It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

9

share:

I just saw these interesting charts on the local news' finance snippet, and would like some clarification/explaination from the money guru's.

The news item i saw is here (skip to 1:06) from the Australian ABC News

The graphs are available here Kohler's Graphs

The charts change over time at this link, but the 2 charts he mentions in the news item are:

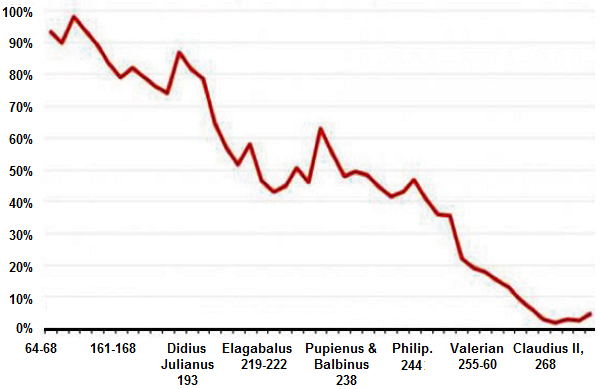

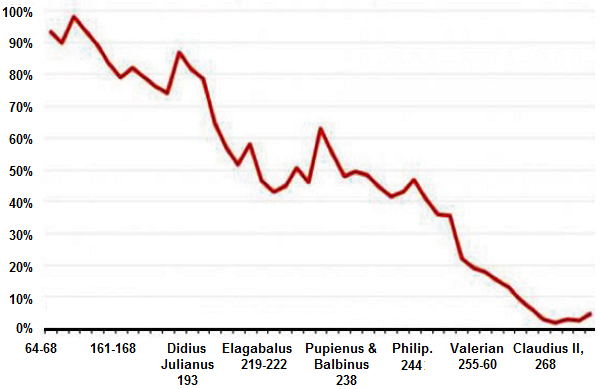

"silver in roman coins"

webpage's comment

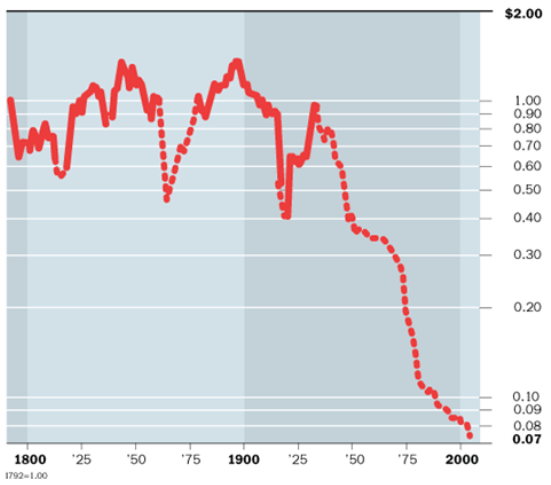

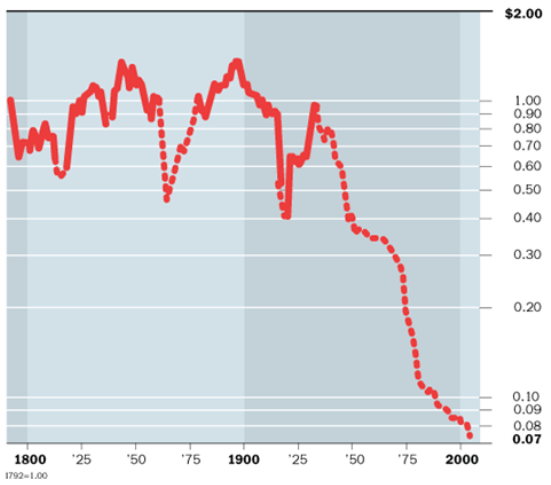

The Greenback's Purchasing Power:

webpage's comment

This 2nd chart is pretty dramatic, and disgusting. But, that said, i guess other countries charts of this would not be much different.

Surely, if this is correct, then Ron Paul wanting to 'End the FED' and get back to gold backed $'s is logical.

Why not, if the USD is worth 7c, declare the 80years of FED abuse an act of war against US and Global interests, take out or imprison those behind it all. seize all assets, and then sort the mess out.

