It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

There is just so much information left out of the OP, quite frankly it's a bit pathetic as is.

First off, statistics lie. I don't care who tells you different. People shape the variables to conform to ill-conceived beliefs they wish to feed their target group.

Okay so let's slice up that 10%, shall we?! Perhaps the top 10% pay 71% of the tax base, but how much do the top .01% pay?! What about the top .1%? What about the top 1% You see, the further away you go from the average, the larger the chance is they're just not paying taxes...legally or not.

So let's apply that to the bottom half. The further down you go, the more likely they are to be

A. Unemployed

B. Underemployed

C also/or receiving government aid

The reasons for both extreme sides paying less than their share are the same:

Unrealistic ideologies that lead to failed political policies.

It's the system itself. You can't blame the people further to the top any more than you can the people further towards the bottom. At this point most everyone is gaming the failed system to survive and/or thrive. Who expects less?

The only people to truly blame are the social engineers who are funding and controlling our political system.

They might as well not even have a damned number attached to them, as their motive is beyond mere greed, and more about control.

On the talk of control, what better way than to have this class warfare you seem to be unwittingly pushing?

You put out controlled informational bits like this, and have seemingly intelligent fools push it to the rest of us via government agencies, MSM, and even online social networking moderators.

This isn't about screw the rich, or screw the poor... we should be about, #### needs to get taken care of, and we'll call out the master manipulators while setting the who rigged system straight.

Out the propaganda!!

First off, statistics lie. I don't care who tells you different. People shape the variables to conform to ill-conceived beliefs they wish to feed their target group.

Okay so let's slice up that 10%, shall we?! Perhaps the top 10% pay 71% of the tax base, but how much do the top .01% pay?! What about the top .1%? What about the top 1% You see, the further away you go from the average, the larger the chance is they're just not paying taxes...legally or not.

So let's apply that to the bottom half. The further down you go, the more likely they are to be

A. Unemployed

B. Underemployed

C also/or receiving government aid

The reasons for both extreme sides paying less than their share are the same:

Unrealistic ideologies that lead to failed political policies.

It's the system itself. You can't blame the people further to the top any more than you can the people further towards the bottom. At this point most everyone is gaming the failed system to survive and/or thrive. Who expects less?

The only people to truly blame are the social engineers who are funding and controlling our political system.

They might as well not even have a damned number attached to them, as their motive is beyond mere greed, and more about control.

On the talk of control, what better way than to have this class warfare you seem to be unwittingly pushing?

You put out controlled informational bits like this, and have seemingly intelligent fools push it to the rest of us via government agencies, MSM, and even online social networking moderators.

This isn't about screw the rich, or screw the poor... we should be about, #### needs to get taken care of, and we'll call out the master manipulators while setting the who rigged system straight.

Out the propaganda!!

edit on 21-2-2012 by unityemissions because: (no reason given)

reply to post by Skyfloating

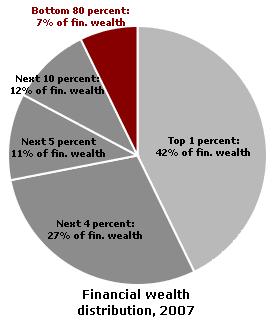

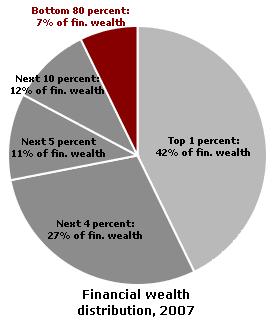

According to some sources, the top 10% hold 80% of the nation's wealth so, unless they are paying 80% of the taxes then, yes, I would say they are not paying their fair share.

Top 1 percent control 42% of wealth

According to some sources, the top 10% hold 80% of the nation's wealth so, unless they are paying 80% of the taxes then, yes, I would say they are not paying their fair share.

Top 1 percent control 42% of wealth

edit on 2/21/12 by FortAnthem because: _________ extra DIV

Originally posted by Skyfloating

I found a chart sourced from the IRS that shows how the top 10% of income earners paid 71% of federal income tax. This is pretty interesting because it would mean that all those calls that the rich should pay more taxes or that they dont pay enough taxes are wrong. The 10%ers seem to be paying plenty of taxes.

Thoughts?

I think you just might be an intelligent person.

If tax is lets say for arguments sake, %1

you make 10 dollars and give one back in tax

someone rich, say $1000 makes you rich and you give back $100

you both paid the same amount of tax percentage wise.

I hope that was simple enough

Originally posted by Skyfloating

Originally posted by Laokin

This is not fair

If I'd agree with you, we'd both be wrong.

Define "fair".

No we wouldn't, I'd be right and you'd be agreeing with me.

