It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

For the past couple of months I've been doing research (on and off) into the Federal Reserve, the ideas behind fiat money and so called sound money,

and things like that. There are many different opinions on this, and it's hard to actually get to the truth of the matter. I remember when I first

watched Zeitgeist, my mind was blown when they described how the FED essentially loans out money to the Government by buying Government bonds, and

they also attach interest to those loans.

So basically, Federal Reserve notes actually represent a debt to the FED, and as you may know the FED isn't really a Government entity, it's some sort of quasi-government entity that seems to be more like a private company then anything else. But here's where it gets confusing, according to what I have read, the FED actually returns its profit to the United States Treasury. So why don't they just give the money to the Government interest free in the first place if they're going to return the profit generated via interest?

This doesn't really make much sense to me. Although the FED does loan out money to other parties such as large banks, not just the US Government. And even though the profits from interest might go back to the treasury, that doesn't change the fact that the Government has to pay back everything it loans, and it can only pay what it borrows by loaning more money, it's an inescapable loop. Many people ask the question: why doesn't the Government just issue it's own debt-free money directly to the citizens instead of borrowing it? This is the golden question in my opinion.

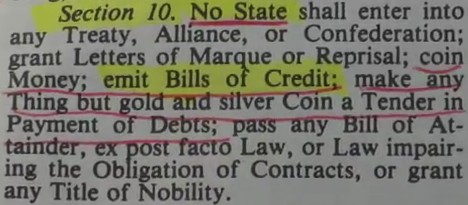

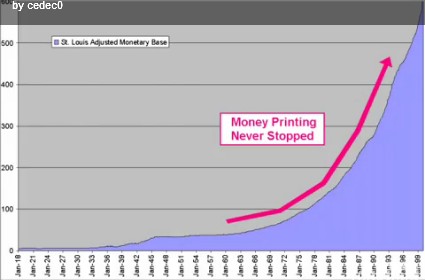

Now we all should know, Ron Paul is a strong supporter of 'sound money'. And sound money, as far as I can tell, is money which is backed by a precious metal or some other commodity that has intrinsic value. According to Ron Paul, as I understand it, he thinks some sort of gold backed currency would be the answer, as stipulated by the Constitution (as in the picture shown above). Now correct me if I am wrong about that, because I would like to think that I am. I am a strong supporter of Ron Paul, but I do not support a gold backed currency.

Let me tell you why I don't support a gold backed currency, but first lets start with the opposite side of the argument. The following video presents the typical case against the FED and 'unsound currencies'. They argue that fiat currencies such as the US dollar aren't backed by anything of real value, and can be created out of thin air at the whim of a central bank such as the Federal Reserve. This process of continually printing more money leads to inflation or super-inflation. They even go so far as to say that Lincoln's Greenback was a disaster and led to a deep depression.

Money, Banking, and the Federal Reserve

However, there is a side to this story which you might not know about. In actuality, the Greenback was a tremendous success for many years, and led to a great industrial boom and a time of flourishing productivity. After the Civil War several economists argued "for building on the precedent of non-debt-based fiat money and making the greenback system permanent". However, there was strong resistance to this idea, and the greenback notes were called in and taken out of circulation.

Eventually this led to the 'Panic of 1907', and as a result the Federal Reserve Note was created to ease the pressure of this artificially induced panic. By removing the Greenback notes from circulation so fast, they created a problem, and then they swooped in to solve the problem with their debt based currency issued by the Federal Reserve. We've also seen this trick played out many times by the elusive puppeteers, but this was one of their biggest scams ever in my opinion, and led to the system of inflationary debt-based currency used today in America.

If you are confused about what a Greenback note (aka United States Note) actually is, and how it differs from the typical Federal Reserve Note, the following snippet from Wikipedia should help fill in the gaps. It's important to understand the difference between these two forms of currency, and the history behind them. Now, in this snippet they try to claim the Federal Reserve Note isn't a fiat currency, and that it is "backed by debt", what ever the hell that is supposed to mean... but clearly, this is not the type if 'sound money' backed by something of intrinsic value that Ron Paul speaks about, and in fact it's much worse than a well controlled fiat currency.

So basically, Federal Reserve notes actually represent a debt to the FED, and as you may know the FED isn't really a Government entity, it's some sort of quasi-government entity that seems to be more like a private company then anything else. But here's where it gets confusing, according to what I have read, the FED actually returns its profit to the United States Treasury. So why don't they just give the money to the Government interest free in the first place if they're going to return the profit generated via interest?

The Fed will return about $45 billion to the U.S. Treasury for 2009, according to calculations by The Washington Post based on public documents. That reflects the highest earnings in the 96-year history of the central bank. The Fed, unlike most government agencies, funds itself from its own operations and returns its profits to the Treasury.

Federal Reserve earned $45 billion in 2009

This doesn't really make much sense to me. Although the FED does loan out money to other parties such as large banks, not just the US Government. And even though the profits from interest might go back to the treasury, that doesn't change the fact that the Government has to pay back everything it loans, and it can only pay what it borrows by loaning more money, it's an inescapable loop. Many people ask the question: why doesn't the Government just issue it's own debt-free money directly to the citizens instead of borrowing it? This is the golden question in my opinion.

Now we all should know, Ron Paul is a strong supporter of 'sound money'. And sound money, as far as I can tell, is money which is backed by a precious metal or some other commodity that has intrinsic value. According to Ron Paul, as I understand it, he thinks some sort of gold backed currency would be the answer, as stipulated by the Constitution (as in the picture shown above). Now correct me if I am wrong about that, because I would like to think that I am. I am a strong supporter of Ron Paul, but I do not support a gold backed currency.

"I wish it were possible to obtain a single amendment to our Constitution, taking from the federal government the power of borrowing."

~ President Thomas Jefferson, 1798

Let me tell you why I don't support a gold backed currency, but first lets start with the opposite side of the argument. The following video presents the typical case against the FED and 'unsound currencies'. They argue that fiat currencies such as the US dollar aren't backed by anything of real value, and can be created out of thin air at the whim of a central bank such as the Federal Reserve. This process of continually printing more money leads to inflation or super-inflation. They even go so far as to say that Lincoln's Greenback was a disaster and led to a deep depression.

Money, Banking, and the Federal Reserve

However, there is a side to this story which you might not know about. In actuality, the Greenback was a tremendous success for many years, and led to a great industrial boom and a time of flourishing productivity. After the Civil War several economists argued "for building on the precedent of non-debt-based fiat money and making the greenback system permanent". However, there was strong resistance to this idea, and the greenback notes were called in and taken out of circulation.

With an eventual return to gold convertibility in mind, the Funding Act of April 12, 1866[17] was passed, authorizing McCulloch to retire $10 million of the Greenbacks within six months and up to $4 million per month thereafter. This he proceeded to do until only $356,000,000 were outstanding in February 1868. By this point, the wartime economic boom was over, the crop harvest was poor, and a panic in Great Britain caused a recession and a sharp drop in prices in the United States.[18] The contraction of the money supply was blamed for the deflationary effects, and led debtors to successfully agitate for a halt to the notes' retirement.[19]

United States Note - Post Civil War

Eventually this led to the 'Panic of 1907', and as a result the Federal Reserve Note was created to ease the pressure of this artificially induced panic. By removing the Greenback notes from circulation so fast, they created a problem, and then they swooped in to solve the problem with their debt based currency issued by the Federal Reserve. We've also seen this trick played out many times by the elusive puppeteers, but this was one of their biggest scams ever in my opinion, and led to the system of inflationary debt-based currency used today in America.

