It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

3

share:

Now I'm going to come right out and admit that when it comes to global economics and finance, that I'm an out and out noob and really have a lot of

trouble following, let alone understanding, just how the world of high finance operates. Having said that, I do have a passing interest in watching

the fluctuations in the price of gold as I believe that it's a good indicator or "barometer" on the global financial pulse and the state of the

global economy where "bad news" forces the price of gold up and conversely, "good news" forces the price of gold down.

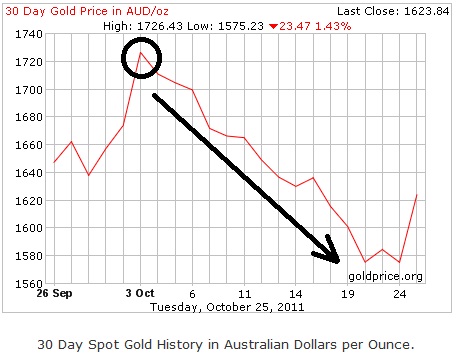

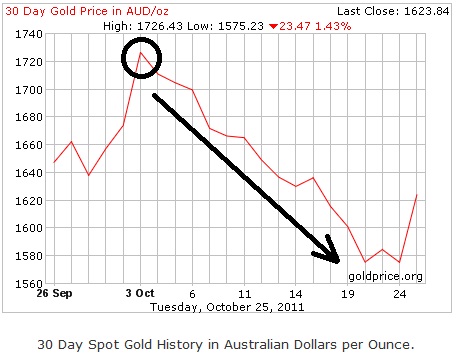

Now, about a month or so ago, the price of gold could do no wrong and just climbed, climbed and then climbed some more to an all time high. However, about 3 weeks ago, around 3 October, gold began to take a nosedive which has continued day after day, until today at which point gold began a sudden and unexpected turn around and began to climb sharply once more.

Here's a graph showing the decline in the price of gold over the last 3 weeks ...

So, I have a few questions that need answering and I'm more than certain that some of our more financially astute members will easily be able to supply and ease my confusion.

1. At 10am New York time today, what was the trigger that caused the sudden reversal in gold's decline and caused it to once again make significant gains ... and all in just the space of 2 short hours ?

2. Was this sudden interest in gold the result of one or 2 "institutions" purchasing large quantities of gold or was it the result of many (millions of ?) individual investors deciding that suddenly gold looks good again ?

3. If it was caused by individual investors, how did they know that they should start buying gold at exactly the same time (10am New York time) regardless of where they lived in the world ?

4. If it was caused by one or two "institutions", then what information did they suddenly become privy to that made them decide to buy gold ? Why 10am and not say, 11am or later that afternoon at perhaps 2pm ?

5. Is there a possibility that for some reason at 10am New York time, the robotic traders, and NOT human traders, around the world began buying up gold based on some algorithm of theirs that suddenly kicked in ? In other words, computers made the decision to buy gold and not humans ?

It all seems so well coordinated to me that surely, something must have happened in the global economic/financial system that caused this sudden re-interest in gold.

Here's a graph clearly showing the sudden surge in gold purchases starting at 10am New York time ... as can be seen, the graph went near vertical at that point in time.

Now, about a month or so ago, the price of gold could do no wrong and just climbed, climbed and then climbed some more to an all time high. However, about 3 weeks ago, around 3 October, gold began to take a nosedive which has continued day after day, until today at which point gold began a sudden and unexpected turn around and began to climb sharply once more.

Here's a graph showing the decline in the price of gold over the last 3 weeks ...

So, I have a few questions that need answering and I'm more than certain that some of our more financially astute members will easily be able to supply and ease my confusion.

1. At 10am New York time today, what was the trigger that caused the sudden reversal in gold's decline and caused it to once again make significant gains ... and all in just the space of 2 short hours ?

2. Was this sudden interest in gold the result of one or 2 "institutions" purchasing large quantities of gold or was it the result of many (millions of ?) individual investors deciding that suddenly gold looks good again ?

3. If it was caused by individual investors, how did they know that they should start buying gold at exactly the same time (10am New York time) regardless of where they lived in the world ?

4. If it was caused by one or two "institutions", then what information did they suddenly become privy to that made them decide to buy gold ? Why 10am and not say, 11am or later that afternoon at perhaps 2pm ?

5. Is there a possibility that for some reason at 10am New York time, the robotic traders, and NOT human traders, around the world began buying up gold based on some algorithm of theirs that suddenly kicked in ? In other words, computers made the decision to buy gold and not humans ?

It all seems so well coordinated to me that surely, something must have happened in the global economic/financial system that caused this sudden re-interest in gold.

Here's a graph clearly showing the sudden surge in gold purchases starting at 10am New York time ... as can be seen, the graph went near vertical at that point in time.

Originally posted by tauristercus

1. At 10am New York time today, what was the trigger that caused the sudden reversal in gold's decline and caused it to once again make significant gains ... and all in just the space of 2 short hours ?

