It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by apacheman

I can't let this comment pass.

By far, most business are small, ethical businesses. These are not people that migrate into government. The people in government raise their kids to be people in government. THEY are the ones with no ethical standards. Corruption is rampant in government, especially the federal government. Nepotism is rampant in all governments, federal, state, city, county, you name it. Corruption in government far outweighs corruption in "business."

The huge corporations are governments unto themselves, and are just as corrupt as governments. It is all about power. Absolute power corrupts absolutely.

I can't let this comment pass.

By far, most business are small, ethical businesses. These are not people that migrate into government. The people in government raise their kids to be people in government. THEY are the ones with no ethical standards. Corruption is rampant in government, especially the federal government. Nepotism is rampant in all governments, federal, state, city, county, you name it. Corruption in government far outweighs corruption in "business."

The huge corporations are governments unto themselves, and are just as corrupt as governments. It is all about power. Absolute power corrupts absolutely.

Originally posted by CosmicCitizen

reply to post by jondave

The MF Global (formerly Man Financial by way of spin off from E.D. & F. Man, the centuries old commodity dealer) collapse and more important, loss of customer segregated funds, is serious because it illuminates the inability of regulators (CME, CFTC, NFA and SEC since they were a public company) along with internal accounting (criminal) and custodial banking (negligent) failures to safeguard the funds of the hedgers and speculators. The CME has done a great job at protecting against counter party risk of defaults in trades but was complicit in this case in that it knew of "irregularities" at MFGX before they were made public. The segregation of customer funds from the operating and investing capital of the respective clearing firms is required by law and the untouchability of same has been sacrosanct. Not only have account holders had their excess funds subject to being siphoned off but some traders with positions were then subject to margin calls and loss of their trading positions. In addition others, who were fortunate enough to close out their accounts or transfer excess funds out of their MF Global accounts in the time leading up to the collapse, are also vulnerable to having those funds "clawed back" by the trustees and those funds shared by the pool of investor victims.

What bugs me about the original article was that it was, effect, blaming it on "Obamaish" policies. Which isn't the case.

The reality is very simple. The firm was highly leveraged, and it was leveraged that high because the CEO wanted to make metric farktons of money to add to his avoirdupois farkton of money.

And he screwed up, And it was inevitable and obvious because inevitably they'll be on the wrong side of a position. And it was inevitable that when TSHTF employees do crazy things and TS is spread.

Now, what prevents this from happening? Enforcement of lower leverage and enforcement of strong government financial regulation---backed by criminal personal penalties if necessary.

Now, who is for this and who is against this? In concrete actions the Republican congress voted to reduce funding for CFTC, which would be the regulatory agency directly responsible for preventing this blowup. And they said they did this because they wanted to hinder the power of the CFTC to implement regulations. This is just a few days old.

And this is *Obama's* fault?

If anything the fact that Corzine would be considered for the Obama administration is, to me, evidence even that Obama is far from a socialist, but has to kiss ass to the slightly-less-crazy faction of Big Money, whereas Republicans are gleeful at letting Big Money run things and blow them up.

Changing this is very simple but very difficult: because you have to get in the way of some very powerful people and take away their very large paychecks.

edit on 18-11-2011 by mbkennel because: (no reason given)

Originally posted by SurrealisticPillow

reply to post by apacheman

I can't let this comment pass.

By far, most business are small, ethical businesses. These are not people that migrate into government. The people in government raise their kids to be people in government. THEY are the ones with no ethical standards. Corruption is rampant in government, especially the federal government. Nepotism is rampant in all governments, federal, state, city, county, you name it. Corruption in government far outweighs corruption in "business."

In my experience, US Federal government is less corrupt and more effective, and the employees far more intelligent, than state and local government.

The real corruption comes from the intersection of political power and private wealth, often bypassing and attacking ethical but much less powerful government underlings.

edit on 18-11-2011 by mbkennel because: (no reason given)

edit on 18-11-2011 by mbkennel because: (no

reason given)

reply to post by jefwane

Position limits are coming. That means she can no longer rob consumer markets via the New York Mercantile Exchange and on the Chicago boards.