Surely it would be the most profitable outcome. Then they can restart their NWO games with new players.

And, after losing 92% of purchasing power in 80 years....

What happens when it gets to 100% lost?

How far away is that scenario? ( 92 / 80 ) x 8 ?

Why no action on 'Financial Terrorism'?

The news item i saw is here (skip to 1:06) from the Australian ABC News

The graphs are available here Kohler's Graphs

The charts change over time at this link, but the 2 charts he mentions in the news item are:

"silver in roman coins"

webpage's comment

Is history repeating itself? Just as the US dollar's purchasing power fell sharply after it was delinked with the gold standard, so the coinage of the Roman Empire was debased as less and less of the precious metal silver was included in the currency.

Chart Source: SocGen, Dylan Grice

The Greenback's Purchasing Power:

webpage's comment

The purchasing power of the US dollar has been trending down since the 1940s (the solid lines are periods when the dollar was pegged to the gold standard). While there was limited convertibility between 1945 and 1971, the loss accelerated when that last link was severed and by 2004 the US dollar had lost 92% of its original purchasing power.

Chart Source: American Institute for Economic Research, from the Whole Price Index compiled by the Bureau of Labor Statistics

This 2nd chart is pretty dramatic, and disgusting. But, that said, i guess other countries charts of this would not be much different.

Surely, if this is correct, then Ron Paul wanting to 'End the FED' and get back to gold backed $'s is logical.

Why not, if the USD is worth 7c, declare the 80years of FED abuse an act of war against US and Global interests, take out or imprison those behind it all. seize all assets, and then sort the mess out.

Surely it would be the most profitable outcome. Then they can restart their NWO games with new players.

And, after losing 92% of purchasing power in 80 years....

What happens when it gets to 100% lost?

How far away is that scenario? ( 92 / 80 ) x 8 ?

Why no action on 'Financial Terrorism'?

this site paints an even more grim image.

source

things every american should know about the FED

How Your Dollar Got To Be Worth Just 3.8 Cents

source

things every american should know about the FED

reply to post by CitizenNum287119327

That's comparing apples and oranges.. The last time the Roman and American coinage was valued using the same method was prior to Nixon ending all links between coinage and precious metals.

In Rome the coins never used "less" of the precious metals (that is to say Rome never used Alloys) in their coins. They valued the Denarius not as Bullion (that is to say the value as the value of the worth of the metal) but rather as Intrinsic Value. They placed the value of a Silver coin higher than the actual worth of Silver. Same for gold. The set value could be changed at any time, since it's not Bullion, they could readjust the worth of a coin, however the worth of the coin never at any time was lower than the metal content of the coin. In fact at the end of the Roman Empire the silver denarius was technically worth more per coin than it was in the beginning of the empire.

The Antoninianus replaced the Denarius with a more modern numerology. Instead of simple silver and gold coins they used weight (size) as the main precursor to value. There were large silver coins and small silver coins with their own names and value. They also included a few sizes of Copper coins. This creates issues with "value" since the coins were smaller than the Denarius they technically had less Silver even though they were "worth" the same .. being an intrinsic currency and not a Bullion currency you could melt the coins together and often the weight of silver was worth more than the value of the coins. Hence you create inflation by trying to adjust prices of goods to equal the value of the metal in the coins. Fiasco.

Emperor Diocletian tried to fix the issue by re-valuing the currency during a time of war and strife which saw Roman borders begin to waver.. the edicts that he issued created a Bronze currency as well as "price controls" which instead of valuing the currency actually valued the goods, which in turn sent the Empires economy into a depression as trade began being disrupted.

In short: The graphs you post mean nothing, because it's comparing two things that are in no way alike. At all. ALL currencies depreciate unless you use a Bullion currency, which is then manipulated by the supply of the metal in the market or else the supply of specific goods. With a Roman Intrinsic currency it was more politics that had to do with the valuation of the currency, but it nearly always depreciates because the value is also dictated by the supply of new metal into the economy (when supply halts, valuation is corrected accordingly created coins worth more of the actual value of the metal)

That's comparing apples and oranges.. The last time the Roman and American coinage was valued using the same method was prior to Nixon ending all links between coinage and precious metals.

