It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

The EPA Regulations will be devastating to the Nation and Economy. Obama made it clear that he wanted energy prices to go up and the administration

has put on so many new regulations, that we are going to see exactly that. Thanks a lot Obama!

New requirements could raise cost of gas, shutter US refineries

“These regulations don’t make sense environmentally or economically,” said National Petrochemical and Refiners Association President Charles Drevna. “The proposal would increase greenhouse gas emissions, hurt American consumers by adding billions of dollars to the cost of manufacturing gasoline, hurt communities and workers by threatening to put some fuel manufacturing plants out of business, and weaken America’s economic and national security.”

According to the study, implementing a nationwide (save for California) summer season 7 pounds per square inch (psia) RVP specification and sulfur limits of 20 ppm per gallon cap and 10 ppm per company annual average would remove a large quantity of natural gas liquids (NGLs) from gasoline. The modeling indicates that US domestic gasoline production would decrease by 1,157 thousand bpd during the summer, which is equivalent to 14% of projected summer 2016 hydrocarbon gasoline consumption. Under this scenario, summer gasoline imports would need to increase by 125%. However, the volume of gasoline with lower sulfur and lower RVP that would be available from foreign refineries is not clear. Regardless, regulations that close US refineries or lead to reduced output will make the US that much more vulnerable to supply disruptions, as more refined product will have to be obtained from overseas.

Domestic refinery investment costs for implementing the lower sulfur and lower RVP standards could range from $10–$17 billion. The study’s authors predict that if such standards are implemented, the US could see the closure of four to seven refineries. These refineries would make the decision to close rather than make the required investments to be compliant. Total compliance costs for the US domestic refining industry would be in the range of $5–$13 billion.

New requirements could raise cost of gas, shutter US refineries

edit on 26/2/12 by spirit_horse because: (no reason given)

The price of these commodities would be very low and very steady if market forces were at work in the usual way that people imagine market forces

work.

The fact is that the derivative market controls the price. The derivative market was created as a control mechanism. If you don't understand it, study it. The price is manipulated not by 'speculators' but by the manipulators. If 'THEY' want the price to rise, it rises. If 'THEY' want the price to fall, it falls. It is easy when you have billions of dollars to trade with. Any market is at equilibrium at all times except very brief moments when those markets are unbalanced. At those moments in time the market is tipped one way or the other in a split second. Any unbalance is almost instantaneously balanced again. So the secret is to have enough money to cause an unbalanced moment. It is all about daily volume x price. If you have enough money you can push a market one way or the other.

This idea that Joe Sixpack at home with a computer and a futures trading account moves the market is total bullcrap. The market is manipulated by a manipulator far bigger than all the at home players combined.

The fact is that the derivative market controls the price. The derivative market was created as a control mechanism. If you don't understand it, study it. The price is manipulated not by 'speculators' but by the manipulators. If 'THEY' want the price to rise, it rises. If 'THEY' want the price to fall, it falls. It is easy when you have billions of dollars to trade with. Any market is at equilibrium at all times except very brief moments when those markets are unbalanced. At those moments in time the market is tipped one way or the other in a split second. Any unbalance is almost instantaneously balanced again. So the secret is to have enough money to cause an unbalanced moment. It is all about daily volume x price. If you have enough money you can push a market one way or the other.

This idea that Joe Sixpack at home with a computer and a futures trading account moves the market is total bullcrap. The market is manipulated by a manipulator far bigger than all the at home players combined.

The Oil Speculators(IE big banks) and the oil industry also want the pipeline from Canada that Obama has blocked and this is a way for them to put

pressure on the administration to get it approved

The big banks in the US also do a lot of business in Canada and would make a lot of money from loans for the pipeline plus new money in there banks from the pipeline after its built.

They don't make that much from Arab oil that it mostly invested in Arab banks and Arab countries government holding..

The big banks in the US also do a lot of business in Canada and would make a lot of money from loans for the pipeline plus new money in there banks from the pipeline after its built.

They don't make that much from Arab oil that it mostly invested in Arab banks and Arab countries government holding..

Originally posted by Blackmarketeer

reply to post by jdub297

Tensions with Iran - in other words, speculation that supply will be cut (we don't actually buy oil from Iran, but other countries do). This hasn't affected our supplies at all, and as repeatedly pointed out, our supplies are at an all time high.

