It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

2

share:

story from CNS

By Terence P. Jeffrey

June 11, 2012

Recession Ended 3 Years Ago This Month, Says National Bureau of Economic Research

This is Great News !!!

The recession ended in June of 2009 !!

Yes it did. It absolutely did !!

This is according to the Business Cycle Dating Committee of the National Bureau of Economic Research

(who are those guys ?)

Wait now .... This gets better.

Not only is the recession long over, we have been in an economic expansion since then !!

[deep long inhale ........ fast loud exhale]

Well that just puts my mind completely at ease.

Here all along I thought the continuous bad economic news was real.

I thought all the weak jobs reports were true.

I thought all the rising foreclosures and bankruptcies were genuine reports.

I thought all that extra welfare and food stamps and unemployment was real too.

(even at the record levels and record "participation)

Funny how they will take 10's of millions of economic prisoners real quick like, and only release one person at a time.

Here is the "Wisdom" (in theory only of course)

“"In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity""

Such Double-Talk !! :shk:

By Terence P. Jeffrey

June 11, 2012

Recession Ended 3 Years Ago This Month, Says National Bureau of Economic Research

This is Great News !!!

The recession ended in June of 2009 !!

Yes it did. It absolutely did !!

This is according to the Business Cycle Dating Committee of the National Bureau of Economic Research

(who are those guys ?)

Wait now .... This gets better.

Not only is the recession long over, we have been in an economic expansion since then !!

[deep long inhale ........ fast loud exhale]

Well that just puts my mind completely at ease.

Here all along I thought the continuous bad economic news was real.

I thought all the weak jobs reports were true.

I thought all the rising foreclosures and bankruptcies were genuine reports.

I thought all that extra welfare and food stamps and unemployment was real too.

(even at the record levels and record "participation)

Funny how they will take 10's of millions of economic prisoners real quick like, and only release one person at a time.

You Gotta read This !!

[mandatory -- read the whole article]

(CNSNews.com) - Although President Barack Obama said in a speech last week that during his time in office “we've gone through three and a half years of very difficult times,” the last recession ended three years ago this month--in June 2009--and since then the United States has been in an economic expansion period, according to the Business Cycle Dating Committee of the National Bureau of Economic Research.

The committee, comprised of prominent economists, is described by the New York Times as “the official arbiter of economic turning points.”

It made its official declaration that the last recession had ended during the month of June 2009 in a statement that it published on Sept. 20, 2010.......................

Here is the "Wisdom" (in theory only of course)

“The committee decided that any future downturn of the economy would be a new recession and not a continuation of the recession that began in December 2007,” the committee said in that Sept. 20, 2010 statement. "The basis for this decision was the length and strength of the recovery to date."

“At its meeting, the committee determined that a trough in business activity occurred in the U.S. economy in June 2009,” the statement said. “The trough marks the end of the recession that began in December 2007 and the beginning of an expansion. The recession lasted 18 months, which makes it the longest of any recession since World War II. Previously the longest postwar recessions were those of 1973-75 and 1981-82, both of which lasted 16 months.

“In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity,” said the committee. “Rather, the committee determined only that the recession ended and a recovery began in that month. A recession is a period of falling economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. The trough marks the end of the declining phase and the start of the rising phase of the business cycle. Economic activity is typically below normal in the early stages of an expansion, and it sometimes remains so well into the expansion.”

“"In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity""

Such Double-Talk !! :shk:

Yes Yes -- we are in a "trough"

Yep it sure did, went from a Recession right on into a Depression, pretty soon that may end and we get the Great Depression II.

reply to post by xuenchen

Boy, who's doing the spinning now???

Right, what ever ya'll say ..... [sarcasm]

Man they are so full of it !!!

Boy, who's doing the spinning now???

Right, what ever ya'll say ..... [sarcasm]

Man they are so full of it !!!

The only way we got out of the recession is if what we are in is the new norm.

Now what does that tell you?

Now what does that tell you?

Rumor has it that the "report" from Sept 2010 was a ploy designed by the White House.

At that time, they needed some "supporting" references to at least attempt to bolster Obama.

The NBER writings in general are very suggestive of a Left Wing agenda.

(they are very subtle however)

The "trough" indicators

more interesting points of their views:

A Political Theory of Populism

Partisan Control, Media Bias, and Viewer Responses

Definitely "donkey economics" at work !!

At that time, they needed some "supporting" references to at least attempt to bolster Obama.

The NBER writings in general are very suggestive of a Left Wing agenda.

(they are very subtle however)

The "trough" indicators

The committee designated June as the month of the trough based on several monthly indicators. The trough dates for these indicators are:

Macroeconomic Advisers' monthly GDP (June)

The Stock-Watson index of monthly GDP (June)

Their index of monthly GDI (July)

An average of their two indexes of monthly GDP and GDI (June)

Real manufacturing and trade sales (June)

Index of Industrial Production (June)

Real personal income less transfers (October)

Aggregate hours of work in the total economy (October)

Payroll survey employment (December)

Household survey employment (December)

September 20, 2010 report

more interesting points of their views:

A Political Theory of Populism

Partisan Control, Media Bias, and Viewer Responses

Definitely "donkey economics" at work !!

Ok we are out of the recession yet trillions more in debt....those idiots need to be kicked in the balls.

If it sounds too good to be true...then it usually is.

ATS taught me that one.

ATS taught me that one.

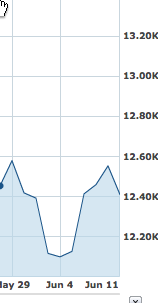

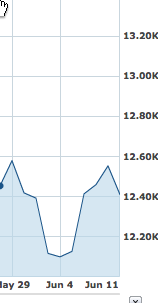

The market looks bullish to me.

screen shots from today's( 6/11/12) Yahoo 3 month view of the Dow

I'm sure its coincidence, but can there be a better picture for how the markets can be manipulated. I really think this whole thing is designed to get people to distrust the markets distrust the dollar. it's like the more you bend a piece of metal the weaker it becomes and eventually will break. New recession same old corruption.

screen shots from today's( 6/11/12) Yahoo 3 month view of the Dow

I'm sure its coincidence, but can there be a better picture for how the markets can be manipulated. I really think this whole thing is designed to get people to distrust the markets distrust the dollar. it's like the more you bend a piece of metal the weaker it becomes and eventually will break. New recession same old corruption.

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 47 minutes ago -

Electrical tricks for saving money

Education and Media: 3 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 5 hours ago -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 6 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 9 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 11 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 16 hours ago, 8 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 5 hours ago, 8 flags -

Bobiverse

Fantasy & Science Fiction: 16 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 13 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 3 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 6 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 5 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 7 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 11 hours ago, 1 flags

active topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 34 • : WeMustCare -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 53 • : pianopraze -

Sunak spinning the sickness figures

Other Current Events • 5 • : glen200376 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 44 • : MikeDeGrasseTyson -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 31 • : budzprime69 -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 33 • : rickymouse -

The Reality of the Laser

Military Projects • 46 • : Zaphod58 -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 0 • : randomuser2034 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 136 • : ImagoDei -

Electrical tricks for saving money

Education and Media • 3 • : Mike72

2