Adios to all these inflationary creating pirate ships.

Position limits are coming. That means she can no longer rob consumer markets via the New York Mercantile Exchange and on the Chicago boards.

Adios to all these inflationary creating pirate ships.

reply to post by SurrealisticPillow

Define, please, what you mean by a "small, ethical business"?

I fear our definitions will be at considerable variance, since a lot of billionaires and near-billionaires consider themselves "small businessmen".

To me, a small business is one that employs fewer than ten people, including the owners, is managed by the owner, and has revenues of under $1M per year. Ethical means they don't stretch the tax rules too outrageously, don't pollute, and pay each and every one of their employees a living wage that doesn't require a state subsidy for them to survive.

What's yours?

ETA: This might help explain my position:

Why you should NEVER vote for anyone who promises "to run government like a business."

Define, please, what you mean by a "small, ethical business"?

I fear our definitions will be at considerable variance, since a lot of billionaires and near-billionaires consider themselves "small businessmen".

To me, a small business is one that employs fewer than ten people, including the owners, is managed by the owner, and has revenues of under $1M per year. Ethical means they don't stretch the tax rules too outrageously, don't pollute, and pay each and every one of their employees a living wage that doesn't require a state subsidy for them to survive.

What's yours?

ETA: This might help explain my position:

Why you should NEVER vote for anyone who promises "to run government like a business."

edit on 18-11-2011 by apacheman because: (no reason given)

reply to post by mbkennel

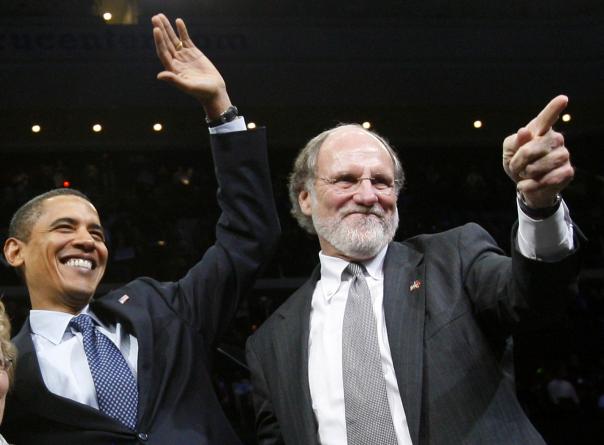

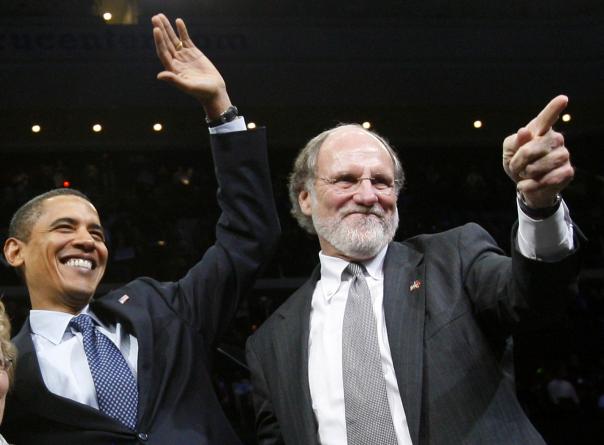

It was not Obama's fault per se. That is, it was not the fault of any policies initiated by his administration. It was; however, on his watch so fair or not he will receive some criticism. Also the fact that Jon Corzine was a big Obama supporter (jock strap might be more a propos in this case) will raise suspicions of favorable treatment for the former CEO in the aftermath of MF Global's collapse. After all of the apparent in proprieties he has not even been charged with any criminal activity (despite the fact that he has hired a criminal lawyer as I understand it). Yes, MFGX was overleveraged in speculative debt (Corzine's supposed specialty at GS) securities...but that is not the crime. If they lose their shirt and cant meet capital requirements then they are out of business but the customer's segregated funds would then be assigned to another clearing member (along with any open positions). The fact that Corzine's firm violated this sacred fiduciary trust is what is criminal. The customers deposited money to use as margin collateral for their commodity futures and options positions not to defacto loan their excess funds to the clearing firm to use without their consent. It is time for the same protective measures for the commodity account customers that exists for securities account customers.