The hard times which occurred after the Civil war could have been avoided if the Greenback legislation had continued as President Lincoln had intended. Instead there was a series of money panics – what we call rescessions’ – which put pressure on Congress to enact legislation to place the banking system under a centralised control."

~ The Truth in Money book, 1980

If you are confused about what a Greenback note (aka United States Note) actually is, and how it differs from the typical Federal Reserve Note, the following snippet from Wikipedia should help fill in the gaps. It's important to understand the difference between these two forms of currency, and the history behind them. Now, in this snippet they try to claim the Federal Reserve Note isn't a fiat currency, and that it is "backed by debt", what ever the hell that is supposed to mean... but clearly, this is not the type if 'sound money' backed by something of intrinsic value that Ron Paul speaks about, and in fact it's much worse than a well controlled fiat currency.

The United States Note was a national currency whereas Federal Reserve Notes are issued by the privately-owned Federal Reserve System.[26] Both have been legal tender since the gold recall of 1933. Both have been used in circulation as money in the same way. However, the issuing authority for them came from different statutes.[24] United States Notes were created as fiat currency, in that the government has never categorically guaranteed to redeem them for precious metal - even though at times, such as after the specie resumption of 1879, federal officials were authorized to do so if requested. The difference between a United States Note and a Federal Reserve Note is that a United States Note represented a "bill of credit" and was inserted by the Treasury directly into circulation free of interest. Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate seigniorage, or interest, for the Federal Reserve System, which serves as a lending intermediary between the Treasury and the public.

United States Note - Comparison to Federal Reserve Notes

edit on 4-2-2012 by ChaoticOrder because: (no reason given)

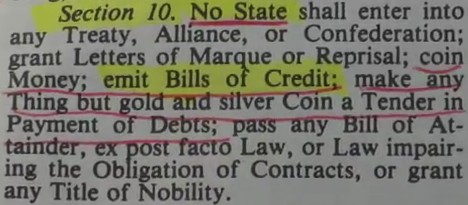

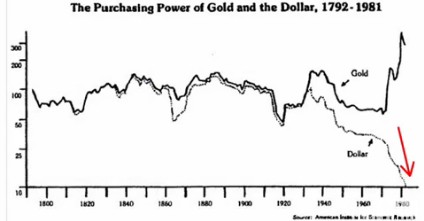

The divergence in the graph above pretty much corresponds to Executive Order 6102 when the Government made it illegal to own gold. Since that time the main form of currency in circulation has been the Federal Reserve Note, a debt-based currency. Now looking at that graph, we can see how the value of the dollar has dramatically dropped in comparison to the value of gold. This looks like pretty good evidence that the dollar should be backed by gold so that we don't get massive inflation like we are seeing in that graph. But the truth is not quite what it seems, take a look at the following graph. It shows the FED has been printing huge amounts of money, starting around 1933.

Once again, the problem has been artificially engineered by the bankers. The devaluation of the dollar has actually been caused by printing too much money. The following video (2 hours long) will take you through the history of money. It provides a some what different perspective on the nature of fiat money and how it is manipulated. It explains why the Greenback was in fact a great success, and how the bankers were scared and determined to stop the Greenback, because it was a debt-free currency issued directly to the people with no interest attached. What you come to understand, is that it doesn't actually matter what backs a currency, but who controls the quantity.

The Secret of Oz

"The underlying idea in the greenback philosophy... is that the issue of currency is a function of the Government, a sovereign right which ought not be delegated to corporations."

~ Dr. Davis Rich Dewey, Professor of Economics and Statistics, 1902

You see, the bankers were very scared of this idea that the US Government could print its own money and issue it directly to the citizens interest free, because it took power away from them and put the power of real wealth into the hands of the citizens. If the quantity of the currency issued by the Government is handled properly, then continuous inflation is a problem that people don't need to worry about. Bankers on the other hand, don't know when to stop. They don't care if their criminal activities result in widespread poverty, in fact they would actually prefer it that way.

"If this mischievous financial policy, which has its origin in North America, shall become endurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous without precedent in the history of the world. The brains, and wealth of all countries will go to North America. That country must be destroyed or it will destroy every monarchy on the globe."

~ Hazard Circular, London Times, 1865

"It is advisable to do all in your power to sustain such prominent daily and weekly newspapers, especially the Agricultural and Religious Press, as will oppose the greenback issue of paper money and that you will also withhold patronage from all applicants who are not willing to oppose the government issue of money. To repeal the Act creating bank notes, or to restore to circulation the government issue of money will be to provide the people with money and will therefore seriously affect our individual profits as bankers and lenders. See your congressman at once and engage him to support our interest that we may control legislation."

~ Letter by James Buel, Secretary American Bankers' Association, 1877

One of the hard hitting examples provided in the The Secret of Oz, is that of the currency used by the Roman Republic. They created cheap coins made from copper and brass, based on the credit and trust of the nation. It was a fiat money - not backed by precious metals - and it was a great success. It is one of the main reasons that Rome was able to prosper for so long and become the great nation that it was. When the bankers forced Rome to revert back to a gold backed currency, productivity came to a sudden halt, a deep depression set in, and it quickly led to their downfall. This is because the bankers control almost all of the worlds gold, thus a gold backed currency is one of the easiest types of currencies for them to manipulate.

"Without the use of either gold or silver, Rome became mistress of the commerce of the world. Her people were the bravest, the most prosperous, the most happy, for they know no grinding poverty. Her money was issued directly to the people, and was composed of a cheap material - copper and brass - based alone upon the faith and credit of the nation.

With this abundant money supply she built her magnificent courts and temples. She distributed her lands among the people in small holdings, and wealth poured into the coffers of Rome..."

~ Howard Milford, The American Plutocracy, 1895

edit on 4-2-2012 by ChaoticOrder because: (no reason given)

In reality, it all comes down to how much of the currency is allowed to be put into circulation. The ultimate proof of this came to me in the form of

a new digital currency called 'Bitcoin'. This digital currency operates on a P2P network, there is no central bank which can control the issuance of

bitcoins. New bitcoins are 'mined' by solving complex algorithms that help create the new bitcoins, but we need not get into too much detail. The

important thing is that the total number of bitcoins that can ever be 'mined' is limited to 21 million. In this way, bitcoin has properties much like

gold.

Bitcoin is a limited quantity digital commodity, a deflationary currency that can't be manipulated by bankers, and it will hold its value in much the same way as gold does. We don't need to trust that a central bank will print the right amount, because trust is placed in the cryptography on which the system operates. In this way, Bitcoin is almost the perfect type of currency from my perspective. Everyone has a chance to mine bitcoins, no one owns them all, and the quantity is set in stone, free from manipulation by any group or individual who might wish to inflate the money supply by continuously printing more money.

A few weeks after President Garfield made the above statement, he was assassinated. Many American Presidents have in fact been assassinated because they attempted to go against the will of the 'all mighty' bankers and their central bank. Quite frankly I find it absolutely disgusting that people have let this happen for so long, without speaking up because they fear the evil bankers will come get them while they're sleeping and steal their life away. I hope this thread has been of some use to some body, and I am looking forward to hearing all your different perspectives on this much diluted subject. Thank you.

NOTE: pics were taken from videos found in this thread.

Bitcoin is a limited quantity digital commodity, a deflationary currency that can't be manipulated by bankers, and it will hold its value in much the same way as gold does. We don't need to trust that a central bank will print the right amount, because trust is placed in the cryptography on which the system operates. In this way, Bitcoin is almost the perfect type of currency from my perspective. Everyone has a chance to mine bitcoins, no one owns them all, and the quantity is set in stone, free from manipulation by any group or individual who might wish to inflate the money supply by continuously printing more money.

"Whosoever controls the volume of money in any country is absolute master of all industry and commerce... And when you realise that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate."

