It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

If BOA says 7K it will be 10...those ETF's are not worth anything - if you don't hold physical you don't hold anything. It won't be worth the

paper its printed on.

Peace

imo - if you hold anything hold silver. I won't go into the illegal hedge on Silver by JP Morgan but their silver hedge is for more then exists on the entire planet & when that collapses those paper ETF's are going to be worth nothing.

What would happen if all the people tried to cash in their ETF's for physical...it would be a bad day for JPM.

Peace

imo - if you hold anything hold silver. I won't go into the illegal hedge on Silver by JP Morgan but their silver hedge is for more then exists on the entire planet & when that collapses those paper ETF's are going to be worth nothing.

What would happen if all the people tried to cash in their ETF's for physical...it would be a bad day for JPM.

reply to post by babybunnies

There is no "if", it's a matter of WHEN.

But save your fed notes, after disinfecting they'll make good tp.

There is no "if", it's a matter of WHEN.

But save your fed notes, after disinfecting they'll make good tp.

Originally posted by FissionSurplus

My husband day-trades stocks, and he has been in a gold mine ETF and also with a gold mining company (JAG). He has been holding these positions for a while. He stated that the prices have been squashed abnormally low for a while now, and when that happens it is usually due to manipulation so that Big Money and their buddies can pick up this stuff cheap before it shoots the moon.

Now that Big Money has their mitts on these stocks at dirt-cheap prices, they can let the news out so all the retail investors jump on the bandwagon and drive the prices up. In fact, news like this is let out purposefully by entities such as B of A in order to guarantee the price jump.

As far as the actual physical gold, I see it shooting out of the range of most people. I still believe silver is the poor folks' choice, still affordable, and the price is still being kept down thanks to crooks like JP Morgan Chase.

It's that, or they are selling to the suckers now....Silver and gold have been coming down for the last few months. Time will tell I guess.

reply to post by jim3981

When the fiat currency is backed by nothing except the full faith & credit of the US Government & that government is 13 or 16 Trillion dollars in debt,,,well you better own something that people want - something tangible - a barrel of oil, a bushel of corn, a silver dollar .

FYI - it won't be a Private Federal Reserve Note or a piece of paper saying we owe you this much in Gold or Silver. lol

Peace

When the fiat currency is backed by nothing except the full faith & credit of the US Government & that government is 13 or 16 Trillion dollars in debt,,,well you better own something that people want - something tangible - a barrel of oil, a bushel of corn, a silver dollar .

FYI - it won't be a Private Federal Reserve Note or a piece of paper saying we owe you this much in Gold or Silver. lol

Peace

Originally posted by oghamxx

Sounds a bit 'off'

"When the US went off the gold standard, prices went up from $35/oz to $800/oz." Over what period of time? 40 years? The AVERAGE price in 1967 was 34.95. It spiked briefly above 800 around 1980 but did not hold above 800 until 2008. And his "Equating the same performance in the current gold market, gold prices will have to rise to $5000/oz from its base of $250/oz." actually happening is IMO highly optimistic misleading cherry picking. In what year was the base 250?

That's because it is a bit off oghamxx.

When Nixon closed the 'Gold Window' in 1971 - Gold was valued at the official rate of $35 an ounce. By December 31, 1974 when private ownership was declared legal for US citizens under President Ford - Gold was trading at $195 an ounce in the international market. In conjunction with the legalization bill effective December 31, 1974 - the Comex began trading Gold futures in January 1975.

As you correctly noted - Gold traded as high as $850 in January 1980. That's a gain of 425% across 5 years - not 40. Or alternatively - a gain of 2400% across 9 years from the 1971 price of $35.

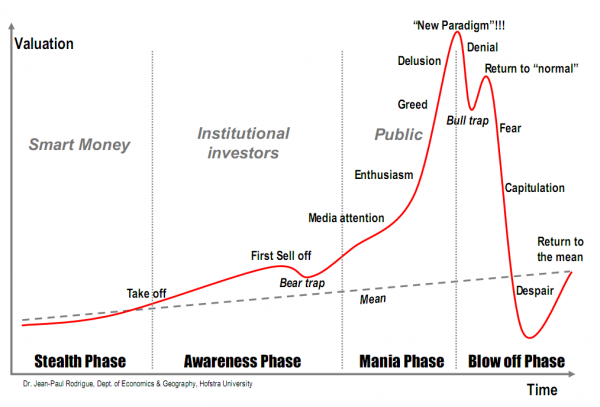

Posted below is a generic graph depicting the progression of a typical bull market by phase. The mania phase is the emotionally driven leg of a bull market which the BOA analyst was referring to when he said:

"Until we see price action take some kind of massive speculative blow-off, where prices effectively double in a year or less, I have to maintain a long-term bullish bias. That says to me, we'll probably see a move in gold, before all is said and done, to between $3,000 to $5,000 (per ounce) and potentially $7,000 per ounce." - Source

We aren't there yet.