Fair is just. Fair is Equal. It means I pay what you pay, and you pay what I pay. Not the rich get to keep more gain because they earn more money. The amount lost to taxes should be equal for everyone.

FLAT = Fair.

Scaling could also be considered fair, if you factor in the affects of earning and not earning money.

I.E.

If earning less money = starving, homelessness and death vs earning more money = a reserve after you flew around the world bought 3 yachts a private jet and ten homes each worth the cost of ten homes for the average person.

Also, the people who make these top dollars don't even work. They get paid to do nothing but have their name on a piece of paper that entitles them to that money.

So who should get the bigger money? The guy who is out there working 80% of his life away, or the guy who is making money doing nothing?

On top of this, the guy making money doing nothing is paying less taxes and crying foul that he has to pay as little as he already does?

Really fair has a definition. You don't get to create or change the meaning of words to suit your argument.

fair

1 [fair] Show IPA adjective, fair·er, fair·est, adverb, fair·er, fair·est, noun, verb

adjective

1.

free from bias, dishonesty, or injustice: a fair decision; a fair judge.

Paying in less money and living free of work and having a surplus on top of a surplus after you spent more than a single average person will make in two life times and having people starve to death despite how hard they work is not JUST, which means it is NOT FAIR.

Education does not equate to big money. This is a myth. Liars, cheaters, and con's lead to Scrooge McDuck money.

This is reality. Bill gates was a Thief. Donald Trump was a Thief. The Rothschild's and Rockerfeller's are thieves.

I mean seriously.... The 1% isn't Beatles or Madonna rich, they are bill gates rich.

People don't understand that what used to be rich is now good money, and what people consider rich, is what we sane people would call SUPER rich.

The 1% pays most of the top 10%'s 71% total figure. Which is less than 10% of what they earn.

If you had 10 billion dollars, would you care if you lost a million? I know I wouldn't.... It would have ZERO affect on your life.

So why do they get to pay less?

That's not JUST, and hence -- it's not fair.

edit on 21-2-2012 by Laokin because: (no reason given)

Originally posted by Skyfloating

Originally posted by chapterhouse

How can you say that when 99% of all income is earned by 1% in this country. Not very informed are you?

How can I say that the rich pay most of the taxes in this country? I can say it by quoting IRS Stats.

They contribute the most towards the total tax income of the country because they make the most money. They could pay the least in respect to their income and still contribute more than the rest.

What don't you understand?

Paying 5% of 400,000 means paying 20,000

Paying 10% of 40,000 means paying 4,000

Person A contributes more towards the total but suffers considerably less burden from what he pays. It's not about what they contribute to the total, it's about what fraction of their income is taken in comparison to others.

edit on 2/21/2012 by eNumbra because: (no reason given)

reply to post by Drew99GT

So you're trying to justify theft. The wealthy already pay a higher percent. But that isn't enough for you, is it?

You want more.

Want it all?

It still wouldn't solve the debt crisis, because while you were whining about the rich, the government has spent it all! And they (the government) will just come back and "ask" for more. And more. And more.

Tell me, how much should the wealthy have?

How much would you allow them to keep?

You want more.

Want it all?

It still wouldn't solve the debt crisis, because while you were whining about the rich, the government has spent it all! And they (the government) will just come back and "ask" for more. And more. And more.

Tell me, how much should the wealthy have?

How much would you allow them to keep?

Originally posted by FortAnthem

reply to post by Skyfloating

According to some sources, the top 10% hold 80% of the nation's wealth so, unless they are paying 80% of the taxes then, yes, I would say they are not paying their fair share.

Top 1 percent control 42% of wealth

edit on 2/21/12 by FortAnthem because: _________ extra DIV

I have no problem with the rich paying more. They can afford it, and should be happy to contribute more to the system that allowed them to be so

successful.

I think taxes should be figured on a sliding scale, with the lowest incomes paying 1 or 2%, and the highest paying maybe 50 or 60%. I know, I know, it's unfair. I don't much care, life's not fair. We all have to deal with that.

If someone makes, say, $600,000,000 a year, they could pay 60% ($360 mil? Is that about right?) and still have $240 million to live off. I don't know about y'all, but as far as I'm concerned, anyone who whines about having to live on $240 million a year should be kicked right in the sascrotch. Were I the fella in this situation, I'd be happy and proud to be able to contribute more to improve the country that enabled me to have that much, and live in such comfort. (I'd also retire after one year)

On the other end, the guy who only pulled in $8,000 last year could pay 2% ($160), and it wouldn't kill him, while the taxman at least gets something, which is better than a lot of nothing.

I'm sure many would disagree with this, but it makes sense to me.

For what it's worth...

I think taxes should be figured on a sliding scale, with the lowest incomes paying 1 or 2%, and the highest paying maybe 50 or 60%. I know, I know, it's unfair. I don't much care, life's not fair. We all have to deal with that.

