It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by LErickson

This is actually a simple argument.

Capitalists -vs- Anticapitalists

Which side are you on?

Do you think it's a great idea to attack the capitalists?

This is actually a simple argument.

Capitalists -vs- Anticapitalists

Which side are you on?

Do you think it's a great idea to attack the capitalists?

Originally posted by Eurisko2012

reply to post by LErickson

This is actually a simple argument.

Capitalists -vs- Anticapitalists

Which side are you on?

Do you think it's a great idea to attack the capitalists?

Just waiting for your numbers.

Send me a private message when you get all that together and we can discuss.

reply to post by Eurisko2012

The argument is simple with reality based figures. The difficulty seems to lie in finding "facts".

The argument is simple with reality based figures. The difficulty seems to lie in finding "facts".

reply to post by LErickson

Why bring Mitt Romney into this? We are looking at the big picture here of Federal income tax alone. If you want to get obscure look at the percentage of all of the other taxes paid by this 10%. It's all relative to their wealth, property holdings, spending habits etc etc.

Incessant debates like this should just motivate all of us to push for serious tax overhaul in this nation. The FAIR tax would be a great start and I would think the progressive element would be all over that just based on its title alone. Wipe out the IRS and all Federal Income Tax. Everyone pays the same rate based on consumption. No VAT just FAIR.

Our country cannot continue to leech off of a distinct percentage of the population. The new numbers released yesterday indicate the 50% give or take a fraction actually pays no federal income tax. Yet the spending continues to swell with no end in sight. That number will continue to grow out of whack until someone puts an end to it. Do the math, run the numbers. Our nation cannot sustain that lopsided logic for much longer.

Our leaders have created a nation that is totally dependent on the govt. Not Good. Continuing to demonize and financially punish those who earn a certain amount is worse. STILL! the 1% rhetoric never ends.

Why bring Mitt Romney into this? We are looking at the big picture here of Federal income tax alone. If you want to get obscure look at the percentage of all of the other taxes paid by this 10%. It's all relative to their wealth, property holdings, spending habits etc etc.

Incessant debates like this should just motivate all of us to push for serious tax overhaul in this nation. The FAIR tax would be a great start and I would think the progressive element would be all over that just based on its title alone. Wipe out the IRS and all Federal Income Tax. Everyone pays the same rate based on consumption. No VAT just FAIR.

Our country cannot continue to leech off of a distinct percentage of the population. The new numbers released yesterday indicate the 50% give or take a fraction actually pays no federal income tax. Yet the spending continues to swell with no end in sight. That number will continue to grow out of whack until someone puts an end to it. Do the math, run the numbers. Our nation cannot sustain that lopsided logic for much longer.

Our leaders have created a nation that is totally dependent on the govt. Not Good. Continuing to demonize and financially punish those who earn a certain amount is worse. STILL! the 1% rhetoric never ends.

reply to post by LErickson

Does that mean you are an anticapitalist?

Don't be afraid. Just tell the truth.

The truth is simple.

------

It's usually the progressives that try find some how some way to explain things to

you in a way that you can't even understand it.

Does that mean you are an anticapitalist?

Don't be afraid. Just tell the truth.

The truth is simple.

------

It's usually the progressives that try find some how some way to explain things to

you in a way that you can't even understand it.

reply to post by Eurisko2012

I'm not trying to punish success nor is Occupy, perhaps you need help with reading comprehension because you missed something somewhere. Okay the 2006 data, as another poster pointed out I was using the data from 2009.

(Dollars in thousands)

106,658,774 Tax Returns filed.

1,061,283,363 Tax Dollars generated.

At the 5% tax rate 3,556,337 tax dollars generated.

At the 10% tax rate 103,363,709

At 10% (from Form 8814) 13,993

At 15% 274,109,914

At 15% (Capital Gains) 106,565,265

At 25% 196,285,637

At 25% (Capital Gains) 3,846,240

At 28% 75,704,323

At 28% (Capital Gains) 654,998

At 33% 78,362,564

At 35% 217,952,702

Equals about $577,329,590 from the 5% to the 28% tax rates (minus capital gains, I added those to the 28% and up) and about $483,086,092 from the 28% and up group (including all Capital Gains).