It was not Obama's fault per se. That is, it was not the fault of any policies initiated by his administration. It was; however, on his watch so fair or not he will receive some criticism. Also the fact that Jon Corzine was a big Obama supporter (jock strap might be more a propos in this case) will raise suspicions of favorable treatment for the former CEO in the aftermath of MF Global's collapse. After all of the apparent in proprieties he has not even been charged with any criminal activity (despite the fact that he has hired a criminal lawyer as I understand it). Yes, MFGX was overleveraged in speculative debt (Corzine's supposed specialty at GS) securities...but that is not the crime. If they lose their shirt and cant meet capital requirements then they are out of business but the customer's segregated funds would then be assigned to another clearing member (along with any open positions). The fact that Corzine's firm violated this sacred fiduciary trust is what is criminal. The customers deposited money to use as margin collateral for their commodity futures and options positions not to defacto loan their excess funds to the clearing firm to use without their consent. It is time for the same protective measures for the commodity account customers that exists for securities account customers.

edit on 18-11-2011 by CosmicCitizen because: (no reason given)

CAFR infoCAFRreply to

post by apacheman

Small businesses in my mind are the local shops, not national or international chains. The SBA has their definition, but it includes much larger businesses, probably for political reasons. So, I don't disagree with you there. Now, many professionals are considered small business, like lawyers in private practice, but they have very powerful lobbies to protect them. They may or may not be ethical, but their lobby is more than likely NOT ethical in my opinion.

But, the local shops are vastly more ethical than the national and international big box stores that have powerful lobbyists and the corrupt governments that take their money. The federal government, at the top, are absolutely corrupt. There is no question. Government workers at the grunt level, don't have the power to be corrupt.

It is all about power.

Avoiding taxes by the way, is not a sign of corruption. Avoiding taxes while getting government contracts is. My business doesn't rely on the federal government in any way. In fact, the federal government is the main obstacle to our economic recovery. They exist off of the revenues from the many assets under their control.

The COMPREHENSIVE ANNUAL FINANCE REPORT is available on the internet. The feds have one, and each state has one.

They don't need our tax money, they get plenty from "public" assets. But, that is a different subject.

Small businesses in my mind are the local shops, not national or international chains. The SBA has their definition, but it includes much larger businesses, probably for political reasons. So, I don't disagree with you there. Now, many professionals are considered small business, like lawyers in private practice, but they have very powerful lobbies to protect them. They may or may not be ethical, but their lobby is more than likely NOT ethical in my opinion.

But, the local shops are vastly more ethical than the national and international big box stores that have powerful lobbyists and the corrupt governments that take their money. The federal government, at the top, are absolutely corrupt. There is no question. Government workers at the grunt level, don't have the power to be corrupt.

It is all about power.

Avoiding taxes by the way, is not a sign of corruption. Avoiding taxes while getting government contracts is. My business doesn't rely on the federal government in any way. In fact, the federal government is the main obstacle to our economic recovery. They exist off of the revenues from the many assets under their control.

The COMPREHENSIVE ANNUAL FINANCE REPORT is available on the internet. The feds have one, and each state has one.

They don't need our tax money, they get plenty from "public" assets. But, that is a different subject.

edit on 18-11-2011 by SurrealisticPillow because: The CAFR

edit on 18-11-2011 by SurrealisticPillow because: (no reason

given)

reply to post by SurrealisticPillow

We agree on more than we disagree.

But most businessmen who enter politics are most assuredly not small businessmen by our definition. Most are corporatists, lawyers, and similar ilk, and bring their predatious corrupt ways into government with them.

Government isn't inherently corrupt and inefficient, it is made so by those who wish to profit from governance, as opposed to those who wish to serve their country's (the whole of it) best interests.

We agree on more than we disagree.

But most businessmen who enter politics are most assuredly not small businessmen by our definition. Most are corporatists, lawyers, and similar ilk, and bring their predatious corrupt ways into government with them.