I did a google search.

Gold futures rallied nearly 3% on Tuesday after a planned a meeting of European finance ministers, scheduled to take place ahead of the summit, was cancelled, casting doubts over hopes that European leaders would be able to make a breakthrough on a plan to tackle the region’s ongoing debt crisis.

European lender HSBC said in a report late Tuesday that, “The catalyst was the finance ministers' meeting cancellation. That really just unleashed a very strong wave of safe-haven buying."

forexpros

reply to post by tauristercus

why the ` run on gold ` on october 2nd ?- markets do fluctuate you know - supply and demand

why the ` run on gold ` on october 2nd ?- markets do fluctuate you know - supply and demand

My guess, the impending annihilation of Iran. NWO are almost set, wouldn't be surprised they are all pocketing before the real Green light. Other

than that I have nothing. Lol

the destroyer is coming,the elite have to buy their freedom from the slave ships.

Originally posted by alfa1

Originally posted by tauristercus

1. At 10am New York time today, what was the trigger that caused the sudden reversal in gold's decline and caused it to once again make significant gains ... and all in just the space of 2 short hours ?

I did a google search.

Gold futures rallied nearly 3% on Tuesday after a planned a meeting of European finance ministers, scheduled to take place ahead of the summit, was cancelled, casting doubts over hopes that European leaders would be able to make a breakthrough on a plan to tackle the region’s ongoing debt crisis.

European lender HSBC said in a report late Tuesday that, “The catalyst was the finance ministers' meeting cancellation. That really just unleashed a very strong wave of safe-haven buying."

forexpros

Ok, so bad news due to the canceled meeting of European finance ministers.

But HOW does this translate to an actual decision to immediately go buy up big on gold ? Do traders around the world sit there watching the news reports and upon hearing that the meeting was canceled, immediately jump up out of their comfortable chairs and go running to the nearest pc terminal to place mega amounts of gold trades ?

Originally posted by ignorant_ape

reply to post by tauristercus

why the ` run on gold ` on october 2nd ?- markets do fluctuate you know - supply and demand

Supply and demand, huh ?

So why not buy, buy, buy yesterday ... or the day before ... when gold was almost as low ?

Is it at all possible that the algorithms used by robotic traders use up/down news reports as part of their automatic input gathering routines and

decided, based upon this new input and their programming, to start a gold run automatically and without human involvement ? Just seems to me like such

"good timing" that "EVERYBODY" started buying gold at EXACTLY the same moment in time.

reply to post by tauristercus

When markets look bad for currency, bonds, etc., people have a tendency to jump back to hard assets like gold, silver, oil, etc. Gold is a particularly valued commodity for this because it's, well, gold.

When markets look bad for currency, bonds, etc., people have a tendency to jump back to hard assets like gold, silver, oil, etc. Gold is a particularly valued commodity for this because it's, well, gold.

Originally posted by AnIntellectualRedneck

reply to post by tauristercus

When markets look bad for currency, bonds, etc., people have a tendency to jump back to hard assets like gold, silver, oil, etc. Gold is a particularly valued commodity for this because it's, well, gold.

Yes, I understand that but I guess I'm just curious as to WHY all the sudden interest in gold around the world took place at a very specific moment in time (10am New York time) wen gold suddenly went from a downward direction to a near vertical climb in a matter of seconds or minutes.

Just HOW did all the gold buyers/traders around the world COORDINATE their buys to happen at just THAT one moment in time ?

Do we have ANY traders here on ATS able to definitively answer the above questions ?

edit on 26/10/11 by tauristercus because: (no reason

given)

Originally posted by tauristercus

Just HOW did all the gold buyers/traders around the world COORDINATE their buys to happen at just THAT one moment in time ?

if just one hedge fund sees an opportunity to go long gold, because political or economic events will likely affect the market.......

it stands to reason that other funds and other private capital groups have their computers linked in to sudden changes in the gold markets and have algorythims locked & loaded to take advantage of the price movements or trends

investment houses like goldman sachs has banks of PCs dedicated to monitoring market movements just like your wondering about...

the mysterious move in gold does not necessarily translate into millions of investors/traders acting in unison..

I suggest a steep rise in gold futures could be initiated by only a few to several big buyers going Long on Gold

just seconds after the initial surge in gold futures

Originally posted by St Udio

Originally posted by tauristercus

Just HOW did all the gold buyers/traders around the world COORDINATE their buys to happen at just THAT one moment in time ?

if just one hedge fund sees an opportunity to go long gold, because political or economic events will likely affect the market.......

it stands to reason that other funds and other private capital groups have their computers linked in to sudden changes in the gold markets and have algorythims locked & loaded to take advantage of the price movements or trends

investment houses like goldman sachs has banks of PCs dedicated to monitoring market movements just like your wondering about...

the mysterious move in gold does not necessarily translate into millions of investors/traders acting in unison..