This is Based off AGI which the link in the OP is based off as well. So where on earth does 71% come from?

I'm not trying to punish success nor is Occupy, perhaps you need help with reading comprehension because you missed something somewhere. Okay the 2006 data, as another poster pointed out I was using the data from 2009.

(Dollars in thousands)

106,658,774 Tax Returns filed.

1,061,283,363 Tax Dollars generated.

At the 5% tax rate 3,556,337 tax dollars generated.

At the 10% tax rate 103,363,709

At 10% (from Form 8814) 13,993

At 15% 274,109,914

At 15% (Capital Gains) 106,565,265

At 25% 196,285,637

At 25% (Capital Gains) 3,846,240

At 28% 75,704,323

At 28% (Capital Gains) 654,998

At 33% 78,362,564

At 35% 217,952,702

Equals about $577,329,590 from the 5% to the 28% tax rates (minus capital gains, I added those to the 28% and up) and about $483,086,092 from the 28% and up group (including all Capital Gains).

This is Based off AGI which the link in the OP is based off as well. So where on earth does 71% come from?

Originally posted by jibeho

reply to post by LErickson

Why bring Mitt Romney into this? We are looking at the big picture here of Federal income tax alone. If you want to get obscure look at the percentage of all of the other taxes paid by this 10%. It's all relative to their wealth, property holdings, spending habits etc etc.

Incessant debates like this should just motivate all of us to push for serious tax overhaul in this nation. The FAIR tax would be a great start and I would think the progressive element would be all over that just based on its title alone. Wipe out the IRS and all Federal Income Tax. Everyone pays the same rate based on consumption. No VAT just FAIR.

Our country cannot continue to leech off of a distinct percentage of the population. The new numbers released yesterday indicate the 50% give or take a fraction actually pays no federal income tax. Yet the spending continues to swell with no end in sight. That number will continue to grow out of whack until someone puts an end to it. Do the math, run the numbers. Our nation cannot sustain that lopsided logic for much longer.

Our leaders have created a nation that is totally dependent on the govt. Not Good. Continuing to demonize and financially punish those who earn a certain amount is worse. STILL! the 1% rhetoric never ends.

That's what they put on the signs at Occupy Wall Street.

The big, bad and evil 1%.

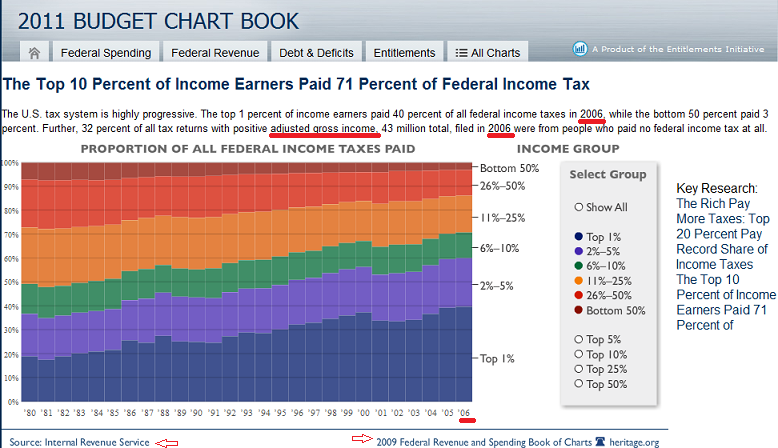

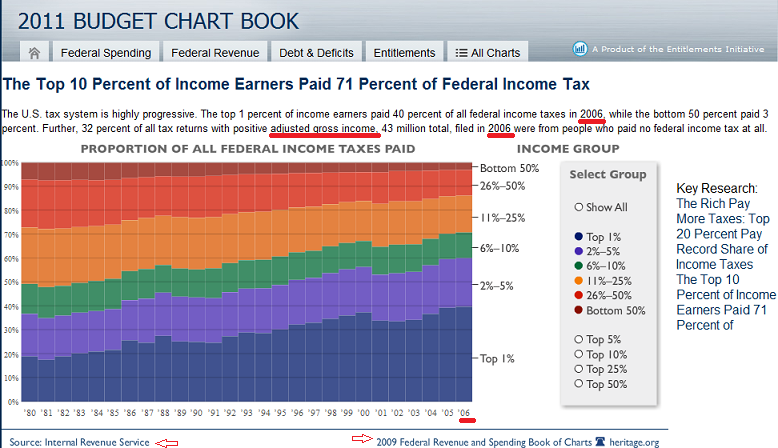

When this thread introduced the idea that the Top 10% pay 70% of the income tax,

that made them recoil in confusion and disbelief.

