It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

0

share:

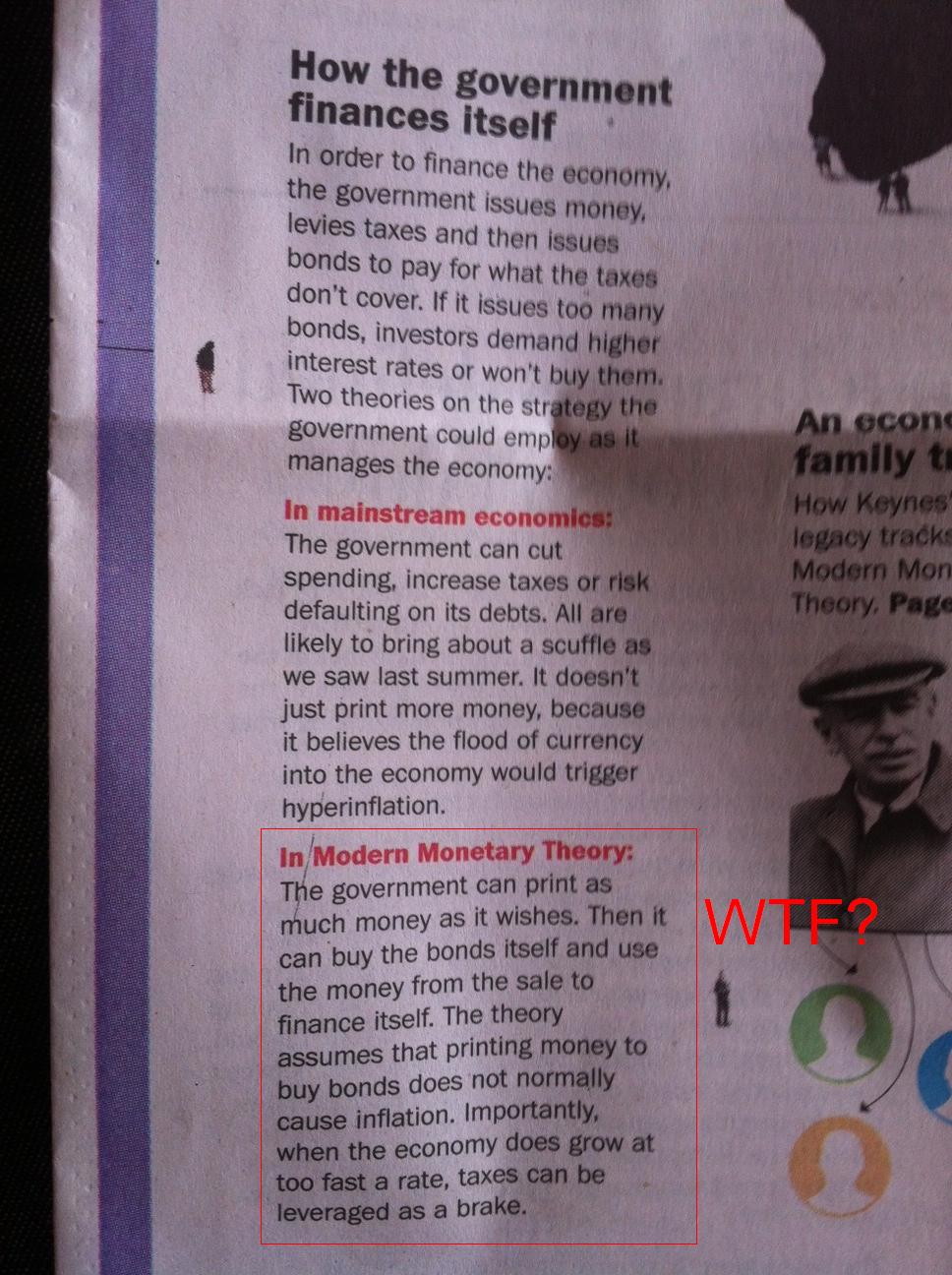

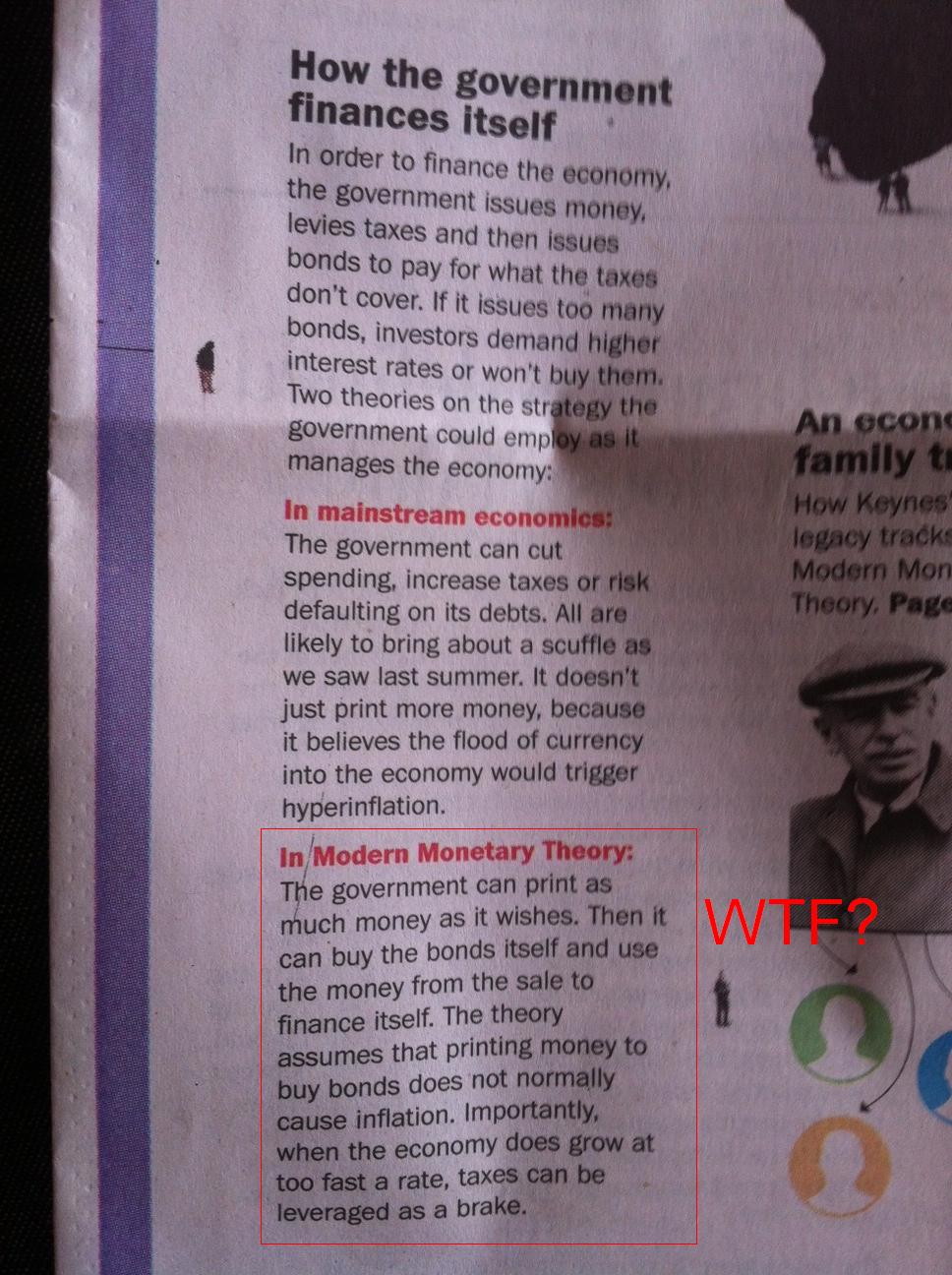

Maybe I'm just seriously out of touch with things, but I was very surprised when I picked up the Post this morning and noticed an article in the

Business section talking about how "modern economists" see surpluses as bad and deficit as good for the economy.

