It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by Skyfloating

Oh blah, Blah, Blah... stop all of the bleeding heart "Woe is us for being rich" crap.

You say that the top 10% are paying 71% of the income taxes.... and that may be true, but it is only half the story.

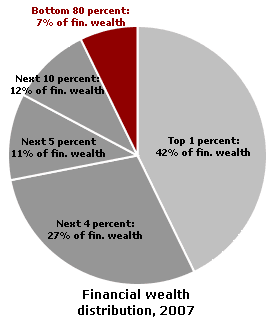

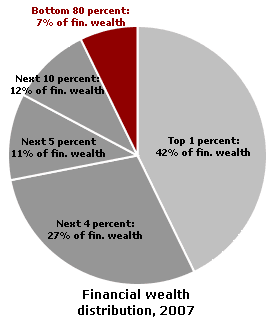

What percentage of all of the income are they *EARNING*?

Because I believe that they are earning pretty much 90% of all income.

And maybe you would like to include capital gains taxes in the mix too?

Oh blah, Blah, Blah... stop all of the bleeding heart "Woe is us for being rich" crap.

You say that the top 10% are paying 71% of the income taxes.... and that may be true, but it is only half the story.

What percentage of all of the income are they *EARNING*?

Because I believe that they are earning pretty much 90% of all income.

And maybe you would like to include capital gains taxes in the mix too?

edit on 22-2-2012 by ErtaiNaGia because: +pic

reply to post by LErickson

Basic math eh?

Like a billionaire who pays 15% in taxes is paying 150 million dollars.

compared to the taxes paid by someone making 30k,50k,100k and 1 million.

Who the hell is paying more?

Then again that is capital gain taxation then agian the wealth people are supposedly talking about is electronic based off investment vehicles such as stocks,bonds,mutal funds and others

That can be wiped out in a matter of seconds as 2008 proved then ovf course other investment vehicles such as real estate the bottom of the market dropped and trillions were lost.

People need to get a damn clue because the majority have no idea what the hell they are talking about.

Basic math eh?

Like a billionaire who pays 15% in taxes is paying 150 million dollars.

compared to the taxes paid by someone making 30k,50k,100k and 1 million.

Who the hell is paying more?

Then again that is capital gain taxation then agian the wealth people are supposedly talking about is electronic based off investment vehicles such as stocks,bonds,mutal funds and others

That can be wiped out in a matter of seconds as 2008 proved then ovf course other investment vehicles such as real estate the bottom of the market dropped and trillions were lost.

People need to get a damn clue because the majority have no idea what the hell they are talking about.

edit on 22-2-2012 by neo96 because: (no

reason given)

reply to post by Skyfloating

I would certainly hope that in a country where 1% holds 90% of the wealth that the top tier would pay the most taxes. They still pay a lower rate than your average single person though. If someone gave you a million bucks it would most certainly hurt to hand over 40%, but on the same note it hurts just as bad to hand over 35-40% of a person’s weekly earnings. It should be a one size fits all rate! Poverty hurts worse than parting with some cash when you have plenty!

I know it sucks to part with large sums, but it hurts all around! It is not fair that millions have no tax liability, but having systems and tools in place to fight extreme poverty keep our commnities and country from resembling Nigeria or similar! You know as well as I do that if we didnt keep em out of the dirt they would bring us all down or we would spend twice as much locking folks up. Look to Lagos for a real world example of what you get with no system to fight poverty.

Oh poor me I had to pay a million in taxes, and my new 3 million dollar vacation home had to be put on hold. Oh poor me I had to pay so much in tax this month that I cannot afford my rent and will sleep in the street, I guess I have no choice but to get on welfare!

Which is worse?

I would certainly hope that in a country where 1% holds 90% of the wealth that the top tier would pay the most taxes. They still pay a lower rate than your average single person though. If someone gave you a million bucks it would most certainly hurt to hand over 40%, but on the same note it hurts just as bad to hand over 35-40% of a person’s weekly earnings. It should be a one size fits all rate! Poverty hurts worse than parting with some cash when you have plenty!

I know it sucks to part with large sums, but it hurts all around! It is not fair that millions have no tax liability, but having systems and tools in place to fight extreme poverty keep our commnities and country from resembling Nigeria or similar! You know as well as I do that if we didnt keep em out of the dirt they would bring us all down or we would spend twice as much locking folks up. Look to Lagos for a real world example of what you get with no system to fight poverty.