Their talking point is disappearing.

edit on 23-2-2012 by Eurisko2012 because: (no reason given)

reply to post by Eurisko2012

The Occupy shift is clearly being made towards the election as depicted in multiple threads around ATS town lately. New members popping up and getting banned everyday. Fun stuff.

The Occupy shift is clearly being made towards the election as depicted in multiple threads around ATS town lately. New members popping up and getting banned everyday. Fun stuff.

edit on 23-2-2012 by jibeho because: (no reason given)

reply to post by Kali74

Ask the IRS. It's their data.

Maybe you could actually call the IRS.

Try not to fall out of your chair when they tell you the simple truth.

The richest 10% pay 70% of the income taxes.

-----------

Stop playing the victim card. It's really sad.

More importantly, it won't work.

- People do what works.-

Ask the IRS. It's their data.

Maybe you could actually call the IRS.

Try not to fall out of your chair when they tell you the simple truth.

The richest 10% pay 70% of the income taxes.

-----------

Stop playing the victim card. It's really sad.

More importantly, it won't work.

- People do what works.-

Originally posted by jibeho

reply to post by Eurisko2012

The shift is clearly being made towards the election as depicted in multiple threads around ATS town lately. New members popping up and getting banned everyday. Fun stuff.

The truth always wins.

Did you watch the debate last night? Newt nuked them all with the simple truth.

reply to post by Kali74

At first glance we appear to have conflicting data presented in this thread. If somehow we can resolve this the answer will be found.

At first glance we appear to have conflicting data presented in this thread. If somehow we can resolve this the answer will be found.

reply to post by Eurisko2012

Where have I ever played the victim card anywhere on ATS let alone in this thread, get off your rhetoric, you're only making yourself look like a fool. The numbers are right there off the IRS site (2006 PDF download) here on this page go look for yourself.

Where have I ever played the victim card anywhere on ATS let alone in this thread, get off your rhetoric, you're only making yourself look like a fool. The numbers are right there off the IRS site (2006 PDF download) here on this page go look for yourself.

reply to post by jibeho

BS lies, the Occupy Movement gets further away from Obama everyday.

Do some research before making claims.

BS lies, the Occupy Movement gets further away from Obama everyday.

Do some research before making claims.

reply to post by Kali74

I like the current link on the first page of this thread.

Go to that link. Yours is from the year 2006? This is February 2012.

You need better links to make a credible argument.

The Heritage Foundation got their data from the CBO.

Go the link and learn. Seek the truth.

It turns out the rich make money and they pay taxes.

I like the current link on the first page of this thread.

Go to that link. Yours is from the year 2006? This is February 2012.

You need better links to make a credible argument.

The Heritage Foundation got their data from the CBO.

Go the link and learn. Seek the truth.

It turns out the rich make money and they pay taxes.

Originally posted by burdman30ott6

Is it "fair" that half the country effectively pays nothing in taxes, yet consumes just as much, if not more of the byproduct of the other 50%'s tax dollars?

I don't know...Is it fair that folks repeatedly trade honesty for idealogy? Ignorance for knowledge? Spin for facts?

Our public discourse is the foundation of our democracy. Is it fair that in that discourse people subjugate truth in favor of political rhetorical convenience?

Your claim above was first tweeted by Pastor Rick Warren and was near immediately debunked by multiple non-partisan sources.

When looking only at federal income tax, Warren is correct. Forty-seven percent of people either have such a low income that they are exempt from the federal income tax or they qualify for enough tax credits that they get more back than they pay in.