~ President James Garfield, 1881

A few weeks after President Garfield made the above statement, he was assassinated. Many American Presidents have in fact been assassinated because they attempted to go against the will of the 'all mighty' bankers and their central bank. Quite frankly I find it absolutely disgusting that people have let this happen for so long, without speaking up because they fear the evil bankers will come get them while they're sleeping and steal their life away. I hope this thread has been of some use to some body, and I am looking forward to hearing all your different perspectives on this much diluted subject. Thank you.

NOTE: pics were taken from videos found in this thread.

edit on 4-2-2012 by

ChaoticOrder because: (no reason given)

great post my friend, and good research done!

Unfortunaly that's the nightmare we're all living in right now - and the main problem is global!

Got any solutions?

Unfortunaly that's the nightmare we're all living in right now - and the main problem is global!

Got any solutions?

Yeah, bitcoin.

Originally posted by Chevalerous

Got any solutions?

reply to post by ChaoticOrder

The Federal Reserve system is confusing.. mostly because the information out there about the Fed is so jacked up by idiots that it serves to confuse people even more.

That movie also forgot to mention that the interest from the loans is given to the Treasury Department. Charging interest on our own loans serves as a inflation control.. by making loans to the Government through an attached bank, then destroying the principle and applying the interest to the Government balance sheets you eliminate the inflation caused by the monetization in the first place. Obviously there are more complicated control mechanisms in place as well, the theory however states that large monetization occurs rarely, so when government spending declines in relation to revenue the total level of inflation due to monetization can be retracted.

Half and half. The Federal Reserve Bank is a government agency .. Congress can take it's charter away at any minute. The Executive Branch appoints the Chairman and the Board Members, Congress approves them. Entirely a government agency.

The Regional Banks are "privately" run. Note.. I said run, not owned. ALL national banks, let me make this very big. ALL National Banks are MEMBERS of the Federal Reserve. That's the "ownership" .. some regional banks are members, but all national banks must be. That means there are several hundred member banks.

There is NO "stock" in the Federal Reserve System .. there is no individual ownership or control.

Inflation control. The Keynesian economic theory of continuous spending is flawed that in times of crisis drastic spending causes severe inflation .. this is a tool they use to mitigate the effects of the inflation, as described above.

That's the point of the inflation control.. the capital, the initial amount given in return for the note, is destroyed. Gone. Never to be seen again. Well .. until politicians spend it.

Golden answer: Inflation!

I could write out the drawn out math for you, let me see if I can make it less complicated.

The USA spends $1000 dollars. It only earns $500 so it borrows from the Fed $500. It earns interest of 2% over 10 years compounded brings us to $609.

The debt matures, and the USA pays the principle + interest to the Federal Reserve. The Reserve destroys $500, and gives $109 to the Treasury. The Treasury then applies the $109 to the current years budget.

This means the USA can spend $500 but really only spend $109. If you add it into the chaos of the mountains of debt accumulated every year, plus the amount maturing it hypothetically creates an inflationary equilibrium. Now.. if you really wanted some f'd up math, you bring in something called Quantitive Easing, or Monetization on steroids. This is going to throw a wrench into the economy when it begins maturing because it was so much so fast that the Government is going to withdraw HUGE amounts of money form the economy, so much so it will probably take more QE just to alleviate the after effects.. if you calculate the algorithms for the total debt projections of the USA eventually we will get to the point where the Fed, ourselves, assume the vast majority of our own debt .. at that point it leads to inescapable inflation.

Ron Paul supports a Gold Standard, but a Gold Standard is not entirely the same thing as a Gold Backed currency.. a Gold Standard simply means that a Dollar at face value can be converted into Gold at market value, whereas today we buy the market value. Subtle difference. Basically what it comes down to is that under a Gold Standard when a country buys our debt they can take the maturity in Gold. Look at our national debt.. if that were to happen the USA would be bankrupt over night. So a Gold Standard is impossible.. hell .. that's the reason we abandoned it.

The Federal Reserve system is confusing.. mostly because the information out there about the Fed is so jacked up by idiots that it serves to confuse people even more.

my mind was blown when they described how the FED essentially loans out money to the Government by buying Government bonds, and they also attach interest to those loans.

That movie also forgot to mention that the interest from the loans is given to the Treasury Department. Charging interest on our own loans serves as a inflation control.. by making loans to the Government through an attached bank, then destroying the principle and applying the interest to the Government balance sheets you eliminate the inflation caused by the monetization in the first place. Obviously there are more complicated control mechanisms in place as well, the theory however states that large monetization occurs rarely, so when government spending declines in relation to revenue the total level of inflation due to monetization can be retracted.

So basically, Federal Reserve notes actually represent a debt to the FED, and as you may know the FED isn't really a Government entity, it's some sort of quasi-government entity that seems to be more like a private company then anything else.

Half and half. The Federal Reserve Bank is a government agency .. Congress can take it's charter away at any minute. The Executive Branch appoints the Chairman and the Board Members, Congress approves them. Entirely a government agency.

The Regional Banks are "privately" run. Note.. I said run, not owned. ALL national banks, let me make this very big. ALL National Banks are MEMBERS of the Federal Reserve. That's the "ownership" .. some regional banks are members, but all national banks must be. That means there are several hundred member banks.

There is NO "stock" in the Federal Reserve System .. there is no individual ownership or control.

the FED actually returns its profit to the United States Treasury. So why don't they just give the money to the Government interest free in the first place if they're going to return the profit generated via interest?

Inflation control. The Keynesian economic theory of continuous spending is flawed that in times of crisis drastic spending causes severe inflation .. this is a tool they use to mitigate the effects of the inflation, as described above.

that doesn't change the fact that the Government has to pay back everything it loans

That's the point of the inflation control.. the capital, the initial amount given in return for the note, is destroyed. Gone. Never to be seen again. Well .. until politicians spend it.

This is the golden question in my opinion.

Golden answer: Inflation!

I could write out the drawn out math for you, let me see if I can make it less complicated.

The USA spends $1000 dollars. It only earns $500 so it borrows from the Fed $500. It earns interest of 2% over 10 years compounded brings us to $609.

The debt matures, and the USA pays the principle + interest to the Federal Reserve. The Reserve destroys $500, and gives $109 to the Treasury. The Treasury then applies the $109 to the current years budget.

This means the USA can spend $500 but really only spend $109. If you add it into the chaos of the mountains of debt accumulated every year, plus the amount maturing it hypothetically creates an inflationary equilibrium. Now.. if you really wanted some f'd up math, you bring in something called Quantitive Easing, or Monetization on steroids. This is going to throw a wrench into the economy when it begins maturing because it was so much so fast that the Government is going to withdraw HUGE amounts of money form the economy, so much so it will probably take more QE just to alleviate the after effects.. if you calculate the algorithms for the total debt projections of the USA eventually we will get to the point where the Fed, ourselves, assume the vast majority of our own debt .. at that point it leads to inescapable inflation.

Now correct me if I am wrong about that, because I would like to think that I am. I am a strong supporter of Ron Paul, but I do not support a gold backed currency.

Ron Paul supports a Gold Standard, but a Gold Standard is not entirely the same thing as a Gold Backed currency.. a Gold Standard simply means that a Dollar at face value can be converted into Gold at market value, whereas today we buy the market value. Subtle difference. Basically what it comes down to is that under a Gold Standard when a country buys our debt they can take the maturity in Gold. Look at our national debt.. if that were to happen the USA would be bankrupt over night. So a Gold Standard is impossible.. hell .. that's the reason we abandoned it.

reply to post by ChaoticOrder

In economics "Debt" simply means "obligation" a Federal Reserve Note is a "debt" it's an obligation of value.