In Rome the coins never used "less" of the precious metals (that is to say Rome never used Alloys) in their coins. They valued the Denarius not as Bullion (that is to say the value as the value of the worth of the metal) but rather as Intrinsic Value. They placed the value of a Silver coin higher than the actual worth of Silver. Same for gold. The set value could be changed at any time, since it's not Bullion, they could readjust the worth of a coin, however the worth of the coin never at any time was lower than the metal content of the coin. In fact at the end of the Roman Empire the silver denarius was technically worth more per coin than it was in the beginning of the empire.

The Antoninianus replaced the Denarius with a more modern numerology. Instead of simple silver and gold coins they used weight (size) as the main precursor to value. There were large silver coins and small silver coins with their own names and value. They also included a few sizes of Copper coins. This creates issues with "value" since the coins were smaller than the Denarius they technically had less Silver even though they were "worth" the same .. being an intrinsic currency and not a Bullion currency you could melt the coins together and often the weight of silver was worth more than the value of the coins. Hence you create inflation by trying to adjust prices of goods to equal the value of the metal in the coins. Fiasco.

Emperor Diocletian tried to fix the issue by re-valuing the currency during a time of war and strife which saw Roman borders begin to waver.. the edicts that he issued created a Bronze currency as well as "price controls" which instead of valuing the currency actually valued the goods, which in turn sent the Empires economy into a depression as trade began being disrupted.

In short: The graphs you post mean nothing, because it's comparing two things that are in no way alike. At all. ALL currencies depreciate unless you use a Bullion currency, which is then manipulated by the supply of the metal in the market or else the supply of specific goods. With a Roman Intrinsic currency it was more politics that had to do with the valuation of the currency, but it nearly always depreciates because the value is also dictated by the supply of new metal into the economy (when supply halts, valuation is corrected accordingly created coins worth more of the actual value of the metal)

reply to post by kn0wh0w

That to is a very flawed way of looking at the value of a currency. With the monetary system we use today you can only compare the average percentage of the price of a specific good as compared to the overall percentage of yearly gross income.

For instance in 1920 I could by a house for an average of $5,000. with an average annual income of $1237

In 2010:

House: $166,100

Income: $46,326

This means that in 1920 a house averaged 404% of my annual income

In 2010 358% of my annual income.

So while valuation changes dramatically, the relative valuation can only be determined as a percentage of income. In this case, as compared to annual income, a house is actually more affordable. In simple terms you could say that while valuation has changed dramatically... we are still richer than we were. Again.. It's all relative. Simple economics.

Now a case for REAL inflation / financial debasing would be the timeframe 2000-2011 .. where the average BUYING POWER, that is, the RELATIVE difference between income and the average cost of goods, has been debased by about 20-30% (depending on the numbers you use).. that's to say, the costs of goods increases while wages do not meet the level of consumer inflation.

That to is a very flawed way of looking at the value of a currency. With the monetary system we use today you can only compare the average percentage of the price of a specific good as compared to the overall percentage of yearly gross income.

For instance in 1920 I could by a house for an average of $5,000. with an average annual income of $1237

In 2010:

House: $166,100

Income: $46,326

This means that in 1920 a house averaged 404% of my annual income

In 2010 358% of my annual income.

So while valuation changes dramatically, the relative valuation can only be determined as a percentage of income. In this case, as compared to annual income, a house is actually more affordable. In simple terms you could say that while valuation has changed dramatically... we are still richer than we were. Again.. It's all relative. Simple economics.

Now a case for REAL inflation / financial debasing would be the timeframe 2000-2011 .. where the average BUYING POWER, that is, the RELATIVE difference between income and the average cost of goods, has been debased by about 20-30% (depending on the numbers you use).. that's to say, the costs of goods increases while wages do not meet the level of consumer inflation.

Originally posted by kn0wh0w

this site paints an even more grim image.

