not close to offering a traditional banking service. A business that needs a traditional banking service like billing and CC processing and checking and lines of credit won't find that at a P2P lending club like Prosper or Lending Club. BUT it does offer an intriguing avenue for future growth... I'd suggest a credit union for your banking needs and if you need to borrow, look into the reputable lending clubs.

No peer to peer lending can not replace traditional banking solely for the fact that there is no guarantee of payback and no insurance up to the

$85,000 that banks have.

Have you heard of micro-lending before?

It's PEER-to PEER lending, but for smallish amounts. I have read a post about someone who has done that. They lent out about $2000 over 10 different loans. Only two of those loans were paid back. He stopped after that.

Have you heard of micro-lending before?

It's PEER-to PEER lending, but for smallish amounts. I have read a post about someone who has done that. They lent out about $2000 over 10 different loans. Only two of those loans were paid back. He stopped after that.

Originally posted by DaRAGE

It's PEER-to PEER lending, but for smallish amounts. I have read a post about someone who has done that. They lent out about $2000 over 10 different loans. Only two of those loans were paid back. He stopped after that.

Then the people offering the service need to do a more thorough credit check. They need to report those findings to the people wanting to loan the money out so they know how risky, or not, it is for them. They also need to tell the people asking for the loans that whatever they do, good or bad, will be reported to the major credit agencies like Equifax. Everyone knows that the better your credit standing is, the lower the interest rates that you can get will be.

Again, people need to remember that this "insurance " of up to $250,000 that the FDIC offers ultimately comes out of YOUR pocket via the taxes you pay the government every April 15. You're basically insuring yourself when you get right down to it. The bailouts of '08 should've taught people that lesson. Everyone knows that there are no financial guarantees anymore. The best you can do is go with the less risky proposition.

Here are some sites that can direct you to a P2P lending institution whether you are looking to borrow money or looking to invest.