In economics "Credit" is actually the meaning of debt that you're thinking. Credit, in economics, means the promise of one party to provide services without value being fairly exchanged until a later date.

See? You have the two switched.. it's a technicality in economics.

The reason the Dollar tanks once it's freed from the bonds of Gold is that foreign debt used to be paid in Gold.. there was a Gold run after the Vietnam War and the USA nearly went bankrupt because of it.. the US stopped all Gold exports and stripped the Gold Standard from the Dollar. The USA then relied on the unusual method of Monetization to control it's spending .. in the 80's we went all out, we spent like there was no tomorrow and we did it on monetization which led to inflation .. coupled with Carter it was a disaster. In the 90's we used personal credit and interest manipulation to gain some balance.. when the economy crashed in 2000 the Federal Reserve used a nuclear option of ultra "cheap" money.. by inflating the currency they thought they could reduce the face value of debt .. in reality they created a personal credit nightmare that destroyed the entire World economy. You can probably deduce we haven't learned our lesson.

The fact is.. since the 1970's the USA has been in a constant state of collapse.. eventually the currency and our government will implode on its self.

As for bitcoin: A limited quantity currency creates a wealth disparity like nothing we've ever seen in our life time. There's a reason why we used a Gold Standard and not actual Gold .. we got tired of killing our neighbors to take their Gold piles, then wait till someone attacks us.. hence the constant state of warfare throughout Human history. With Gold we never would have had the ability to maintain the semblance of Capitalism that has given us a technological explosion .. under Gold you cannot have capitalism, only Mercantilism.

"backed by debt", what ever the hell that is supposed to mean...

In economics "Debt" simply means "obligation" a Federal Reserve Note is a "debt" it's an obligation of value.

In economics "Credit" is actually the meaning of debt that you're thinking. Credit, in economics, means the promise of one party to provide services without value being fairly exchanged until a later date.

See? You have the two switched.. it's a technicality in economics.

Since that time the main form of currency in circulation has been the Federal Reserve Note, a debt-based currency.

The reason the Dollar tanks once it's freed from the bonds of Gold is that foreign debt used to be paid in Gold.. there was a Gold run after the Vietnam War and the USA nearly went bankrupt because of it.. the US stopped all Gold exports and stripped the Gold Standard from the Dollar. The USA then relied on the unusual method of Monetization to control it's spending .. in the 80's we went all out, we spent like there was no tomorrow and we did it on monetization which led to inflation .. coupled with Carter it was a disaster. In the 90's we used personal credit and interest manipulation to gain some balance.. when the economy crashed in 2000 the Federal Reserve used a nuclear option of ultra "cheap" money.. by inflating the currency they thought they could reduce the face value of debt .. in reality they created a personal credit nightmare that destroyed the entire World economy. You can probably deduce we haven't learned our lesson.

The fact is.. since the 1970's the USA has been in a constant state of collapse.. eventually the currency and our government will implode on its self.

As for bitcoin: A limited quantity currency creates a wealth disparity like nothing we've ever seen in our life time. There's a reason why we used a Gold Standard and not actual Gold .. we got tired of killing our neighbors to take their Gold piles, then wait till someone attacks us.. hence the constant state of warfare throughout Human history. With Gold we never would have had the ability to maintain the semblance of Capitalism that has given us a technological explosion .. under Gold you cannot have capitalism, only Mercantilism.

reply to post by Rockpuck

Thanks for making a few things about the FED a bit clearer. The charged interest sort of makes sense now.

Thanks for making a few things about the FED a bit clearer. The charged interest sort of makes sense now.

But inflation would only happen if the Government kept needing to borrow more and more money, which means the FED would would need to keep printing more. That's the root cause of the problem of inflation, they shouldn't need these silly methods to counter the effect of inflation, because it clearly doesn't work anyway, the dollar has lost so much value since the implementation of the FED.

Golden answer: Inflation!

So either way (gold backed or gold standard), it's not a good idea right? I can see why I gold backed currency is a terribly bad idea, but I think if Ron Paul believes a "gold standard" would be a good thing, then there must be something to it. Wouldn't he be able to predict what you are saying?

Ron Paul supports a Gold Standard, but a Gold Standard is not entirely the same thing as a Gold Backed currency.. a Gold Standard simply means that a Dollar at face value can be converted into Gold at market value, whereas today we buy the market value. Subtle difference. Basically what it comes down to is that under a Gold Standard when a country buys our debt they can take the maturity in Gold. Look at our national debt.. if that were to happen the USA would be bankrupt over night. So a Gold Standard is impossible.. hell .. that's the reason we abandoned it.

edit

on 4-2-2012 by ChaoticOrder because: (no reason given)

reply to post by Rockpuck

I don't see the difference. You just defined debt. If I have credit with someone, I am in debt to that someone, right?

In economics "Credit" is actually the meaning of debt that you're thinking. Credit, in economics, means the promise of one party to provide services without value being fairly exchanged until a later date.

Pffft, a limited quantity commodity is the only thing that works. The only alternative is a currency that continues to lose value for infinity, and beyond! Bitcoin ensures sufficient granularity by being divisible by up to 8 decimal places.

As for bitcoin: A limited quantity currency creates a wealth disparity like nothing we've ever seen in our life time.

edit on 4-2-2012 by ChaoticOrder because: (no reason

given)

reply to post by ChaoticOrder

The root cause of the problem is politicians and Socialism. If you spend more than you make you have to borrow. Since we spend more than the World can ever possibly loan us we borrow from ourselves. In order to mitigate the effects of inflation over the long haul we created the system we use today.

You can have a Nation where you get all the goodies Government has to offer.. security, healthcare, education, defense, research, the cuddly wuddly feeling that politicians actually give a #. And borrow money to have it.

Or you have an austere Nation where you live within your means, even if it means during hard times the Government throws you on your ass.

Two examples of both extremes: Stalin's Soviet Union was the not so cuddly wuddly version of a Socialistic paradise, where to have all they ever wanted the Government spent and spent.. and when they couldn't afford something they used forced labor to make it happen anyways.

Then there's 1845 Ireland where the Government could have borrowed and used resources to help people .. but decided not to (simply on principle) which resulted in millions dieing. Later they decided damn, that was cold.

My long winded point being that GOVERNMENT in general is the cause of the problem, not the Reserve. the Reserve is a tool, a pawn .. if the Reserve somehow limited or stifled government action or inaction they would tear down the Fed instantly and put something else in its place. It serves the Government and the Government serves... the Government.

No no .. it's a wonderful idea. Just not in the United States. It would collapse us.. unless you can somehow convince Americans we don't need Socialism and need to live within our means. But .. to do that would kill the economy anyways, it's a lose lose situation.

There's a subtle difference.. it's an economic legal phrase, that's all. When giving something to someone who do it in debt, not credit.. by giving a Dollar as "debt" youre offering the value of the Dollar.. to give a Dollar on "credit" you're saying bring that to the bank and they will redeem the value. See?

Yeah. That's the point. It's a theory.. called "Keynesian Economics" .. the point is perpetual growth, perpetual inflation. The Dollar is designed to constantly be inflated .. if it's over inflated it dies, if it deflates it dies.. hence all the wacky rules and regulations to our economic system. We came as close to perfecting it as anyone ever hoped.. the long term livability of it is extended due to oil and our military power. Europe tried a more regulated version of our own system .. but they didn't have the resources we do, and they had an infatuation with Socialism .. it results in their demise. Soon they will monetize like we do .. but the long term livability is very short indeed.