And also that governments can just print the money they need to pay off debt. I mean, really? If that's the case, then why isn't Zimbabwe the richest country on Earth and why doesn't Greece have 0% unemployment? Maybe I'm missing something here, but this seems very off to me.

Here's a key part of the article:

www.washingtonpost.com...

And also that governments can just print the money they need to pay off debt. I mean, really? If that's the case, then why isn't Zimbabwe the richest country on Earth and why doesn't Greece have 0% unemployment? Maybe I'm missing something here, but this seems very off to me.

Here's a key part of the article:

What’s more, his father, John Kenneth Galbraith, was the most famous economist of his generation: a Harvard professor, best-selling author and confidante of the Kennedy family. Jamie has embraced a role as protector and promoter of the elder’s legacy.

But if Galbraith stood out on the panel, it was because of his offbeat message. Most viewed the budget surplus as opportune: a chance to pay down the national debt, cut taxes, shore up entitlements or pursue new spending programs.

He viewed it as a danger: If the government is running a surplus, money is accruing in government coffers rather than in the hands of ordinary people and companies, where it might be spent and help the economy.

“I said economists used to understand that the running of a surplus was fiscal (economic) drag,” he said, “and with 250 economists, they giggled.”

Galbraith says the 2001 recession — which followed a few years of surpluses — proves he was right.

A decade later, as the soaring federal budget deficit has sharpened political and economic differences in Washington, Galbraith is mostly concerned about the dangers of keeping it too small. He’s a key figure in a core debate among economists about whether deficits are important and in what way. The issue has divided the nation’s best-known economists and inspired pockets of passion in academic circles. Any embrace by policymakers of one view or the other could affect everything from employment to the price of goods to the tax code.

www.washingtonpost.com...

e

dit on 19-2-2012 by mossme89 because: (no reason given)

This story belongs in the Humor Section.

I know the OP reported a real story ,so for that reason it is were it should be.

But this economist is the guy who once sold his Cow for "magic beans".

I know the OP reported a real story ,so for that reason it is were it should be.

But this economist is the guy who once sold his Cow for "magic beans".

Originally posted by Tw0Sides

This story belongs in the Humor Section.

I know the OP reported a real story ,so for that reason it is were it should be.

But this economist is the guy who once sold his Cow for "magic beans".

Seriously? wow yeah, the guy they were describing seemed kinda koo-koo

If they repeat it enough, people will believe it. They know this as well as you and I.

Money, in and of itself, IS a DEBT NOTE. It is an i.o.u.; an "i'll pay you wednesday, for a burger today", type thing. People that are WEALTHY

have ASSETS, and the people that are 'RICH' have money. Wealthy people own corporations; rich people own businesses. Rockefeller/Rothschild's are

WEALTHY and the other 1% are RICH!

Debt makes the world go 'round. And, without debt, there would be no need for SLAVES! "The borrower becomes SLAVE to the lender."

Debt makes the world go 'round. And, without debt, there would be no need for SLAVES! "The borrower becomes SLAVE to the lender."

reply to post by mossme89

My understanding is that there is a school of economics that says if the government spends a dollar it will improve the economy by $1.80 or more. (The multiplier effect.) Under this theory, the more the government spends, the greater our economy will be. Unfortunately it doesn't work that way in practice.

There are several reasons why that doesn't work. If you get the money from taxes, consider that you have to take a dollar from someone, thus slowing down the economy. Then it goes to Washington (the IRS) where it loses some of its value to pay for salaries, enforcement and other things that produce nothing. What's left of the dollar then goes in to the pot to spend. Some of it goes to projects that don't add anything to the economy. (We can all think of those). So now what's left of the money gets paid to individuals as benefits of one kind or another. So now person X has part of the money that came from person Y, the rest is lost.

