It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

The Writing is On the Wall! OL's Map of the Wherewithall! Free End Game Taxtics and Exit Strategy!

page: 12

share:

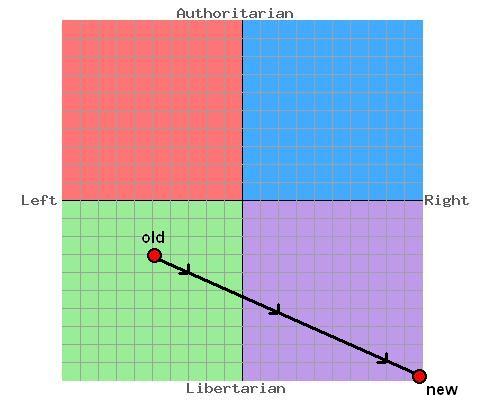

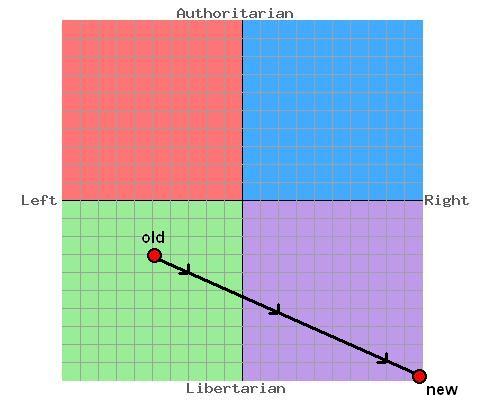

Explantion: Recently OL picked up his political flag and shifted very far away from being the

Socialist I once was.

Having explored my newfound political landscape from the vantage point of my mindseye I have a single statement to make and following that I shall briefly detail the map that I made up for my own personal education.

1stly I started with ATS Survival forum ... and found that shelter is the most important prioritory!

Because nobody wants to die from exposure in under a few hours.

2ndly I assumed that a small farm would suit that purpose amicably and I used google to search for average sized small farms and found out that in Israel in 1995 the average sized small farm was between 1 and 9 hectares [ 1 Hectare = 100^2m or 100m x 100m area ] ...

Agriculture in Israel: Today [wiki]

I also found more comprehensive data from Sussex University Here but I haven't had the time to digest that and so I arbitrarily set this variable at the largest small sized Israeli farm which is 9 hectares.

9 hectares is a nice number because it forms a 3 x 3 grid of individual hectares and is easy to visualize.

3rdly I had recently done some serious investigation into the USA tax system and although I am an Australian I have tailored this thread to be targeted at an American audience ... and one of the things I learned was ...

Income tax in the United States [wiki]

Note OL has edited the above quotes to bold and underline the important bits of data.

Standard deduction [wiki]

Personal exemption (United States) [wiki]

So one can earn just shy of

Having explored my newfound political landscape from the vantage point of my mindseye I have a single statement to make and following that I shall briefly detail the map that I made up for my own personal education.

"I don't hate socialism! I just want a way out!"

1stly I started with ATS Survival forum ... and found that shelter is the most important prioritory!

Because nobody wants to die from exposure in under a few hours.

2ndly I assumed that a small farm would suit that purpose amicably and I used google to search for average sized small farms and found out that in Israel in 1995 the average sized small farm was between 1 and 9 hectares [ 1 Hectare = 100^2m or 100m x 100m area ] ...

Agriculture in Israel: Today [wiki]

In 1995, there were 43,000 farm units with an average size of 13.5 hectares. 19.8% of these were smaller than 1 hectare, 75.7% were 1 to 9 hectares in size, 3.3% were between 10 and 49 hectares, 0.4% were between 50 and 190 hectares, and 0.8% were larger than 200 hectares. Of the 380,000 hectares under cultivation in 1995, 20.8% was under permanent cultivation and 79.2% under rotating cultivation. Farm units included 160,000 hectares used for activities other than cultivation. Cultivation was based mainly in the northern coastal plains, the hills of the interior, and the upper Jordan Valley.

I also found more comprehensive data from Sussex University Here but I haven't had the time to digest that and so I arbitrarily set this variable at the largest small sized Israeli farm which is 9 hectares.

9 hectares is a nice number because it forms a 3 x 3 grid of individual hectares and is easy to visualize.

