It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

9

share:

This just in from The Economic Collapse blog on the back of the recent voting results across the European continent, which indicate big change across

the European political landscape - if only in principle at this point. Whether newly elected politicians follow through with their election campaign

rhetoric is another thing, one that would almost certainly bring about signficant disruption to the Eurozone and perhaps the European Union more

broadly, leading to possible break up to either one of those unions. Of course what will become of (and what will come out of) the new political

European entity is yet to be seen - and what impacts the change might mean for Europe's economies and that of the world economy.

This article does a good job in bringing together a number of key points recently cited in various media to support what the author calls is the official beginnings of the break up of the euro. Intro only cited, see link for full article.

The Economic Collapse Blog

This article does a good job in bringing together a number of key points recently cited in various media to support what the author calls is the official beginnings of the break up of the euro. Intro only cited, see link for full article.

The Economic Collapse Blog

The results of the elections in France and Greece have made it abundantly clear that there is a tremendous backlash against the austerity approach that Germany has been pushing. All over Europe, prominent politicians and incumbent political parties are being voted out. In fact, Nicolas Sarkozy has become the 11th leader of a European nation to be defeated in an election since 2008. We have seen governments fall in the Netherlands, the UK, Spain, Ireland, Italy, Portugal and Greece. Whenever they get a chance, the citizens of Europe are using the ballot box to send a message that they do not like what is going on. It turns out that austerity is extremely unpopular. But if newly elected politicians all over Europe begin rejecting austerity, this puts Germany in a very difficult position. Should Germany be expected to indefinitely bail out all of the members of the eurozone that choose to live way beyond their means? If Germany pulled out of the euro tomorrow, the euro would absolutely collapse, bond yields for the rest of the eurozone would skyrocket to unprecedented heights, and without German bailout money troubled nations such as Greece would be headed directly for default. The rest of the eurozone is absolutely and completely dependent on Germany at this point. But as we have seen, much of the rest of the eurozone is sick and tired of taking orders from Germany and is rejecting austerity. A lot of politicians in Europe apparently believe that they should be able to run up gigantic amounts of debt indefinitely and that the Germans should be expected to always be there to bail them out whenever they need it. Will the Germans be willing to tolerate such a situation, or will they simply pick up their ball and go home at some point?

reply to post by surrealist

This is big, you can see this happening in America too at some point, the people have to vote with their feet but how will Germany respond to this?Id say that they are going to leave the Euro and then things are going to get ugly within central Europe.

This might be the turning point where Asia is going to be acknowledged as becoming the economic hub of the world.

This is big, you can see this happening in America too at some point, the people have to vote with their feet but how will Germany respond to this?Id say that they are going to leave the Euro and then things are going to get ugly within central Europe.

This might be the turning point where Asia is going to be acknowledged as becoming the economic hub of the world.

Even though it would spell disaster, I hope Germany does take it's ball and go home. Expecting them to keep shoveling cash, so the politicians can

look good, is just too much. When are these guys gonna realize you can't spend your way out of debt?

I think it's likely the Eurozone will shrink, but it seems unlikely to me that it will completely collapse.

The most probable outcome is that outliers such as Greece will be evicted due to insolvency. Then the rules for the Eurozone will be relaxed a bit so that a few of the on the fence countries will ride out the economic storm - even if it lasts 20 years.

The end result will be a Eurozone more predominantly of the northern European countries headlined by Germany and France. They will likely bolster one of the two large nations that are insolvent (Italy and Spain) and allow a few others to retreat from the Euro and reinstate their own sovereign currencies. My prediction therefor is that the Eurozone will continue but exist at about 2/3 it's current size.

The most probable outcome is that outliers such as Greece will be evicted due to insolvency. Then the rules for the Eurozone will be relaxed a bit so that a few of the on the fence countries will ride out the economic storm - even if it lasts 20 years.

The end result will be a Eurozone more predominantly of the northern European countries headlined by Germany and France. They will likely bolster one of the two large nations that are insolvent (Italy and Spain) and allow a few others to retreat from the Euro and reinstate their own sovereign currencies. My prediction therefor is that the Eurozone will continue but exist at about 2/3 it's current size.

