It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Pffft - why do people say I have zero debt, own everything seem to think they are "safe."

If the economy collapses, you have riots in the streets - doesn't really matter that you have zero debt. People will be breaking your door down to get what you have. Forget about having some debt, I would be more worried about having surplus food/water/ammo and the like.

If the economy collapses, you have riots in the streets - doesn't really matter that you have zero debt. People will be breaking your door down to get what you have. Forget about having some debt, I would be more worried about having surplus food/water/ammo and the like.

reply to post by MidnightTide

In 1929, the riots in the streets didn't last for very long... the financial misery that most experienced lasted for years and the ripple effect for generations.

IMHO, it is foolish to believe that guns will keep you safe, just as it is foolish to believe just staying out of debt will keep you safe. Neither of those choices preclude the other. The most important thing you can have to keep yourself safe if the SHTF is knowledge... which is why I keep my ears open for any hint of what is to come.

TheRedneck

In 1929, the riots in the streets didn't last for very long... the financial misery that most experienced lasted for years and the ripple effect for generations.

IMHO, it is foolish to believe that guns will keep you safe, just as it is foolish to believe just staying out of debt will keep you safe. Neither of those choices preclude the other. The most important thing you can have to keep yourself safe if the SHTF is knowledge... which is why I keep my ears open for any hint of what is to come.

TheRedneck

I put my real estate licence in retirement this year because I honestly cannot sell houses to people I know will be losing them as quick as they get

in them. Here in TN foreclosures have not flooded the market even though it appears to some they have. They haven't. Over the next five years we will

see more and more.

Its going to get a lot worse before it gets better in my opinion.

I heard from senior realtors say that if you don't own your home out right (paid for with cash) any debt you have when the shtf will add fuel to the fire. They will come and take your home and anything else of value to help pay off the debt. This is what some of them were saying about our future outlook.

So... I got out of the rat race as I am not into making money off people who are naive to the facts because the MSM likes to paint a pretty picture. It's a trap.

Where is the accountability? Oh I forgot...no one is making them be accountable. We are still sitting back all comfy watching American Idol to care.

Its going to get a lot worse before it gets better in my opinion.

I heard from senior realtors say that if you don't own your home out right (paid for with cash) any debt you have when the shtf will add fuel to the fire. They will come and take your home and anything else of value to help pay off the debt. This is what some of them were saying about our future outlook.

So... I got out of the rat race as I am not into making money off people who are naive to the facts because the MSM likes to paint a pretty picture. It's a trap.

Where is the accountability? Oh I forgot...no one is making them be accountable. We are still sitting back all comfy watching American Idol to care.

Alabama, hm, so must be Jeff Sessions or Richard Shelby. Both Republicans. Both wealthy. Both well connected.

reply to post by Trolloks

Interesting observation, I had my banker friend who is a VP for a major financial institution tell me that one of the reasons people walked away from there houses so easily is that they had been advised by the banks to transfer all there debt onto there houses. So when the housing market collapsed the debt was on the house and people walked away from all debt by walking away from there house. The regulations you speak of would stop that from happening. Some abused the system for sure, for example taking out a 300K mortgage on a 200K house, the banks allowed this because the market was appreciating at the time. But there are also innocent people who just bought in at the wrong time too.

Bottom line debt is bad right now, but the cost of living almost forces it upon people these days. For example you get car bill for $1200 and you need your car to commute to work for because there is no public transit.

Interesting observation, I had my banker friend who is a VP for a major financial institution tell me that one of the reasons people walked away from there houses so easily is that they had been advised by the banks to transfer all there debt onto there houses. So when the housing market collapsed the debt was on the house and people walked away from all debt by walking away from there house. The regulations you speak of would stop that from happening. Some abused the system for sure, for example taking out a 300K mortgage on a 200K house, the banks allowed this because the market was appreciating at the time. But there are also innocent people who just bought in at the wrong time too.