But inflation would only happen if the Government kept needing to borrow more and more money, which means the FED would would need to keep printing more. That's the root cause of the problem of inflation, they shouldn't need these silly methods to counter the effect of inflation, because it clearly doesn't work anyway, the dollar has lost so much value since the implementation of the FED.

The root cause of the problem is politicians and Socialism. If you spend more than you make you have to borrow. Since we spend more than the World can ever possibly loan us we borrow from ourselves. In order to mitigate the effects of inflation over the long haul we created the system we use today.

You can have a Nation where you get all the goodies Government has to offer.. security, healthcare, education, defense, research, the cuddly wuddly feeling that politicians actually give a #. And borrow money to have it.

Or you have an austere Nation where you live within your means, even if it means during hard times the Government throws you on your ass.

Two examples of both extremes: Stalin's Soviet Union was the not so cuddly wuddly version of a Socialistic paradise, where to have all they ever wanted the Government spent and spent.. and when they couldn't afford something they used forced labor to make it happen anyways.

Then there's 1845 Ireland where the Government could have borrowed and used resources to help people .. but decided not to (simply on principle) which resulted in millions dieing. Later they decided damn, that was cold.

My long winded point being that GOVERNMENT in general is the cause of the problem, not the Reserve. the Reserve is a tool, a pawn .. if the Reserve somehow limited or stifled government action or inaction they would tear down the Fed instantly and put something else in its place. It serves the Government and the Government serves... the Government.

So either way (gold backed or gold standard), it's not a good idea right? I can see why I gold backed currency is a terribly bad idea, but I think if Ron Paul believes a "gold standard" would be a good thing, then there must be something to it. Wouldn't he be able to predict what you are saying?

No no .. it's a wonderful idea. Just not in the United States. It would collapse us.. unless you can somehow convince Americans we don't need Socialism and need to live within our means. But .. to do that would kill the economy anyways, it's a lose lose situation.

I don't see the difference. You just defined debt. If I have credit with someone, I am in debt to that someone, right?

There's a subtle difference.. it's an economic legal phrase, that's all. When giving something to someone who do it in debt, not credit.. by giving a Dollar as "debt" youre offering the value of the Dollar.. to give a Dollar on "credit" you're saying bring that to the bank and they will redeem the value. See?

Pffft, a limited quantity commodity is the only thing that works. The only alternative is a currency that continues to lose value for infinity, and beyond! Bitcoin ensures sufficient granularity by being divisible by up to 8 decimal places.

Yeah. That's the point. It's a theory.. called "Keynesian Economics" .. the point is perpetual growth, perpetual inflation. The Dollar is designed to constantly be inflated .. if it's over inflated it dies, if it deflates it dies.. hence all the wacky rules and regulations to our economic system. We came as close to perfecting it as anyone ever hoped.. the long term livability of it is extended due to oil and our military power. Europe tried a more regulated version of our own system .. but they didn't have the resources we do, and they had an infatuation with Socialism .. it results in their demise. Soon they will monetize like we do .. but the long term livability is very short indeed.

reply to post by Rockpuck

Exactly. And that act of borrowing requires the printing of more money. The end result is continuous inflation. The same thing would happen even with Government issued currency, if they kept printing too much it would cause inflation. Thus the answer is a limited quantity currency.

If you spend more than you make you have to borrow. Since we spend more than the World can ever possibly loan us we borrow from ourselves.

I just cannot completely agree with that statement. History makes it clear how the bankers have done everything possible to implement their semi-private central banks and wrap their claws around money creation, history also shows how multiple Presidents have done everything in their power to abolish these institutions. The Government should just print it's own debt-free currency that it doesn't have to pay back to anyone. It's as simple as that.

My long winded point being that GOVERNMENT in general is the cause of the problem, not the Reserve. the Reserve is a tool, a pawn .. if the Reserve somehow limited or stifled government action or inaction they would tear down the Fed instantly and put something else in its place. It serves the Government and the Government serves... the Government.

But perpetual growth is a myth. The population can't grow forever. The currency supply should be constant, and it should fan out among the population. As growth continues, the currency will deflate, because more people want it, but there's only a set amount of it. Now I don't know about you, but I certainly would prefer my savings to grow in value, not continuously decrease. Infinite inflation is a scam, a hidden tax, a god damn insane delusion that people are brainwashed into thinking is a good thing.

Yeah. That's the point. It's a theory.. called "Keynesian Economics" .. the point is perpetual growth, perpetual inflation.

edit on 4-2-2012 by ChaoticOrder because: (no reason given)

reply to post by ChaoticOrder

Sure.. and when the currency floods out of the country? With our trade deficit alone? We'd be done for within a month.

And limited quantity DOES have inflation .. called supply and demand. When Gold is plentiful costs go up .. when Gold goes away, costs decline. When Gold disappears .. so does business, and people's livelihoods.

History has made it perfectly clear that politicians and government are inept at managing their own finances. Central Banking .. with as many flaws as it has, is a must for the type of society we built. There is no alternative.. if you want to change the support system, you have to change the system .. and people don't want to change.

Ohhhh boy.. tisk tisk tisk .. my Keynesian novice, I will explain:

Perpetual growth IS possible. Until society succumbs and crumbles to tiny little pieces in a morbid catastrophe of epic proportions.

First rule to perpetual growth is a positive Birth Death Cycle. Old people die, young people are born. The United States in the 1970's and 80's was the first nation in the World to experience a phenomenon never before seen in Human history: When people were wealthy, they stopped breeding. This created a conundrum for economist and politicians. By the 1990's it was evident: White people were going to die off due to their wealth status.

Solution?

Brown people!

The USA imports millions of Asians and Hispanics every year, and an additional 25+ million illegal immigrants.

Now the population is booming. Growth at last.

Europe saw it after us, but this decade is the first they too experienced the same phenomenon .. white people stopped breeding when they had money.. so they imported brown people! Arabs, Africans, Asians .. if you were dumb and desperate and willing to work for pennies on the dollar, the Western World wanted you.

Japan is expected to lose 30% of it's population in the next 20 years .. their generation after WWII never had the baby boom we did, and their children didn't have as many children as they did.. the result is a top heavy demographic society, they stagnate while they don't import workers .. but slowly they are allowing more and more people to immigrate .. soon it will be a flood.

But you are right, disperse a fixed currency across the economy and all will be fine. Until people start collecting it. I'll horde it.. I might even kill you for it .. and when the politicians and the judges raise a ruccous I'll throw some at them to keep them happy.. yeah, we've used a fixed currency through much of our history. The worst of Human violence happened for the sake of Gold, manipulation, control, deceit, wars, slavery .. you name it, all for the sake of Gold.

Exactly. And that act of borrowing requires the printing of more money. The end result is continous inflation. The same thing would happen even with Government issued currency, if they kept printing too much it would cause inflation. Thus the answer is a limited quantity currency.

Sure.. and when the currency floods out of the country? With our trade deficit alone? We'd be done for within a month.

And limited quantity DOES have inflation .. called supply and demand. When Gold is plentiful costs go up .. when Gold goes away, costs decline. When Gold disappears .. so does business, and people's livelihoods.

I just cannot completley agree with that statment. History makes it clear how the bankers have done everything possible to impliment their semi-private central banks and wrap their claws around money creation, history also shows how multiple Presidents have done everything in their power to abolish these institutions. The Government should just print it's own debt-free currency that it doesn't have to pay back to anyone. It's as simple as that.

History has made it perfectly clear that politicians and government are inept at managing their own finances. Central Banking .. with as many flaws as it has, is a must for the type of society we built. There is no alternative.. if you want to change the support system, you have to change the system .. and people don't want to change.