I think it's likely the Eurozone will shrink, but it seems unlikely to me that it will completely collapse.

The most probable outcome is that outliers such as Greece will be evicted due to insolvency. Then the rules for the Eurozone will be relaxed a bit so that a few of the on the fence countries will ride out the economic storm - even if it lasts 20 years.

The end result will be a Eurozone more predominantly of the northern European countries headlined by Germany and France. They will likely bolster one of the two large nations that are insolvent (Italy and Spain) and allow a few others to retreat from the Euro and reinstate their own sovereign currencies. My prediction therefor is that the Eurozone will continue but exist at about 2/3 it's current size.

I'm basing this one purely on my gut feeling - not any actual data - so read it as such.

The most probable outcome is that outliers such as Greece will be evicted due to insolvency. Then the rules for the Eurozone will be relaxed a bit so that a few of the on the fence countries will ride out the economic storm - even if it lasts 20 years.

The end result will be a Eurozone more predominantly of the northern European countries headlined by Germany and France. They will likely bolster one of the two large nations that are insolvent (Italy and Spain) and allow a few others to retreat from the Euro and reinstate their own sovereign currencies. My prediction therefor is that the Eurozone will continue but exist at about 2/3 it's current size.

I'm basing this one purely on my gut feeling - not any actual data - so read it as such.

At least they get to vote. Here in America, we were never given an opportunity to vote (kind of ironic, isn't it?). Instead, the government decided

that the American people would have no problem filling the rich banker's pockets while our economy remained in the dumps. Personally, I believe our

entire world economy is so over inflated, the best thing we can do, is... nothing. Let everything equalize on its own. We will reach a new

equilibruim that is natural and sustainable. Let people fend for themselves and stop with all the hand outs.

$20 bucks says, somehow we get sucked into their bailout too and continue to spend money we don't have.

$20 bucks says, somehow we get sucked into their bailout too and continue to spend money we don't have.

Will this house of cards collapse? Probably. This isn't the end of the road however but just another road sign along the way. Nobody likes being

treated like cattle so expect more grumbling from the kids in the back seat before something we can honestly call revolt occurs. "Are we there yet?"

"Are we there yet?".

reply to post by pirhanna

The eurozone will continue, the EU agreements are to be met, no matter if a government changes.

Even Greece, but if they do not they can choose to leave the EU.

It is already stated that new negotiations are not on the table, Greece wants that but the agreement is already there and must be met.

The eurozone will continue, the EU agreements are to be met, no matter if a government changes.

Even Greece, but if they do not they can choose to leave the EU.

It is already stated that new negotiations are not on the table, Greece wants that but the agreement is already there and must be met.

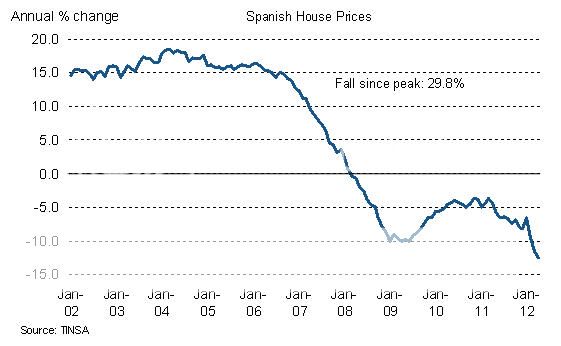

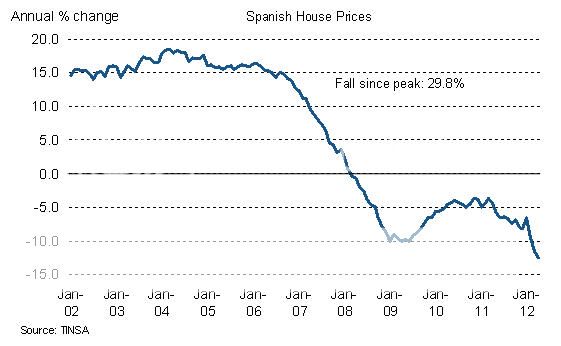

Look at housing prices in Spain, apparently

are down 12% YOY in April.

Is Spain, and then Europe about to be smashed with a housing bust like that in the United States?