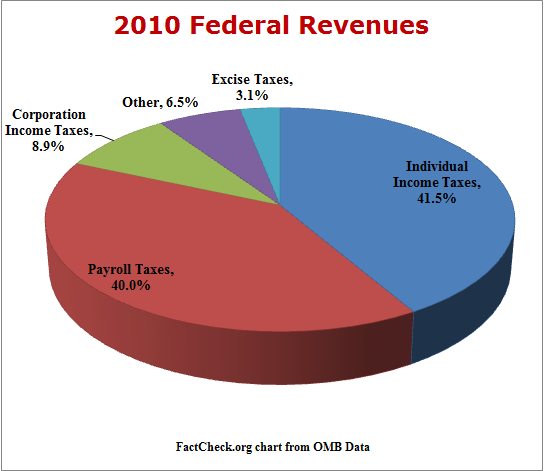

But federal income taxes are just a small part of the overall tax picture. There are still property taxes, state income taxes, payroll taxes, sales taxes and excise taxes, just to name a few.

abcnews.go.com...

Niether the OP or yours and Rick Warren's debunked claim above acknowledges that the INCOME TAX numbers used ONLY ACCOUNTs FOR 40% OF TAX RECIEPTS.

AN EQUAL AMOUNT OF TAXES, 40% IS COLLECTED BY THE FEDERAL GOVERNMENT FROM THE MIDDLE AND LOWER CLASSES IN THE FORM OF PAYROLL TAX NOT MEASURED AS "INCOME TAX"....which wealthy folks like Romney pay ZERO as he enjoys a reduced 14% rate on capital gains.

And that is before we add in taxes on fuel, groceries, properties and every day expenses that are often sheltered under the umbrella of corporate expenses by the wealthy. As Romney earned his paultry 300k in speaking fees last year...all of his meals, travel expenses, hotels, even home offices and associated utilities for his "home office" etc. etc. etc. come right off the top of that number as deductions.

Average Americans enjoy no such deductions as they grind out theier daily jobs and feed thier families.

YOUR CLAIM is FALSE

But the modifiers here — federal and income — are important. Income taxes aren’t the only kind of federal taxes that people pay.

There are also payroll taxes and investment taxes, among others. And, of course, people pay state and local taxes, too.

Even if the discussion is restricted to federal taxes (for which the statistics are better), a vast majority of households end up paying federal taxes.

Congressional Budget Office data suggests that, at most, about 10 percent of all households pay no net federal taxes. The number 10 is obviously a lot smaller than 47.

The reason is that poor families generally pay more in payroll taxes than they receive through benefits like the Earned Income Tax Credit. It’s not just poor families for whom the payroll tax is a big deal, either. About three-quarters of all American households pay more in payroll taxes, which go toward Medicare and Social Security, than in income taxes.

www.nytimes.com...

edit on 23-2-2012 by Indigo5 because: (no reason given)

Honestly, Money is the main reason we are in the fickle state of affairs. Due to the Ignorance that these Big wigs and corp holders have, about owning

95% of the world, and 5% being enough for the rest of us is bull#. We live in a 21th century, with 15th century ideals revolving around money. Money

was created so we could encourage people to produce goods, services, to exchange for other goods and services each other had. A means to balance what

people can do effectively.

Now what we have today, is people working Many many service jobs ( What we made people who had no rights ( I.E. slaves ( from everywhere )). Well why do we have such a system still in place today, raping the people of their dignity, their freewill, and their ability to creatively contribute to this world. Because, don't forget, they are forced to work whatever they can to make money to live. Why the hay, do we need to still work to live in a intelligent world? Should we by now be focusing on the understanding, that all people need certain things to survive, give them those things, and they can focus on what they may be naturally good at, and contribute to the world via their natural inherit gifts. Instead of being forced to work whatever is available in this ever increasing land of Servitude.

Money and our Value of life's freely abundant resources is Old tech, we need new tech in the matter, or the world will easily crumble from various negative human emotions related to the matter.

If I made 400,000,000 Last year, I should have to pay 10% of that. Easy, 10% of my earning obviously won't hurt me, I'm ripping someone off somewhere anyhow...

It's only a matter of time, keep telling the people there isn't a fire and the ones running around burning are gonna get pissed.