But perpetual growth is a myth. The population can't grow forever, and only a certain amount of buildings can ever exist. The currency suppy should be constant, and it should fan out among the population. As growth continues, the currency will deflate, because more people want it, but there's only a set amount of it. Now I don't know about you, but I certainly would prefer my saving to grow in value, not continuoly decrease. It's a scam, a hidden tax, a god damn insane delusion that people are brainwashed into thinking is a good thing.

Ohhhh boy.. tisk tisk tisk .. my Keynesian novice, I will explain:

Perpetual growth IS possible. Until society succumbs and crumbles to tiny little pieces in a morbid catastrophe of epic proportions.

First rule to perpetual growth is a positive Birth Death Cycle. Old people die, young people are born. The United States in the 1970's and 80's was the first nation in the World to experience a phenomenon never before seen in Human history: When people were wealthy, they stopped breeding. This created a conundrum for economist and politicians. By the 1990's it was evident: White people were going to die off due to their wealth status.

Solution?

Brown people!

The USA imports millions of Asians and Hispanics every year, and an additional 25+ million illegal immigrants.

Now the population is booming. Growth at last.

Europe saw it after us, but this decade is the first they too experienced the same phenomenon .. white people stopped breeding when they had money.. so they imported brown people! Arabs, Africans, Asians .. if you were dumb and desperate and willing to work for pennies on the dollar, the Western World wanted you.

Japan is expected to lose 30% of it's population in the next 20 years .. their generation after WWII never had the baby boom we did, and their children didn't have as many children as they did.. the result is a top heavy demographic society, they stagnate while they don't import workers .. but slowly they are allowing more and more people to immigrate .. soon it will be a flood.

But you are right, disperse a fixed currency across the economy and all will be fine. Until people start collecting it. I'll horde it.. I might even kill you for it .. and when the politicians and the judges raise a ruccous I'll throw some at them to keep them happy.. yeah, we've used a fixed currency through much of our history. The worst of Human violence happened for the sake of Gold, manipulation, control, deceit, wars, slavery .. you name it, all for the sake of Gold.

edit on 2/4/2012 by Rockpuck because: (no reason given)

reply to post by Rockpuck

There exists en equilibrium between saving and spending, it will work its self out if given time. You can't be scared of a currency simply because you think everyone will save it and not spend it, it's simply absurd reasoning. People will save what they need and spend what they need, and businesses will simply have to deal with that. It shouldn't be within anyone's power to enforce a crappy currency so no one wants to save it.

Gold never really goes 'away', there is always a relatively constant amount on Earth. That's why it goes up in the long term and always seems to hold it's value well, that's why people buy gold, to protect themselves from inflationary currency. If the dollar wasn't designed to constantly lose value, then perhaps people wouldn't be so inclined to horde gold and take it 'away' from circulation. People do the exact same thing with bitcoin, but I still see plenty of people buying things with bitcoin.

And limited quantity DOES have inflation .. called supply and demand. When Gold is plentiful costs go up .. when Gold goes away, costs decline.

How many people do you think can fit on Earth? Not to mention, inflation is happening at a much faster rate then the growth, so the argument is flawed, there is no balance between growth and inflation, just epic devaluation of the dollar.

First rule to perpetual growth is a positive Birth Death Cycle. Old people die, young people are born.

That's a typical argument against limit quantity currencies. I doubt anyone has died over Bitcoin so far, and even if they have, you can't blame the tool for how it is used. I don't see a problem with 'hording', it's exactly the same as saving. People should be allowed to have savings that don't inflate over time, not be discouraged from saving because the currency wont hold its value.

I'll horde it.. I might even kill you for it ..

There exists en equilibrium between saving and spending, it will work its self out if given time. You can't be scared of a currency simply because you think everyone will save it and not spend it, it's simply absurd reasoning. People will save what they need and spend what they need, and businesses will simply have to deal with that. It shouldn't be within anyone's power to enforce a crappy currency so no one wants to save it.

edit on

4-2-2012 by ChaoticOrder because: (no reason given)

edit on 4-2-2012 by ChaoticOrder because: (no reason given)

I think this article explains the misconceptions of deflation well:

And yet, many experts still say we should "worry about falling prices" because they represent a "destructive force" (according to Martin Wolk at MSNBC, for example). He explains as follows: "As prices keep going down, money grows more valuable. . . ." So far so good!

But he goes on to say that this is actually a bad thing because it creates "an enormous disincentive for consumers and businesses to spend money. Economic activity slows, unemployment rises and demand continues to decline." Well, but that presumes that consumers have something to gain by forever stocking up on dollars and never buying anything, which is absurd. It's true that falling prices create incentives to save, but so long as the preference of consumers is to save instead of spend, that can only prepare the way for a future of economic growth. Consumers save for a reason, namely, to spend later.

---

In economics, it is a good rule that what is good for individuals and families is also good for the economy. Everyone wants a bargain, which is to say a low price. Sadly, in our present age of inflation, lower prices mostly affect specific products and sectors. May the joy we take in falling prices for electronics be expanded to anything and everything we buy. Let the commentators fret and worry about what their fallacious macroeconomic models tell them. The rest of us can sit back and watch our standard of living rise and rise.

Sadly, I doubt we will see any deflation. Even based on the last ten years of data, overall price increases are still the norm.

In fact, since 1913 and the founding of the Fed, the dollar has lost 95 percent of its value. It is far more likely that this robbery will continue rather than for our lost purchasing power to be restored to its rightful owners: you and me.

The Blessings of Deflation

edit on 4-2-2012 by ChaoticOrder because: (no reason

given)

edit on 4-2-2012 by ChaoticOrder because: (no reason given)

reply to post by ChaoticOrder

Uhh .. no, Gold goes away? You spend it, it's gone unless you can get it back. The reason Gold always goes up is because of inflation .. but it's kind of stupid to equate the value of Gold in a hypothetical society that uses Gold as a currency to a society that values Gold in a supposed "fake" currency? Gold can be any value we want it to be.. In an economy that uses Gold as a currency .. the valuation of Gold is based on the total supply in the economy.

Gold can leave an economy, never to return. As has happened numerous times throughout history. It can also be in such abundance as happened in Rome once that the value drops significantly. This is why other metals are used, such as copper, bronze, silver. The poor could live their entire lives and never once see Gold, aside from what they'd see in the Church.

First, I'm never wrong on economic theory. Second it's not about "how may can fit on the planet" it's about moving people. When one group stops breeding you move another group to take its place. That group becomes the new lower class, and they breed accordingly. If they don't breed fast enough you find more, but usually immigrants breed like rabbits. Just look at the juvenile populations of America and Europe: Whites are now a minority, and the immigrants over the past 15 years are now the majority.

This creates the effect of increased demand.. notice this has nothing to do with Dollar devaluation either.. this is about the GDP, economic activity, economic growth. Perpetual growth. The Government then spends accordingly as to what the population needs .. in our case that far exceeds our current revenue so we monetize, devalue the Dollar, and create large amounts of inflation.

I really didn't want to get into the retardation that is Bitcoin. Yeah, no ones ever died from someone stealing bitcoins because bitcoins don't exist. It's a figment of your imagination .. little numbers on a screen, backed by nothing .. you pour money into it and some sap gets rich while you feel like you own something tangible while missing the point of the word. You don't see a problem with hording gold, in a gold backed society? The poor become poorer, they will never see a gold coin, and the rich will have all the power .. it's pre 1600's all over again. There's a lot of flaws with command currencies but one thing can be said for it: It's liberated the people. It's created a surge of prosperity, invention, production and a very wealthy middle class. There are a lot of # up things with our society and our government, but the currency is the least of the troubles.. it all stems to Government and their inept ability at controlling the economy without succumbing to the wills of the very few corporations.