Yes, and Iran also cut off England and France for agreeing to sanctions. They wanted to quit buying from Iran in June or July (don't recall which), but Iran cut them off immediately. Somewhere they have to make that up and that means a cut in on other supplies of oil.

edit on 26/2/12 by spirit_horse because: (no reason given)

reply to post by Blackmarketeer

Source

Doesn't look like it will be changing things any time soon however.

The Dodd-Frank Financial Reform bill, signed into law on July 21, 2010, mandated that the CFTC write rules for the oil markets designed to stop speculation from controlling prices on crude oil and gasoline and driving them to astronomical levels, as they did in 2008. The bill also demanded that these rules be in place and working by February of this year.

There's just one problem: Those rules haven't yet been written and approved.

They haven't been written largely because of the pushback that the CFTC has received from the traders that make massive profits from the financial oil markets and the advocacy groups and lawyers that represent them. As the CFTC has proposed new rules, they've been met by a who's who of derivative traders and their advocates arguing for the status quo and urging caution, including PIMCO, BlackRock, Goldman Sachs, JPMorgan, the Futures Industry Association (FIA) and the Securities Industry and Financial Markets Association (SIFMA) -- to name only a few. The lawyers arguing their case are predictably the best, brightest and most expensive in Washington, including attorneys from Alston & Bird, Gibson, Dunn & Crutcher, Patton Boggs, Sullivan, Cromwell and Skadden, Arps.

Under this pressure, the CFTC has buckled and thrown in the towel on much of the needed rulemaking, at least for now. To take one example, the Commission has given up trying to craft a rule on position limits in oil derivatives until at least 2012, and position limits is only one of thirty complex rulemaking areas the CFTC has acknowledged it must tackle before its mandate is complete.

Source

Doesn't look like it will be changing things any time soon however.

reply to post by Blackmarketeer

Economics is such a tricky subject and difficult to comprehend. My view is that MANIPULATION of the free markets by our so called govt and corp leaders gouges us. But with respect to Obama, i recall when he was campaigning for office, his fix to gas prices was to check your tire pressure frequently.....out of touch with someone like me who travels a couple hundred miles every other weekend to visit my son.

Economics is such a tricky subject and difficult to comprehend. My view is that MANIPULATION of the free markets by our so called govt and corp leaders gouges us. But with respect to Obama, i recall when he was campaigning for office, his fix to gas prices was to check your tire pressure frequently.....out of touch with someone like me who travels a couple hundred miles every other weekend to visit my son.

The Oil Speculators(IE big banks) and the oil industry also want the pipeline from Canada that Obama has blocked and this is a way for them to put pressure on the administration to get it approved

The big banks in the US also do a lot of business in Canada and would make a lot of money from loans for the pipeline plus new money in there banks from the pipeline after its built.

Tar sands oil is already shipped to Midwestern refineries. What they want is to SKIP these refineries and bring the oil straight to the gulf coast for the more profitable export to Europe and Latin America.

In other words, the pipeline isn't about lowering prices here in America, it's about allowing Big Oil to increase profits. It will in actuality INCREASE the prices Americans pay for gas, especially in the Midwest.

TransCanada stated as much in their prospectus to investors;

(Key Facts on Keystone XL)

- By draining Midwestern refineries of cheap Canadian crude into export-oriented refineries in the Gulf Coast, Keystone XL will increase the cost of gas for Americans.

- TransCanada’s 2008 Permit Application states “Existing markets for Canadian heavy crude, principally PADD II [U.S. Midwest], are currently oversupplied, resulting in price discounting for Canadian heavy crude oil. Access to the USGC [U.S. Gulf Coast] via the Keystone XL Pipeline is expected to strengthen Canadian crude oil pricing in [the Midwest] by removing this oversupply. This is expected to increase the price of heavy crude to the equivalent cost of imported crude. The resultant increase in the price of heavy crude is estimated to provide an increase in annual revenue to the Canadian producing industry in 2013 of US $2 billion to US $3.9 billion.”

- Independent analysis of these figures found this would increase per-gallon prices by 20 cents/gallon in the Midwest.

- According to an independent analysis U.S. farmers, who spent $12.4 billion on fuel in 2009 could see expenses rise to $15 billion or higher in 2012 or 2013 if the pipeline goes through. At least $500 million of the added expense would come from the Canadian market manipulation.

