It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Illegal:

www.bloomberg.com...

www.yesmagazine.org...

OP is just the tip of the lice burger

this criminality goes right to the heart of the whole western financial and political system and could collapse the hole enchillada like an eaten out corpse

“A Bank of America Corp. (BAC) unit conducting home foreclosures in Utah is violating the law, the attorney general said in a letter as individual states advanced their investigations of mortgage servicing.

ReconTrust Co. isn’t meeting requirements for carrying out foreclosures in the state, Utah Attorney General Mark Shurtleff said in a letter to Bank of America Chief Executive Officer Brian Moynihan. The letter, dated May 19, was released today by Shurtleff’s office.

All real estate foreclosures conducted by ReconTrust in the state of Utah are not in compliance with Utah’s statutes, and are hence illegal,” Shurtleff wrote.

www.bloomberg.com...

Over 62 million mortgages are now held in the name of MERS, an electronic recording system devised by and for the convenience of the mortgage industry. A California bankruptcy court, following landmark cases in other jurisdictions, recently held that this electronic shortcut makes it impossible for banks to establish their ownership of property titles—and therefore to foreclose on mortgaged properties. The logical result could be 62 million homes that are foreclosure-proof.

www.yesmagazine.org...

OP is just the tip of the lice burger

this criminality goes right to the heart of the whole western financial and political system and could collapse the hole enchillada like an eaten out corpse

reply to post by Blaine91555

let me give you a lesson

what about illegal robosigning?

the banks sold the MBS (morgage backed securities) to pension funds world wide,

we lost billions,

i recognise where the REAL problem lies,

people like you excusing bankers crimes and blaming the people,

if this was a cut and dry as you suggest,

WHY?

why did the FBI point out morgage fraud FROM THE LENDER was at an "epidemic" in 06?

why did massive numbers of people get foreclosed on when they applied for loan modifycation?

case in point,

these people WANTED to pay they just wanted to renegotiate,

you are blind to the truth

people are being denyed the right to pay cash to make it harder to keep up

WAKE UP please

xploder

let me give you a lesson

The lesson here? When you borrow money to buy something, you don't own it until the money is paid back. Most children understand that.

what about illegal robosigning?

the banks sold the MBS (morgage backed securities) to pension funds world wide,

we lost billions,

i recognise where the REAL problem lies,

people like you excusing bankers crimes and blaming the people,

if this was a cut and dry as you suggest,

WHY?

why did the FBI point out morgage fraud FROM THE LENDER was at an "epidemic" in 06?

why did massive numbers of people get foreclosed on when they applied for loan modifycation?

case in point,

these people WANTED to pay they just wanted to renegotiate,

you are blind to the truth

people are being denyed the right to pay cash to make it harder to keep up

WAKE UP please

xploder

edit on 22-2-2012 by XPLodER because: (no reason given)

reply to post by XPLodER

Hi, XPlodER. Nice to see you join the discussion.

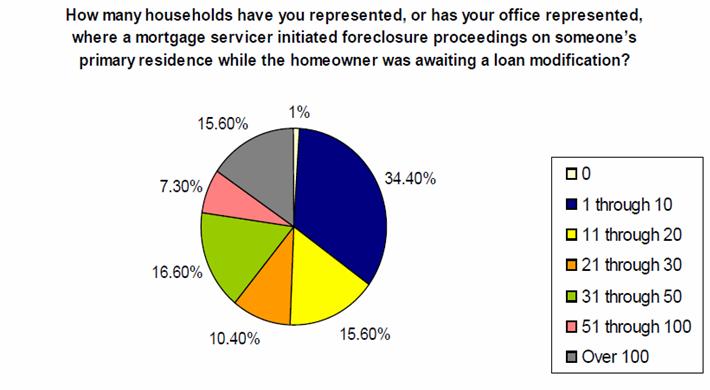

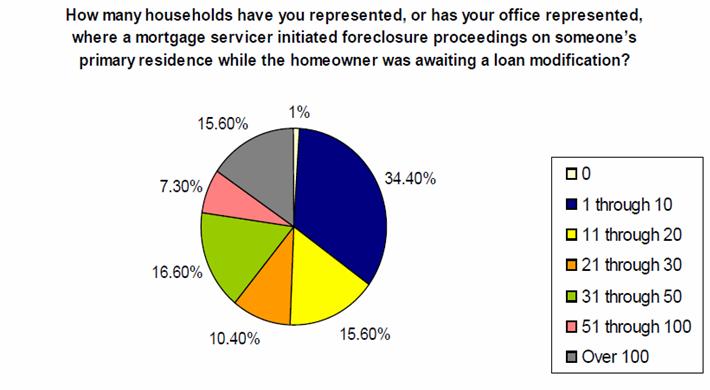

Nice graph! I hadn't seen that before.