Now what we have today, is people working Many many service jobs ( What we made people who had no rights ( I.E. slaves ( from everywhere )). Well why do we have such a system still in place today, raping the people of their dignity, their freewill, and their ability to creatively contribute to this world. Because, don't forget, they are forced to work whatever they can to make money to live. Why the hay, do we need to still work to live in a intelligent world? Should we by now be focusing on the understanding, that all people need certain things to survive, give them those things, and they can focus on what they may be naturally good at, and contribute to the world via their natural inherit gifts. Instead of being forced to work whatever is available in this ever increasing land of Servitude.

Money and our Value of life's freely abundant resources is Old tech, we need new tech in the matter, or the world will easily crumble from various negative human emotions related to the matter.

If I made 400,000,000 Last year, I should have to pay 10% of that. Easy, 10% of my earning obviously won't hurt me, I'm ripping someone off somewhere anyhow...

It's only a matter of time, keep telling the people there isn't a fire and the ones running around burning are gonna get pissed.

edit on

23-2-2012 by Moneyisgodlifeisrented because: (no reason given)

edit on 23-2-2012 by Moneyisgodlifeisrented because: (no reason

given)

Originally posted by Kali74

reply to post by jibeho

BS lies, the Occupy Movement gets further away from Obama everyday.

Do some research before making claims.

OOPS! You just stepped in it there.

On day 1 the Occupy Movement and Obama were on the - same - page.

When the polling data showed them losing, then Obama started walking away.

--------

Occupy Oakland was the most damaging. The liberal major gave her employees

the day off with pay! Go join the protest! Provoke the police! OH! Get it on video

when they counterattack! Post it on YouTube!!!

reply to post by Kali74

Easy tiger. I'm not saying that they are backing Obama. I'm saying that they are regrouping to focus on politics and the election. Why are Occupiers showing up at GOP events? They have there eyes on the 2012 election.

Enjoy the reading. This is just the tip of the iceberg

allianceforajustsociety.org...

Easy tiger. I'm not saying that they are backing Obama. I'm saying that they are regrouping to focus on politics and the election. Why are Occupiers showing up at GOP events? They have there eyes on the 2012 election.

Enjoy the reading. This is just the tip of the iceberg

allianceforajustsociety.org...

Originally posted by jibeho

reply to post by Kali74

Easy tiger. I'm not saying that they are backing Obama. I'm saying that they are regrouping to focus on politics and the election. Why are Occupiers showing up at GOP events? They have there eyes on the 2012 election.

Enjoy the reading. This is just the tip of the iceberg

allianceforajustsociety.org...

The Occupiers are failing miserably.

They work outside the system.

The Tea Party on the other hand works inside the system and it's working.

- November 2010 Election -

Obama called it a shellacking.

reply to post by Eurisko2012

The chart in the OP is used off 2006 Data as well.

I noted some important points on there.

The chart in the OP is used off 2006 Data as well.

I noted some important points on there.

new topics

-

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 55 minutes ago -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 1 hours ago -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 2 hours ago -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 3 hours ago -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 3 hours ago -

The good, the Bad and the Ugly!

Diseases and Pandemics: 5 hours ago -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 7 hours ago -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 8 hours ago -

Russia Flooding

Fragile Earth: 9 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 10 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 2 hours ago, 13 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 3 hours ago, 13 flags -

Elites disapearing

Political Conspiracies: 16 hours ago, 11 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 14 hours ago, 11 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 8 hours ago, 11 flags -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 11 hours ago, 7 flags -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 11 hours ago, 6 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 16 hours ago, 5 flags -

Russia Flooding

Fragile Earth: 9 hours ago, 5 flags -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 7 hours ago, 4 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 324 • : Justoneman -

Marjorie Taylor Greene Files Motion to Vacate Speaker Mike Johnson

US Political Madness • 61 • : WeMustCare -

Mandela Effect - It Happened to Me!

The Gray Area • 105 • : CCoburn -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 52 • : nugget1 -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 3 • : CataclysmicRockets -

Afterlife, unknown, so prepare, or just go into the unknown (bad)!!

ATS Skunk Works • 64 • : CCoburn -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 30 • : ToneD -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 7 • : ScarletDarkness -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 26 • : CarlLaFong -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 148 • : RussianTroll