Government isn't inherently corrupt and inefficient, it is made so by those who wish to profit from governance, as opposed to those who wish to serve their country's (the whole of it) best interests.

edit on 18-11-2011 by apacheman because: (no reason given)

reply to post by apacheman

True.

What I have noticed over the last several decades, is that punishment for crimes by those in high offices is practically nonexistent. This is a sure sign of corruption. Certainly it happens at the state level as well.

I pay more in taxes than I take home. In fact, last year, I survived by being given a loan by a personal friend because my business made NO money and I was not able to take a check. Yet, we still had to pay taxes.

The government has a weird way of determining if you made money that has nothing to do with whether you actually made money. Only the wealthy it seems are able to turn that around and make millions while showing a loss. I sure can't.

Anyway, we probably agree on more than we disagree as you say.

True.

What I have noticed over the last several decades, is that punishment for crimes by those in high offices is practically nonexistent. This is a sure sign of corruption. Certainly it happens at the state level as well.

I pay more in taxes than I take home. In fact, last year, I survived by being given a loan by a personal friend because my business made NO money and I was not able to take a check. Yet, we still had to pay taxes.

The government has a weird way of determining if you made money that has nothing to do with whether you actually made money. Only the wealthy it seems are able to turn that around and make millions while showing a loss. I sure can't.

Anyway, we probably agree on more than we disagree as you say.

The collapse of our monetary system will be complete. The US administration knows this, and is preparing. Soon war will come to Iran as a

distraction, but they know it will not work this time. The OWS movement will become an anti-war movement as well. It will become more and more

violent, and the USA will use this as an excuse to declare martial law. Your rights will then be removed one by one.

We are entering some very interesting times. Prepare yourselves.

We are entering some very interesting times. Prepare yourselves.

Linked from Jesse's Café Américain.

ETA: More On Legal Stealing - The Infamous CFTC Rule 1.29

Tiny Rule Change at Heart of MF Global Failure

By William D. Cohan

November 15, 2011, 9:15 PM EST

Nov. 16 (Bloomberg) -- Laurie R. Ferber has quite a resume. She is currently the general counsel of MF Global Holdings Ltd., the New York-based futures and commodities brokerage that filed for bankruptcy on Oct. 31, listing some $40 billion in liabilities....

Before that, she spent more than 20 years at Goldman Sachs Group Inc., where first she was general counsel for J. Aron & Co., a commodities business that Goldman Sachs bought in 1981, and then was the co-general counsel of Goldman’s principal business, known as FICC -- for Fixed Income, Currency and Commodities -- when J. Aron was merged into the rest of Goldman’s fixed-income division.

But at the moment, her greatest significance may be as a long-time advocate for revisions to a little-known and vastly underappreciated Commodities Futures Trading Commission rule called Regulation 1.25.

Before 2000, the rule permitted futures brokers to take money from their customers’ accounts and invest it in a number of approved securities limited to “obligations of the United States and obligations fully guaranteed as to principal and interest by the United States (U.S. government securities), and general obligations of any State or of any political subdivision thereof (municipal securities.)” That is, relatively safe securities with high liquidity.

Internal Repo Allowed

The banks, however, pushed the CFTC to expand the investment options that would allow firms to practice “internal repo.” In this scheme, money is taken from customer accounts and invested short-term in a variety of securities, with the futures brokers reaping the not- insignificant financial rewards from their customers’ money.

And, lo and behold, such efforts were successful. In December 2000, the CFTC agreed to amend Regulation 1.25 “to permit investments in general obligations issued by any enterprise sponsored by the United States, bank certificates of deposit, commercial paper, corporate notes, general obligations of a sovereign nation, and interests in money market mutual funds” -- in other words, riskier investments that could make more money for Wall Street.