Some people will always believe that the bank can do no wrong and everyone who got booted from their homes are deadbeats.

I'm so happy that some of us aren't drinking the kool-aid.

Hi, XPlodER. Nice to see you join the discussion.

Nice graph! I hadn't seen that before.

Some people will always believe that the bank can do no wrong and everyone who got booted from their homes are deadbeats.

I'm so happy that some of us aren't drinking the kool-aid.

Originally posted by Danbones

PS

because of derivitives and credit default swaps...Gambling losses that are actually outright theft...

the banks had to get a whole bunch of assets onto the books or they would go under

so they inflated the hell out of house prices on the way up to create the financial vehicles based on debt

and then used those fictional values gained by illegal forclosures to stay solvent.

holy carp!

just googled "illegal forclosures legal" looking to see how that story was progressing, and i found this:

5,000 Active-Duty Military Foreclosures Reviewed for Violations of Law

news.firedoglake.com...

my sympathies OP... every homeless person due to evil

...veterans are terrorists dontcha know?

also eminent domain has been used to take houses from people who own them and they are then sold to private companies..in one case a pharma company in Virginnia I think it was..the home owners lost their homes and had to PAY over 60,000 dollars as a penalty for fighting it.

Whoa Dan; The CDO and deratives have nothing to do with this guy losing his home. # happens and he got behind in his payment. Ok, that said; his foreclosure might have been illegal even if he defaulted on the "promissory note" which is the loan. If the banks used robo-signed documents and could not find the dee or the original note they would have trouble proving tthat they have the right to title to foreclose.

The problem which the banks have is that they can not find most of the documentation so they made it up. This guy needs to have all of his paperwork gone over for irregularties from the securtizating process. Often this was done very poorly or not at all since by this stage of the game the banks had the cash in their pocket and moved eargerly onto the next victim.

The swaps and deratives are akin to mortgage debt futures where they future equity of the securtized asset (the home) is sold off to investors and leveraged .......

The banks and the FED are nothing more than a scam... they are providing cheap money at the FEd window driving prices up destroying our money through inflation ... and yes the housing bubble is still an issue...

I work on foreclosed properties!

reply to post by JibbyJedi

You really should read what I posted and point out the falsehoods if you can find one. Injecting other topics I did not mention is not debate. It's a diversionary tactic to avoid hard truths.

The corruption in business leaders and government does not mean that the bank and it's stockholders (mostly middle class people who have their retirement money invested) owe people who do not pay their debts a free house.

Wanting handouts instead of working for what we get is a short trip to nationwide poverty and just as dishonest as those you are complaining about. It's OK for students and the to young to know any better to fantasize about not having to work and getting everything handed to them, but it does not change the fact you get back what you put in.

These people knew what ARM's were when they signed. If they did not, how dumb do you have to be to sign a loan document not having any idea what it says. These were not illegal loans and in fact thanks to Barney Franks and others they were forced to make these loans, so they ran with it. So why is Barney such a hero of the people he screwed I wonder?

I feel for the guy. I really do. I also feel those getting sucked into the Obama madness by the lies and his attempt to divide the country for his own purposes. I really do. One day they will see through it, but it will be to late and they will have alienated the people who would have been their freinds.

What would be wonderful right now is if the real Occupy Protestors could get rid of the ACORN Marxists, the Union Thugs and the Anarchists and join together in peaceful meaningful protest with the Tea Party since many of their wants are the same. Only by uniting do we stand a chance. As long as we are kept artificially divided it will not work.

What would be better for this man is if our system was allowed to work as intended and he had a bright future in meaningful profession and could then buy himself a house, like so many of the rest of us have done.

8 in 10 of us are still doing just fine through our hard work and efforts. We don't owe those who refuse to even try anything and yet we give and give. What do we get in return? People who want to take our fruits and give them to themselves.