Oh poor me I had to pay a million in taxes, and my new 3 million dollar vacation home had to be put on hold. Oh poor me I had to pay so much in tax this month that I cannot afford my rent and will sleep in the street, I guess I have no choice but to get on welfare!

Which is worse?

edit on 22-2-2012 by Donkey_Dean because: (no reason given)

reply to post by Donkey_Dean

It doesn't matter. If they both paid 10% flat... lets say one pays 3k in taxes the other 3 million in taxes. The one who pays 3k would still think it's unfair because the guy paying 3 million still has a bigger house.

It doesn't matter. If they both paid 10% flat... lets say one pays 3k in taxes the other 3 million in taxes. The one who pays 3k would still think it's unfair because the guy paying 3 million still has a bigger house.

Originally posted by neo96

reply to post by LErickson

Basic math eh?

Like a billionaire who pays 15% in taxes is paying 150 million dollars.

compared to the taxes paid by someone making 30k,50k,100k and 1 million.

Who the hell is paying more?

Then again that is capital gain taxation then agian the wealth people are supposedly talking about is electronic based off investment vehicles such as stocks,bonds,mutal funds and others

That can be wiped out in a matter of seconds as 2008 proved then ovf course other investment vehicles such as real estate the bottom of the market dropped and trillions were lost.

People need to get a damn clue because the majority have no idea what the hell they are talking about.edit on 22-2-2012 by neo96 because: (no reason given)

Ya, you have little clue about what you are talking about, its not a secret.

Taxing a person who makes a billion dollars a 90% would not make that person marginal.

Taxing a person at 25% who makes $240 a week is going to to make them A. hungry,

B. Homeless, then that person goes on welfare and you will bitch about that.

Originally posted by Skyfloating

Originally posted by Laokin

Are you for or against the super rich?

Cuz I'm against them.

Im not "against" anybody, including the poor and rich. Live and let live.

I would agree with you also. I'm not against rich or poor, but to have a level playing field. Currently, because of income richer people can shelter their taxes and minimize them. Make no mistake about it, I'm NOT for increasing taxes, but just making sure the taxes that should have been collected, are. Over time we really need to decrease the size of government spending on wasteful things. Social Security is not a wasteful thing. We need a baseline to keep people form losing it all. Over time, if we revise our financial system we might see less predatory situations that will allow us to back out of Social Security.

If we didn't spend money on proxy wars, which makes nothing and returns nothing to our economy we'd be better off money-wise too. Setting up situations to benefit an elite rich never lasts and drains wealth from the rest of the people with no benefit to them. Diplomacy and smart use of military force will take care of our safety quite well. Reckless expansionism will not be sustainable, and we'll see all that has happened over the last few decades will not serve us well in the long run too. The economy today is a result of bad actions in banking and through some military recklessness supporting a select few.

My opinion is that we don't necessarily collectively protest in the streets (due to negative chance of riots defeating your efforts), but collectively change our spending habits and actions to punish the companies and politicians we don't support. I worked in advertising and I've personally seen small, active and organized movements that has moved a company to change certain plans or practices with a sustained online campaign. They have also coupled this with coordinated civil outdoor demonstrations or appearances at company meetings to advance people's notice of the group as well as starting YouTube channels, etc. The goal is to avoid the negative and do things positively with a goal in mind and gauge what gets results. Once people see the positive changes and how it benefits them or others they care for, real changes can be made.

The KEY ingredient to every successful organization is a clear purpose of goal and strong coordinated efforts by members.

Added Note:

I don't want to see more regulations for companies either. We have far too many regulations as it is. I even think we need to cut regulations out too. That said, the existing laws we have aren't being enforced, but congress, senate and President enact new laws to make sure the old laws are being acted upon. That's crazy and one of the reasons businesses want to invest in other countries. Too many crazy and Bureaucratic procedures that only specialized lawyers can decipher. Hold companies accountable for bad business practices, but don't punish everyone. Go after the offenders, unlike the free pass that some companies get today, and order can be restored.

edit on 23-2-2012 by thepixelpusher because: (no reason given)

Originally posted by Laokin

Originally posted by beezzer

Originally posted by jacklondonmiller

They should pay more and entitlements should be reformed.

And there you have it!

Could have come straight from the Obama administration. The wealthy need to pay their "fair share". And 71% isn't fair enough yet.

To the OP, nice.

Simple, clear and to the point.

It's not, it's clearly misleading. They pay more money, because they make more, but they pay a smaller percentage out of the money they earn than the rest of us.