I suggest a steep rise in gold futures could be initiated by only a few to several big buyers going Long on Gold

just seconds after the initial surge in gold futures

Thanks St Udio for that explanation

But that certainly opens up the very real prospect of stock market manipulation by just a few (as if we didn't know that already happens ).

Either pump and dump or investors can see on the horizon that the Euro is over.

reply to post by tauristercus

yo, friend... you likely were very aware of what i said... i just did a sort of long explaination for the readers that pop-in & out

sure there are the privleged few that guide the gold markets, that's because they have the money necessary to trade futures whereas the small-guys like myself & most everyone on ATS cannot afford the $25.k margin call (i think i recall that figure after they upped the Gold futures just once..)

remember they upped the Silver margin something like 5 times in 7 days a month or so ago...

the reasoning was to barracade the little guys and keep silver secure from the 'bust JPM' crowd that wanted to make JPM (a long time silver manipulator) pay-through-the-nose to hold their positions in silver shorts

its a tricky playing field

do not forget the Presidents working team or 'PPT' plunge-protection-team that has a decade of manipulating PM markets along sides with GS ML & the other 1% elites

yo, friend... you likely were very aware of what i said... i just did a sort of long explaination for the readers that pop-in & out

sure there are the privleged few that guide the gold markets, that's because they have the money necessary to trade futures whereas the small-guys like myself & most everyone on ATS cannot afford the $25.k margin call (i think i recall that figure after they upped the Gold futures just once..)

remember they upped the Silver margin something like 5 times in 7 days a month or so ago...

the reasoning was to barracade the little guys and keep silver secure from the 'bust JPM' crowd that wanted to make JPM (a long time silver manipulator) pay-through-the-nose to hold their positions in silver shorts

its a tricky playing field

do not forget the Presidents working team or 'PPT' plunge-protection-team that has a decade of manipulating PM markets along sides with GS ML & the other 1% elites

edit on 26-10-2011 by St Udio because: (no reason given)

Don't try to find any logic in price movememt when it comes to gold/silver.

The game is fixed when paper dictates the price of the metal and you have 100 bits of paper for every ounce of gold/silver.and if they want 1000 bit of paper then who's stopping them.

Nope i'm logical and if/when the system crashes then 10oz of silver is going to be worth more than a ton of fiat paper notes so i will hold on to my physical silver at $5oz or $100oz and i've asked lots of people to sell to me and offer 30% of the peak price like the paper price was a fews weeks.!

No one came forwards, not one else i would had got myself a few more Kilos

The game is fixed when paper dictates the price of the metal and you have 100 bits of paper for every ounce of gold/silver.and if they want 1000 bit of paper then who's stopping them.

Nope i'm logical and if/when the system crashes then 10oz of silver is going to be worth more than a ton of fiat paper notes so i will hold on to my physical silver at $5oz or $100oz and i've asked lots of people to sell to me and offer 30% of the peak price like the paper price was a fews weeks.!

No one came forwards, not one else i would had got myself a few more Kilos

reply to post by tauristercus

News in Europe is driving everything right now, and Gold is a safe haven if the Euro falls.

Usually the correlations between these two are a little fuzzy, though. In the short term, the Euro and Metals/Commodities tend to run together as a single entity, but in the longer term a crashing Euro would be bullish for Silver/Gold. If the goal is a Euro/Gold divergence, try to avoid trading with the USD

News in Europe is driving everything right now, and Gold is a safe haven if the Euro falls.

Usually the correlations between these two are a little fuzzy, though. In the short term, the Euro and Metals/Commodities tend to run together as a single entity, but in the longer term a crashing Euro would be bullish for Silver/Gold. If the goal is a Euro/Gold divergence, try to avoid trading with the USD

edit on 26-10-2011 by CarlosAranha because: (no reason given)

new topics

-

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 1 hours ago -

Bobiverse

Fantasy & Science Fiction: 3 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 4 hours ago -

Former Labour minister Frank Field dies aged 81

People: 6 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 7 hours ago -

This is our Story

General Entertainment: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 12 hours ago, 16 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 17 hours ago, 6 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 4 hours ago, 6 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 7 hours ago, 5 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 17 hours ago, 4 flags -

Ditching physical money

History: 17 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 6 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 3 hours ago, 3 flags -

This is our Story

General Entertainment: 10 hours ago, 3 flags -

Ode to Artemis

General Chit Chat: 13 hours ago, 3 flags

active topics

-

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 129 • : yuppa -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry • 10 • : ATruGod -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 477 • : ArMaP -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 644 • : cherokeetroy -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 8 • : Astyanax -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 51 • : Ophiuchus1 -

The Reality of the Laser

Military Projects • 40 • : Zaphod58 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 67 • : UnderAether -

Windows tracking links to WEF and more:

New World Order • 21 • : milaganenogan -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 29 • : SchrodingersRat

3