It's not about spending .. think if there was a limited amount of Dollars how fast do you think ALL of the Dollars would be in the hands of the few? Already the top 1% hold the vast majority of the wealth in this country, and that's even with a constantly ever increasing monetary supply. Trust me .. on this .. you don't know what you're talking about. The World isn't rainbows, leprechauns and skittle sh#!$ing unicorns.

It's lost far more than that. It's lost 47% since 2000? Wars. Bailouts. Socialism. Who? The Government.

Gold never really goes 'away', there is always a relatively constant amount on Earth. That's why it goes up in the long term and always seems to hold it's value well, that's why people buy gold, to protect themselves from inflationary currency. If the dollar wasn't designed to constantly lose value, then perhaps people wouldn't be so inclined to horde gold and take it 'away' from circulation. People do the exact same thing with bitcoin, but I still see plenty of people buying things with bitcoin.

Uhh .. no, Gold goes away? You spend it, it's gone unless you can get it back. The reason Gold always goes up is because of inflation .. but it's kind of stupid to equate the value of Gold in a hypothetical society that uses Gold as a currency to a society that values Gold in a supposed "fake" currency? Gold can be any value we want it to be.. In an economy that uses Gold as a currency .. the valuation of Gold is based on the total supply in the economy.

Gold can leave an economy, never to return. As has happened numerous times throughout history. It can also be in such abundance as happened in Rome once that the value drops significantly. This is why other metals are used, such as copper, bronze, silver. The poor could live their entire lives and never once see Gold, aside from what they'd see in the Church.

How many people do you think can fit on Earth? Not to mention, inflation is happening at a much faster rate then the growth, so the argument is flawed, there is no balance between growth and inflation, just epic devaluation of the dollar.

First, I'm never wrong on economic theory. Second it's not about "how may can fit on the planet" it's about moving people. When one group stops breeding you move another group to take its place. That group becomes the new lower class, and they breed accordingly. If they don't breed fast enough you find more, but usually immigrants breed like rabbits. Just look at the juvenile populations of America and Europe: Whites are now a minority, and the immigrants over the past 15 years are now the majority.

This creates the effect of increased demand.. notice this has nothing to do with Dollar devaluation either.. this is about the GDP, economic activity, economic growth. Perpetual growth. The Government then spends accordingly as to what the population needs .. in our case that far exceeds our current revenue so we monetize, devalue the Dollar, and create large amounts of inflation.

That's a typical argument against limit quantity currencies. I doubt anyone has died over Bitcoin so far, and even if they have, you can't blame the tool for how it is used. I don't see a problem with 'hording', it's exactly the same as saving. People should be allowed to have savings that don't inflate over time, not be discouraged from saving because the currency wont hold its value.

I really didn't want to get into the retardation that is Bitcoin. Yeah, no ones ever died from someone stealing bitcoins because bitcoins don't exist. It's a figment of your imagination .. little numbers on a screen, backed by nothing .. you pour money into it and some sap gets rich while you feel like you own something tangible while missing the point of the word. You don't see a problem with hording gold, in a gold backed society? The poor become poorer, they will never see a gold coin, and the rich will have all the power .. it's pre 1600's all over again. There's a lot of flaws with command currencies but one thing can be said for it: It's liberated the people. It's created a surge of prosperity, invention, production and a very wealthy middle class. There are a lot of # up things with our society and our government, but the currency is the least of the troubles.. it all stems to Government and their inept ability at controlling the economy without succumbing to the wills of the very few corporations.

You can't be scared of a currency simply because you think everyone will save it and not spend it

It's not about spending .. think if there was a limited amount of Dollars how fast do you think ALL of the Dollars would be in the hands of the few? Already the top 1% hold the vast majority of the wealth in this country, and that's even with a constantly ever increasing monetary supply. Trust me .. on this .. you don't know what you're talking about. The World isn't rainbows, leprechauns and skittle sh#!$ing unicorns.

In fact, since 1913 and the founding of the Fed, the dollar has lost 95 percent of its value. It is far more likely that this robbery will continue rather than for our lost purchasing power to be restored to its rightful owners: you and me.

It's lost far more than that. It's lost 47% since 2000? Wars. Bailouts. Socialism. Who? The Government.

reply to post by Rockpuck

edit: and I presume it's going to be handed out to the needy? Too bad most of the new money that gets injected into circulation first gets used by the rich and then filters down into the wider economy and inflates the dollar for everyone, after they have used it at its full value.

I'm not talking about it's value in comparison to the dollar, I'm talking about it's overall value compared to all currencies. It slowly goes up because of growth, but the amount of gold can't grow at the same rate, thus it will slowly go up as more and more people want a piece of the limited pie.

The reason Gold always goes up is because of inflation

You can't move people if there's no place to move them pal. It doesn't matter how you try to spin it, you can't ignore the simple logic that infinite growth is impossible. Not to mention you sound like some sort of Human curator trying to manage people based on what an economy is doing, it's absurd.

Second it's not about "how may can fit on the planet" it's about moving people.

I don't think this even deserves a response. You do realize that the majority of money isn't even printed on paper, and is simply numbers on a computer? Bitcoin represents a symbol of exchange, it doesn't need to be backed by anything, and that is the whole entire point I was trying to make in this thread, but you mustn't have understood what I was trying to say.

I really didn't want to get into the retardation that is Bitcoin. Yeah, no ones ever died from someone stealing bitcoins because bitcoins don't exist. It's a figment of your imagination .. little numbers on a screen, backed by nothing ..

Uh huh... so by your logic, the way to stop the rich having so much money is to simply print some more? Your logic is slowly degrading into pure nonsense my friend.

You don't see a problem with hording gold, in a gold backed society? The poor become poorer, they will never see a gold coin, and the rich will have all the power ..

--

It's not about spending .. think if there was a limited amount of Dollars how fast do you think ALL of the Dollars would be in the hands of the few? Already the top 1% hold the vast majority of the wealth in this country, and that's even with a constantly ever increasing monetary supply.

edit: and I presume it's going to be handed out to the needy? Too bad most of the new money that gets injected into circulation first gets used by the rich and then filters down into the wider economy and inflates the dollar for everyone, after they have used it at its full value.

edit on

4-2-2012 by ChaoticOrder because: (no reason given)

I'm sure I understood some of it.

Originally posted by Rockpuck

reply to post by ChaoticOrder

lol.. I don't think you've understood anything I've said... sigh.

You seem to be flip-flopping on basic concepts in order to rationalize different parts of your argument. The main thing you seem to be saying is that the FED is fine, and does it's job (we'll just ignore their secret loans for now) properly, and that the Government is to blame for most for the problems. I agree that the Government is very much responsible, in that it spends way too much and therefore needs to borrow more money, and therefore the FED needs to print more. Considering how much the dollar has been devaluated since the FED came into existence, I would have to say that the FED has something to do with the problem too.

But that's not really the issue of this thread, it's fiat money vs sound money. Can we agree that too much money printing has taken place (caused by excessive Government spending), and this is the cause of the rampant inflation over the last few decades? If so, I would like you to explain to me how such an inflationary currency is a 'good' thing in any sense of the word. Your idea that inflationary currencies are good because we can print more so the rich don't have it all, is just, quite frankly, stupid imo. Explain it to me properly.

edit on 4-2-2012 by ChaoticOrder because: (no reason

given)

edit on 4-2-2012 by ChaoticOrder because: (no reason given)

I just have one thing to say. Gold will soon act like any other asset class in the markets. Just like Real estate, dotcoms, tulips, etc. gold will

reverse in a big way and will stay down for a couple of decades. I don't need to read anymore about how Gold is different and won't crash, just as I

read about real estate, dot coms, etc. Gold is going to crash and it is going to be very soon. All you have to do is look at a long term chart of

Gold. It does a miserable job of keeping up with inflation, until we get economic destruction and then fear drives it back up. Once the fear subsides

it goes right back down.....every time.