It just so happens that if you make more money a lower % ends up being a higher figure. This is how math works.

A simple example.

10% of 100 is 10.

10% of 200 is 20.

That means, 5% of 400 is also 20.

This means 5% of 800 is 40.

So if you make $800 and I make $100 and you pay 5%($40) and I pay 10%($10), you contribute more money, even though I paid in more money on what I earned than you who made 8x what I did.

This is not fair, especially once you consider the fact that those with the $800 have more to spare, and those with the one hundred can barely live, yet the ones with the $100 have to pay more on that $100, even though they can't really afford to.

The OPs Figure of 71% is the total amount of taxes paid, NOT the percentage of what they pay on what they earn.

It's really quite simple. If you don't do it this way, the finite amount of resources gets consolidated into the hands of the wealthy and the government, leaving the rest of the country broke, amongst a myriad of other scams living along side of the tax codes and exemptions for those with power money.

edit on 21-2-2012 by Laokin because: (no reason given)

So I guess you won't like this percentage either. 49.5% of Amercians pay zero income tax! Got any fancy math to make that look twisted.

Originally posted by Donkey_Dean

reply to post by Skyfloating

I would certainly hope that in a country where 1% holds 90% of the wealth that the top tier would pay the most taxes. They still pay a lower rate than your average single person though. If someone gave you a million bucks it would most certainly hurt to hand over 40%, but on the same note it hurts just as bad to hand over 35-40% of a person’s weekly earnings. It should be a one size fits all rate! Poverty hurts worse than parting with some cash when you have plenty!

I know it sucks to part with large sums, but it hurts all around! It is not fair that millions have no tax liability, but having systems and tools in place to fight extreme poverty keep our commnities and country from resembling Nigeria or similar! You know as well as I do that if we didnt keep em out of the dirt they would bring us all down or we would spend twice as much locking folks up. Look to Lagos for a real world example of what you get with no system to fight poverty.

Oh poor me I had to pay a million in taxes, and my new 3 million dollar vacation home had to be put on hold. Oh poor me I had to pay so much in tax this month that I cannot afford my rent and will sleep in the street, I guess I have no choice but to get on welfare!

Which is worse?

edit on 22-2-2012 by Donkey_Dean because: (no reason given)

Simplifying this is ridiculous. Unfortunately we live in a "produce or perish" world. Social programs were designed to take care of those that cannot take care of themselves. Not for 33% of Amercans to be on some sort of assistance and 49.5% to pay zero income tax. Your argument only encourages or certainly excuses laziness.

reply to post by jacklondonmiller

Is that right?

Idiots are comparing payroll taxes to investment taxes 2 entirely different animals which is why Bill Gates and Warren Buffet and others have a yearly salary of $1.

Is that right?

Idiots are comparing payroll taxes to investment taxes 2 entirely different animals which is why Bill Gates and Warren Buffet and others have a yearly salary of $1.

Originally posted by neo96

reply to post by LErickson

Basic math eh?

Like a billionaire who pays 15% in taxes is paying 150 million dollars.

compared to the taxes paid by someone making 30k,50k,100k and 1 million.

Who the hell is paying more?

Here is where you get lost.

What do you mean by more? I thought you were smart enough to see the difference.

More than someone else? More than they want? More than you think is fair?

More than what?

Then again that is capital gain taxation then agian the wealth people are supposedly talking about is electronic based off investment vehicles such as stocks,bonds,mutal funds and others

Then again it matters NOT ONE BIT where they made the money with what I posted. Interested path of distraction but no.

That can be wiped out in a matter of seconds as 2008 proved then ovf course other investment vehicles such as real estate the bottom of the market dropped and trillions were lost.

You can lose your home, car, family, everything you own in minutes. I am supposed to feel bad for someone who's millions are not locked in a vault?

You are just babbling.

People need to get a damn clue

You are telling me. I was hoping this response would have something correct or intelligent and it has neither.

because the majority have no idea what the hell they are talking about.edit on 22-2-2012 by neo96 because: (no reason given)

Maybe you should find out before talking so much then.

Originally posted by neo96

reply to post by jacklondonmiller

Is that right?

Idiots are comparing payroll taxes to investment taxes 2 entirely different animals which is why Bill Gates and Warren Buffet and others have a yearly salary of $1.

The relevance of which means what? It seems like you really want that to mean something significant but I do not believe it does even a little. I have to ask.