“Tar Sands Oil Means High Gas Prices” Corporate Ethics International

“Pipeline Profiteering” National Wildlife Federation

The biggest lie about the Keystone pipeline is that it will increase domestic gas production. All it's about is letting TransCanada export the oil from Texas to more profitable foreign markets. Right now the pipelines from the tar sands take the oil to the Midwest which is causing market pressure to lower prices, something Big Oil is working hard to stop.

This site says it all very well:

Keystone XL is a tar sands pipeline to export oil out of the United States

One of the most important facts that is missing in the national debate surrounding the proposed Keystone XL tar sands pipeline is this – Keystone XL will not bring any more oil into the United State for decades to come. Canada doesn’t have nearly enough oil to fill existing pipelines going to the United States. However, existing Canadian oil pipelines all go to the Midwest, where the only buyer for their crude is the United States. Keystone XL would divert Canadian oil from refineries in the Midwest to the Gulf Coast where it can be refined and exported. Many of these refineries are in Foriegn Trade Zones where oil may be exported to international buyers without paying U.S. taxes. And that is exactly what Valero, one of the largest potential buyers of Keystone XL's oil, has told its investors it will do. The idea that Keystone XL will improve U.S. oil supply is a documented scam being played on the American people by Big Oil and its friends in Washington DC.

edit on 26-2-2012 by Blackmarketeer

because: (no reason given)

I think all the liquidity they are pumping into the system worldwide it makes sense they would invest that freshly printed liquidity into commodities

such as oil. This would drive the price up. So blame the Fed and the world's other central banks.

reply to post by spirit_horse

reply to post by spirit_horse

None of these refineries are currently shut down, the study states they could be IF these new rules go into effect, but that wouldn't explain the price manipulation taking place now.

You put the effect before the cause.

reply to post by spirit_horse

None of these refineries are currently shut down, the study states they could be IF these new rules go into effect, but that wouldn't explain the price manipulation taking place now.

The study examines the potential costs of the EPA’s “Tier 3” fuel standard for gasoline blends, which could be proposed at the end of the year. It determined that the new requirements could boost the cost of making gasoline by up to 25 cents per gallon and could shutter up to seven US refineries.

You put the effect before the cause.

the most galling part for me is that the US can supply all of it's own needs domestically or with import from allies like canada

I say tell the oil companies to supply the US citizens needs or face massive funding for alternative fuel sources

a joke of course, because they own congress

I say tell the oil companies to supply the US citizens needs or face massive funding for alternative fuel sources

a joke of course, because they own congress

This is bull.

It's the FED/ECB printing + warmongering from NATO in the middle-east.

It's the FED/ECB printing + warmongering from NATO in the middle-east.

Hey all,

Great posts in here by all, thanks.

I hope you don’t mind, I did a little mash-up of some of the posts – things that stick out to me as being fairly realistic, and that I tend to agree with.

I would also like to mention the impending BP Oil Spill trial set to begin Monday.

BP Oil Spill Trial begins Monday

It's not a great article mind you, but the fact remains, there will be a trial.

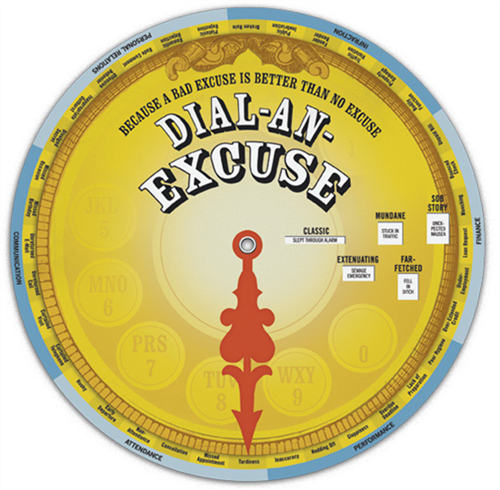

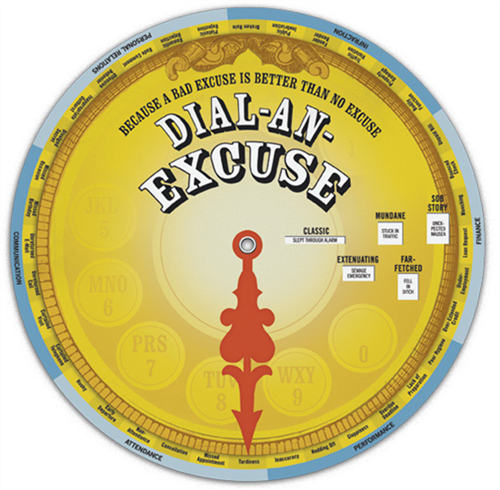

To me it looks like there are plenty of excuses available to be deployed – why, it’s so easy now with the Dial and Excuse Magic Wheel!