If someone makes, say, $600,000,000 a year, they could pay 60% ($360 mil? Is that about right?) and still have $240 million to live off. I don't know about y'all, but as far as I'm concerned, anyone who whines about having to live on $240 million a year should be kicked right in the sascrotch. Were I the fella in this situation, I'd be happy and proud to be able to contribute more to improve the country that enabled me to have that much, and live in such comfort. (I'd also retire after one year)

On the other end, the guy who only pulled in $8,000 last year could pay 2% ($160), and it wouldn't kill him, while the taxman at least gets something, which is better than a lot of nothing.

I'm sure many would disagree with this, but it makes sense to me.

For what it's worth...

Originally posted by Laokin

They pay more money, because they make more, but they pay a smaller percentage out of the money they earn than the rest of us.

That's wrong.

Income tax rates on wages

$0 - $8,500 income tax rate is 10%

8,500 - 34,500 income tax rate is 15%

$34,500 - $83,600 income tax rate is 25%

$83,600 - $174,400 income tax rate is 28%

$174,400 - $379,140 income tax rate is 33%

$379,140 and up income tax rate is 35%

Investment income is different and is taxed at 15%

It's done that way as a REWARD for those who invest in our economy and who create jobs.

Originally posted by beezzer

reply to post by Drew99GT

So you're trying to justify theft. The wealthy already pay a higher percent. But that isn't enough for you, is it?

You want more.

Want it all?

It still wouldn't solve the debt crisis, because while you were whining about the rich, the government has spent it all! And they (the government) will just come back and "ask" for more. And more. And more.

Tell me, how much should the wealthy have?

How much would you allow them to keep?

No they do not pay a higher percentage. Average Jane and Average Joe pay the higher percentage.

Originally posted by eNumbra

reply to post by Skyfloating

I'd rather see numbers than percentages, The upper half of the country could pay a significantly smaller percentage of their income than the lower half, and still be contributing more just by the nature of percentages.

Numbers (in an absolute way) mean nothing. That's why we have the concept of percentages to put numbers into perspective. That's why we have things like per capita when dealing with economic statistics.

Originally posted by chapterhouse

Originally posted by Skyfloating

I found a chart sourced from the IRS that shows how the top 10% of income earners paid 71% of federal income tax. This is pretty interesting because it would mean that all those calls that the rich should pay more taxes or that they dont pay enough taxes are wrong. The 10%ers seem to be paying plenty of taxes.

Thoughts?

How can you say that when 99% of all income is earned by 1% in this country. Not very informed are you?

It is not. 99% of all income is most definitely NOT *earned* by 1% of the population. Propaganda.

YOU are the one who is not well informed. Actually, you have been well informed, but by people who are spreading crappy data. Sounds like info straight from Occupy Wall Street.

I wish I could imbed a chart. Go to www.taxfoundation.org... and scroll down until you get to Table 1. The data is from 2009, but that year, the top 1% paid an effective tax rate of 24% of their income which is the HIGHEST RATE PERCENTAGE-WISE OF ANY INCOME GROUP. Their share of the country's adjusted gross income (AGI) was 16.9%, FAR from the 99% you claim it is.

So sick of the idea that they are not paying their "fair" share. They pay a higher percentage than any other group, AND they pay the bulk of all taxes received. What more do you want? Their firstborn?

And no, I am not a member of the top 1%, I am not a slave to them, and I am not a shill. But I am fed up with this "not fair" whining.

Originally posted by Drew99GT

Originally posted by eNumbra

reply to post by Skyfloating

I'd rather see numbers than percentages, The upper half of the country could pay a significantly smaller percentage of their income than the lower half, and still be contributing more just by the nature of percentages.

Numbers (in an absolute way) mean nothing. That's why we have the concept of percentages to put numbers into perspective. That's why we have things like per capita when dealing with economic statistics.

What I meant when I said numbers, is what those people were earning and how much they were paying. Thus, figuring out the percentage of their income they contributed, rather than the percentage of the total amount taken in by the government. My apologies if I was unclear.

Percentages can obscure just as often and plain numbers, statistics can be manipulated to illustrate just as easily as they can to hide.

Originally posted by beezzer

reply to post by Drew99GT

So you're trying to justify theft. The wealthy already pay a higher percent. But that isn't enough for you, is it?

You want more.

Want it all?

It still wouldn't solve the debt crisis, because while you were whining about the rich, the government has spent it all! And they (the government) will just come back and "ask" for more. And more. And more.

Tell me, how much should the wealthy have?

How much would you allow them to keep?

They don't pay a higher percent. Read the thread.

They pay a smaller percent but earn more, and so their smaller percent totals a bigger sum.

The question you need to ask yourself is percent of what? Percent of taxes collected in total? Or the percent of taxes paid out of what you earned?