3rdly I had recently done some serious investigation into the USA tax system and although I am an Australian I have tailored this thread to be targeted at an American audience ... and one of the things I learned was ...

Income tax in the United States [wiki]

Taxable income is total income less allowable deductions. Income is broadly defined. Most business expenses are deductible. Individuals may also deduct a personal allowance (exemption) and certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits.

Capital gains are fully taxable, and capital losses reduce taxable income only to the extent of gains. Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

Example of a tax computationIncome tax for year 2011:

Single taxpayer, no children, under 65 and not blind, taking standard deduction;

$40,000 gross income – $5,800 standard deduction – $3,700 personal exemption = $30,500 taxable income

$8,500 × 10% = $850.00 (taxation of the first income bracket)

$30,500 – $8,500 = $22,000.00 (amount in the second income bracket)

$22,000.00 × 15% = $3,300.00 (taxation of the amount in the second income bracket)

Total income tax is $850.00 + $3,300.00 = $4,150.00 (10.375% effective tax)

Note that in addition to income tax, a wage earner would also have to pay Federal Insurance Contributions Act tax (FICA) (and an equal amount of FICA tax must be paid by the employer):

$40,000 (adjusted gross income)

$40,000 × 4.2%[7] = $1,680 (Social Security portion)

$40,000 × 1.45% = $580 (Medicare portion)

Total FICA tax = $2,260 (5.65% of income)

Total Federal tax of individual = $6,410.00 (16.025% of income)

Note OL has edited the above quotes to bold and underline the important bits of data.

Standard deduction [wiki]

The standard deduction, as defined under United States tax law, is a dollar amount that non-itemizers may subtract from their income and is based upon filing status. It is available to US citizens and resident aliens (for tax purposes) who are individuals, married persons, and heads of household and increases every year. It is not available to nonresident aliens residing in the United States. Additional amounts are available for persons who are blind and/or are at least 65 years of age. The standard deduction is distinct from personal exemptions, which also are available to all taxpayers and dependents. As one may not take both itemized deductions and a standard deduction, taxpayers generally choose the deduction that results in the lesser amount of tax owed.

Personal exemption (United States) [wiki]

When Congress enacted Section 151 of the Internal Revenue Code, it did so believing that a certain level of income, “personal exemptions”, should not be subject to the federal income tax. Congress reasoned that the level of income insulated from taxation under §151 should roughly correspond to the minimal amount of money someone would need to get by at a subsistence level (i.e., enough money for food, clothes, shelter, etc.). The amount listed in §151 (see below), even adjusted for inflation, may seem inadequate for a taxpayer to subsist on. It is important to remember however, that in addition to personal exemptions, taxpayers may claim other deductions that further reduce the level of gross income subject to taxation.

Generally speaking, taxpayers may claim a personal exemption for themselves, §151(b), and their qualifying dependents, §151(c). A personal exemption may also be claimed for a spouse if (1) the couple files separately, (2) the spouse has no gross income, and (3) the spouse is not the dependent of another, §151(b). For taxpayers filing a joint return with their spouse, the IRS Regulations allow two personal exemptions as well, §1.151-1(b).

In computing their taxable income, taxpayers may claim all personal exemptions they are eligible for under §151, and deduct that amount from their adjusted gross income. The size of the personal exemption a taxpayer may take each year is adjusted for inflation.

So one can earn just shy of

reply to post by OmegaLogos

Explanation: Cont. from above post ...

Less Taxes = Smaller Government = Less intrusion into our lives.

But I found out that one cannot FULLY escape from either death and or taxes and the horrible reality boils down to ...

Yearly LOCAL Council Land Rates! :shk:

The quickest to hand online information on such things for me was ...

Council rating [localgovt.sa.gov.au]

... which is purely Australian information and might not fully conform to the USA but I think they will be similar and I have again arbitrarily chosen to just go with the information contain within at face value.

But upon further [undisclosed] research it appears that annual local council land rates will cost less than $10,000.oo per year for a farm of the size I have set out in the post above this post = 9 hectares.

One also gets to vote and participate in local council elections etc. and I encourage one to do so vigourously as being on the board can help ensure the keeping of land rates down low!

This is clearly a conflict of interest but one that must be endured for the sake of financial security and ones own self survival.