Bank of America makes no mention of what having $7000 is guaranteed to be like in the future. Also they don't state if their use of the term gold is

to mean holding your own ounce of gold or a promise from a MF Global like company for an ounce, the two are clearly different things but both called

gold.

There seems to be so much confusion in our use of the three words 'money', 'dollars' and 'gold' that these mainstream articles are now pointless.

Money does not give goods and services value but goods and services do give money it's value.

Dollars do not give goods and services value but goods and services do give dollars it's value.

Gold does not give goods and services value but goods and services do give gold it's value.

There seems to be so much confusion in our use of the three words 'money', 'dollars' and 'gold' that these mainstream articles are now pointless.

Money does not give goods and services value but goods and services do give money it's value.

Dollars do not give goods and services value but goods and services do give dollars it's value.

Gold does not give goods and services value but goods and services do give gold it's value.

In terms of price, an ounce of Gold is an ounce of Gold...paper or physical.

The US dollar price of physical Gold (spot price) is determined by the front month paper contract trading in the futures market. At any given moment, 100 ounces of physical bullion stored in a hole in the ground, is equal in value to a 100 ounce GC contract trading on the Comex. This also holds true for allocated accounts, pool accounts, and certificate programs. As the front month price of Gold fluctuates on the futures exchange, the value of your investment follows suit regardless of it's form.

Now the wisdom of 'owning' Gold in paper form is a whole other issue. I would even extend this caution to buying futures contracts with the ultimate goal of taking delivery; ask Gerald Celente .

Personally I adhere to the idiom: If you can't hold it in your grubby little hands, you don't own it. But the BOA analyst was merely speculating on blow-off top scenarios priced in USD; he wasn't writing a treatise on Physical v Paper and counterparty risk.

The US dollar price of physical Gold (spot price) is determined by the front month paper contract trading in the futures market. At any given moment, 100 ounces of physical bullion stored in a hole in the ground, is equal in value to a 100 ounce GC contract trading on the Comex. This also holds true for allocated accounts, pool accounts, and certificate programs. As the front month price of Gold fluctuates on the futures exchange, the value of your investment follows suit regardless of it's form.

Now the wisdom of 'owning' Gold in paper form is a whole other issue. I would even extend this caution to buying futures contracts with the ultimate goal of taking delivery; ask Gerald Celente .

Personally I adhere to the idiom: If you can't hold it in your grubby little hands, you don't own it. But the BOA analyst was merely speculating on blow-off top scenarios priced in USD; he wasn't writing a treatise on Physical v Paper and counterparty risk.

edit on 30-4-2012

by OBE1 because: (no reason given)

new topics

-

Bobiverse

Fantasy & Science Fiction: 25 minutes ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 30 minutes ago -

Former Labour minister Frank Field dies aged 81

People: 2 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 4 hours ago -

This is our Story

General Entertainment: 7 hours ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 9 hours ago -

Ode to Artemis

General Chit Chat: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 9 hours ago, 13 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 15 hours ago, 6 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 13 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 14 hours ago, 4 flags -

Ditching physical money

History: 13 hours ago, 4 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 4 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 10 hours ago, 3 flags -

Former Labour minister Frank Field dies aged 81

People: 2 hours ago, 3 flags -

VirginOfGrand says hello

Introductions: 14 hours ago, 2 flags -

This is our Story

General Entertainment: 7 hours ago, 2 flags

active topics

-

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7131 • : baddmove -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 28 • : CarlLaFong -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 250 • : FlyersFan -

Russia Ukraine Update Thread - part 3

World War Three • 5725 • : BernnieJGato -

NASA Researchers Discover a Parallel Universe That Runs Backwards through Time - Alongside Us

Space Exploration • 70 • : seekshelter -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 21 • : network dude -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues • 43 • : TheWoker -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 44 • : confuzedcitizen -

Who guards the guards

US Political Madness • 6 • : covent -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 53 • : Justoneman