Bottom line debt is bad right now, but the cost of living almost forces it upon people these days. For example you get car bill for $1200 and you need your car to commute to work for because there is no public transit.

reply to post by Blue_Jay33

I disagree... the desire for accumulation of things right now forces one into debt.

When I made the decision to get out of debt, people kept telling me it wasn't possible. I'm glad I didn't listen. It was hard, yes, but far from impossible. I had to drive some seriously clunker cars for a while, but by setting back what I would have paid for a new car, I was able to save enough to pay cash for a good used car before long. I bought a house out of bankruptcy court just before making the leap and was able to pay it off quickly... then I turned around and sold it to buy another, better house.

I did without things my friends were getting, but when I did get them, they meant a lot more to me and I took better care of them. I ate at home instead of going out. I started carrying drinks in the trunk of my car instead of buying them in convenience stores. I also carried snacks in the trunk...things like Vienna sausages that were cheap... and snacked while working instead of stopping for a burger. Instead of buying new furniture, I let my friends buy new furniture and I got their old furniture. I fixed things instead of buying new ones. I even started rolling my own cigarettes and cut that cost by 75+%.

Little things, sacrifices, patience, commitment... and now I own my home, my car, and two trucks. I own them, not some bank.

It can be done. I did it, and I'm just a redneck.

TheRedneck

Bottom line debt is bad right now, but the cost of living almost forces it upon people these days.

I disagree... the desire for accumulation of things right now forces one into debt.

When I made the decision to get out of debt, people kept telling me it wasn't possible. I'm glad I didn't listen. It was hard, yes, but far from impossible. I had to drive some seriously clunker cars for a while, but by setting back what I would have paid for a new car, I was able to save enough to pay cash for a good used car before long. I bought a house out of bankruptcy court just before making the leap and was able to pay it off quickly... then I turned around and sold it to buy another, better house.

I did without things my friends were getting, but when I did get them, they meant a lot more to me and I took better care of them. I ate at home instead of going out. I started carrying drinks in the trunk of my car instead of buying them in convenience stores. I also carried snacks in the trunk...things like Vienna sausages that were cheap... and snacked while working instead of stopping for a burger. Instead of buying new furniture, I let my friends buy new furniture and I got their old furniture. I fixed things instead of buying new ones. I even started rolling my own cigarettes and cut that cost by 75+%.

Little things, sacrifices, patience, commitment... and now I own my home, my car, and two trucks. I own them, not some bank.

It can be done. I did it, and I'm just a redneck.

TheRedneck

Many in the banking industry see the cliff ahead as 'Bernanke' implied. To many shakeups and resignations also in big business and banking. So i

feel many of the responses hit it on the head with the devalued dollar. To many dollars out there to keep the price up and inflation down with the

printing presses so active. Plus the amount circulating in the economy is way to low a level.

reply to post by TheRedneck

you think maybe the reason the Government is getting buying gold like crazy from American Citizens ?

this is just a Wild guess here ....

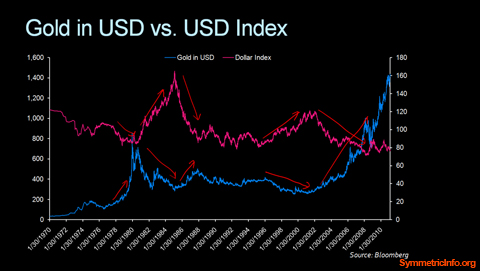

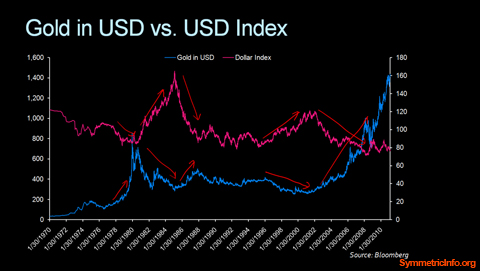

What is the relationship between US Dollars and Gold Prices?

symmetricinfo.org...

Pt14. What is the relationship between Gold Prices and the US Dollar?