Is Spain, and then Europe about to be smashed with a housing bust like that in the United States?

edit on 8-5-2012 by surrealist because:

Embed image

I would not be surprised to see 'fortress Germany' emerge, Germany has money, well trained army, if it kicked all the foreigners out, it could

become self sufficient in food stuffs, there only worry is vehicle fuel, but they could go over to Methane or Hydrogen fuel.

from various sources, and over the last several weeks there has been noise the Germany and the Northern EU members will create a Nordic

Euro...

very separate from the present Euro used throughout the EU... this Southern Euro or Mediterranian Euro would have a value of about Half of what the gold-backed Nordic Euro would be worth in Forex trade

(sources: 321 gold & others)

very separate from the present Euro used throughout the EU... this Southern Euro or Mediterranian Euro would have a value of about Half of what the gold-backed Nordic Euro would be worth in Forex trade

(sources: 321 gold & others)

edit on 8-5-2012 by St Udio because: (no reason given)

reply to post by surrealist

What i know is that Spain has a housing bust, as well as Ireland, they, as well as the country i live in (the Netherlands) had many years of fast rising prices.

In 1995 i bought a house myself for fl79.000.- (€35000) and sold in in 2005 for €95000.

The prices have almost tripled here in the Netherlands.

A small group, mainly the buyers who bought in 2006 and later are having problems.

The market here in the netherlands has stalled, most are unable to buy, and certainly the buyers between 2006 and now are unable to sell because it would mean that they remain with a percentage of debt as their house is worth less now compared to the height of their mortgage, so they stay where they are.

Germany has no problem, france neither, although there has been a doubling in home prices in france, they seem to do well.

Prices dropped a little in france, but they are rising again slowly since 2010.

This gives me the reason to thing that Europe will not experience the same.

What i know is that Spain has a housing bust, as well as Ireland, they, as well as the country i live in (the Netherlands) had many years of fast rising prices.

In 1995 i bought a house myself for fl79.000.- (€35000) and sold in in 2005 for €95000.

The prices have almost tripled here in the Netherlands.

A small group, mainly the buyers who bought in 2006 and later are having problems.

The market here in the netherlands has stalled, most are unable to buy, and certainly the buyers between 2006 and now are unable to sell because it would mean that they remain with a percentage of debt as their house is worth less now compared to the height of their mortgage, so they stay where they are.

Germany has no problem, france neither, although there has been a doubling in home prices in france, they seem to do well.

Prices dropped a little in france, but they are rising again slowly since 2010.

This gives me the reason to thing that Europe will not experience the same.

new topics

-

Russia Flooding

Other Current Events: 54 minutes ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 1 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 2 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 2 hours ago -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 4 hours ago -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 4 hours ago -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 5 hours ago -

Elites disapearing

Political Conspiracies: 7 hours ago -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 7 hours ago -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 9 hours ago

top topics

-

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media: 14 hours ago, 17 flags -

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 9 hours ago, 12 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 5 hours ago, 11 flags -

Trump To Hold Dinner with President of Poland At Trump Tower Tonight

2024 Elections: 17 hours ago, 8 flags -

Elites disapearing

Political Conspiracies: 7 hours ago, 7 flags -

Freddie Mercury

Paranormal Studies: 9 hours ago, 7 flags -

Tucker Carlson interviews Christian pastor from Bethlehem.

Middle East Issues: 16 hours ago, 7 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 7 hours ago, 5 flags -

Nirvana - Immigrant Song

Music: 13 hours ago, 5 flags -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 4 hours ago, 4 flags

active topics

-

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies • 16 • : GotterDameron23 -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three • 12 • : GENERAL EYES -

Elites disapearing

Political Conspiracies • 17 • : AwakeNotWoke -

A family from Kansas with six children moved to the Moscow region

Other Current Events • 74 • : Freeborn -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 7 • : Zaphod58 -

The US Supreme Court Appears to Side With the January 6th 2021 Capitol Protestors.

Political Conspiracies • 43 • : GotterDameron23 -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies • 4 • : AwakeNotWoke -

Running Through Idiot Protestors Who Block The Road

Rant • 105 • : Astyanax -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 517 • : cherokeetroy -

Nirvana - Immigrant Song

Music • 7 • : Astrocometus

9