Because the rich pay less taxes on what they earn even though they contribute the most to the total taxes collected.

They are two different metrics. Metric 1, the total amount of taxes paid in, has nothing to do with the amount of taxes we pay on what we earn.

Metric 2 is the total amount of taxes we pay on what we earn, which is what determines how much money you get to keep out of what you make.

The rich get to keep more of what they make, when the poor get to keep less of what they make.

Get it yet? The IRS purposefully uses the metric of 71% to mislead the poor people into supporting the riches gained by blatant thievery.

It's called "Misdirection" when you use a metric out of context to get people to support a system that does them harm, rather than improves their life.

edit on 21-2-2012 by Laokin because: (no reason given)

Originally posted by FlyersFan

Originally posted by Laokin

They pay more money, because they make more, but they pay a smaller percentage out of the money they earn than the rest of us.

That's wrong.

Income tax rates on wages

$0 - $8,500 income tax rate is 10%

8,500 - 34,500 income tax rate is 15%

$34,500 - $83,600 income tax rate is 25%

$83,600 - $174,400 income tax rate is 28%

$174,400 - $379,140 income tax rate is 33%

$379,140 and up income tax rate is 35%

Investment income is different and is taxed at 15%

It's done that way as a REWARD for those who invest in our economy and who create jobs.

Totally bogus information. Those are marginal tax rates that in no way account for deductions and other things that create the affective tax rates someone pays; that is, the amount of income tax paid vs what was earned.

Under the United States' progressive tax system, income is taxed at graduated rates. An individual's tax bracket, sometimes referred to as the marginal tax rate, refers to the percentage of income that's taxed at the top tax rate — not the rate for the entire amount. The effective tax rate, meanwhile, is the amount a taxpayer pays in taxes as a percentage of total income.

Source

Let me ask all those who think we should tax the successful more this;

(already asnswered by one poster)

But how much money would you allow the successful to keep?

How much is good for you?

(already asnswered by one poster)

But how much money would you allow the successful to keep?

How much is good for you?

Originally posted by Laokin

They don't pay a higher percent. Read the thread.

They pay a smaller percent but earn more, and so their smaller percent totals a bigger sum.

Again .. that's WRONG. Like you said .. go back a few spaces.

I posted the percents that each wage earning group must pay.

The more you make .. the higher a percent you pay.

Originally posted by beezzer

Let me ask all those who think we should tax the successful more this;

(already asnswered by one poster)

But how much money would you allow the successful to keep?

How much is good for you?

Let me ask you this: why are you equating success with ultra wealthiness??? Especially when many ultra wealthy get that way through corruption of government?

By your logic, the median wage earner isn't successful.

Originally posted by beezzer

reply to post by Drew99GT

So you're trying to justify theft. The wealthy already pay a higher percent. But that isn't enough for you, is it?

You want more.

Want it all?

Stop exaggerating

In the 50's when I was young they paid nearly 90% of their income.

This is best taxes they have had in well over 50 years yet you keep

complaining.

Originally posted by FlyersFan

Originally posted by Laokin

They don't pay a higher percent. Read the thread.

They pay a smaller percent but earn more, and so their smaller percent totals a bigger sum.

Again .. that's WRONG. Like you said .. go back a few spaces.

I posted the percents that each wage earning group must pay.

The more you make .. the higher a percent you pay.

The more you make, the more skilled the accounts you hire are.

new topics

-

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 27 seconds ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 1 hours ago -

MH370 Again....

Disaster Conspiracies: 2 hours ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 4 hours ago -

Chronological time line of open source information

History: 6 hours ago -

A man of the people

Diseases and Pandemics: 7 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 7 hours ago -

4 plans of US elites to defeat Russia

New World Order: 9 hours ago

top topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 16 hours ago, 17 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 1 hours ago, 14 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 12 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 15 hours ago, 6 flags -

A man of the people

Diseases and Pandemics: 7 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 9 hours ago, 4 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 15 hours ago, 4 flags -

Chronological time line of open source information

History: 6 hours ago, 2 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 4 hours ago, 2 flags -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 7 hours ago, 1 flags

active topics

-

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest • 0 • : trollz -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness • 20 • : WeMustCare -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 541 • : IndieA -

A man of the people

Diseases and Pandemics • 8 • : charlest2 -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 6 • : KrustyKrab -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 76 • : WeMustCare -

Eclipse picture taken by my son from the NH-ME border - Cool!

General Chit Chat • 25 • : 20241105 -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 25 • : KnowItAllKnowNothin -

New Photo's reveal Railway System underneathe the Pyramids

Breaking Alternative News • 29 • : jshdnl -

12 jurors selected in Trump criminal trial

US Political Madness • 50 • : Xtrozero