Then, in February 2004 and May 2005, Regulation 1.25 was further amended and refined to the liking of Ferber and the banks. In the end, the door was opened for firms such as MF Global to do internal repos of customers’ deposits and invest the funds in the “general obligations of a sovereign nation.” - Full Post

ETA: More On Legal Stealing - The Infamous CFTC Rule 1.29

edit on 18-11-2011 by OBE1 because: (no reason given)

Thanks to everyone for participating in this thread. I especially appreciate those who've been here since '08. I wanna reply to some of the things

I've seen addressed since last night.

reply to post by bone13

First this COLLAPSE was started under Clintons congress, then Bushes congress made it worst, with all the infomation WE as voters have, lets put the blame where it belongs, CONGRESS

I agree, but you must realize that the institution of TBTF and bailouts started as far back as Reagan. Check out Continental Illinois. This and Chrysler were really the first time the words two big to fail entered our lexicon. That along with the beginnings of dismantling Glaas-Steagal, the beginings of the de-industrialization and finacialization of the US, and the exponential growth in debt

reply to post by apacheman

I'm glad your position refined a bit after that first post because without follow up it is hands down the stupidest post on this thread. Mainly the part about the efficiency of government versus business. That sentiment is laughable. I have experience in government specifically the military, small business specifically my first job and a couple of other jobs through the years, and large corporations specifically 2 different major telecoms. Of the three the small business was by far the most efficient. The 2 major companies are surprisingly nearly as bad as the military in pissing away money.

Like I said I'm glad you refined your view when challenged. I whole heartedly believe that business and governments should have totally different societal roles. Business's job is to make a profit for those that put their capital at risk. Governments job is to provide for the common welfare. I don't believe business should ever be: running prisons, enforcing laws, collecting taxes, or making war. Likewise there are a myriad of things done by business the government should never be a part of foremost of which should be bailing out those that made stupid business risks.There are several industries and services that can be debated by logical and reasonable people as to whether they should be business or government roles. Education, Healthcare, and certain utilities come to mind as well as some gov/biz partnerships.

reply to post by Earthmuffin33

You're welcome. Crazy and Correct are not mutual exclusive terms are they?She's also a hard right conservative. I feel most of her assessment

is correct.

I'm wondering when where the next boom will originate. I'm reasonably certain that US exposure to European debt woes is vastly understated.

I also find it interesting that the biggest company collapse since Lehman has gotten so little attention. Imagine if it was a company run by Cheney or Paulson. It is also noteworthy that the MF Global failure also marks the high water mark thus far democratic support for OWS and toleration of the protests. Can you imagine what could happen if suddenly a major financial institution fails to the point of blackmailing the .gov like in 2008 for a bailout while there are thousands on the street nationwide? Hmmmm

reply to post by bone13

First this COLLAPSE was started under Clintons congress, then Bushes congress made it worst, with all the infomation WE as voters have, lets put the blame where it belongs, CONGRESS

I agree, but you must realize that the institution of TBTF and bailouts started as far back as Reagan. Check out Continental Illinois. This and Chrysler were really the first time the words two big to fail entered our lexicon. That along with the beginnings of dismantling Glaas-Steagal, the beginings of the de-industrialization and finacialization of the US, and the exponential growth in debt

reply to post by apacheman

I'm glad your position refined a bit after that first post because without follow up it is hands down the stupidest post on this thread. Mainly the part about the efficiency of government versus business. That sentiment is laughable. I have experience in government specifically the military, small business specifically my first job and a couple of other jobs through the years, and large corporations specifically 2 different major telecoms. Of the three the small business was by far the most efficient. The 2 major companies are surprisingly nearly as bad as the military in pissing away money.

Like I said I'm glad you refined your view when challenged. I whole heartedly believe that business and governments should have totally different societal roles. Business's job is to make a profit for those that put their capital at risk. Governments job is to provide for the common welfare. I don't believe business should ever be: running prisons, enforcing laws, collecting taxes, or making war. Likewise there are a myriad of things done by business the government should never be a part of foremost of which should be bailing out those that made stupid business risks.There are several industries and services that can be debated by logical and reasonable people as to whether they should be business or government roles. Education, Healthcare, and certain utilities come to mind as well as some gov/biz partnerships.

reply to post by Earthmuffin33

I'm wondering when where the next boom will originate. I'm reasonably certain that US exposure to European debt woes is vastly understated.