Originally posted by Jean Paul Zodeaux

reply to post by OutKast Searcher

My friend, you can disagree all you like, what I am telling you is that when I worked for 40 hours a week - I was paid a commission - I generally made $1000 a week and generally paid roughly 30% in state and federal taxes. When I doubled that amount in one week I paid nearly 50% in taxes. That increase ensured I would never work those kind of hours again...not under those conditions.

There is no way in hell anyone is going to convince me that those extra 30 hours I worked that week made me one of the "rich" who "only got that wealth off of the backs of the poor" and I "enjoy more of the system" because of my one week advantage and so I "have to pay more".

When I made a million dollars a year, I only brought home about 500 grand.

Now that I make minimum wage, I get to keep almost 75% of my $12,000 yearly salary.

I am with you. Why the hell should I work more, just to make more, just to pay more taxes?

Who the hell wants a $500,000 tax bill? Sure, I had another half a million to spare but I paid a half a million.

Now I pay a few thousand dollars and keep all my money. I am with you. Way better to be poor and not pay taxes.

Originally posted by MidnightTide

My time is better spent just staying at home.....and this is what will happen with those who produce.

Why work so others don't have to.

If you do not have to work, can afford to just sit home, then why are you not doing that now? There are a lot of people that would be happy to earn a paycheck right now. Perhaps all you complaining about the money you earn and threatening to stop earning it should finally make good.

Originally posted by LErickson

Originally posted by Jean Paul Zodeaux

reply to post by OutKast Searcher

My friend, you can disagree all you like, what I am telling you is that when I worked for 40 hours a week - I was paid a commission - I generally made $1000 a week and generally paid roughly 30% in state and federal taxes. When I doubled that amount in one week I paid nearly 50% in taxes. That increase ensured I would never work those kind of hours again...not under those conditions.

There is no way in hell anyone is going to convince me that those extra 30 hours I worked that week made me one of the "rich" who "only got that wealth off of the backs of the poor" and I "enjoy more of the system" because of my one week advantage and so I "have to pay more".

When I made a million dollars a year, I only brought home about 500 grand.

Now that I make minimum wage, I get to keep almost 75% of my $12,000 yearly salary.

I am with you. Why the hell should I work more, just to make more, just to pay more taxes?

Who the hell wants a $500,000 tax bill? Sure, I had another half a million to spare but I paid a half a million.

Now I pay a few thousand dollars and keep all my money. I am with you. Way better to be poor and not pay taxes.

That sounds like a big fat farce if I have ever heard one.

I know people who work for 16 hours a day, doing damn hard work who are also very poor and on the

margins. Those people could work 24 a day, everyday and they would never achieve a tiny fraction of

a million dollars in a year.

Work and quantity of work have nothing to do with volume of pay, that is a crock of bull crap.

reply to post by LErickson

Right love the personal attacks it would do some good to read ATS terms and conditions since personal observations have nothing to do with any given topic being discussed never has and never will.

Smart enough to know the origin of taxation is relevant to the topic being discussed and that is capital gains tax where the top 10% make the bulk of their wealth off of.

But all the geniuses of the thread just don't seem to fathom that also smart enough to know the comparison is apples and oranges.

Registered on 2-22-2012 eh been banned before wonder what the odds are?

Right love the personal attacks it would do some good to read ATS terms and conditions since personal observations have nothing to do with any given topic being discussed never has and never will.

Smart enough to know the origin of taxation is relevant to the topic being discussed and that is capital gains tax where the top 10% make the bulk of their wealth off of.

But all the geniuses of the thread just don't seem to fathom that also smart enough to know the comparison is apples and oranges.

Registered on 2-22-2012 eh been banned before wonder what the odds are?

Originally posted by jacklondonmiller

Originally posted by LErickson

Originally posted by neo96

reply to post by jacklondonmiller

Is that right?

Idiots are comparing payroll taxes to investment taxes 2 entirely different animals which is why Bill Gates and Warren Buffet and others have a yearly salary of $1.

The relevance of which means what? It seems like you really want that to mean something significant but I do not believe it does even a little. I have to ask.

I have been seeing this guy and he doesn't even seem to know what he is typing

half of the time. It is hard to believe the person is even real

I would say... You are correct.

I am starting to think that the best way avoid having a real discussion is to act like you

are psycho or suffering from early onset dementia.

The political strategy is to confuse or pollute every issue and social construct so much, a PhD

cannot even begin to explain the fundamental flaws that are present with in the entire conservative

construct.