Fed Banks Spend Spend ... making money out of thin air and Nothing to back it Up...

of the Main Source of Currency is Gold & Silver

The US Federal Reserve May Have a Golden Secret: it May Be Panic Buying Gold to Fill or Replace 'Lost' Strategic Gold Reserves

voices.yahoo.com...

the plausible answer ?

Should Governments Buy Gold?

Why Gold Owners Are Targets of the Government

Gary North

www.garynorth.com...

thinking Debt China , the uncounted for money before 911

the resignation of a mess load of banking officials around the world Etc....

THE Fed Banks cant keep UP they.. the Ones we are in debt with

want their Money with a Proof of Value they cant get the Gold fast enough ...

as I remember Ron Paul said about inflation vs Gold in a Video on you tube

Ron Paul - Inflation & Gold w/ Colbert

The Feds has Destroyed Our Currency

- Stephen Colbert

thanks for your story ....

you think maybe the reason the Government is getting buying gold like crazy from American Citizens ?

this is just a Wild guess here ....

What is the relationship between US Dollars and Gold Prices?

symmetricinfo.org...

The graph covers the period from 1970 to 2011. The blue line shows the price of gold in US dollars which we’ve been referring to as the exchange rate between US dollars and gold. The pink line shows the value of the US dollar relative to a basket of currencies from the ROW and so when the pink line is going up it means that the value of the dollar is strengthening relative to other currencies and if the pink line is going down it means that the dollar is weakening relative to other currencies. As you can sort of see these two lines tend to the inverses of one another.

Pt14. What is the relationship between Gold Prices and the US Dollar?

Fed Banks Spend Spend ... making money out of thin air and Nothing to back it Up...

of the Main Source of Currency is Gold & Silver

The US Federal Reserve May Have a Golden Secret: it May Be Panic Buying Gold to Fill or Replace 'Lost' Strategic Gold Reserves

voices.yahoo.com...

the plausible answer ?

Should Governments Buy Gold?

Private investors and central banks have scrambled in recent years to stock up on gold. This summer, they drove the price over $1,600 an ounce for the first time ever.

Why Gold Owners Are Targets of the Government

Gary North

www.garynorth.com...

thinking Debt China , the uncounted for money before 911

the resignation of a mess load of banking officials around the world Etc....

THE Fed Banks cant keep UP they.. the Ones we are in debt with

want their Money with a Proof of Value they cant get the Gold fast enough ...

as I remember Ron Paul said about inflation vs Gold in a Video on you tube

Ron Paul - Inflation & Gold w/ Colbert

The Feds has Destroyed Our Currency

- Stephen Colbert

thanks for your story ....

reply to post by TheRedneck

I also received a vague warning from a prominent geologist, who I wont name, who said to not build a house in the central part of the United States because a super volcano will blow sometime in the future...

I personally have a lot of faith in this guy, take this warning for what it is....

I also received a vague warning from a prominent geologist, who I wont name, who said to not build a house in the central part of the United States because a super volcano will blow sometime in the future...

I personally have a lot of faith in this guy, take this warning for what it is....

5 years is a long time to borrow money.

Seems like a logical statement the senator was making.

Seems like a logical statement the senator was making.

Here we go 5 months and counting, I am a residential home builder from Toronto ,most of my clients now are Americans coming here to purchase [modestly

priced]homes and prepare them for occupancy whether it be increasing the square footage or adding another story they are coming "if you build it they

will come"most are in their mid 30 s and up ,when I ask what brings you North[ and I know its not the Toronto Maple Leafs ]the answer usually is the

same, investment purposes or retirement.

Now I am not an investment banker or wall street guru, here its [bay street ]but I know they are better investment returns on 5 year terms than Toronto,however if your coming to dump your money and assets in a vault that is secure from outside geopolitical turmoil than Canada is the place .

We are so cheap and conservative that we make the Brits and Japanese look like party animals when it comes to loaning money.

Which comes to my last point the Banks in Toronto are not loaning to people who have don't have at least 30 percent equity in your home ,America may be going broke ,but the folks I deal with don't even blink when I start my pricing at a 100,000 and move north from there.