I also find it interesting that the biggest company collapse since Lehman has gotten so little attention. Imagine if it was a company run by Cheney or Paulson. It is also noteworthy that the MF Global failure also marks the high water mark thus far democratic support for OWS and toleration of the protests. Can you imagine what could happen if suddenly a major financial institution fails to the point of blackmailing the .gov like in 2008 for a bailout while there are thousands on the street nationwide? Hmmmm

For those saying it's not Obama's fault...

You're right it's not just Obama's fault. It's Every single politician in office right now's fault. Rather than reinstating glass steagal and appointing special prosecutors they have bailed out the rich time and again. Truth be told not a single serving member of congress the senate or the presidency should ever get another vote from us again.

We as a people need a grand gesture to show those at the top we're serious about the rule of law being enforced for EVERYONE, and not just the poor like it is now.

What that gesture should be I do not know, but I suspect that if we started voting out every single incumbent in every single election from here on out it would be a good start.

You're right it's not just Obama's fault. It's Every single politician in office right now's fault. Rather than reinstating glass steagal and appointing special prosecutors they have bailed out the rich time and again. Truth be told not a single serving member of congress the senate or the presidency should ever get another vote from us again.

We as a people need a grand gesture to show those at the top we're serious about the rule of law being enforced for EVERYONE, and not just the poor like it is now.

What that gesture should be I do not know, but I suspect that if we started voting out every single incumbent in every single election from here on out it would be a good start.

Any economy based in truth will survive the tumult we stand on the brink of.

Even if we have to pare it down to bartering via wifi, we need to get together as PEOPLE, and run big business out of our government.

The only way to do that that seems viable is what we are seeing develop in the streets right now.

Support your local OWS'ers!

Even if we have to pare it down to bartering via wifi, we need to get together as PEOPLE, and run big business out of our government.

The only way to do that that seems viable is what we are seeing develop in the streets right now.

Support your local OWS'ers!

Originally posted by CosmicCitizen

reply to post by mbkennel

It was not Obama's fault per se. That is, it was not the fault of any policies initiated by his administration. It was; however, on his watch so fair or not he will receive some criticism. Also the fact that Jon Corzine was a big Obama supporter (jock strap might be more a propos in this case) will raise suspicions of favorable treatment for the former CEO in the aftermath of MF Global's collapse. After all of the apparent in proprieties he has not even been charged with any criminal activity (despite the fact that he has hired a criminal lawyer as I understand it).

And there have been some subpoenas from the FBI. It looks serious. And it doesn't look like Corzine has gotten or will be getting any special treatment---so far, and it doesn't appear, so far, that Obama is pulling any strings to get him off easy.

I expect that Corzine will be at least charged with serious civil penalties (probably because somebody lower actually committed the crimes) and probably convicted.

Look at the prosecutorial record so far:

* Bernie Madoff---and only because he confessed to his sons who turned him in. (BTW, I really don't think the sons knew. One was so angry he was not on speaking terms with his father and committed suicide).

* A Sri Lankan guy for stock trading. (The stock market this time was completely innocent of anything in the global collapse, financial crises nearly always come from bond markets)

* Probably some people at MF Global

* One low-level trader at Goldman with a French name.

Notice who is NOT getting any attention? The huge conspirators of the real, ginormous conspiracies. Fabrice Tourree (the goldman guy) was doing what his bosses told him to (move deals), and he assumed that people who put them together passed it by legal.

Yes, MFGX was overleveraged in speculative debt (Corzine's supposed specialty at GS) securities...but that is not the crime. If they lose their shirt and cant meet capital requirements then they are out of business but the customer's segregated funds would then be assigned to another clearing member (along with any open positions). The fact that Corzine's firm violated this sacred fiduciary trust is what is criminal. The customers deposited money to use as margin collateral for their commodity futures and options positions not to defacto loan their excess funds to the clearing firm to use without their consent. It is time for the same protective measures for the commodity account customers that exists for securities account customers.

edit on 18-11-2011 by CosmicCitizen because: (no reason given)

I agree 100%. It's true that leverage by itself didn't cause the crime. But leverage means blowups, and blowups are inevitably temptations for crime. And really, the world does not benefit from having 40:1 leverage. Unless you're a private trader on a small private hedge fund where the blowup is 100% your problem, there is too much collateral damage. The Fed had to bail out LTCM. MF Global has clients. There's no such thing as "segregated" when the push of a button makes it "desgregated". It's only "segregated" if there is no access at all, ever.