You really should read what I posted and point out the falsehoods if you can find one. Injecting other topics I did not mention is not debate. It's a diversionary tactic to avoid hard truths.

The corruption in business leaders and government does not mean that the bank and it's stockholders (mostly middle class people who have their retirement money invested) owe people who do not pay their debts a free house.

Wanting handouts instead of working for what we get is a short trip to nationwide poverty and just as dishonest as those you are complaining about. It's OK for students and the to young to know any better to fantasize about not having to work and getting everything handed to them, but it does not change the fact you get back what you put in.

These people knew what ARM's were when they signed. If they did not, how dumb do you have to be to sign a loan document not having any idea what it says. These were not illegal loans and in fact thanks to Barney Franks and others they were forced to make these loans, so they ran with it. So why is Barney such a hero of the people he screwed I wonder?

I feel for the guy. I really do. I also feel those getting sucked into the Obama madness by the lies and his attempt to divide the country for his own purposes. I really do. One day they will see through it, but it will be to late and they will have alienated the people who would have been their freinds.

What would be wonderful right now is if the real Occupy Protestors could get rid of the ACORN Marxists, the Union Thugs and the Anarchists and join together in peaceful meaningful protest with the Tea Party since many of their wants are the same. Only by uniting do we stand a chance. As long as we are kept artificially divided it will not work.

What would be better for this man is if our system was allowed to work as intended and he had a bright future in meaningful profession and could then buy himself a house, like so many of the rest of us have done.

8 in 10 of us are still doing just fine through our hard work and efforts. We don't owe those who refuse to even try anything and yet we give and give. What do we get in return? People who want to take our fruits and give them to themselves.

reply to post by fnpmitchreturns

This is what I wish you would have placed in your first post.

If the bank did him like they did me, then this is why they are wanting to get rid of him so badly. I raised a real stink about what the bank was doing to everyone who would listen by writing letters and making phone calls. Now, my mortgage and how it was handled is under investigation and the bank is going to have to answer some hard questions that they've been avoiding.

The banks have caused many problems and I don't see how they are able to sleep at night. They know what they're doing and it will come back to smack them in the end.

This guy needs to have all of his paperwork gone over for irregularties from the securtizating process.

This is what I wish you would have placed in your first post.

If the bank did him like they did me, then this is why they are wanting to get rid of him so badly. I raised a real stink about what the bank was doing to everyone who would listen by writing letters and making phone calls. Now, my mortgage and how it was handled is under investigation and the bank is going to have to answer some hard questions that they've been avoiding.

The banks have caused many problems and I don't see how they are able to sleep at night. They know what they're doing and it will come back to smack them in the end.

reply to post by Afterthought

Here's a novel concept... don't take out a loan that you won't be able to pay back. To be fair... Bankers shouldn't give loans to people that will obviously have trouble paying them back. In short, this guy has as much fault in this as the bank.

Here's a novel concept... don't take out a loan that you won't be able to pay back. To be fair... Bankers shouldn't give loans to people that will obviously have trouble paying them back. In short, this guy has as much fault in this as the bank.

reply to post by OptimusSubprime

Are you always on the side of corporate corruption or just when it has to do with the banks?

Are you always on the side of corporate corruption or just when it has to do with the banks?

reply to post by Afterthought

Are you always a demagogue? Saying that the housing crisis or the fact that this guy got his house foreclosed on is 100% the bankers fault is the same as saying that it is McDonald's fault that people are fat, or that it is the Tobacco companies fault that people are dying from lung cancer. Personal responsibility be damned. Of course the banks and corporations are greedy... BUT the bank didn't hold a gun to this guy's head and make him sign the loan documents. This guy had the responsibility of knowing what he was signing and if he didn't then the only one to blame is him.

Are you always a demagogue? Saying that the housing crisis or the fact that this guy got his house foreclosed on is 100% the bankers fault is the same as saying that it is McDonald's fault that people are fat, or that it is the Tobacco companies fault that people are dying from lung cancer. Personal responsibility be damned. Of course the banks and corporations are greedy... BUT the bank didn't hold a gun to this guy's head and make him sign the loan documents. This guy had the responsibility of knowing what he was signing and if he didn't then the only one to blame is him.

reply to post by OptimusSubprime

No, the fact that you aren't able to see that not everyone purchased homes they weren't able to afford is being quite obtuse. Not even acknowledging the fact that the banks are using underhanded schemes is simply being blind.