I have digressed from my point I apologise [cant help it, love New York license plates when they are parked in the driveway of a potential sale]most of my American clients don't need financing at all!

Where as Canadian clients need some type of financing when you start getting to 50, 000 and up, most banks are declining second mortgages to couples with perfectly good credit and very profitable careers ,matter of fact I was telling this to one of my clients from New Hampshire and he offered to do in house financing for a couple who were having trouble securing a second mortgage.

Point is, Bankers are not stupid they have stopped loaning money where the residence is collateral, if you don't have at least 30 percent up front they shut the door,that tells me simply there is no 5 years from now. I know I have rambled on here but deception never introduces itself, you have to look very hard for inconsistencies and usually when it comes to money its all pretty linear if the numbers don't add up then there's a problem because the only thing that never lies in our society is greed .

Now I am not an investment banker or wall street guru, here its [bay street ]but I know they are better investment returns on 5 year terms than Toronto,however if your coming to dump your money and assets in a vault that is secure from outside geopolitical turmoil than Canada is the place .

We are so cheap and conservative that we make the Brits and Japanese look like party animals when it comes to loaning money.

Which comes to my last point the Banks in Toronto are not loaning to people who have don't have at least 30 percent equity in your home ,America may be going broke ,but the folks I deal with don't even blink when I start my pricing at a 100,000 and move north from there.

I have digressed from my point I apologise [cant help it, love New York license plates when they are parked in the driveway of a potential sale]most of my American clients don't need financing at all!

Where as Canadian clients need some type of financing when you start getting to 50, 000 and up, most banks are declining second mortgages to couples with perfectly good credit and very profitable careers ,matter of fact I was telling this to one of my clients from New Hampshire and he offered to do in house financing for a couple who were having trouble securing a second mortgage.

Point is, Bankers are not stupid they have stopped loaning money where the residence is collateral, if you don't have at least 30 percent up front they shut the door,that tells me simply there is no 5 years from now. I know I have rambled on here but deception never introduces itself, you have to look very hard for inconsistencies and usually when it comes to money its all pretty linear if the numbers don't add up then there's a problem because the only thing that never lies in our society is greed .

reply to post by MamaJ

Greetings:

As far as I know, the mortgage laws do not include the ability to seize property - other than sell your house.

As far as attempting to remove my personal possessions, meet my little friend, Mr. Desert Eagle.

And we agree that it is going to get worse... say June, maybe July when things get wonky and food riots begin.

Good on you for your integrity.

Just south of you in Rabun County, Ga, we remain,

Sincerely yours

tfw

Greetings:

As far as I know, the mortgage laws do not include the ability to seize property - other than sell your house.

As far as attempting to remove my personal possessions, meet my little friend, Mr. Desert Eagle.

And we agree that it is going to get worse... say June, maybe July when things get wonky and food riots begin.

Good on you for your integrity.

Just south of you in Rabun County, Ga, we remain,

Sincerely yours

tfw

Originally posted by thorfourwinds

reply to post by MamaJ

Greetings:

As far as I know, the mortgage laws do not include the ability to seize property - other than sell your house.

As far as attempting to remove my personal possessions, meet my little friend, Mr. Desert Eagle.

And we agree that it is going to get worse... say June, maybe July when things get wonky and food riots begin.

Good on you for your integrity.

Just south of you in Rabun County, Ga, we remain,

Sincerely yours

tfw

Union County here Neighbor....Big Foot territory....

Des

edit on 28-4-2012 by Destinyone because: (no reason given)

It means when the crash comes, and it IS coming, everything will lose most of its value, EXCEPT for how much you owe. Just like they did in the

thirties. People are already "upside down" or "underwater" on their mortgages, meaning they owe more than the house is worth.

Imagine that times, say, a hundred. Anyone who takes out loans now at what they perceive as realistic amounts, will be in for a big surprise. Let's say you get a mortgage for a hundred grand and buy a little shack to live in with it. Suddenly, everything crashes. Your little shack is now worth ten bucks. Your pay, if you can even find a job, drops to one dollar a day. But you still owe a hundred grand. You could work the rest of your life and not pay it. So, to recoup their "losses", they will take your shack and anything else they want from you, and you will STILL owe more.