How Your Dollar Got To Be Worth Just 3.8 Cents

source

thanks... i was gonna tell the OP that they gave the $ a 100% increase in value...

it is only worth .03¢ not the .07¢ the author says its worth from sources

in fact there are rumors that the Walking Liberty Dollars will be steel clad with gold in the near future

hows that for bottom-of-the-barrel

but there is another wrinkle in this tapestry...

the administration and Fed apologists will try to link the decline of our money with the hisdorical life of the country (236 + years) rather than bringing into account the creation of the USA's central bank = The Federal Reserve at some 99 years ago...

but another deflection of their blame is for the Fed to cite the

Nixxon era decoupling of Gold from the Dollar

will these elites ever admit that they are the Leeches of society, cannibals and scavengers all rolled into one !

edit on 15-2-2012 by St Udio

because: (no reason given)

edit on 15-2-2012 by St Udio because: (no reason given)

reply to post by St Udio

The Centralized Banking theorems allow for a more liquid flow of inflation, or currency valuation, that's true. But the actual levels of inflation based on the performance of the general economy would be no better under an intrinsic form of currency. As a matter of fact the intrinsic currencies the US used before the Federal Reserve saw severe inflation/deflation. The only currency that will not have inflation based on economic manipulation is a Bullion form of currency (gold and silver coinage.. not notes, nor intrinsic valuations of the coin and not the metal) a simple worth for worth transaction. Which, it should be pointed out, the USA has never in it's life used a Bullion Currency. Only an Intrinsic currency and a Reserve currency.

the administration and Fed apologists will try to link the decline of our money with the hisdorical life of the country (236 + years) rather than bringing into account the creation of the USA's central bank = The Federal Reserve at some 99 years ago...

The Centralized Banking theorems allow for a more liquid flow of inflation, or currency valuation, that's true. But the actual levels of inflation based on the performance of the general economy would be no better under an intrinsic form of currency. As a matter of fact the intrinsic currencies the US used before the Federal Reserve saw severe inflation/deflation. The only currency that will not have inflation based on economic manipulation is a Bullion form of currency (gold and silver coinage.. not notes, nor intrinsic valuations of the coin and not the metal) a simple worth for worth transaction. Which, it should be pointed out, the USA has never in it's life used a Bullion Currency. Only an Intrinsic currency and a Reserve currency.

Sad, but true.

That means based on $10/hr, most of us earn some 38 cents an hour,

and most of that is taken by IRS to fund global terrorism

That means based on $10/hr, most of us earn some 38 cents an hour,

and most of that is taken by IRS to fund global terrorism

Originally posted by kn0wh0w

How Your Dollar Got To Be Worth Just 3.8 Cents

source

things every american should know about the FED

Now that figure is more realistic considering what $1 buys anymore as far as housing or real property

Originally posted by ignant

Sad, but true.

That means based on $10/hr, most of us earn some 38 cents an hour,

and most of that is taken by IRS to fund global terrorism

No, no it doesn't mean you earn 38 cents an hour. Read the lengthy post a few up from yours Which explains relative worth.

Just because a loaf of bread cost 2 cents a 100 years ago doesn't mean your currency is screwed because it costs 2 dollars now. Chances are your wages have increased in proportion to the price of goods!

Some of the lunacy on threads that have anything to do with finances is actually quite staggering.

Thanks for all the input.

Much reading to do now.

again thanks.

Much reading to do now.

again thanks.

new topics

-

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 1 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 2 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 5 hours ago -

Bobiverse

Fantasy & Science Fiction: 7 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 8 hours ago -

Former Labour minister Frank Field dies aged 81

People: 10 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 11 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 16 hours ago, 19 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 8 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 11 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 10 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 7 hours ago, 3 flags -

Ode to Artemis

General Chit Chat: 17 hours ago, 3 flags -

This is our Story

General Entertainment: 14 hours ago, 3 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 1 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 5 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 2 hours ago, 0 flags

active topics

-

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 2 • : Cre8chaos79 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 649 • : RookQueen2 -

Mood Music Part VI

Music • 3098 • : BrucellaOrchitis -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 19 • : KnowItAllKnowNothin -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 14 • : Raptured -

DerBeobachter - Electric Boogaloo 2

Introductions • 14 • : ElitePlebeian2 -

LaBTop is back at last.

Introductions • 16 • : ElitePlebeian2 -

VirginOfGrand says hello

Introductions • 4 • : ElitePlebeian2 -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat • 9 • : ElitePlebeian2 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 32 • : bhtaylor53

9