I purchased my home for $70,000 when I was making $46,000 a year with very little debt hanging over me. So, please explain to me why my money wasn't good? Please explain to me why the bank wasn't able to keep promises they made to my attorney and I? Please explain to me why they are able to change the rules in the middle of the game?

No, the fact that you aren't able to see that not everyone purchased homes they weren't able to afford is being quite obtuse. Not even acknowledging the fact that the banks are using underhanded schemes is simply being blind.

I purchased my home for $70,000 when I was making $46,000 a year with very little debt hanging over me. So, please explain to me why my money wasn't good? Please explain to me why the bank wasn't able to keep promises they made to my attorney and I? Please explain to me why they are able to change the rules in the middle of the game?

Originally posted by Afterthought

reply to post by XPLodER

Hi, XPlodER. Nice to see you join the discussion.

Nice graph! I hadn't seen that before.

Some people will always believe that the bank can do no wrong and everyone who got booted from their homes are deadbeats.

I'm so happy that some of us aren't drinking the kool-aid.

Why is it one or the other? Why does this topic always end in some nihilist conclusion with absolutely no middle ground? The banks are corrupt, greedy, unethical, and the vast majority of the bank execs get away with things on a daily basis that would end in a prison term for you and I. Having said that, what is the reason for a loan modification? The reason, or purpose, is to lower one's payment, from something they can't afford, to something that they can afford. Why can't the person afford it? Well, extreme circumstances aside, or those out of one's control (loss of job, unforeseen medical expenses, etc...) a lot of people bought homes that they had no chance of affording. They were told things like "Take an interst only loan... then refi in a year". People also bought houses they couldn't afford longterm because they thought that the equity would explode over the course of a couple of years and then they would sell for a massive profit... but then the market crashed, and all of those irresponsible people lost those homes. That is their fault. All of the mortgage backed securities, blah blah, are completely irrelevant IF the home owner is paying the mortgage payment, but because a person that makes $60,000 a year decided that it would be a good idea to take out a loan on a $500,000 house they can't afford it.

The banks are certainly at fault for allowing stated income loans, meaning that if a borrower had great credit they could just "state" what their income was with no proof, and guess what... A lot of people lied about that. So is that the bank's fault? No... it is the borrowers fault for lying. Again, both the borrowers and the banks are equally responsible for this mess, extreme circumstances aside. A bank doesn't have to modify a loan, that is just a courtesy they decide to offer, mainly because it costs a bank a lot of money to foreclose on a property. Now I know... I'm just some hack for the big banks... no, in fact my house just got foreclosed on last month, but that's my fault for taking out a loan that I was pretty sure that I couldn't afford. I knew it at the time, but I still did it. There is a lot of corruption in the banking industry, but most of that starts in Washington D.C., promoted by the very politicans that most of these ignorant OWS morons vote for... and guess what, next election they will stand in line, with all of their cool and hip Che shirts on (with no real idea of who he was), and their cliche 1968 signs and mis-informed, idiotic Ed Schultz talking points and vote for them again. The real truth is that this housing crisis and sub-prime loans would have never happened had Barney Frank and Chris Dodd not jammed a law down the banks throats that all but forced them to loan money to poor people, you know, in the interest of fairness.

Constitution Halts Sheriff

www.youtube.com...

On the 20 February 2012

the deputy Sheriff arrived at another Irish family's home to repossess it

and give the keys to the bank in Co Laois. (Ireland)

Thus putting another Irish family onto the streets.

Hey at least it's catching,,,,standing up with the law on your side,,fighting it with words,,

lets just say there was a time when someone woulda got hurt,,no shot,,

but if u can justify your actions with the word of "law",, well hey thats what law was written for.

Me.

www.youtube.com...

On the 20 February 2012

the deputy Sheriff arrived at another Irish family's home to repossess it

and give the keys to the bank in Co Laois. (Ireland)

Thus putting another Irish family onto the streets.

Hey at least it's catching,,,,standing up with the law on your side,,fighting it with words,,

lets just say there was a time when someone woulda got hurt,,no shot,,

but if u can justify your actions with the word of "law",, well hey thats what law was written for.