I mean really, a millionaire is going to give up and such his thumb because he takes home $40,000

a month?

I am ready to get thunderdome at this point, just give me a hatchet and lets go, words have failed.

reply to post by LErickson

This coming from the poser who keeps yammering on about simple math. The simple mathematical problem with jumping up in tax brackets the way I did was that earning gross income of $1,000 generally meant take home pay of $700 for a 40 hour work week, but that 70 hour work week meant a $2,000 gross income and roughly $1,100 take home meant an increase of only $400 dollars which meant those hours I worked were ultimately for less money per hour than if I worked only 40 hours for $1000. Of course, and here is the simple math of it, even if I did decide to keep working for 70 hours a week to take home roughly $55k a year, this would never amount to the ludicrous figure you offered.

Here's the deal, if the IRS came to me and offered me a job for a million dollars a year but the catch was that I would have to start filing and pay 90% income tax, but I am guaranteed employment with benefits and a solid retirement package, I would seriously consider taking that gig. However, if all I have on the table is some stupid sales job that after working a year of 70 hour work weeks can only generate a take home pay of $55k a year and that's pretty much the ceiling, then it is clearly time to start looking for another job, for one thing, and if the value placed on time comes to more than the value paid for that time after 40 hours then the rational person is going to stay with what has more value.

Look, I find it stupid when people say they don't pay the lottery because if they won half would go to taxes, and under this circumstances 50% of something is far better than 100% of nothing, if that something only cost the purchase of a single lottery ticket or relatively few compared to the winnings. That's playing the lottery and that is nothing at all like earning an income. You may have the right to gamble your money, but you have a demonstrable necessity to earn income. And, of course, this is really simple math too, in order for your strange logic to have any validity we must necessarily presume that all people who earn income are made liable for this so called "Personal Income Tax".

You want to yammer on about how necessary taxing lotteries are, I'm all for that! If, however, you want me to pretend that liability and the rule of law are irrelevant and have nothing to do with taxation just long enough to go along with you on this notion that I can't possibly earn a million dollars and not be liable for an income tax, you're dreaming, sport.

Let's say I make a million dollars and clearly you have assessed my liability regarding income taxation, so let's say you're the tax collector. You've come knocking on my door and have presented me with a $500,000 dollar bill and I look at you like you're some insane con artist and I ask you; "What is the subject of this tax?" What's your simple math answer to that question, sport?

The law, just like math, is simple. If you are going to ask me to presume with you that I am actually liable for this so called "Personal Income Tax", my answer is no. If you are going to insist that I am liable regardless o what I say, then my answer is; Prove it! Without that proof, your nonsensical math games of earnings and tax rates is meaningless.

I am with you. Why the hell should I work more, just to make more, just to pay more taxes? Who the hell wants a $500,000 tax bill? Sure, I had another half a million to spare but I paid a half a million.

This coming from the poser who keeps yammering on about simple math. The simple mathematical problem with jumping up in tax brackets the way I did was that earning gross income of $1,000 generally meant take home pay of $700 for a 40 hour work week, but that 70 hour work week meant a $2,000 gross income and roughly $1,100 take home meant an increase of only $400 dollars which meant those hours I worked were ultimately for less money per hour than if I worked only 40 hours for $1000. Of course, and here is the simple math of it, even if I did decide to keep working for 70 hours a week to take home roughly $55k a year, this would never amount to the ludicrous figure you offered.

Here's the deal, if the IRS came to me and offered me a job for a million dollars a year but the catch was that I would have to start filing and pay 90% income tax, but I am guaranteed employment with benefits and a solid retirement package, I would seriously consider taking that gig. However, if all I have on the table is some stupid sales job that after working a year of 70 hour work weeks can only generate a take home pay of $55k a year and that's pretty much the ceiling, then it is clearly time to start looking for another job, for one thing, and if the value placed on time comes to more than the value paid for that time after 40 hours then the rational person is going to stay with what has more value.

Look, I find it stupid when people say they don't pay the lottery because if they won half would go to taxes, and under this circumstances 50% of something is far better than 100% of nothing, if that something only cost the purchase of a single lottery ticket or relatively few compared to the winnings. That's playing the lottery and that is nothing at all like earning an income. You may have the right to gamble your money, but you have a demonstrable necessity to earn income. And, of course, this is really simple math too, in order for your strange logic to have any validity we must necessarily presume that all people who earn income are made liable for this so called "Personal Income Tax".