If MF Global and all other similar firms had only 10:1 leverage what would be the problem? Nothing, other than a handful of CEOs would have to choose if they wanted to run an operational company which made money from other people, or ran a hedge fund where their own rear was 100% on the line for losses as well as profits.

They wanted both: paid like a hedge fund, but with a steady source of other people's capital, other people who didn't sign up for this risk in the slightest. The temptation to do this is enormous because the rewards are enormous (it is the same as in banking).

The solution is generally pretty simple, and in fact existed for many decades with a successful, placid financial system: bring back the modern Glass-Steagall Act, and turn all investment banks into *unlimited* liability partnerships. How it was from 1933 through the late 1980's,1990's. (in the 19th century there were massive banking crises and panics every 10-20 years; with FDR regulation, none; with modern conservative deregulation, one big one (S&L), and one giant one (2008), right on schedule).

Glass Steagall: regulated operations with other people's money are separated, completely and fundamentally, from risk-taking hedge funds and investment banks. JP Morgan needs to divorce Chase Manhattan.

Partnerhips: back in the day, a firm like Goldman Sachs and the like were not LLC or C-corporations. The managing partners (what it means to 'make partner') owned a fraction of the business. Most of their personal wealth was this ownership share, and they risked that and their houses & personal bank accounts on everything.

Well well a broker with some integrity.... I heard Rush Limbagh read the letter on his radio program...

Also the hacks bashing Celente did not listen to the video to discover what actually happened and he was following his own advice the money they stole from him was not being traded in the market and he explained how he used futures contracts to take possession of physical gold and it is only one part of his strategy, he buys physical gold directly also as his mainstay. futures contracts were only to expand his physical holdings, and he can afford it. Most of those he advised to get out of the markets probably could not afford to do what he was doing and lose the money to crooked brokers.

Also the hacks bashing Celente did not listen to the video to discover what actually happened and he was following his own advice the money they stole from him was not being traded in the market and he explained how he used futures contracts to take possession of physical gold and it is only one part of his strategy, he buys physical gold directly also as his mainstay. futures contracts were only to expand his physical holdings, and he can afford it. Most of those he advised to get out of the markets probably could not afford to do what he was doing and lose the money to crooked brokers.

Rather than start another thread, I figured I'd post this here.

MF Global trustee says $1.2B or more missing

That's double the initial amount that was missing from customer accounts. The yahoo link is sourced from the AP, notice anything missing in Corzine's bio?

I think it's notable that Goldman Sachs chief is more worthy of mention than Governor of New Jersey or United States Senator from New Jersey. The lack of media coverage of something like this is quite frankly disgusting. This is the crap that pissed people off enough to start the Tea Party and is exactly the type of corruption that has thousands in the streets for OWS.

The fallout from this still ain't over. In my opinion every day Jon Corzine walks free is a day that proves there is one set of laws for us and another for the powerful and corrupt in both parties. I've seen some allegations that certain counterparties (cough JP Morgan cough) of MF Global were able to get out just before things went to hell. This is a story to watch people. Not as important as the European debt woes that caused the bets to sour,but important because it's another example of the corruption that has looted this country from both DC and Wallstreet.

MF Global trustee says $1.2B or more missing

The court-appointed trustee overseeing MF Global's bankruptcy says up to $1.2 billion is missing from customer accounts, double what the firm had reported to regulators last month.

That's double the initial amount that was missing from customer accounts. The yahoo link is sourced from the AP, notice anything missing in Corzine's bio?

MF Global was led by former Goldman Sachs chief Jon Corzine. The firm collapsed after making a disastrous bet on European debt.