They are also re-instituting debtor's prisons. You will end up there, once they have squeezed you dry, and then you will work for Wackenhut for free till you die.

Imagine that times, say, a hundred. Anyone who takes out loans now at what they perceive as realistic amounts, will be in for a big surprise. Let's say you get a mortgage for a hundred grand and buy a little shack to live in with it. Suddenly, everything crashes. Your little shack is now worth ten bucks. Your pay, if you can even find a job, drops to one dollar a day. But you still owe a hundred grand. You could work the rest of your life and not pay it. So, to recoup their "losses", they will take your shack and anything else they want from you, and you will STILL owe more.

They are also re-instituting debtor's prisons. You will end up there, once they have squeezed you dry, and then you will work for Wackenhut for free till you die.

reply to post by Destinyone

Hi Union County!

We've been busy readying the compound and lands for spring planting and have missed you here.

We shared an interesting piece on the GOM that may interest you.

Looking forward to your company... we have that bottle of '95 Screaming Eagle PRO ready to decant...

Peace Love Light

tfw

[align=center][color=magenta]Liberty & Equality or Revolution[/align]

Hi Union County!

We've been busy readying the compound and lands for spring planting and have missed you here.

We shared an interesting piece on the GOM that may interest you.

Looking forward to your company... we have that bottle of '95 Screaming Eagle PRO ready to decant...

Peace Love Light

tfw

[align=center][color=magenta]Liberty & Equality or Revolution[/align]

reply to post by thorfourwinds

If you will read a mortgage sometime, it is actually a deed to your property. The only thing that distinguishes it from an actual deed of transfer is a clause that states it is null and void as long as you make the payments according to the payment agreement it references.

That's why mortgages are so much easier to get than other loans. If you put up a car as collateral, you can drive that car across the state line and it makes it very hard (and very expensive) to collect it... especially since the car hasn't been conditionally transferred already. The same goes with almost any personal property. But if you put up land in a mortgage, not only is the land not capable of being moved, but ownership has already been transferred as soon as you miss a payment.

Some states have laws on the books that restrict that transfer to a small degree, such as mandatory grace periods, but once that protection is exhausted there is no need for a mortgage holder to make a formal claim to the property... they simply record the deed and the property then belongs to them... no court, no probate, no auction required. It was sold as soon as you signed on the dotted line and transferred as soon as you defaulted.

TheRedneck

If you will read a mortgage sometime, it is actually a deed to your property. The only thing that distinguishes it from an actual deed of transfer is a clause that states it is null and void as long as you make the payments according to the payment agreement it references.

That's why mortgages are so much easier to get than other loans. If you put up a car as collateral, you can drive that car across the state line and it makes it very hard (and very expensive) to collect it... especially since the car hasn't been conditionally transferred already. The same goes with almost any personal property. But if you put up land in a mortgage, not only is the land not capable of being moved, but ownership has already been transferred as soon as you miss a payment.

Some states have laws on the books that restrict that transfer to a small degree, such as mandatory grace periods, but once that protection is exhausted there is no need for a mortgage holder to make a formal claim to the property... they simply record the deed and the property then belongs to them... no court, no probate, no auction required. It was sold as soon as you signed on the dotted line and transferred as soon as you defaulted.

TheRedneck

Originally posted by CaptChaos

(...)

They are also re-instituting debtor's prisons...

Greetings:

Very interesting.

Do you have any more info on this?

Thanks for your time and consideration.

tfw

reply to post by thorfourwinds

finance.yahoo.com...

thinkprogress.org... =nc

Now that I've read the whole thread, I realize no one even remotely understands the money system. I only see ONE post that seems to get it. You guys act like they are printing all this money, and you'll just hang on to it. However, only three percent of all the money in "circulation" is even paper. The rest is all just numbers in computers. They can take it all away from you with a keystroke.

