It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

just had a look at the indices, snp and currencies, you may have a point, doji's everywhere in line with the current trendline on both western and

asian markets, also it's struggling to make headway beyond the fib on the pivots. SELL SELL SELL

Hope and pray nothing happens...My parents are interested in buying a house and their super-excited about it. This would crush their ambitions and

leave them despondant.

I myself am cognizant enough not to entertain vain desires like 'buying a house' though, nonetheless, i am excited about moving. House we currently live in a little cramped.

If something does happen Monday, and the economy finally buckles, or alteast undergoes another 2008 fiasco, then, thats life. Enjoy it. Its always full of surprises.

I myself am cognizant enough not to entertain vain desires like 'buying a house' though, nonetheless, i am excited about moving. House we currently live in a little cramped.

If something does happen Monday, and the economy finally buckles, or alteast undergoes another 2008 fiasco, then, thats life. Enjoy it. Its always full of surprises.

I just read this comment from cowdiddly in the comments section located on the Zero Hedge article:

If this is indeed true, what we're seeing here is the CME existing in J.P. Morgan's pocket and the CME making another move to SUBSTANTIALLY line J.P. Morgan's pockets in silver thread. While it would take a great deal of connecting the dots to prove this, if indeed this is true then what we're seeing is another blatant strong arm robbery of the American people by the CME and J.P. Morgan!!!

Can anyone here verify exactly how many silver contracts J.P. Morgan has in it's portfolio currently?

Edit to Add:

The CFTC announced an investigation into the manipulation of the silver market Friday...

huh? Did they catch that J.P.Morgan thingy?

Dang, that post just reminded me of something. JPM silver shorts-MON. I would guess they still have at least 25k 5000 ounce contracts short if not substantially more, as they have not crashed it but one time and seem in no hurry to unload the rest. Everyone is waiting for round two to be unloaded before Jan1 when the m Frank posistion limits kick in and the dumb#s finally define what a swap is. Is this to force them out? The price of holding those shorts just went up bigtime.? If thats the case I take back every vile thing I ever called you Gensler. You little worm.

Silver is fixing to get MONKEYHAMMERED ShortTerm. No wonder Gainsville sent me an ad for eagles at 2.29 over spot after asking a 5er all year. Hmmmmm....................Im going to have to rent an armored car.

If this is indeed true, what we're seeing here is the CME existing in J.P. Morgan's pocket and the CME making another move to SUBSTANTIALLY line J.P. Morgan's pockets in silver thread. While it would take a great deal of connecting the dots to prove this, if indeed this is true then what we're seeing is another blatant strong arm robbery of the American people by the CME and J.P. Morgan!!!

Can anyone here verify exactly how many silver contracts J.P. Morgan has in it's portfolio currently?

Edit to Add:

The CFTC announced an investigation into the manipulation of the silver market Friday...

huh? Did they catch that J.P.Morgan thingy?

edit on 5-11-2011 by Heyyo_yoyo because: (no reason given)

Originally posted by mrsparkles669

THIS WHOLE TOPIC HAS IT WRONG.

Listen to the above Dance4life poster,

They are LOWERING initial deposit margin.

This is actually allowing people MORE leverage/margin at the moment, not less........no margin calls, no massive chaos on monday, just more contracts for less money. Most likely temporarily.

This is coming from the CME Twitter feed after they saw the blowback.

The simple fact is......MF Global is going bankrupt and has billions in remaining customer accounts and open positions that the customers do not wish to close yet. CME will be taking on, hundreds of millions of dollars in customer accounts over the next few days weeks.

To avoid forcing the former MF Global clients to have to close their positions or put in millions more, they are, for the time being, lowering the initial margin requirements so they can transfer their accounts!

This is the exact opposite of the initial interpretation and hence, has the exact opposite effect of this alarmist post.

REMEMBER: When a huge event does happen, just like in 9/11/01 and just like 3/11 this year, there may be some small indicators, but it sure won't be broadcast so openly.

I just think they didn't expect people to understand what was going on and when they saw the crap starting to hit the net, they reversed the situation.

TPTB were about the lower the bomb that was going to destroy the global economy.

People been warned - get your preps ready, they are starting the beginning of the end.

just a fyi,

Chase bank disabled online bill pay today and sunday. no time to make a thread but something is going on.

Chase bank disabled online bill pay today and sunday. no time to make a thread but something is going on.

UPDATE : IT WAS CLARIFIED BY CME :

CME Issues Clarification On Margins: To Usher More Risk, Less Liquidity In MF Aftermath

But this move by CME REDUCES margins requirements, meaning : even more leverage, more risk.

This is insanity.

So no crash monday, but it will create a bigger crash when it does happen.