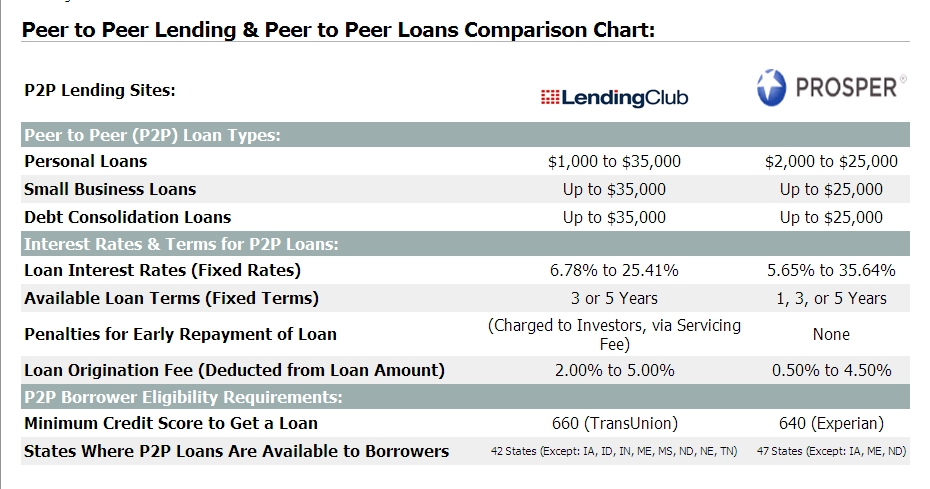

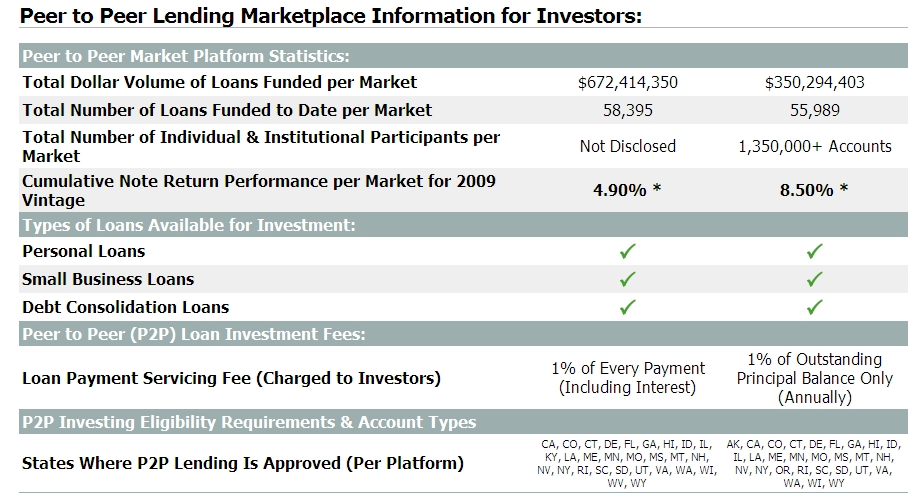

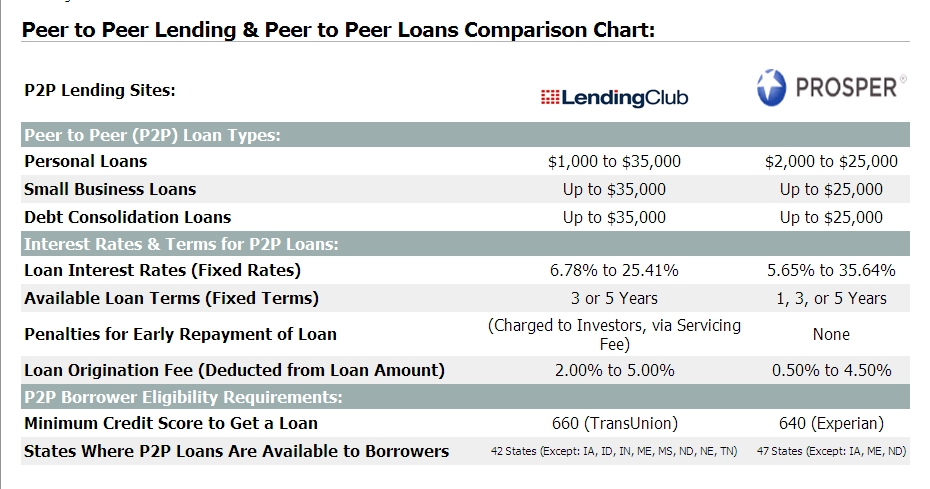

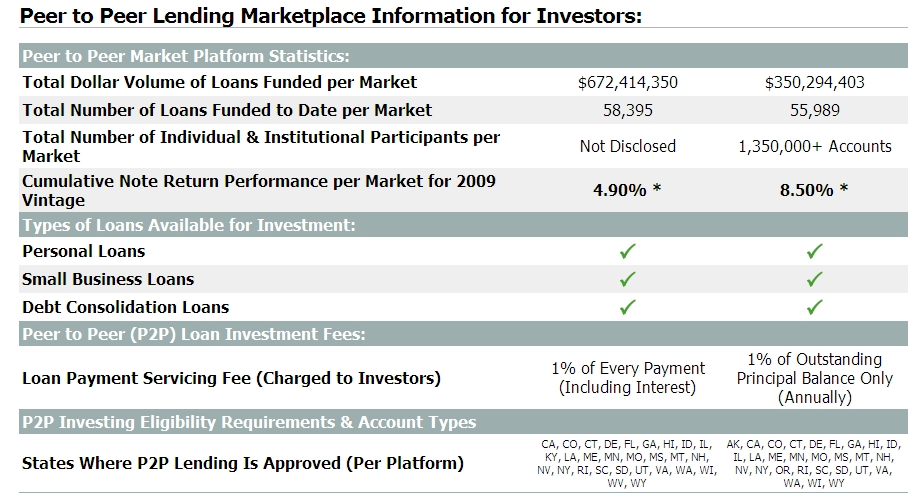

Peer Lend.com compares two companies:

Peer To Peer Lending Sites recommends a few other sites for both the US and the UK.

Peer Lend.com compares two companies:

Peer To Peer Lending Sites recommends a few other sites for both the US and the UK.

new topics

-

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago -

Bobiverse

Fantasy & Science Fiction: 9 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago -

Former Labour minister Frank Field dies aged 81

People: 11 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 13 hours ago, 7 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago, 7 flags -

This is our Story

General Entertainment: 15 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 11 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 9 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago, 2 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 93 • : SchrodingersRat -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 7 • : ScarletDarkness -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 140 • : Annee -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 16 • : grey580 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 22 • : RickyD -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 35 • : Consvoli -

Late Night with the Devil - a really good unusual modern horror film.

Movies • 1 • : DAVID64 -

Ditching physical money

History • 18 • : annonentity -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 32 • : SchrodingersRat -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 279 • : KrustyKrab

4