Great posts in here by all, thanks.

I hope you don’t mind, I did a little mash-up of some of the posts – things that stick out to me as being fairly realistic, and that I tend to agree with.

I would also like to mention the impending BP Oil Spill trial set to begin Monday.

BP Oil Spill Trial begins Monday

It's not a great article mind you, but the fact remains, there will be a trial.

To me it looks like there are plenty of excuses available to be deployed – why, it’s so easy now with the Dial and Excuse Magic Wheel!

Originally posted by jdub297

...tell the whole story.

The truth is simple market forces: supply v. demand.

...

...tell the truth.

(edit: mine)

As the NPR broadcast states, oil production is up higher than ever, and use is lower. They state "US energy policy is not to blame".

What is to blame is the unregulatedspeculators(corporate interests, lobbyist’s, politicians) that are using any opportunity - like fear over Iran - to gouge prices.

Originally posted by spirit_horse

One thing that is also causing higher prices is that many US refineries are shut down right now to set the refineries up for new blending regulations that the EPA has made them do by spring 2012.

New requirements could raise cost of gas, shutter US refineries

edit on 26/2/12 by spirit_horse because: (no reason given)

Originally posted by ANNED

The Oil Speculators(IE big banks) and the oil industry also want the pipeline from Canada that Obama has blocked and this is a way for them to put pressure on the administration to get it approved

Originally posted by type0civ

reply to post by Blackmarketeer

Economics is such a tricky subject and difficult to comprehend. My view is that MANIPULATION of the free markets by our so called govt and corp leaders gouges us.

Originally posted by syrinx high priest

the most galling part for me is ...

...a joke of course, because they own congress

Originally posted by XXX777

The price of these commodities would be very low and very steady if market forces were at work in the usual way that people imagine market forces work.

The fact is that the derivative market controls the price. The derivative market was created as a control mechanism. If you don't understand it, study it. The price is manipulated not by 'speculators' but by the manipulators.

This idea that Joe Sixpack at home with a computer and a futures trading account moves the market is total bullcrap. The market is manipulated by a manipulator far bigger than all the at home players combined.

Blame Oil Speculators, Not Obama, For Rising Oil Prices

I think there's a case for spreading the blame around... even if the word 'responsibility' better fits the bill.

The speculators serve no purpose other than drive the cost of oil higher than it would be without them so... you can be certain the big oil has no problem with their existence in the market.

On the other hand, Obama has shown no real interest in helping America gain an inch of energy independence. To the contrary, his blockading of the Keystone Pipeline has had an opposite effect, giving those speculators more latitude to drive prices higher.

And then, we (the driving public) have never shown much resolve to do anything but complain. There's never been a serious attempt at cutting back on consumption or making any moves towards forcing the prices down. To the contrary... we've ignored the electric car market and have actually begun a return engagement with the behemoth SUV.

So, like I said... there's plenty of blame to go around for everyone, including Mr. Obama.

reply to post by redoubt

As reported earlier; Fadel Gheit in his testimony to Congress states:

Financial speculators historically accounted for about 30 percent of oil trading in commodity markets; producers and end users made up about 70 percent. Today, it's almost the reverse.

And to ensure they can drive up prices on demand they warehouse 300 millions barrels in rented supertankers.

Less demand, excess product, and oil being exported form the US for the first time in decades - prices should be at rock bottom but speculators in a badly unregulated market are what's driving prices up.

The speculators serve no purpose other than drive the cost of oil higher than it would be without them so... you can be certain the big oil has no problem with their existence in the market.

As reported earlier; Fadel Gheit in his testimony to Congress states:

Financial speculators historically accounted for about 30 percent of oil trading in commodity markets; producers and end users made up about 70 percent. Today, it's almost the reverse.

And to ensure they can drive up prices on demand they warehouse 300 millions barrels in rented supertankers.

What's indisputable is that oil and gasoline are not in short supply, and that demand is weak. That was clear in the latest weekly energy market update by the Energy Information Administration (EIA) — for the week ending Feb. 10.

Less demand, excess product, and oil being exported form the US for the first time in decades - prices should be at rock bottom but speculators in a badly unregulated market are what's driving prices up.

reply to post by Vitchilo

Yes, and who uses that war mongering to their advantage: SPECULATORS.