You want to yammer on about how necessary taxing lotteries are, I'm all for that! If, however, you want me to pretend that liability and the rule of law are irrelevant and have nothing to do with taxation just long enough to go along with you on this notion that I can't possibly earn a million dollars and not be liable for an income tax, you're dreaming, sport.

Let's say I make a million dollars and clearly you have assessed my liability regarding income taxation, so let's say you're the tax collector. You've come knocking on my door and have presented me with a $500,000 dollar bill and I look at you like you're some insane con artist and I ask you; "What is the subject of this tax?" What's your simple math answer to that question, sport?

The law, just like math, is simple. If you are going to ask me to presume with you that I am actually liable for this so called "Personal Income Tax", my answer is no. If you are going to insist that I am liable regardless o what I say, then my answer is; Prove it! Without that proof, your nonsensical math games of earnings and tax rates is meaningless.

Originally posted by neo96

reply to post by LErickson

Right love the personal attacks it would do some good to read ATS terms and conditions since personal observations have nothing to do with any given topic being discussed never has and never will.

Gosh, super sorry for calling you smart.

Smart enough to know the origin of taxation is relevant to the topic being discussed and that is capital gains tax where the top 10% make the bulk of their wealth off of.

So why am I asking you again what it is?

But all the geniuses of the thread just don't seem to fathom that also smart enough to know the comparison is apples and oranges.

Registered on 2-22-2012 eh been banned before wonder what the odds are?

Great. You understand the relevance. What is it?

reply to post by Jean Paul Zodeaux

Thank you. You are my hero. I will never have the patience you do in dealing with such matters. (back everyday calm and collected ready to make another well thought out post while im raging so hard i cant think)

inspirational

LErickson..... you gave up a half million dollars a year for a job that pays 12k....over taxes...... really? Thats incredibly foolish most of us would give our left arm for that opportunity. (im incredibly skeptical... i believe youre trying to make a point)

Thank you. You are my hero. I will never have the patience you do in dealing with such matters. (back everyday calm and collected ready to make another well thought out post while im raging so hard i cant think)

inspirational

LErickson..... you gave up a half million dollars a year for a job that pays 12k....over taxes...... really? Thats incredibly foolish most of us would give our left arm for that opportunity. (im incredibly skeptical... i believe youre trying to make a point)

new topics

-

How does my computer know

Education and Media: 48 minutes ago -

USO 10 miles west of caladesi island, Clearwater beach Florida

Aliens and UFOs: 5 hours ago

top topics

-

Anti-Israel Protesters in CHICAGO Chant 'Death to Israel and 'Death to America'

Social Issues and Civil Unrest: 17 hours ago, 15 flags -

Running Through Idiot Protestors Who Block The Road

Rant: 15 hours ago, 12 flags -

Tesla cutting 14,000 jobs

Global Meltdown: 14 hours ago, 6 flags -

USO 10 miles west of caladesi island, Clearwater beach Florida

Aliens and UFOs: 5 hours ago, 6 flags -

Israel ufo shoot down drones?

Aliens and UFOs: 14 hours ago, 5 flags -

Abortions in first 12 weeks should be legalised in Germany, commission says

Medical Issues & Conspiracies: 13 hours ago, 5 flags -

On this Day in History, April 15, 1865, Abraham Lincoln Passed Away.

General Chit Chat: 14 hours ago, 4 flags -

How does my computer know

Education and Media: 48 minutes ago, 0 flags

active topics

-

How does my computer know

Education and Media • 1 • : UpIsNowDown2 -

Canadian Police Urge Citizens To Avoid Conflict With Armed Robbers By Leaving Keys At Front Door

Social Issues and Civil Unrest • 68 • : Astyanax -

Gold and silver prices....woo hoo

History • 71 • : SchrodingersRat -

Afterlife, unknown, so prepare, or just go into the unknown (bad)!!

ATS Skunk Works • 49 • : Kennyb75 -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 46 • : matafuchs -

President BIDEN Warned IRAN Not to Attack ISRAEL - Iran Responded with a Military Attack on Israel.

World War Three • 37 • : nugget1 -

America's Infant Mortality Rate Increases for the First Time in 20 Years

Medical Issues & Conspiracies • 17 • : nugget1 -

Mandela Effect - It Happened to Me!

The Gray Area • 98 • : BeTheGoddess2 -

The Truth About Jesus

Conspiracies in Religions • 265 • : glend -

J Balvin Columbian Singer captured this Triangle UFO footage…….

Aliens and UFOs • 13 • : magicai