To pay for these rates I encourage people to invest in blue chip stocks which collectively pay a yearly dividend of about

Explanation: Cont. from above post ...

Less Taxes = Smaller Government = Less intrusion into our lives.

But I found out that one cannot FULLY escape from either death and or taxes and the horrible reality boils down to ...

Yearly LOCAL Council Land Rates! :shk:

The quickest to hand online information on such things for me was ...

Council rating [localgovt.sa.gov.au]

... which is purely Australian information and might not fully conform to the USA but I think they will be similar and I have again arbitrarily chosen to just go with the information contain within at face value.

4. What types of rating structures can councils use?

General rates

The largest component of the charges on your rates notice is general rates. General rates may be based on property value alone or based on a combination of property value, and a fixed charge (flat rate).

The council will set a “rate in the dollar” (or several differential rates in the dollar, one of) which is then applied to your land (and added to a fixed charge, if any) to calculate the amount of general rates for the year. The phrase “rate in the dollar” means a percentage of the property value. A council could apply no fixed charge and would apply the same rate in the dollar to all land. However, many councils, mindful of balancing the principles of taxation, choose to make some variation to this basic strategy. The options for variation may include one or more of the following:

•Differentials between categories of land (differential general rates)

•A fixed charge; or a

•Minimum rate

•Adjustments for specified values

1. Differential Rates

Councils may choose to apply different rates in the dollar for:

(a) Different land uses within their area, or for

(b) Different localities within the area, or for

(c) A combination of both locality and land use, as follows.

a) Land uses

There are nine different land uses that councils can differentiate between. They are:

1.Residential

2.Commercial - shop

3.Commercial - office

4.Commercial - other

5.Industry - light

6.Industry - other

7.Primary production

8.Vacant

9.Other

The definition of each category is set out in detail in the Local Government (General) Regulations 1999 (at regulation 10).

b) Locality

Locality means either a zone (defined in the Council’s Development Plan) or whether land is inside or outside a particular named township, or both. For example, a council might set one differential rate for all land in a (named) town, a second differential rate for all land in a second (named) town, and a third differential rate for all other land. Alternatively a council might set one differential rate for a Town Centre zone, a second differential rate for land in a Flood Plain zone; and a third differential rate for all other land.

c) Combination of land use and locality

For example, a council might declare one rate for all residential land inside a (named) town, another differential rate for all residential land outside any town, a third differential rate for commercial land in its Town Centre zone, a fourth differential rate for industrial land inside towns, a fifth differential rate for industrial land outside towns, and so on.

But upon further [undisclosed] research it appears that annual local council land rates will cost less than $10,000.oo per year for a farm of the size I have set out in the post above this post = 9 hectares.

One also gets to vote and participate in local council elections etc. and I encourage one to do so vigourously as being on the board can help ensure the keeping of land rates down low!

This is clearly a conflict of interest but one that must be endured for the sake of financial security and ones own self survival.

To pay for these rates I encourage people to invest in blue chip stocks which collectively pay a yearly dividend of about

reply to post by OmegaLogos

Explanation: Cont. from above post ...

Now why is this all important?

And some previous pinko commie positions of mine on those issues ...

Good luck building your pansy assed micky mouse loser country into an economic powerhouse now! (by OmegaLogos posted on 21-3-2011 @ 10:30 PM) [ATS]

[Macho's ONLY!] A gun is a VERY WEAK attitude to carry! Whats the matter with you? Be a Man OK! (by OmegaLogos posted on 20-2-2011 @ 10:38 PM) [ATS]

I no longer support either position I held when I posted those threads.

But back to the base issue of shelter aka PROPERTY and FREEHOLD LAND ...

The Minimum requirement appears to be a 9 hectare farm and enough blue chip stcokcs so the annual dividends cover the local council land rates.

Furthermore to prevent one being LITERALLY undermined I recommend buying up the mineral rights as well!

I am not very knowledgable in such things but I have a feeling one may be able to bypass that by buying up the underground water rights and using them and environmental concerns as a hedge bet against any future legal actions to do with mining and mineral rights.