CME Issues Clarification On Margins: To Usher More Risk, Less Liquidity In MF Aftermath

Yesterday, in what is the worst-phrased and most misleading press release to ever come out of the CME, the exchange issued a notice that going forward all Initial margin would be equal to Maintenance margin. Our gut interpretation was that "Unless we are completely reading it incorrectly, it is nothing short of a margin call for tens if not hundreds of billions worth of product." Judging by the broad response, our initial reaction is what a prudent, logical human being would assume: after all, it is precisely the undercollateralization of customer accounts, and general underfunding at MF Global that is what brought that particular company down. Well, we were wrong.

But this move by CME REDUCES margins requirements, meaning : even more leverage, more risk.

the CME has followed up its vague press release from yesterday by inviting even more risk in lowering the initial margin. Why is this a cause for even greater concern? As the CME itself says, "Initial margins are set to provide an additional buffer against future losses in the account" - so going forward that buffer has been reduced by about 30%. But what is the reasoning provided by CME: "The intent and effect of these changes is to decrease the size of any margin calls resulting from the bulk transfer of MF Global customers to new clearing members, not to increase them." So basically the CME is implicitly putting all of its existing and current clients and customers at further risk by onboarding the accounts of those clients who, like lemmings, held on to their MF Global accounts until after it was too late. Because while the lower Initial margin may apply to MF accounts, it will also apply to any Tom, Dick and Harry beginning Monday, who will suddenly see a 30% reduced gating threshold to put on a position. Any position, no matter how risky.

This is insanity.

So no crash monday, but it will create a bigger crash when it does happen.

What is particularly strange, and for that matter, annoying, is the wording of the initial CME release as per ZH's post. Why be so careless to post

something that at best is ambiguous to be misinterpreted when the information is clearly something so crucial and important to investors involved?

There is no way such crucial information made public would not of been cleared by anyone less than top management or whoever the equivalent.

This is not a fear-mongering issue as some have argued here, this is plain incompetence on the part of CME.

This is not a fear-mongering issue as some have argued here, this is plain incompetence on the part of CME.

reply to post by Dinogur

No!

he will commit suicide.

have you not noticed his depress't looks!

off to the cash machine!

going to empty it.

I cannot find a credit union in birmingham that is saine.

you have to go to church!!!!

oh well. it all falls down any way.

No!

he will commit suicide.

have you not noticed his depress't looks!

off to the cash machine!

going to empty it.

I cannot find a credit union in birmingham that is saine.

you have to go to church!!!!

oh well. it all falls down any way.

edit on 5-11-2011 by buddha because: why not

Originally posted by surrealist

What is particularly strange, and for that matter, annoying, is the wording of the initial CME release as per ZH's post. Why be so careless to post something that at best is ambiguous to be misinterpreted when the information is clearly something so crucial and important to investors involved? There is no way such crucial information made public would not of been cleared by anyone less than top management or whoever the equivalent.

This is not a fear-mongering issue as some have argued here, this is plain incompetence on the part of CME.

Exactly. I bet most will blame ZeroHedge for that anyways...

I like reading ZeroHedge, even if he is wrong, still fun to read.

People need to relax a little (and this is coming from one who preps for an economic collapse - you still have to have fun in your life)

People need to relax a little (and this is coming from one who preps for an economic collapse - you still have to have fun in your life)

reply to post by Vitchilo

What time (GMT) on Monday does all this happen? I need to know because usually on Mondays I travel on my flying saucer to Nibiru to begin my new week in the proper way but if there is to be a margin melt (like a cheese melt only with green cheese) then I'll stick around to watch it happen. If you don't know what time that's OK too I'll just either watch the reruns or next year when it appears as an episode on South Park...

What time (GMT) on Monday does all this happen? I need to know because usually on Mondays I travel on my flying saucer to Nibiru to begin my new week in the proper way but if there is to be a margin melt (like a cheese melt only with green cheese) then I'll stick around to watch it happen. If you don't know what time that's OK too I'll just either watch the reruns or next year when it appears as an episode on South Park...

edit on 5-11-2011 by trailertrash because: (no reason given)

Darn and here i was getting ready to say YAWN another sky is falling thread turns out it won't be falling Monday but someday soon.

Heard this song and dance before so no offense wake me when it's over.

Heard this song and dance before so no offense wake me when it's over.

I cannot post a new thread, because I am too new, but this "It Ends Monday" thread needs a new thread, because all the assumptions of the OP are now

borne out to be wrong. Tyler Durden misinterpreted the CME advisory. The CME issued a clarification today, saying that the INITIAL MARGIN will be

lowered to the MAINTENANCE MARGIN on all futures positions. So if you are going to make bets Monday morning based on Zero Hedge's prognostications as

of Friday night, STOP!!!!!!!!! So Apocalypse Later, just not now.

edit on 5-11-2011 by artfuldodger because: Misspeilling.

edit

on 5-11-2011 by artfuldodger because: Grammar

What I would like to know is where do I put My small retirement savings. US dollar bonds? Gold? Silver? rice? or what? Everyone seems so negative on

everything. If everything tanks, what is the loss, it seems something has to hold.