I think it's notable that Goldman Sachs chief is more worthy of mention than Governor of New Jersey or United States Senator from New Jersey. The lack of media coverage of something like this is quite frankly disgusting. This is the crap that pissed people off enough to start the Tea Party and is exactly the type of corruption that has thousands in the streets for OWS.

The fallout from this still ain't over. In my opinion every day Jon Corzine walks free is a day that proves there is one set of laws for us and another for the powerful and corrupt in both parties. I've seen some allegations that certain counterparties (cough JP Morgan cough) of MF Global were able to get out just before things went to hell. This is a story to watch people. Not as important as the European debt woes that caused the bets to sour,but important because it's another example of the corruption that has looted this country from both DC and Wallstreet.

Check this out.

Open Secrets

Open Secrets

Barack Obama BundlersMin Max Name City State Employer Contributions

Katzenberg, Jeffrey Los Angeles CA DreamWorks SKG 2,054,292

Cohen, David Philadelphia PA Comcast Corp 1,059,381

Stetson, Jane Norwich VT Democratic National Cmte 990,048

Effron, Blair New York NY Centerview Partners 946,037

Corzine, Jon Hoboken NJ MF Global 933,032

Kempner, Michael East Rutherford NJ MWW Group 729,803

edit on 21-11-2011 by jefwane because: (no reason given)

reply to post by OBE1

It is sickening, is it not? So JP Morgan transferred money out of customer funds...

And they still have it! 2Mil so it seems...

And in the mean time, www.thisislondon.co.uk

And the Ranchers and Farmers who trusted MF Global are left high and dry.

Pardon me while I rant...

And even more damning...

Joe Biden called Jon Corzine for advice on what to do about the economy.

It is sickening, is it not? So JP Morgan transferred money out of customer funds...

And they still have it! 2Mil so it seems...

And in the mean time, www.thisislondon.co.uk

Investigators on the hunt for more than $1 billion (£644 million) of customers' money that seems to have gone missing from collapsed broker MF Global reckon a chunk of it has turned up in the London accounts of JPMorgan.

And the Ranchers and Farmers who trusted MF Global are left high and dry.

“The farmers, small business owners and others who trusted this firm are now facing tremendous hardship and may ultimately never recover all of their money,” said Michigan Sen. Debbie Stabenow, Senate Agriculture Committee Chairwoman. “A discovery of this magnitude demonstrates yet again the need for strong oversight and protections for consumers to prevent this sort of abuse from occurring. Anyone engaged in wrongdoing in this matter must be swiftly held accountable, to help bring justice to victims and to prevent further erosion of confidence in the financial system.” insurancenewsnet.com...

Pardon me while I rant...

And even more damning...

Joe Biden called Jon Corzine for advice on what to do about the economy.

new topics

-

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 32 minutes ago -

Hate makes for strange bedfellows

US Political Madness: 2 hours ago -

Who guards the guards

US Political Madness: 5 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 7 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 2 hours ago, 12 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 17 hours ago, 11 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 12 hours ago, 10 flags -

Who guards the guards

US Political Madness: 5 hours ago, 9 flags -

1980s Arcade

General Chit Chat: 14 hours ago, 6 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 16 hours ago, 4 flags -

Deadpool and Wolverine

Movies: 15 hours ago, 4 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 7 hours ago, 2 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 32 minutes ago, 2 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 691 • : Threadbarer -

The Fight for Election Integrity Continues -- Audits, Criminal Investigations, Legislative Reform

2024 Elections • 4142 • : IndieA -

Hate makes for strange bedfellows

US Political Madness • 20 • : Cvastar -

1980s Arcade

General Chit Chat • 16 • : theatreboy -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 107 • : WeMustCare -

What do you guys think of this UFO footage?

Aliens and UFOs • 12 • : Cvastar -

Fast Moving Disc Shaped UFO Captured on Camera During Flight from Florida to New York City

Aliens and UFOs • 21 • : Cvastar -

New York Governor Hochul Assures Business Owners that ONLY Donald Trump is being Targeted.

General Conspiracies • 94 • : WeMustCare -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat • 1 • : network dude -

Russia Ukraine Update Thread - part 3

World War Three • 5714 • : stu119