I congratulate those who made the trade successfully, but if you look at it as a way of life then you have some ugly developments coming down the pike. Don't worry... I'll be here to remind you again after it happens. 100% equities is the only way to go at this point.

I congratulate those who made the trade successfully, but if you look at it as a way of life then you have some ugly developments coming down the pike. Don't worry... I'll be here to remind you again after it happens. 100% equities is the only way to go at this point.

reply to post by ChaoticOrder

Yeah I'm pretty positive you don't. When talking about economic theory you have to understand it's a theory.. you've demonstrated in your words that your taking it as literal fact or at face value. It's a theory. It happens to be the main economic theory that the entire Western World revolves around.

That would be my opinion over the theory.. I subscribe to a theory called Classical Economics. The Western World (including the USA) uses Keynesian Economics.

No. I'm saying that the Fed works exactly like it's supposed to within the economic theorem I've described. You cannot have the type of economic model we use without the Fed. And without the current economic model our society could not exist as it does. Everything would have to change.

Of course? The Government is spending the money, not the Fed. The Government outlines the budget, not the Fed. The Government issues the debt, not the Fed. The Government appoints the Chairman who adjusts the interest rates. The Government is the one declaring wars we cannot pay for. The Government is the one dishing out billions to buy votes from the poor, or lowering taxes on the rich for financial gain. The Government is the inept asshats who lose bilions every year. Who spend on ridiculous pork projects. The Fed is a tool. When someone hits you in the head with a hammer, do you yell at the hammer? No. You yell at the jackass that hit you!

It's relative and comparable? The currency before the Fed was trash? Literally garbage. We used precious metals (mostly Silver) in coinage, and Credits for paper. But. There is a ratio to value to coinage, it's pre set and alterable .. I won't get into it to much because you won't understand it, but it basically allowed the Government to alter at any time the actual worth and value of a Dollar we gram of Gold. Before that, the Civil War, we had numerous currencies.. some states even printed their own.. aside from silver coins, most of it had no "real" value. And the levels of inflation were insane prior to the Fed, the number of recessions/depressions and economic instability. So you say the Dollar lost value .. compared the relative purchasing power? All currencies change in value, even fixed currencies as you propose because it all comes down to how much is in the market place, which determines the value. Ah damn, see now we get back into the theorems you don't understand..

All money is Fiat money. Fiat means "Command" or implied value. All currencies have implied value unless you're using a fixed resource.. meaning all your coins have to be silver or gold, no credits or valuation, and they have to be 99% pure.

Bah.. you're driving me insane. Under the theory of Keynesian Economics perpetual economic growth is the ultimate goal.. if through small levels of inflation, usually at around 5% per year, the inflation levels alone will account for a portion of the GDP growth needed to give the appearance of growth. Appearance of growth. Appearance. See? It doesn't actually need to grow, people just need to believe it does. Our economy recycles 70% of it's wealth in an internal conveyor belt called "Services" .. everything from wal mart to mcdonalds where there is no production of goods only consumption. Without inflation the currency consolidates or expatriates and it leads to a decline in the consumer monetary supply which in turn leads to something called a "Deflationary Spiral".

A Deflationary Spiral is the death throws of a Keynesian economy.. there have only ever been two Deflationary Spirals in our history: 1929/1930 and 2008. In both cases due to excessive spending on the part of the consumer it led to the use of extended credit to continue the average growth of consumption. When the leverage becomes to high the credit contracts leaving the consumer with a negative revenue to outstanding debt, drastically reducing purchasing power. This all because of the fact that spending in a Keynesian Economy, without proper inflation, will always end with over leverage.

I'm sure I understood some of it.

Yeah I'm pretty positive you don't. When talking about economic theory you have to understand it's a theory.. you've demonstrated in your words that your taking it as literal fact or at face value. It's a theory. It happens to be the main economic theory that the entire Western World revolves around.

You seem to be flip-flopping on basic concepts in order to rationalize different parts of your argument.

That would be my opinion over the theory.. I subscribe to a theory called Classical Economics. The Western World (including the USA) uses Keynesian Economics.

The main thing you seem to be saying is that the FED is fine, and does it's job (we'll just ignore their secret loans for now) properly

No. I'm saying that the Fed works exactly like it's supposed to within the economic theorem I've described. You cannot have the type of economic model we use without the Fed. And without the current economic model our society could not exist as it does. Everything would have to change.

and that the Government is to blame for most for the problems.

Of course? The Government is spending the money, not the Fed. The Government outlines the budget, not the Fed. The Government issues the debt, not the Fed. The Government appoints the Chairman who adjusts the interest rates. The Government is the one declaring wars we cannot pay for. The Government is the one dishing out billions to buy votes from the poor, or lowering taxes on the rich for financial gain. The Government is the inept asshats who lose bilions every year. Who spend on ridiculous pork projects. The Fed is a tool. When someone hits you in the head with a hammer, do you yell at the hammer? No. You yell at the jackass that hit you!

Considering how much the dollar has been devaluated since the FED came into existence

It's relative and comparable? The currency before the Fed was trash? Literally garbage. We used precious metals (mostly Silver) in coinage, and Credits for paper. But. There is a ratio to value to coinage, it's pre set and alterable .. I won't get into it to much because you won't understand it, but it basically allowed the Government to alter at any time the actual worth and value of a Dollar we gram of Gold. Before that, the Civil War, we had numerous currencies.. some states even printed their own.. aside from silver coins, most of it had no "real" value. And the levels of inflation were insane prior to the Fed, the number of recessions/depressions and economic instability. So you say the Dollar lost value .. compared the relative purchasing power? All currencies change in value, even fixed currencies as you propose because it all comes down to how much is in the market place, which determines the value. Ah damn, see now we get back into the theorems you don't understand..

it's fiat money vs sound money

All money is Fiat money. Fiat means "Command" or implied value. All currencies have implied value unless you're using a fixed resource.. meaning all your coins have to be silver or gold, no credits or valuation, and they have to be 99% pure.

Your idea that inflationary currencies are good because we can print more so the rich don't have it all, is just, quite frankly, quite stupid imo. Explain it to me properly.

Bah.. you're driving me insane. Under the theory of Keynesian Economics perpetual economic growth is the ultimate goal.. if through small levels of inflation, usually at around 5% per year, the inflation levels alone will account for a portion of the GDP growth needed to give the appearance of growth. Appearance of growth. Appearance. See? It doesn't actually need to grow, people just need to believe it does. Our economy recycles 70% of it's wealth in an internal conveyor belt called "Services" .. everything from wal mart to mcdonalds where there is no production of goods only consumption. Without inflation the currency consolidates or expatriates and it leads to a decline in the consumer monetary supply which in turn leads to something called a "Deflationary Spiral".

A Deflationary Spiral is the death throws of a Keynesian economy.. there have only ever been two Deflationary Spirals in our history: 1929/1930 and 2008. In both cases due to excessive spending on the part of the consumer it led to the use of extended credit to continue the average growth of consumption. When the leverage becomes to high the credit contracts leaving the consumer with a negative revenue to outstanding debt, drastically reducing purchasing power. This all because of the fact that spending in a Keynesian Economy, without proper inflation, will always end with over leverage.

new topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 26 minutes ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 35 minutes ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 3 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 5 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 14 hours ago, 11 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 15 hours ago, 5 flags -

Sunak spinning the sickness figures

Other Current Events: 14 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 12 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 16 hours ago, 3 flags -

Krystalnacht on today's most elite Universities?