Originally posted by Advantage

Originally posted by Screwed

Please explain to those of us who are financially retarded WHAT exactly ends Monday?

My Mommy told me there's no such thing as a stupid question.

Zombie apocalypse monetary armageddon domino doomtardedness!!! DUDE, RUN!!!

Nahh, just banks getting a wake up call with the "pull all your money out of the bank" thing and the usual domino-of-bad-banking-practices-hopefully-coming-to-a-head-but-I-doubt-it scenario and of course the world economy imploding.. and look, just run around in circles and scream.. .

If the food trucks stop coming to the cities due to hyperinflation, then I will be "going camping".

For us "doomtards" that might be defined as bugging out as ppl figure out

fiat currency has no intrinsic value and really is just paper and ink backed by nothing.

Originally posted by Hellas

Originally posted by bobs_uruncle

reply to post by Vitchilo

Isn't November 7th a little early? Isn't the Obamanator going to be doing the DEFCON 1 test hunkered down in a bunker on November 9th? Isn't the "big rock" Yu-55 suppose to come by and say "hello....buh-bye" between November 9th and 10th? And what about 11.11.11? Too many disasters in for one week, but at least we know the most useless parasites in society are well prepared, that being politicians.

Cheers - Daveedit on 11/4.2011 by bobs_uruncle because: (no reason given)

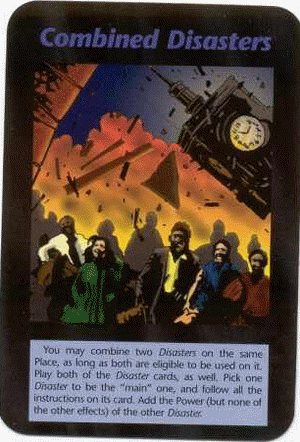

The Clock shows 11:11edit on 5-11-2011 by Hellas because: (no reason given)

But that could be 11:11 which happens twice per day (unless you are on mil time like me) or 11/11 once per year every ear. No year has been specified in the Illuminati Card game. Are there other clues that would date this year as the specific year? Maybe it's 11:11 on November 11, 2012? Or maybe it's 11:11 in the morning on April Fool's Day 2015. I realize that there do seem to be an overwhelming number of "disasters" and tests this coming week, but I think we need better data before we jump to any conclusions. But then again... who knows?

Edit: One thing I did notice on that card however, is there are five people and six shadows of heads, 11? The falling timer also looks like an inverted cross. There seems quite a few symbols in the card, of course it may just be a coincidence (while remember my CO's rule about that).

Cheers - Dave

edit on 11/5.2011 by bobs_uruncle because: (no reason given)

Originally posted by artfuldodger

I cannot post a new thread, because I am too new, but this "It Ends Monday" thread needs a new thread, because all the assumptions of the OP are now borne out to be wrong. Tyler Durden misinterpreted the CME advisory. The CME issued a clarification today, saying that the INITIAL MARGIN will be lowered to the MAINTENANCE MARGIN on all futures positions. So if you are going to make bets Monday morning based on Zero Hedge's prognostications as of Friday night, STOP!!!!!!!!! So Apocalypse Later, just not now.edit on 5-11-2011 by artfuldodger because: Misspeilling.edit on 5-11-2011 by artfuldodger because: Grammar

No Tyler Durden didn't misinterpret anything. CME #&$^ed up with their pathetic press release! CME had to clarify because they were the ones who first telegraphed an ambiguous misleading message.

And there is a new thread on the forum already.

if you fell for this whole post, you are a loser. zerohedge had to admit they were wrong BABABAB

new topics

-

Ditching physical money

History: 2 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 2 hours ago -

Don't take advantage of people just because it seems easy it will backfire

Rant: 2 hours ago -

VirginOfGrand says hello

Introductions: 3 hours ago -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 3 hours ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 6 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 7 hours ago -

God lived as a Devil Dog.

Short Stories: 7 hours ago -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 9 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 10 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 12 hours ago, 18 flags -

Who guards the guards

US Political Madness: 15 hours ago, 13 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 6 hours ago, 11 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 10 hours ago, 7 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 3 hours ago, 5 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 16 hours ago, 3 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 2 hours ago, 2 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 2 hours ago, 2 flags -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 7 hours ago, 2 flags

active topics

-

1980s Arcade

General Chit Chat • 24 • : 5thHead -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 34 • : YourFaceAgain -

Hate makes for strange bedfellows

US Political Madness • 36 • : Solvedit -

Don't take advantage of people just because it seems easy it will backfire

Rant • 4 • : VirginOfGrand -

Ditching physical money

History • 10 • : annonentity -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 21 • : VirginOfGrand -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 633 • : Justoneman -

VirginOfGrand says hello

Introductions • 1 • : VirginOfGrand -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 740 • : matafuchs -

Gold and silver prices....woo hoo

History • 84 • : annonentity