Lets get real: Supply is up and demand is down, and gas prices are going through the roof.

And people are STILL trying to argue gas prices are purely a result of a perfectly free market devoid of corruption, and that supply and demand are the only things driving up the price.

These same people probably put out milk and cookies for Santa Claus.

news.firedoglake.com...

www.mcclatchydc.com...

www.abovetopsecret.com...

The same thing that happened in 2008 is happening now: Speculators are driving up the price and now retail investors are jumping on board.

According to the Saudis, if they pump out more oil in any meaningful fashion, they won't have enough buyers or storage for it.

Supply and demand my a$$

Yes, and who uses that war mongering to their advantage: SPECULATORS.

Lets get real: Supply is up and demand is down, and gas prices are going through the roof.

And people are STILL trying to argue gas prices are purely a result of a perfectly free market devoid of corruption, and that supply and demand are the only things driving up the price.

These same people probably put out milk and cookies for Santa Claus.

news.firedoglake.com...

www.mcclatchydc.com...

www.abovetopsecret.com...

The same thing that happened in 2008 is happening now: Speculators are driving up the price and now retail investors are jumping on board.

According to the Saudis, if they pump out more oil in any meaningful fashion, they won't have enough buyers or storage for it.

Supply and demand my a$$

Obama's moratoriums on

oil is Obama's fault.

He said no to the PIPELINE.

He is doing everything he can

to pass cap and trade..

He might not be the only factor

but he for sure is part of the problem.

oil is Obama's fault.

He said no to the PIPELINE.

He is doing everything he can

to pass cap and trade..

He might not be the only factor

but he for sure is part of the problem.

I blame obama...

2 reasons

1. because when gas prices were 3$ a gallon liberals blamed bush

2. The Keystone Oil Pipeline and his political stagecraft

ANYONE BUT OBAMA 2012

2 reasons

1. because when gas prices were 3$ a gallon liberals blamed bush

2. The Keystone Oil Pipeline and his political stagecraft

ANYONE BUT OBAMA 2012

reply to post by Blackmarketeer

Well the problems is that the oil speculators are in the pockets of big oil mafia still we have a government that also is in the pockets of big corporations so while the government could enforce how speculators work in Walls Street they rather keep encouraging with inaction their activities

So we can actually deduce that our corporate run congress and president are at fault after all while whoring for the pimps that fill their pockets.

Well the problems is that the oil speculators are in the pockets of big oil mafia still we have a government that also is in the pockets of big corporations so while the government could enforce how speculators work in Walls Street they rather keep encouraging with inaction their activities

So we can actually deduce that our corporate run congress and president are at fault after all while whoring for the pimps that fill their pockets.

You can no more blame just Obama, or just Speculators, or just Bush, or just Goldman Sachs, or just Anyone Else for this mess anymore than you can

blame a single cancer cell for killing you.

The mess is systemic. The patient is dying and all the doctors are out golfing.......

The mess is systemic. The patient is dying and all the doctors are out golfing.......

Originally posted by SkyMuerte

You can no more blame just Obama, or just Speculators, or just Bush, or just Goldman Sachs, or just Anyone Else for this mess anymore than you can blame a single cancer cell for killing you.

The mess is systemic. The patient is dying and all the doctors are out golfing.......

You know what? There's more truth in your post than any post in this thread. The system is BROKEN and every last corrupt actor is scrambling for the crumbs that remain of the US's economic pie.

new topics

-

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 3 hours ago -

Electrical tricks for saving money

Education and Media: 7 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 8 hours ago -

Sunak spinning the sickness figures

Other Current Events: 9 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 9 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 8 hours ago, 9 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 12 hours ago, 8 flags -

Electrical tricks for saving money

Education and Media: 7 hours ago, 4 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 16 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 9 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 9 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 11 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 14 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 3 hours ago, 0 flags

active topics

-

Sunak spinning the sickness figures

Other Current Events • 6 • : angelchemuel -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 33 • : Degradation33 -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 34 • : angelchemuel -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 13 • : Freeborn -

Mood Music Part VI

Music • 3101 • : ThatSmellsStrange -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 41 • : ThatSmellsStrange -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 55 • : baablacksheep1 -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 20 • : Asher47 -

Electrical tricks for saving money

Education and Media • 4 • : Lumenari -

DONALD J. TRUMP - 2024 Candidate for President - His Communications to Americans and the World.

2024 Elections • 514 • : WeMustCare