Everyone seems to think inflation just "happens", like it's a force of nature or something. None of this stuff is happening by accident, not in the least. The wildest market fluctuations and frenzies are all carefully scripted, just a lot of the actors don't know they are mere extras.

Ask anyone from Argentina what 2001 was like. Or, look it up. Just a small taste of your future.

And, by the way, the crash in 1929 was not really felt by anyone until 1933. It's like a slow motion train wreck, and they are doing it again, and bigger this time.

ANd for those who think they will not be able to get goons to enforce all these foreclosures and debtor's prisons, you've got another think coming. They've done it before and they'll do it again. "Just doing their jobs" as you all are so happy to say now.

You'll see.

finance.yahoo.com...

thinkprogress.org... =nc

Now that I've read the whole thread, I realize no one even remotely understands the money system. I only see ONE post that seems to get it. You guys act like they are printing all this money, and you'll just hang on to it. However, only three percent of all the money in "circulation" is even paper. The rest is all just numbers in computers. They can take it all away from you with a keystroke.

Everyone seems to think inflation just "happens", like it's a force of nature or something. None of this stuff is happening by accident, not in the least. The wildest market fluctuations and frenzies are all carefully scripted, just a lot of the actors don't know they are mere extras.

Ask anyone from Argentina what 2001 was like. Or, look it up. Just a small taste of your future.

And, by the way, the crash in 1929 was not really felt by anyone until 1933. It's like a slow motion train wreck, and they are doing it again, and bigger this time.

ANd for those who think they will not be able to get goons to enforce all these foreclosures and debtor's prisons, you've got another think coming. They've done it before and they'll do it again. "Just doing their jobs" as you all are so happy to say now.

You'll see.

Originally posted by MidnightTide

Pffft - why do people say I have zero debt, own everything seem to think they are "safe."

If the economy collapses, you have riots in the streets - doesn't really matter that you have zero debt. People will be breaking your door down to get what you have. Forget about having some debt, I would be more worried about having surplus food/water/ammo and the like.

This is why I'm happy to live in a nice Mormon community, it is almost like being a survivalist is built into the religion. Almost all of my neighbors have good food storage and have personal and community gardens.

We have semi-religious meetings where we learn how to can/bottle food, garden, proper food storage methods etc.

Religious dogma aside, it will be great to be surrounded by people who are prepaid for whatever may come... We even have rapid response disaster plans.

reply to post by jerryznv

Hmm... Not that I don't believe the senator said it, and not that I don't believe your friend relating the story, but like everyone else, I'm confused by what this vague comment could have meant.

You're telling me - This comes just a week after I took out a $10,000 Federal student loan.

Oh well...nothing I can do about it now - if I don't go to school I'm stuck working a 9-5 and scraping by anyway.

I'll make ATS my one phone call if I get thrown in the clink.

Hmm... Not that I don't believe the senator said it, and not that I don't believe your friend relating the story, but like everyone else, I'm confused by what this vague comment could have meant.

Or we are all screwed...I know I am up to my eyeballs in debt!

You're telling me - This comes just a week after I took out a $10,000 Federal student loan.

Oh well...nothing I can do about it now - if I don't go to school I'm stuck working a 9-5 and scraping by anyway.

I'll make ATS my one phone call if I get thrown in the clink.

new topics

-

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 26 minutes ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 13 hours ago, 10 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 17 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 14 hours ago, 5 flags -

Sunak spinning the sickness figures

Other Current Events: 14 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 12 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 16 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago, 2 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago, 0 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 26 minutes ago, 0 flags

active topics

-

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 61 • : YourFaceAgain -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 21 • : FlyersFan -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 3 • : ImagoDei -

Hate makes for strange bedfellows

US Political Madness • 45 • : YourFaceAgain -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7134 • : baddmove -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 140 • : ImagoDei -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 62 • : Ophiuchus1 -

Sunak spinning the sickness figures

Other Current Events • 17 • : Ohanka -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 261 • : YourFaceAgain -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 8 • : mysterioustranger