If the money is printed, you have inflationary problems which make each dollar in the country worth less. And America less competitive in world trading because of its inflate prices.

If the money is borrowed. it's the same analysis as taxes, except the money is given to person X that will come from the pocket of the son of person Y. This option is popular because you get a small benefit now, and some other President will have to worry about the mess you caused.

My understanding is that there is a school of economics that says if the government spends a dollar it will improve the economy by $1.80 or more. (The multiplier effect.) Under this theory, the more the government spends, the greater our economy will be. Unfortunately it doesn't work that way in practice.

There are several reasons why that doesn't work. If you get the money from taxes, consider that you have to take a dollar from someone, thus slowing down the economy. Then it goes to Washington (the IRS) where it loses some of its value to pay for salaries, enforcement and other things that produce nothing. What's left of the dollar then goes in to the pot to spend. Some of it goes to projects that don't add anything to the economy. (We can all think of those). So now what's left of the money gets paid to individuals as benefits of one kind or another. So now person X has part of the money that came from person Y, the rest is lost.

If the money is printed, you have inflationary problems which make each dollar in the country worth less. And America less competitive in world trading because of its inflate prices.

If the money is borrowed. it's the same analysis as taxes, except the money is given to person X that will come from the pocket of the son of person Y. This option is popular because you get a small benefit now, and some other President will have to worry about the mess you caused.

I expect the Jedi mind wave everytime I hear the idiots say that.

Deficit and debt are gooood,

Deficit and debt are gooood,

Deficit and debt are gooood,

Now when I snap my fingers, you'll wake up, vote for the cute chick on Idol, and state that deficit and debt are good for the economy.

Deficit and debt are gooood,

Deficit and debt are gooood,

Deficit and debt are gooood,

Now when I snap my fingers, you'll wake up, vote for the cute chick on Idol, and state that deficit and debt are good for the economy.

As someone trained in economics, I will say this. Deficit and debt are neither bad nor good. What hurts us is blind ideology, like saying that debt

is always bad, or that debt is always good. The ideologically driven are people who have political agendas to support or the dunces who follow

them.

One thing that is certain: going more deeply in debt to spend domestically (within reason) at a time of recession will stimulate the economy, and reducing the debt at a time of recession will cause the economy to contract further. See Europe for examples of economic suicide through austerity. That the Obama administration has chosen to take us further into debt during a time when austerity would have crippled us is a testament to their wisdom, not their recklessness.

But there is something else you need to understand. The U.S. is not like any other country. Other countries cannot print themselves out of debt because this causes their currencies to fall in relation to the dollar, and the dollar is how the world buys stuff. So printing more currency, for them, changes the value of their currency more or less proportionally to the amount they print. And their debt is, in essence, denominated in dollars (or Euros, which still puts the weaker Euro countries at a similar disadvantage). The U.S., on the other hand, when putting more dollars in circulation, essentially changes the ground rules under which the world plays, INCLUDING ITSELF, so that the full effect of the stimulous is not nearly as dangerous to the U.S. This is the advantage of winning WWII and being able to enforce economic hegemony on the world.

What "printing" money is all about is implicitly taxing wealth. If you hold a billion in dollars and I devalue the dollar by 10%, you have the purchasing power of 900 million. The difference has been used to implicitly reduce the country's debt obligation, which presumably means that the economy was stimulated and wealth was redistributed more widely. Which gets to why Repubs/conservatives hate this idea. They are the ones with all the money, and they want to keep it for themselves. If that means the economy collapses, too bad, they're rich and will do fine anyway. If you are not rich, by the way, and you buy into this economic or budget austerity nonsense, you are voting against your own interests. You are voting for you and your neighbors to starve in order to protect the wealth of a few rich families.

One thing that is certain: going more deeply in debt to spend domestically (within reason) at a time of recession will stimulate the economy, and reducing the debt at a time of recession will cause the economy to contract further. See Europe for examples of economic suicide through austerity. That the Obama administration has chosen to take us further into debt during a time when austerity would have crippled us is a testament to their wisdom, not their recklessness.