8.13 Property Ownership In Australia 8. Property Rights by Doctor Mark Cooray (1995) [ourcivilisation.com]

I did some research and it seems that 9 hectares (in Australia) costs anywhere fro $4,000.oo AUD to 3 x times that cost per hectare bought as freehold land. [does NOT include mineral/water rights which would cost extra]

I arbitrarily set the cost at $11,000.oo per hectare for a rounded off total of $100,000.oo to just buy the base land without mineral rights and I then quadrupled that cost [arbitrary] and added $100,000.oo in blue chip stocks paying an annual dividend of between 5% - 10% for a grand total of 1/2 million $'s startup outlay for shelter alone.

I am hoping that turns out to be a huge overestimate.

Personal Disclosure: So concludes this subsection on Shelter and the wherewithall to attain and maintain that.

Next section is Water!

Explanation: Cont. from above post ...

Now why is this all important?

And some previous pinko commie positions of mine on those issues ...

Good luck building your pansy assed micky mouse loser country into an economic powerhouse now! (by OmegaLogos posted on 21-3-2011 @ 10:30 PM) [ATS]

[Macho's ONLY!] A gun is a VERY WEAK attitude to carry! Whats the matter with you? Be a Man OK! (by OmegaLogos posted on 20-2-2011 @ 10:38 PM) [ATS]

I no longer support either position I held when I posted those threads.

But back to the base issue of shelter aka PROPERTY and FREEHOLD LAND ...

The Minimum requirement appears to be a 9 hectare farm and enough blue chip stcokcs so the annual dividends cover the local council land rates.

Furthermore to prevent one being LITERALLY undermined I recommend buying up the mineral rights as well!

I am not very knowledgable in such things but I have a feeling one may be able to bypass that by buying up the underground water rights and using them and environmental concerns as a hedge bet against any future legal actions to do with mining and mineral rights.

8.13 Property Ownership In Australia 8. Property Rights by Doctor Mark Cooray (1995) [ourcivilisation.com]

Property rights are the basis of all other rights. With 10% private property in land and virtually 0% private property in minerals, it is obvious that freedom and enterprise in Australia rest on very insecure foundations indeed.

In a country like the United States, where the right to property is placed above the law, where the sole function of the public police force is to safeguard this natural right, each person can in full confidence dedicate his capital and his labor to production. He does not have to fear that his plans and calculations will be upset from one instant to another by the legislature. -Frederic Bastiat (1850)

I did some research and it seems that 9 hectares (in Australia) costs anywhere fro $4,000.oo AUD to 3 x times that cost per hectare bought as freehold land. [does NOT include mineral/water rights which would cost extra]

I arbitrarily set the cost at $11,000.oo per hectare for a rounded off total of $100,000.oo to just buy the base land without mineral rights and I then quadrupled that cost [arbitrary] and added $100,000.oo in blue chip stocks paying an annual dividend of between 5% - 10% for a grand total of 1/2 million $'s startup outlay for shelter alone.

I am hoping that turns out to be a huge overestimate.

Personal Disclosure: So concludes this subsection on Shelter and the wherewithall to attain and maintain that.

Next section is Water!

edit on 23-4-2012 by OmegaLogos because: Edited to add the entire body of text and redact the reserved tag.

Hi OP

I do not get it !

Whats the point or idea you are trying to get across ( or am I just been dumb )

I do not get it !

Whats the point or idea you are trying to get across ( or am I just been dumb )

Yea could we maybe get a small summary of your findings. I dont see a major pattern in your data collection which im not saying the evidence isnt

linked, I just need to see it the way you do to understand. Hopefully OP can clarify.

new topics

-

Intro once again

Introductions: 1 hours ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 2 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 3 hours ago -

God lived as a Devil Dog.

Short Stories: 3 hours ago -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 5 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 6 hours ago -

Hate makes for strange bedfellows

US Political Madness: 8 hours ago -

Who guards the guards

US Political Madness: 11 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 8 hours ago, 16 flags -

Who guards the guards

US Political Madness: 11 hours ago, 13 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 17 hours ago, 12 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 5 hours ago, 8 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 6 hours ago, 5 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 2 hours ago, 5 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 12 hours ago, 2 flags -

God lived as a Devil Dog.

Short Stories: 3 hours ago, 2 flags -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 3 hours ago, 2 flags -

Intro once again

Introductions: 1 hours ago, 2 flags

2