Me.

reply to post by OptimusSubprime

I understand how the pendulum swings both ways, but we're talking about this man's issue in this thread and how I can identify with him and his situation. There are several threads about people taking a bigger bite than they could chew, but that isn't happening in this case. I just don't want to junk up this thread with all the other circumstances surrounding the housing crisis. The bottom line in this case is that he tried to pay and they wouldn't take his money. A bank cannot decide to reject legal tender. If they wanted him out, they should have found a better way. I'm sorry to see that he folded by moving out, but the bank should have to explain their actions. They should not be allowed to simply pick and choose whose money they are going to accept. Not to mention, his house was still vacant. They hadn't even sold it yet, so what's the deal with that? The bank is just allowing it to rot instead of allowing someone to live there so it can be tended to, which also keeps the value of the houses around it from falling? Very wasteful if you ask me.

I understand how the pendulum swings both ways, but we're talking about this man's issue in this thread and how I can identify with him and his situation. There are several threads about people taking a bigger bite than they could chew, but that isn't happening in this case. I just don't want to junk up this thread with all the other circumstances surrounding the housing crisis. The bottom line in this case is that he tried to pay and they wouldn't take his money. A bank cannot decide to reject legal tender. If they wanted him out, they should have found a better way. I'm sorry to see that he folded by moving out, but the bank should have to explain their actions. They should not be allowed to simply pick and choose whose money they are going to accept. Not to mention, his house was still vacant. They hadn't even sold it yet, so what's the deal with that? The bank is just allowing it to rot instead of allowing someone to live there so it can be tended to, which also keeps the value of the houses around it from falling? Very wasteful if you ask me.

reply to post by BobAthome

Thanks for that video. I'm not done watching it yet, but it's just another example of how they aren't playing by the rules and changing them in the middle of the game. Such a pathetic situation. It's funny watching the sheriff's rep stumbling over his words.

Thanks for that video. I'm not done watching it yet, but it's just another example of how they aren't playing by the rules and changing them in the middle of the game. Such a pathetic situation. It's funny watching the sheriff's rep stumbling over his words.

Originally posted by Afterthought

reply to post by OptimusSubprime

I understand how the pendulum swings both ways, but we're talking about this man's issue in this thread and how I can identify with him and his situation. There are several threads about people taking a bigger bite than they could chew, but that isn't happening in this case. I just don't want to junk up this thread with all the other circumstances surrounding the housing crisis. The bottom line in this case is that he tried to pay and they wouldn't take his money. A bank cannot decide to reject legal tender. If they wanted him out, they should have found a better way. I'm sorry to see that he folded by moving out, but the bank should have to explain their actions. They should not be allowed to simply pick and choose whose money they are going to accept. Not to mention, his house was still vacant. They hadn't even sold it yet, so what's the deal with that? The bank is just allowing it to rot instead of allowing someone to live there so it can be tended to, which also keeps the value of the houses around it from falling? Very wasteful if you ask me.

Agreed, this is a case that favors the borrower, and I should have stuck to the situation at hand.

reply to post by OptimusSubprime

Thank you and much appreciated.

I'm happy we could reach an agreement regarding this particular situation.

There are people out there who are very materialistic and did purchase more home than they could afford, but we can't forget about those who were trying to be responsible and are now getting shafted in a big way.

Thank you and much appreciated.

I'm happy we could reach an agreement regarding this particular situation.

There are people out there who are very materialistic and did purchase more home than they could afford, but we can't forget about those who were trying to be responsible and are now getting shafted in a big way.

new topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 56 minutes ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 1 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 3 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 5 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 10 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 14 hours ago, 11 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 15 hours ago, 6 flags -

Sunak spinning the sickness figures

Other Current Events: 15 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 13 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 17 hours ago, 3 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 1 hours ago, 3 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 56 minutes ago, 3 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 5 hours ago, 2 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 3 hours ago, 2 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago, 1 flags

active topics

-

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 282 • : 5thHead -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 73 • : network dude -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 152 • : PorkChop96 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 745 • : network dude -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 4 • : FlyersFan -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 71 • : SchrodingersRat -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 141 • : Euronymous2625 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 664 • : 777Vader -

Hate makes for strange bedfellows

US Political Madness • 46 • : network dude -

The Reality of the Laser

Military Projects • 48 • : 5thHead