But there is something else you need to understand. The U.S. is not like any other country. Other countries cannot print themselves out of debt because this causes their currencies to fall in relation to the dollar, and the dollar is how the world buys stuff. So printing more currency, for them, changes the value of their currency more or less proportionally to the amount they print. And their debt is, in essence, denominated in dollars (or Euros, which still puts the weaker Euro countries at a similar disadvantage). The U.S., on the other hand, when putting more dollars in circulation, essentially changes the ground rules under which the world plays, INCLUDING ITSELF, so that the full effect of the stimulous is not nearly as dangerous to the U.S. This is the advantage of winning WWII and being able to enforce economic hegemony on the world.

What "printing" money is all about is implicitly taxing wealth. If you hold a billion in dollars and I devalue the dollar by 10%, you have the purchasing power of 900 million. The difference has been used to implicitly reduce the country's debt obligation, which presumably means that the economy was stimulated and wealth was redistributed more widely. Which gets to why Repubs/conservatives hate this idea. They are the ones with all the money, and they want to keep it for themselves. If that means the economy collapses, too bad, they're rich and will do fine anyway. If you are not rich, by the way, and you buy into this economic or budget austerity nonsense, you are voting against your own interests. You are voting for you and your neighbors to starve in order to protect the wealth of a few rich families.

Modern Monetary Theory is just another name for Chartalism. Look it up, it was the economic theory that inspired the Weimar Republic's hyperinflation

and ultimately the rise of the Nazis following the German economic collapse..

It has been resurrected by a small but very vocal group that includes economists and politicians. It uses mathematical tautologies to try and convince people that it is a sound mathematical theory of the economy, however these are simply accounting identities and do not represent the real economy at all. Its conclusions are only vaguely linked to anything remotely resembling the real world.

Its another form of central planning in disguise, and is such a stupid theory that only economists or financial professionals could believe it (ie it fails the common sense test rather badly, but features enough economic and financial jargon to seem plausible to some).

It has been resurrected by a small but very vocal group that includes economists and politicians. It uses mathematical tautologies to try and convince people that it is a sound mathematical theory of the economy, however these are simply accounting identities and do not represent the real economy at all. Its conclusions are only vaguely linked to anything remotely resembling the real world.

Its another form of central planning in disguise, and is such a stupid theory that only economists or financial professionals could believe it (ie it fails the common sense test rather badly, but features enough economic and financial jargon to seem plausible to some).

edit on 20-2-2012 by

zvezdar because: (no reason given)

new topics

-

Former Labour minister Frank Field dies aged 81

People: 39 minutes ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 2 hours ago -

This is our Story

General Entertainment: 4 hours ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 7 hours ago -

Ode to Artemis

General Chit Chat: 8 hours ago -

Ditching physical money

History: 11 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 11 hours ago

top topics

-

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 15 hours ago, 14 flags -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 7 hours ago, 10 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 11 hours ago, 6 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 13 hours ago, 6 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 2 hours ago, 4 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 12 hours ago, 4 flags -

Ditching physical money

History: 11 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 8 hours ago, 3 flags -

God lived as a Devil Dog.

Short Stories: 17 hours ago, 3 flags -

VirginOfGrand says hello

Introductions: 12 hours ago, 2 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 5 • : crayzeed -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 35 • : KrustyKrab -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 14 • : CosmicFocus -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 133 • : KrustyKrab -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 472 • : Justoneman -

Election Year 2024 - Interesting Election-Related Tidbits as They Happen.

2024 Elections • 69 • : Threadbarer -

Former Labour minister Frank Field dies aged 81

People • 2 • : Freeborn -

Terrifying Encounters With The Black Eyed Kids

Paranormal Studies • 72 • : Consvoli -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 24 • : angelchemuel -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 266 • : KrustyKrab

0